This year, the most critical time node for the Ethereum ecosystem (and even the entire blockchain technology field) is the "merge" (The Merge) of ETH1 and ETH2.

Although the official did not give an exact date for the "merger" to occur, according to V God's prediction, if all goes well, the "merger" may take place as early as August. At that time, the Ethereum consensus mechanism will change from Proof of Work (PoW) to Proof of Stake (PoS), and the ETH1 difficulty bomb will also be launched after the merger is completed (mid-September).

The impact of the "merger" will be all-round, and this article will focus on the Ethereum miners who bear the brunt.There is only more than one month left before the expected time of merger, how is their survival status? What countermeasures did they take for the mainnet merger? Will the Ethereum miners who have persisted for seven years since the first Ethereum block was dug out in July 2015 lose their jobs because there is no mine to mine?Odaily communicated with several miners to clarify the above issues.

1. "At least one more year of digging"

With the merger approaching, the Ethereum miners are not as anxious as the outside world imagined, and they are still optimistic about the future of the mining industry. Many miners even bluntly said that they don’t think the “merger” can be carried out as scheduled, conservatively estimating that “mining can last at least one year”.

"I think the possibility of Ethereum completing the merger this year is very low, and it may not be possible next year. If you look at the previous PoS tests, you will find that various bugs continue." Old miner A told Odaily, "According to the consistent adjustment of Ethereum There is a high probability that the merger in August will continue to be postponed.”

The situation that old A said does exist. The Ropsten test network merged in early June this year, and various bugs such as concurrency vulnerabilities, block proposal problems, and synchronization problems appeared one after another, causing 14% of validators to go offline during the transition period. Fortunately, in the end The merger was successfully completed on schedule. After learning lessons, the development team completed the merger of the Ethereum Sepolia testnet in early July; the last testnet merger (Goerli) before the mainnet merger is also on the agenda, but the specific time has not yet been determined.

According to the prediction of V God, the founder of Ethereum, if all goes well, the merger may be carried out as early as August; if other circumstances arise, it may be postponed to September or October. Ethereum developer Tim Beiko said that Ethereum is expected to merge between late August and November, and only catastrophic events or failures can stop this year's merger; date.

The uncertainty of the specific timing of the merger is one of the motivations for Ethereum miners to continue to persist.In addition, in the eyes of many miners,Even if the merger is completed, PoW mining will not be terminated immediately, but will continue to exist for a long time, in the "PoS+PoW" coexistence mode.

"After the merger is completed, it will take some time to verify the security; the project will not be migrated to PoS immediately, and the PoW chain still needs miners to maintain operation. This cycle is very long, and it may take one or two years." Miner Lao Jia believes that it is expected The ETH1 difficulty bomb that broke out in September this year will continue to be postponed, and miners will not face the situation of no mine to mine.

In addition, miners are not optimistic about the future of PoS. "After ETH is converted to PoS, it will completely become a digital bond, which may cause US regulatory intervention." Old A revealed,Several major mining machine manufacturers have expressed concern about the future regulatory difficulties of PoS, "With the entry of supervision, the community consensus may split, which may eventually lead to a fork of Ethereum. For me, mining an ETH can get airdrops of other forked coins, not to worry about the income issue."

2. After the currency price falls, ASIC chips are more resistant to risks

Positive predictions about the future have prompted ethereum miners to expand their operations.

