Original post by Augustine Wagner@GeekCartel

Preface——This article comprehensively introduces the definition, types, characteristics, excellent projects in the ecology of ReFi, the design principles of ReFi token economics and issues that need attention, ReFi investment methodology, etc., so the article is long and readers can choose their own Read the section of interest.

A luxury NFT project developed by an Italian team chose to issue their NFT on Polygon, but did not choose the "noble chain" ETH that matches the positioning of luxury goods.

Is it because they are "Muggles" living in the old classical world? No, they know web3 very well, understand ERC721, and understand Ethereum's market position in the web3 world and in the NFT field, but they insist that the attributes of Polygon's carbon-neutral public chain are more in line with their luxury NFT brand positioning.

Of course, we can laugh at them from the perspective of market strategy as selling diamond rings in a charity second-hand store, but it is undeniable that their choices reflect the trend that the values of environmental protection, inclusiveness, and diversity are quietly infiltrating into the Web3 world.

We know that due to various historical and realistic reasons, the Web3 industry was shrouded in an atmosphere of social Darwinism and neoliberal ideology in the early days. Many web3 practitioners regard environmental protection, inclusiveness, diversity and other issues as hippie utopian fantasies .

However, things are changing.

With the development of Web3 today, the internal and external environment of the industry has been turned upside down compared with the past, and great changes have taken place. The values of practitioners are more inclusive, open and diverse.

At the same time, the narrative power of the neoliberal discourse system, such as resistance to censorship and permissionlessness, is weakening, and Web3 capital (such as A16z) is trying to find or invent new narrative paradigms.

Therefore, Web3 projects that are environmentally friendly, inclusive, and diverse are receiving more and more attention and attention from capital and the industry. Examples are as follows:

Gitcoin’s donation activities, which have a reputation as an industry vane, have dedicated web3 project sections for environmental protection, inclusiveness, and diversity in both GR-13 and GR-14.

ReFI projects such as Amazon rainforest protection and carbon credit project moss.earth, carbon credit version of OlympusDAO fork KlimaDAO, carbon credit asset tokenization protocol Toucan Protocol and RegenNetwork have achieved considerable brand awareness and market influence

first level title

secondary title

1. Definition of ReFi

ReFi is an acronym for Regenerate Finance. As a brand new concept and capital narrative paradigm in the Web3 industry, ReFi has not yet had an authoritative and unified definition. GeekCartel believes that the concept of ReFi will eventually be defined by builders, developers, participants, etc., and will exist in an open and self-evolving consensus.

Currently, there are two main definitions of ReFi in the Web3 community:

Green public chain Celo's definition of ReFi:

ReFi = reimagining traditionalfinance (TradFi) tobetterintegratenatureand humanity, makingmoneymoreaccessibleandbeautiful.

The definition of Celo emphasizes ReFi's reconstruction of traditional finance (TradFi). Celo believes that the philosophical cornerstone of the modern financial system is to abstract the world into a space where resources can be obtained infinitely. However, to quote economist Herman Daly, the real world we live in has planetary boundaries, carrying capacities, and tipping points.

Acknowledging that we live in a "full world," ReFi aims to correct this exploitation and better interweave our economies and ecosystems together.

By using money as a vehicle to give value to assets backed by natural assets, ReFi prices externalities, charging those who create negative externalities and rewarding those who create positive externalities.

Externalities: the actions of individual economic units that affect society or other individual sectors without assuming corresponding obligations or receiving rewards

The definition of ReFi by CryptoAltruism, a Web3 public welfare organization:

ReFi is a movement focused on the power of blockchain and web3 to fight climate change, support environmental protection and biodiversity, and create a more equitable and sustainable financial system.

The definition of CryptoAltruism emphasizes the social movement attributes of ReFi. ReFi not only exists as a powerful tool for people to create a more fair and sustainable financial system, but also a green social movement with positive externalities.

As a VCDAO that has been paying attention to the field of Web3 innovation for a long time, GeekCartel tries to propose an understanding of ReFi from its own perspective:

First of all, ReFi is a brand new Web3 narrative paradigm. An obvious difference between it and the previous Web3 narrative paradigms L1, L2, DeFi, NFT, PlaytoEarn, etc. lies in its positive externality. ReFi supports other groups to benefit from the development of Web3 without paying additional costs. This new Web3 narrative that shines with the brilliance of humanity (perfect humanity is divinity) will inject new vitality into the Web3 industry facing the crisis of narrative exhaustion.

