Table of contents

Table of contents

Introduction: Lido's Distress

1. Route Planning of Ethereum 2.0

1.1 Roadmap of Ethereum 2.0

2. Market size

2.1 Staking function enabled

2.2 Node scale

3. Nodes play an important role in the staking ecosystem

3.1 Responsibilities of nodes

3.2 Factors limiting nodes

4. Types of Staking Service Providers

4.1 Node Operators

Currently the main types of node operators:

4.2 Liquidity pledge service providers to solve liquidity problems

4.2.1 Self-running node type - Ouyi OKX earns coins

4.2.2 Non-running node type - Lido

4.3 Infrastructure Service Providers

4.4 Summary

first level title

Introduction: Lido's Distress

The risk of unanchoring of ETH and stETH on Lido is a recent hotspot, and it is also a dark cloud that hangs over the Ethereum ecology recently.

Lido is an Ethereum 2.0 liquidity staking protocol. We can deposit ETH through Lido to earn stETH. After stETH is connected to AAVE for staking, we can lend ETH through AAVE, so many people are established under the revolving loan between AAVE and Lido. billions of leverage scale. However, due to the postponement of the merger of the Ethereum 2.0 mainnet, participants cannot unstake stETH within a short period of time. This means that if the anchoring of stETH/ETH fails, ETH bulls may be completely liquidated after exceeding a certain limit, and stETH/ETH becomes a time bomb that can be detonated at any time.

The reason is that the revolving loan combined with AAVE magnifies the market risk. At this time, the non-redeemability of stETH becomes a huge bug that may cause the system to crash.

first level title

secondary title

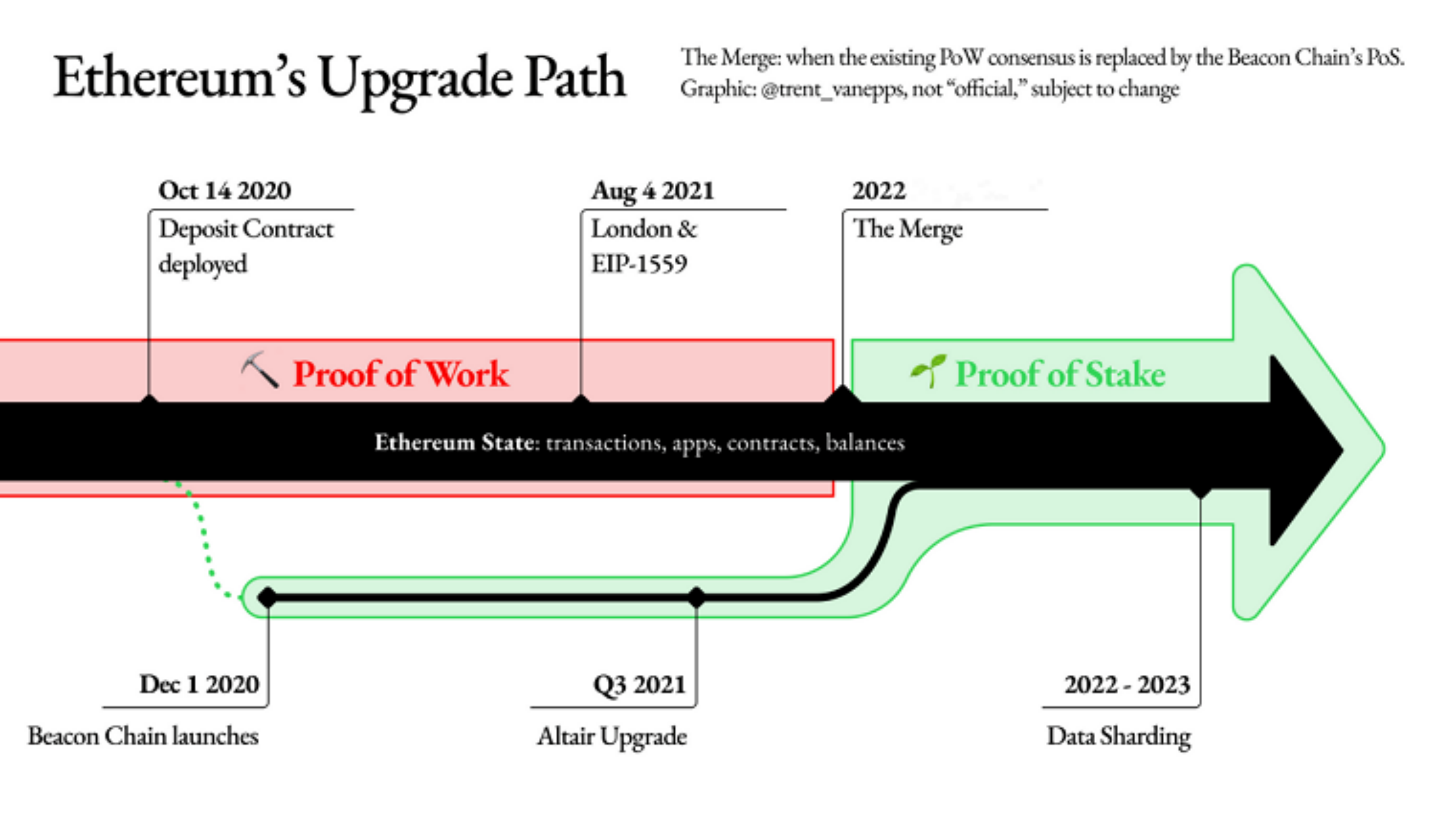

1.1 Roadmap of Ethereum 2.0

The goal of Ethereum is to become a distributed financial and smart contract execution platform, becoming "a real world computer". In order to achieve the goal of the world's computer, it set four development stages at the beginning of its birth in 2014: Frontier (frontier), Homestead (home), Metropolis (metropolis), Serenity (tranquility).

