Author |

Editor | Hao Fangzhou

Produced | Odaily (ID: o-daily)

Editor | Hao Fangzhou

Produced | Odaily (ID: o-daily)

In the past few days, the cryptocurrency market has ushered in a new round of waterfall market. As the "vanguard" of this round of decline, ETH has successively lost important barriers such as 1,700, 1,500, and 1,200 US dollars. Above the weekly line, ETH has been negative for 10 consecutive weeks, which also means that ETH has almost unilaterally declined in the past three months.

image description

Data taken from: FTX

Under the extreme market conditions, collateral impacts followed. In terms of the contract market, the total amount of liquidation funds on the entire network exceeded US$500 million for two consecutive days; in terms of DeFi, the total value of assets locked in major ecosystems has fallen below the US$100 billion mark; Both the transaction volume and the floor price of the project dropped.Where does FUD come from?Regarding the fuse of ETH's recent plunge, there are many opinions in the market. Aside from the clichéd impact of macro-interest rate hikes and the overall financial environment, the increasing discount of stETH is undoubtedly the potential black swan that most affects short-term market sentiment.On this point, a few days ago Odaily published "

StETH de-anchoring intensifies, can "discounted ETH" still buy bottom?

", the article details the mechanism of stETH, the reasons for the discount, the influence of Celsius, the potential arbitrage space, etc., combined with the optimistic expectations for the development process of ETH 2.0,In the end, we concluded that stETH may continue to discount, but under the balance of arbitrage funds, it is difficult for its quotation relative to ETH to deviate too much, let alone a complete collapse like UST.However, with the sharp drop of ETH in the past few days, the FUD sentiment about stETH in the market has become more and more intense. Discourses such as "the next UST", "death spiral", and "Celsius has completely exploded" appear frequently on social media. During the discussion... Given that the market environment is so bad, I can't afford too many unnecessary troubles. As a media practitioner, it is necessary to do a "removal of the false and preserve the truth" as much as possible, and review the latest situation of stETH in combination with market dynamics.

The first thing that needs to be clarified is the source of the panic. Why does the decline of ETH intensify the market's panic about stETH? There are two main reasons,

One is that with the further decline of ETH, the market judges that Celsius will face greater pressure to withdraw funds, so it has to sell the stETH in its hands in exchange for ETH to repay the debt; the other is that there are quite large-scale stETH loans on lending platforms such as Aave Positions, the rapid decline in prices may cause these stETHs to fall into liquidation risks.

Both of them will further enlarge the discount of stETH compared with ETH, which will aggravate the panic in the entire market.

Celsius: In order to survive, I had to take strong medicine

So, what is the situation with these two lines now? Let's talk about Celsius first, the platform has two pretty important news today.

The first is that Celsius has announced that all withdrawals, transactions, and transfers have been suspended. Prior to the announcement, Celsius also transferred 9,500 wBTC and 50,000 ETH to the exchange.

This series of events brought Celsius directly to the forefront. It is not sure what the follow-up actions Celsius will sell this part of assets (personal speculation may be to reduce the leverage of on-chain lending, see the follow-up on-chain dynamics), and suspend the withdrawal The move of withdrawal is like a dose of "a strong medicine with more than three points of poison". Such an operation will obviously have a rather negative impact on the reputation and future development of the platform. It is also a helpless move that can prevent a short-term systemic collapse.

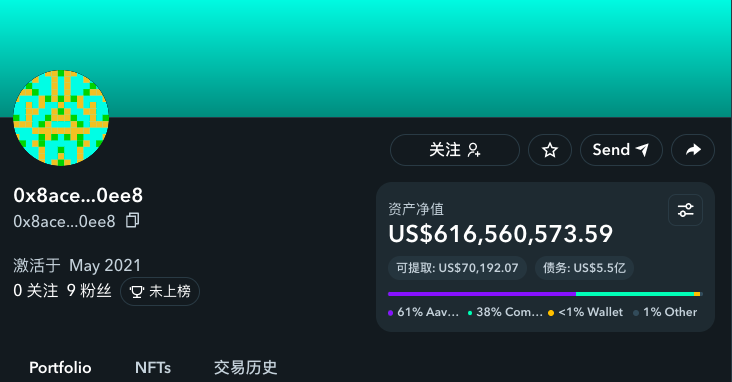

As for the so-called "Celsius completely thunderstorm", the author personally disagrees, because most of the positions in Celsius's hands have not been moved, and there are still more than 409,000 stETH in its main address 0x8aceab8167c80cb8b3de7fa6228b889bb1130ee8, even after deducting the loan debt, there are still 6.16 net worth in billions of dollars. Although the closure of withdrawals will inevitably cause some market panic, it is much better than 409,000 stETH directly hitting the market.