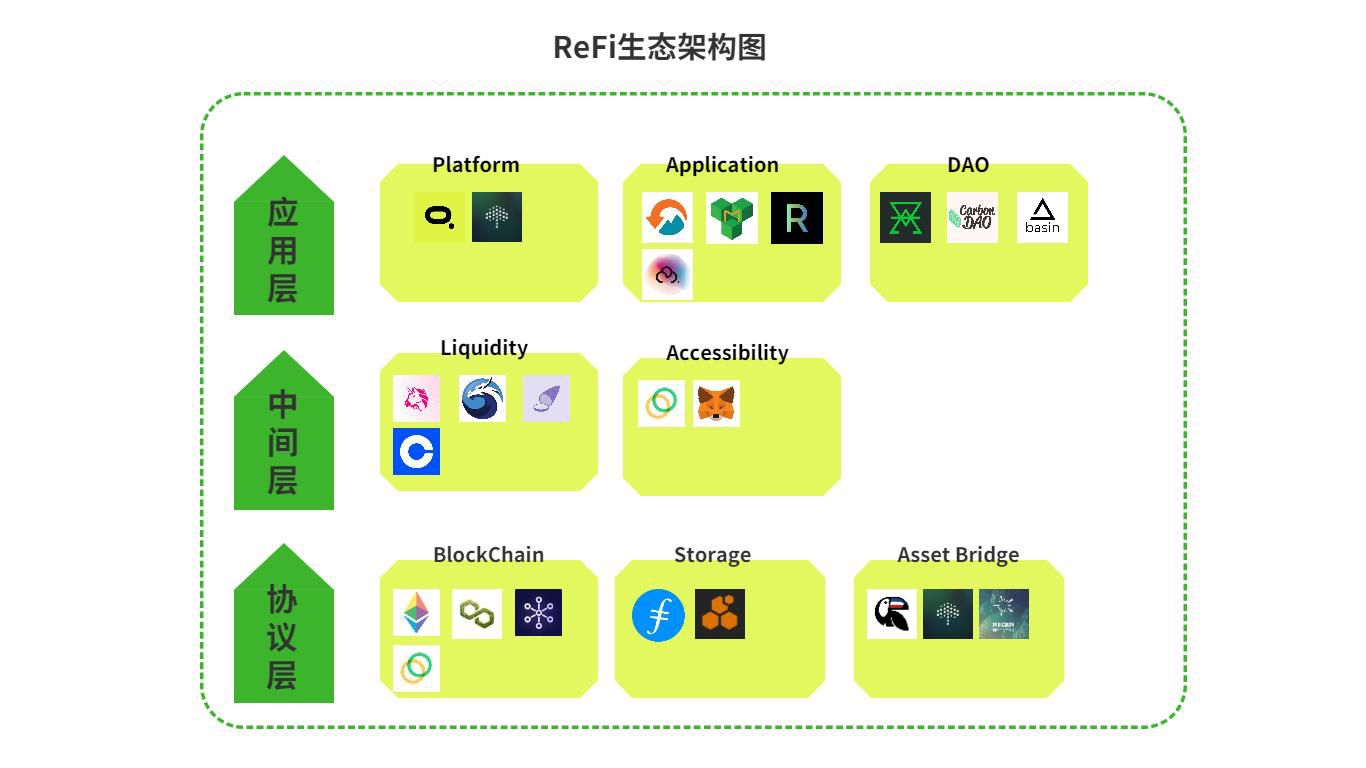

Second, ReFi is a combined innovation like the iPhone. ReFi is not a technological innovation. In fact, the Web3 technology used by ReFi is just some basic technologies, such as Token issuance, DeFi lending, AMM Swap and DAO tools. Its innovation is to combine these Web3 technologies to provide a new solution for addressing climate change, supporting the diversity of sustainable development projects such as environmental protection and biology.

first level title

2. Types of ReFi

ReFi does not belong to one of the main narrative lines of this round of bull market. As a new thing, it is still in the early stage of latent growth, or borrowing the terminology of MOBA games, it is in the Farming stage. However, even though the number of projects in the entire ReFi ecosystem is still relatively scarce, its types are relatively rich.

text

climate solutions

Climate solution ReFi projects include: Toucan Protocol, KlimaDAO, FlowCarbon, Moss.earth, RegenNetwork, Nori, basinDAO, etc.

