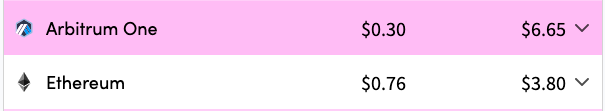

according to L2Fees according to

According to website statistics, the transaction GAS fee on Arbitrum has soared for a short time today, and is currently $6.65, surpassing the Ethereum mainnet ($3.8).

This seems to be against the common sense that "L2 is cheaper than L1", so that some users jokingly said: "I have never known what L2 means. I went to L2 to interact with it today. It turns out that L2 means that the gas is twice that of L1."But the reality is that the GAS fees of most applications on Arbitrum have not increased significantly.

This seems to be against the common sense that "L2 is cheaper than L1", so that some users jokingly said: "I have never known what L2 means. I went to L2 to interact with it today. It turns out that L2 means that the gas is twice that of L1."But the reality is that the GAS fees of most applications on Arbitrum have not increased significantly.

Taking Uniswap as an example, the Ethereum mainnet fee is 0.005 ETH, and the GAS fee on Arbitrum is half of that - 0.0025 ETH ($2.75); in addition, arbiscan data shows that most transactions on the Arbitrum chain cost 0.002 ETH to 0.003 ETH (less than $3) and no more than $6.The soaring transaction GAS fee on Arbitrum today is mainly related to two factors:

One is that the Odyssey event stimulated the rise of transaction volume on Arbitrum, mainly focusing on cross-chain transfers and very few applications; the other is that the GMX platform artificially increased the GAS fee, which raised the overall average GAS on the chain.

