Compilation of the original text: Paimon

Compilation of the original text: Paimon

Foreword, this article is short and unproofed and may contain errors. First of all, the opinions in this article cannot be regarded as investment advice, but only represent the author's personal opinions. Second, although I was part of the early Lido team, the author is no longer with Lido, so this article does not represent Lido. Finally, due to holding LDO, ETH and stETH, this article may be biased, but try to be as impartial as possible for readers to find the correct answer.

What is Lido?

Cobie published a blog post introducing Lido in October 2020:

In a nutshell, Lido is an autonomous staking pool that tokenizes ETH staked by users.

When a user chooses to pledge an Ethereum, Lido will select a verification node and return a stETH in return. When this ETH obtains pledge income, the balance of stETH held by the user will automatically change to match the balance on the beacon chain. When the Ethereum staff finally announces the next step, stETH will automatically release the pledge, and the target will also allow redemption.

The lack of Ethereum's own pledge mechanism, and the beacon chain that was launched at the end of 2020 but has no specific merger time are all the reasons why Lido is very popular. For users, Lido is undoubtedly the most popular way to stake Ethereum.

The "anchor" of stETH?

During most of its life cycle, stETH and ETH are basically 1:1 exchange.

While highly volatile in the first few months - with prices ranging from 0.92 to 1.02 ETH per stETH - the stETH-to-ETH ratio has become increasingly stable as liquidity has increased and time has passed.

However, the following story is the unanchoring of UST and the collapse of LUNA, and stETH is also affected to a certain extent. Since then, the price of Ethereum has fallen for almost 10 consecutive weeks, a drop of about 50%.

Perhaps because the relatively stable 1:1 exchange ratio between stETH and ETH is unprecedented (or "anchoring" has become a hot topic in ptsd after the UST crash), many people mistakenly believe that stETH is also linked to ETH.

In fact, stETH is not strictly anchored to ETH, and the 1:1 exchange ratio is not an inevitable requirement of Lido. stETH will actually conduct market pricing based on the demand or liquidity of pledged ETH, rather than simple anchoring.

secondary title

secondary title

AETHC by Ankr:

These two staking derivatives work similarly to Lido, with Ankr launching before Lido and Binance’s BETH coming a few months later, arguably they’ve been around for roughly the same amount of time.

As shown in the figure above, AETHC and BETH have basically never been traded at an "anchor" price since their inception-BETH fell as low as 0.85 ETH per BETH, and AETHC fell to 0.80 ETH.

Pledged derivatives are not stable coins, and they do not even reach the level of so-called "algorithmic stability". Some see them more akin to Gretscale's GBTC, or a futures market with unknown future delivery dates. Fundamentally, they lock in collateral tokenization rights, and it is not surprising that they trade at a discount to the price of the underlying asset they lock.

Reasonable pricing methods for redemption, arbitrage and pledged ETH

Users can quickly mint a stETH on Lido by staking an ETH.

Because of this, stETH should not trade for more than 1 ETH. If stETH ever traded at 1.10 ETH, traders could simply mint 1 stETH for 1 ETH and sell it for 1.10 ETH - they arbitrage it repeatedly until parity is restored.

This "convenient" arbitrage opportunity is currently not realistic in the other direction.

ETH liquid pledged tokens such as stETH, BETH, RETH, and AETHC cannot be redeemed on eth2, which supports transactions after the merger.

However, the exact time of the merger has not been determined, it may be in October this year, and the possibility of being pushed to the end of this year or the beginning of next year is not ruled out. The timing of state transition and branch update after merging is also uncertain, and to a large extent it will take up to 6 months after merging.

Of course, the amount of ETH that can be unstaked at one time is also a limiting factor. If the ETH pledged in various ways is unstaked at the same time, the unbinding team may have to queue for more than a year.

After all the dust settles, there will be a two-way arbitrage opportunity for liquid pledged currency - traders can buy 1 stETH with 0.9 ETH, and then redeem it with 1 ETH, and so on.

However, even in a bull market with the possibility of two-way arbitrage, the price of liquid pledged tokens may still be lower than the price of the underlying asset. A reasonable pricing standard is actually a ratio that can effectively weigh the buyer's risk of redemption/de-pledge period and the potential benefits that this risk can bring, and the seller weighs the impact of the de-pledge period on himself to determine whether to sell immediately. The dynamic equilibrium point that maximizes the benefits for the entire system.

For now, the lack of a redemption path has resulted in greatly reduced liquidity.

