The main points:

Original compilation: Frank

The main points:

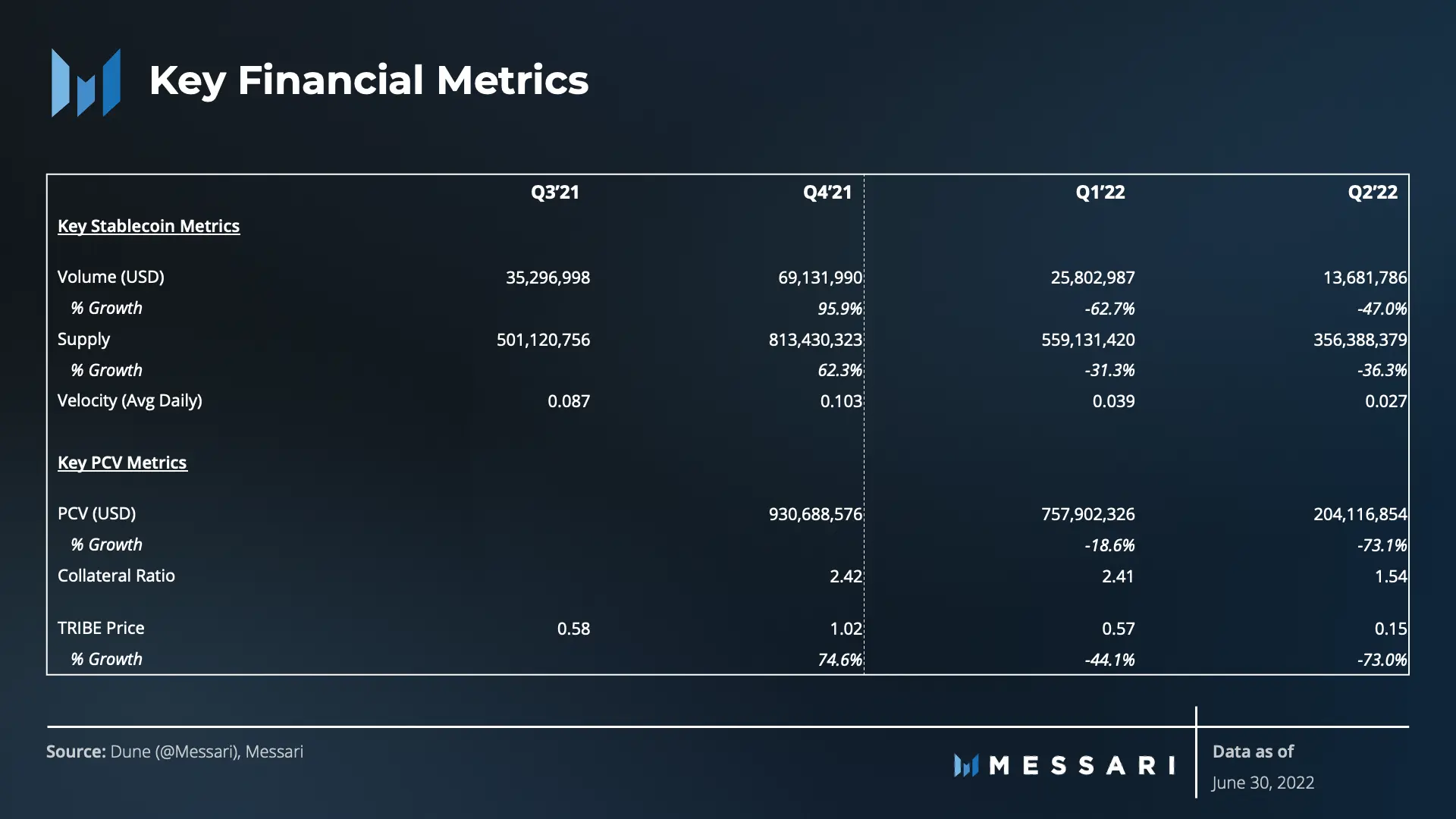

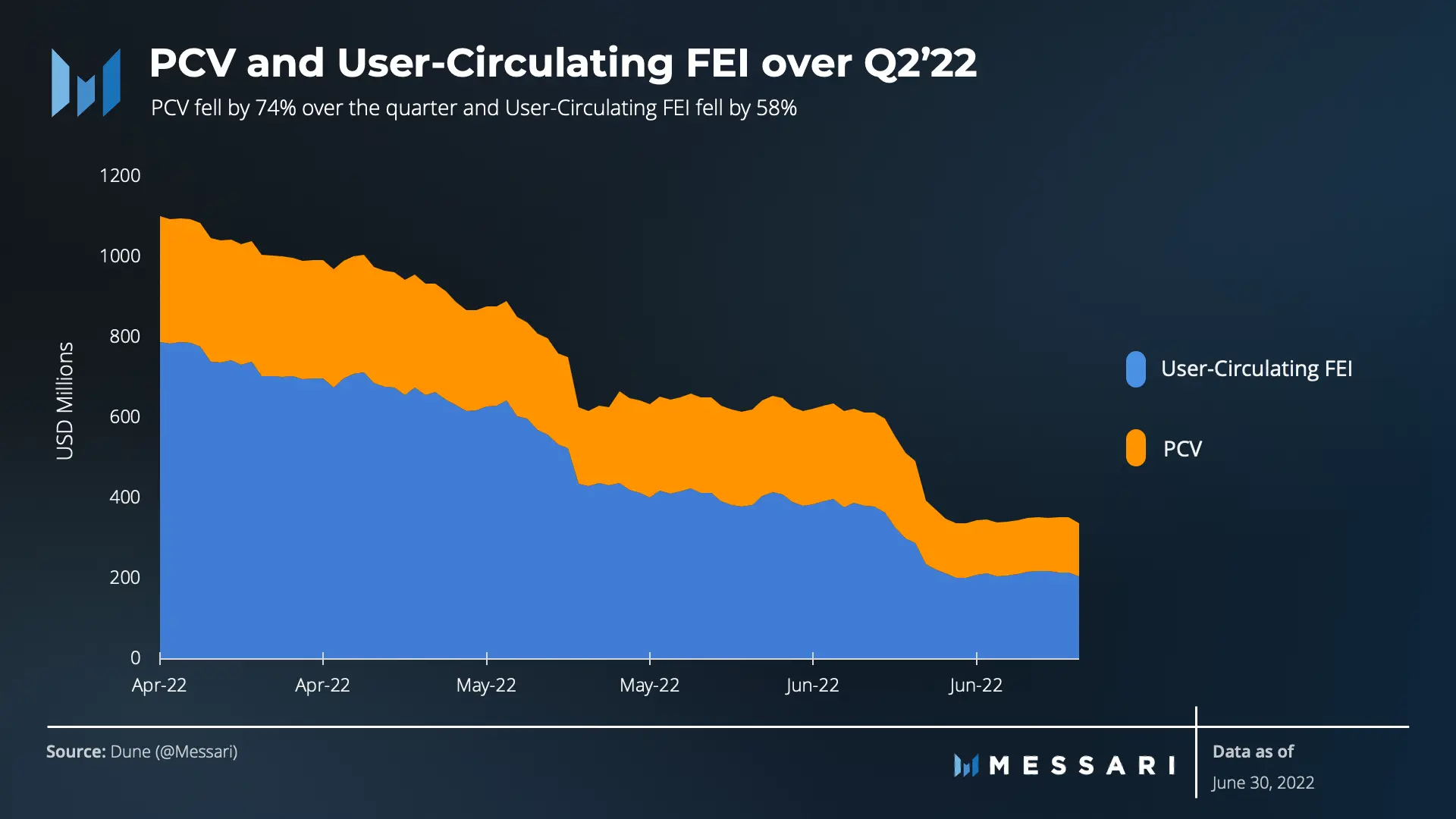

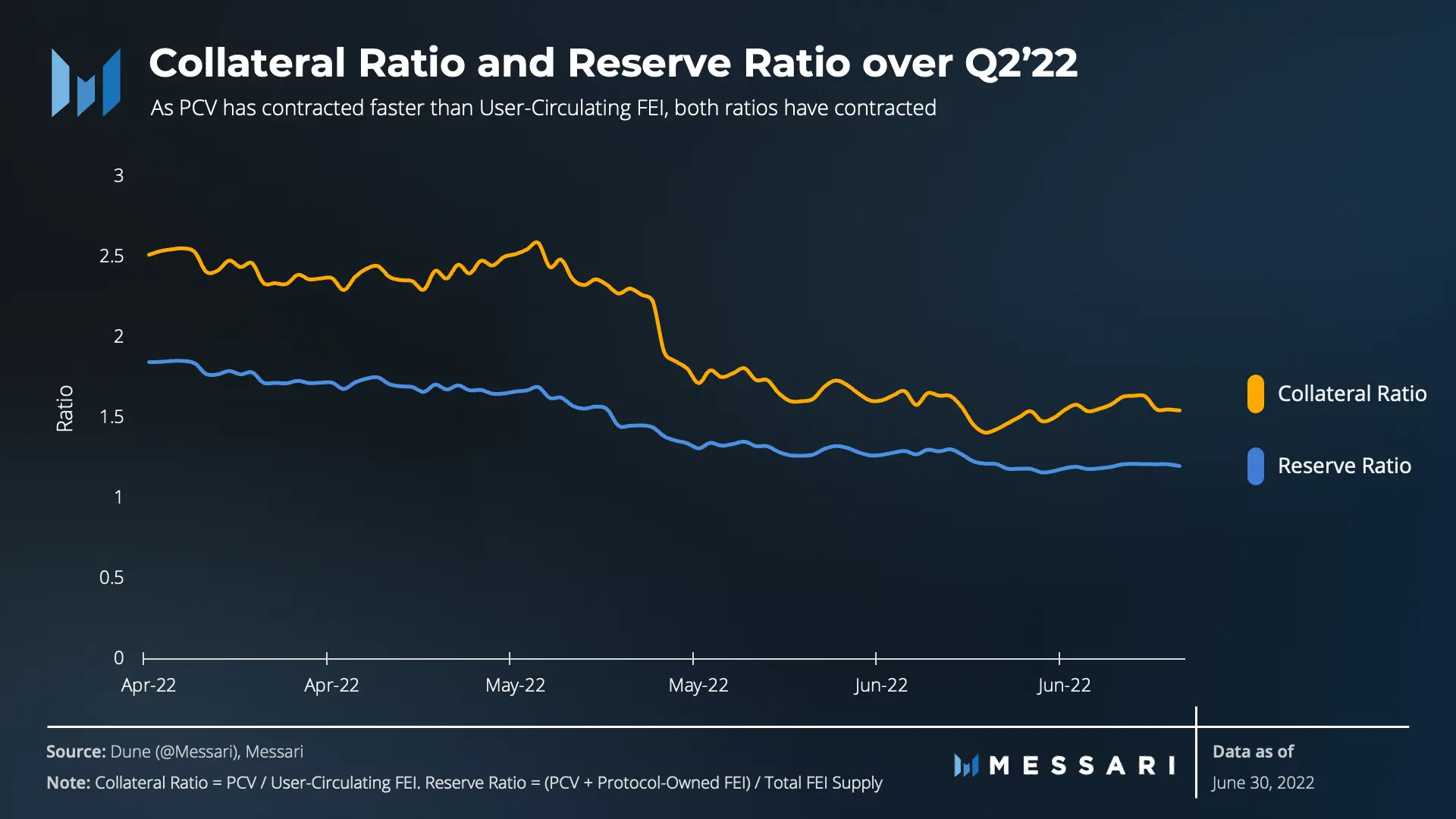

When the mortgage ratio drops from 2.41 to 1.54, Fei's priority is to keep the protocol control value (PCV) higher than the user's circulating FEI to support FEI's peg to the US dollar;

FEI's supply has fallen by more than 36% in the second quarter;

The new governance structure is functioning as intended, but some decisions require stronger consensus from the DAO;

The development of Rari is facing resistance. Its main product Fuse was hacked and lost 80 million US dollars. At the same time, the co-founder of Rari has also left;

Current market conditions make it necessary to delay product launches and focus on surviving first;

Getting Started with Fei Protocol

Fei Protocol

Launched in April 2021, Fei Protocol innovatively proposes Protocol Controlled Value (PCV) to support the algorithmic incentives it created to secure the stablecoin peg.

Since PCV is not debt or seigniorage, there is no risk of liquidation events or death spirals, the risk only depends on the value and volatility of PCV assets, and PCV is currently used to provide liquidity and earn income."Collateralization ratio" specifically refers to the ratio of FEI's circulating supply to the value of PCV, which is a key indicator for measuring the linkage status.

Fei V2

Launched in October 2021, Fei V2 removes the direct incentive mechanism that favors FEI’s 1:1 redemption of ETH, DAI, and LUSD, and manages the reserve pool that supports the minting/redemption mechanism through DAO. The current spread is 0.5%.

At the same time, as part of V2, DAO puts TRIBE (project governance token) on an equal footing with the stable currency FEI as a seigniorage tax——TRIBE is now able to benefit from PCV proceeds in the form of buybacks, and it will also play a supporting role if PCV is unable to support the existing stablecoin supply.

