Author: Tiga

Revision: Evelyn

first level title

secondary title

Business basics

Ethereum Name Service (ENS) was launched on Ethereum in May 2017. The service provided by ENS is to map user-defined domain names with the suffix .eth to user addresses. For example, when a user needs to transfer money, they only need to enter vitalik.eth to transfer money without entering complicated wallet addresses. When using wallets such as Little Fox to connect to the website, the user's ENS domain name will also be displayed directly on the front end. Each ENS address is an ERC721 NFT, which can be traded in NFT trading markets such as Opensea.

The domain name service of ENS is priced and paid according to the character length of the domain name.

Domain names ≥ 5 characters in length: $5 per year;

4-character domain names: $160 per year;

secondary title

Business data performance

The total number of domain name registrations in the ENS protocol currently reaches 112w. At present, 500+ wallets or protocols have been integrated, and the number of users exceeds 400,000.

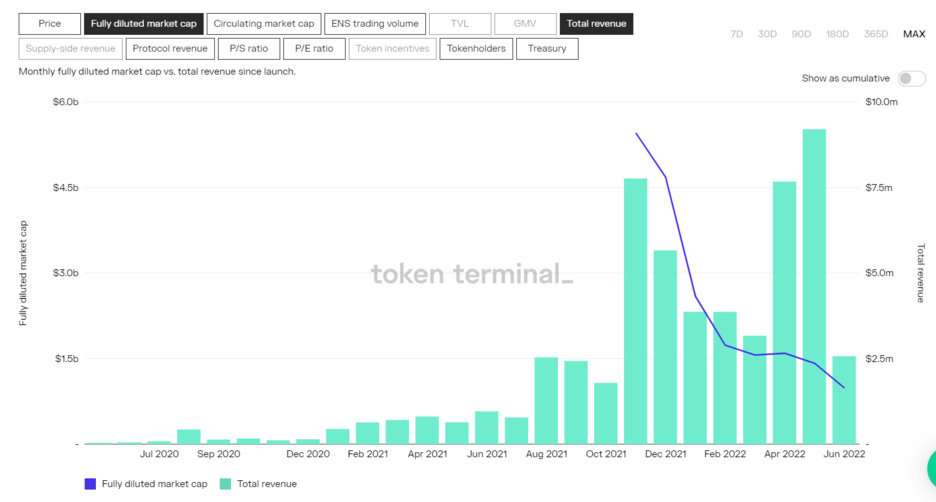

Among the total historical revenue of all projects, the historical revenue of ENS is about $56.7m, ranking 15th among all projects, with strong profitability. Different from other protocols, the ENS protocol only generates income when the user first purchases or renews. For nearly 90% of players, they have a 90% probability that their annual consumption in ENS is $5.

Since ENS announced the airdrop, the revenue data of ENS has shown explosive growth, and the revenue of ENS has increased by more than eight times in the past year. Revenue has exceeded $180w for 11 consecutive months.

In terms of business structure, new domain name registration fees are the main source of ENS's revenue, and the revenue from new domain name registrations is more than 10 times that of renewal fees. At present, most of the income of ENS is incremental income.

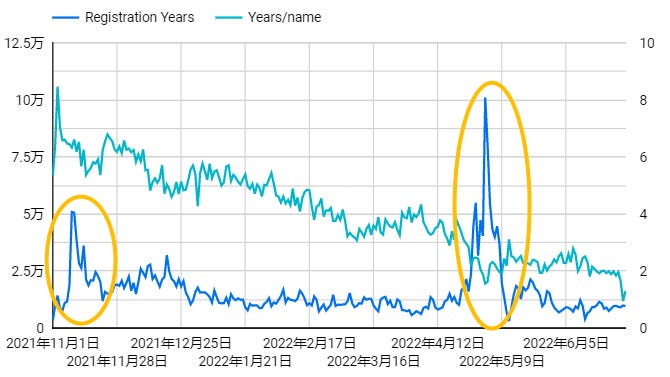

The registration volume of ENS has gone through two periods of explosion (shown in the yellow circle in the figure above):

ENS announced the airdrop during the first explosive period, and a large number of users entered the field at zero hour to "mix" the airdrop

The second explosive period is the wave of ENS domain name hype starting in April 2022.

With the influx of trying users, especially domain speculators who purchase ENS domain names on a monthly basis, the average registration time of ENS has also been continuously diluted. The current average user registration time is 1.64 years.

