Original author:TJ Keel(The Tie)

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

The merger of Ethereum will bring new centralization problems to Ethereum, which is mainly reflected in three aspects. While centralization issues after the Ethereum merger are solvable, if left unchecked, the following three areas of centralization have the potential to control and disrupt the Ethereum blockchain:

Diversity of consensus layer clients

Diversity of Execution Layer Clients

The Ethereum node runs on the client, which is more easily understood as a software engine. Without the client, the node will not be able to verify blocks and transaction data. There are currently many clients written in different programming languages; however, miners, node operators, and validators tend to prefer the few clients with good reputations. After all, a client written in a less-than-perfect language can affect hashrate, validator uptime, attestations, frequency of block proposals, and in the worst case scenario for validators, risk slashing.

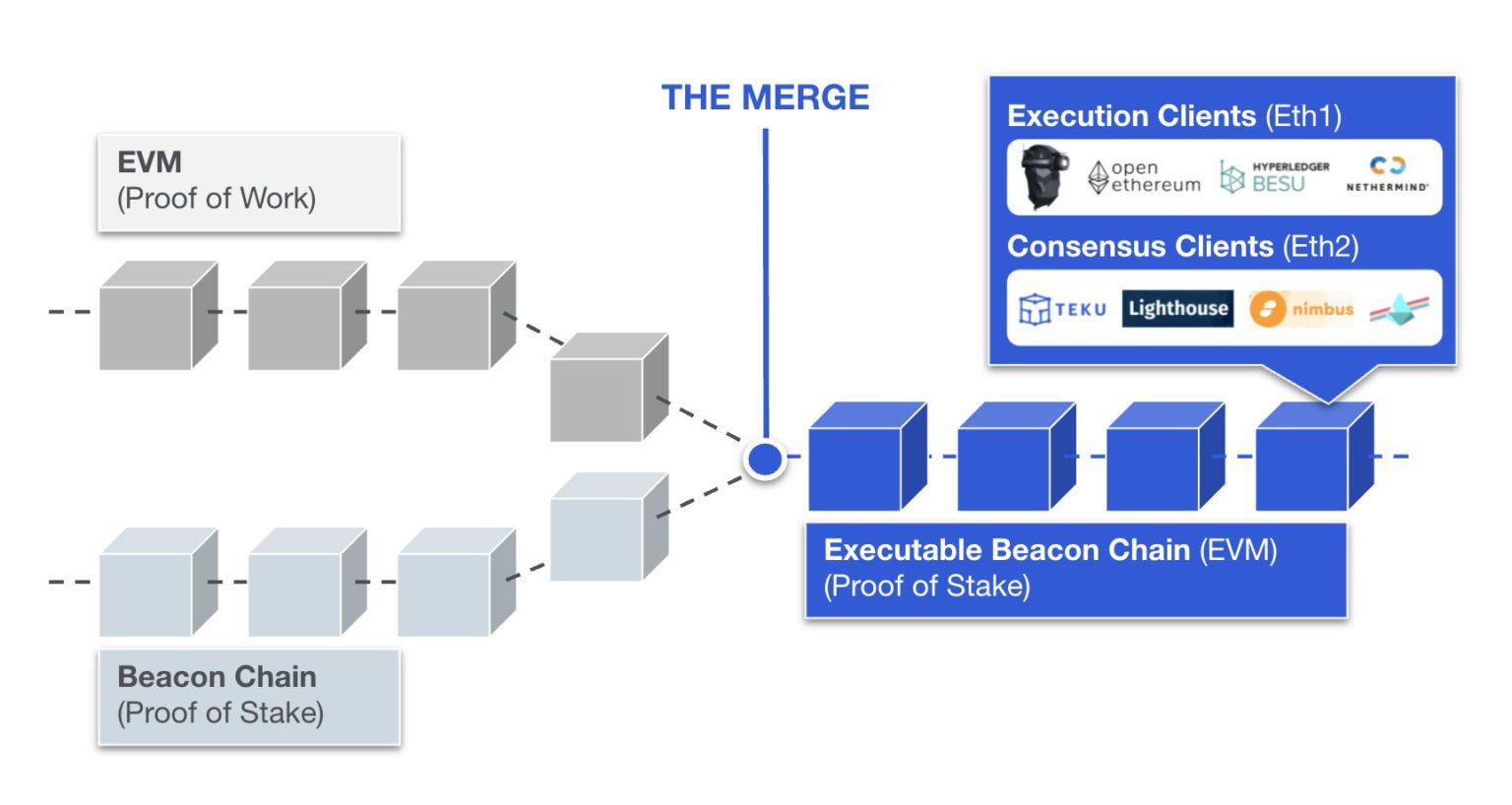

consensus layer

After the merger of Ethereum, both the consensus layer and the execution layer of Ethereum will run on the Beacon Chain. Both the consensus layer and the execution layer have their own clients, and they all have their own client diversity issues. .

consensus layer

The following provides an overview of each Ethereum layer in its current and merged state, and their unique risks in terms of client diversity. Additionally, we will analyze the current distribution of staking on the Beacon Chain and how this centralization is exacerbated by monopolistic liquid staking derivatives.

Ethereum has chosen a multi-client approach to validating blocks from the beginning. Ethereum clients are built by different teams, in different programming languages, with the main purpose of increasing immunity to potential problems. Specifically, this is done to prevent unwanted and otherwise incorrect block proposals. All things being equal, this is better than a single-client approach.

Of course, a multi-client approach without sufficient diversity is worse than a blockchain running on a single client.

However, when a blockchain running on a single client incorrectly proposes a block, the same incorrect record will be verified, but it doesn't penalize a minority of clients because they simply don't exist. In either case, incorrect blocks are validated. But in the case of multi-clients, the super-majority client will also fine innocent and hard-working participants.

