TL;DR

1. zkSync is in the early stages of development, and a large number of applications have not yet been launched. The applications that have been launched are mainly DEX, DeFi, bridges, infrastructure, and NFT that provide basic functions.

2. zkSync 1.0 is positioned as a payment solution, and 2.0 solves the "combinable" problem. To achieve breakthrough development, zkSync needs to find an irreplaceable development direction, and also needs to build a differentiated advantage for StarkWare.

3. The originality and innovation of the zkSync ecological project, and the "privacy" to be realized in the next stage can become the scalable advantages of zkSync.

For these reasons, ZK Rollup is widely supported as Layer 2. For example, the wallet project Argent once expressed its preference for the ZK system. Argent stated that it will not support the Optimistic Rollup ecology because it will focus on zkSync and StarkNet of the ZK system.

Ethereum Layer 2 has obvious security and decentralization advantages over alt L1. Competing public chains are often exposed to downtime and security incidents, and Layer2 rarely has such news.

Among all Layer 2, the Layer 2 of the ZK Rollup system is the most orthodox branch of Ethereum. It is the most secure among all Layer2. Moreover, as the number of transactions increases, the transaction fee shared by each person will decrease, which has a better expansion effect.

For these reasons, ZK Rollup is widely supported as Layer 2. For example, the wallet project Argent once expressed its preference for the ZK system. Argent stated that it will not support the Optimistic Rollup ecology because it will focus on zkSync and StarkNet of the ZK system.

image description

first level title

1 Introduction

1 Introduction

zkSync is Layer 2 developed by Matter Labs, using ZK Rollup technology. zkSync initially focused on the expansion of payment scenarios. Because of the low gas fee, many users use zkSync 1.0 to make Gitcoin donations.

In June 2021, Matter Labs launched zkSync 2.0, which is dedicated to solving the composability problem among DAPPs and further improving the expansion effect.

As far as the development stage is concerned, zkSync has achieved the goals of "scalable payment" and "smart contract" in the roadmap. Now the official focus is on upgrading version 2.0 (still in the testnet stage), and the "smart contract" and "combinability "There should be more efforts and improvements in the attempt.

secondary title

2. Financing information

According to Crunchbase, Matter Labs has completed a total of 3 rounds of financing (seed round, A round, B round), with a total of 58 million US dollars.

secondary title

3. On-chain data

TVL:$58.33 million. Among them, ETH and stable coins are the main force of the lock-up amount. The total lock-up value of the zkSync ecosystem is at the middle to lower level among the mainstream Layer 2.

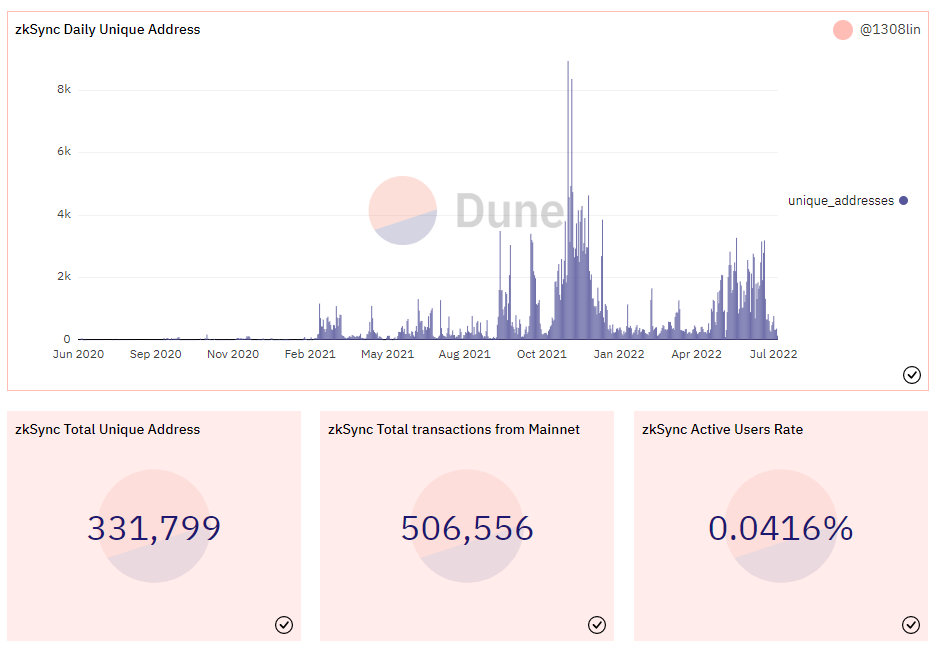

Number of independent addresses:Source: Dune Analytics

Source: Dune Analytics

In the past two weeks, the zkSync ecosystem has only a few hundred active addresses per day on average, and the number of daily transactions is only a few hundred, which is far lower than the tens of thousands of transactions per day of Optimism.

