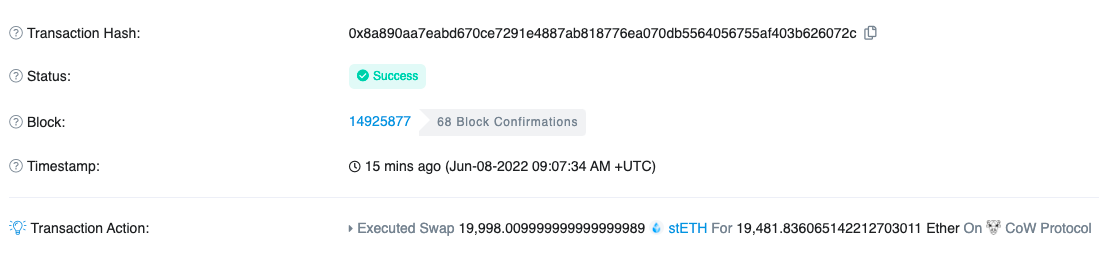

tradetrade, the address starting with 0x2e dumped 19,998 stETH through CowSwap's DEX aggregation routing, and "discounted" exchanged 19,481 ETH.

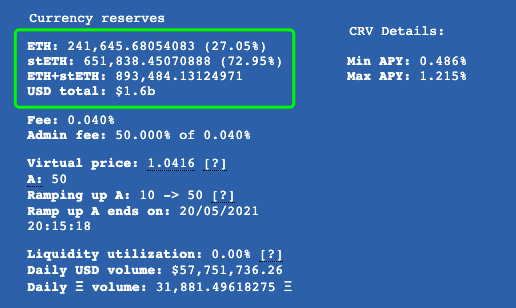

With the completion of this transaction, the deviation of the stETH / ETH liquidity pool on Curve has further intensified. As of 18:00, there are 241,645 ETH (27.05%) and 651,838 stETH (72.95%) in the pool, and the ratio of the two has fallen below "37" pass.

From the secondary market (data from CoinGecko), the impact of the deviation is that the discount of stETH compared to ETH is further widened. As of 18:00, the two quotes were 1768 US dollars and 1810 US dollars respectively, with a discount rate of about 2.3%.

While the de-anchoring of stETH is intensifying, the voice of "buying the bottom" in the market is also getting louder.Marc Zeller, director of developer relations at Aava, tweeted today (after the above-mentioned transaction occurred), suggesting that users who intend to buy ETH now choose stETH, which is "temporarily discounted but has a greater long-term value", and use the information difference to amplify the benefits .

So, is it possible to buy the bottom of stETH now? As far as the author is concerned, in order to find out the answer to this question, we need to start from multiple levels of small problems in order:

First, what exactly is stETH? Why do you say it has greater long-term value?

Secondly, why is the price of stETH that "obviously has greater value" discounted? And why has the discount accelerated in the near future?

Furthermore, what is the probability of a systemic crash? What will happen if you continue to fall?

Finally, can you buy the bottom?

In the following, we will analyze these four issues one by one.

Question 1: What is stETH? (Friends who are familiar with the Lido mechanism can skip directly)

stETH is a Liquid Staking token issued by Lido for the ETH2.0 pledge scenario.

At the end of 2020, the ETH2.0 beacon chain (phase 0) was officially launched, activating the on-chain pledge function. Because the beacon chain does not support the reverse unlocking of the pledge for the time being, and the funds (at least 32 ETH) and technical thresholds for direct participation in the pledge are a bit too high for ordinary users, thus giving birth to a new track - liquidity Pledge service.

Lido is the best player on this track. The core mechanism of the agreement is to allow ETH holders to deposit their ETH into Lido's smart contract in exchange for the interest-earning asset stETH at a ratio of 1:1.

stETH represents the rights and interests of users to redeem their pledged ETH principal and interest after the activation and unlocking function of ETH 2.0 in the future. At the same time, stETH that adopts the ERC-20 standard can be freely traded and transferred, which solves the Opened the liquidity lost by ETH due to long-term pledge.

To put it simply, the value of stETH is equal to "the same amount of ETH" plus "the pledge income of these ETHs on the beacon chain", which is why Marc Zeller said that the forward value of stETH is greater.

