Originally Posted by Kunal Goel, Analyst, Messari

key points

OpenSea continues to dominate the NFT market landscape. Although its decentralized competitors X2Y2 and LooksRare will incentivize NFT transactions and obtain a certain market share of transaction volume, they have not obtained significant user volume and transaction volume share.

Uniswap’s acquisition of NFT market aggregator Genie may give challengers their biggest chance to take on the king.

Even after adjusting for market capitalization differences, the fundamentals of the rest of the alternative NFT market are less than impressive.

OpenSeaMaintain the dominance of the NFT trading market throughout 2021, accounting for 80% of the market share. Its near-monopoly position allows it to build a strong brand, maintain centralized ownership, and charge high transaction fees of 2.5%.

Recently, however, several alternatives have emerged that challenge OpenSea's dominance. Chief among these is the launch in the first quarter of 2022X2Y2 and LooksRare. Are they effectively gaining market share? Now that the mania for NFTs has faded, do their native tokens present a compelling investment opportunity?

challenger appears

X2Y2 and LooksRare have pitched themselves as decentralized, community-owned alternatives to OpenSea.

The two platforms launched a community airdrop in the first quarter of 2022 and have since attempted to incentivize user participation to challenge OpenSea's dominance.

Both have lower transaction fees than OpenSea. OpenSea charges 2.5% of each transaction, while X2Y2 and LooksRare charge 0.5% and 2% respectively.

They reward their native tokens (X2Y2 and LOOKS respectively) for every transaction they make to their users.

They will subsidize Gas fees and reward NFTs listed on their platforms.

All fee income collected by the platform is shared with token stakers.

good, bad, ugly

image description

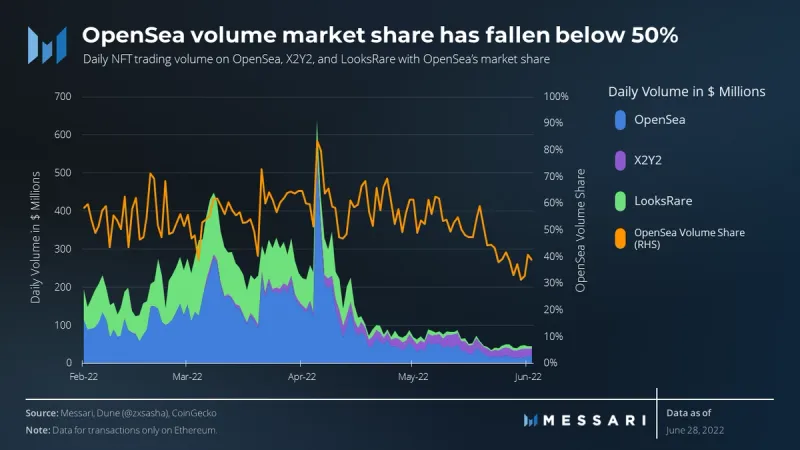

Above: OpenSea's daily turnover market share has fallen below 50%

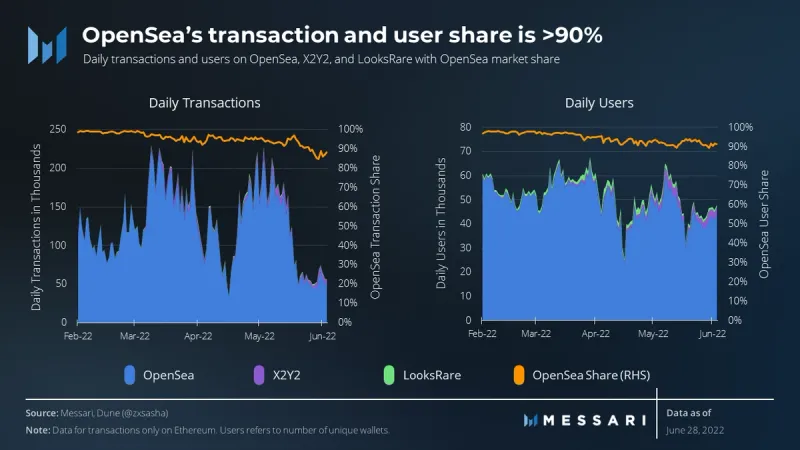

However, the volume and user volume shares of these alternative NFT platforms are much lower than their volume share would suggest.This discrepancy is caused by the incentives provided by these alternative platforms that ultimately benefit wash traders. Wash trading is profitable when transaction fees are lower than transaction incentives. These wash trades are usually of high value and are conducted by a small number of arbitrageurs, giving X2Y2 and LooksRare a high value market share.image description