This shows that users are optimistic about the overall development of zkSync and have deployed zkSync addresses in advance, but the ecology has not yet developed to a stage where users are trading daily.

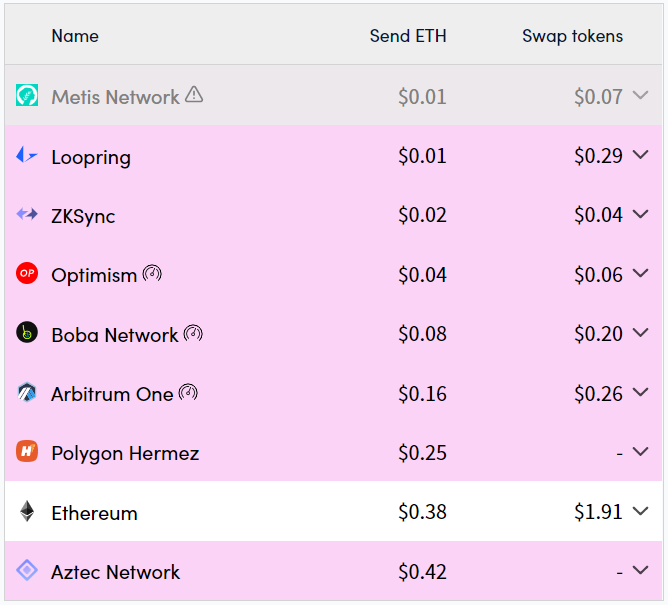

Gas fee:image description

Layer2 gas fee comparison source: l2fees.info

first level title

zkSync ecological application

zkSync is still in the early stages of development, which is reflected in the ecological application dimension, mainly because a large number of projects have not been launched yet, and the projects that have been launched are mainly DeFi and infrastructure applications, and the track is relatively limited.

secondary title

1. DEX

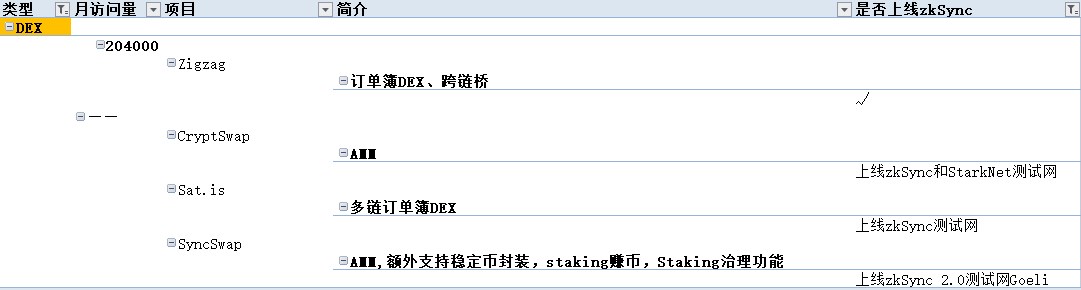

There are 11 DEX projects counted by Beep News, of which only 4 have been launched on the main network or test network.

image description

4 DEXs already available on zkSync Source: Beep News

secondary title

2. DeFi

DeFi is the most explorable track at the current stage of zkSync. DeFi goes beyond the basic DEX scenario, and there is a certain room for innovation for project parties. In terms of lending, portfolio management, and perpetual contracts, there are already some cases for the zkSync ecological project to learn from.

In the zkSync ecosystem, many innovative DeFi projects have been deployed on other networks, such as Gro Protocol, which focuses on stablecoin income, and Babylon Finance, an asset management protocol. Most of these projects are not listed in zkSync.

zkSync’s native DeFi applications such as Mute.io and Trustless’ attempts to DeFi focus on basic functions such as staking and farming. Increment is committed to building a sustainable swap, which is a relatively bold attempt and has not yet launched.

DeFi is also the track most favored by investment institutions. Among the 16 projects counted by Beep News, 7 have financing information, a higher proportion than other tracks. Most of the DeFi projects deployed by institutions are also not online.

image description

secondary title

3. Infrastructure

Infrastructure and wallets are the other two tracks that institutions are keen to invest in. The infrastructure is mainly the general-purpose infrastructure of the whole chain such as ChainLink and The Graph. These projects have very high website traffic, reflecting a high usage rate.

Wallets in the zkSync ecosystem are special compared to other ecosystems. Some general-purpose wallets deployed in multiple chains, such as Coinbase Wallet, are not suitable for Layer 2 of the ZK Rollup system. Argent is the most important wallet in Layer 2 of the ZK Rollup series, and is unique to Layer 2 of the ZK Rollup series.

first level title

secondary title

1. A large number of projects are not online

As mentioned many times above, there are a large number of projects in the zkSync ecosystem that are not online. The projects that have been launched are mainly DAPPs that provide basic functions, such as AMM, cross-chain bridge, DeFi that supports farming and pledge, wallets, etc.