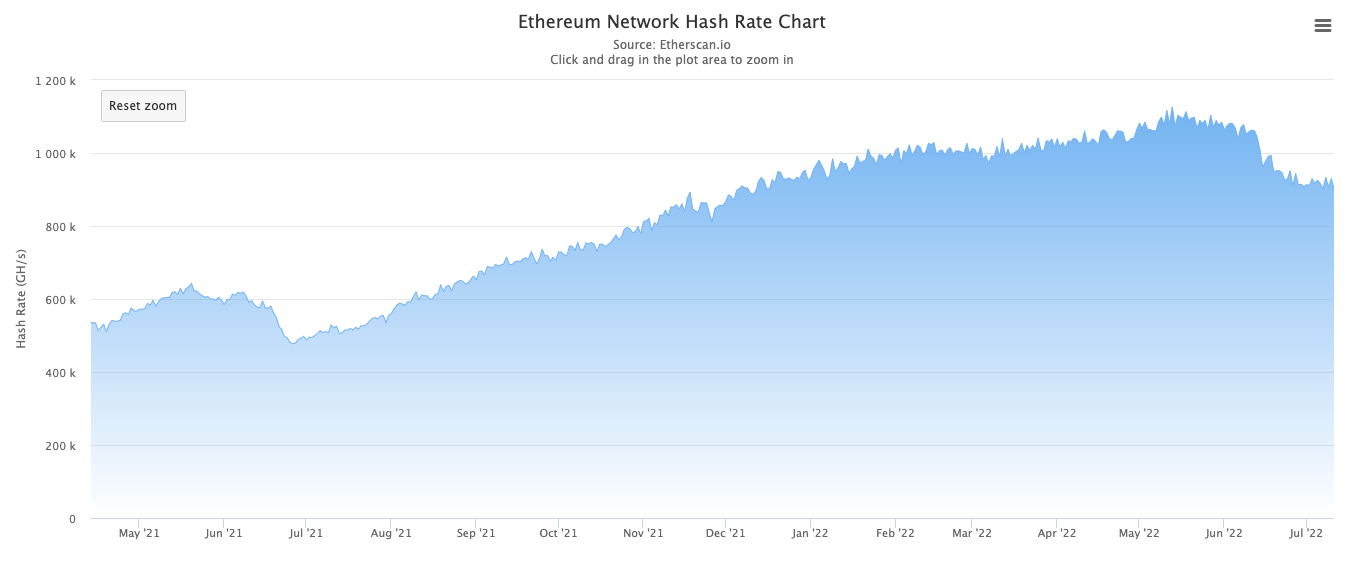

According to data from Etherscan, in June last year, when China cleared the mining farms, the computing power of Ethereum dropped to 480 TH/s when the entire network was interrupted; The historical record is 1126 TH/s, and the highest increase in the past year has exceeded 130%.

The rising computing power is partly due to the official arrival of the mining machine futures ordered early last year, and the large mines continue to expand production; the other part of the computing power is contributed by retail investors, especially in the second half of last year, when the price of ETH soared from $2,200 to $4800 (November 2021), driving retail FOMO sentiment. Slava Karpenko, CTO of 2Miners mining pool, which specializes in serving small miners and retail investors, said that since November last year, the number of active users of the organization has increased by 70% to about 120,000.

However, over the past month or so, the computing power of Ethereum’s entire network has experienced a slight correction. The data shows that the computing power of the entire network is currently reported at 930 TH/s, a drop of 17% compared to the high point.

The decline in computing power was mainly due to the cliff-like drop in the price of ETH, which once fell below $1,000 from $3,000 in early May to a minimum of $880, with a maximum drop of more than 70%. As a result, some mining machines were forced to drop below the shutdown price. shutdown. According to Glassnode data, the revenue of ETH miners in May decreased by 27% compared with April ($1.39 billion), and decreased by 57% compared with the same period last year.

However, many interviewed miners told Odaily,They started hedging as early as 2000-3000 US dollars, so the short-term downturn in currency prices has little impact on them. In addition, they feel that the current ETH price has been severely oversold and is in the bottoming stage, so they did not choose the "mining-withdrawal-sell" model, and gradually began to hoard coins.

In addition to using financial instruments for hedging,Some miners have chosen ASIC mining machines with higher mining efficiency since last year to improve their ability to resist risksAmong them, A10 and A11 of Innosilicon, Pineapple V1 of OmniVision and E9 of Antminer of Bitmain are very popular.

Take E9 as an example,antpoolminer In fact,

In fact,The price of ASIC mining machines is generally between (Ethereum) 100-200 US dollars, the decline in currency prices has little impact on it. Some miners, including old A, have gradually iterated some mining machines into ASIC mining machines since last year (old A chose to replace 100%). According to BitPro CEO Michael D'Aria, the current ratio of ASIC and GPU mining machines in the entire network is about 1:9, that is, only 10% of the computing power comes from ASIC; Bitsbetipping host Michael Carter believes that the proportion of ASIC computing power is higher than 10%, and may reach 20% to 30%.