The first three stages all adopt the PoW model, and the fourth stage will complete the transformation from PoW to PoS, which is the final form of Ethereum, which is what we often call Ethereum 2.0. It is committed to greatly improving the scalability and performance of the Ethereum network without reducing decentralization. It improves the processing capacity of the network by introducing fragmentation. The beacon chain is the "commander" of the entire Ethereum 2.0 network. and Control Center".

image description

(The latest roadmap for Ethereum upgrades)

first level title

secondary title

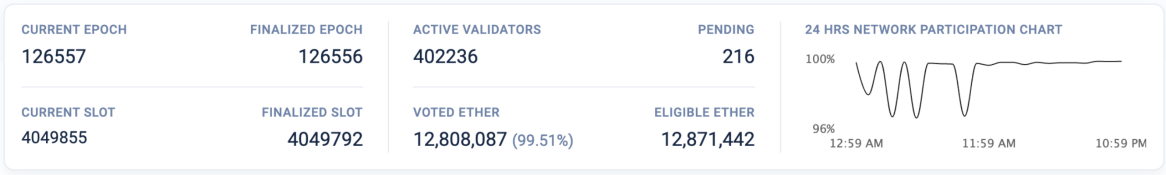

2.1 Staking function enabled

image description

(Beacon chain block data, picture from https://beaconscan.com/)