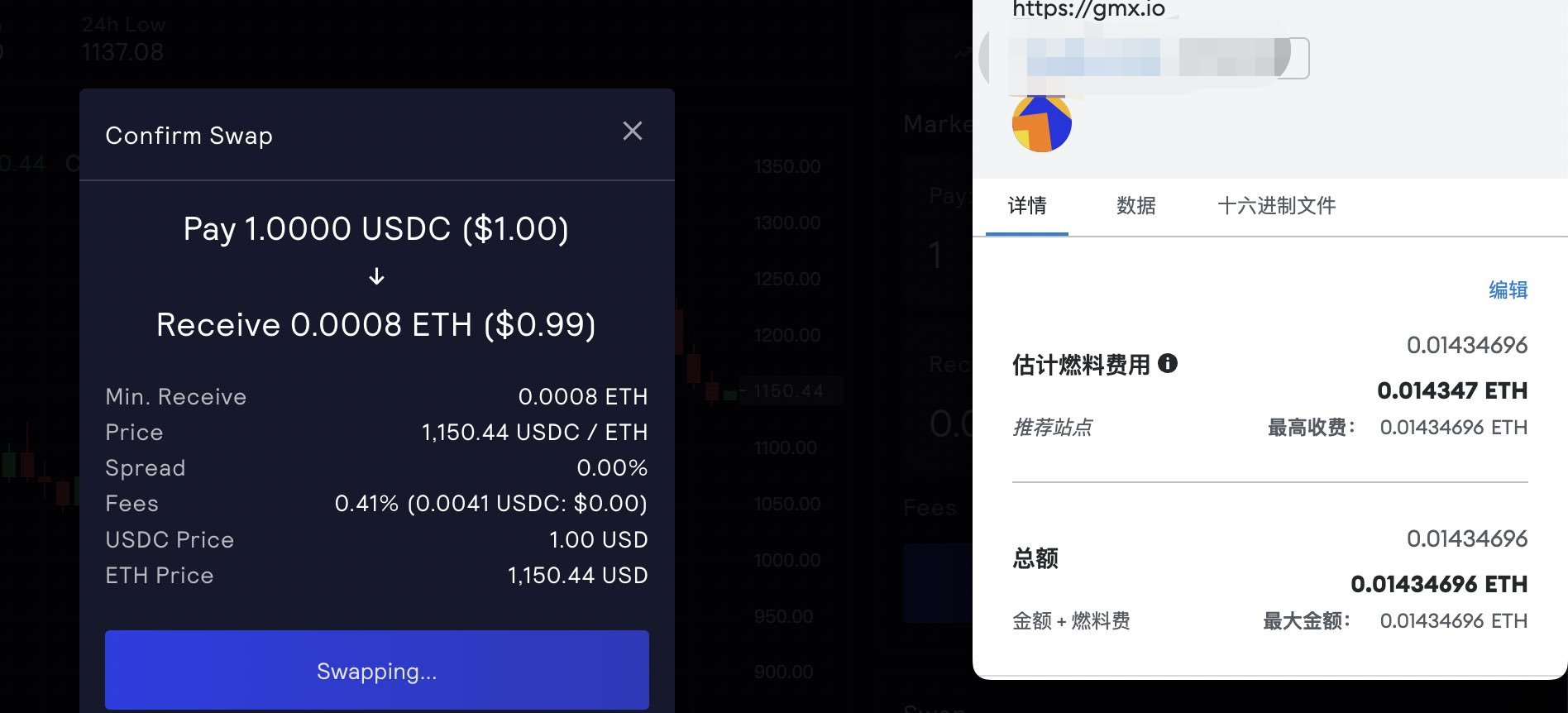

In the early hours of this morning, the second week of "Odyssey" began, and users' enthusiasm for participation remained undiminished, resulting in a surge in transaction fees on the chain. Of course, the user transaction volume is still concentrated on the two projects in the second phase: Yield Protocol, a fixed-rate lending agreement, and GMX, a decentralized trading platform. Data on the chain shows that the current Yield Protocol transaction gas fee is 0.005 ETH, while the GMX transaction gas fee once soared to more than 0.01 ETH (11 US dollars), and the highest even reached 0.015 ETH (18 US dollars).

image description

(GMX platform transaction gas fee)

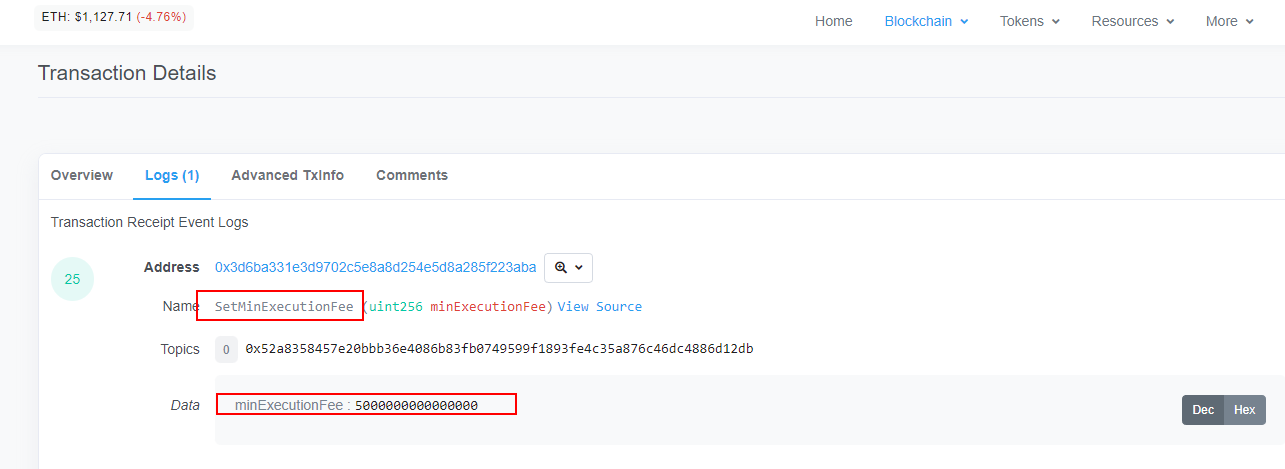

It is also a popular project of "Odyssey", why the transaction GAS fee on the GMX platform is far higher than Yield Protocol, and it is also more than 4 times the average level of the Arbitrum network? The main reason is that the GMX platform artificially increases the GAS transaction fee. @CryptoCicoThe first post stated that the GMX platform manually increased the "minimum execution fee" (setMinExecutionFee) this morning, and these fees were charged separately when switching contracts (implying that GMX benefited from charging GAS fees): the execution fee was 0.0006 yesterday afternoon ETH was changed to 0.005 ETH this morning, which caused the GAS fee to soar; after being "tucked up" by users, the official reduced the execution fee to 0.002 ETH.

image description

(GMX modifies the "Minimum Execution Fee")

As soon as the news came out, many participating users of the "Odyssey" condemned the GMX platform for using the "Odyssey" event to make profits and generate income, and even demanded the disqualification of the GMX event. "The GMX team deliberately raised the minimum execution fee in their contract before the Odyssey started. The Arbitrum team should consider removing those scumbags from the Odyssey list, because they are taking advantage of users."soon,GMX issued an announcement explaining that the official did not profit from the handling fee. The reason for increasing the execution fee is that the process of opening and closing a position on GMX involves two parts of the transaction

: Users send requests to open/close positions and keeper execution requests. The cost of both transactions varies according to the prevailing Arbitrum fee. Odyssey has caused a large increase in on-chain activity, and the price has surged in the past few hours. In addition, the transaction fee will only be used to execute the transaction, and GMX does not earn any income from such fees, if there is a difference when it is collected, GMX will make up the difference, and list examples to prove that the transaction user pays less than the actual cost transaction costs.

However, such an explanation is somewhat unconvincing. Temporary artificial modification of smart contracts does not conform to the spirit of decentralization, and the Arbitrum network fee increased at that time, but it was still within the acceptable range. On the contrary, it was the adjustment of GMX that caused the entire network fee soaring.

"GMX only cited an example that is beneficial to itself, why not mention those users who really paid high gas fees?" Some users questioned.