This article comes from TwitterThis article comes from

, the original author: pastry & korpi, compiled by Odaily translator Katie Ku.

The Ropsten testnet merger is a big day for Ethereum. This marks the final testing phase before deployment on mainnet.

secondary title

Ethereum Tests Final Phase of Merger Preparations

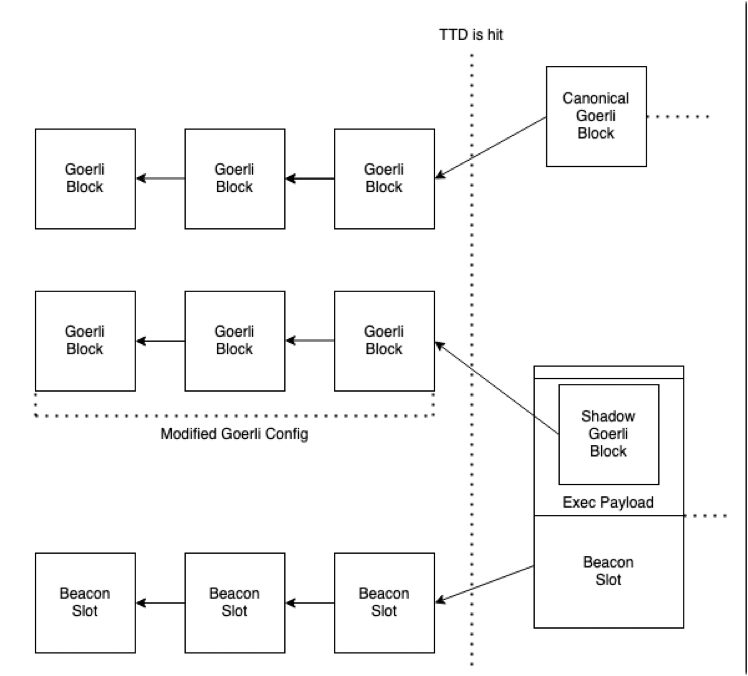

Over the past few months, developers have been testing clients on Kintsugi, Kiln, and other shadow forks. A shadow fork is a new development network created by forking a small number of nodes from the existing network.

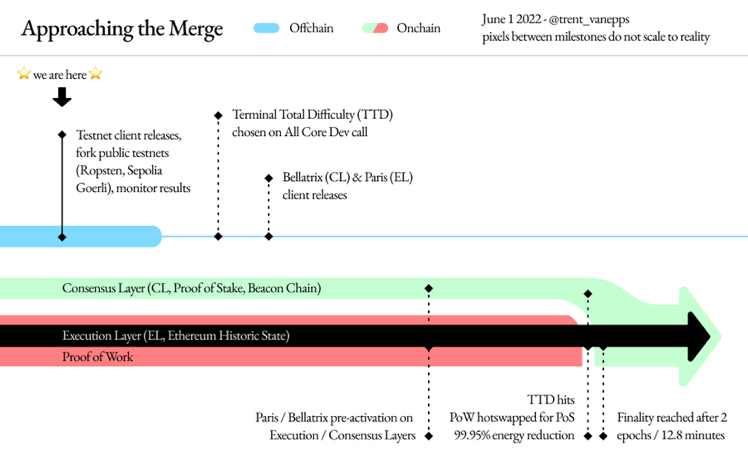

After successfully achieving multiple goals on the shadow fork, we are now entering the final phase: the testnet deployment. In preparation for the Ropsten testnet merger, the new Ropsten Beacon Chain (Beacon Chain) was launched on May 30 to provide a consensus foundation for the network.

secondary title

Performance before and after the merger

First, the consensus layer needs to be upgraded to incorporate compatible protocol rules (Bellatrix), triggered by slot height. This transition occurs at slot 24000 on June 2.

Next, the execution layer portion of this transformation will take place. In this step we will determine a new "TTD" (Total Terminal Difficulty) value.

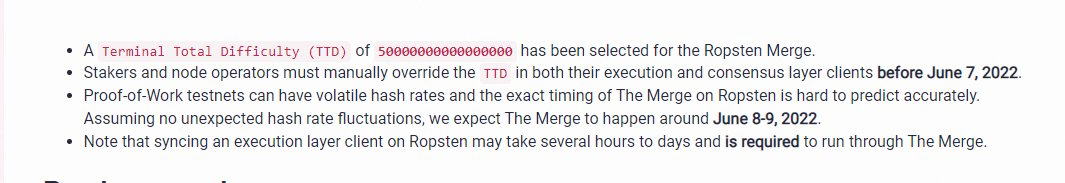

On June 3, the exact TTD for the merge was set to "50000000000000". When the selected TTD is reached, the chains will merge.Once the execution layer exceeds "TTD", the next block will be produced solely by the Beacon Chain validators. Once this block is complete, the merge is considered complete.