secondary title

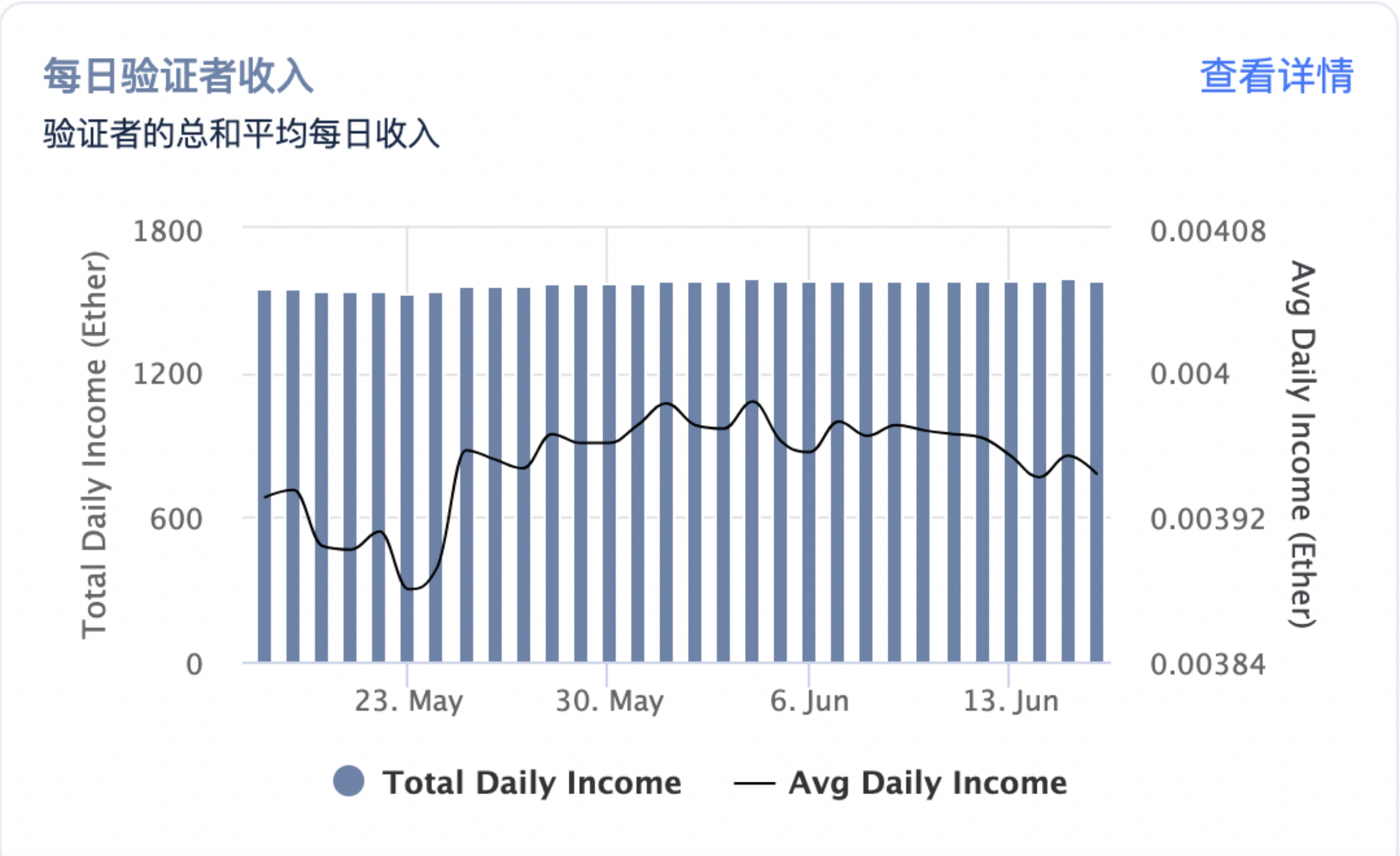

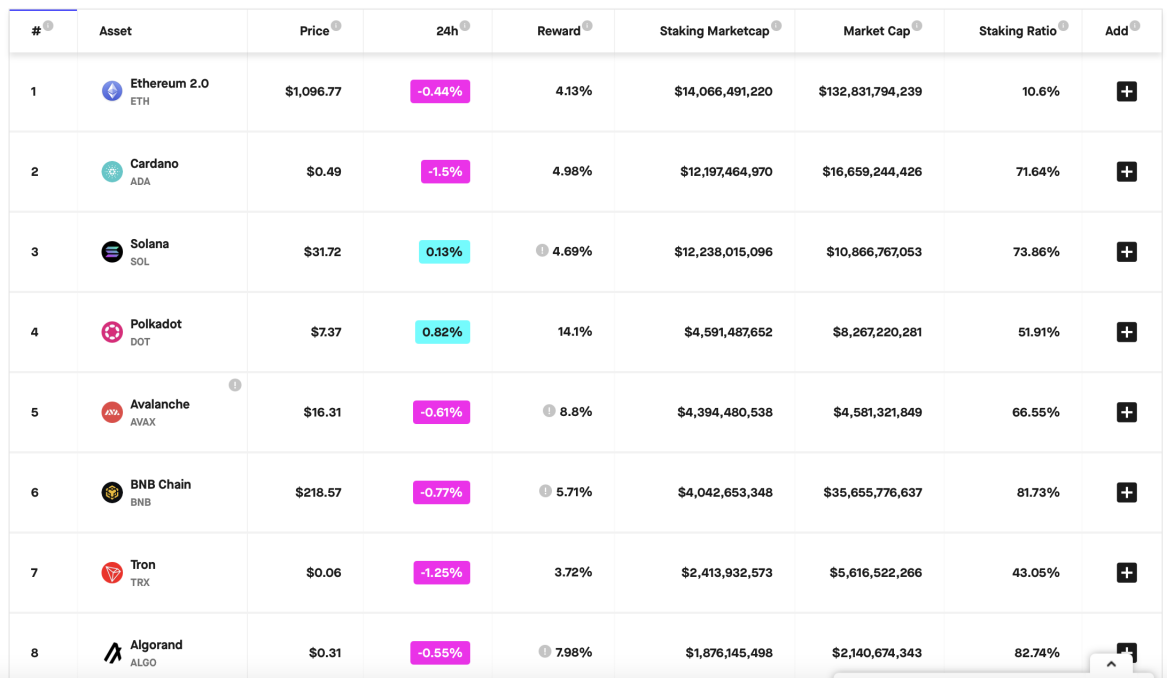

2.2 Node scale

image description

(POS pledge sorting, the picture comes from stakingrewards)