client distribution

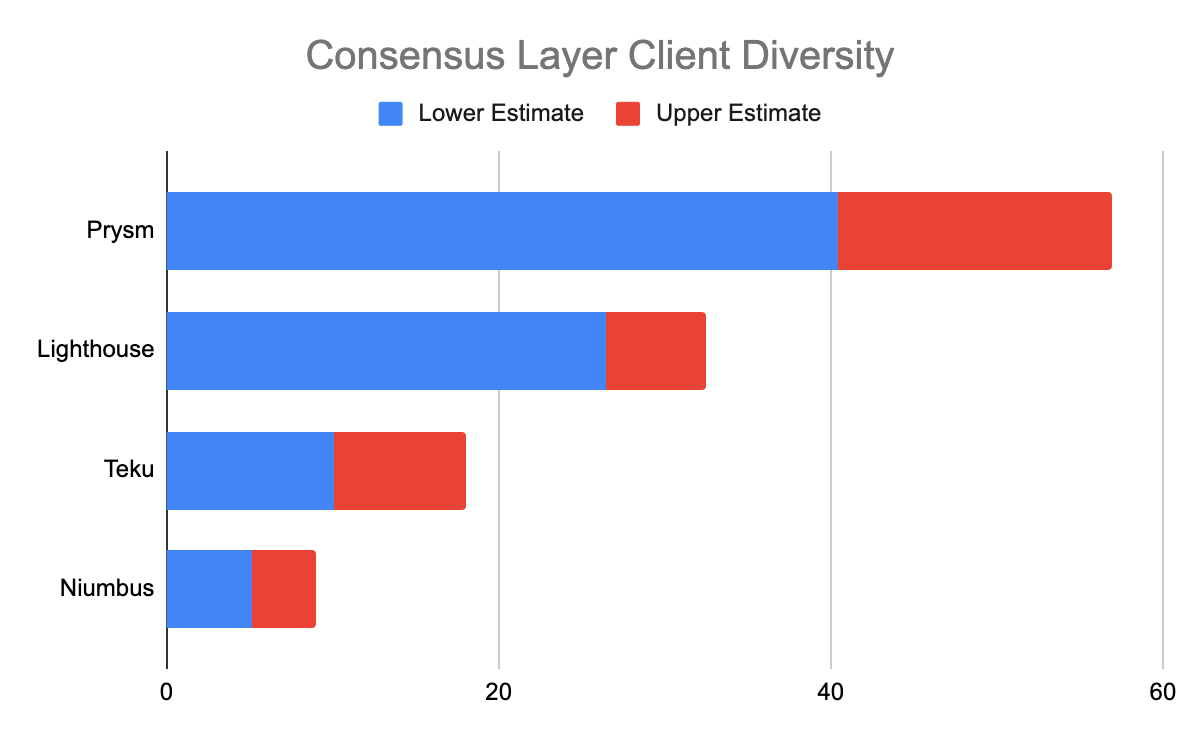

Healthy client diversity is fundamental to Ethereum's transition to proof-of-stake, and in the first half of 2022, the community has focused efforts on decentralizing the client share of Ethereum's emerging consensus layer. The community has made some progress in reducing Prysm's share of usage, and its dominance has indeed dropped from a super-majority (>66% share), to a mere majority.

client distribution

It is not technically feasible to know the exact client distribution on the Ethereum beacon chain, but there have been some reputable attempts to estimate it.Miga Labs)

Miga Labs uses a crawler to count beacon nodes and their self-reported identities. However, this means that validators sharing a node are only counted once, and nodes with fewer validators have a larger influence on the estimate. (tweetsAnother method, developed by Michael Sproul of Sigma Prime, analyzes each client's block proposal style, as in the

described in .

Below I summarize the two sampling methods and give lower and upper bounds for the estimates used.

image description

Data as of June 13

While Prysm’s dominance is still a clear threat to the overall health of Ethereum, the problem has been far more serious in just a few months. In fact, full-year 2021 usage of Prysm is estimated to be close to 70%.

In March of this year, the Kiln testnet merged the execution and consensus layers, simulating the much-anticipated merger of the Ethereum mainnet. During this time there was a hiccup in Prysm, while other clients merged without issue. Client diversity on Kiln is not equivalent to client diversity on the Beacon Chain. In fact, Prysm only accounts for about 20% of validators on Kiln, which is not enough to break the consensus of the testnet merge and prevent the final result. While client diversity is not important in this test merge, it also serves as a wake-up call for the current insecurity of the beacon chain.

However, this incentive structure does not apply to clients with more than 2/3 stake, as their super-majority status would prevent the aforementioned slashing. In fact, this safety net works in reverse: once a client reaches supermajority status, new validators are protected by joining the superclient.

