text

The fourth largest stablecoin is coming to Cosmos after cross-chain protocol Umee and Maker teamed up.

From UST to DAI stablecoins, Cosmos wants to fill the void

Following Terra's $40 billion debacle last month, the Cosmos ecosystem is looking for a new decentralized stablecoin.

At that time, the team of the cross-chain protocol Umee announced that DAI will fill this gap.

“The UST debacle clearly shows that the Cosmos ecosystem needs a strong, secure stablecoin,” Umee CEO Brent Xu told Decrypt. "Going forward, Umee's broader mission includes creating a cross-chain stablecoin and adding Cosmos assets to MakerDAO."

Unlike Terra’s UST, DAI is an over-collateralized stablecoin with a market cap of $6.9 billion. It's still a lot smaller than market leader Tether (USDT), but it's also built very differently.

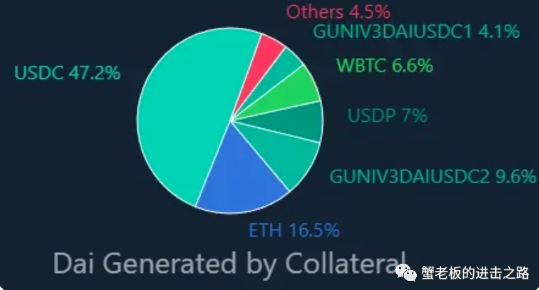

For example, in order to mint $1 of DAI, you need to deposit a maximum of $1.75 in Ethereum. Many other cryptocurrencies are also eligible to be used as collateral, including Wrapped Bitcoin (WBTC), Uniswap (UNI), Polygon (MATIC) and more.

Each collateral asset also has its own "minimum collateralization ratio", which determines how much of said asset you need to stake to mint DAI.

Data dashboard DAI Stats shows that the most popular collateral for minting Maker stablecoins is Circle’s USDC. Given how centralized USDC is, this dominance has also drawn criticism of DAI's claim to be a "decentralized" stablecoin.

DAI is already integrated with over 20 different crypto networks, including Solana, Fantom, and Polygon.

In addition to stablecoins, the Cosmos ecosystem urgently needs a decentralized stablecoin. And UMEE stood up.

First up is UMEE, and while users will technically utilize Gravity Bridge, a connector between Cosmos and EVM-compatible blockchains, for DAI transfers, Xu claims that Umee is more than just a bridge protocol.

“Other protocols use bridges to create packaged assets—essentially a certain amount of blockchain-native currency equivalent to a non-native asset. Umee is different from those protocols,” he told Decrypt. “Instead of building a bridge, we allow users to borrow and stake without creating any additional wrapper assets to gain exposure and participate in another ecosystem.”.

In simple terms, this means that Umee is building a tool that allows users to lend and borrow cryptocurrencies that are usually incompatible.

This idea has also attracted the attention of several well-known investment institutions.

Last June, Umee received $6.3 million in backing from Coinbase Ventures, Polychain and others.

Let me briefly introduce DAI, because this article mainly talks about the impact of bringing into Cosmos.

NOTE: The market cap and circulating supply here only reflect the supply of DAI as an ERC-20 token. Other DAI recorded elsewhere, such as the Dai Savings Rate (DSR) lockup, are not included in the numbers published here.

secondary title

The impact of Umee and DAI accessing the universe

Umee chose DAI because it is a durable product that has withstood many market downturns. This is because MakerDAO greatly overcompensated for systemic risk by requiring overcollateralization of ether and other liquid cryptoassets while using an aggressive interest rate mechanism to strengthen the peg. "

Essentially, the DeFi lending hub wants to strengthen the Cosmos ecosystem with efficient and securely backed stablecoins.

Why it matters: In terms of the landscape, there is significant investor uncertainty surrounding stablecoins. Luna’s precipitous crash was the result of the infamous unpegged stablecoin due to an algorithm error.

Umee is presenting Dai to the Cosmos ecosystem, a stablecoin with a 5-year track record of reliability and stability, generated by "Maker Vaults" and backed by collateralized assets for security.

Umee's Gravity Bridge aims to introduce Dai into the Cosmos ecosystem, enabling lending activities. With a strong focus on security, Umee ensures their bridges are audited by Code4rena, Trail of Bits, Least Authority, and Informal.

Therefore, in order to restore the confidence of retail and institutional investors, Umee's decision to focus on collateralized assets is critical to its long-term success.

When asked about the advantages of collateralized stablecoins over algorithmic stablecoins: “As the past few weeks have shown, not all stablecoins are stable. Compared to the liquidity of 1:1 fiat-collateralized stablecoins such as USDC , the cryptoeconomic design of algorithmic stablecoins is poor and prone to decoupling. This is why active risk management measures, such as interest rate mechanisms and over-collateralization, must be adopted when developing viable stablecoins.

"One of the key flaws in the design of the Terra protocol is that it does not fully collateralize UST's underlying assets to mitigate inevitable market volatility,"

Right now, everything points to DAI as the go-to stablecoin that the entire cross-chain can rely on.

Cross-chain refers to all blockchains connected through Cosmos Hub through inter-chain communication (IBC).

DAI can be minted using a myriad of collateral on Ethereum, though primarily Ether. In its roughly five years of existence, it has weathered multiple market cycles, including periods of high volatility.

Cosmos-native approach

Expanding DAI's collateral set to include Cosmos native assets, such as ATOMs, both in terms of usability and collateral.

To achieve this goal, Umee has developed a new cross-chain technology called "Bridgeless Staking". The idea is that users can keep their assets on one blockchain instead of sending them to another blockchain to become wrapped assets on another blockchain. In theory, this should avoid the security issues involving wrapped assets seen in several high-profile exploits

This bridgeless form, however, calls it "a more sustainable model than having multiple bridges for a particular asset", but will come later. Initially, Umee plans to use DAI's decentralized Gravity Bridge as a packaged asset.

Take a bridge-agnostic approach and have a stable swap on the roadmap. ” This will allow users to move between various stable assets, including different types of wrapped DAI.

For example, the largest Cosmos-based dex, Osmosis, has adopted Axelar Network’s bridge DAI as the canonical version of its Ethereum stablecoin.

In order to realize Umee's vision, Maker governance votes are required. The details of the process are yet to be determined, but it is expected to take three to six months to gain support from the Maker community.

UMEE Project Party: We see this as a deep partnership,” he said. “We want to encourage as much use of DAI as possible in Cosmos [as much as possible] to help address the lack of viable stablecoins in the Cosmos ecosystem ,” he added, who has personally worked with MakerDAO for years.

Value summary:

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

That's all for today's sharing, and I will bring you an analysis of leading projects on other tracks later. If you are interested, you can pay attention. I will also sort out some cutting-edge consultation and project reviews from time to time, and welcome all like-minded people in the currency circle to explore together.

Everyone, remember to like and repost after watching!