image description

first level title

secondary title

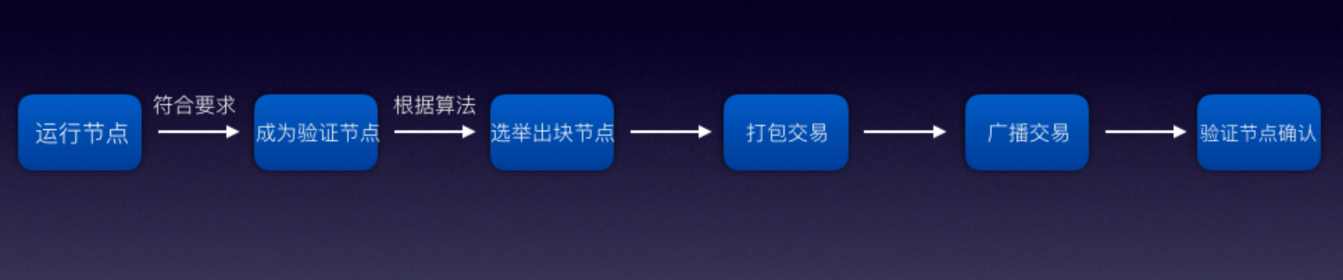

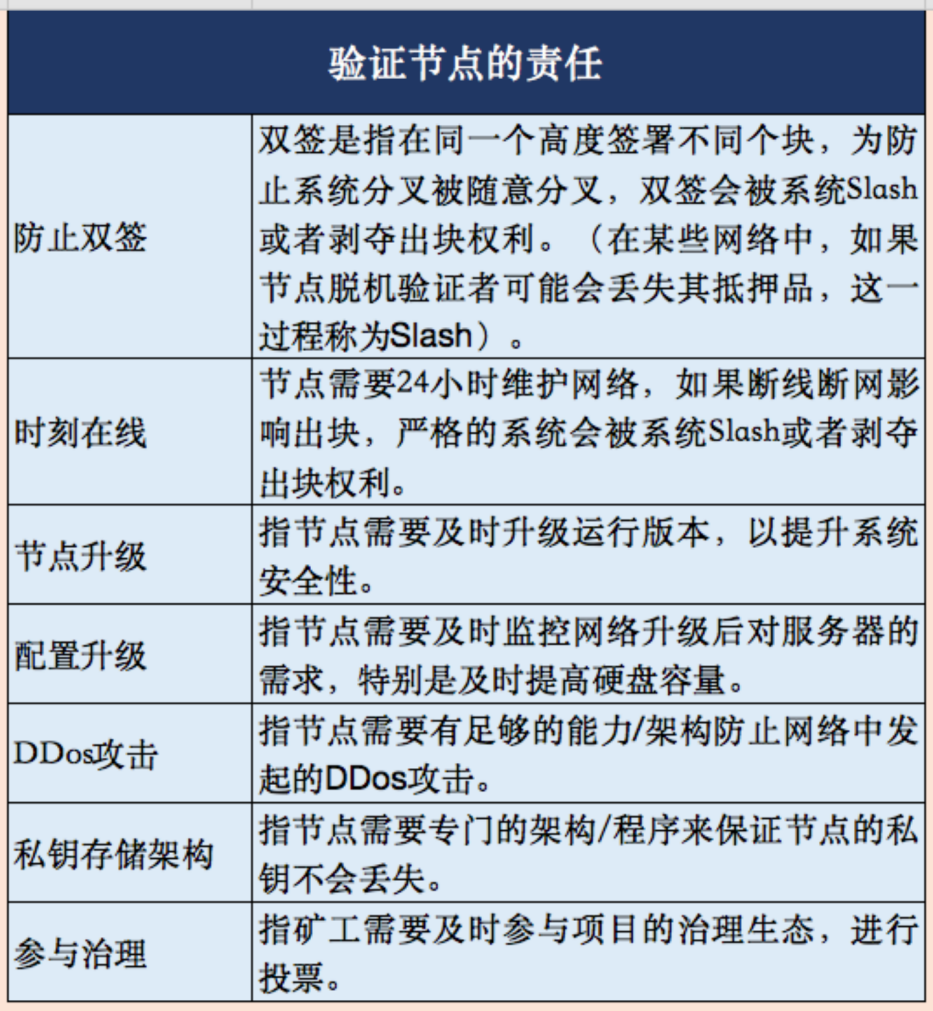

3.1 Responsibilities of nodes

image description

(Node block production process, the picture comes from Ouyi Research Institute)

image description

(Node responsibility, the picture comes from Ouyi Research Institute)

secondary title

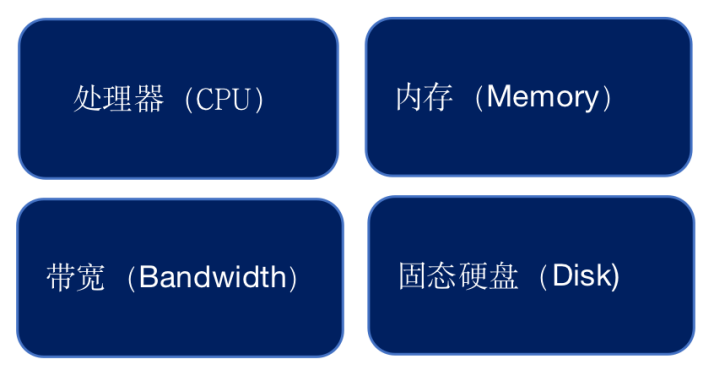

3.2 Factors limiting nodes

It is an indisputable fact that nodes have great responsibilities, so if we are going to run an ETH node, we need to consider the following limiting factors:

Hardware threshold

image description

(Node hardware requirements, the picture comes from Ouyi Research Institute)

The self-built server method requires purchasing a hardware server, connecting to electricity and the Internet, and running the service. Hardware costs, site costs, and operating labor costs must be taken into account, and 24-hour uninterrupted power and network are required, and the environmental requirements are relatively high.

Mortgage Token Threshold

liquidity risk

liquidity risk

Since the PoS chain and the PoW chain have not yet been merged, the current ETH can only be stored one-way from the PoW chain to the beacon chain, and cannot be retrieved, which means that early deposit users will lose liquidity. The encrypted asset market is a highly volatile market, and Staking is mostly accompanied by a token lock for a certain period of time. Once the user entrusts to participate in Staking, the funds cannot be realized in time under the extreme market conditions of large price fluctuations. From the perspective of the currency standard, the number of currency holdings has indeed increased after staking, but if it is for fiat currency, it may suffer certain losses under special market conditions.

Forfeiture risk

In order to ensure the security of the chain, the system requires at least 32 ETH to be pledged. If validators do evil, they will not be able to obtain Staking rewards as punishment, or even lose their pledge. This is the unique punishment mechanism in PoS, Slash. The most important point for token holders to participate in Staking is to ensure the security of their Token. When nodes do nothing actively or passively after being attacked when producing blocks, they will be financially punished for doing so improperly or maliciously. If the punishment is light, the node will not be able to continue to obtain the block production qualification, and if the punishment is severe, the token locked by mortgage will be directly confiscated.

first level title

4. Types of Staking Service Providers

secondary title

4.1 Node Operators

Node operators can solve staking hardware issues and token threshold issues. They require devices to run clients of the chain, stay online, and maintain the consensus of the blockchain. Ordinary currency holders can directly entrust the ETH they hold to the node operator, and the operator will replace them to maintain the network consensus and get rewards. The Ethereum income that the currency holder can obtain will be pledged with the ETH accounted for by the entire network ETH pledge The ratio is related, and it is no longer necessary to purchase hardware such as mining machines. However, the node will also charge users a certain fee as a service fee, usually charging 5%-15% of the user's pledge reward as a reward for the services provided. In this way, node operators can also get rewards for accepting entrusted services in addition to their own staking rewards.

