This text byNansenauthorization,Compiled by Odaily translator Katie Koo.

With the further development of the stETH unanchor incident a while ago, a lot of speculation has sprung up around this topic. Curve's stETH/ETH pool is out of balance, which apparently can be traced back to the UST unpegging.

Nansen’s report starts with the explosion of LUNA, and covers a series of “domino” flips of crypto giants that occurred after that. After understanding the wallets of large-scale transactions of stETH, it conducts in-depth research on various entities and analyzes their trading behavior. Conclusions include:

stETH is a derivative of ETH. Strictly speaking, it does not need to be traded equally with ETH (that is, 1:1 ETH pegged);

The price of stETH is still changing, which creates an opportunity for others to buy stETH at a lower price than ETH;

secondary title

StETH unanchored hits Curve TVL

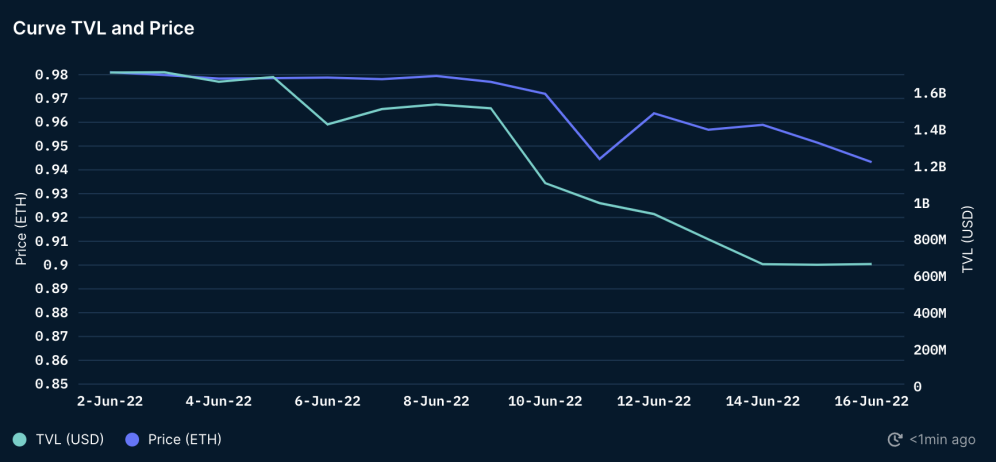

Before UST was unanchored, the prices of stETH and ETH had been relatively equal. After UST exploded, the stETH/ETH exchange rate began to be lower than 1:1, and the gap has continued to widen since then.

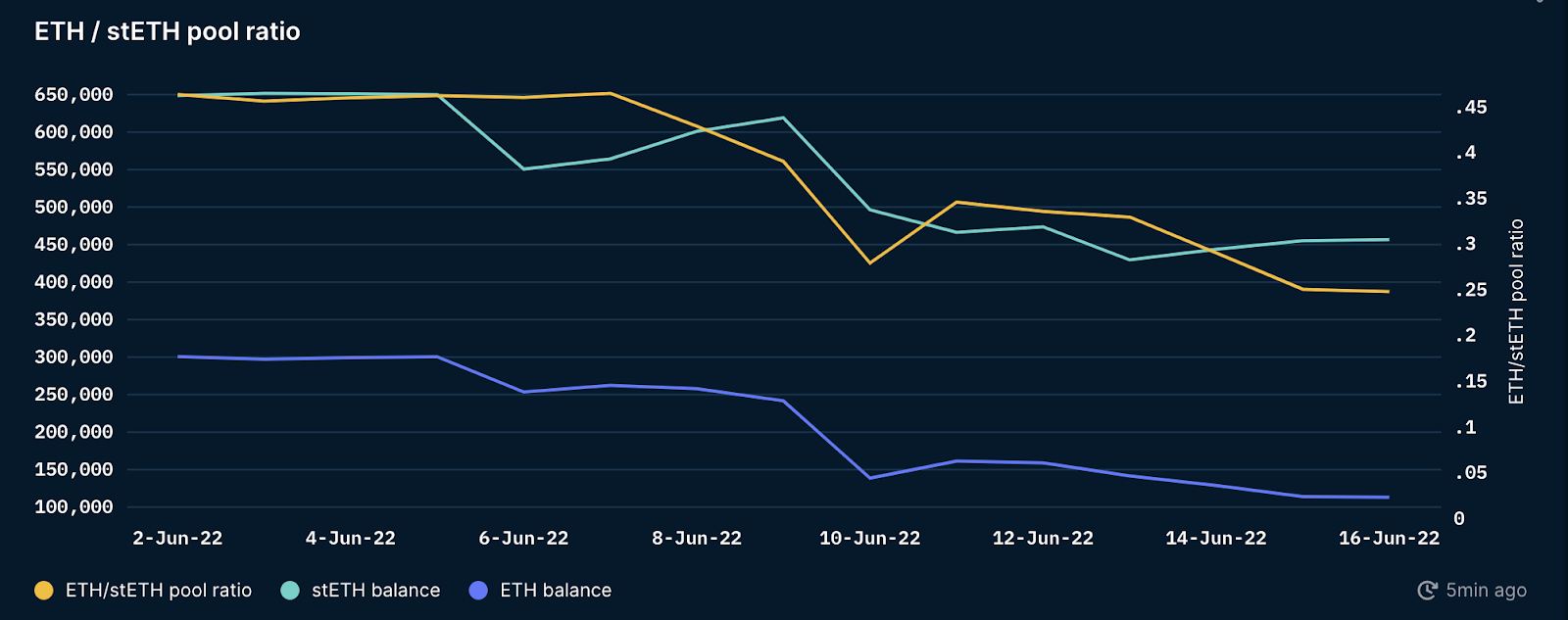

From June 1-7, the ETH/stETH ratio in the Curve pool remained relatively stable at 0.45, while the stETH price was at 0.98 ETH. Signs of a lower stETH/ETH exchange rate began to appear on June 7, when ETH balances decreased and stETH balances increased.

From June 9 to June 10, both ETH and stETH balances decreased by more than 100,000, as stETH continued to trade at a discount of 0.97. Given the unstable macro environment, this led users to further de-risk their positions by withdrawing liquidity and/or selling stETH for ETH. The loss of liquidity and additional selling pressure put further pressure on stETH, with the exchange rate falling to a low of 0.94 on June 11.