introduce

introduce

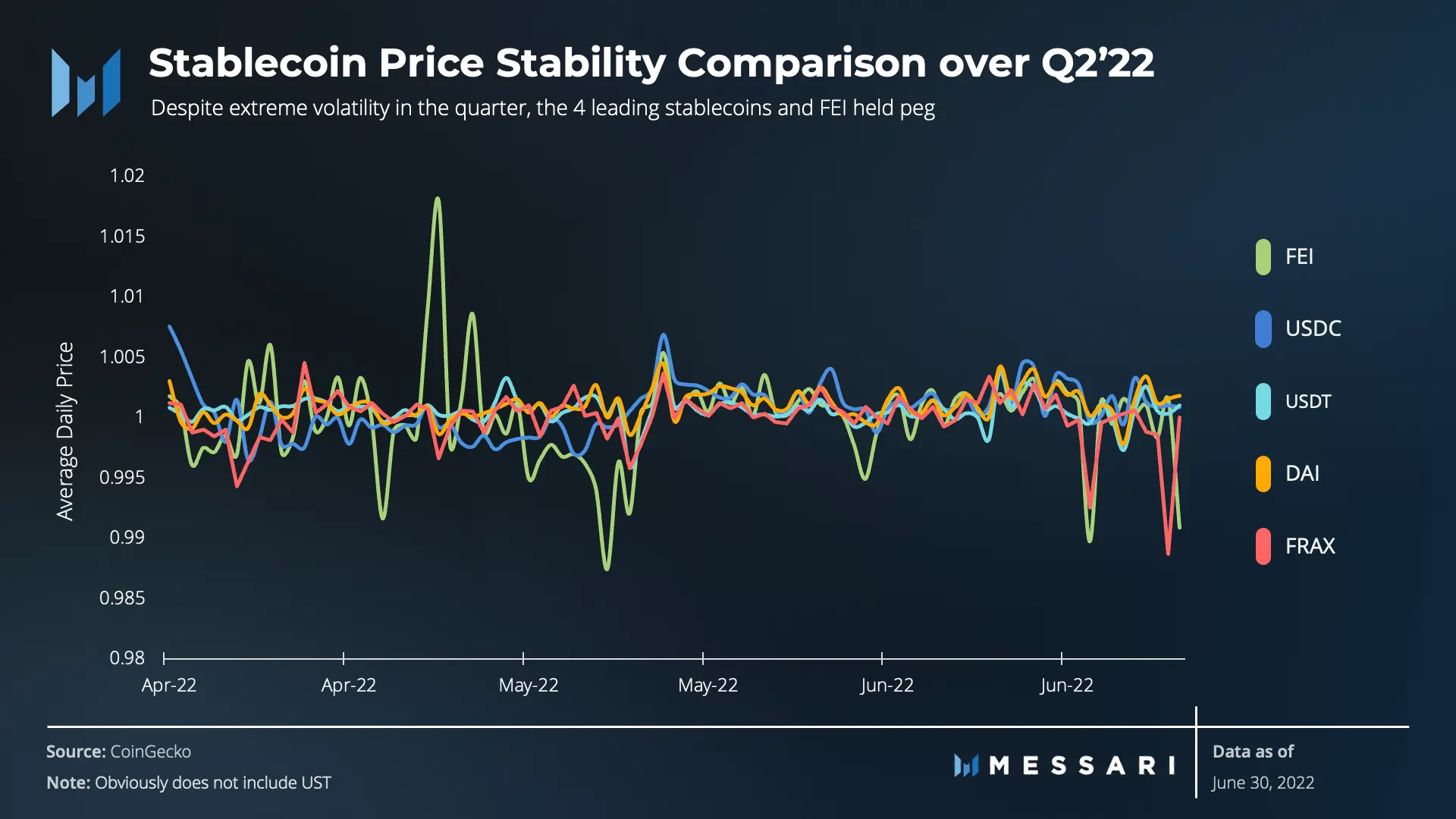

In the second quarter of this year, multiple stablecoins faced the test of decoupling, and FEI undoubtedly succeeded.

FEI aims to be a PCV-backed stablecoin, with the DAO controlling PCV and deciding how to allocate it, so a balance needs to be found between taking risks in developing PCV and retaining pegged support for FEI.

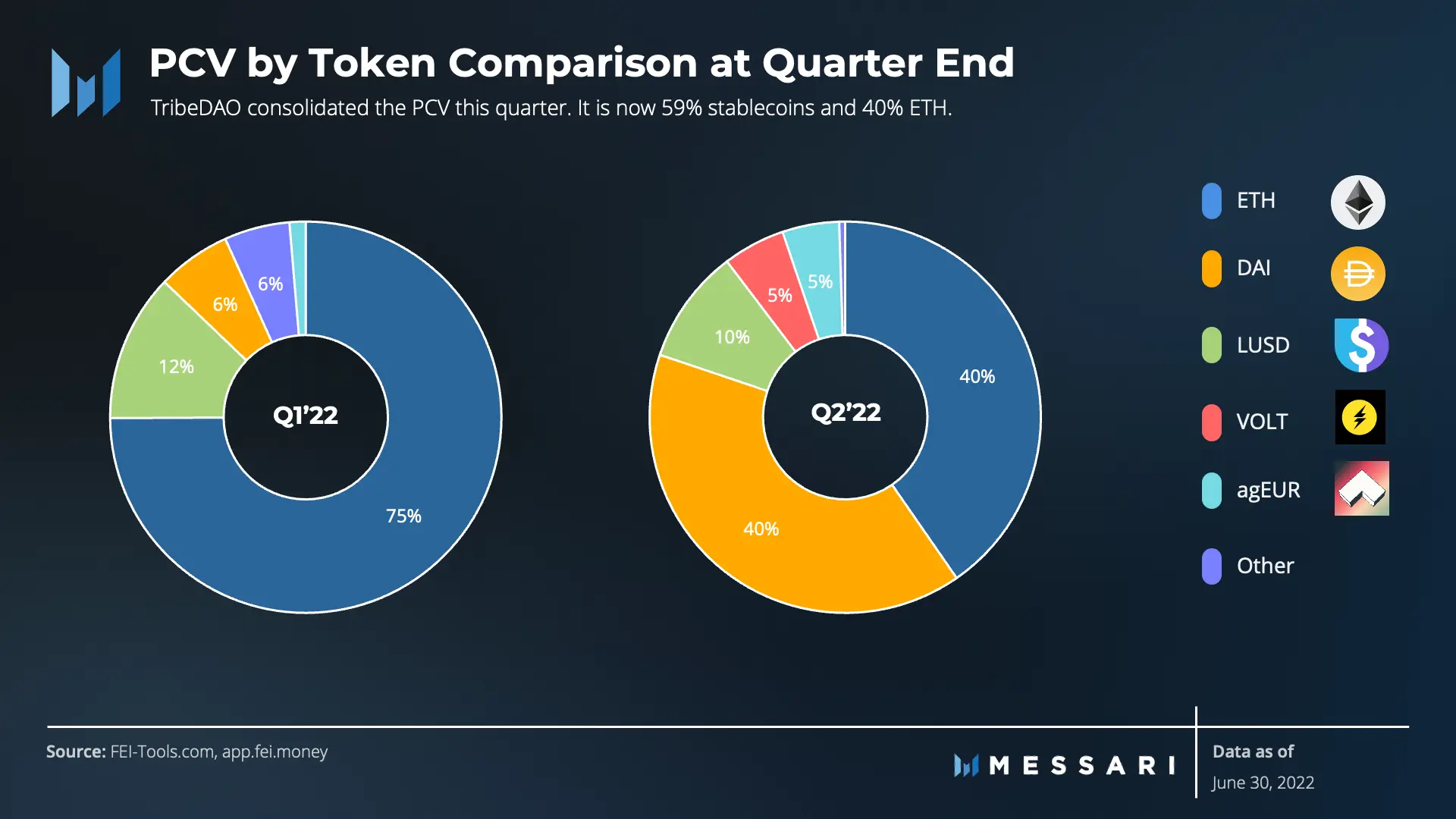

In fact, it doesn't matter which asset the protocol chooses as its PCV reserve in the second quarter of this year - almost all assets (denominated in USD) are down. Therefore, Fei DAO made many decisions in the second quarter to integrate PCV assets and increase stablecoin holdings.

On April 30, the fund pool of Rari Capital on Fuse was attacked, and the hackers made a profit of nearly 80 million US dollars.The Rari core team has also left, less than six months after the merger, Rari's core team has only one member left.

But another important change this quarter was the implementation of a new governance structure. Optimistic governance aims to speed up the easy decisions and slow down the hard ones.

The Tribe DAO Council is elected and has the authority to execute most transactions for the DAO, they are limited by a timelock, i.e. each action has a vetoable vote for the newly formed NopeDAO, all TRIBE holders can vote for NopeDAO proposal.

which likeSell ETH to add stablecoins backing FEIWhile some proposals ran into no issues, decisions like implementing Rari hack repayments took longer and the first attempt was rejected, governance discussions are currently underway to find the best approach.

