Original Author: Breeze

Original Author: Breeze

Layer 2 has become the most important narrative of Ethereum.

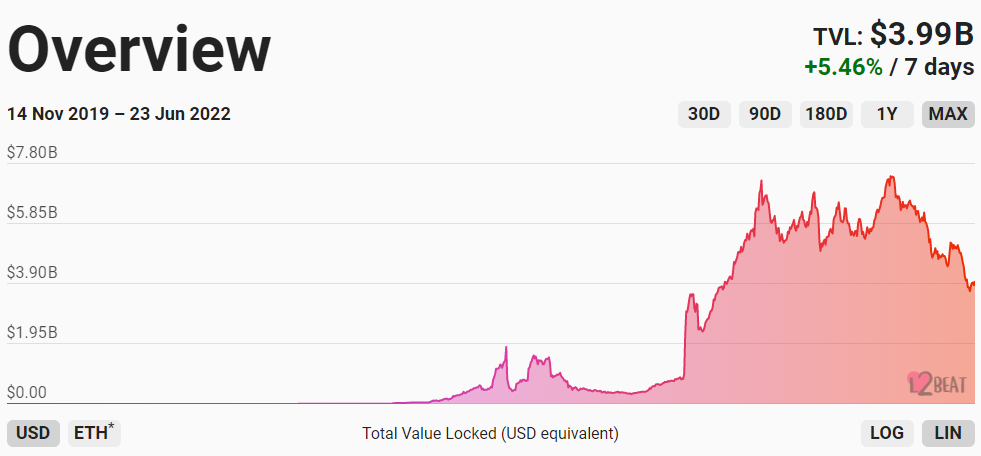

According to L2beat.com, starting from September 2021, Layer2 TVL has experienced a substantial increase, with a peak of 3 times the previous increase. Even though the market is now in a downward phase, the overall lock-up volume of Layer2 is still more than 3.9 billion US dollars. Layer2 has become the main recipient of Ethereum overflow funds and users.

image description

Layer2 TVL source: l2beat.com

The Alt L1 competition of the year is being staged at Layer2. The main expansion direction of Layer2 Rollup has developed solutions such as Validium and Volition from ZK Rollup and Optimistic Rollup at the beginning; Polygon has acquired/integrated a variety of solutions; Loopring and Metis have developed into dedicated Layer2; Aztec focuses on the privacy track; Boba Forked Optimism.

The richness, complexity, and challenges of the Layer2 ecosystem are no less than those of the Ethereum mainnet. Beep News will conduct a panoramic scan and comparison of the Layer2 ecology in this article, so as to better describe the current development of Layer2 and explore its future direction.

