Let’s talk about StETH/ETH today, that is, the liquidity of the trading pair is about to run out. As the name suggests, stETH is a pledged version on ETH, and its purpose is to protect the security of the merged ETH. Let me first introduce what is stETH?

stETH is a supporter of the Ethereum ecosystem, and the Smart Yield program has been committed to providing the best risk-reward ratio for generating ETH income. Staking strategies using native protocols are the least risky strategies to generate yield in a single asset — we can compare native staking strategies to the risks faced by government bonds in traditional finance.

The risk that needs to be carefully analyzed in Ethereum Staking is the counterparty risk of the platform that provides the Staking mechanism. Lido was identified as the best collateral provider due to internal due diligence and risk assessment analysis. The Ethereum community agrees, too, as Lido has the 4th largest TVL in the industry and Ethereum is number one, holding 32% (4.2 million ETH) of the circulating supply of ETH.

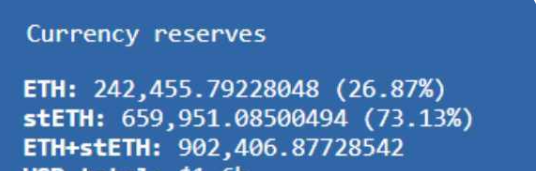

Therefore, there should be a one-to-one correspondence between stETH and ETH, and there is a liquidity pool on Curve. However, the liquidity pool on Curve has now become extremely unbalanced, with the proportion of stETH approaching 75%, which is an unprecedented slope rate.

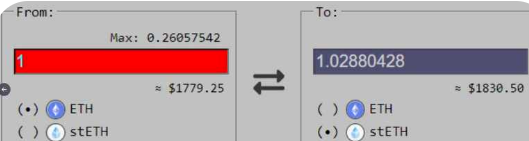

This has resulted in a 1.03:1 conversion ratio of stETH to ETH, and the tendency is still increasing.

In theory, the rhythm of de-anchoring is determined by the slope rate of the liquidity pool. Regarding the A-factor question, in short, stETH mining pools are currently at a critical level, and decoupling may accelerate at any time. stETH and ETH are pegged one-to-one, and the merger will happen within a few months. Buying stETH now seems to be a profitable arbitrage operation, which is very different from UST without asset backing, so why should investors withdraw?

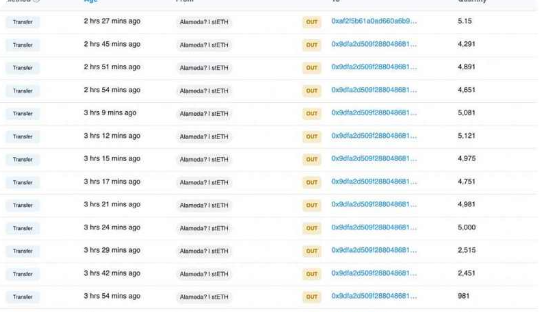

Observe that Alameda Research is exiting their positions. Despite the slippage loss, nearly 50,000 stETH was withdrawn within a few hours.

As we all know, Alameda has a very keen sense of smell in the market. In fact, they are among the top seven holders of stETH on Lido, and their move is likely to spark a run.

Then look at other major shareholders. Start with lending platform Celsius. Celsius owns nearly 450,000 stETH worth approximately $1.5 billion. They deposit these stETHs with Aave as collateral and lend about $1.2 billion in assets.

That might not be a big deal, but Celsius is rapidly depleting its liquid investors' redemption positions. They used billions of dollars in illiquid assets to make huge loans to repay clients' redemptions. Celsius is struggling, they have lost huge sums of money in hacks over the past year, and it's only getting worse. Initially, they lost $70 million in the Stakehound event. (Note: On June 7, according to Dirty Bubble Media, the encrypted lending platform Celsius Network lost at least 35,000 ETH when the Stakehound private key was lost.)

Then another $50 million was lost in the BadgerDAO theft. On top of that, $500 million in customer deposits was wiped out in the recent LUNA crash. Their reckless manipulation of client funds is beyond words. These are only the theft losses of public information, and other unknown theft incidents are not excluded.

Investors are now redeeming their positions at a rate of 50,000 ETH per week, which means Celsius has only two options:

1. Swap their stETH to ETH and then to stablecoins to increase liquidity.

2. Mortgage stETH and repay customers with loans.

If they choose the first option, they hold about 450,000 stETH, but Curve's pool only has 242,000 ETH. Each sell-off exacerbates the exchange rate deviation of the trading pair, which is a big loss for them.

There is still about $5 million in stETH liquidity on Uniswap, and CEX liquidity is unknown. But the liquidity of CEX, Uniswap and Curve should not be enough to support them to sell all positions. If they can, they should go directly to CEX instead of selling on Curve.

The trading pair of stETH is only ETH, (there is USDC trading pair on FTX, but the proportion is very small), that is to say, after stETH is replaced by ETH, ETH will also face selling pressure.

They have borrowed a lot of money in stETH, and these multi-billion dollar selloffs will make their mortgage ratios even more dangerous.

Let's say stETH decoupling is severe or market conditions get worse.

Alameda can be liquidated. Borrowing becomes more expensive, their collateral loses value due to market conditions, sell-offs below the peg cost them more, and liquidity dries up. Negative feedback loop.

Another thing worth noting is how Aave will liquidate illiquid assets like stETH.

Are they responsible for these assets, or are they forced to remain illiquid for months while risking a drop in the price of ETH? What should they do?

Celsius is likely to be frozen for redemption before liquidation.

Celsius has only a few weeks of funding left and has suffered significant losses due to the risks of decoupling, borrowing fees and delayed mergers. Seems like it's only a matter of time before it gets frozen.

Let's not forget that they're not the only giant whales in this case. When other whales smell blood, they add fuel to the fire, shorting the futures market while liquidating other positions. This is probably why Alameda dumped 50k stETH and swapped it for a stablecoin…

Asset management platforms such as SwissBorg hold approximately 80,000 stETH of client assets. Looking through their wallets, they have invested $27 million in stETH in the Curve liquidity pool and have 51,000 stETH available. If they exit the liquidity pool and dump stETH, Celsius will be in a dilemma.

After the banquet, the giant whale will leave, who will be the first?

Judging by today's transactions, there have been some large exits, including 24 million stETH (approximately $4.2 million).

Keep an eye on Celsius for other positions that need to be liquidated as stETH becomes increasingly illiquid. About $7 million in LINK, over $400 million in WBTC, already on the way...

A large number of retail investors are using leverage to arbitrage on Aave, and if the price of ETH plummets, the situation may become very ugly.

Everyone needs collateral to cover their leverage and sell their other positions.

at risk of liquidation

Alameda, a16z, Coinbase, Paradigm, DCG, Jump Crypto, and Three Arrows Capital are the seven largest holders of stETH that could cause a massive run to happen, and when looking at some of the other large stETH holders like Celsius Network See some warning signs.

Celsius Network has huge positions including nearly 450k $stETH worth $1.5 billion, they also deposited $stETH using Aave as collateral, and amassed about $1.2 billion in liabilities, this still shouldn't be a problem, question It was Celsius Network that was rapidly running out of liquidity to pay off investors who had redeemed positions. Billions of dollars were in illiquid positions, and they took advantage of huge loans to pay customers for redemptions.

If I were a VC or a market maker, I would play like this:

1. Close the position and go short at the same time;

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

Remember to like and repost after reading it!