After the Ropsten testnet, other testnets (Goerli and Sepolia) will also transition to PoS in the coming weeks.

When Goerli and Sepolia are successfully transitioned and stabilized, a slot height will be chosen for the Bellatrix upgrade on the beacon chain and a TTD value will be set for the mainnet transition. The client will then publish a merge-enabled version on mainnet. The path from today's situation to a full transition to PoS is now in sight.

After completing the following operations, we can enter the main network:

Shadow fork deployed without issue (Completed)

Client passes various test suites (completed)

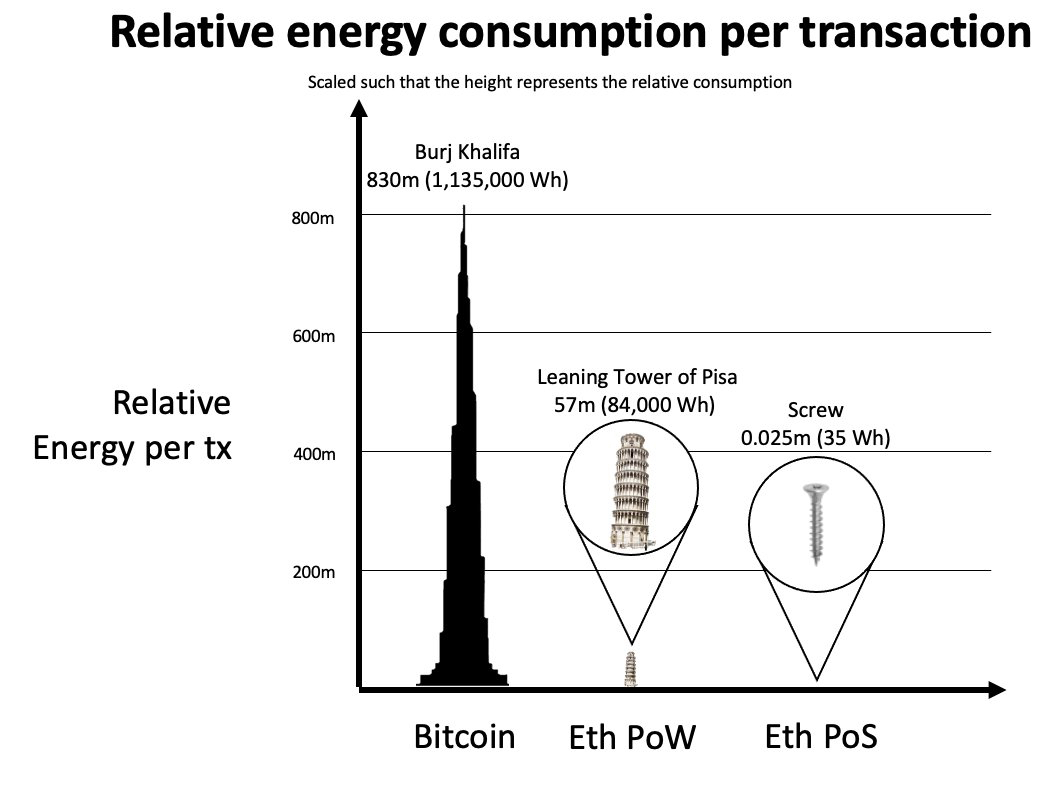

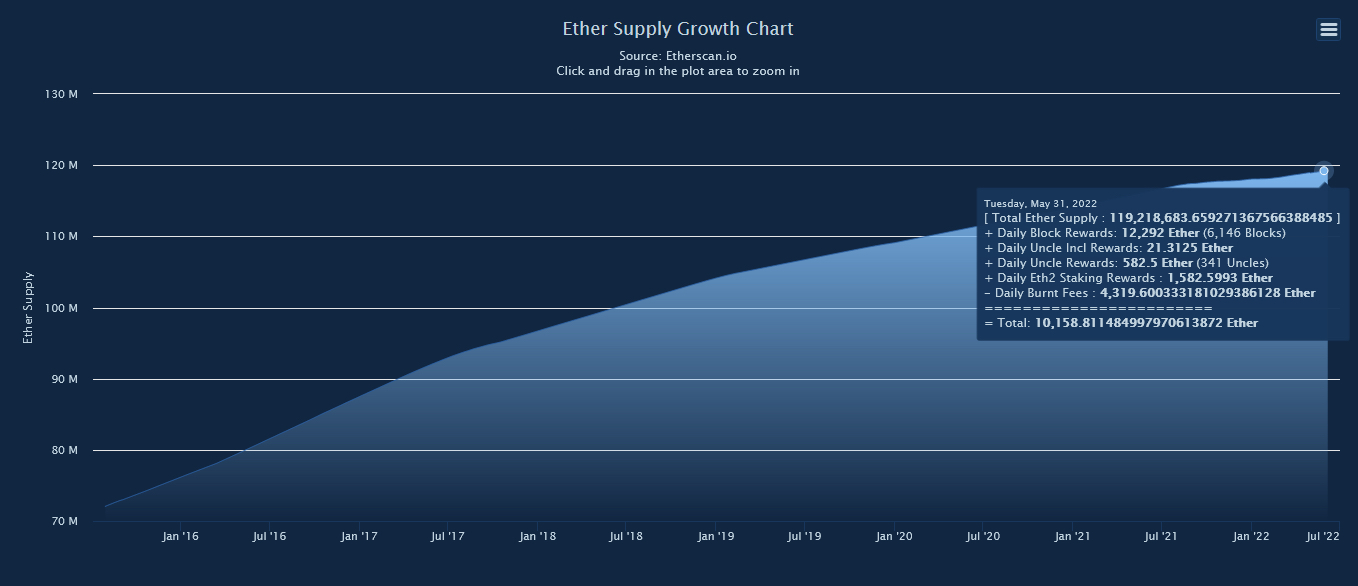

The shift to PoS will mark the end of PoW Ethereum and usher in a more sustainable and greener blockchain era. In fact, it is estimated that PoS will use 99.5% less energy than PoW.