Team, investment, partner strength

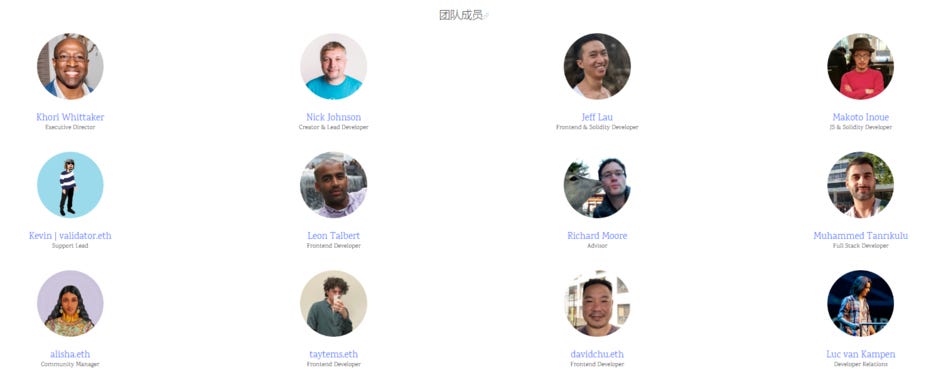

ENS was founded in 2016 by Nick Johnson, a former software engineer at Google. At first, ENS was a sideline project authorized by the ETH Foundation, and then the ENS team was established with the support of the ETH Foundation. There are currently 16 team members. Team members CEO × 1, CTO × 1, "customer service" × 1, community × 1, consultant × 1, technology × 7.

ENS has not made any investment since its establishment. Only got donations from ETH foundation, biance_x etc.

Partner

There are currently 500+ projects integrating the ENS protocol, and almost all well-known projects have integrated the ENS protocol. And integrating the ENS protocol is becoming a standard.

Among them, there is an important sign of a partner that cannot be ignored, that is, every user who changes the twitter username to a .eth suffix. These include crypto twitter big V, ordinary retail investors, VCs, project parties, and even traditional brands such as PUMA.

first level title

secondary title

Valuation Rise Driving Force

If the valuation of ENS shows explosive growth in the future, what factors will drive it?

Income side (business): The number of sales of ENS domain names continues to skyrocket

Functional side (imagination space): ENS domain names will play an important role in the future web3

The income of ENS business can be divided into two parts: stock and increment:

Inventory income refers to the income generated by users renewing their domain names

Incremental revenue refers to the revenue from new purchases of domain names by users

At present, the ENS protocol has entered a period of rapid expansion, and the number of new ENS domain name registrations continues to grow.

Judging from the revenue component data in the last one and a half years, the renewal revenue of old users has been increasing steadily, accounting for about 10% of the total revenue.

first level title

competitor

first level title

Token model analysis

ENS tokens will be issued for the first time on November 9, 2021, with a total of 100 million tokens. Token distribution is as follows:

5kw (50%) treasury [unlocked in 4 years]

Released at 10% DAO

2.5kw (25%) airdropped to users (>137k accounts) [immediate release]

Only 1.96kw (78.5%) was claimed.

2.5kw (25%) airdropped to ENS contributors (100 individuals and groups, plus hundreds of Discord users). [Unlocked for 4 years]

18.96% core development (11 people)

0.58% Lauch Advisors (2 persons)

1.25% Future Contributors

1.29% Extemal Contributors (17 people)

0.05% Translators (13 people)

2.5% Select Integrations (54 people)

0.25% Keyholders (10 people)

0.125% Active Discord Users (>400 people)

The annual inflation rate is up to 2%, and the specific amount is determined by the DAO.

Overall, ENS airdrops 50% of the total tokens to ENS users and contributors very web3. Although 25% of the total tokens airdropped to ENS contributors have a 4-year unlocking period, such a huge amount The airdrop is bound to cause a lot of selling pressure on the $ENS token in the future.

Token Basic Information(Data sampling time is June 29, 2022):

Circulating Supply: 20,244,862.09 ENS (20%)

Maximum Supply: 100,000,000

Total Supply: 100,000,000

Market cap: $176,105,477

FDV: $870,415,465

Rank: 135

Token issuance date: November 9, 2021

The highest price in history: $85.69 (November 11, 2021), the highest price in BTC history is November 10, 2021.

first level title

Risks to ENS

The development of ETH determines the development of ENS. Therefore, the important risk that ENS faces in the future is also the risk that ETH may fall behind in the future public chain competition. However, according to the current ecological development of capital, technology, and users, it is more likely that ETH will maintain a strong competitiveness in the future.

