Original editor: Colin Wu

Original editor: Colin Wu

Risk warning: This article does not involve any guidance and guidance on trading behavior, readers are requested to strictly abide by local laws and regulations

Maple Finance is a lending protocol built on Ethereum and Solana that provides institutions with unsecured credit. Recently, the official issued a document stating that starting from the week of June 20, there may be insufficient funds in the fund pool, and lenders will have to wait for borrowers to repay.

The earliest research on this comes from the Twitter account @plzcallmedj, which inspired this article.

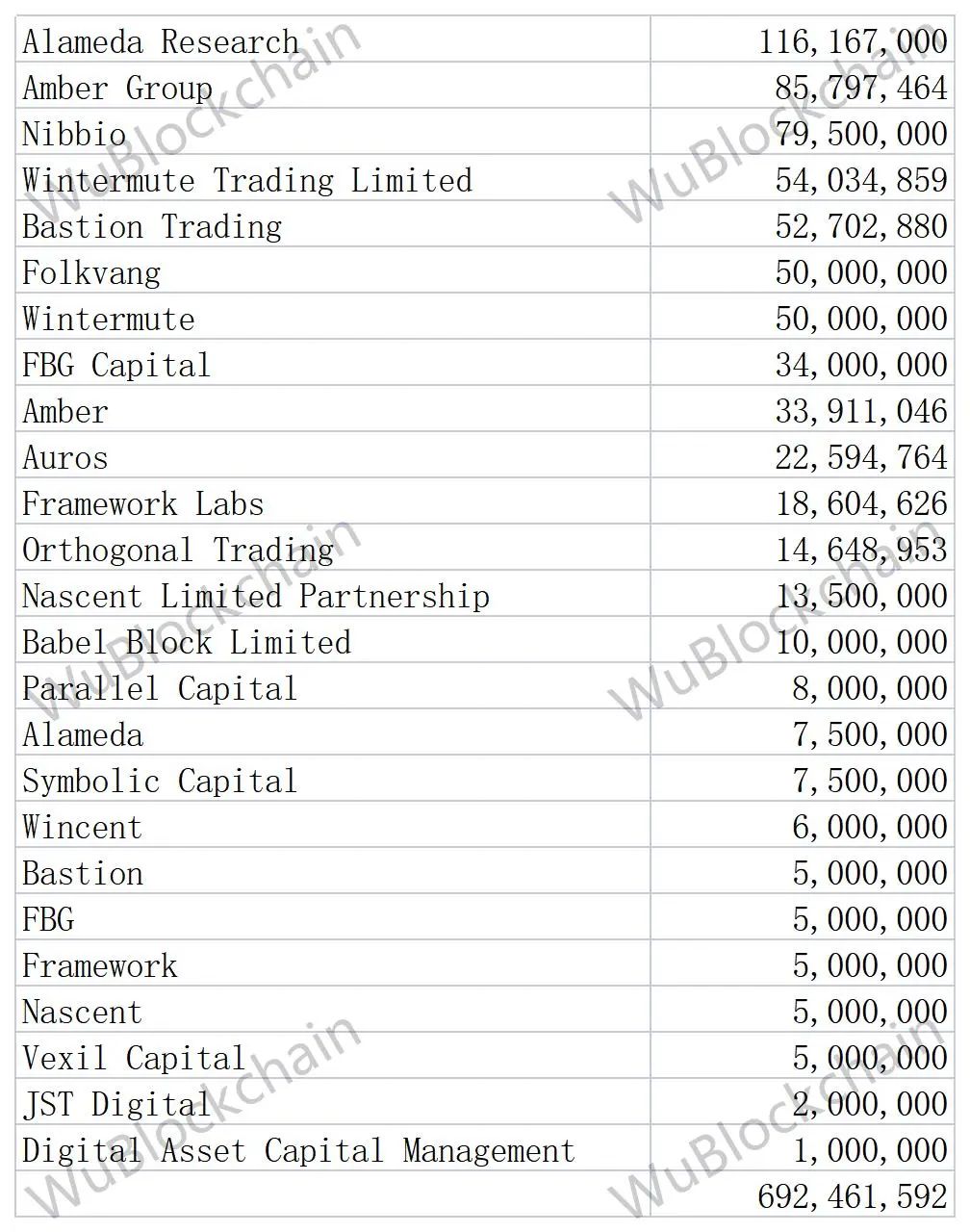

Maple has issued a total of $692 million in loans so far, and Alameda Research, the largest borrower, has lent $116 million. However, Alameda Research is also a depositor of Maple, depositing a total of $89.17 million, resulting in a net lending position of $26.37 million.

In second place is the Amber Group, which lent a total of US$89.8 million at interest rates ranging from 3.75% to 7.6%, with maturities between July 19 and December 10.

In third place is Nibbio, which lent a total of $79.5 million at interest rates ranging from 7.1% to 9.75%, with maturities between August 11 and October 29.