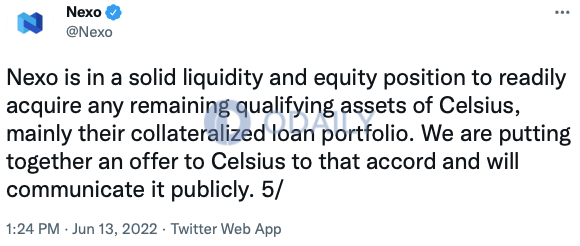

The second key development is that the CeFi giant Nexo has announced that it is ready to make an acquisition proposal to Celsius, which may bring an end to the Celsius incident.

In general, whether it is acquired by Nexo or continues to carry on to the opening of redemption on the stETH chain, Celsius no longer needs to be forced to sell hundreds of thousands of stETH in its hands after suspending withdrawals (it does not rule out active and slow exchange) , the underlying selling pressure on this line looks like it should ease in the short term.

Will stETH be liquidated on a large scale?CryptoScott.ethLet's talk about the second line, whether the stETH mortgage assets in the loan will encounter large-scale liquidation. According to the different types of loaned assets, this point should actually be divided into two parts. One is the revolving loan leverage position of mortgage stETH to lend ETH (take the loaned ETH for stETH, re-mortgage and then lend out, cycle operation... …), and the second is to mortgage stETH to directly lend USDC and other stable coins (this is how the main address of Celsius operates).As far as these two parts are concerned, what is related to the discount of stETH and will have a further impact on it is obviously the situation in which stETH is mortgaged to lend ETH. As for the situation in which stETH is mortgaged to directly lend stable coins, the liquidation is mainly due to the price drop of ETH Driven by the two, the liquidation of the two often occurs simultaneously.Researcher at RealResearchDao

Did a very detailed data analysis (if you are interested, you can directly read CryptoScott.eth's

series of tweets

), gave a very clear data calculation on the liquidation price of stETH and the institutional arbitrage window. Some of the views in the tweet will be excerpted below.

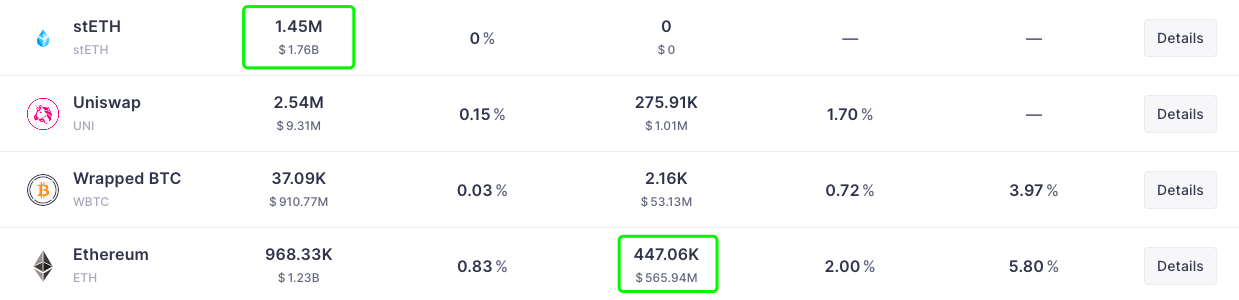

Based on the data of stETH deposits (approximately 1.45 million pieces) and ETH loans (approximately 447,000 pieces) in the Aave lending market, the proportion of stablecoin positions deposited in stETH is actually higher than that of ETH loans. This also means that the situation of staking stETH to recycle ETH is not as extreme as imagined.