secondary title

Large redemption earlier than 4 days before the drop

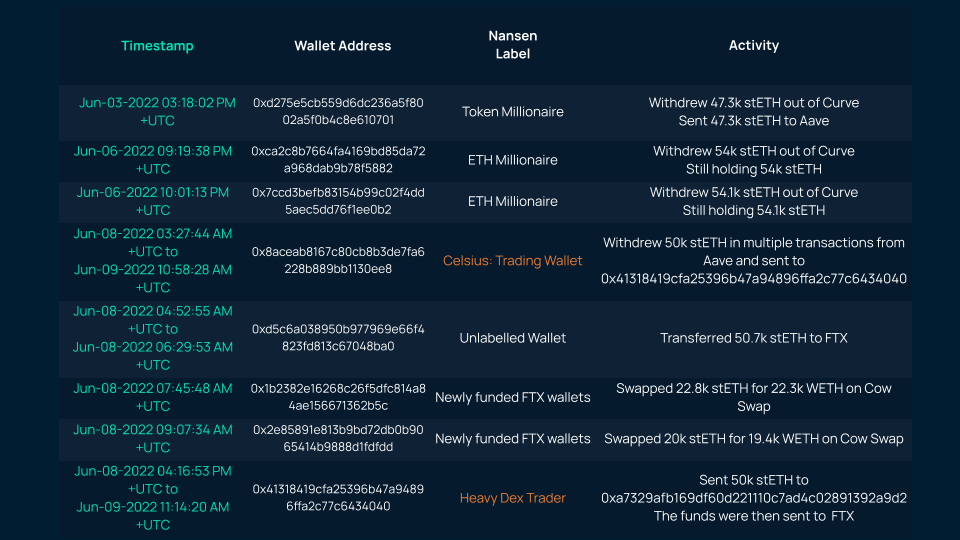

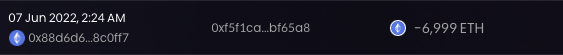

To understand what caused the price of stETH to drop relative to ETH, we looked at wallets that made a large number of stETH transfers in June. Although the first price drop occurred on June 7, the mass redemption began on June 3.

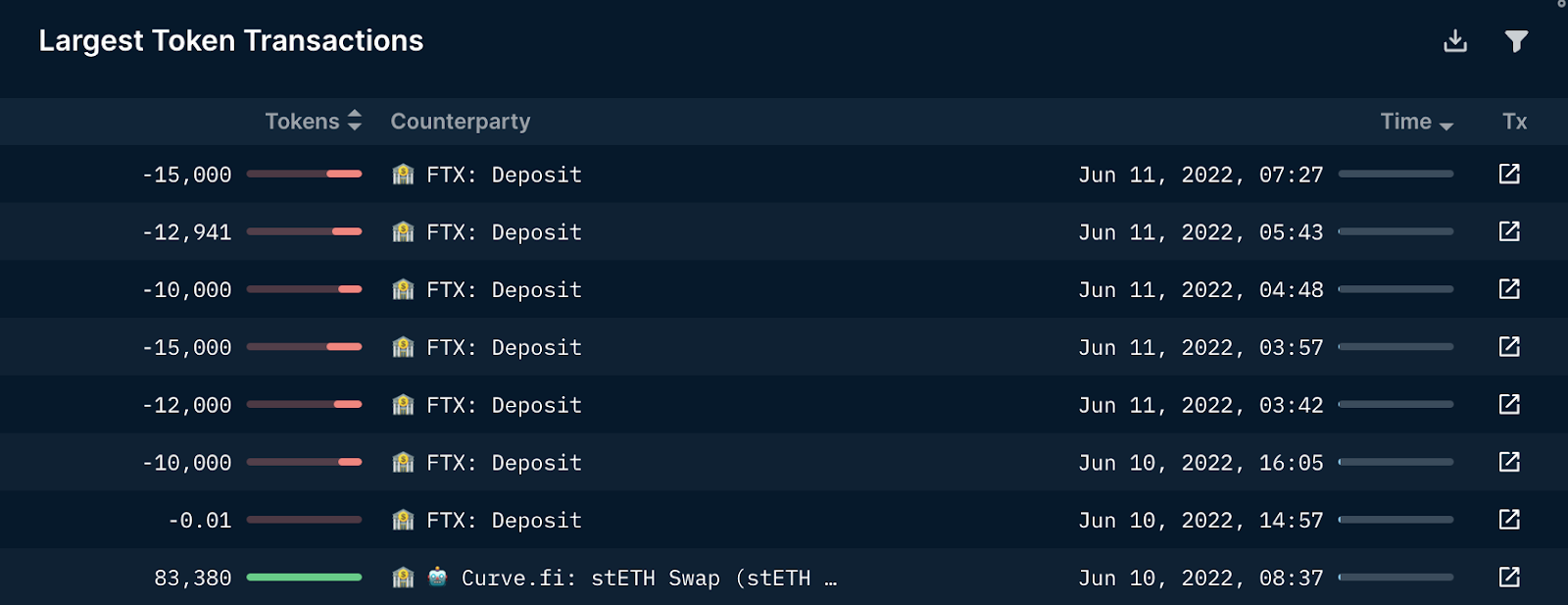

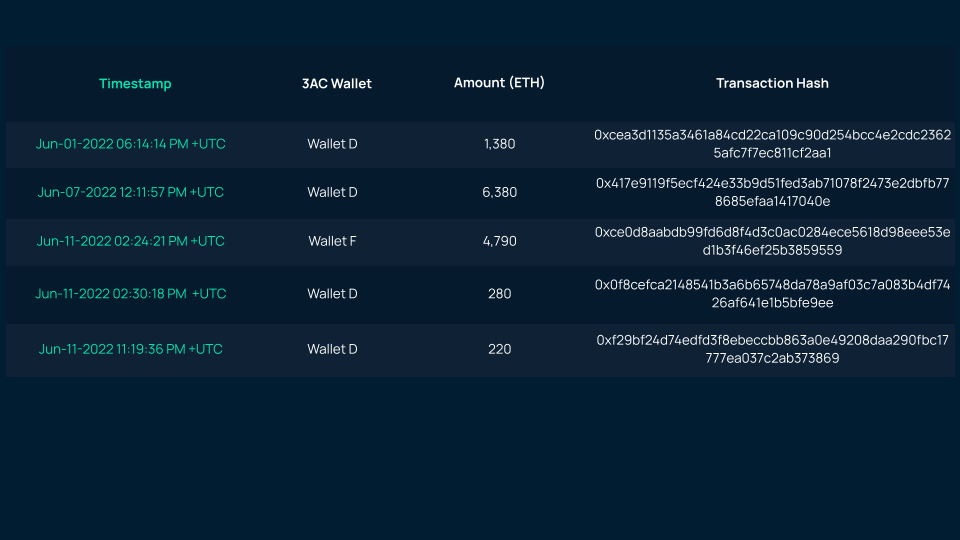

The chart below shows the largest transactions in stETH between June 1st and June 12th. Based on this data, we analyzed the top deals for each entity, mainly between June 3rd and June 11th.

secondary title

What is the encrypted asset management platform Amber Group doing?

