After freezing user withdrawals and transfers for about a month, the cryptocurrency lending platform Celsius officially announced today (14th) that the company has voluntarily filed for bankruptcy protection in the Southern District of New York, becoming the third largest cryptocurrency lender after Three Arrows Capital and Voyager Digital. Cryptocurrency operators who fell into the currency market crash.

Celsius will conduct a comprehensive reorganization in accordance with Chapter 11 of the U.S. Bankruptcy Code. It is estimated that it has more than 100,000 creditors, of which Pharos USD Fund SP and Pharos Fund SP are listed as the largest unsecured creditors. Other designated creditors include ICB Solutions, Caen Group LLC, Alameda Research, B2C2 and Covario AG, among others.

Celsius reported assets between $1 billion and $10 billion, with liabilities estimated to be equal, according to the filing. Celsius co-founder and CEO Alex Mashinsky said in a press release:

“This was the right decision for our community and company, and we have a strong and experienced team to lead Celsius through this process. I am confident that when we look back at Celsius’s history, we will see this A defining moment, with firm and confident action to serve the community and secure the company's future"

Celsius pointed out that filing for bankruptcy protection will provide the company with the opportunity to stabilize the business and complete a comprehensive restructuring to maximize value for all stakeholders. Celsius continued that the company also has $167 million in cash on hand to support the restructuring process. Some of the businesses in offer ample liquidity.

According to the arrangement of Chapter 11 of the "U.S. Bankruptcy Code", if the insolvent debtor successfully applies for bankruptcy protection, it will be able to keep the company's property and management control, and give the debtor and creditor considerable flexibility to cooperate in reorganizing the company and help the company to survive. difficulties.

On June 13 this year, Celsius cited "extreme market conditions" as an excuse to suspend user withdrawals, currency exchanges, and transfers, triggering further declines in the cryptocurrency market. In the next month, Celsius repaid a total of more than $1 billion in loans and outstanding debts, but there were also reports of insolvency, a deep liquidity crisis, and even the verge of bankruptcy.

Regulators in Alabama, Kentucky, New Jersey, Texas and Washington are currently investigating Celsius' business practices.

secondary title

What happened to Celsius?

Whether it is Celsius or BlockFi, the bankruptcy of all banking-like business models stems from the liquidity crisis, which can be divided into several situations:

1. Bad debt losses

In fact, all banks will have bad debts, but as long as they do not hurt their muscles and bones, it is not a particularly serious problem. The key depends on the scale of bad debts. The worst case is a huge deficit and insolvency.

2. Mismatch between current liabilities and non-current assets

Generally speaking, the term of the liability side is short, such as demand deposits; while the term of the asset side is relatively long, such as long-term loans, so as to obtain higher cash flow returns, but once a black swan event occurs, liquidity shortages are prone to occur. And lead to asset sell-offs and runs.

The interest rate spread is actually the compensation for the "bank" to bear the liquidity risk.

3. Withdrawal demand increases and liquidity decreases

Whether on-chain or off-chain, the financial market needs confidence most. Even traditional large banks are afraid of a run, because any bank will have a liquidity mismatch problem.

Unfortunately for Celsius, it has all of these problems.

If you have to talk about the fuse, the first is the decoupling of UST.

Celsius used to have $535 million in assets in Anchor Protocol. Since then, Nansen's on-chain data analysis has confirmed that Celsius is one of the seven giant whale wallets that contributed to the decoupling of UST.

That is to say, Celsius fled before UST was completely thunderstormed, and perhaps did not suffer much asset loss, but this severely hit market confidence and caused distrust of Celsius.

Since the decoupling of UST, the withdrawal of funds from Celsius has accelerated. From May 6th to May 14th, more than $750 million was lost.

Then, Celsius’s previous two theft incidents were exposed and fermented:

35,000 ETH lost on Stakehound

On June 22, 2021, Stakehound, an Eth2.0 pledge solution company, announced that it had lost the private keys of more than 38,000 ETH deposited on behalf of its customers. Later, through the analysis of the addresses on the chain, 35,000 of them belonged to Celsius, but Celsius has been concealing this. The incident has not been confirmed so far.

BadgerDAO Hack Loses $50 Million

In December 2021, BadgerDAO was hacked and suffered a loss of US$120.3 million, of which more than US$50 million came from Celsius, including about 2,100 BTC and 151 ETH.

A total loss of US$120 million will not destroy Celsius’s balance sheet. As a unicorn that has completed US$750 million in financing in 2021 and enjoyed the bull market dividend, its cash flow should be relatively healthy, but in fact it is not so optimism.

During the bull market, Celsius chose to expand into the mining industry and sprint to go public.

In June 2021, Celsius Network announced a $200 million investment in the Bitcoin mining industry, including the purchase of equipment and the acquisition of shares in Core Scientific.

