Take a look at the recent Arbitrum Odyssey, which has been hotter

It will be divided into two parts. This article will mainly give insights into the potential of Arbitrum. As for how to make the airdrop, there will be an explanation in the second part of the article.

first level title

What is Arbitrum?

secondary title

When will Arbitrum release its native token?

secondary title

Arbitrum Aims to Solve Ethereum Gas and Congestion Problems

Arbitrum is Ethereum's Layer 2 expansion solution, which provides a solution to the high gas fees and network congestion problems faced by Ethereum.

As Layer 1, the base layer of Ethereum is limited to only 15 transactions per second, which limits the scalability of Ethereum under the current situation of huge demand for Ethereum usage. Arbitrum uses Rollup expansion technology, which acts like an outsourced worker. When the Layer 1 blockchain network is congested, the smart contract connects it to the Arbitrum main chain of Layer 2, moves the complex and computationally intensive work to L2, and then packs and transmits the records back to the Ethereum blockchain, saving The computing power of Ethereum.

secondary title

Introduction to Arbitrum Functions

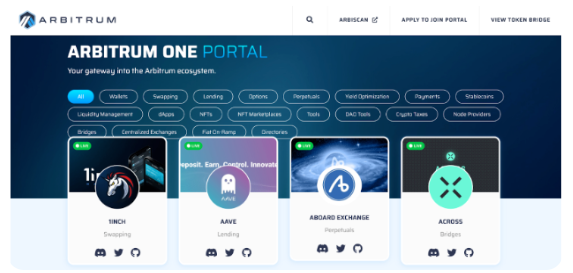

As mentioned above, Arbitrum is the expansion solution of Ethereum, and it is fully compatible with the smart

The ability to contract means that a large number of Ethereum-based projects are integrated on the Arbitrum chain, including protocols such as cryptocurrency transactions, loans, derivatives, NFT transactions, and mortgage interest collection.

first level title

Arbitrum's Ethereum Expansion Solution—Rollup Technology Introduction

The 7-day challenge period from Arbitrum cross-chain to Ethereum is due to the rollup technology it uses.

The expansion technology used by Arbitrum is the mainstream Optimistic Rollups, which is to compress and transfer the transaction data of Ethereum to an additional L2 blockchain for calculation, and then transmit the data back to the Ethereum main chain for verification after the transaction is executed.

The L2 Arbitrum chain has higher computational efficiency and lower operating costs than Ethereum. And by computing on an additional main chain, it helps to reduce the network burden of Ethereum and relieve congestion.

Rollup technology requires a smart contract connecting the L2 chain and the L1 chain. The contract is used to transfer and verify that the calculations and transactions on the Rollup chain are correct. The Rollup technology is divided into Optimistic Rollup and ZK-Rollup. The Optimistic Rollups technology used by Arbitrum uses a "fraud proof" mechanism. When a transaction is executed and processed, it assumes that the result is correct without any verification, and publishes the data to the main chain.

So how can Optimistic Rollup ensure that the data is correct? That's why there's a 7-day challenge period. Optimistic Rollup uses the "dispute resolution system" mechanism. To commit a transaction from the Rollup chain to the main chain, the submitter needs to provide a security deposit, which is usually submitted in ETH. If someone in the Rollup network finds that the transaction is fraudulent or invalid, they can submit a deposit to submit a "fraud proof". The deadline for submitting a "proof of fraud" is seven days.

first level title

secondary title

AAVE、Uniswap、Sushiswap

Aave is a decentralized cryptocurrency lending system, the latest v3 version runs on 6 blockchains. Aave acts like a traditional bank, allowing users to deposit or lend cryptocurrencies without requiring third-party intermediaries to intervene in the lending process. Depositors provide liquidity to the market by depositing cryptocurrencies into Aave's deposit pool to earn interest as passive income. Borrowers can borrow money by pledging designated cryptocurrencies. On Aave, it is possible to lend or deposit more than 30 cryptocurrencies, such as BTC, ETH, DAI, AVAX, FTM, USDC, and more.

Uniswap is a decentralized exchange based on the Ethereum blockchain, which can support the exchange between ETH and other different tokens, or between tokens and tokens issued based on the Ethereum ERC20 protocol. In addition, users can deposit funds for liquidity mining.

Liquidity mining needs to deposit two currencies, and set the exchange rate range of the two currencies, as well as the handling fee. When the user wants to exchange currency, the handling fee can be charged in return.

secondary title

Arbitrum Hot Discussion: How to Get More Airdrop Rewards?

Arbitrum, as the largest Ethereum expansion L2 blockchain, has not yet launched a native token, which has caused many people to discuss and look forward to the "airdrop" when Arbitrum issues tokens to earn a wave. So if you want to get more airdrops, what should you do to prepare?

Summarize

Summarize

Odyssey will welcome a new wave of Arbitrum users and further grow the L2 community.

Arbitrum, the L2 itself, is still in beta, which means the technology's highs haven't come yet, so to speak. However, the arrival of Odyssey shows that the builders of Arbitrum are confident in their current ability to scale the solution and are ready to advance L2 into the next chapter.

For now, we can only speculate on what the next chapter will look like. If it does involve issuing native tokens, participating in Odyssey and its quests seems like an easy way to qualify for an airinvestment while backing up-and-coming L2 and collecting cool NFTs.

watch nextOdyssey Cross-chain Weekly Tutorial of Arbitrum Ecology