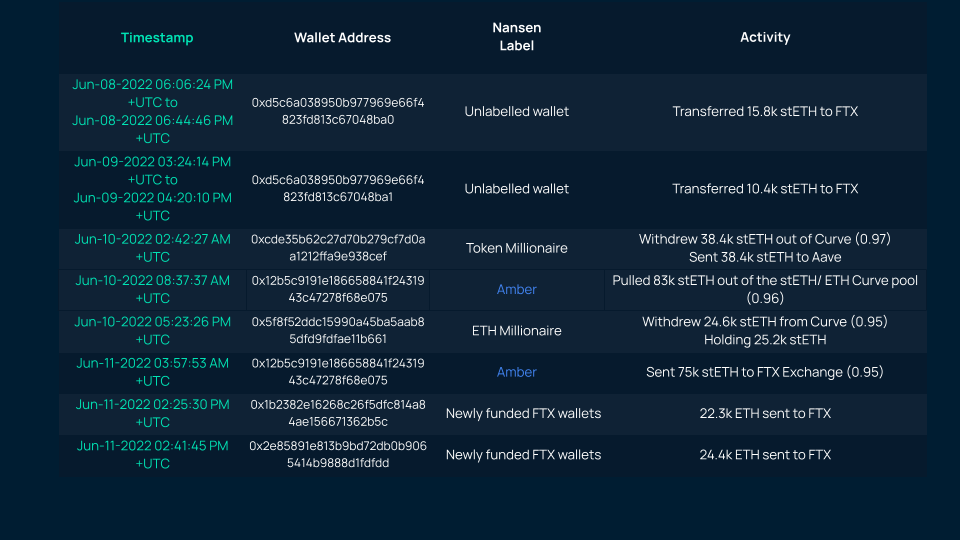

At 8:37 on June 10 (the full text is based on UTC time), Amber Group (0x12b5c9191e186658841f24319433c47278f68e075) withdrew all liquidity from the stETH-ETH Curve pool, a total of 83,380.47 stETH and 26,733.52 ETH. At the time, the price of stETH was 0.96 ETH. With an ETH/stETH ratio of 28% on the Curve pool, Amber Group is likely looking to “keep in” liquidity before more ETH is drained.

secondary title

Crypto lending platform Celsius

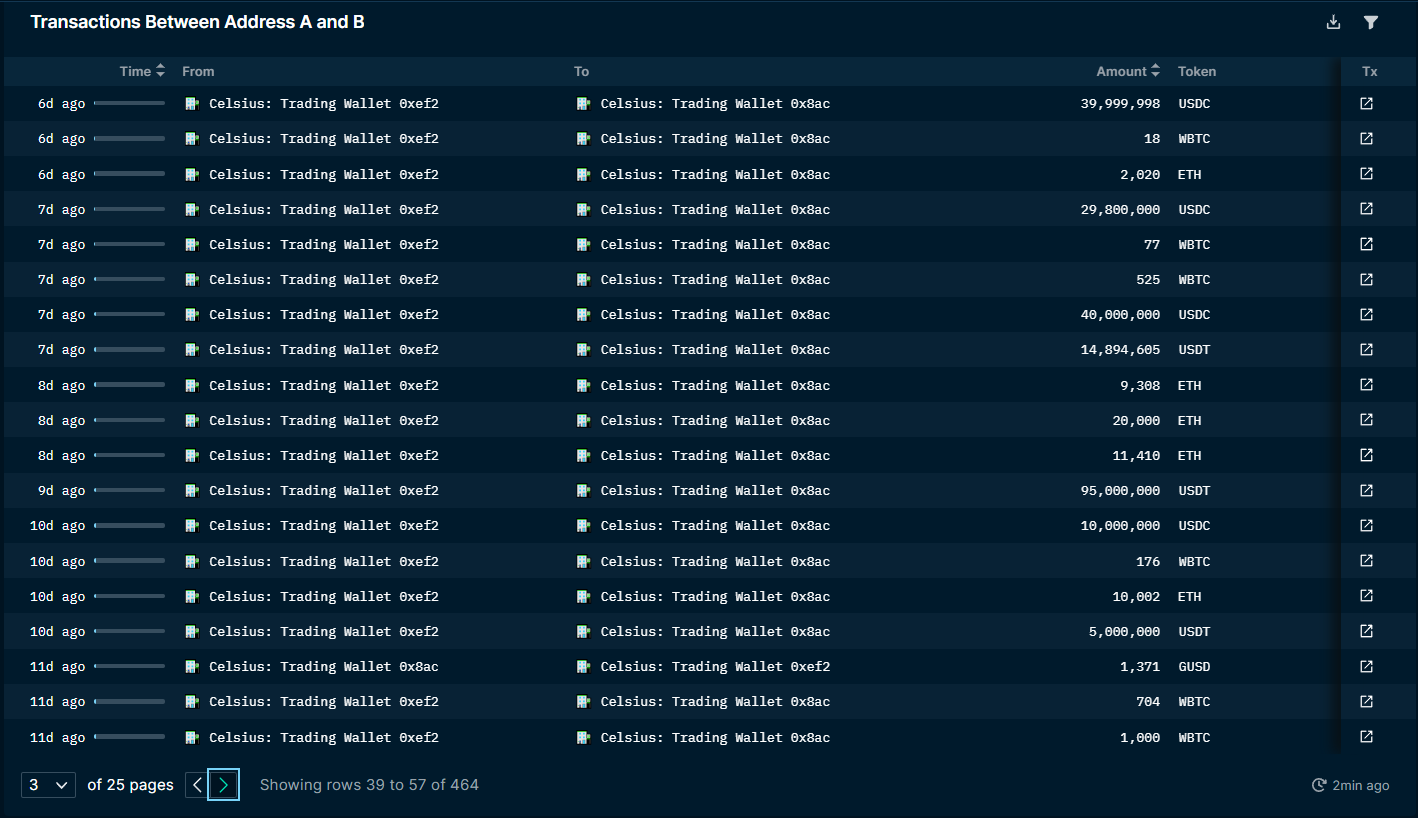

The wallets to be analyzed below include:

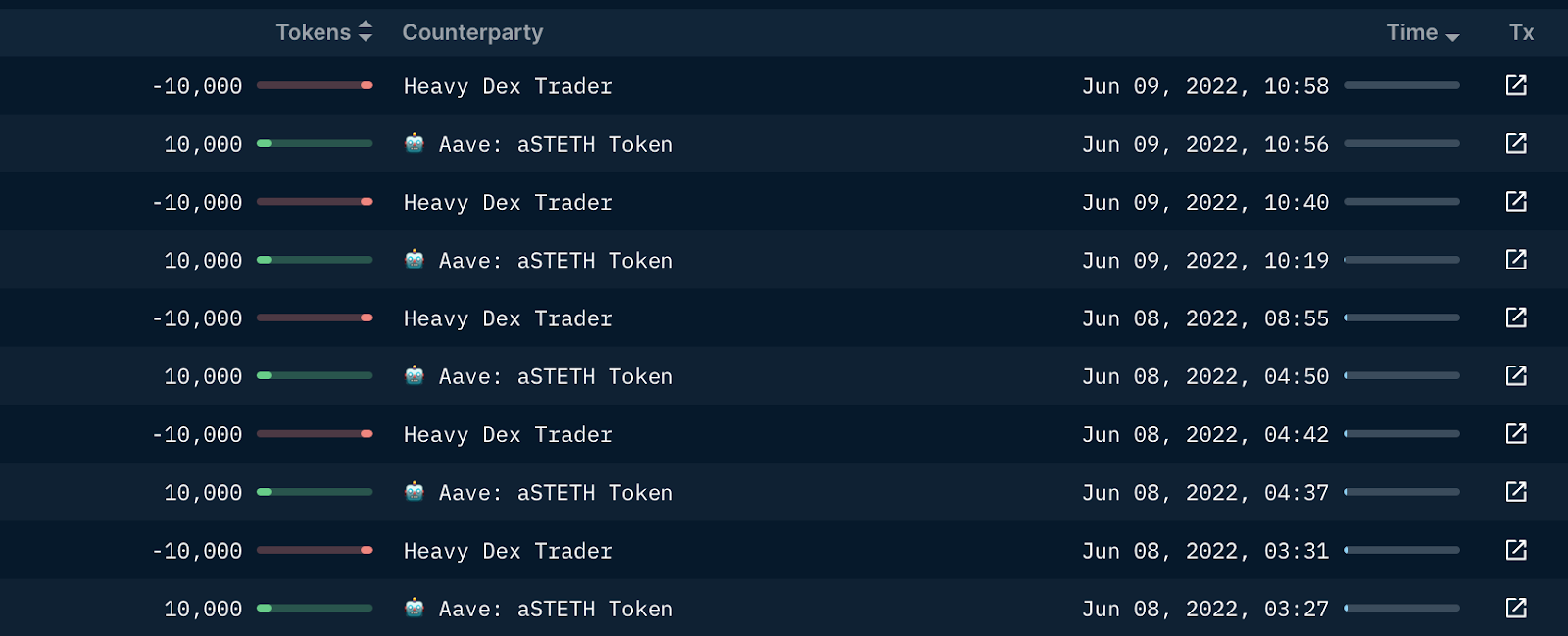

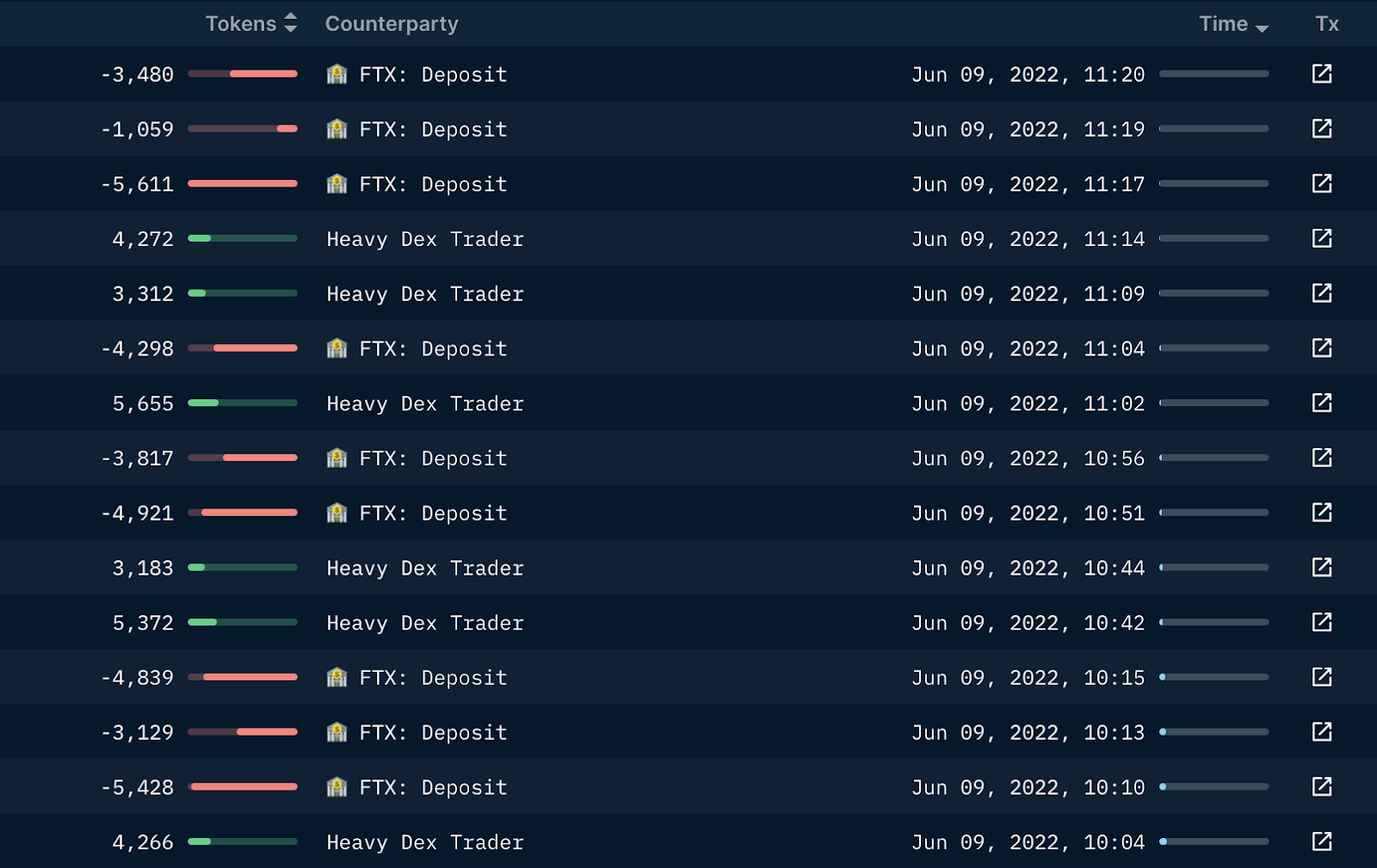

From June 8th to June 9th, Celsius withdrew a total of 50,000 stETH from Aave through multiple transactions in wallet A. Funds are sent to Wallet A's close counterparty - Wallet B, then through Wallet C, and eventually into FTX deposits, which could be a signal for an OTC (over the counter) trade.