From last year to this year, ENS has poured in a large number of hyped and early adopters users. When their domain names expire, coupled with the coldness of the encryption market, ENS's revenue data may face the pressure of a sharp decline in the short to medium term.

For ENS tokens, the ENS project party has not empowered $ENS. And in the next 3.5 years, 25% of the total tokens will be unlocked, and ENS tokens will be under considerable selling pressure.

first level title

ENS Valuation Assessment

The function of ENS is to perfect ETH, and to use the first-mover advantage to gradually establish a network effect in the domain name field on ETH when ETH is fledgling. And obtained official endorsement and support, and finally obtained the exclusive franchise monopoly of the ETH ecological .eth domain name. Due to its relatively simple business, ENS has less pressure on subsequent innovation and development after the core function development is completed in the early stage. ETH will likely continue to be the leader in the future L1 competition, and ENS can almost get a large piece of cake from the ETH development dividend in a lying posture.

As crypto further expands the market in the future, web3 will move from concept to popularization step by step. Blockchain-based web3 will inevitably stimulate the demand for readable domain names. The sales of ENS will also continue to grow predictably with the development of the industry. Contrary to the predictable increase in sales revenue, ENS domain names are free of cost, essentially a business with zero marginal effect.

At present, the user base of ENS is still relatively small, and the number of ENS users is only 460,000. According to the current ENS domain name sales rules, when a large number of new users flood into web3 in the future, users will find that domain names with 3 and 4 characters are already sold out, and they can only buy "second-hand" domain names from the NFT market, or register domain names with 5 characters or more . At present, the proportion of domain names with 5 characters or above is about 91%, and the influx of new users in the future will cause this proportion to continue to increase. In this way, when the number of ENS users reaches a certain scale, the annual revenue of ENS is close to $5 × user base. Without changing the charging rules, there may be an invisible ceiling for ENS revenue.

Summarize

Summarize

ENS is a monopoly company that exclusively sells .eth domain names. It has a broad mass base and a deep moat.

ENS tokens do not have a strong connection with the ENS project. ENS tokens can only capture the emotional value of the good news of the ENS protocol.

first level title

secondary title

Macro perspective

According to Opensea's data, there are currently 183,680 ENS domain names that have been placed on Opensea, and the proportion of pending orders is close to 13%.

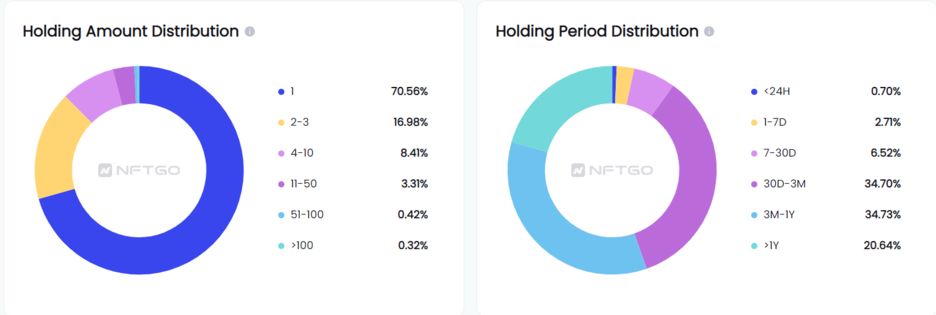

Judging from the data of ENS domain names in the NFT market, ordinary users are still the main theme of ENS. More than 70% of users hold one ENS, and about 87% of users hold less than or equal to 3 ENS. From the perspective of holding time, users who have held for more than 3 months account for about 55%.