executive layer

executive layer

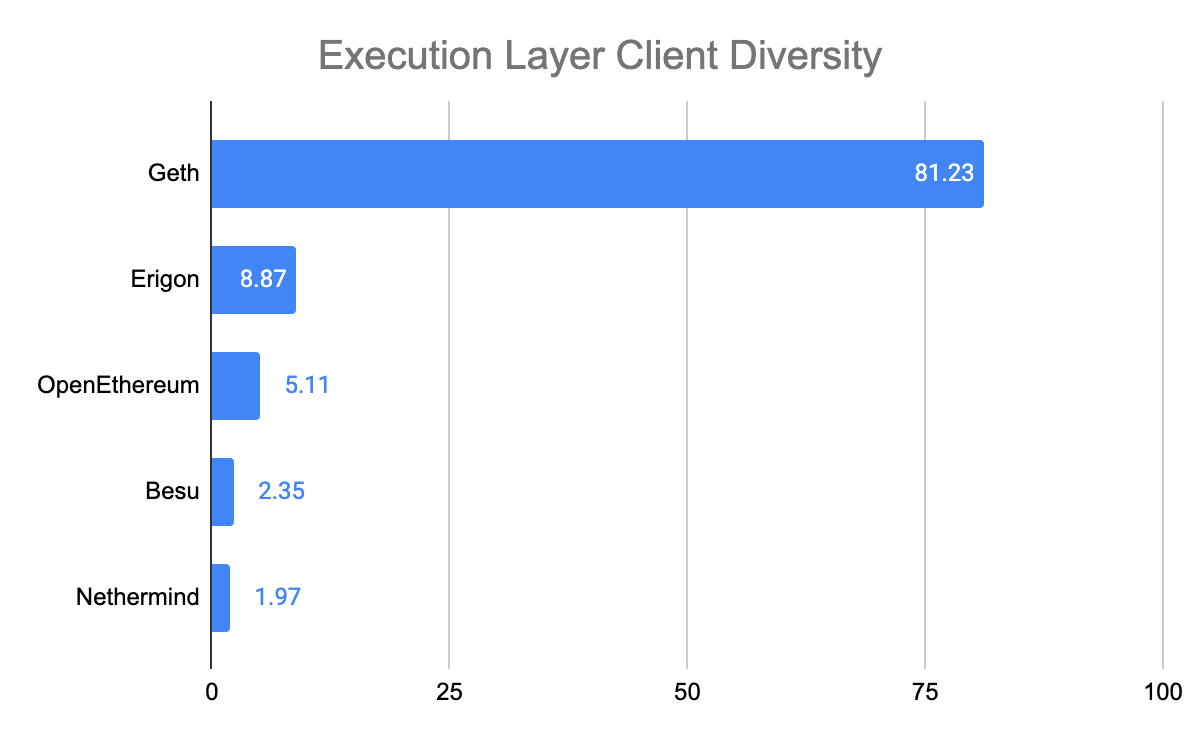

Compared with the consensus layer, the distribution of execution layer clients is much less, and most of the load falls on Geth. Currently, a supermajority of clients in both the consensus layer and the execution layer does not pose equal existential risk, as critical failures in the consensus layer are guaranteed to have more catastrophic effects. However, this will change after the merge.

image description

Data as of June 13

In contrast to the consensus layer, the client diversity of the execution layer has actually been deteriorating, further evidence of the lack of some urgency to improve Geth’s dominance at the moment.

Currently, centralization has unequal consequences for the consensus layer and the execution layer. Concerns about Geth’s dominance didn’t extend as it currently only runs on Ethereum’s proof-of-work blockchain. Someone will always execute a block, even if a supermajority client cannot do so. For example, if there is a problem with Geth, the user running the client will not be able to interpret instructions and execute blocks, but the blockchain will not stop. Instead, the corresponding responsibility is transferred to the users running Erigon, Besu, etc., who in turn will happily reap more mining rewards. As we pointed out above, the consensus layer does not have this luxury, it requires the participation of the entire client community.

client distribution

For this reason, Geth's centralization issue has been put on hold for now, which is effectively passing the buck.

Unlike consensus layer clients on the beacon chain (they have little performance variance during uptime), execution layer clients vary widely in quality. Geth's huge lead has accelerated this gap, but the problem here is fundamental: consensus layer clients have clear norms to follow, while execution layer clients have degrees of freedom, often pursuing different strategies. This pioneering has led to uncertainty for some clients; Erigon, Besu, and Nethermind are still sorting out issues.

After the merger, however, the consensus layer will rely on the enforcement layer for the authenticity of the blockchain, forcing it to inherit ultimate responsibility. The two will be intertwined, and diversity in one will work best only when there is diversity in the other. In other words, after the Ethereum merger, all consensus layer clients will ultimately make decisions based on the information given to them by their chosen execution layer.

image description

While the community is currently focused on Prysm’s dominance, Geth will likely be seen as the next largest centralized vehicle post-merger. Some competing clients, such as Besu and Nethermind, wanted to strengthen their reputations before the eventual fallout.