In response to global warming, a series of international institutional arrangements such as the "Paris Agreement" and the "Kyoto Protocol" reached by sovereign countries around the world regard the carbon credit market mechanism as an important climate solution. The carbon credit market is divided into a compliance carbon credit market and a voluntary carbon credit market.

Among them, the compliance carbon credit market can only be participated by institutions approved by the regulatory agencies of various sovereign countries. The voluntary carbon credit market is relatively open and everyone can participate. However, the voluntary carbon credit market has problems such as non-uniform carbon credit standards, opaque trading market, and poor market liquidity. And this happens to be the starting point and focus of climate solution ReFi projects.

text

environmental protection

text

Biodiversity Conservation

Biodiversity conservation ReFi is dominated by DAOs, such as The EndangeredTokens (ENTS) foundation that protects endangered forests.

● Types by web3 technology stack:

protocol class

The main ReFi projects of the protocol category are: Toucan Protocol, Regen Network.

platform class

The main ReFi projects in the platform category are: FlowCarbon, Moss.earth.

application class

The main ReFi projects in the application category are: Kumo, ReturnProtocol, Meltek.

DAO class

first level titleCarbonDAO、basinDAO。

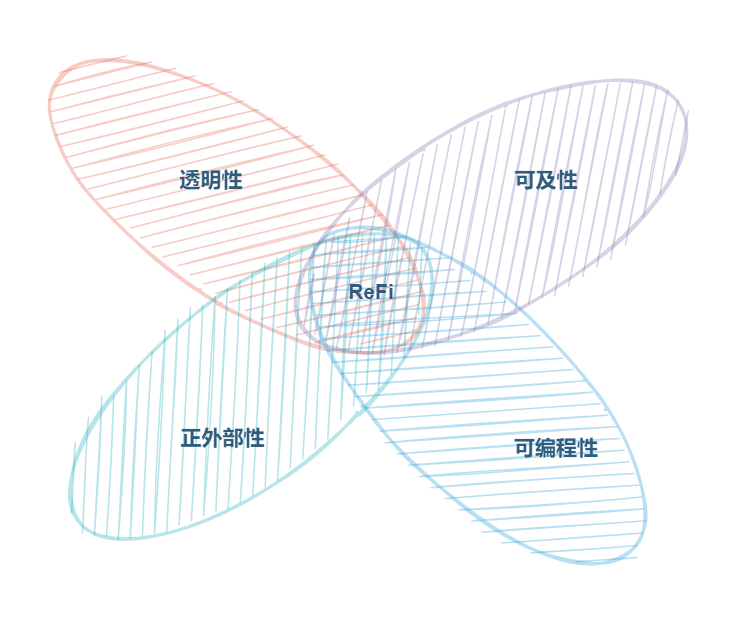

3. Characteristics of ReFi

transparency.

transparency.Whether web3, web2 or a more traditional organization, there is a commitment to transparency. However, only the web3 project can achieve trustless transparency technically and logically. And ReFi inherits this feature of web3. If a user purchases carbon credits to offset his own carbon emissions through the traditional carbon credit market, he will eventually get only one PDF certification document, and other information is a black box for him. The ReFi project will put the carbon credit token registration agency, credit type, and batch year on the chain, and users can view this information through the blockchain browser at any time.

accessibility.After the ReFi project tokenizes natural assets, with the help of web3 infrastructure, wallets and DeFi applications, global users can freely invest, purchase, use, and trade these natural asset tokens without permission.

Programmability.Programmability is a prerequisite for the ReFi project to achieve the two characteristics of transparency and accessibility. Smart contracts endow ReFi projects with the ability to unlock natural asset tokenization, pooling (standardization), and the use of decentralized lending and AMM Swap, enabling ReFi projects to improve the capital efficiency and transparency of natural assets.

positive externality.first level title

secondary title

Carbon Market Public Market Infrastructure ToucanProtocol

ToucanProtocol's mission is to build a regenerative economy for the planet on the open web. Toucan Protocol chose to start with the public infrastructure needed to create a new currency LEGO: programmable carbon.