The rest of the rankings are as follows:

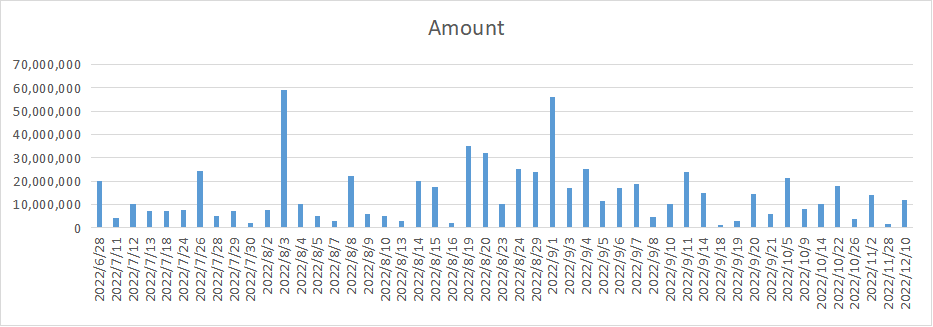

The earliest repayment date for all outstanding loans is June 28 and the latest is December 10.

In addition, Maple Finance currently has US$150 million in cash available for loans, and only US$697.5 billion left in the Alameda Research pool (for self-borrowing only).

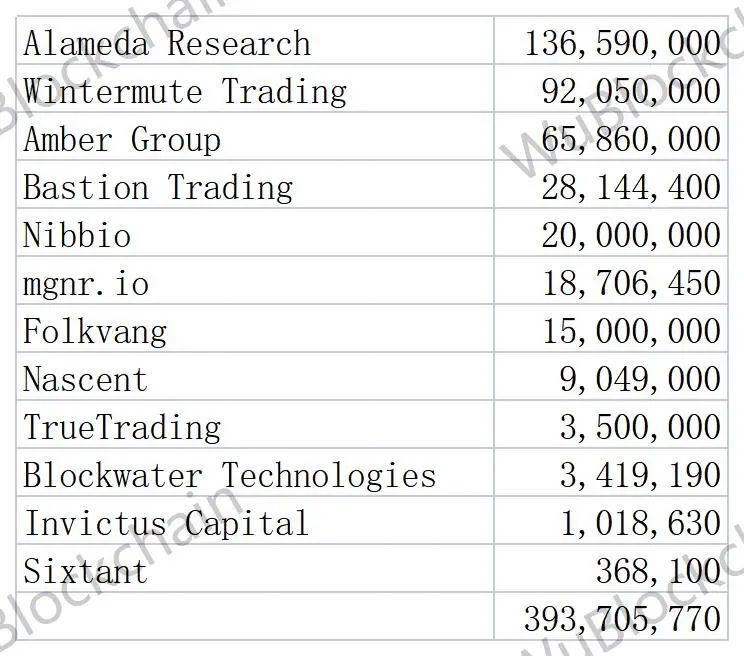

The institutional lending platform that is also facing the depletion of deposits is TrueFi, and the borrowers of this platform must be white-listed institutions with funds of more than 10 million US dollars.

At present, TrueFi has issued a total of 394 million US dollars in loans. The largest borrower is Alameda Research, which has lent 137 million US dollars with an interest rate of 7.05% to 7.15% and a maturity date of early August.

In second place is Wintermute Trading, which lent a total of US$92.05 million at an interest rate of 8.73% with a due date of October 15.

The third place is Amber Group, which lent a total of 65.86 million US dollars, with interest ranging from 9.23% to 9.35%, and the due date is August 18.

The rest of the rankings are as follows:

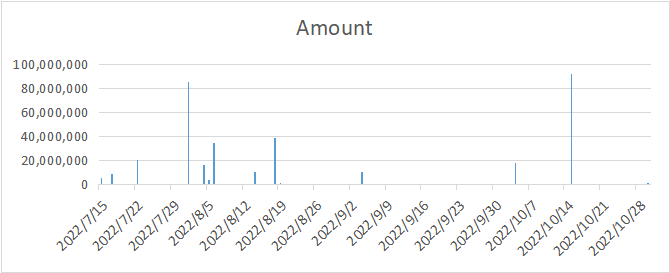

The earliest repayment date for all outstanding loans is July 15 and the latest is October 30.

In terms of deposits, the total amount of TrueFi is 407 million US dollars, 96.6% of which have been borrowed so far, and the remaining cash available for loans is only 13.59 million US dollars.

Both platforms are facing the problem of depleted deposits, and the dates for large repayments are concentrated from the end of July to the beginning of August. However, since these two platforms are unsecured lending, depositors' rights and interests are only protected by pledging platform tokens, so even if a default event occurs at that time, only the depositor's funds, the price of platform tokens and the credit score of the borrower will be affected , but has no impact on the encryption market (it will not cause serial liquidation of BTC or ETH).

In addition, Maple Finance posted on its official website that Orthogonal admitted that the Orthogonal USDC pool on Maple provided a loan of $10 million to Babel. Since Babel stopped withdrawing funds, Orthogonal has been in touch with Babel's management.