TribeDAO has been working on a product to increase the adoption rate of FEI, and its target customers are other DAOs, butperformance analysis

performance analysis

FEI Stablecoin

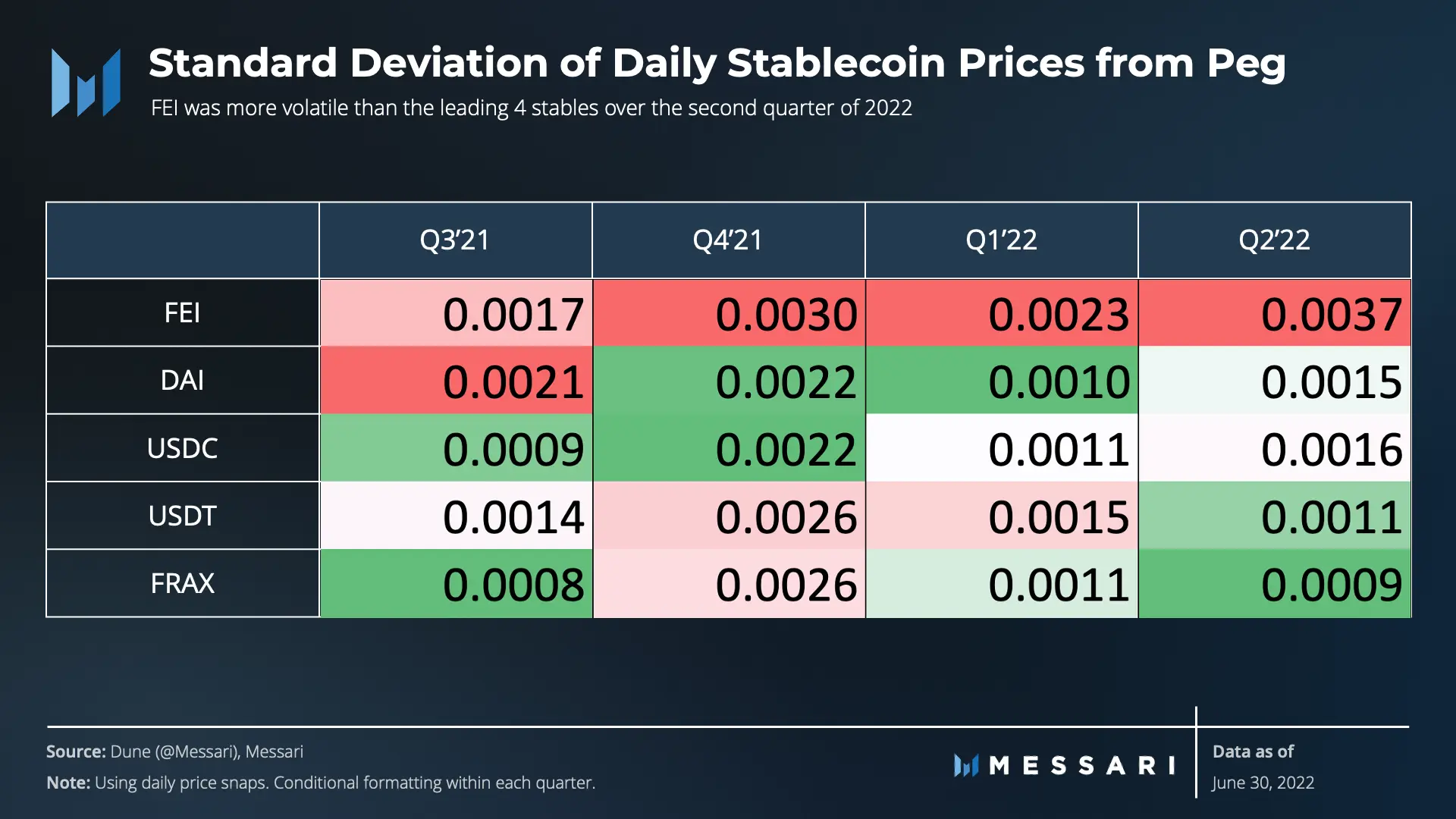

From the perspective of average daily prices, FEI is still more volatile than the four major stablecoins DAI, USDC, USDT, and FRAX in terms of anchoring the US dollar.

While increased adoption should help reduce this volatility, part of it is due to the design of the Price Stabilization Module (PSM):

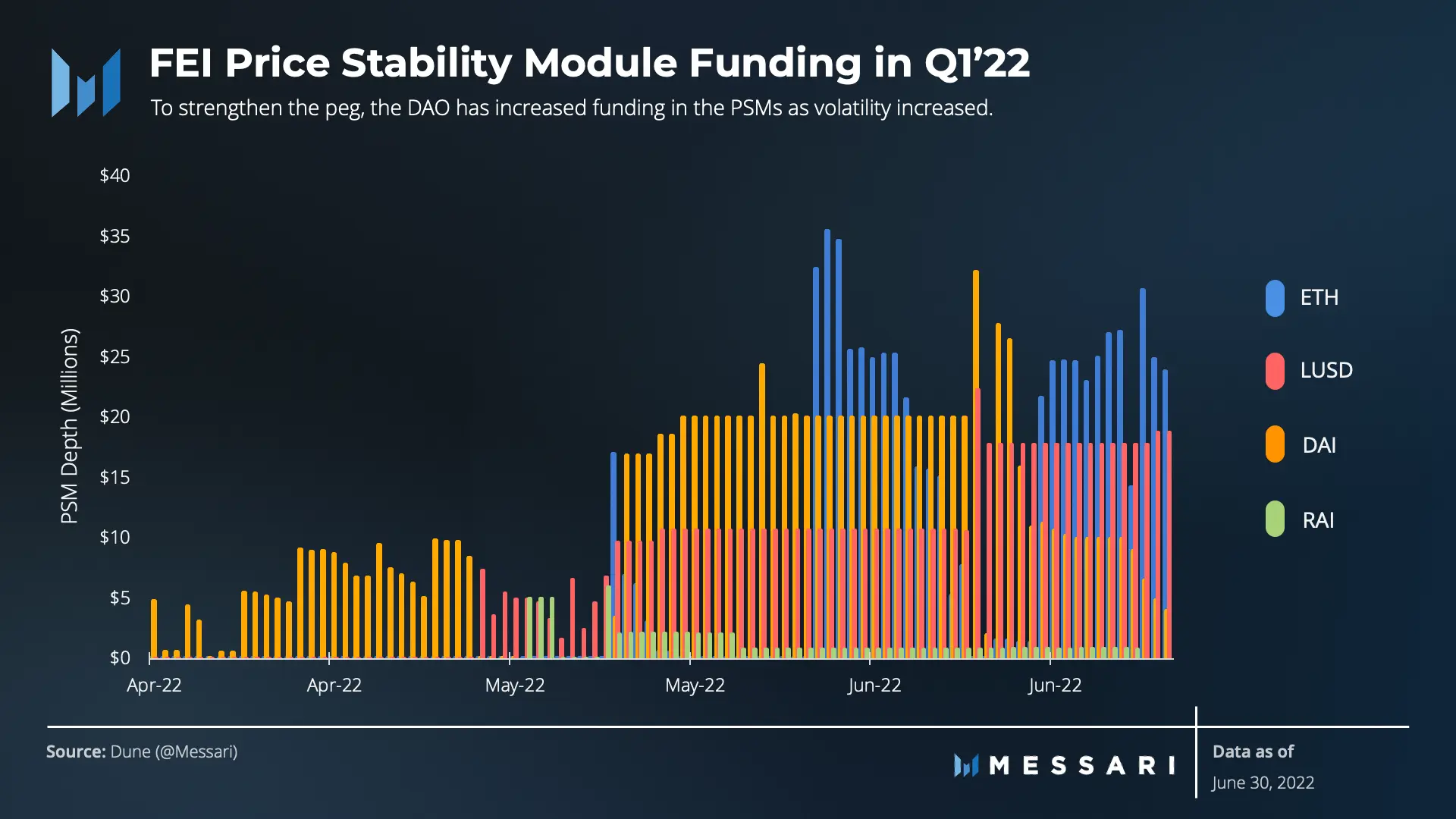

The main mechanism of the DAO management hook is also through PSM - FEI's PSM allows users to exchange FEI for DAI, LUSD, ETH and RAI, and the price of FEI in these PSM transactions is determined by the DAI TWAP oracle machine, in the case of DAI depeg Use a $1 oracle service.