Toucan Protocol's product structure consists of two parts: carbon asset bridge and standardized carbon pool.

Carbon asset bridge.In order to put the carbon chain on the chain, Toucan Protocol builds a carbon bridge. It allows anyone to tokenize their carbon credits and make them available in the DeFi world.

ToucanProtocol's carbon asset bridge is the first universal bridge in the ReFi ecosystem. In principle, it can be connected to any carbon reduction resource. But Verra is currently supported by Toucan Protocol before being extended to GoldStandard and other institutions.

During the bridging process, carbon reductions are normalized and attributes recorded. At the end of the process, users receive TCO2 tokens: fungible tokens representing tokenized carbon tons. By tokenizing existing carbon offsets, it is possible to build a robust carbon standard and validator ecosystem, and connect these markets to DeFi.

Standardized carbon pool.Toucan Protocol converts tokenized carbon points into more liquid carbon combination tokens, provides price discovery for different types of carbon assets, and provides a new currency Lego for DeFi.

Not all carbon offsets are created equal - they come from a wide range of projects that use different technologies to reduce emissions or remove greenhouse gases from the atmosphere. In addition, each project creates a different emission reduction vintage approximately every year, and like wine, the quality of the vintage varies. This change disperses liquidity, for which Toucan Protocol has developed the Toucan Carbon Pool. A carbon pool is a pool of carbon combinations with corresponding carbon tokens. When these pools are created, a set of attributes are whitelisted - in order for carbon credit tokens to be deposited into the pool, TCO2 tokens must match a list of gated attributes.

The Toucan carbon pool transparently solves the liquidity problem that hinders price discovery in the off-chain carbon market. Carbon Composite Tokens are ERC20 tokens that are composable with the entire DeFi world - they can be traded on AMMs like SushiSwap, used as collateral on KLIMADAO and more.

ToucanProtocol is currently developed based on Polygon, and the next step is to expand to the Celo public chain.

secondary title

Layer0 infrastructure RegenNetwork of ReFi ecology

The goal of Regen Network is to establish a basic financial technology infrastructure for the ReFi ecology, that is, to become the Layer 0 of the ReFi ecology. Other projects and protocols can build on and leverage this Regen Network to execute their own climate-focused business models. RegenNetwork creates new tools for the relationship between humans and the environment through the use of blockchain ledgers and modern remote sensing technology.

The architecture of RegenNetwork consists of RegenLedger developed based on CosmosSDK and RegenRegistry, a decentralized carbon asset registry.

Regen Ledger。Regen Ledger provides support for RegenRegistry, enabling multiple registries to communicate and trade with each other to form a public ecological accounting system.

RegenLedger is a public chain developed based on the Cosmos SDK and adopts the PoS consensus mechanism. Regen Ledger has a dual goal, one is to index assets and rights related to ecological health, and the other is to track ecological service points that quantify the degree of ecological health change.

RegenLedger focuses on open source and welcomes the active participation of software developers working in blockchain, climate solutions, or agricultural technology to participate in a community-driven approach to open source protocol design.

RegenLedger is a core player in the Cosmos ecosystem. Contract directly with InterchainFoundation as the main maintainer of CosmosSDK. With the advent of IBC, any Cosmos SDK blockchain connected to the Cosmos Hub will be able to interact with assets and ecological data on RegenLedger.

RegenRegistry。RegenRegistry allows earth stewards (owners/producers of natural assets in the regenerative economy) to register their ecosystem services and generate carbon credit token CarbonPlusCredits to sell directly to buyers around the world.

Unlike Toucan Protocol's carbon asset bridge, RegenRegistry does not rely on third-party carbon asset registration agencies such as Verra, but uses blockchain and remote sensing monitoring technology to directly sign a carbon asset registration contract with the registrant to generate a carbon credit token.

Current carbon assets supported by the Regen Registry focus on soil organic carbon in grasslands and rangelands. Under development are forestry-based credits (for afforestation, reforestation, avoided deforestation, and agroforestry) and cropland-based soil organic carbon credits (no- and low-till, cover crops, and crop rotations).