image description

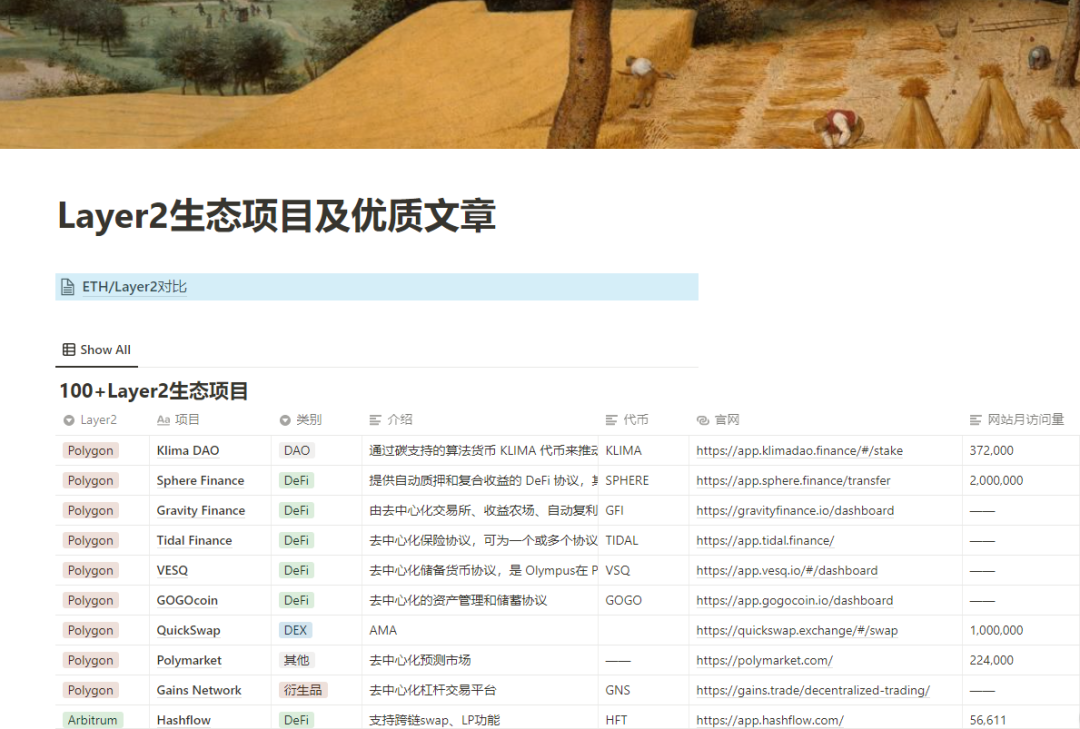

100+Layer2 Ecological Project Source: Beep News

Layer 2 data status

Through data comparison, we found that Layer2 is still an affiliated ecology of Ethereum.

Taking the data collected on June 21 as an example, the TVL (total locked amount) of the Ethereum network is 51.5 billion US dollars, and the Layer 2 as a whole is about 5.8 billion US dollars, and the TVL of Layer 2 is about 1/9 of that of Ethereum.

The number of independent wallet addresses in the Ethereum network has reached 210 million, and the number of Layer 2 as a whole is about 1.45 million. The number of independent wallet addresses in Layer 2 is about 1/140 of that in Ethereum. In terms of development activity, the Ethereum network far exceeds Layer 2.

The advantage of this main network over Layer 2 benefits from the irreplaceability of Ethereum on the one hand. Layer 2 can have multiple alternatives, while there is only one main network. On the other hand, it comes from the accumulation of time.

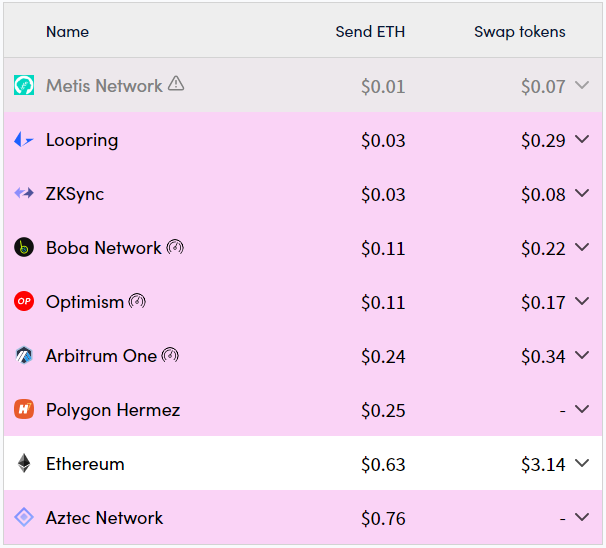

From the perspective of transaction costs, the current transaction fee consumed by each major Layer 2 swap is between 0.07-0.3 US dollars, and more than 3 US dollars on Ethereum. Using Layer 2 instead of the Ethereum mainnet to execute transactions can save more than 90% of transaction fees.