DAO controls the funds of each PSM, there is no mandatory mechanism for peg when short positions, but in turbulent times, arbitrageurs usually have more opportunities to trade with PSM and help maintain the peg, DAO must also ensure that the mechanism can work properly.

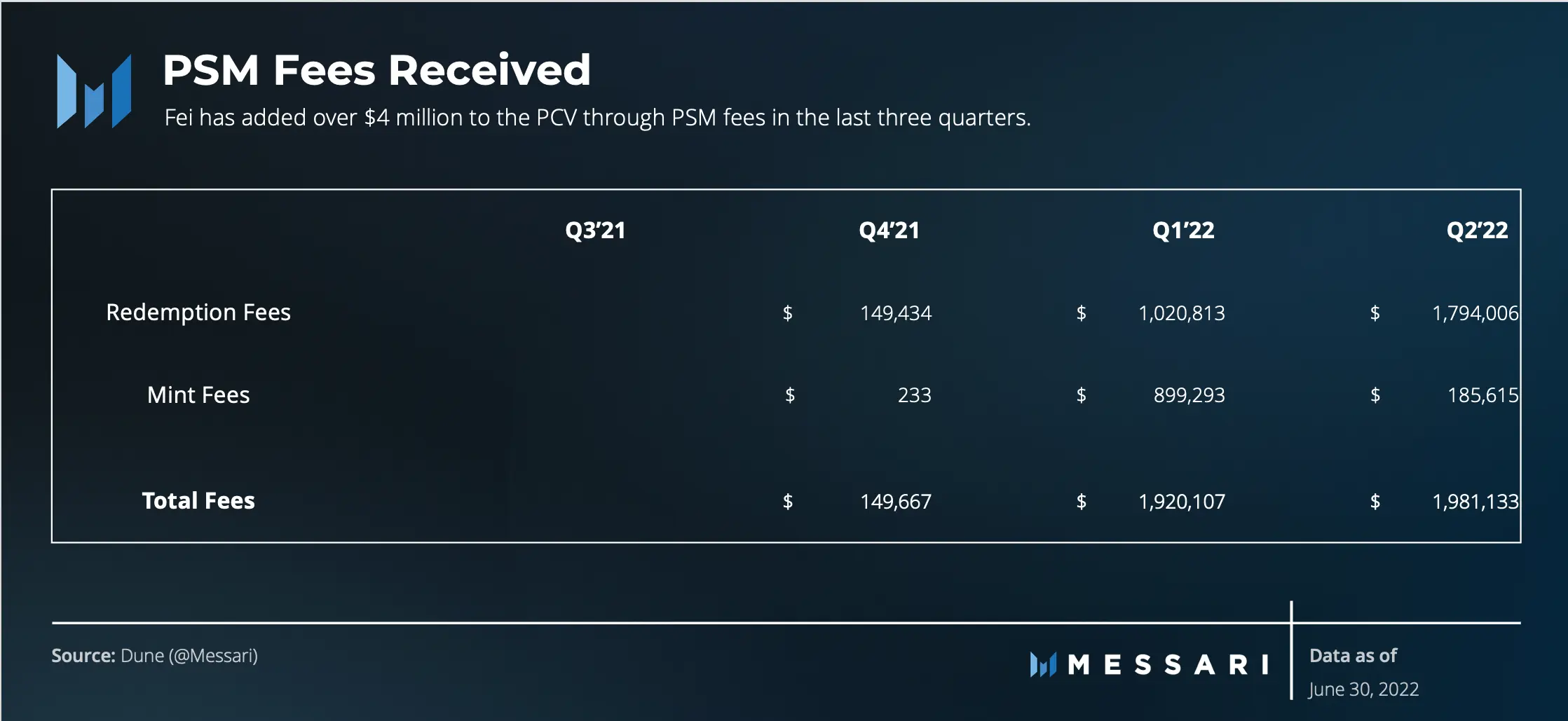

inThe DAO also incurs fees for minting and exchanging FEI while pegged, and they adjust these fees to incentivize/disincentive the use of PSM.