Compared with the path of ToucanProtocol, RegenNetwork chose a path that focuses on operations and is more web3 native. This may be related to the long-term and deep participation of the team"open agriculture"secondary title

Amazon Rainforest Carbon Asset Agreement Moss.earth

MossEarth, a climate technology company focused on environmental services, simplifies the offsetting process and guarantees traceability and transparency by using blockchain technology. In 2020, it will use the 150,000 carbon credits generated by the Amazon rainforest every year as asset reserves. These carbon credits have passed the verification and registration of the standard agency Verra, and by freezing the carbon credits of Verra's centralized trading center, mint MCO2 assets on the chain for trading buy and sell. Users can purchase, store and offset MCO2 to protect the atmosphere.

MossEarth mainly uses funds from carbon credits on the platform in three ways:

Protect native forests: reduce greenhouse gas emissions by protecting woodlands and preventing forest degradation, and create monitoring, patrolling and other employment opportunities for local communities.

Reforestation: Projects that sequester greenhouse gases from the atmosphere by reforesting with native species.

Carbon sequestration: Collaboration on projects that promote sustainable agriculture through agroforestry systems or reduce the use of chemical fertilizers, thereby reducing greenhouse gas emissions.

secondary title

FlowCarbon, an open-source protocol for carbon credits double-blessed by capital and celebrities

Flowcarbon is a Celo-based open source protocol for carbon credits, which promotes institutional capital into climate change mitigation efforts by tokenizing traditional carbon credits. In addition, the agreement aims to become a transparent and threshold-free carbon trading market, which will continue to help companies reduce carbon emissions to net zero or net negative.

The Flowcarbon team believes that the most effective way to mitigate climate change is the tokenization of carbon credits. Traditional voluntary carbon markets are inefficient, opaque, and have high barriers to entry. Various brokers and consultants take commissions as high as 20%, and it is not uncommon for a single type of credit to be sold to different buyers at different prices. At present, at each step of carbon credit trading (issuance, clearing, settlement and custody), the transaction process is expensive and slow.

a16z stated on the official website that in the Flowcarbon protocol, on-chain carbon is an innovative tool that can be integrated into the existing DeFi ecosystem as an innovative combination of finance, and is explained by the builders in web3 and a16z For a whole new way to inspire climate positive behaviour. Flowcarbon's GNT is fully backed by the real-time value of off-chain credits, which can be used as collateral, protocol treasury assets, stablecoin reserves or offset on-chain carbon credits. On-chain carbon credits will become a key part of the financial architecture, driving the creation of a zero-carbon future.

secondary title

Effective carbon credit token market Nori

Nori is a blockchain-based carbon reduction platform founded in 2017 and headquartered in Seattle, Washington. Nori's goal is to create a marketplace that solves double counting and fraud in existing marketplaces and builds a strong economy around carbon reduction.

Suppliers first register their carbon reduction projects with the Nori platform, report the carbon reduction cases that have been taken, and provide enough data to establish an accurate project baseline. Once project data is fully entered, the Nori platform commissions an independent third-party carbon quantification tool to estimate carbon reductions, and then uses that estimate to determine the amount of NRT tokens to create for suppliers. Afterwards, buyers can purchase NRT directly from suppliers on the Nori marketplace and receive carbon reduction certificates. In Nori's marketplace, suppliers receive the total price of NRT purchased, and Nori charges buyers an additional 15% transaction fee. One NRT represents one ton of CO2 removed.

secondary title

Green version of MakerDAOKumo

KUMO supports users to borrow the stable currency KUSD issued by KUMO with carbon credit token without interest rate.

The KUMO protocol is an over-collateralized lending protocol. This means that the value of locked carbon tokens (collateral) will always exceed the value of minted KUSD. As an additional buffer, the KUMO protocol provides each asset with a stable pool containing deep liquidity to further protect loans and repay debts in the event of liquidation.

KUMO can be simply understood as a green version of MakerDAO.

The idea of KUMO is very simple and straightforward: Let money automatically recognize regenerative economic behaviors to heal our biosphere.

