The long-awaited merger will transform Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS)-based network. Due to its early reliance on the PoW mechanism supported by GPU computing power, Ethereum has created a globally distributed mining industry that will generate nearly $19 billion in revenue by 2021. The size of industry players has grown from individual miners with small mining machines to large operators. With thousands of rigs and publicly listed miners.

Instead of using computing power to determine which miner should create a new block, the PoS mechanism relies on collateral pledged by nodes to determine the creator of a new block. Therefore, if the transition of Ethereum to PoS is successful, Ethereum miners will be eliminated. So, what is the impact on miners and miners after the merger?

Calculations drop:

While an Ethereum merger has been promised for years, ongoing technical challenges keep pushing back its timeline. Based on the enthusiasm of ETH core developers and the successful merger of the Ropsten test network, assuming nothing unexpected, it is expected that the main network merger will be on track in August-September.

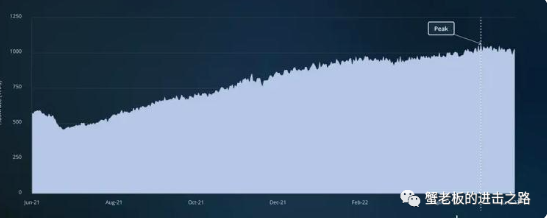

In May 2022, Ethereum's hash rate will reach its peak. Since then, its hash rate has been trending downwards, suggesting that miners expect the merger to happen soon. The drop in hash rate could be due to miners shutting down GPU miners and moving to exchanges for sale after the testnet merge.

secondary title

ASIC and GPU miners

There are two types of Ethereum miners: ASICs and GPUs. An ASIC (Application Specific Integrated Circuit) is computer hardware designed for a specific purpose, and Ethereum's hashing algorithm is written in Ethereum ASIC miners. GPU miners can solve complex PoW calculations and can also be used for more general applications. For example, GPUs are often found in workstations and gaming computers to render images, encode video, or perform any other application that requires repeated calculations.

Due to the distributed nature of Ethereum mining, it is difficult to determine the exact proportion of ASIC and GPU miners on the network. BitPro CEO Michael D'Aria estimates that 90% of miners are GPU-based, while the other 10% are ASIC-based. Bitsbetipping host Michael Carter, who specializes in crypto mining consulting, told Messari that he estimates 20-30% of miners on the network are ASIC-based.

The problem with Ethereum ASIC miners is that they can only be used for ETH mining and cannot be reused for other applications. Ethereum Classic is the only other PoW cryptocurrency that can be mined with an Ethereum ASIC because its hash algorithm is compatible with ETH. If it is not profitable to mine Ethereum Classic, then there is likely no resale market for ASIC miners and they will be discarded after the Ethereum merger.

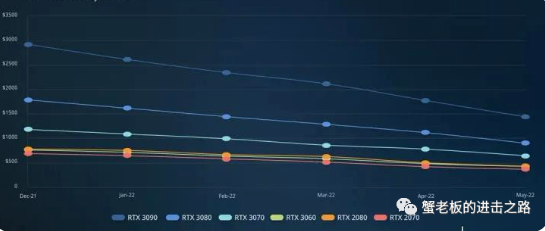

Therefore, after the Ethereum merger, GPU miners became the only Ethereum miners that could be reused for other applications. After analyzing the multiplexing schemes of a large number of GPU mining machines, we propose the following feasible schemes:

Mining other PoW tokens

Data centers that provide high-performance computing

Computing for the Web3 protocol

secondary title

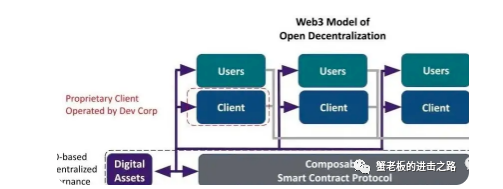

Provide computing power for Web3 protocol

The purpose of Web3 is to rebuild the internet on an open, decentralized and permissionless protocol. To do this, a distributed infrastructure needs to be established as the base layer. This includes building infrastructure for video streaming applications, rendering of 2D and 3D objects, and cloud servers. What these services have in common is that they rely on a distributed network of participants to provide GPU computing services.

Miners can redirect their GPU power to a handful of Web3 protocols, including:

Rendering Network: A distributed GPU computing power market that allows users to contribute computing power for rendering. The network allows GPU miners to sell their rendering power to anyone who needs it, such as artists, designers, and researchers.

Livepeer Network: A decentralized video streaming network that relies on miners to provide video transcoding services using GPUs.

Akash Network: A decentralized cloud computing power marketplace that provides a collaborative platform for providers with additional computing power and users seeking computing power. Akash aims to integrate the GPU market into its platform by the second quarter of 2022, enabling the network to handle data-intensive workloads such as machine learning, artificial intelligence, and cloud gaming.

secondary title

Transition to PoS staking

Summarize

Summarize

The GPU mining market for PoW tokens may shrink rapidly after Ethereum successfully merges with its mainnet. Most GPU miners will resell on the secondary market as miners realize that mining other PoW tokens will only be profitable for the few miners with access to cheap energy. Miners willing to invest time and money will be able to transition to high performance data center operators or node providers for the Web3 hash rate protocol - both markets are growing rapidly. Most new technological advances require hardware support. "From cloud computing to computer graphics, artificial intelligence, and machine learning, all major tech industries are hitting bottlenecks, requiring faster computing and more efficient hardware." While the ethereum merger appears to be the end of GPU mining, It could also usher in another era, as displaced miners look for new opportunities in Web3.

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

Everyone, remember to like and repost after watching!