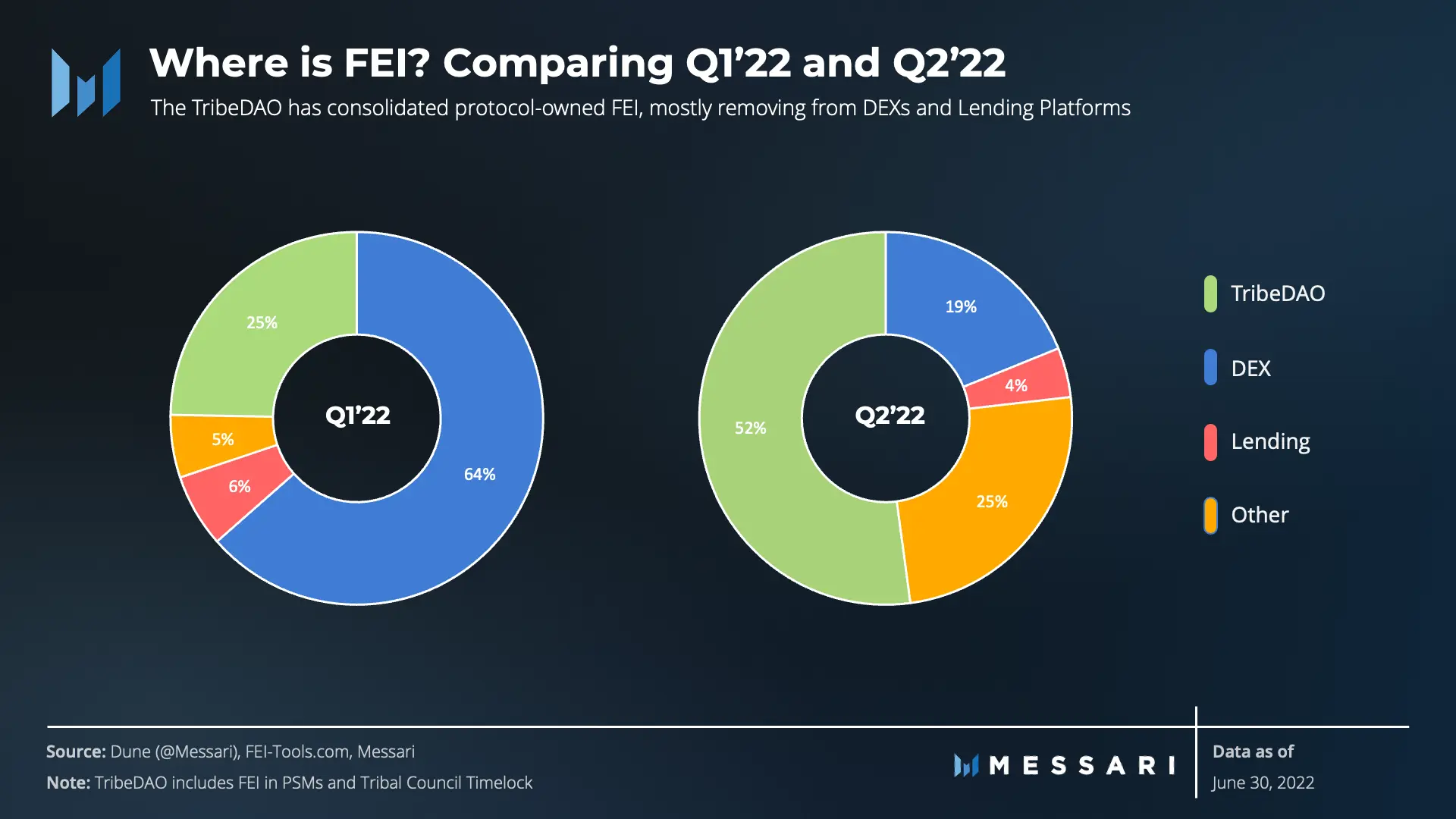

At present, most of the FEI is in the TribeDAO lockers (lockers), and the team has removed the FEI owned by the agreement from the loan market and DEX. In addition, since there are not many FEI used as collateral, FEI is currently used on DEX.

Protocol Controlled Value

Adverse market conditions, increased liabilities due to recent exploits, and increased FEI redemptions have all put pressure on the protocol's PCV. So the DAO voted to simplify its PCV distribution at the end of the quarter, increasing FEI's reliance on stablecoin backing.

We adjusted the reserve ratio (RR) to include FEI owned by the agreement in both assets and liabilities, soRR = (PCV + FEI owned by the protocol) / total supply of FEI.

This measure more accurately represents the DAO's current risk and ability to mint new FEI against PCV,Any minting of FEI will push this ratio towards 1, implying increased risk.But this measure has two limitations:

Once the ratio breaks 1, it is no longer useful as minting new FEI will push it back to 1;

It does not take into account FEI sitting idle in TribedDAO wallets after minting;

The Collateral Ratio (CR) previously used will therefore be retained, ie CR = PCV / User Circulating FEI, which we believe accurately represents the DAO's total borrowing capacity.

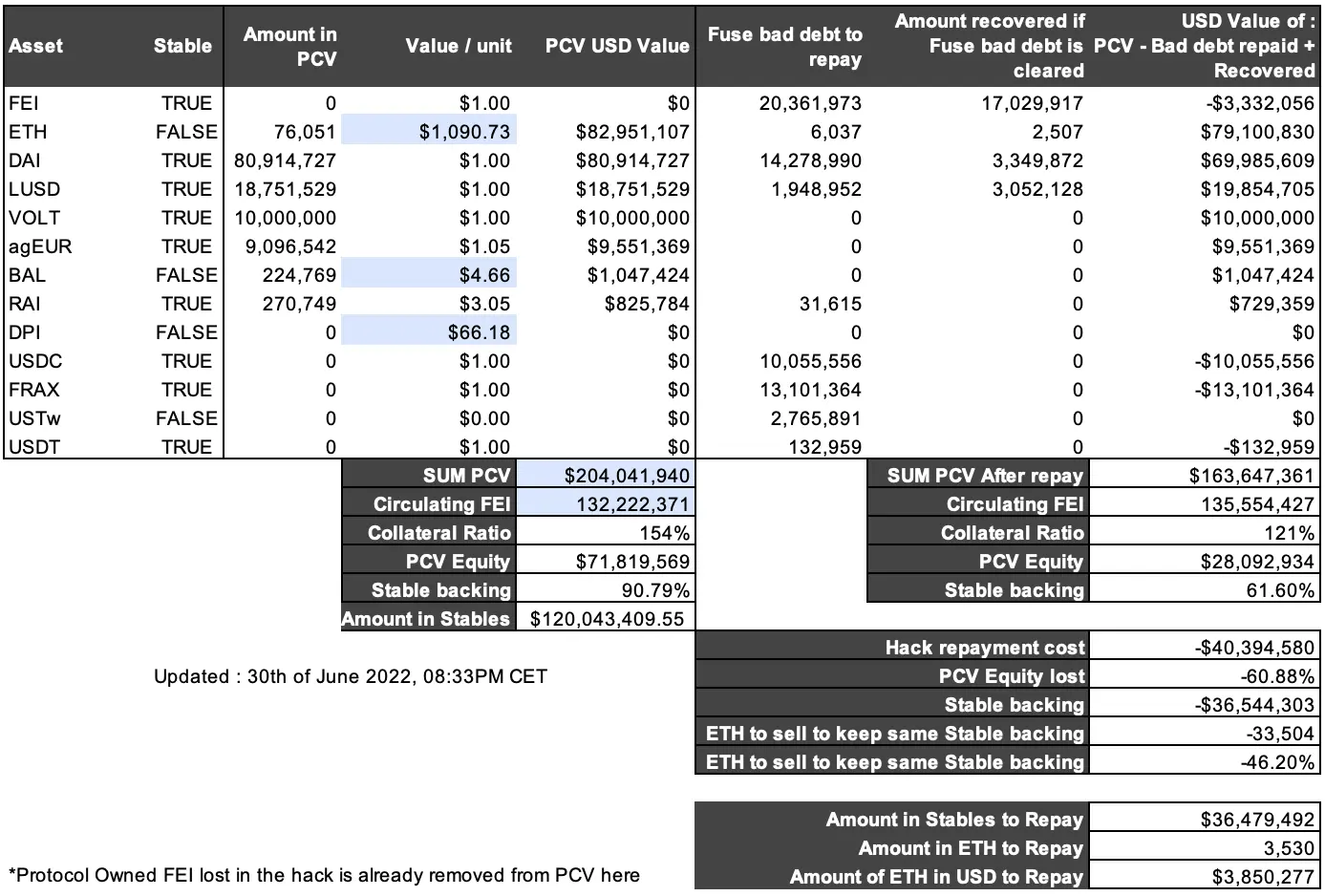

In order to enforce the repayment, the Tribal Committee mustAllocate existing PCV assets or sell assetsimage description

source:@Eswak(TribeDAO community members and contributors)