The more KUSD in circulation, the more carbon emissions outside the market, and the more financing carbon projects can obtain. Through this cycle, KUMO makes money an ally in the fight against climate change.

secondary title

ReturnProtocol, an automatic emission reduction tool on the chain of "emission reduction is mining"

The goal of Return Protocol is to drive mass adoption of ReFi in Web3 to make blockchain transactions environmentally sustainable.

ReturnProtocol is an environmental reduction protocol for on-chain wallets. Create an environmentally friendly Web3 for all by allowing on-chain wallets to reduce emissions in a simple, automated and economically beneficial way, driving funds to projects that are good for the planet.

ReturnProtoco is a fully automated dApp hosted on Polygon, allowing accurate and automatic on-chain environmental mitigation of every cross-chain transaction. The process of automatic emission reduction is simple:

Store the ReturnNFT in the wallet that you want to automatically shave. Return NFT can serve as a passport into the ReFi ecosystem, providing access to the ReFi dashboard. Also serves as social proof of commitment to environmental neutrality.

Customize emission reduction preferences. On the Return dashboard, users are allowed to set the percentage of each transaction they want to offset, which carbon credit token to use (NCT, MCO2, PRC, etc.), and the underlying project types they want to support. Users can also decide whether to initiate the burning of carbon credits and subsequently offset carbon emissions, or to bind and stake with the underlying protocol.

secondary title

ReFi version of OlympusDAO protocol KlimaDAO

KlimaDAO is a protocol that seeks to drive climate action by accelerating the price appreciation of carbon assets through its KLIMA token. Incentivizing emission reductions by driving up the price of carbon assets, each KLIMA token is backed by real-world carbon assets.

The reserve asset of KlimaDAO is Base Carbon Ton (BCT), a carbon offset index token representing a basket of carbon emissions including TCO2. Each TCO2 unit represents an individual carbon offset that users can purchase on the Polygon blockchain through the Tucano carbon bridge. In addition, TCO2 carbon offsets contain characteristics such as project name and type, serial number and verification year.

KlimaDAO is a fork of the popular Olympus DAO protocol that offers users two incentives:

Bonding: Encourage other carbon emission reduction agreements or application projects to participate in Klima's ecological construction. If they are willing to give up the assets on the chain of other agreements or application projects, they can obtain Klima's assets on the chain equivalent to the public market and corresponding discounted rewards as compensation.

Staking: Encourage participants to hold assets on the Klima chain for a long time, allowing holders to receive rewards and participate in governance. Participants who mortgage Klima will get 1:1 sKlima, and hold sKlima to obtain corresponding income according to the length of time and the floating interest rate of re-baseline.

Launched in August 2021, KlimaDAO has accumulated more than $110 million worth of treasury assets in one month. However, as the crypto market has entered a cold winter this year, Klima DAO's TVL and currency prices have entered a terrible negative feedback loop known as the "death spiral".

first level title

Issues that need attention in the design of ReFi token economics

In the past, the core issues dealt with in the design of L1, L2, GameFi, and DeFi pass-through models are:

1. The strength of economic incentives and the stability/sustainability of the economic system;

2. The empowerment of tokens refers to the application scenarios of tokens.

In the design of some ponzi internal circular token economic systems, such as some DeFi2.0 projects and Play to Earn game projects, the two indicators that people generally value are APR and ROI.

These design principles are obviously not very applicable to ReFi projects. Because the ReFi project does not need to create people's market demand for tokens through economic incentives like most other Web3 projects, nor does it need to rack their brains to find application scenarios for tokens. Of course they can do that too, but it doesn't have to be. ReFi assets, especially carbon credit tokens, have real market demands and usage scenarios.

For example, Polygon will purchase $400,000 in carbon credits (approximately 90,000 tons of carbon dioxide emissions) through KlimaInfinity, the carbon credit market on KlimaDAO, and plans to invest $20 million to achieve Polygon's carbon neutrality. Celo purchased the carbon credit token issued by Moss.earth as the reserve asset of its stablecoin cUSD.

Of course, we are soberly aware that the market size of ReFi projects is not very large now (it is predicted that the total size of the carbon credit market will reach 50 billion US dollars by 2030), and it is not just what ordinary users need. Currently, Web3 companies are mainly based on ESG Ideas to take the initiative to buy.