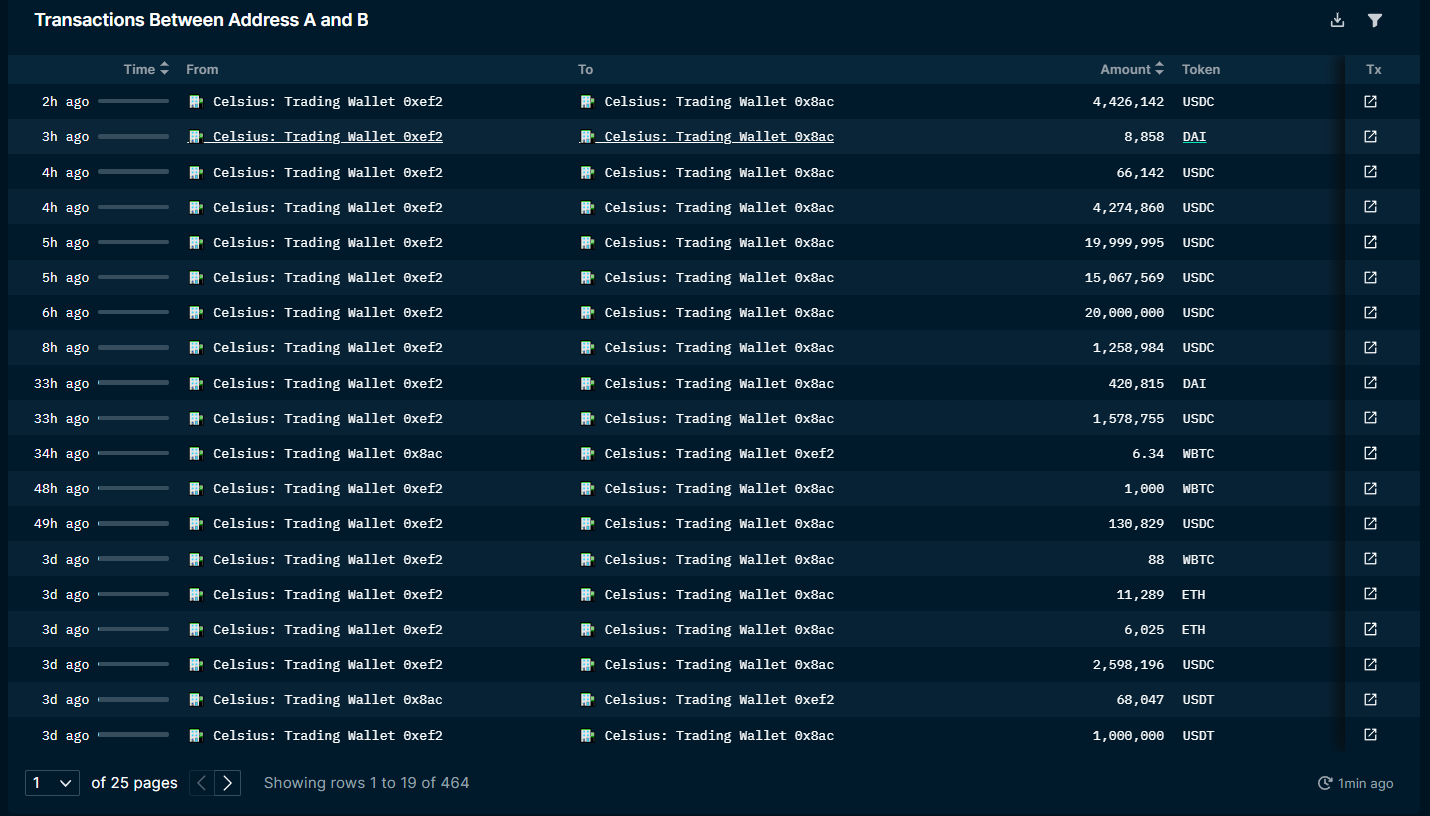

During the same time period, wallet D sent additional funds to wallet A in the form of WBTC, USDT, USDC, DAI. These funds were either used to increase collateral or to pay down debt on Aave and Compound.

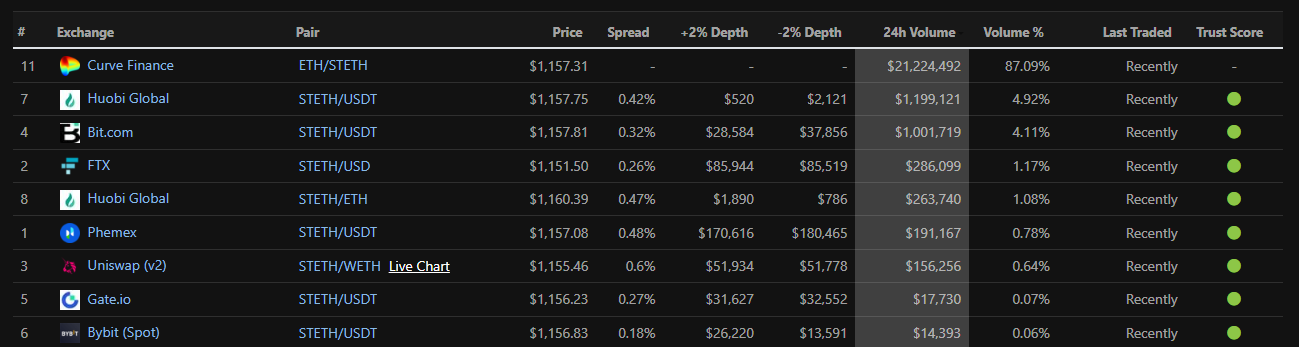

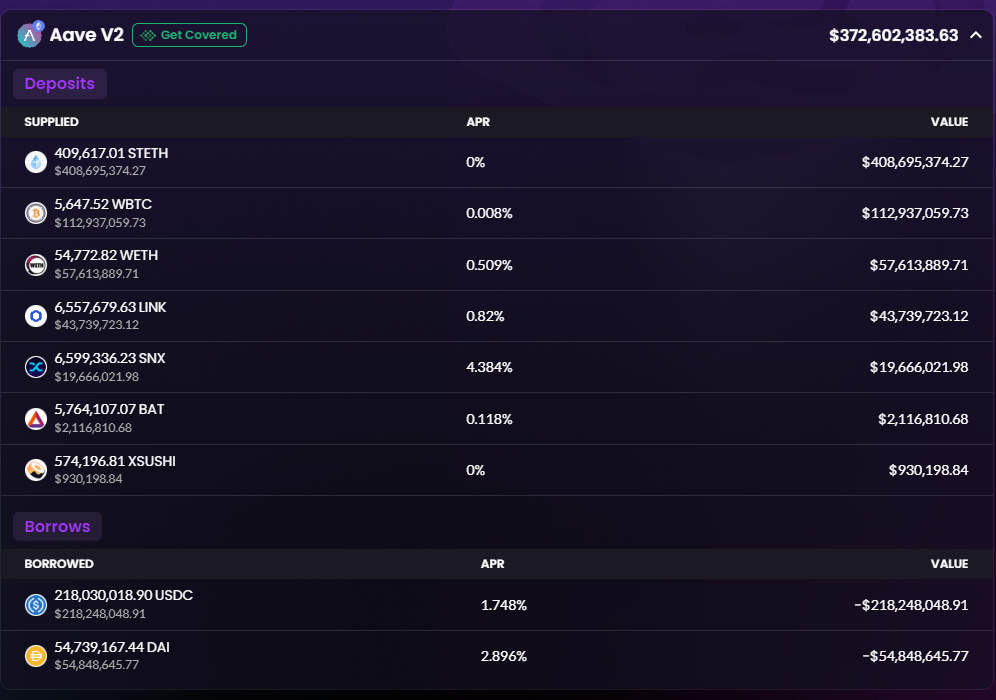

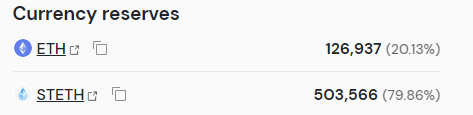

Considering market volatility and meeting customer redemption needs, Celsius may face liquidity issues. With the stETH-ETH Curve pool depleted and liquidity drying up, Celsius will not have enough liquidity to exit its stETH position.Within 6-12 months after the merger of Ethereum, stETH cannot be exchanged for ETH, and the only intermediary that can trade ETH is the secondary market. With 409,000 stETH deposited into Aave and only 127,000 ETH left in Compound, Celsius was unable to "offload" stETH on-chain without incurring slippage losses. Additionally, CEX has negligible liquidity and trading volume compared to Curve pools, making dumping via CEX impossible.

Additionally, between June 8th and 12th, Celsius used Wallet A to borrow USDC and USDT from Compound and Aave, and sent the funds to Wallet E, presumably to cover redemptions. A total of $59.5 million in USDC and $2 million in USDT was borrowed on-chain. Wallet A also withdraws 112,500 ETH and sends it to wallet E. To maintain a healthy loan-to-value ratio, they continually send funds from Wallet D to Wallet A to repay the loan and replenish collateral.

June 10-12: Wallet B sent a total of 108,900 ETH to Wallet F after Celsius stopped withdrawals, which then sent the same amount to 0xfdc8eb4815e58152c956c367323b5e08d29f0438 (FTX deposit address), and then transferred to 0xc098b2a3aa256 d2140208c3de6543aaef5cd3a94 (FTX address).