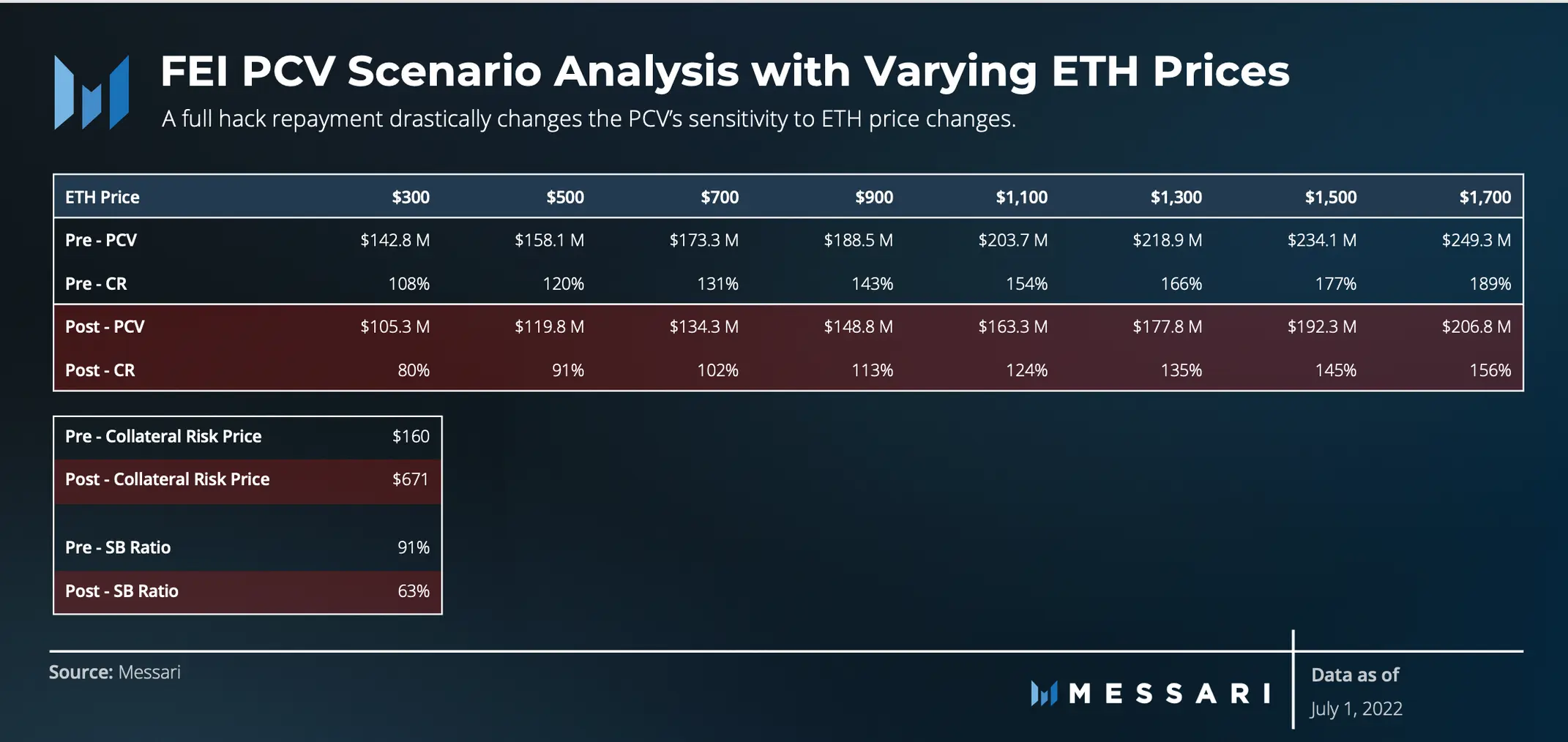

Assuming full repayment of hack victims at current prices (as of June 30, 2022), we updated the Collateral Ratio (CR) and Stable Backing Ratio (SB), we also ran a PCV scenario analysis based on different ETH prices.

The core team recommends using the Stable Support (SB) ratio, which helps inform the current market risk in PCV relative to the FEI used by users in circulation - with the recent PCV consolidation, the SB ratio is 91%, which means that even if ETH falls Its stablecoin liabilities can be covered up to $200 or less.

And if the DAO fully compensates for the hacker’s loss, it will change the situation dramatically - assuming full repayment and no change in PCV distribution, the SB ratio will drop to 63%, which means that ETH below $700 may would put FEI at risk.

TRIBE

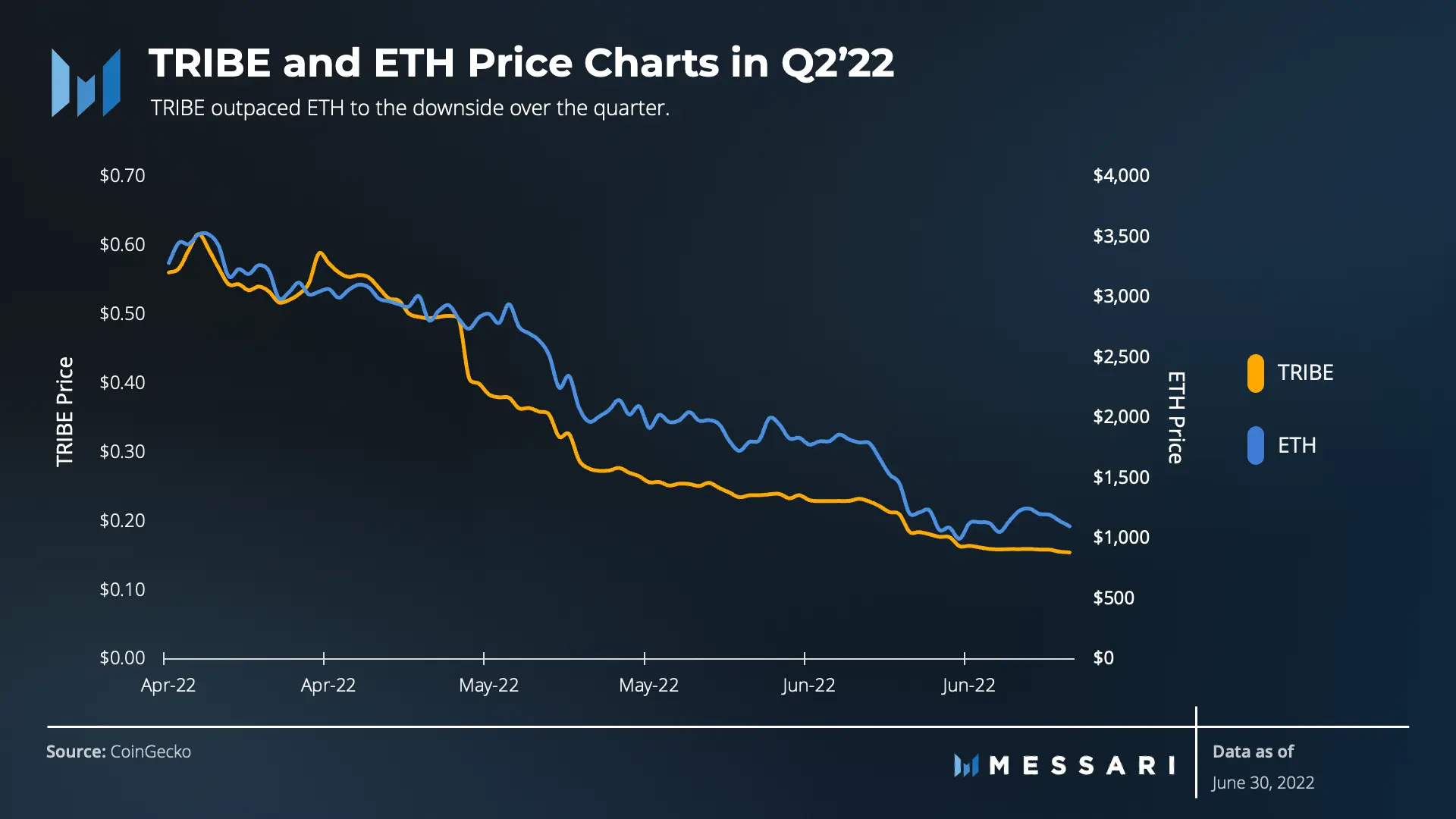

TRIBE is down 72% in Q2, while Ethereum is down 66%, and the token currently has a market cap of $124.8 million (as of June 30, 2022, assuming a TRIBE circulating supply of 832 million).