As the price of ETH fell, the resale price of GPU mining machines in the second-hand market was almost halved, and even Nvidia's stock price began to fall. In the past three months, it fell from $286 to $152, a cumulative drop of 47%. Pierre Ferragu of New Street Research added that since the beginning of 2021, miners have bought about $3 billion worth of graphics cards, which are "now flooding the second-hand market."

Either way, as the market moves lower, it becomes more challenging for miners to recover their costs. Many miners also gave suggestions,It is not an excellent time to buy bottom graphics cards or buy ASIC mining machines, especially for retail investors, it is best not to choose heavy asset investment.

3. Dig until the last moment

"I am the "leek" who took over the mining machine at the high point last year, and now there is still one year before I can pay back. "Miner Xiao C bought 2 core-powered mining machines A10 last year, "I hope I can continue mining until the last moment. There's a lot of uncertainty here, and no one really knows what's going to happen. "

Fighting to the last moment is the current choice of Ethereum miners. It is not only a kind of emotional persistence, but also a consideration of interests. After all, compared with other PoW currencies, the mining income of Ethereum is still considerable. Once the day comes when there is no mine to dig, the miners will not really lose their jobs.

image description

(GPU mining)

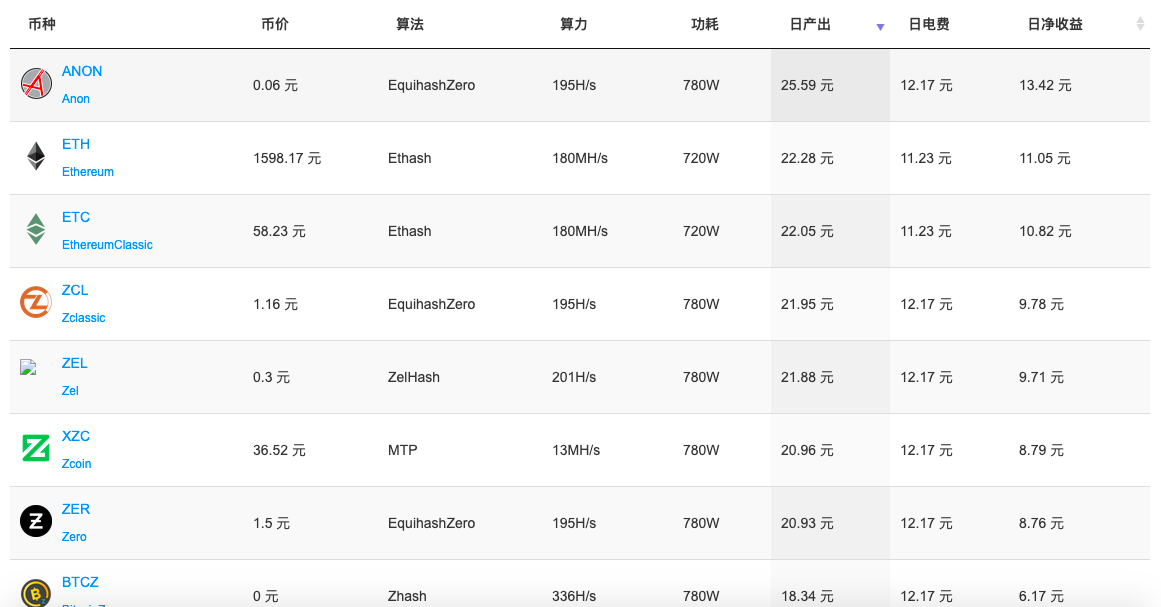

For GPU mining machines, there are relatively many directions to choose from. First of all, you can continue to mine other PoW tokens (ANON, ETC, Zcash, Zclassic, ZEL, etc.) - of course, the more computing power cut in, the greater the competition, and the lower the income. Secondly, the GPU can also provide high-performance computing, rendering and other services for the Web3 middleware protocol. For example, Hut 8 will open its data center as a node operator/provider for Web3 protocols such as Render Network.

“There are other uses for these GPUs: you can turn it into a render farm, you can do different machine learning options. They just won’t be as profitable as mining,” miner Petzold explained.