image description

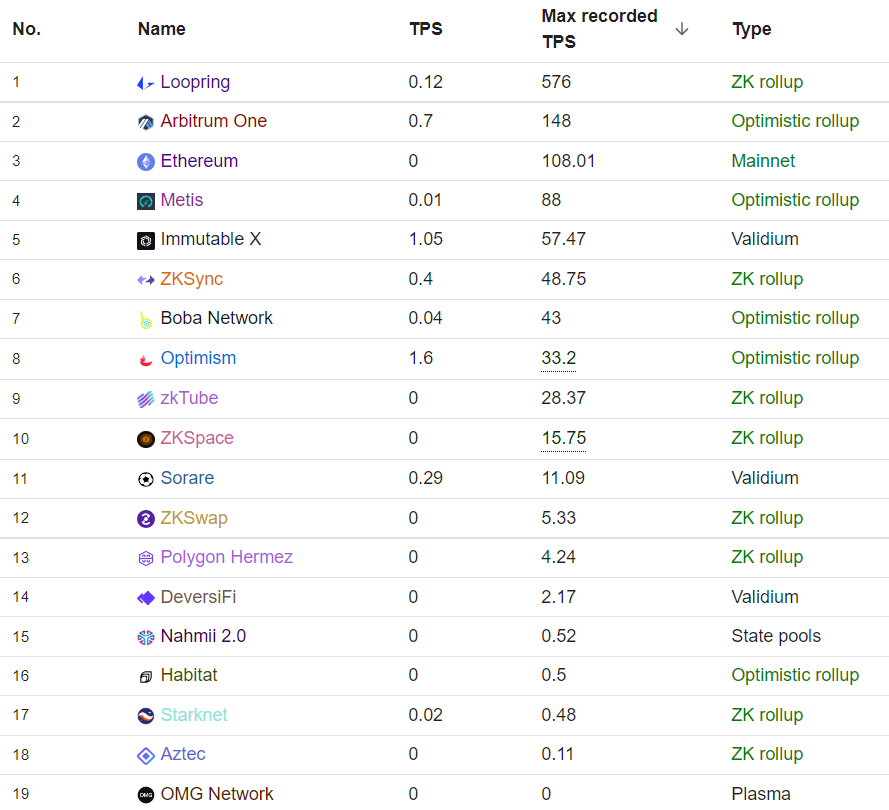

The highest recorded TPS (max recorded TPS) of Ethereum is 108, which means that Ethereum has executed up to 108 transactions within 1 second. In this data dimension, Loopring and Arbitrum reached 576 and 148 respectively, indicating that the peak period of interaction between these two Layer 2 has far exceeded the congestion period of the Ethereum mainnet. Layer2 has indeed successfully helped the Ethereum mainnet share the interactive pressure.

image description

Ethereum and Layer2 Max recorded TPS Source: ethtps.info

In addition, the daily transaction fees (part of the ecological agreement revenue) generated by the Polygon, Arbitrum, and Optimism networks have recently exceeded $20,000, which is a symbol of ecological sustainability.

The number of DAPPs in the Polygon, Arbitrum, and Optimism ecosystems has reached more than 100, of which Polygon has more than 7,000. The rich performance of DAPP types and quantities explains the health of Layer2 to a certain extent.

Layer 2 expansion solution

At present, Layer 2 of Ethereum mainly includes Polygon, Arbitrum, StarkEx, Optimism, Loopring, Metis, zkSync, Boba Network, ZKSpace, Aztec, StarkNet, etc. These ecology adopt different rollup schemes, and the ecology also has its own characteristics.