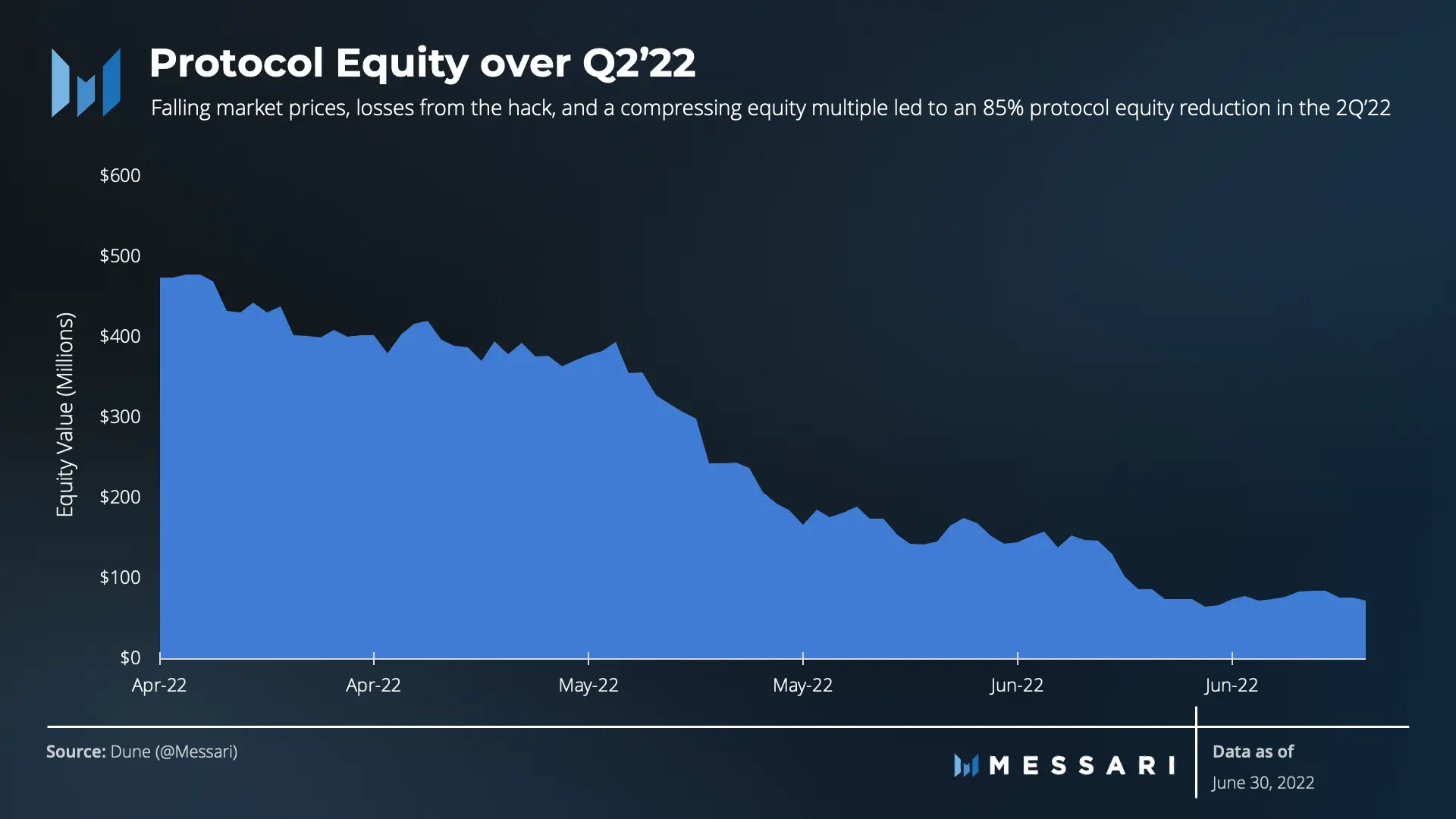

The equity value of the agreement can be measured by subtracting the FEI (liability) used by users in circulation from the PCV (asset).

We estimate that there are approximately 832 million TRIBEs in circulation and another 148 million TRIBEs will be attributed to Fei Labs, investors and individual contributors over the next 3 years.

If 832 million is used as the circulating supply, we calculate the TRIBE net value multiple by dividing the circulating market value by the protocol equity:

$125 million / [$204 million - $132 million] = 1.74 times

qualitative analysis

qualitative analysis

FEI Demand Drivers

Fei Protocol is focused on growing into a DAO-to-DAO (D2D) liquidity solution. inTurbo launches April 20, but failed to launch due to the Fuse hack and asset freeze.

Turbo can help DAO effectively revitalize treasury assets while increasing the liquidity of the protocol’s native tokens. The core measure is TribeDAO’s zero-interest stablecoin loan:

Among them, the borrower provides collateral (usually local treasury assets, which can be broadly referred to as TKN) and obtains the same amount of FEI. This part of FEI must be allocated to the loan pool and matched with the same amount of TKN, while the borrowed DAO and FEI will share fees and interest from this pool of loans.

In this way, the borrowed DAO can effectively use its treasury assets, and at the same time provide liquidity to the holders in the form of a stablecoin loan pool, and in return TribeDAO can also obtain income.

Will Turbo be a demand driver for FEI? Sure, because TKN holders add TKN as collateral and withdraw FEI, and vice versa. For example the first Turbo partner program is Balancer, and given the veBAL rewards, it might be economically attractive to buy FEI, deposit collateral, and withdraw BAL. Users can then participate in the veBAL tokenomics and earn income this way.

This setup is expected to reasonably drive demand for FEI, although there are certainly more changes and risks to the deal than discussed here.

PCV Yield Optimization

In a situation similar to FEI's demand growth, DAO is to create new revenue creation opportunities for FEI's PCV.

Historically, the main use of DAO for PCV has been to borrow money to mint FEI and deposit it in the Fuse pool, similar strategies have been adopted on DEXs of FEI/wETH or other trading pairs, but DAO's use of PCV to diversify and generate returns is also open to new use cases.

For example, before the PCV integration at the end of this quarter, the DAO leveraged its partnerships with other protocols to generate revenue. Two examples:

The DAO holds LUSD as a PCV asset and needs to fund its PSM. Therefore, DAO can also participate in the Liquity liquidation pool to obtain additional income (Liquity is a lending platform like MakerDAO, but the initial mortgage ratio requirement is smaller and the liquidation speed is faster);

governance

governance

Last quarter, TribeDAO voted to change its governance structure to Liquid Representative Democracy, with the DAO electing nine council members who manage Optimistic timelock multisig (5-of-9 multisig).

Tribe councils can implement virtually any change through timelocks - through NopeDAO's on-chain governance voting that gives TRIBE holders oversight over the Tribe council.

Fei-Frax Alliance

On May 18, Joey launchedFrax x Fei Stablecoin Alliance, FEI will replace UST in Curve 4pool and create a new FEI-FRAX-DAI 3pool on Balancer.

Summarize

Summarize

For Fei Protocol and TribeDAO, the second quarter of this year was a difficult one.

FEI is backed by a stable PCV, whileThe new governance structure may have saved the DAO as it preserved the PCV and refocused the community to find new solutions, but the structure also creates risks for future governance processes- May lead to a freeze in product development and protocol growth.

At the moment, for FEI, survival is the most important thing.