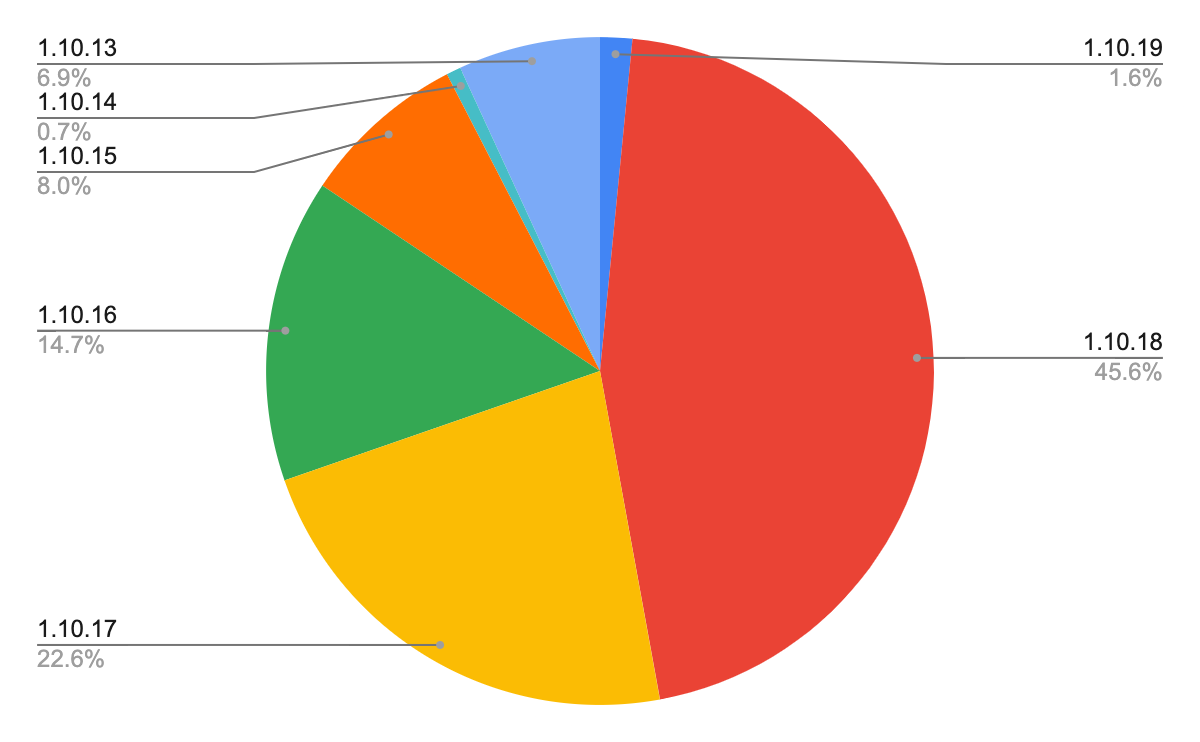

Finally, client diversity is further complicated by version issues, meaning not all nodes are running the same version of Geth. A significant portion of Geth block producers do not consistently update their nodes to the latest version of the software, while others deliberately customize versions to better maximize their MEV (miner extractable value) strategy (often Some forks of MEV-Geth).

image description

Code Version - Data as of June 13

In this sense, all Geth operators do not run strictly the same code, which is most desirable when all things are equal. Still, the differences between Geth 1.10.19 and Geth 1.10.16 are negligible when comparing Geth to another client managed by a different team, written in a different language, and with different logic.

In addition to the client diversity issue, the pool distribution of Ethereum on the Beacon Chain has likewise become centralized in fewer and fewer hands, which presents a very real and measurable centralization issue for the future of Ethereum.