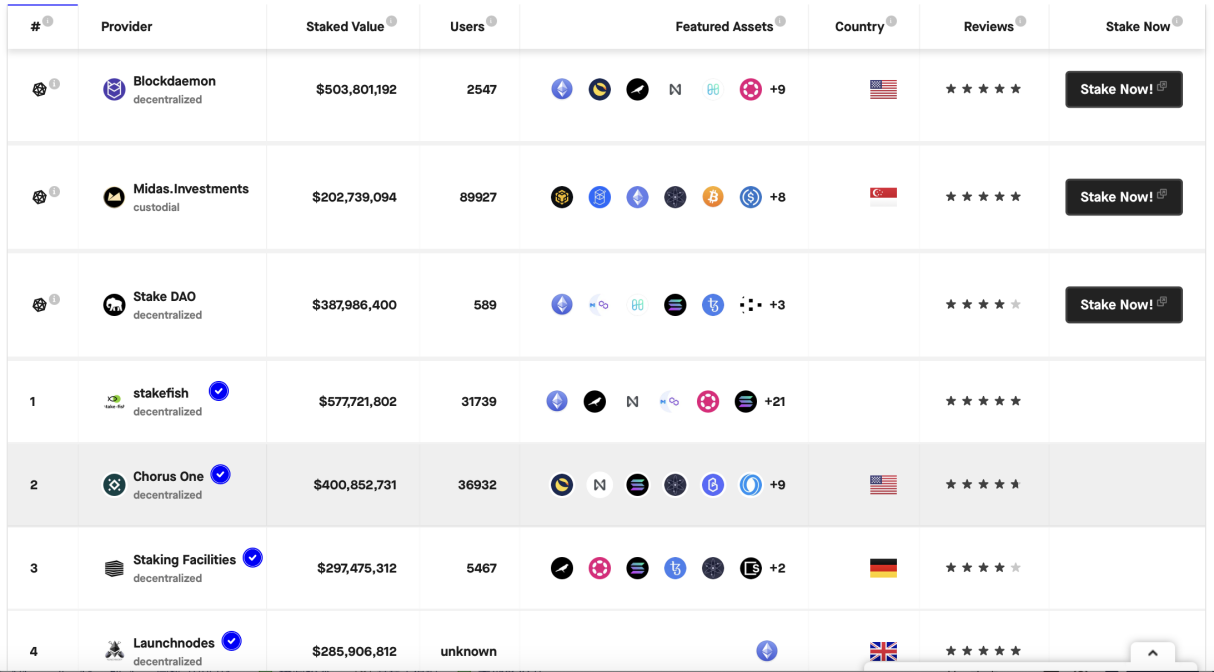

Currently the main types of node operators:

(1) Wallet: As a tool for managing multi-chain assets, the wallet has a sufficient user base and is a natural tool to help users participate in Staking. At present, many official wallets and decentralized wallets have been able to support entrusting to different validator nodes. The coin holder has the right to choose a suitable node. In the wallet, the coin holder can find the delegation button and entrust a certain amount of coins to the favorite node. You can also mortgage redemption, one-click reinvestment, and check your daily income.

(2) Mining pools: The major mining pools have gathered a group of miners who are familiar with the blockchain mechanism. They naturally coincide with the attributes of staking users, so the mining pools are also the main node operators. Just as computing power mining pools attract miners to join with their computing power, they also encourage token holders to stake their voting rights in their own mining pools in projects that support staking, compete for the right to generate blocks and share the benefits.

(3) Exchange: The exchange uses the deposits of internal users for staking and enjoys the benefits of additional issuance every year. This will become an additional income for the exchange in addition to transaction service fees and currency listing fees. When users start to pay more attention to the equity benefits of holding currencies, exchanges that can provide staking services and users can get rewards will be better than exchanges without staking services.

(4) Community nodes: Community nodes are usually groups that pay close attention to project development and make positive contributions to project governance. They can further influence the development direction of the project and obtain the benefits of additional issuance of projects by participating in the nodes. .

(5) Investment institutions: Early investors or institutions of the project are more likely to hold a large amount of Token. If the investment institution is very optimistic about the project it invests in, it can directly become a node after getting the Token and continue to contribute to the project.

image description

(Mainstream node operators, pictures from https://www.stakingrewards.com/providers/)

With the deepening of competition among nodes, many node operators continue to lower the Token threshold for pledgers, and are also providing more flexible revenue settlement models, such as:

(1) Service fee adjustment mode: Different nodes attract clients through service fee rate competition, which is the factor that most directly affects the entrusted user's income, but too low a fee rate will also damage the interests of nodes. The currently observed gameplay It is to promote the service rate first and then adjust it, or lower the service rate in the middle of a few cycles.

(2) Guaranteed income model: When the node loses the block for any reason and loses the reward, the node still guarantees that the client has the reward of the block.