In November 2021, Celsius will invest another US$300 million in the Bitcoin mining business, bringing the total investment to US$500 million.

In May 2022, Celsius Mining LLC, a wholly-owned subsidiary of Celsius, secretly submitted a draft registration statement of Form S-1 (Registration Form for Stock Listing Application) to the US Securities and Exchange Commission (SEC), kicking off the listing journey.

The mining industry is an investment project with heavy assets, high expenditures, and slow returns. It is difficult to withdraw funds quickly when the funds are trapped. Of course, the harsh market environment does not support high-valued IPOs.

In the current volatile market environment, Celsius has encountered another problem of liquidity mismatch.

Celsius allows assets to be redeemed at any time, but many assets are not liquid. If a large number of depositors run out, Celsius cannot meet the redemption needs. For example, Celsius has 73% of ETH locked in stETH or ETH2, and only 27% of ETH has liquidity .

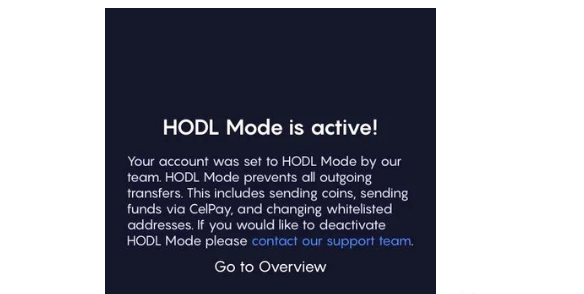

Under the impact of the run, Celsius continued to "operate" and developed the "HODL Mode", which prohibits users from withdrawing cash and needs to submit more documents and applications to cancel this mode. This seems to tell investors: We can't stand it anymore. Intensify the panic.

In order to cope with cash withdrawals and obtain liquidity, on the one hand, Celsius dumped assets such as BTC and ETH on a large scale, and on the other hand mortgaged assets through DeFi agreements such as AAVE and Compound, and lent stable coins such as USDC.

Celsius has $594 million in collateral on AAVE, of which more than $400 million is stETH, and has lent a total of $306 million in assets.

Celsius has over $441 million in collateral on Compound and $225 million in liabilities.

On Maker, Celsius has $546 million in assets and $279 million in liabilities.

It seems that the mortgage rate is acceptable, but it is actually dangerous.

The decoupling of stETH and the continuous decline in the prices of ETH and BTC forced it to increase asset collateral, and at the same time, the constant demand for withdrawals would reduce its current assets, so Celsius took the ultimate measure - prohibiting withdrawals, transactions and transfers.

In the dark forest of DeFi, Celsius has become the target of public criticism. Hunters lurk in the dark, ready to pull the trigger, snipe at its assets and liquidation lines, and pick up corpses.

It's a horrible vicious cycle:

Unable to obtain high returns—fund shortage—liquidity mismatch—run—mortgage assets—price drop—cover up—continue to fall—continue to run

At present, Celsius's balance sheet is still a black box, and perhaps desperately needs the rescue of the white knight. Nexo, a cryptocurrency lending platform, tweeted that it can acquire any remaining qualified assets of Celsius at any time, and Celsius responded lukewarm.

Some people also pin their hopes on Tether, an early investor in Celsius, the USDT issuer. However, Tether seems to just want to distance itself, saying that the ongoing crisis in Celsius has nothing to do with Tether and will not affect its USDT reserves.

Every round of bull-bear cycle conversion will always experience the pain of deleveraging, and there will always be people or institutions that become the "price" of being sacrificed. After the LUNA algorithmic stablecoin DeFi narrative is shattered, CeFi also ushered in a moment of narrative disillusionment.

Entrepreneurial madman Mashinsky has not had too many ups and downs in his life, and he is rebellious. Now, in the face of the cycle, he may have to bow his head and admit defeat to the market.

in conclusion

in conclusion

There is nothing new in the world. Looking at Celsius today, it is full of shadows of the former enterprise.

Growing wildly in the era of flooding liquidity, using high yields as a bait, frantically marketing and absorbing savings, expanding the debt side, when the lending business cannot meet the use of huge accumulated funds, it begins to invest wildly in foreign countries, real estate, listed company debt, VC LP... …In order to pursue higher returns, assets have sunk to the secondary, bad debts and capital mismatches have become the emperor’s new clothes.

Liquid music will always stop one day, and Buffett's famous saying will never go out of style. Only when the tide ebbs will you know who is swimming naked.

Self-knowledge is the most important thing in life. Whether it is US stocks or cryptocurrencies, the winners enjoy the Beta dividend after all. Most people’s wealth comes from cycles, not strength.

I hope this article will be of some help to you.

I hope this article will be of some help to you.