Above: OpenSea's daily trading volume and user share still exceeds 90%

image description

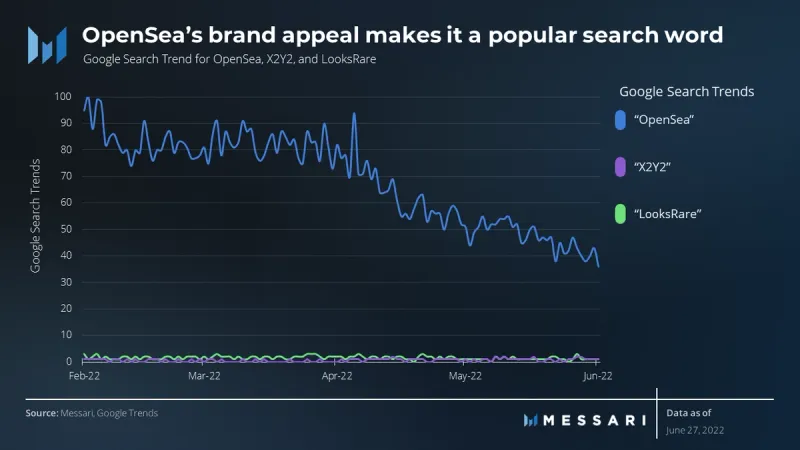

Above: OpenSea's brand appeal made it a top search term

genie in a bottle

While the outlook for these alternative platforms looks bleak right now, it may soon be helped. Uniswap Labs recently announced the acquisition of NFT marketplace aggregator Genie.Uniswap's Genie has the potential to erode OpenSea's brand moat and provide a competitive channel for these alternative NFT platforms.

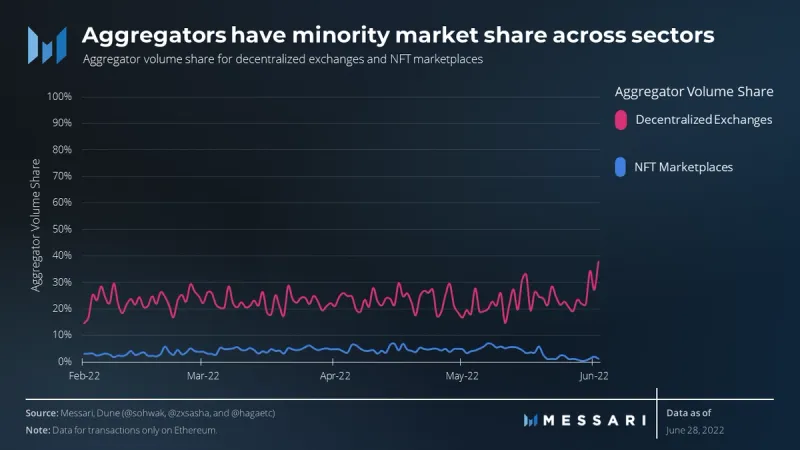

In the field of encryption, whether it is a DEX aggregator like 1inch and Matcha, or an NFT aggregator like Gem and Genie,Aggregators have yet to capture a significant market.image description

Above: In both DEX and NFT markets, aggregators only occupy a small market share.

