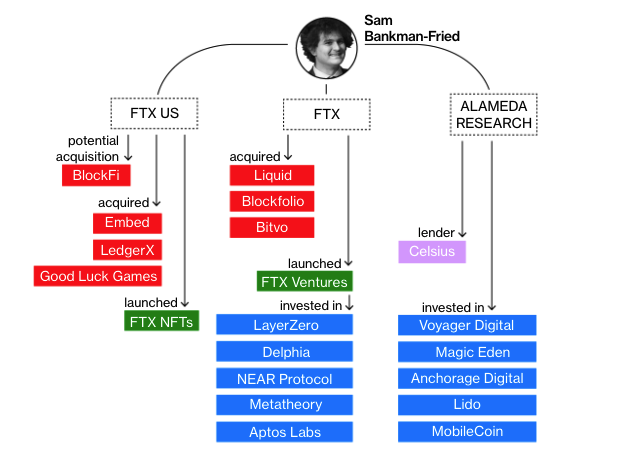

tidytidyThe "encryption map" of SBF, including invested and potential investments.

The bear market doesn’t appear to be slowing FTX down. In June alone, FTX completed two acquisitions: Canadian exchange Bitvo and American securities brokerage Embed. In addition, FTX has also acted as the "borrower of last resort" in the encryption market, providing BlockFi with a large amount of credit lines, and at the same time lending a large amount of loans to save Voyager Digital, although Voyager Digital later declared bankruptcy.

In short, SBF has prepared a loan line of approximately US$1-2 billion for encryption companies, hoping to prevent the spread of the liquidation crisis and protect a wider range of industries and retail investors.

SBF's Crypto Empire

"Bloomberg"Summarysecondary title

FTX

Among them, FTX Exchange has acquired the Japanese exchange Liquid, the Canadian exchange Bitvo, and Blockfolio, and entered the Japanese and Canadian markets through these two acquisitions.

FTX announced the launch of the Japanese compliance exchange FTX Japan on June 3, and said that after the acquisition process is completed, it will also enter the Canadian market. It is worth mentioning that at present, FTX has also launched FTX Australia and FTX Europe in Australia and Europe respectively, so the footprint of FTX has spread all over the world.

FTX acquired Blockfolio in mid-2020. The company was originally an app for tracking investment portfolios, with nearly 6 million users worldwide. It can be connected to exchanges to track the profit and loss of investor accounts, real-time prices of cryptocurrencies, and the latest developments in the crypto market. After the acquisition of FTX, it was renamed as FTX APP, and has access to wallet and transaction functions, including regular quota and fixed income.

secondary title

FTX US

FTX US is a compliant exchange launched by FTX in the United States. At the beginning, it only provided "spot trading". However, after FTX US acquired LedgerX and Embed, FTX US has begun to provide some users with "securities trading".

Embed Financial is a compliant securities broker, responsible for securities custody, trade execution, clearing, and it is also a member of FINRA, the financial regulatory authority.

LedgerX was originally a US-compliant "derivatives exchange" with three CFTC regulatory licenses: DCM (Designated Contract Market), SEC (Swap Execution), and DCO (Derivatives Clearing Organization).

secondary title

Alameda Research

Alameda is a well-known quantitative fund in the encryption market, with more than $1 billion in assets under management and a daily derivatives trading volume of approximately $10 billion. In addition to investing in crypto start-ups, he is also a well-known market maker.

image description

image description

first level title

Is SBF a philanthropist or a careerist? Maybe both!

After the thunder of TerraUSD, Celsius, and Sanjian Capital, the encryption market ushered in its own Lehman moment. More than once, the SBF has publicly stated its responsibility to prevent contagion. After that, he did two things, providing Voyager Digital with $480 million and BlockFi with a $400 million revolving line of credit.

According to Bloomberg statistics, SBF has been buying on dips this year:

1. 2022/02/02: FTX acquired the Japanese compliance exchange Liquid, and then changed its name to FTX Japan

2. 2022/03/22: FTX US acquired Good Luck Games and merged into FTX Gaming

3. 2022/05/02: SBF buys Robinhood stock for $648 million, about 7.6%

4. 2022/06/17: FTX acquires Canadian exchange Bitvo and enters the Canadian market

5. 2022/06/17: Alameda provides approximately $485 million in loans to Voyage Digital

6. 2022/06/22: FTX US acquires Embed to provide FTX Stocks services

7. 2022/06/30: FTX US provides BlockFi with a $640 million loan, of which $240 million can be converted into BlockFi equity

The outcome of offering Voyager Digital looked negative, and the company still ended up declaring bankruptcy. Regarding this matter, SBF stated that because of the sudden incident, FTX only had two days, not months, to "due diligence".

"We only have two days, and the original intention is to protect user assets, not to support Voyager's business."

In contrast, offering BlockFi loans becomes a win-win for both SBF and BlockFi users, even competitors.

Mauricio Di Bartolomeo, co-founder of Ledn, said:

“SBF could buy this $3 billion company for pennies a share, which would be great for FTX, BlockFi users, and even the industry as a whole.”

Mauricio Di Bartolomeo further pointed out that regardless of whether the final result is an investment or an acquisition of BlockFi, it is a good thing for FTX US. On the one hand, it can build brand reputation and get more potential users, on the other hand, SBF can expand into the "encrypted lending field".

For supporters, such a move by SBF is in line with his long-standing personality: altruism.

Supporters believe that in the most difficult time for the encryption industry, SBF will naturally stand up. But for others, SBF is just taking advantage of the fire and using the liquidation "big fire sale" to expand its territory, just like Warren Buffett and JP Morgan, the big banker, did in the past.

However, the two statements do not appear to be in conflict.

In an exclusive interview with CNN a few days ago, SBF stated that although FTX is willing to lend money to other companies to set a stop loss line for the crisis, lending money to these companies is not doing charity, so it must be carefully evaluated.

FTX's criteria is to look for companies that are "doing business well." These companies only have temporary liquidity problems, so as long as some loans are provided, users of these companies can be protected and systemic crises can be prevented in advance.

What is certain is that SBF manages the company's capital well.

Investment strategy analyst Lyn Alden believes that SBF is properly controlled during the bull market, and the general direction is set correctly: focus on the profitability of the company itself, rather than blindly pursuing growth.

"Other companies are now facing staffing constraints and have raised capital when they didn't need to in the past, which allows SBF to buy on dips when other companies are facing liquidation crises."

Peer Review: The largest provider of crisis financing in the industry

SBF revealed that the team has studied 10 deals so far, including Terra and Celsius. But he walked away from both deals. In addition to BlockFi and Voyager, SBF also disclosed loans to other companies, but did not disclose the exact name of the company.

From the frequency of media reports and peer evaluations, SBF's influence seems to be increasing rapidly. Some in the encryption industry say Alameda Research has become an influential venture capital firm.

According to M&A advisory firm Architect Partner, FTX and Alameda Research could become the “largest provider of crisis financing” in the crypto industry in the second half of 2022. The expanding influence of SBF may also reduce competition in the encryption market.

“You can imagine, if FTX continues to maintain this level of development, who can keep up?”