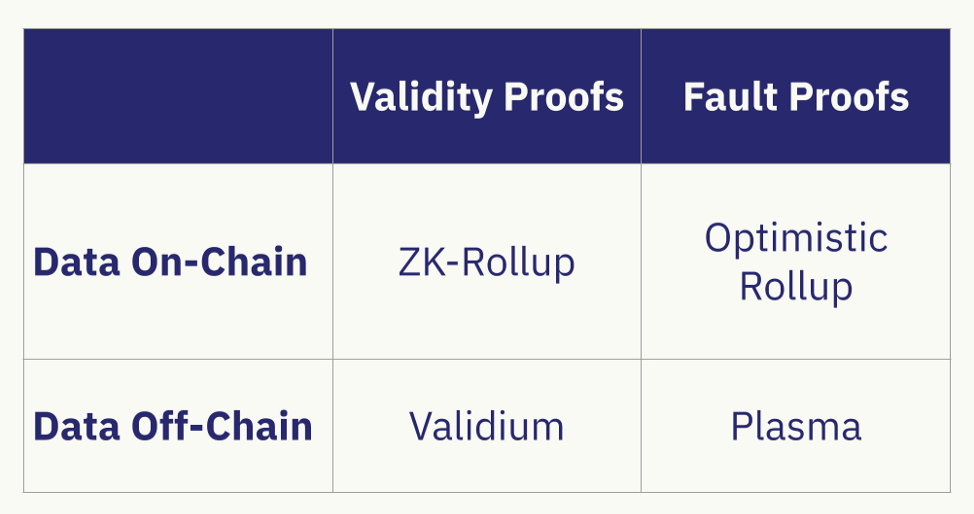

Rollup can be divided into 4 types according to different authentication methods and data availability (DA). The verification methods are divided into Validity Proof and Fraud Proof. Data availability (DA) is divided into on-chain and off-chain.

image description

Source: StarkWare

The so-called validity proof refers to positive reasoning that the transaction is valid, and the so-called fraud proof means that the default transaction is valid, and invalid proofs are eliminated within a fixed time window. To use an analogy, it is like solving a math problem. The validity proof is to solve the problem positively, and the fraud proof is to prove that a certain value is not the solution.

Therefore, the validity proof is a difficult action, and the fraud proof is relatively simple. This is why in a short period of time, projects using the ZK Rollup scheme, such as zkSync and Starkware, develop slower than Optimistic Rollup projects. ZK Rollup projects are not as compatible with EVM (Ethereum Virtual Machine) as Optimistic Rollup projects.

The other side of the coin is that using Layer 2 of Optimistic Rollup, users want to withdraw funds back to Ethereum, and there is often a "challenge period" of about 7 days, which is used to screen invalid transactions and lock funds at the same time to ensure fund security.

The difference between Data Availability (DA) on-chain and off-chain is whether the data used to prove transactions is placed on-chain or off-chain. Putting it on the chain is more secure, but it will affect the expansion effect.

Therefore, on the whole, among the above four types of Rollup schemes, ZK Rollup is the most secure, Plasma is the fastest, and Optimistic Rollup and Validium are a compromise solution.

Based on these Rollup solutions, each Layer 2 has customized its own expansion solution and explored its own application direction.

Layer 2 that adopts the Optimistic Rollup scheme includes Arbitrum, Optimism, Metis, and Boba Network.

Arbitrum's compatibility with EVM (Ethereum Virtual Machine) is its biggest advantage. Arbitrum is almost fully compatible with EVM, and developers can use it directly after migrating DAPPs on Ethereum to Arbitrum. Arbitrum is also the first Layer 2 to go live on the mainnet, which gives it a first-mover advantage.

At present, Arbitrum is one of the most active ecology among all Layer2, TVL is the highest among all Layer2, and the number of DAPP in the ecology is second only to Polygon. The recently launched Odyssey activity will bring heat to it and help it attract users and funds. Promote the development of DAPP.

Optimism has achieved full compatibility between OVM (Optimistic Virtual Machine, used to execute transactions on Optimism) and EVM, and the development tools on the original Ethereum can also run directly on OVM.

The biggest feature of Optimism is that the ecological DAPP has access, and at the same time it is committed to the development of public goods. The team promises that all profits will be used to promote the development of public goods. Vitalik has repeatedly expressed his support and appreciation for Optimism, which may be an important reason.

Boba Network and Metis also adopt the Optimistic Rollup scheme. Among them, Boba Network is forked from Optimism. Boba shortens the exit cycle of Optimistic Rollup from 7 days to a few minutes through the community-driven liquidity pool. This should be Boba's biggest improvement on Optimism.

Metis uses a parallel Optimistic Rollup architecture. It can be understood as a network with different execution layers. Different execution layers are dedicated to specific applications. The applications are mainly DAC (Decentralized Autonomous Company), etc. DAC is a concept that Metis emphasizes very much.