These funds in wallet B come from several wallets - 52,800 ETH from wallet A, 42,000 ETH from wallet F, 13,600 ETH from wallet D, 1400 ETH from 0x07ce9e0375497c81c603c63f37ffbc03860c23f9 and 0xe081abb7d9e327e89a13e 1000 ETH from 65b3e2b6fcaf2eceb97.

From 1-2 o'clock on June 13, wallet B also sent a total of 9000 WBTC to 0x76a05277b81b9ca6c06c9ab4136116fc53e9c9e1 (FTX deposit address). These funds all come from Wallet A.

secondary title

Whale Wallet

In addition to the aforementioned entities, we also looked at whale wallets with significant stETH transactions between June 1-15 and narrowed it down to seven key wallets.

1. Wallet address: xd275e5cb559d6dc236a5f8002a5f0b4c8e610701 (large DEX trader)

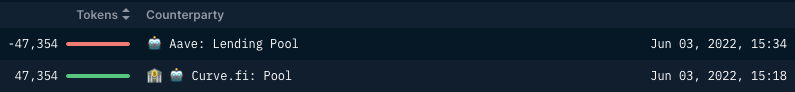

At 15:18 on June 3, the wallet withdrew all liquidity of 47353 stETH and 3991 ETH from the stETH-ETH Curve pool. The ratio at the time was 0.978 stETH/ETH. In less than 20 minutes, the wallet had deposited all the money into Aave to replenish the collateral. From 13:40 on June 10 to 15:54 on June 13, the wallet traded ETH and stETH multiple times, earning a net profit of 3421 stETH, which was finally deposited into its Aave loan position.There doesn’t appear to be any malicious activity here, the wallet is simply taking their liquidity out of Curve and depositing it into Aave as collateral, likely to prevent liquidations during market volatility.

2. Wallet address: 0xca2c8b7664fa4169bd85da72a968dab9b78f5882 (large Token holder), 0x7ccd3befb83154b99c02f4dd5aec5dd76f1ee0b2 (large ETH holder)

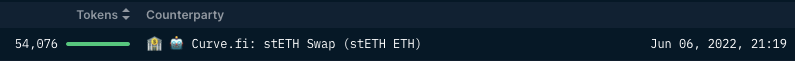

During 9-10pm on June 6th, two wallets withdrew all liquidity from the stETH-ETH Curve pool: 54076 stETH/23515 ETH and 54103 stETH/23489 ETH. Both wallets still hold all stETH, at the time liquidity was removed from Curve, the stETH/ETH ratio was 0.978. It is likely that both wallets wanted to avoid illiquidity in the pool and decided to pre-emptively remove liquidity.

3. Wallet address: 0x1b2382E16268c26F5dfC814a84ae156671362B5C, 0x2E85891e813b9Bd72db0b9065414B9888D1FDFDD

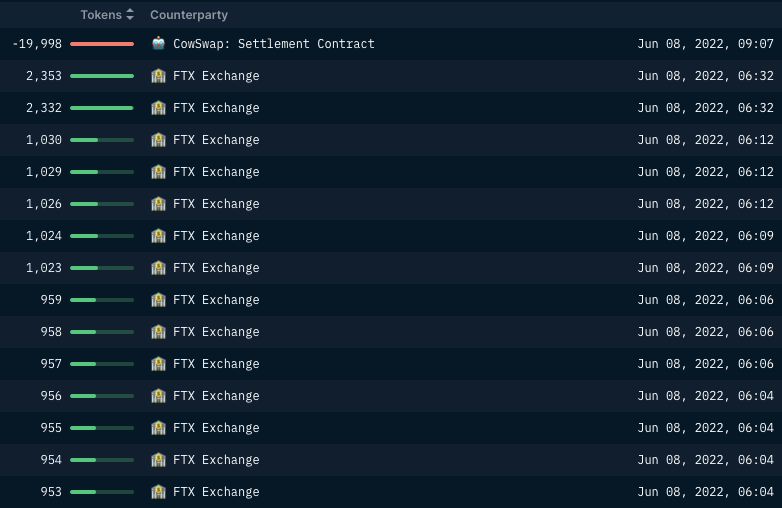

From 4:57 to 6:32 on June 8, the two wallets received 22855 stETH and 19998 stETH from the FTX exchange wallet respectively. At 7:45 on June 8th, 0x1b exchanged all 22855 stETH for 22323 ETH through Cowswap, and 0x2E exchanged 19998 stETH for 19481 wETH through CoW Protocol. Over the next two days, the exchanged ETH was sent to their FTX deposit address and the wallet was emptied. Note that both wallets added ETH from FTX and are brand new wallets.

4. Wallet address: 0xcde35b62c27d70b279cf7d0aa1212ffa9e938cef

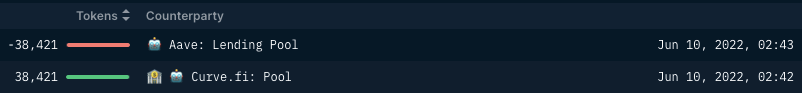

The wallet withdrew all liquidity of 38,420 stETH and 2,706 WETH from the stETH-ETH pool at 2:42 on June 10. Subsequently, all stETH funds are deposited into their Aave loan to supplement the collateral. Between June 10 and 12, they began to further reduce risk by repaying the Aave loan.

5. Wallet address: 0x5f8f52ddc15990a45ba5aab85dfd9fdfae11b661

secondary title

Cryptocurrency Hedge Fund - Three Arrows Capital

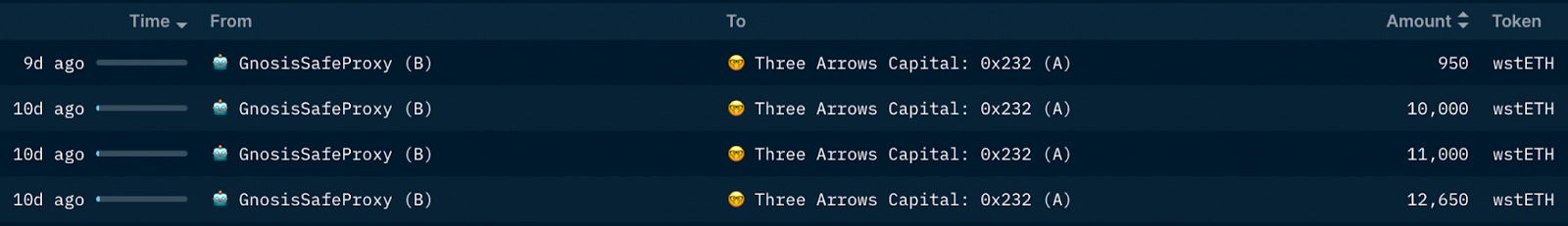

Between June 1st and June 11th, we saw a total of 18,050 ETH transferred from 3AC to Deribit, most of which were delivered after June 7th. These ETH deposits into derivatives may be used as additional collateral to protect 3AC's current positions or to take new positions, thereby hedging 3AC's current portfolio.