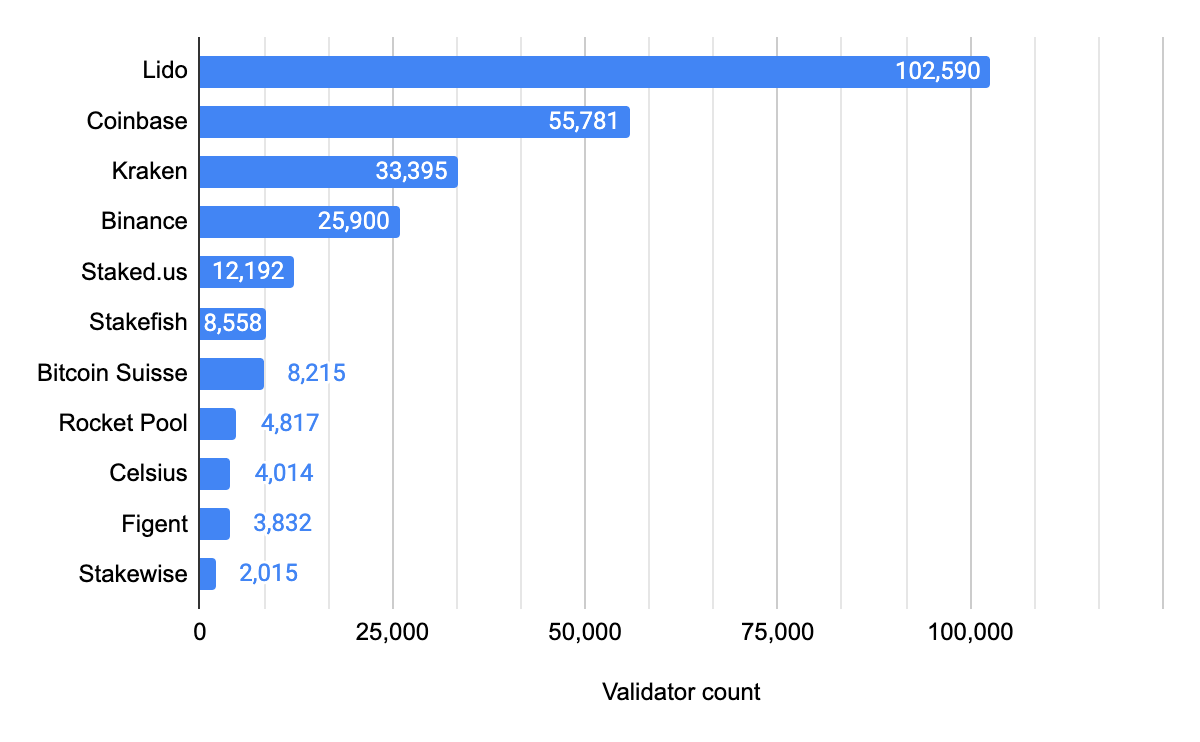

Validator counts for on-chain staking pools like Lido are easily retrievable because we can see the exact number of liquid staked tokens on-chain. In other words, we know exactly how much stETH was minted.

When counting centralized exchange validators, we again run into uncertainty. Exchanges like Coinbase do not stake directly from their known addresses. Instead, they fund a new wallet with ETH, start a validator top-up, and then send the dust to one of their known wallets. Because there is not a single deposit address, bots have to count all the funds they think are managed by the exchange. This wallet-hopping tactic is used by Coinbase, Kraken, Binance, and others.

image description

Data as of June 13

Any analysis of staked ETH must account for withdrawals. Not only were these funds irreversibly locked prior to the merger, but a second hard fork had to occur to withdraw ETH before any returns could be realized. At press time, roughly 13 million of the 121 million ETH in existence are locked in the beacon chain’s deposit contract. We will likely see the distribution of locked ETH affected and redistributed after withdrawals are enabled, but until then, this number will only increase further.

centralization risk

In the long run, the proportion of ETH staked may further increase; a successful merger and the successful enablement of withdrawals will greatly reduce the associated risk borne by validators. At least for the time being, the combined staking yield will be significantly higher, as the fees paid by the blockchain to miners are effectively passed on to the stakers. t This higher rate of return will further stimulate the demand for staking, leading to a dynamic balance of returns.

centralization risk

All this information tells us that the centralization risk of staked ETH is the most uncertain of the three vectors we studied, and that it may be The least sticky vector. However, we cannot rule out arbitrary lock-ups by centralized entities, preventing withdrawals, reallocations, or otherwise impeding the timely exit of staked ETH.