Layer 2 that adopts the ZK Rollup scheme includes StarkWare, Loopring, zkSync, ZKSpace, etc.

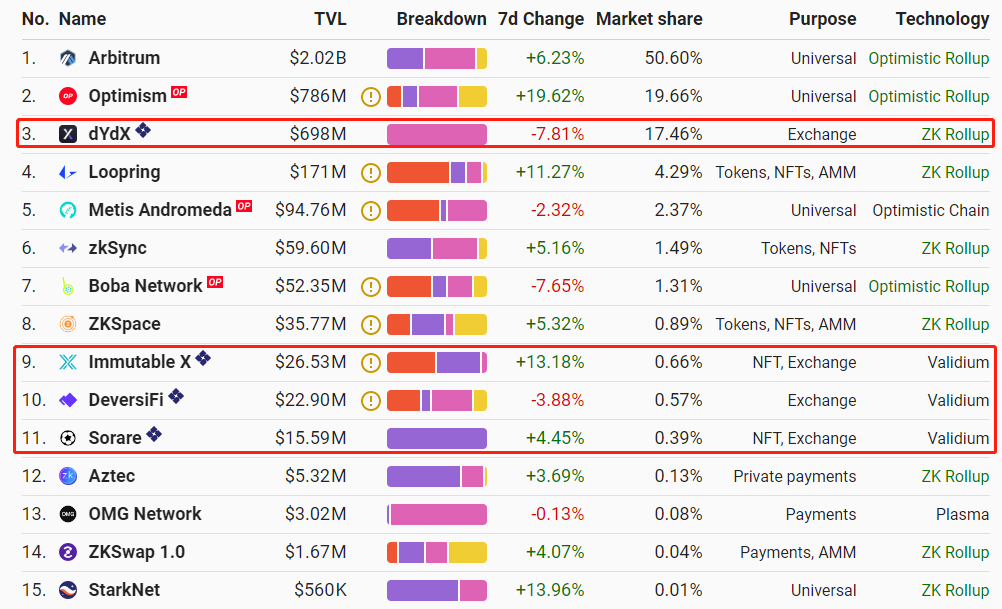

StarkWare mainly launched two products - StarkEx and StarkNet. StarkEx is oriented to operators. Currently, only dYdX (dYdX recently stated that it will use the Cosmos SDK to launch its own application chain, and StarkEx may not be able to meet the performance requirements), Immutable X, DeversiFi, and Sorare use StarkEx. Although the number of applications is small, the data of these DAPPs can stand alone.

image description

dYdX, Immutable X, DeversiFi, Sorare Source: l2beat.com

Among them, DeversiFi and Sorare are StarkEx's Validium implementation (validity proof + off-chain DA), and Immutable X adopts the Volition scheme. Volition is an architecture pioneered by StarkWare. For each transaction, operators/users can choose to adopt ZK-Rollup or Validium scheme.

Compared with StarkEx, StarkNet is more open. It is a permissionless Layer 2. Any developer can deploy DAPP on it, and Voliton is also adopted.

At present, StarkWare and zkSync are the two relatively large ecosystems in the ZK Rollup solution, which embodies the market's expectations for the development of ZK Rollup. However, due to the difficulty of development and slow progress, most of the DAPPs in these two ecosystems have not yet been launched.

In addition, Aztec and Polygon are also worth mentioning. Aztec focuses on Layer 2 with privacy protection. Polygon is taking the route of acquiring/integrating multiple expansion solutions.

Polygon currently mainly relies on side chains (PoS chains) for expansion. It also uses Plasma (fraud proof + off-chain DA), and a data availability layer Polygon Avail, and has acquired Hermez in the direction of zkEVM (zero-knowledge Ethereum virtual machine). Polygon's ecological richness is prominent among all Layer2s, but its originality and whether it belongs to the orthodox Ethereum ecology have also been questioned.

Layer2 ecological comparison

On the whole, DAPP has obvious repeated layout phenomenon between Layer2.