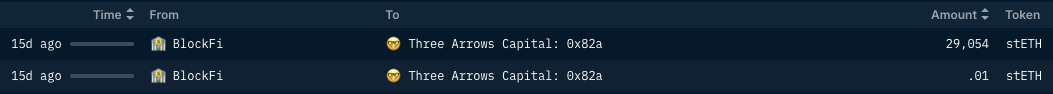

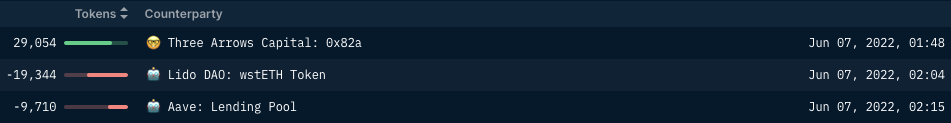

At 1:41 on June 7, Wallet A withdrew a large amount of 29054 stETH from BlockFi and sent it directly to Wallet B. Shortly after, the received 9710 stETH was deposited into Aave as collateral.

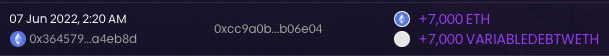

At 2:20 on the same day, 3AC became more cautious, because wallet B borrowed 7000 ETH from Aave using the previously deposited 9709 stETH as collateral. Within 5 minutes, the 7000 ETH was promptly sent to 3AC's FTX deposit address, possibly for sale. The trade may be used as a hedge against downward pressure on ETH prices.

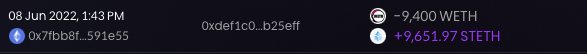

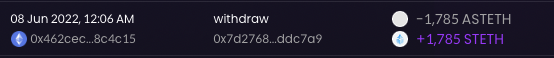

On June 8, perhaps 3AC was still quite happy with their position. It is observed that wallet B withdraws 1785 stETH collateral from Aave, and wallet E exchanges 9400 wETH for 9652 stETH on 0x Protocol.

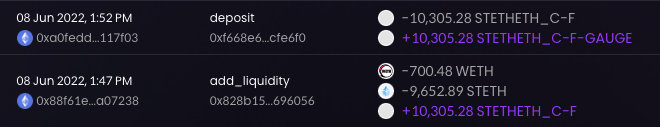

Shortly after the transaction, wallet E then deposits 700.48 wETH and 9652.89 stETH into the Curve stETH centralized pool.

Interestingly, between June 8 and 9, we saw that wallet D received 2,500 ETH from a wallet marked as highly active on Nansen (0x962fe6f349c320417e1992443c0852b1d95060f2), and 1,700 ETH from Deribit; 4000 were sent to FTX again.

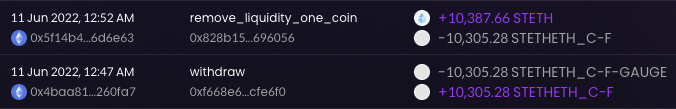

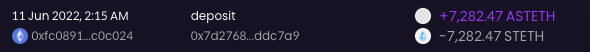

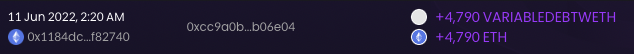

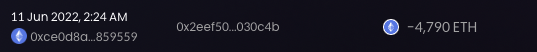

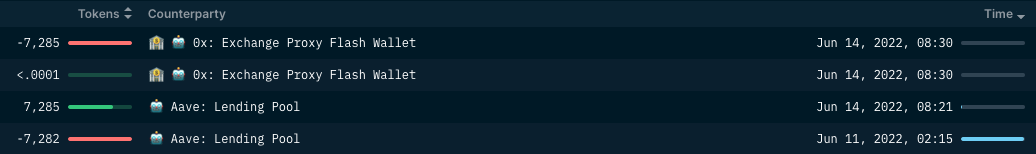

On June 11, wallet E took out liquidity from the Curve stETH centralized pool added on June 8, and then sent 10387.66 stETH to wallet F, which then deposited the received 7282.4 stETH into Aave as a pledge, and borrowed 4790 ETH, sent directly to Deribit.

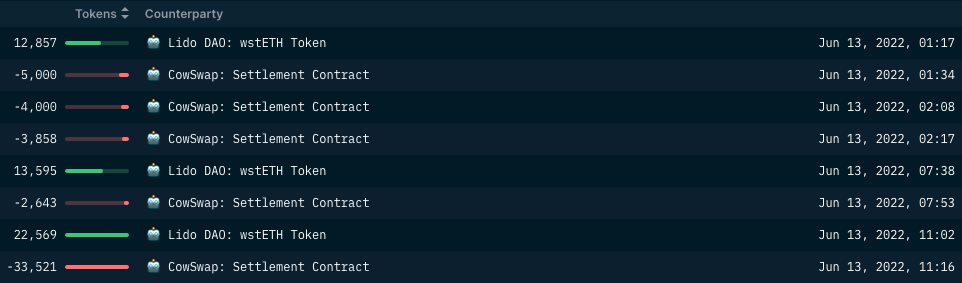

On June 13, we started to see signs of panic. Wallet G starts to unwrap its wstETH and sell it through Cow Protocol in exchange for wETH. Only this wallet exchanged about 46,100 wETH for 49022 stETH in 5 transactions on Cow Protocol that day.

A large part of these wstETH was confirmed to come from Wallet I. Between June 13th and 14th, this wallet alone transferred a total of 34,600 wstETH to Wallet G.

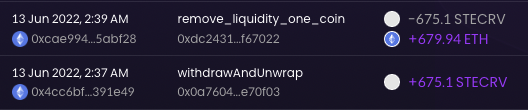

Wallet G also withdraws 675.1 steCRV liquidity from the Curve stETH pool and exchanges it for 679.9 ETH. Interestingly, wallet G also sent two large transactions to wallet H, which Nansen labeled as a "giant whale". The steCrv token represents a share in the Curve stETH-ETH pool.

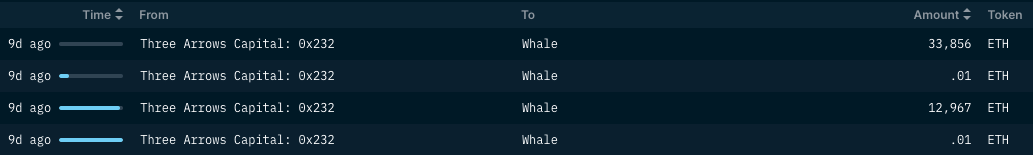

The first of these two transactions was a transfer of 12967 ETH to the H wallet at 4:11 on June 13. At around 17:35, another transaction with an amount of 33856 ETH was subsequently transferred to the same wallet H.