In a bull market, ETH is in high demand, and traders being able to buy stETH at a price below 1ETH is also a way to earn extra ETH, so buying stETH at a small discount is very attractive. In addition, the demand for liquidity in the bull market is low, and investors are willing to hold assets that can bring income, so stETH will not face relatively large selling pressure.

However, in a bear market, the demand for ETH is extremely small, and people's demand for liquidity increases rapidly. The demand for long-term holding of such "reflexive" assets has been greatly reduced, and more and more users will choose to sell pledged ETH positions and prefer short-term holdings of ETH.

The discount ratio between stETH and ETH actually represents the relationship between the liquidity demand of stETH holders and the demand for purchasing pledged ETH derivatives at a discount.

At the same time, some big players have expressed their recent demand for liquidity by withdrawing from the stETH market.

Of course, the determination of the discount rate is also affected by smart contract risks, governance risks, beacon chain risks, and whether mergers occur. While these risks may appear to be constants compared to variables such as the willingness of buyers and sellers to demand, people's assessment of their importance will also change with concerns about changes in the market.

It looks like macro liquidity preferences are still the biggest factor, while perceptions of consolidation are more like a lesser factor so far.

Who is selling?

While many focus on the price of stETH due to UST ptsd, it is possible that stETH is a different story.

The most notable question in the discussion about stETH right now is: who are the "fixed" sellers?

The answer seems to point to several groups:

Leveraged stakers, identifiable on-chain

Entities that need to process deposit redemptions

Leveraged stakers

Investors use Aave to increase leverage and pledge ETH. The transaction process is as follows:

Buy ETH

Stake ETH to mint stETH (or buy stETH on the market)

Deposit new stETH into Aave

Borrow ETH with this deposit

Pledge borrowed ETH and mint stETH

Repeat the above operation

Instadapp and other similar products turned this transaction into a "vault", attracting sizable deposits to buy leveraged stETH positions.

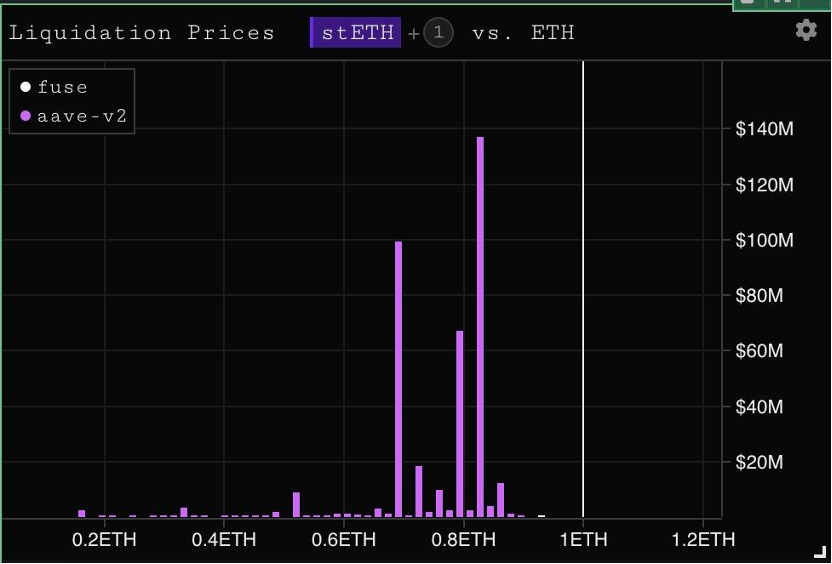

Unless traders are able to provide more collateral to these positions, they have an on-chain liquidation price. At the same time, if you want to deleverage, you need to sell stETH in exchange for ETH, which will also help the pricing of stETH.

If on-chain liquidation is triggered, this part of the selling pressure will naturally cause the price of stETH to drop.

CeFi deposit and withdrawal behavior

The second group is less transparent.

Rumors and on-chain research suggest that entities like Celsius have so-called liquidity problems. Of course, since Celsius is a "CeFi" business, its financial status or fund management strategy will not be fully disclosed to the outside world.

As such, this is all speculation, and it's impossible for an outsider to really know what's going on inside Celsius.