(3) Timely arrival mode: Each PoS consensus blockchain will have a token lock-up period to ensure that nodes do not do evil. Nodes with a certain amount of liquidity promise that the income will be issued in a timely manner on the same day to meet the liquidity needs of users.

image description

secondary title

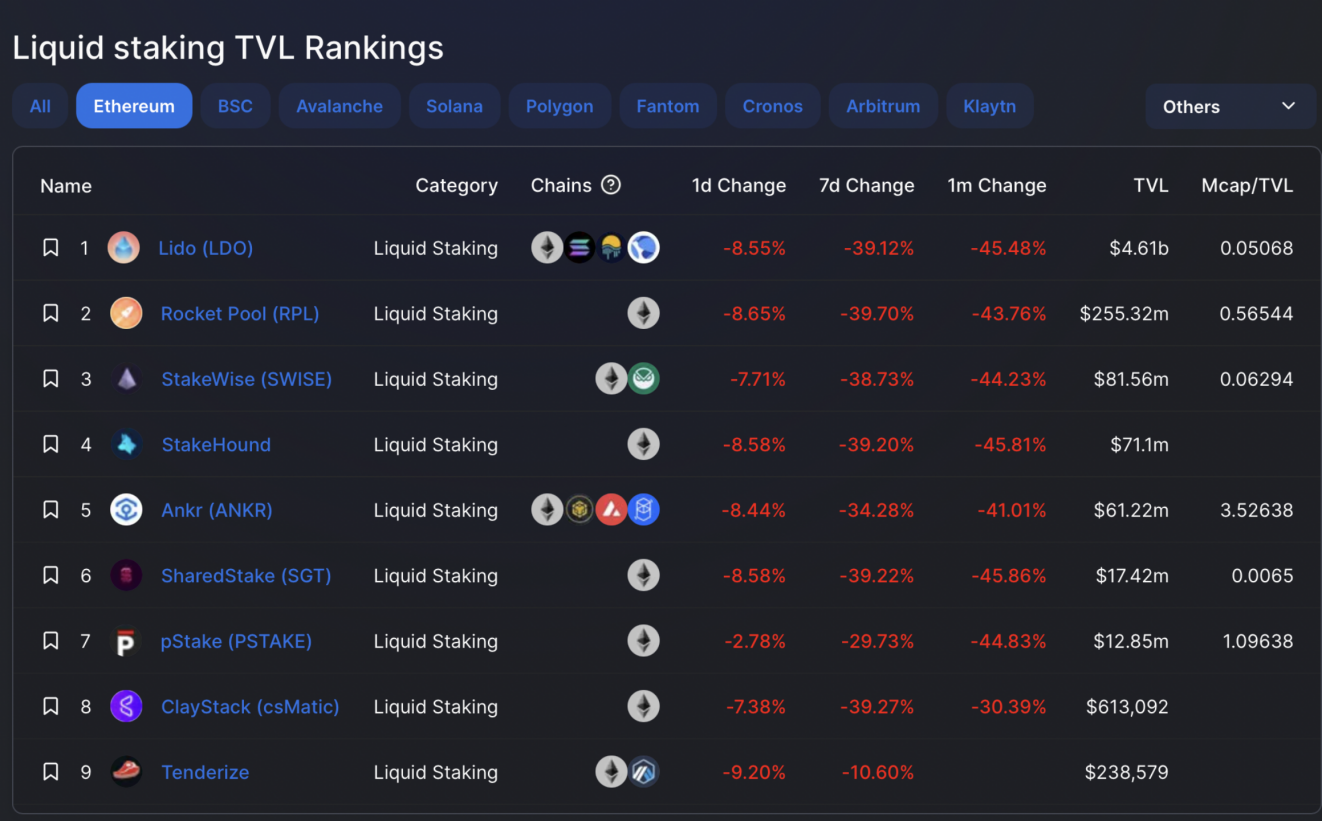

4.2 Liquidity pledge service providers to solve liquidity problems

text

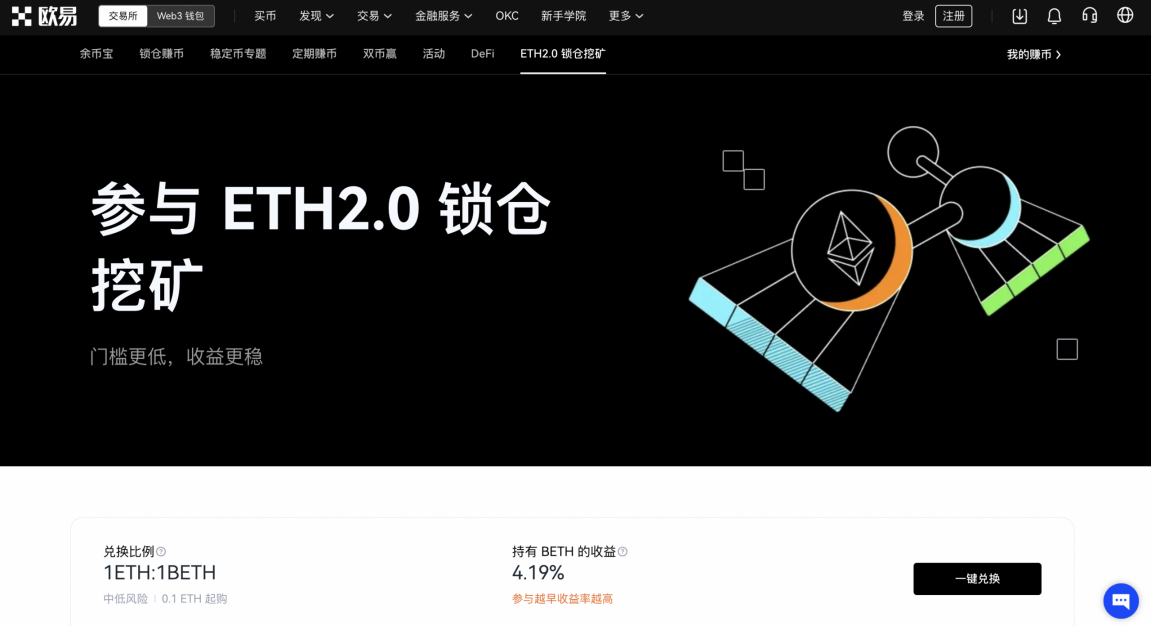

4.2.1 Self-running node type - Ouyi OKX earns coins

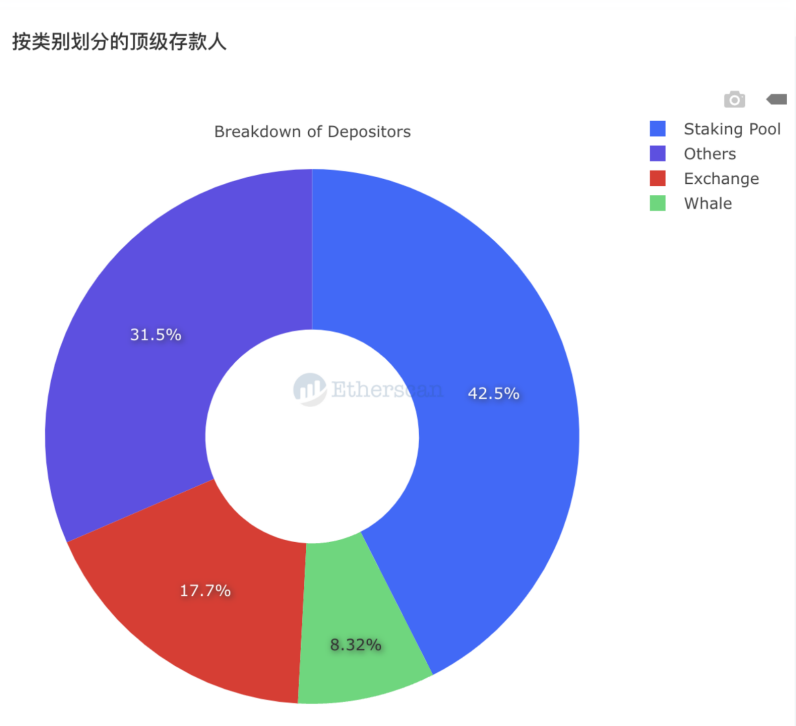

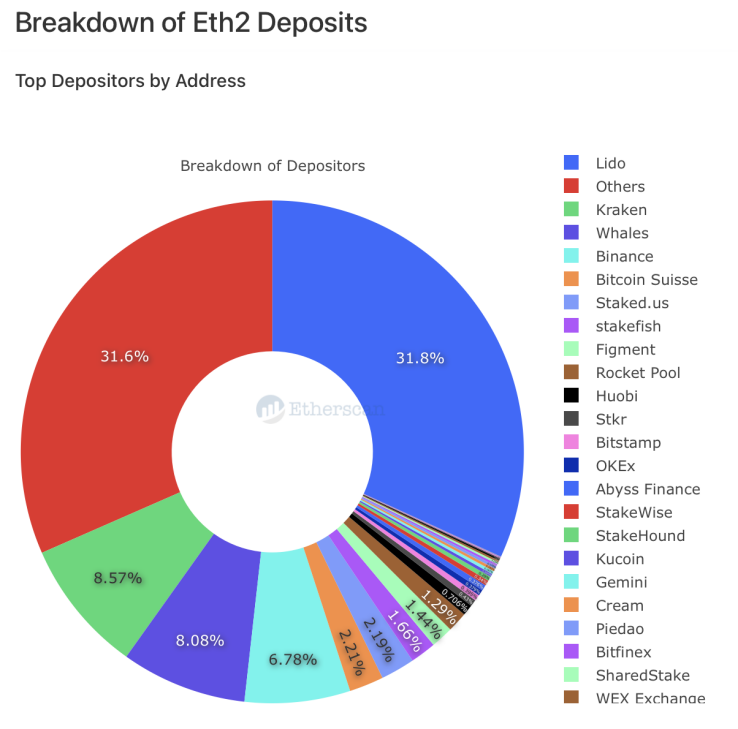

Since the centralized exchange naturally accumulates various PoS chain assets, and has relatively professional knowledge reserves and equipment resources, it has an advantage in pledge operation services. In addition, the exchange can directly open the trading pair service of pledged derivatives to release liquidity, so most of the current mainstream centralized exchanges in the industry are ETH2.0 self-running node pledge service providers. The data that exchanges accounted for 17.7% in the ETH2.0 node category distribution diagram in Chapter 2 also illustrates this point.