This is related to the difficulty of developing Layer 2 of the ZK Rollup system. zkSync is not as compatible with Ethereum as Optimism and Arbitrum (zkSync 2.0 test network is also compatible with EVM, but not fully compatible or equivalent to EVM like OP and Arbitrum), which leads to resistance for projects in the Ethereum ecosystem to migrate to zkSync. It is more difficult to deploy in zkSync.

So we see that there are relatively few projects that have been launched, and the track is relatively limited. Among the 60 projects counted by Beep News, less than 60% have been launched.

secondary title

2. There are many native applications

The poor compatibility of EVM also brings about the second feature of the zkSync ecosystem, that is, there are more native projects. In the zkSync ecosystem, we have not seen a large number of projects like Arbitrum and Optimism migrating from the Ethereum ecosystem. Except for infrastructure, most projects are native to zkSync or ZK Rollup.

On the one hand, the composable implementation between DAPPs is relatively slow. On the other hand, it also means that project deployment has a certain technical threshold, and projects deployed to zkSync generally have relatively strong technical capabilities.

Compared with directly migrating projects from Ethereum (or copying open source code to make a forked version) + directly realizing nestable and combinable projects, projects in the zkSync ecosystem are required to be more "self-reliant", which provides soil for innovation.

Among the 60 projects counted by Beep News, only about 23% were deployed to ZK and OP systems at the same time. The proportion of projects specially deployed to zkSync (not deployed to Arbitrum, Optimism, StarkWare) is close to 50%.

first level title

zkSync Valuation

At present, there is no clear statement on the valuation of zkSync, but the following data can provide some reference significance.

StarkWare's total financing amount is 273 million US dollars, and the latest round of financing is 100 million US dollars, with a valuation of 8 billion US dollars.

Arbitrum’s total funding is $123.7 million, with the latest round of financing at $100 million at a valuation of $1.2 billion.

Optimism’s total financing amount is 178.5 million US dollars, and the latest round of financing is 150 million US dollars, with a valuation of 1.65 billion US dollars.

So far, zkSync has completed a total of $58 million in financing. As the top four seed players on the Layer 2 track, and an important ecology of the ZK Rollup track with more potential in the long run, zkSync embodies the market's expectations for the development of the ZK Series Layer 2. Whether it is funds or market sentiment, zkSync has sufficient support.

In addition, zkSync also promises that there will be ecologically native tokens. In the future, zkSync will be decentralized, and users can become network verifiers by staking tokens. This has a relatively large incentive effect on the market.

first level title

Challenges and Future Prospects of zkSync

The challenges zkSync faces mainly come from alt L1 and Layer 2, which is highly compatible with EVM.

Competitive public chains have sufficient funds, and because their operations are more centralized, they bring better user experience. These advantages have attracted enough users and funds for competing public chains. We have seen the development of Solana and Avalanche in recent years. However, due to the downtime of competing public chains and frequent security incidents,Security and decentralization are the biggest advantages of zkSync over competing public chains.

In the Layer 2 track, in the short term, zkSync's main competitors are Arbitrum and Optimism. In the long run, zkSync and StarkWare will compete in the ZK Rollup series Layer 2.

Because Arbitrum and Optimism adopt Optimistic Rollup, they are technically better than ZK Rollup, so they are compatible with Ethereum and the development of the ecology itself is faster than zkSync.

Arbitrum and Optimism have already gained first-mover advantage. The projects, users, and transaction data in both ecology are better than zkSync. And zkSync is still stuck in the development progress.also,

also,zkSync also needs to build a moat and develop ecological features.Just as Optimism emphasizes the development of public goods, and Arbitrum emphasizes first-mover advantages and ecological incentives, zkSync also needs to find an irreplaceable development direction or application track.

The original intention of zkSync is to provide a low-cost payment solution, and it has been recognized by the market. Many users participate in Gitcoin donations through zkSync 1.0. In the payment scenario, zkSync also specially developed the zkSync Checkout tool to support users to transfer funds to different payees in batches. Therefore, zkSync 1.0 has a very clear and effective positioning for payment scenarios.

As zkSync 2.0 is expected to be launched on the mainnet, zkSync's "combinability" goal is also put on the agenda. In the 2.0 test network, the biggest feature of zkSync is that the ecological project is original, unique, innovative, and high-quality. These may be scalable advantages.

In the future, "privacy" will also be written into the zkSync ecological gene. At present, the Layer 2 that emphasizes privacy attributes seems to be only Aztec. This is also a possible development direction.

However, the premise of all this is that zkSync can expand the ecology, get rid of the poor ecological situation in the early stage, and make up for the shortcomings in EVM compatibility and DAPP composability. Eco-incentive schemes may help.

Finally, as the same Layer 2 of the ZK Rollup system, StarkWare's current development data is better than zkSync, especially the data of StarkEx.How to build differentiated advantages in ZK Rollup Layer2 is also a question that zkSync should think about.