With over 1/3 of all ETH staked, Lido is the first protocol to offer staking tokens and the largest staking entity to date. Their stETH tokens were quickly integrated with popular DeFi tools like Aave, Maker, Bancor... this first mover status allowed them to quickly scale and eat the liquid staking market. To put it bluntly, it's not necessarily because they're the first team to solve a unique technical problem. Lido's centralized and permissioned structure allows them to quickly onboard large amounts of ETH in a short amount of time, and of course, their marketing helps with this.

Instead of having to onboard infrastructure providers and liquid providers at the same time (a cumbersome network balancing act, similar to what car-sharing companies face), Lido essentially outsources all of its infrastructure to a few carefully selected entities . We can compare Lido to Uber in that Lido doesn't need more drivers to carry a lot of passengers; they just need to send all the users they can attract to a dozen large taxi companies, and take a cut of the revenue.

In addition to the obvious risk of running away, this fast and centralized strategy has some additional drawbacks.

The total amount of Lido minted is equal to the amount of ETH staked in their protocol, minus any ETH that is queued. There is no buffer zone in the middle, and there is no pool where you can withdraw or recharge. Currently, if a user wants to exit their liquid staking position on Lido, his only option is to swap on a decentralized exchange. Relatively speaking, if a person wants to buy Lido's liquid pledge positions, they also need to exchange them on the same decentralized exchange, or mint coins directly through the agreement. This apparent mismatch is the fundamental driver of the stETH:ETH discount in DeFi right now (although one can presume it's temporary until it pulls off the Beacon Chain).

Lido currently controls about 1/3 of all ether, which is a legitimate concern and definitely worth monitoring. If Lido controlled more than half of the ether, the DAO would be seen as a parasitic attack on the consensus of the entire blockchain. If Lido controlled more than 2/3 of the ether, they would effectively own the entire blockchain and Ethereum, the decentralized internet experiment, would be over.

Of course, there are other liquid staking projects on the market that aim to take market share from Lido. Some projects like Rocket Pool have the added benefit of being trustless and decentralized; that is, even if they become majority pools, the risk calculation will be fundamentally different.

image description

Summarize

Ethereum Staking Income

Summarize

At first glance, this article can be summarized as three potential threats to Ethereum’s post-merger existence, which is partly true. While it may be shooting itself in the foot, distributing core infrastructure dependencies among multiple actors in each sub-sector is more conducive to the health of Ethereum.

The scale of Ethereum's current state presents challenges for client teams, whether they are building a new client or maintaining an existing one. The client is vigorously maintained by a small, often rotating team, often underpaid. The developers argue that the state size adds enormous complexity to the client's work and does not provide sufficient monetary incentives for the client team.

Future Ethereum upgrades such as statelessness and state expiration cannot be directly used to help client diversity, which may bring great relief to current and future client teams. Shrinking Ethereum's state to a manageable size primarily helps decentralize the validator network by reducing hardware requirements and reducing sync times, but there are also many second-order effects. While these issues are rarely discussed, it is reasonable to assume that future Ethereum Improvement Proposals (EIPs) for Ethereum state size will significantly reduce the complexity and effort of client development and maintenance.

The staking pool market is young and growing rapidly. Unlike each pool that mines on, which is highly specific to the hardware, switching costs for stakers will be minimal when withdrawals are enabled. For most of 2021, stETH is the only liquid collateralized derivative available within DeFi. It remains to be seen how competing tokens such as Rocket Pool's rEth will develop, or how the distribution will evolve in the long term. Exchanges keeping large caches of staked ether creates other problems and may disappoint those embracing ethereum due to its unbanked status.