The hedge fund Three Arrows Capital is rumored to be bankrupt. Today, Terra researcher FatMan revealed that Three Arrows Capital used the money from the institution to secretly transfer the Anchor without the institution’s knowledge to earn 20% interest rate. Before the collapse of LUNA, it held at least Hundreds of millions of dollars in UST. FatMan also claimed that the recent USDD decoupling was caused by the sell-off of Three Arrows Capital.

Three Arrows Capital, a crypto hedge fund in Singapore, was rumored to be bankrupt. It recently dumped a large amount of Ethereum and caused panic in the market. Today (17th), Terra researcher FatMan broke the news on Twitter, saying that Three Arrows Capital had borrowed from multiple funds and institutions, and Without the lender's knowledge, they put the money into Anchor to earn 20% interest rate. Before LUNA collapsed, FatMan said that Three Arrows Capital had at least hundreds of millions of UST.

In addition, Three Arrows Capital also owes a large amount of debt to the BitMEX exchange. FatMan said that the creditors who contacted him could not contact the relevant people of Three Arrows Capital. And FatMan also raised the stakes and broke the news that Sanjian Capital also held USDD positions, which were forced to sell this week and triggered a small decoupling

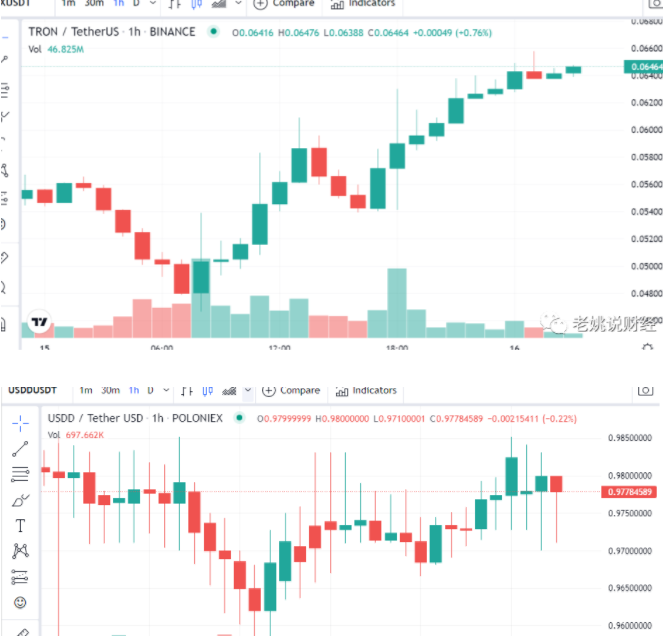

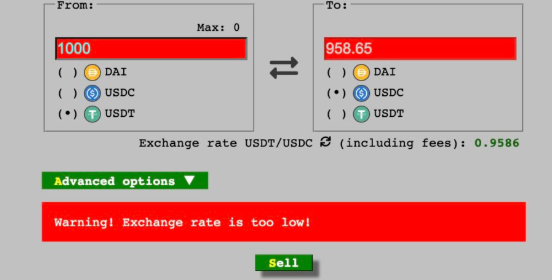

The algorithmic stablecoin USDD reported yesterday (15th) that decoupling intensified and fell to US$0.9582 at around 4 pm on the 15th. The Tron Reserve Foundation immediately started to protect the market and purchased US$220 million TRX, driving the token to soar by 33%. 2.5 billion TRX were withdrawn from Binance, but the tilt of the Curve USDD/3crv pool is still intensified. The current 3crv part has been withdrawn and only 16% remains.

The TRON Reserve Foundation has launched a series of disaster relief operations since 4:32 pm yesterday (15th). It has successively purchased US$100 million and US$120 million in TRX as reserve funds, and announced that it will receive 25% from Binance. 100 million TRX (worth about 160 million US dollars), in order to prevent short sellers from having enough liquidity to act.

Brother Sun reversed after defending the market?

Since June 13, USDD began to decoupling. At that time, the TRX token also plummeted, dropping from $0.07336 to only $0.04744 on June 15. At that time, Justin Sun had announced that $2 billion had been deployed to fight against short sellers.

After Tron and Justin Sun defended the market, USDD and TRX reversed, and the USDD exchange rate has returned to 0.9799, while TRX surged more than 33% in a single day to reach 0.06428 US dollars.

Although it seems to be successful in protecting the market, the current Curve USDD/3CRV pool has not improved, and even the slope is still intensified. The current 3CRV (USDT+USDC+DAI) part of the pool is only 16%. The dynamic zone reminds readers that the current market fluctuates violently, and the algorithmic stable currency has certain risks. Please be cautious when participating in the project.

Avalanche clarifies relationship with Three Arrows Capital

secondary title

Black material continues

8 Blocks Capital angry charge: Misappropriation of 1 million US dollars by Three Arrows Capital "to increase the margin"

The insolvency crisis of Singapore’s cryptocurrency hedge fund Three Arrows Capital continues to spread. The head of Hong Kong’s cryptocurrency hedge fund 8 Blocks Capital’s transaction today wrote an article about the ins and outs of the fund’s cooperation with Three Arrows Capital, accusing Three Arrows of recently embezzling the fund’s assets in three Arrow capital trading account of $1 million for margin calls, so far no response.

Danny Yuan explained:

As a Delta neutral market maker, we are very sensitive to transaction fee rates. When you trade 9-figure USD value every day, 1 BIP of 100 million USD is 10,000 USD, if you have to pay so much every day, it will quickly add a lot of burden.

Therefore, our agreement with Three Arrows Capital is: we can withdraw at any time, 100% of the profit and loss (PNL) belongs to us, and Three Arrows Capital will never transfer our funds without permission (increasing the risk of our positions being liquidated) , and in return we pay them for the service.

Danny Yuan mentioned that this is a mutually beneficial relationship of more than 1.5 years. 8 Blocks Capital has known Three Arrows Capital since 2018, and believes that Three Arrows Capital is capable, and does not think that Three Arrows Capital is depraved enough to lose billions of dollars, and there is no Do basic risk management.

Accused of misappropriating 1 million US dollars without reason

However, Danny Yuan pointed out that prior to the appropriation, something unusual started to happen this month:

On June 12th, as the market fell, we needed to withdraw some funds from our account for positions on other exchanges, so we asked Three Arrows Capital Operations Team to let us withdraw funds.

On June 13th, as the downtrend continued, we asked for a larger withdrawal, got no response, we didn't think much of it at the time, after a while, the market stabilized and we didn't need the funds anymore, we wanted to Say, maybe they're just busy.

Danny Yuan further accused, and then something even more bizarre happened:

Fast forward to 24 hours ago, our funds monitoring script noticed that our account with Three Arrows Capital was missing about $1 million, we reached out to Three Arrows Capital co-founder Kyle Davies and the operations team on Telegram to ask about Missing funds thing - no reply. We tried calling them - they were online but they didn't answer.

Then our traders noticed that there were some rumors circulating on twitter about the bankruptcy of Three Arrows Capital. Since we were directly involved, we felt compelled to tell the world what was happening and measure the extent to which the Three Arrows incident spread.

Call for Freeze of Three Arrows Capital Assets

Referring to the rumors that Three Arrows Capital has been liquidated by institutions recently, Danny Yuan revealed that what 8 Blocks Capital learned was that Three Arrows Capital carried out leveraged transactions everywhere and was issued a margin call, but Three Arrows Capital did not respond to the additional Margin calls responded, but left every platform in a bind, with platforms having no choice but to liquidate, leading to further sell-offs in the market.

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.