image description

text

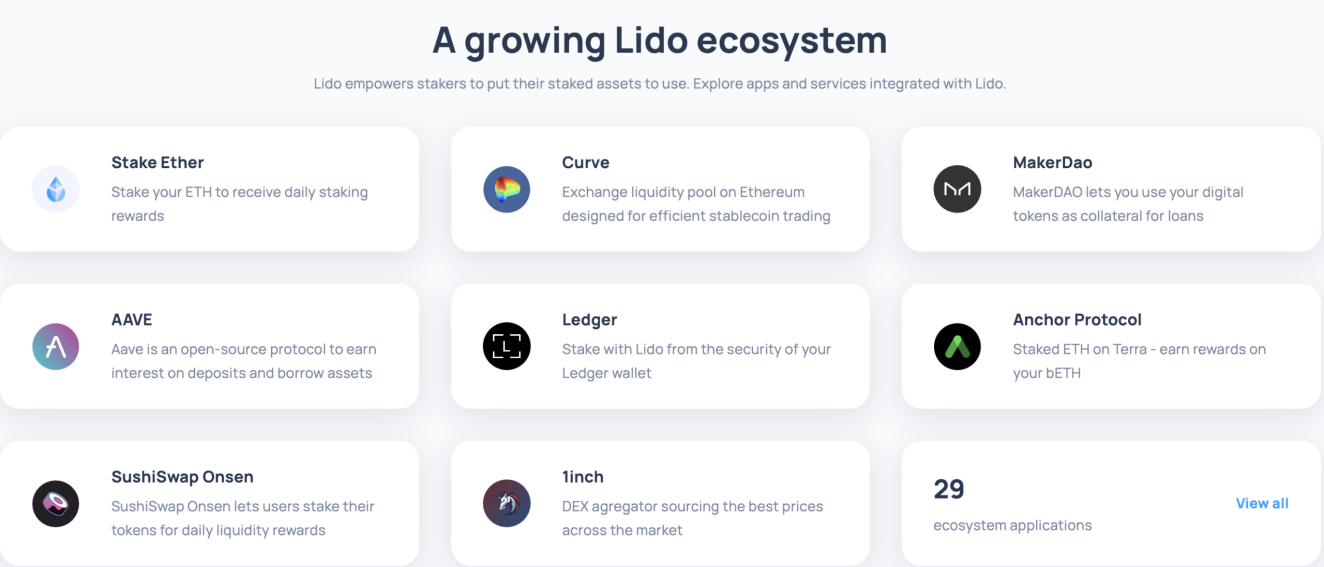

4.2.2 Non-running node type - Lido

image description

(lido pledge flow chart)

image description

(Lido supports the protocol, the picture comes from https://lido.fi/#networks)

In addition, Lido will charge users 10% of fees, 5% of which will be given to node operators, and the other 5% will be reserved for Lido’s insurance fund for Slash compensation for stakers.

image description

(ETH2.0 node sorting, the picture comes from etherscan)

image description

(The node operator cooperated by Lido, the picture comes from https://lido.fi/)

In addition, Lido also began to provide staking services for other PoS chains after the scale of Ethereum Staking. At present, Lido has provided liquid staking services for multiple public chains such as Solana, Kusama, Polygon, and Polkadot.

secondary title

4.3 Infrastructure Service Providers

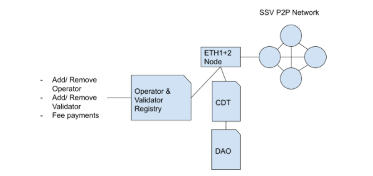

Infrastructure service providers are protocols similar to the oracle machine Chainlink, the index protocol The Graph, and the MEV protocol Flashbots that can solve or reduce key ecological problems. There are also such infrastructure service providers in Staking pledge services, such as SSV Network.

image description

(SSV mechanism design)

It provides a trustless ETH gateway, splits the key of the verification node in a secure manner, and generates private keys in a distributed manner to ensure that node operators cannot make unidirectional operations on the entire private key while maintaining the operation of the verification node. For example, the verifier key is divided into 4 parts and handed over to different node operators, then when one node operator is offline, the other 3 operators holding the verifier key can also promote the verification work normally. In this way, individual groups can verify together more safely, optimize rewards and significantly reduce risks and costs, avoid the impact of a single point of failure of a single PoS service provider on users, and reduce part of the staking risk of staking. By undertaking node operation and maintenance work, it becomes a means for nodes to operate and maintain disaster recovery and reduce the probability of being fined for being dropped.

secondary title

4.4 Summary

In the Staking track, traditional players are node operators. With the lock-up of the pledge liquidity at the Ethereum consensus layer, service providers for liquidity pledges have emerged. Compared with traditional service providers who only provide node operations, liquid staking service providers provide staking users with more liquid and composable options than ordinary node operators. At the same time, for the public chain, the existence of infrastructure service providers enhances the security of the entire public chain network.

On the whole, node operators, liquidity staking service providers, and infrastructure service providers have each solved the problems of Ethereum 2.0 staking:

Node operators - hardware issues, Token threshold issues

Liquidity Staking Service Provider - Liquidity Issues

Infrastructure Service Provider - Confiscation Issue

first level title

V. Conclusion: Use advantages to avoid risks

For ETH holders, staking is the best way to preserve and increase the value of their rights. The POS public chain will issue additional tokens as node rewards for block generation. Verification nodes have hardware configuration requirements, mortgage requirements, and other soft requirements. Token holders with a small share of tokens and no hardware equipment can earn points through staking Token holders who do not participate in staking will suffer from inflationary losses caused by token issuance. In this way, through the action of Staking, ordinary currency holders can not only increase their currency holding income, but also contribute to network security and stability, and also increase the participation in the ecological governance of the entire network.

However, while Staking brings convenience, there are also various risks in terms of security and governance, such as the liquidity risk caused by tokens being locked in a high-volatility market, and tokens that may suffer after nodes are slashed or attacked In addition, it will inevitably face the risk of node centralization. Since different node service providers have different revenue rates and security, they have different risks, which will affect the final revenue of users. If you want to participate in Staking, you must carefully study its expected annual rate of return and service fee rate, and avoid defi risk transmission and coupling losses.

Reference article:

Reference article:

1. Staking economy research report

2. Ouyi Research Institute: Ethereum 2.0 program and progress research report

3. Ethereum to PoS is coming soon: in-depth analysis of the Staking track and representative projects

4. Explore the intrinsic value of SSV from cost, positioning, service objects, etc.