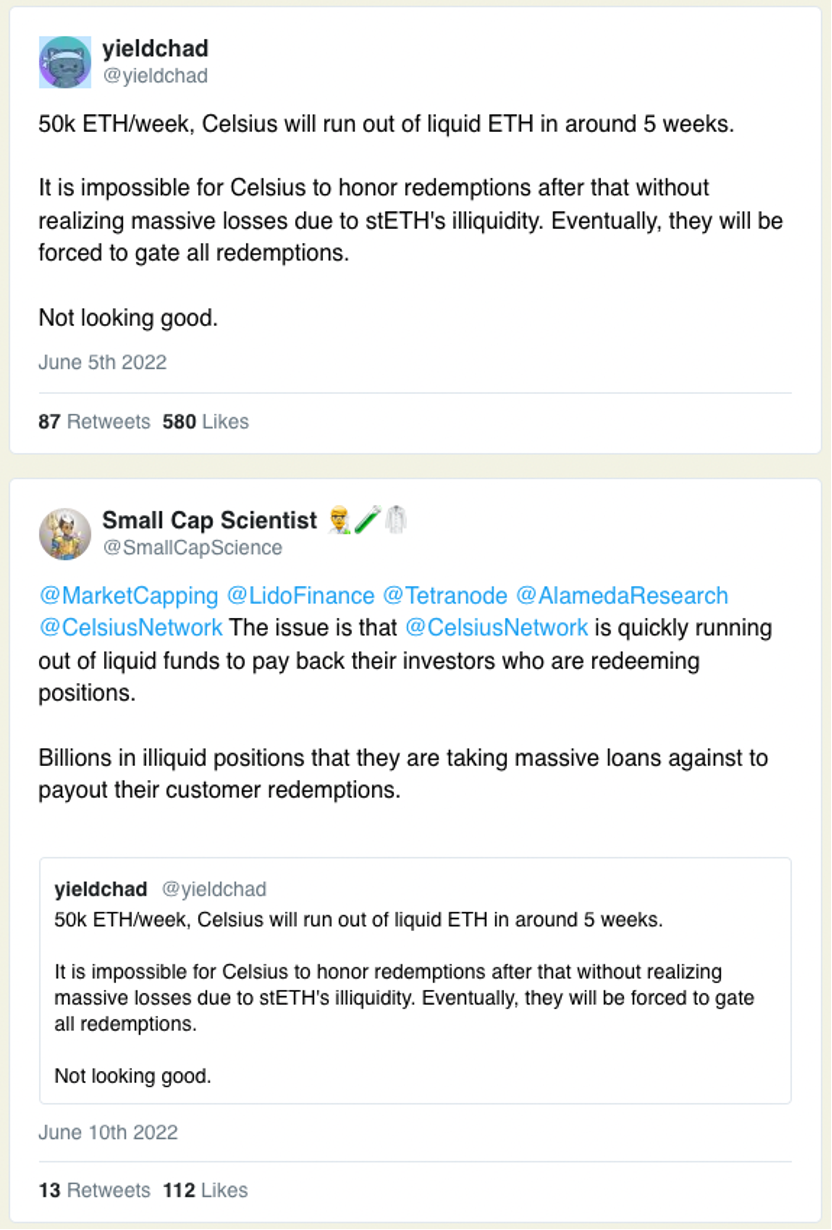

But the researchers speculate that the current rate of user withdrawals will soon exceed the liquidity Celsius has.

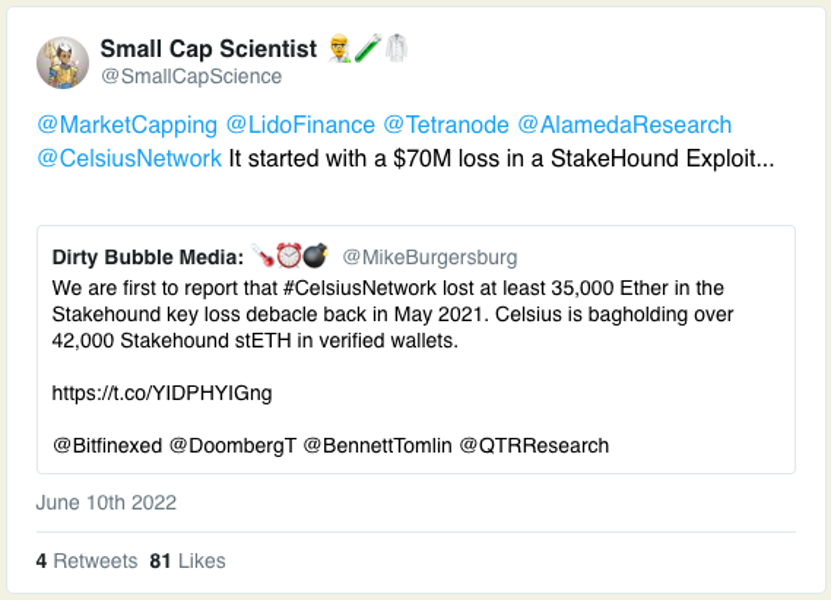

There are also speculations about Celsius's previous investment losses in DeFi. Celsius allegedly lost funds in StakeHound, Badger, and Luna/UST.

