ETH From last night to today, the word you hear most is nothing more than what happened to Three Arrows Capital? Did Three Arrows Capital explode? became a hot topic today.

This year is quite difficult, including institutions. We saw that LUNA, the top five in terms of market value, was close to zero overnight. Two days ago, the lending platform Celsius had to suspend withdrawals. Today, the rumors of Three Arrows Capital’s position exploded. , Is Three Arrows Capital going to be the next giant to fall?

First of all, let's understand the past and present of Three Arrows Capital. In 2017, he transformed into a crypto fund. In the early years, he made his fortune by investing in eth and btc. He held a large amount of btc and eth. The fund management scale was more than one billion US dollars (estimated)~ The founder zhesu advocated the concept of a super bull market, not only in words, but in the second half of 2022 Build a large amount of ETH. It can be said that Sanjian Capital was very capable of being the dealer of Ethereum back then, and Sanjian Capital was one of the institutions that enjoyed the dividend period of the encryption market. Everything starts very quickly, and the speed of making money is also top-notch.

Looking at the current Three Arrows Capital:

1. A total of 100,000 ETH has been transferred to FTX since May, and hundreds of millions of dollars have been realized in total. The loss is unknown, and it should be hundreds of millions of dollars

2. The LUNA crash event, led the investment of 500 million US dollars during the financing process in May on the eve of the luna crash. At present, the value of the investment is close to zero, and the loss position is 500 million US dollars

3. Three Arrows ranked second in the loss list of bitfinex exchanges, with a loss of more than 30 million US dollars in May

4. It is rumored that Sanjian mortgaged its 30,000 btc to a family fund in Singapore, and the mortgage rate of 800 million US dollars was 90%. took it

5. Three Arrows Capital’s large option account in derbit should have lost a lot of money. After all, it is an exchange with 10% of its own shares, so it is kept secret.

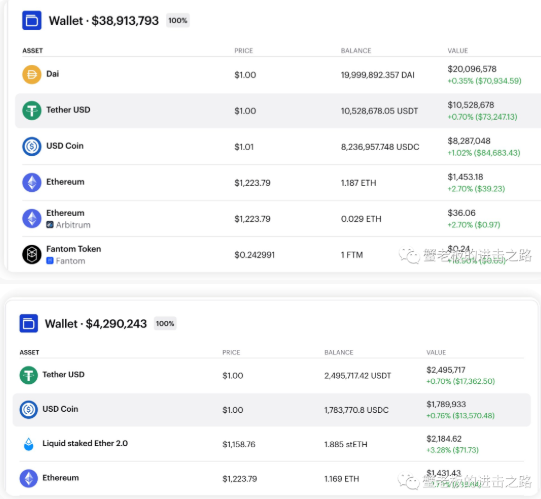

6. Zhusu joined forces with a Chinese institution to call for avax at the high point, and cashed out most of the conclusions at the high point: Sanjian’s cash flow is very difficult now, and it was exchanged for 200 million dai (it can not be frozen by the speech)

text

GBTC

According to public information, as of the end of 2020, Three Arrows Capital was the largest holder of Grayscale GBTC, holding 5.6168% of GBTC shares, and its market value at that time was approximately US$1.24 billion.

As we all know, GBTC cannot be redeemed and can only be sold in the secondary market. If Sanjian wants to make up the Margin call, it can only sell GBTC in the secondary market.

Worse than Bitcoin’s drop, Three Arrows appears to be using leverage to buy Bitcoin. According to the disclosure of crypto trader degentrading on his social networking site, Three Arrows Capital has lending positions with multiple mainstream lending platforms (such as BlockFi, Genesis, Nexo, Celsius, etc.). Therefore, if Sanjian Capital is liquidated, the impact will be extremely extensive.

stETH

The recent problems of stETH mainly come from the revolving loan. Sanjian Capital seems to be leveraging on the revolving loan, and the market decline also forced Sanjian to sell.

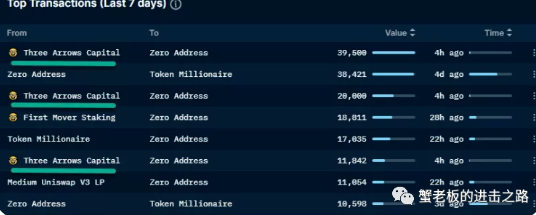

According to the summary of trader MoonOverload on the social networking site, people think that Celsius is the biggest dumper of stETH, but this is not the case: the biggest sell-off comes from Three Arrows Capital. The selling timing of the two institutions is different. Most of Celsius's selling was a week ago, while Three Arrows' selling was in the past two days. On-chain data shows that Three Arrows is selling stETH through every account and seed round investment address it owns.

MoonOverload believes that most of these sell-offs look like they are paying down their debts and borrowings.

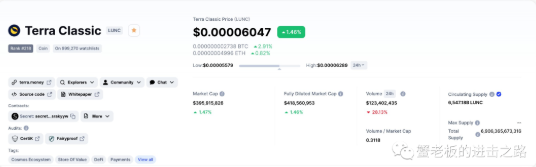

LUNC

The LUNA crash event led the investment of 500 million US dollars in the financing process in May on the eve of the luna crash. At present, the value of the investment is close to zero, and the loss position is 500 million US dollars

Let me talk about how much money Sanjian Capital lost on LUNC? Three Arrows Capital purchased 10.9 million Luncs with USD 559.6 million, and then locked and pledged the 10.9 million LUNCs on the nodes to earn interest. These 10.9 million LUNC are now worth $6.60. It can be seen that there is basically no loss left.

Then we analyze some data from the address disclosed by Three Arrows Capital:

Public Ethereum address 1: 0x4862733B5FdDFd35f35ea8CCf08F5045e57388B3

Check out the records above. On May 18, 2022, Sanjian Capital transferred 5,895 Ethereum to LIDOFinance to obtain 5,895 steth, transferred 23,105 ETH to LIDOFinance to obtain 23,105 stETH on May 21, 2022, and then today (June 2022) 14th) Abandoned these two investments that lasted about one month: According to data on the chain, the address marked as Three Arrows Capital exchanged 17,780.08 stETH for 16,625.07 ETH, the conversion ratio was 0.9350:1, and the value was about 20 million US dollars. And all 16,625 ETHs have been exchanged for nearly 20 million DAIs. This also verifies the situation of Sanjian Capital in this life mentioned above.

According to earlier news, Sanjian Capital exchanged 38,900 stETH for 36,718.64 ETH.

Let’s take a look at Sanjian Capital’s public address 2: 0x5491fb87ebc0d870ddaa1f757719e11928b1a8cb

This address today (June 14, 2022) received 17,780.0841 stETHs from Three Arrows Capital address 1, and then Three Arrows Capital exchanged 17,780.0841 stETHs for 4,816,474.12 DAIs at MEVprotecion, and then Three Arrows Capitals are still in MEVprotecion exchanged 16,625 ETH into 15 million DAI in three breaths. At present, the addresses 1 and 2 of Three Arrows Capital only have about 1 digital currency in the ETH wallet. All the digital currencies in the wallet are stable coins.

Continue to talk about the situation of Sanjian Capital in the decentralized exchange. First of all, on the bitfinex exchange, Sanjian Capital is invested by Mingpai. Last May

in conclusion

in conclusion

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.