secondary title

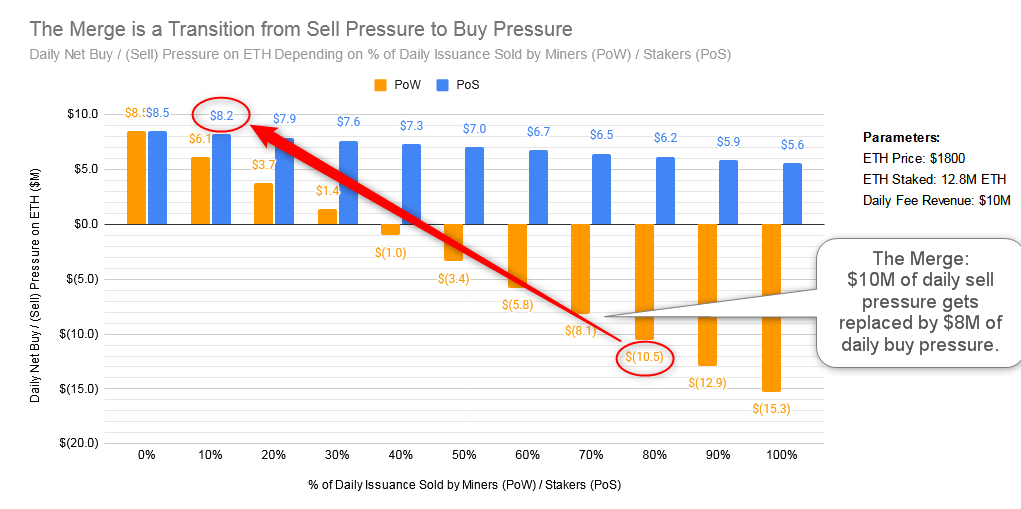

Mergers lead to changes in ETH supply and demand forces

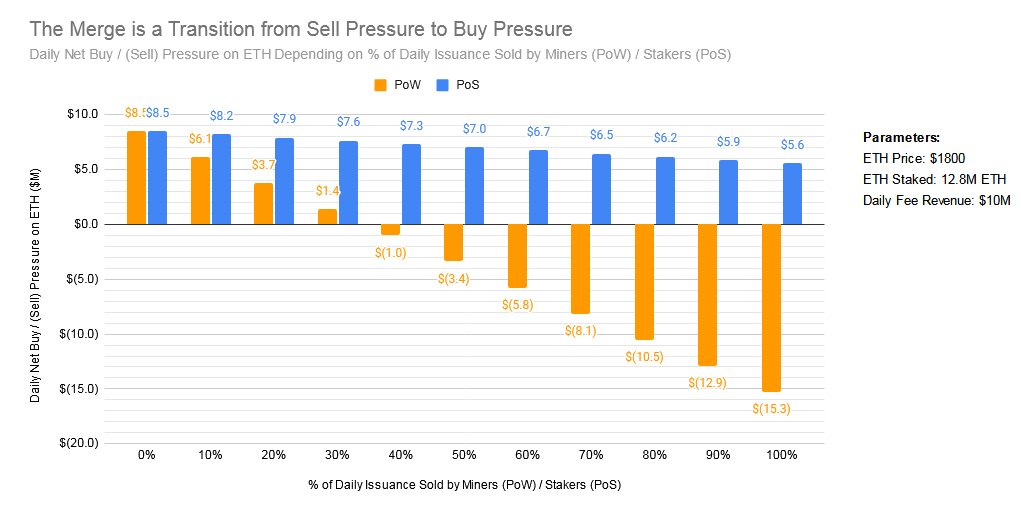

Immediately after, circulation will be reduced by more than 90%, and selling pressure by the millions every day will be replaced by buying pressure. This is equivalent to halving 3 BTC.

"Consolidation" is a major change in supply/demand that most people underestimate. Daily selling pressure on ETH will be replaced by buying pressure. We need new sellers every day to "block" price increases.

If the merger were to materialize today, ETH's ~$10m/day sell pressure would be replaced by ~$8m buy pressure. While we now need about $10 million in new funds per day to keep prices stable, we need about $8 million in existing holders to sell their ETH to hold back price growth.

Before proceeding with these calculations, let's clarify where we are and how we are going to get there.

Purpose: We want to see the impact of the merger after it happened.

parameter:

fact:

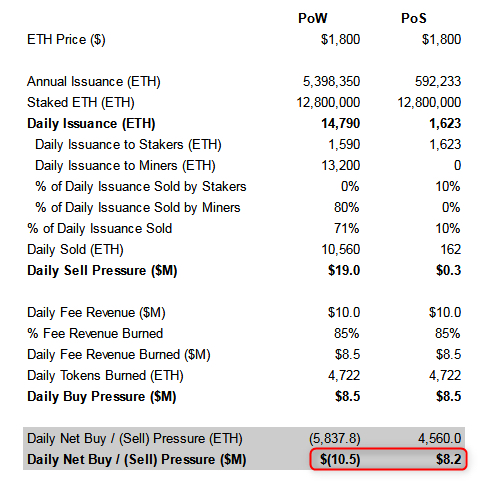

F1. Issuing ETH in PoW

F2. Issuing ETH in PoS

F4. Percentage of Fee Income Consumed Due to EIP-1559

Assumptions:

Assumptions:

A2. Percentage of staker’s daily issuance (PoS)

text

F1. Issuing ETH in PoW

In merging blocks, the two chains "merge" into one, and the PoS era begins.

text

F2. Issuing ETH in PoS

Post-merger, since PoW is removed from Ethereum, the issuance rate is drastically reduced and only stakeholders are rewarded for producing blocks. The drop from about 14,790 ETH to about 1590 ETH represents a 90% reduction in issuance. Equivalent to 3 BTC halvings.