The cross-chain bridge is standard, and Orbiter and LayerSwap are common in Optimistic and ZK systems

Cross-chain bridges are standard for all Layer 2, and almost every Layer 2 is equipped with multiple bridges, among which Polygon, Arbitrum, and Optimism include almost all bridges because of their strong compatibility, including Hop, Stargate, Bungee, Orbiter, Synapse, Layerswap , Multichain, etc.

Due to the poor compatibility of ZK-based Layer2, the matching cross-chain facilities are relatively limited, mainly Orbiter and Layerswap. These two bridges are commonly used in Optimistic and ZK systems, so you can focus on them.

There are many native DAPPs in Layer 2 of the ZK series, many of which are not online, and Argent and Zigzag are essential DAPPs

Also because of poor compatibility, zkSync and StarkNet ecological DAPPs of the ZK series are relatively native, and a large number of projects are in the state of "to be launched". However, if you go to understand these two ecologies, you will definitely hear that there are two essential DAPPs, namely the wallet Argent and the order book DEX Zigzag.

In contrast, among Polygon, Arbitrum, Optimism, and Boba of the Optimistic Rollup series, DAPPs are abundant, even to the point of flooding. The regular DAPPs of each track, such as Uniswap, Sushi, Aave, Curve, Wepiggy, BoringDAO, Hundred Finance, etc., are generally deployed on these Layer 2.

tofuNFT and Taker Protocol are the most common NFT projects in Layer2

On the NFT track, the NFT projects that appear frequently on each Layer 2 are tofuNFT and Taker Protocol, which are the multi-chain NFT market and the NFT mortgage loan market respectively.

In addition, although Optimism is an ecology with access (DAPP needs to be deployed through application), the NFT project on Optimism has an obvious Ethereum NFT imitation style.

DeFi is the most mature track in the Layer2 ecosystem

Among all the tracks in the Layer2 ecology, DeFi is the most complete. In contrast, NFT, GameFi, and SocialFi tracks are relatively "barren" (except Polygon).

Generally speaking, the Layer2 ecosystem does not lack DEX and payment DAPPs. In addition, there are some revenue optimization, asset management, lending, and derivative projects. The track and applications are relatively rich.

There is also no lack of innovation in the DeFi track. In addition to AMMs, there are also many order book DEXs, such as Zigzag, Aboard, Unidex, Rubicon, and Sat.is. Decentralized trading of derivatives such as futures, options, and perpetual swaps is the direction of many DAPP attempts. In addition, there are some platforms that support the construction of trading strategies among DeFi.

Other innovative and exciting projects

Innovation and optimization of user experience have also appeared in some non-DeFi tracks. For example, Layerswap is a cross-chain bridge dedicated to cross-chain from CEX to Layer2. Newer cross-chain bridges such as Bungee have introduced the function of "refueling" (supplementing the gas of chain A to chain B).

A platform like XDAO is a good DAO tool. It is a DAO creation and management platform. It aggregates all DAOs built on XDAO, and you can view the funds and membership of these DAOs, and participate in voting. You can also swap different DAO assets. The platform also provides some templates for creating DAO without code. For example, through these templates, DAO can distribute dividends to members, provide gas fee compensation, set token unlocking, etc.

Among the Layer 2, only Aztec focuses on the privacy track, which is its biggest feature. However, Aztec currently has a single ecology, with only one DAPP, zk.money. Therefore, the interactive options of this ecology are very clear.

epilogue

epilogue

The Layer2 track is on the rise. Based on solutions such as ZK Rollup, Optimistic Rollup, Validium, Volition, and Plasma, Layer 2 has customized different expansion routes and clarified the ecological direction.

Layer 2 ecological data has seen a significant increase, and some high-quality projects have also emerged, such as Zigzag, XDAO, etc. The competition between Layer 2 is becoming fierce, and DAPPs are repeatedly deploying between Layer 2, but the liquidity split between layers and the security of cross-chain facilities are still unsolved problems.