The SEC on Wednesday rejected Grayscale Investments' (Grayscale) application to convert its Grayscale Bitcoin Trust (GBTC) into an ETF, an effort Grayscale has been pushing publicly since last April. Grayscale is currently suing the US Securities and Exchange Commission.

The reason for the rejection was also very perfunctory, with the SEC saying in its ruling that the Grayscale spot ETF application did not do enough to protect investors from “fraudulent and manipulative acts and practices.”

Review ETF history:

On October 16, 2021, the SEC approved a Bitcoin ETF for the first time: ProShares Bitcoin Futures ETF (NYSEARCA: BITO). This opened the prelude to the approval of futures bitcoin ETF. Then BTF, XBTF and other bitcoin futures ETFs established in accordance with the Investment Advisory Act and Investment Company Act of 1940 came out one after another.

Unlike these ETFs, Teucrium was first approved to issue Bitcoin futures ETFs under the 1933 Securities Act and the 1934 Securities Exchange Act in April this year; in May, Valkyrie also launched the Bitcoin futures ETF VBB under Act 33/34; In June, ProShares launched the first short-selling Bitcoin ETF BITI against the backdrop of a 70% plunge in the overall crypto market value.

The passage of these ETFs based on Act 33/34 makes us optimistic that at the end of June and early July, the Bitcoin spot ETFs of Bitwise and Grayscale will most likely be approved by the SEC.

But things always go wrong, and today’s ETF was rejected, leading to Grayscale’s prosecution.

Based on this prior optimism, GBTC’s negative premium has recently been reduced significantly — from a low of -34% on June 17 to -29% today. Once the spot ETF is approved, it is conservatively estimated that even if only 1% of the funds flow into the encryption market from the financial market of tens of trillions of dollars, it will be hundreds of billions of dollars, equivalent to dozens of GBTC. Under the leverage effect, the market value will increase exponentially, which may become a catalyst for the entire crypto market to return to the bull market.

secondary title

Why did the spot ETF fail to pass?

Let's start with the reason why Grayscale's last application for a bitcoin spot ETF was rejected by the SEC.

1. The main reason why the SEC opposes cryptocurrency spot ETFs is that they are worried that these cryptocurrencies are traded on unregulated trading platforms, making it difficult to monitor, and that market manipulation is also a long-standing problem in the spot market. Although the SEC has approved cryptocurrency futures ETFs, these ETFs are all on platforms under the supervision of the US financial regulatory authority.

2. Many investors of BTC spot ETF invest with pension funds. They cannot afford ETF products with high volatility and high risk, which will cause investors to suffer losses.

However, there are also many supporters who believe that the SEC's skepticism is unfounded.

1. Grayscale’s trust fund was initiated by a private trust. Previously, the underlying assets of similar commodity ETFs were physical silver and physical gold such as GLD, SLV, and IAU. This time Grayscale is also building a BTC spot ETF with the product structure of a traditional spot ETF, which is completely reasonable and compliant.

2. Other ETFs that have been approved by the SEC, such as many gold ETFs, come with 2 times or even higher leverage. ETFs based on the stocks of many emerging market countries are not only as volatile as Bitcoin, but also have the possibility of being manipulated in their underlying markets.

3. The SEC's decision to approve a bitcoin futures ETF but not spot spot has led to a strange situation in which investing in derivatives such as bitcoin futures is considered a safer investment than actually owning bitcoin spot assets, and for a long time everyone Think derivatives are clearly riskier. And due to the futures shift, the contract must be closed at the end of each month and a new contract (Roll Yield Cost) must be purchased, which may result in asset losses of up to 30%.

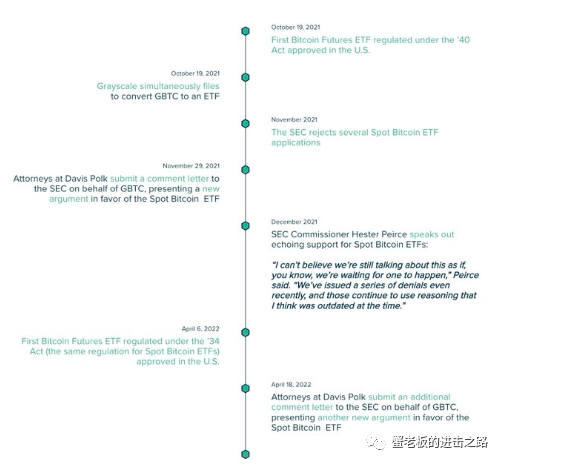

image description

Figure: Grayscale Bitcoin Spot ETF Timeline

In fact, both Act 33/34 and Act 40 were created after the 1929 stock market crash to create a more stable regulatory framework for financial markets. Among them, the biggest difference in the regulations on ETFs lies in the different procedures required for issuing ETFs.

Act 40 emphasizes the regulation of retail financial products, which provides great protection for individual retirement savings (because pension is an important source of funds for mutual funds), thus emphasizing the public adaptability of financial products. Act 40 requires investment firms to register with the SEC in order to offer securities in the open market.

The 33/34 bill mainly emphasizes the transparency of financial products to investors, and has more relaxed requirements on the issuance process. Given that Teucrium’s Bitcoin futures ETF has been approved by the SEC under Act 33/34, many believe that this opens the way for spot ETFs to be approved under Act 33/34.

Another interesting point is that FTX may help the BTC spot ETF to be approved.

1. SEC Chairman Gary Gensler once said that the "basically unregulated" bitcoin market has raised concerns about fraud and manipulation. He called on cryptocurrency trading platforms to register with the SEC and believed that most cryptocurrencies are securities and belong to Jurisdiction of the SEC.

2. Earlier this year, FTXUS proposed to Congress to be regulated by the Commodity Futures Trading Commission (CFTC). The CFTC has received inquiries from Derivatives Clearing Organizations (DCOs) or potential DCO applicants seeking to provide margin product clearing directly to participants so that participants do not clear through futures commission merchant intermediaries (i.e. a disintermediation model) .

3. SEC Chairman Gary Gensler also said yesterday that Bitcoin is a "commodity" and "the only cryptocurrency that I would call a commodity." This also seems to hint at the possibility of Bitcoin transactions being regulated by the CFTC.

secondary title

Why does Grayscale want to pass an ETF?

Exchange-traded funds (ETFs) bundle together securities such as stocks or commodities, allowing investors to buy shares — in this case bitcoin — on the open market without owning the asset directly. Last October, the SEC finally approved a bitcoin futures ETF, which offers derivative contracts to speculate on the future price of bitcoin. It still doesn’t allow bitcoin spot ETFs pegged to bitcoin’s current price.

According to Grayscale, the Grayscale Bitcoin Trust currently manages $12.9 billion. Since February 2021, shares in the Grayscale Bitcoin Trust (GBTC) have traded at a significant discount to the net worth of Grayscale's Bitcoin holdings.

in conclusion:

in conclusion:

If Grayscale’s ETF is approved, it will undoubtedly be a great benefit, but it has been rejected today, and it is useless to say more. Grayscale has already started to sue the US Securities and Exchange Commission. We should pay more attention to the progress in the later stage Well, this year there is only the big benefit of the merger of Ethereum, and I hope it will not be postponed.