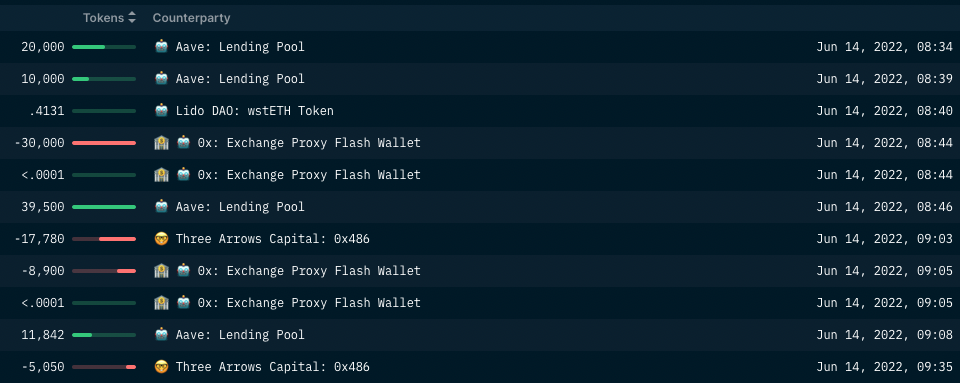

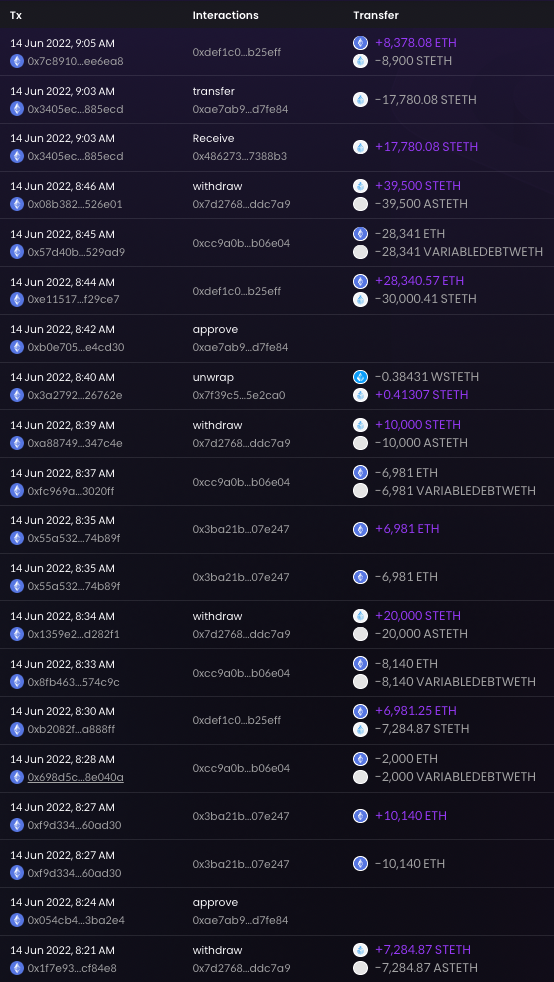

On June 14, 3AC actively repaid Aave's debt.

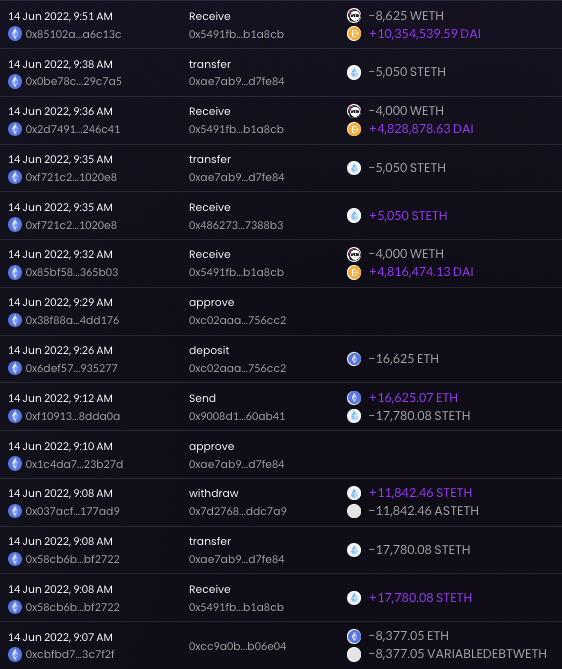

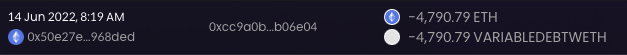

From 8:08, Wallet D received 14,950 ETH from FTX in 9 transactions. Among them, 4790 ETH was transferred to Wallet F at 8:17, and then at 8:19, they were transferred to Aave to repay the loan.

On the same day, Wallet B and Wallet F also banned stETH as collateral on Aave, marking the end of their Aave positions. At 9:10, at least 88626 stETH was raised from Aave.

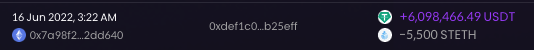

Throughout the morning, we observed wallets B/C/F withdrawing stETH collateral from Aave and clearing it by exchanging stETH they owned (including previously withdrawn from Aave) for ETH on 0x Protocol and CoW Protocol stETH position. A large portion of these ETHs were also used to repay 3AC's loan on Aave. Subsequently, Wallet C sold the previously received ETH to DAI.

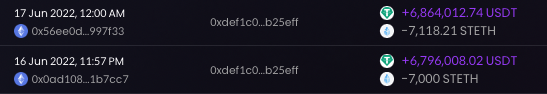

Wallet B accumulatively traded 38900 stETH into 36718 ETH in 2 transactions;

Wallet C accumulatively traded 17780 stETH into 16625 ETH, which was used to trade 20 million DAI;

Wallet F trades 7284 stETH for 6981 ETH.

Summarize

Summarize

There has been a lot of talk lately about stETH "unanchoring," but the groundwork for the current situation was laid during the UST crash a month ago.

Observing the main liquidity pool of stETH on Curve, it can be seen that the first major liquidity drop occurred during this period, and the reserves of stETH and ETH in the pool were seriously unbalanced. Terra's largest protocol, Anchor, was home to a large amount of stETH, and with Terra's eventual collapse, the vast majority returned to mainnet during May 7-16. On May 8th, a single entity transferred 74,700 stETH from Terra back to the mainnet via the cross-chain bridge, and sold most of it to UST, possibly to resist UST’s unanchoring. Later cross-chain activity was likely driven by fears of Terra crashing and stETH getting stuck, or being drained due to the chain's weakened security.

This increased selling pressure on stETH, which in turn may have prompted many LPs in the stETH/ETHCurve pool to withdraw their liquidity, the largest of which were 3AC and Celsius, which together pulled out $780M worth of liquidity on May 12th(It’s worth noting that neither 3AC nor Celsius were big sellers of stETH during this period, nor did they retain most of the stETH, despite withdrawing a large amount of liquidity from the pool in the form of stETH as the main form). As a result, some other large players with (over)leveraged stETH/ETH positions on Aave attempted to unwind their positions, which relied on a stETH:ETH price ratio close to 1, causing more selling pressure on stETH. At present, the main stETH Curve pool has not recovered, and still maintains significantly low liquidity and serious ETH/stETH imbalance.

Withdrawals from Curve pools in recent events indicate that many want to de-risk their investments. Big players like Celsius and 3AC were affected by the market downturn, which further exacerbated the stETH/ETH price skew.In Celsius' case, maintaining liquidity to satisfy customers' redemptions may be its top priority. Therefore, they must wean themselves off their dependence on other liquid assets while protecting their leveraged assets by paying down debt. The suspension of withdrawals is likely to help prevent a bank run while giving Celsius time to realign and manage risk in its investments.

From the on-chain data, we observe that 3AC is unlikely to cause a significant deviation in the price of stETH from the price of ETH between June 9-11, but seems to be a victim of this "contagion". 3AC's lack of sound risk management, coupled with excessive leverage, can be said to be a bomb detonated by the "unanchor" of stETH. As previously mentioned, 3AC did not begin unwinding its stETH positions for both ETH and stablecoins until June 13 and 14, most likely reducing its risk and reducing losses.