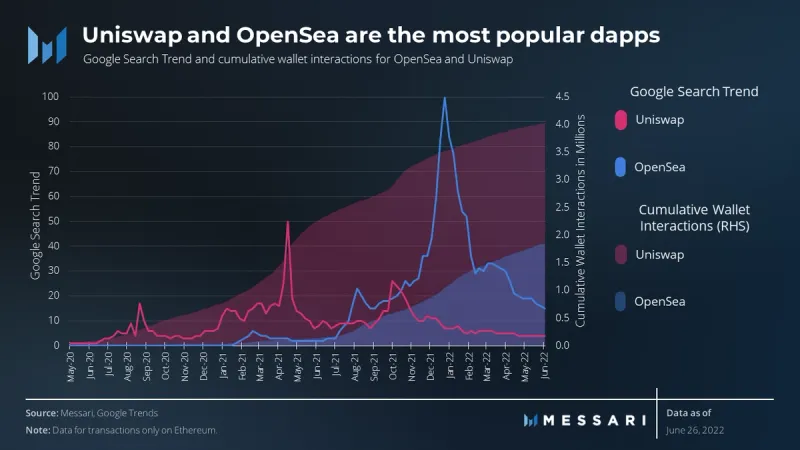

However, this time may be different. Uniswap may be the only Crypto application other than OpenSea that has successfully developed a brand for a large number of non-local users. Of the 4.8 million wallets that traded on Ethereum through DeFi platforms, more than 4 million wallets traded on Uniswap. The next most popular DeFi app, SushiSwap, only had half a million wallet interactions at the time of writing. In comparison, OpenSea has a total of 1.9 million traders.

Testing the popularity of smart contract applications on Google Search Trends shows that Uniswap has a much higher peak popularity than any other application except OpenSea. As shown below:

The popularity of Uniswap will bring Genie a lot of attention, far more than other aggregators in the Crypto space. Additionally, Uniswap Labs has a proven track record of developing user experiences that have attracted a broad user base and may be able to replicate that experience at Genie.

Backed by Uniswap's popularity and execution, Genie may succeed in becoming the go-to platform for NFT trading.As an aggregator, Genie will present the best priced NFTs to users of the NFT marketplace. As such, transaction fees will take precedence over branding and may tip the balance in favor of alternative platforms.

Profitability & Valuation

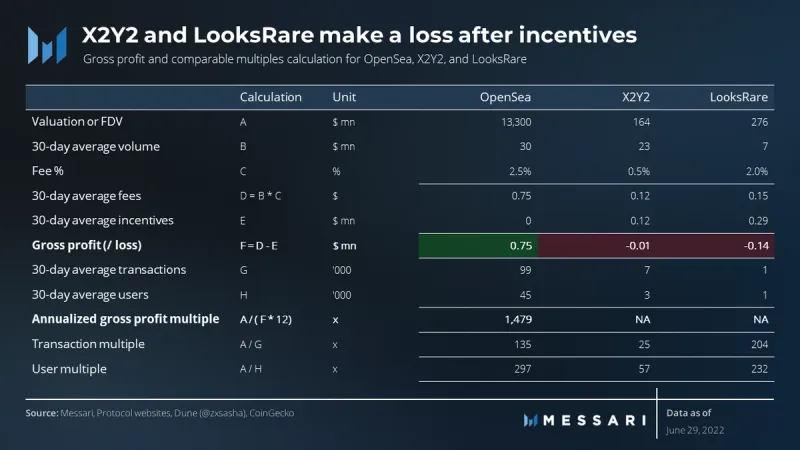

In its latest funding round in January 2022, OpenSea was valued at $13.3 billion. In comparison, the fully diluted valuations of X2Y2 and LooksRare are much lower at $164 million and $276 million, respectively.

However, cheap doesn't necessarily mean attractive. Unlike OpenSea,Both of these alternative NFT platforms (i.e. X2Y2 and LooksRare) are losing money overall, meaning they pay users more incentives than they earn in fees.As shown below:

View

Both X2Y2 and LooksRare failed to impress fundamentally, despite having a market capitalization a fraction of OpenSea's. Gross profit close to zero means that the actual user transaction volume is lower than the platform's daily transaction incentives. When the daily incentive paid by the platform is much higher than the fee income, it also makes financial sense for arbitrageurs to pay fees to the platform in wash trading.

However, at such low valuation levels, any improvement in market sentiment, NFT trading volume, or market share has the potential to provide significant upside to these alternative platforms. Uniswap’s acquisition of Genie could benefit these alternative platforms. As mentioned earlier, this could erode OpenSea's brand moat and give these alternative platforms a boost. As Robinhood and Zerodha demonstrated in traditional finance,Lower commission fees tend to prevail as more users are brought in through a better user experience.

Valuation Notes

LooksRare will have a strategic sale, team and vault token unlock in July. This will increase its token supply by ~18%. Since we use FDV (Fully Diluted Valuation) in our calculations, it does not affect the calculated multiples.

Summarize

Summarize

OpenSea's branding allows it to outcompete alternative platforms X2Y2 and LooksRare, even with their high fees and centralized ownership model. Currently, loss-making X2Y2 and LooksRare are valued at much lower valuations than profitable OpenSea. However, Uniswap’s acquisition of Genie may provide a way for these alternative platforms to compete with OpenSea on price rather than brand.