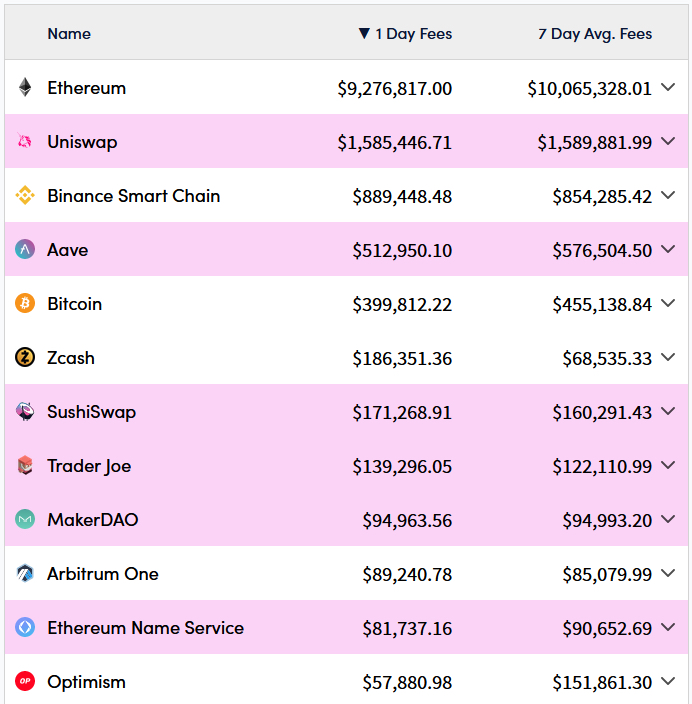

F3. Ethereum daily fee income

All Ethereum users pay transaction fees - they represent revenue for the Ethereum protocol. Daily fee income varies based on activity on Ethereum (expressed as gas fees). Based on the past 7 days, the average daily revenue is about $10 million.

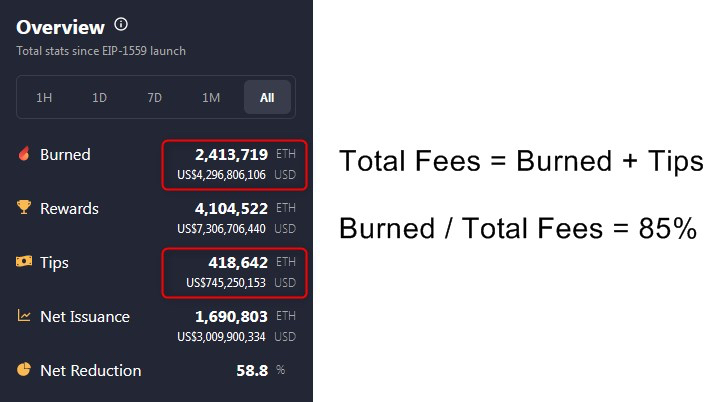

F4. Percentage of Fee Income Burned

Part of the total fees paid by users goes to nodes and another part is burned (EIP-1559). Regardless of the time period analyzed, the percentage burned was fairly consistent, around 85% of total fees.

A1. Percentage of Miner’s Daily Issuance (PoW)

Miners usually aim to profit from their operations, not to accumulate more cryptocurrency. They also have high fixed costs, such as electricity, rent and hardware, so they are often forced to sell. They probably sold about 80%.

A2. Percentage of staker’s daily issuance (PoS)

In short, it's all about the constant repetition of supply and demand. @NorthRockLP calls them "structural" forces and thinks they drive prices over the long term.

secondary title

What is the structural supply and demand for ETH?

Supply: Selling pressure from miners/stakers.

It's simple, they get newly issued ETH and keep selling some of it.

Demand: Fee income is burned.

This is more complicated. Why do burn fees represent structural demand?

Fees paid on Ethereum come from users who need to periodically buy back tokens to maintain their allocation to ETH and/or continue to use Ethereum. If we assume the current state of Ethereum investors and Ethereum usage, total fees = total buybacks.

But total costs do not represent structural needs.

A portion of the fee goes to miners/stakers, who sell it on the open market. In this case, the user's repos simply change hands: user => block producer => user.

The story takes a dramatic turn as the fee burns. The cost of burning will be deducted from the supply. User buybacks no longer change hands because burned ETH cannot be bought back. Therefore, a portion of the total fee is burned, which is equivalent to new funds flowing into a system.

Burn costs = structural needs.

PoW:

Let's look at the daily structural supply and structural demand together.

Daily selling pressure: $19 million

Daily buying pressure: $8.5 million

PoS:

Net profit: $10.5 million in selling pressure per day

Daily Selling Pressure: $300,000

Daily buying pressure: $8.5 million

Net profit: $8.2 million in daily buying pressureI calculated other percentages as well.secondary title

Summarize

Summarize

The merger is one of the most complicated events for Ethereum to date, and arguably one of the largest ever. After years of testing, development, and delays, we are finally entering the final stretch before the merger.

The merger had a huge impact on structural demand and supply forces. Daily selling pressure is replaced by buying pressure. In the long run, even without an influx of new buyers, this fundamental shift will drive prices higher.