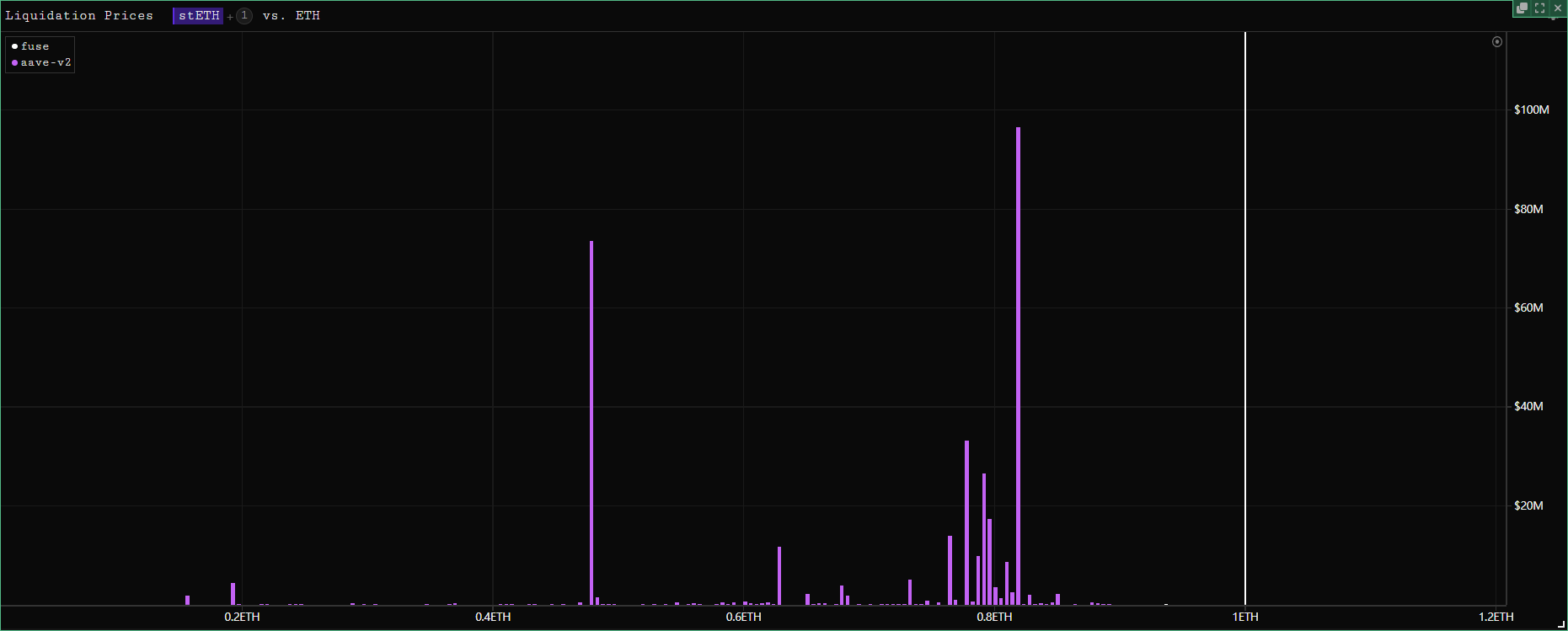

Let’s look at the situation of mortgage stETH revolving loan ETH from the loan structure (this is also a factor that the market is particularly worried about). Parsec data shows that the large liquidation point of this type of loan position is about 0.818 (stETH/ETH), which is about 0.94 from the current There is still some room for real-time exchange prices.Considering that the exchange price of 0.818 is approximately equal to an 18% discount, plus a 4% pledge income, it means that the unknown purchase of stETH at this level can obtain about 22% after the on-chain redemption is opened (expected about one year) The ETH standard income, which has completely exceeded the interest expenses during the holding period (the unsecured credit loan interest rate of institutions on Maple is about 10.5%), so under the balance of arbitrage funds, the possibility of stETH touching this point Not big.

stETH will not be the next UST

Based on the above review of the latest situation of Celsius, on-chain liquidation, etc., we still insist on the judgment we made in the previous article——