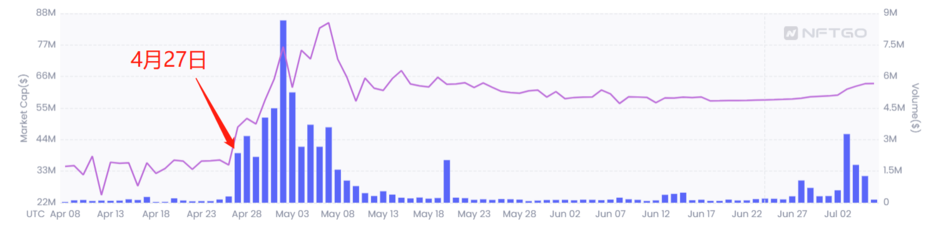

From the transaction data of ENS domain names, the turnover rate of ENS is nearly 5.74%. According to the transaction data of Opensea in the past year, especially the transaction data after the issuance of ENS, before the domain name hype boom, the daily transactions were only dozens of orders, but after the domain name hype boom, the number of transactions dropped sharply. Dropped to the order of hundreds of transactions per day. Corresponding to such a large plate of ENS, the overall liquidity of ENS domain names is low.

first level title

The particularity of ENS domain name NFT

quasi-official

As a project supported by the ETH Foundation, ENS has also been named and praised by V God. ENS is by far the most successful non-financial Ethereum application. Vitalik also changed his Twitter name to vitalik.eth to "bring goods" to ENS. The ENS project does not accept any external investment, and only receives funding from various foundations such as the ETH Foundation, thereby maintaining the independence of the ENS project. The ENS project can be regarded as the "son" of ETH, and the ENS domain name NFT can be regarded as the official NFT issued by ETH.

Long-term and stable real use requirements and potential application scenarios

first level title

ENS domain name transaction data analysis

first level title

secondary title

Data statement:

Data collection range: April 25, 2022 - July 7, 2022

There are some errors in the data captured by the API used this time. The reasons include using other ERC20 tokens as the settlement currency, errors caused by the API, and the transaction volume of a specific single NFT cannot be found in batch transactions. Ignore the data for various reasons of error. And ignore the transactions whose transaction amount is less than 0.001Ξ.

The subsequent data analysis of this article is inevitably wrong, and it is not used as any investment reference

secondary title

ENS Domain Name Classification:

Using the classification method in the ENS official API, a domain name has two attributes:

length: domain name character length

trait_type : domain name traits

digit: purely numeric domain name

letter: pure English letter domain name

alphanumeric: Contains only numbers and characters (Chinese, English, Arabic characters, etc. are all counted as characters)

secondary title

From the perspective of price range

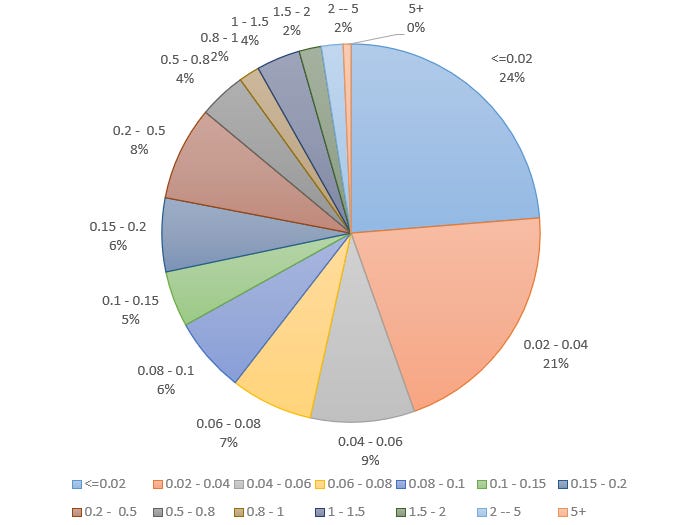

Among all transactions, the proportion of turnover <0.1Ξ was 66.94%, and the proportion of turnover <1Ξ was 91.84%. There are only 623 transactions with a turnover greater than >5Ξ, accounting for only 0.66%. Judging from the results of transaction data, low-priced ENS domain names are the mainstream of transactions. The data shows an average price of 0.344Ξ for all transactions. The 25th percentile price is 0.02Ξ, the 50th percentile (median) price is 0.05Ξ, and the 75th percentile is 0.18Ξ.