Therefore, the core issues to be dealt with in the token economics design of the ReFi project are:

1. Standardization and homogenization of natural asset tokens. As the underlying assets of ReFi, the natural asset attributes are naturally non-homogeneous. A newly planted forest in the Amazon Basin, a new hydropower station in the Mekong River Basin, and a carbon-negative farmland on the Mexican plateau. The standardization and homogenization of these natural assets is a very professional and complicated work.

The current mainstream operation process of ReFi is:

The assessment of natural assets is conducted by international third-party professional institutions such as Verra, GoldStandard, the US Carbon Registry, and the Climate Action Reserve Program;

The ReFi project uses the verification data such as the registration agency, point type, batch year, token name, token conformity, and UUID or Hash string in the evaluation results as metadata for token casting;

The minted tokens of different batches are packaged into a so-called bundle token according to a certain ratio, and the bundle token and different batches of tokens can be freely exchanged. And this bundletoken will be deployed in the decentralized lending agreement and DEX to realize the liquidity optimization of ReFi assets.

2. Transparency and de-trust mechanism of chaining process. ReFi's natural asset on-chain process relies more on the cooperation of international third-party professional institutions, especially Verra has a relatively high share in the carbon credit tokenization market. On May 25th, because Verra Carbon credits believed that the ReFi project had brought chaos to the carbon credit market, the related services were suspended, which seriously affected the market's confidence in the carbon credit token project.

Of course, problems encountered during development will be resolved during development. Based on the public chain Regen network developed by cosmos SDK, it is exploring the solution of decentralized natural asset on-chain.

3. Prevent Sybil attacks and "double spending". With the help of web3 technology and decentralized architecture, the emergence of ReFi has greatly improved the transparency and capital efficiency of natural assets. However, information asymmetry and arbitrage abuse still exist. For example, a hydropower station uses the Toucan protocol for regulatory arbitrage, and arbitrages 1 million BCT (the Toucan protocol's carbon credit standardization token). In the design of the ReFi token economic model, such phenomena can be prevented by increasing on-chain/off-chain handling fees, prolonging the on-chain time of natural assets, and limiting the amount of a single natural asset on-chain.

At this stage, it is not necessary for the ReFi project to issue governance tokens for two reasons:

1. The ReFi field is different from the financial application scenarios of DeFi. There is no market demand for high-frequency transactions, and the value capture efficiency of governance tokens is very low.

2. The ReFi field is an expert-dominated field. It is difficult for ordinary token holders to express mature opinions and actionable suggestions on ReFi, which makes governance tokens in name only.

Judging from historical data, the performance of issued governance tokens such as KlimaDAO and Moss.earth in the secondary market (24h transaction volume and price trend) is also unsatisfactory.

first level title

ReFi's investment methodology

Although Celo, the leader of the ReFi ecosystem, is doing its best to market the story of ReFi Summer, in fact we know that ReFi is still a long way from reaching the scale and popularity of DeFi/GameFi/NFTSummer.

The investment nature of the ReFi track belongs to the ultra-early stage investment, which is accompanied by high uncertainty and risk, and of course, it also implies a high return on investment.

Incorporating ReFi into a Web3 investment portfolio is somewhat similar to incorporating BTC into a traditional investment portfolio, which can increase returns while reducing risks (free lunch brought by diversified investments).

The above is GeekCartel’s general understanding and investment principles of the ReFi track.

When it comes to deciding whether to invest in a ReFi project, our judgment dimensions include: the incremental positive externality of the underlying assets, the degree of decentralization of the asset on-chain process, the ReFi ecological niche of the project, the team's values and experience, and the positive externality Token economics.

The incremental positive externality of the underlying asset.GeekCartel believes that the underlying assets of the ReFi project must not only have positive externalities, but also have incremental positive externalities.

For example, a hydropower station tokenized the ancient carbon credits through the Verra-Toucan carbon bridge, and successfully exchanged 1 million Toucan standard carbon tokens BCT. Although the operation of the hydropower station complies with the platform rules, it is essentially just a perfect arbitrage behavior of the hydropower station, which does not generate new positive externalities and make the earth better.