Celsius allegedly uses customer deposits to reinvest in DeFi to provide additional yield, during which time they may suffer losses through omissions. In addition, they also cooperate through Lido and other illiquid mortgage node operators to mortgage a large amount of ETH, which is not liquid and may take half a year or even a year to redeem.

For Celsius, even so-called liquid staking is not actually liquid since their position size is larger than stETH's available liquidity.

If Celsius becomes a forced seller of stETH in order to restore the liquidity of user withdrawals, this may become the trigger for multiple liquidations. In fact, fear of the event may also be a trigger.

Of course, these are all speculations. Celsius' actual financial status, tools, and customer liabilities are actually unknown to outsiders.

While it’s unlikely that Celsius would lose customers’ funds entirely, it is theoretically possible that Celsius could end up in such a situation if the redemption date for assets on the beacon chain is nowhere in sight when users request withdrawals.

The way Celsius handles this situation seems particularly important. Using these locked assets to borrow money to repay customers will only delay their time as "Forced sellers" and make things worse in the end.

So, who is the "big injustice"?

It is not realistic to know the future price trend of stETH, BETH, AETHC, and RETH now.

On the contrary, just imagine, if Celsius's scam is true, or if the leveraged pledgers on the chain have been unable to provide mortgages, etc., who will be the biggest loser?

Without a doubt, of course Celsius and its users. Celsius may not be able to process withdrawals for every user, and may suffer considerable losses due to underselling to fill withdrawal loopholes prior to the merger.

PS: From the perspective of Celsius, it may be a good choice to withdraw from stETH in private OTC with an appropriate discount to save face and maintain credibility.

Those who increase leverage are also doomed.

Likewise, anyone wanting to exit their stETH position prior to the state transition on the beacon chain will find it tricky. Just imagine, traders or investors who pledge ETH today (or buy stETH at a "discount price" today) need to exit after 3 weeks or 3 months, and the ratio of stETH/ETH obviously cannot be exactly the same as when they entered the market.

After the merger is over, since each stETH has an equal amount of exchanged ETH on the beacon chain, unleveraged stETH holders will exit the market directly by unstaking on the beacon chain and will not suffer losses.

Is 1:1 redemption guaranteed?

stETH, BETH, and AETHC can redeem ETH in equal proportions when the Ethereum merger is completed and can be redeemed.

However, there may be the following two situations that can break the 1:1 redemption:

If you hold 10 stETH today, and Lido’s verification node is punished, the losses incurred will be paid by the stETH holders. For example, due to the penalty of the Slash mechanism, 10 stETH may be devalued to 9.5 stETH. This can also happen on Ankr, however since RocketPool requires validators to post additional collateral, the situation is different.

Fatal protocol bug — Whether it’s Lido, RocketPool, Ankr or any other staking pool, a fatal protocol bug could have an impact on their liquidity staking protocol.

Although Slash rarely occurs on the beacon chain, and most liquidity staking protocols also have complete verification nodes, the occurrence of the above two low-probability events cannot be ruled out.

Of course, the audit process of the agreement must be very comprehensive - but what is certain is that the vast majority of people in the world may have audit ptsd.

While these risks, minor or severe, may be real, the probability of their occurrence is extremely remote, and the risk exposure does not change over time.

There are also some delivery risks such as eth2 (whether the merger occurs and the events of the merger, etc.) and governance risks, which also have no substantial increase or decrease.

PS: If eth2 is not implemented, people may be able to speculate what will happen to the pledged ETH. Since mobile staking derivatives only account for 1/3 of all pledged ETH, every cryptocurrency company and exchange has ETH pledged in some way, so perhaps there needs to be some way to give social consensus to the final redemption, so to speak is a more complex issue than just discussing staking tokens.

In short, regardless of the above risks, and there is enough ETH to pay back, regardless of the stETH/ETH ratio in the market, any "*ETH" minted in the liquid pledge pool will eventually be redeemed at the price of 1ETH.

Market preferences are quietly changing

These situations present an interesting opportunity for those willing to accept the risks of smart contracts and validators. So, how long will traders be willing to hold stETH, and at what price will they be willing to enter the market?

Original link