The transaction price>1Ξ contributed nearly 68% of the transaction amount with a proportion of nearly 8.16% of the transaction volume. In particular, transactions with a transaction price > 5Ξ accounted for 30% of the transaction quota with a transaction volume of 0.66% (623 transactions). Combined with the transaction volume, the transaction volume contributed by TOP 0.66% and 91.84% The trading volume contributed by exchanges is evenly matched.

secondary title

From the perspective of ENS domain name category

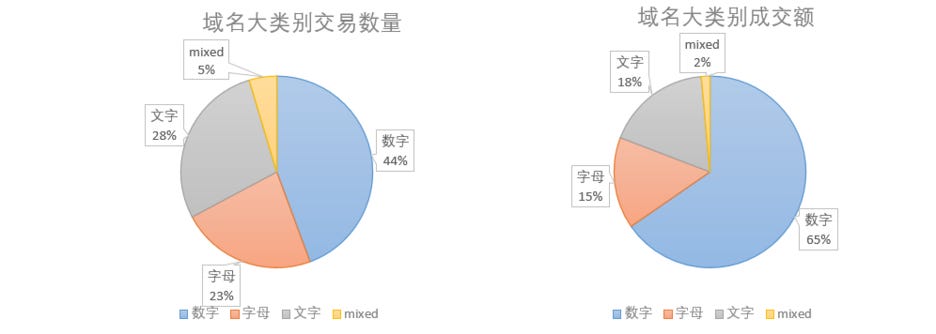

Judging from the median and average transaction prices of domain names in various categories, the average transaction price and median transaction price of only 3-digit domain names and 4-digit domain names can significantly exceed the gas fee when the ETH main network is congested. Except for these two categories of domain names, the average transaction price and median transaction price of other types of domain names are low. Combined with the characteristics of poor liquidity of NFT transactions, investing in these domain names may have high liquidity risks.

From the perspective of domain names, digital domain names are the largest component in terms of transaction volume and turnover. For other types of domain names, the volume-price relationship between the number of transactions and the amount of transactions does not match. To put it simply, digital domain names are well received and well received. Alphabetic and text domain names are popular but not popular, while mixed domain names are neither popular nor popular.

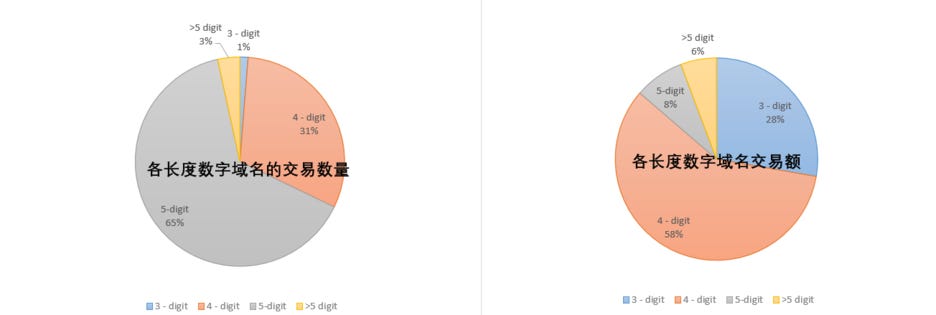

In the subdivision of digital domain names, 3-digit domain names accounted for 1% of the transaction volume and contributed 29% of the transaction amount. The 4-digit digital domain name accounts for a relatively large proportion of both the transaction volume and the transaction amount.

From the ratio of the TOP10-100 transactions of each digital domain name to the overall turnover, it can be seen that the top transaction amount of 3-digit and 5-digit domain names accounted for nearly 50%, indicating that some special domain names sold a far more than similar domain names. In essence, a small number of transactions inflated the overall transaction, rather than "common prosperity".

The data shows that the number of transactions of 3-digit domain names is 522, and the number of 3-digit domain names with transaction records is 344. The number of transactions of 4-digit domain names was 12,790, and the number of 4-digit domain names with transaction records was 6,135. The number of transactions of ≥5-digit domain names was 28,118, and the number of ≥5-digit domain names with transaction records was 24,418. From the above transaction data, it can be seen that the liquidity of 4-character domain names is the highest among digital domain names.

secondary title

Other types of domain names

For other types of domain names, there are too many domain name combinations, and the number of scarce domain names is relatively small. In the investment process of this type of domain name, the difficulty of selecting investment targets is far greater than that of digital domain names. Moreover, in these domain name transactions, TOP exchanges accounted for an excessively large proportion of the total transaction volume. Even with such a large proportion of top transaction volume, the average transaction price and median transaction price are still low. Compared with digital domain names, unless you encounter obviously better domain names, it is more difficult to invest.