We think this is a departure from the original intention of ReFi. An ideal ReFi should use web3 technology (mainly programmable currency at present) to reshape the economic cycle and reward those behaviors that generate new positive externalities, such as creating a new forest in the Amazon Basin, cultivating a new seabuckthorn field in the Mu Us Desert, Fields where carbon sequestration farming practices were first attempted in the Mexican Altiplano.

The degree of decentralization of the asset on-chain process.As mentioned earlier, the current asset on-chain of the ReFi ecosystem relies on third-party centralized institutions, more correctly, it relies on Verra’s carbon asset certification. For example, the Toucan protocol of the well-known ReFi project and Moss.earth and other assets are currently using the Verra-carbon bridge solution.

This is a major existing pain point in the ReFi field. Fortunately, the industry has been aware of this problem, and the ReFi project team, including Regen network, is exploring a decentralized carbon bridge solution.

The ReFi ecological niche of the project.There is a phenomenon of "fat protocol" in the Web3 field, and the protocol layer is in a dominant position in the value capture game with the application layer. For example, in the first half of 2022, Stepn became a phenomenon-level application, driving its public chain Solana’s token $SOL to rise sharply, but the Solana Foundation did not make equivalent efforts to obtain benefits, which is a typical “free ride” Phenomenon, the protocol layer receives the positive externality benefits of the application layer. Therefore, when we invest in ReFi projects, we are more inclined to invest in protocol layer projects.

Team values and knowledge experience.The ReFi field is different from other fields of Web3, and the team values must be inclusive, open and diverse. It is hard for us to believe that an avid Trump fan would genuinely agree with the value of ReFi.

At the same time, the ReFi field is also a high-threshold entrepreneurial field, which requires the team to have years of deep cultivation in areas such as climate warming, environmental protection, and biodiversity protection, and have extensive professional knowledge and experience.

Token Economics of Positive Externalities.Summarize

Summarize

At present, the underlying facilities of Web3 such as public chains, protocols, middleware, etc. are relatively prosperous, but the application layer is showing a scene of excessive financialization.

According to the degree of financial complexity, we divide the token economics of web3 applications into three types: α, β, and γ.

α: There are token rewards, no additional mechanism;

β: There are token rewards, yield farming or staking mechanism;

γ: There are token rewards, yieldfarming or staking mechanisms, and Bond and PCV (protocol control liquidity) mechanisms or algorithmic stable currency mechanisms.

Suppose the short-term return α is 1, β is 2, and γ is 3;

Suppose the externality α is 1, β is 0, and γ is -1.

Under the constraints of such a model, as economically rational people, many web3 project parties will choose γ-type token economics to pursue the maximization of short-term interests, leading to excessive financialization of the web3 application layer.

The excessive financialization of Web3 did not help realize the vision of web3 eating web2, but instead produced a large number of negative externalities such as ICO fraud, pyramid investment scams, UST collapse, etc., resulting in many Web3 applications eventually becoming financial idle games.

The excessive financialization of the application layer has led to the phenomenon that "there is no grass growing under the big tree", which crowds out the resources for the growth of other types of web3 applications, which arouses the concerns of V God and other web3 industry leaders.

This has also become one of the arguments for the authority in the traditional world to attack web3 as a dragon-slaying technique, or a useless technology.

The future of Web3 cannot be 100% bet on the application of financial scenarios. Web3 needs to generate real value (neoliberal or environmentalist, beneficial to others/society/world) to prove its own value.

As Gitcoin founder Kevin Owocki (source: Bankless) put it: "Let's face it... cryptocurrencies don't have the best reputation, when mainstream media covers cryptocurrencies it's either portrayed as get-rich-quick dreams, or be portrayed as the Wild West of a Ponzi world. Can we describe to the world a more rewarding side of Web3?"

By combining web3 technology + decentralized architecture, ReFi creates a programmable economic cycle for the earth's regenerative economy, which can sustainably promote the regeneration of the earth and generate sustainable positive externalities. This is one of the problems that Web3 has developed to today. righteous.

the term

the term

ESG: Environmental, Social and Corporate Governance

MRV:Measurement,Acronym for Reporting and Verification

first level title

quote link

1. INFOGRAPHIC: DeFi, ReFi, andDeSci - Breakingdowntheacronyms