Question 2: Why is stETH discounted? Why has the discount accelerated in the near future?

From the above equation, stETH obviously has a greater long-term value, why is its price lower than ETH itself now? The reason is simple, because the time for this equation to be established should be after ETH 2.0 activates the unlocking function. Although stETH represents the user's redemption rights to their pledged principal and interest, this redemption is still technically unavailable for the time being. .

At present, the exchange of stETH back to ETH is mainly through the stETH / ETH liquidity pool on Curve. In order to expand the liquidity scale of this pool, Lido took out a large number of LDO tokens as incentives, and finally piled up a A huge pool of billions of dollars.

However, using the secondary market as an exchange channel also means that the price relationship between stETH and ETH will be affected by market sentiment. In the early stage, when the market continued to rise, the situation was good. Anyway, ETH has been rising. Wouldn’t it be beautiful to use ETH and stETH to mine while waiting for unlocking? This is also the main reason why stETH and ETH have maintained a good anchor in the early stage.

However, as the market went bearish, the situation began to change. On the one hand, some liquidity providers will think that the price of ETH may not be as good as it is when the unlock is activated, so they choose to take out ETH with better liquidity to cash out; ETH liquidity, so I chose to take out ETH that is more abundant in usage scenarios (replenishment margin, bottom-buying NFT).

As a large amount of ETH began to be withdrawn from the pool, the liquidity pool naturally deviated (ETH decreased and stETH increased), and the price of stETH also had a discount.

So why is this discount accelerating in the near future? This has to mention Celsius, which has frequently appeared in the news in recent days.

Celsius is one of the largest CeFi financial management platforms in the market. Last year, the platform deposited more than 40,000 ETH into another ETH2.0 pledge service, StakeHound, but lost all the coins... This After suppressing the matter for about a year, it was still not covered after all, and it was picked up by the market recently.

For users of Celsius, when such a thing happened, they would definitely think of withdrawing their money first, but at this time people found that from a technical point of view, Celsius seems to have fallen into "insolvency" now, It’s not that the platform has holes bigger than 40,000 ETH, but that the platform has money but can’t get it out…

The problem still lies in the fact that ETH2.0 does not support pledge unlocking. According to the statistics of Twitter user yieldchad, Celsius has about 1 million ETH assets, but only 268,000 (nearly 27%) have sufficient liquidity, and the other 44.5 The 10,000 tokens are stETH. According to the latest Curve exchange rate, only more than 230,000 ETHs can be exchanged, and the last 288,000 tokens are directly pledged into ETH2.0, and it will be even less likely to be taken out in a while.

Affected by this objective situation, a large number of liquidity providers began to worry that if there is a centralized run on Celsius, the platform will be forced to sell stETH to repay the debt, which will further cause the deviation of the liquidity pool. Instead of sitting still, it is better to run first... …which has resulted in an acceleration in the discount of stETH in the near term.

Question 3: Will there be a total collapse? What will happen if you continue to fall?

Before answering this question, I recommend that you read the specific analysis of the Celsius incident by two teachers, 0x.Gene and 0x_Todd (see "A few thoughts on Celsius Network's 1 million Ethereum positions "insolvency"》)。

In a brief summary, although the situation of Celsius is indeed a bit bloody, considering from multiple perspectives such as the user entrustment cycle, actual asset reserves, and the possibility of processing methods, it is unlikely that Celsius will be forced to sell stETH due to a run .

Going back to stETH itself, although I personally agree that stETH may continue to be discounted due to the FUD sentiment in the market in the short term, but I don't think it will be too large (unlike LUNA and UST). I say this for two reasons.

one,As a liquid pledged token, each stETH is backed by a sufficient amount of ETH, there is no doubt about it. In view of the fact that the development of ETH2.0 in the testnet has not encountered too many unexpected obstacles, and Lido's own smart contract has also withstood the market's long-term test, we can relatively optimistically evaluate the channel of stETH to redeem ETH. Opened successfully after a few months.

Second,The stETH discount has created a very clear arbitrage window, it is foreseeable that when institutional funds determine that the discount opportunity of stETH can cover the loss of capital rate, there is a high probability that hedge funds will choose to buy stETH spot with one hand, and short the same amount of ETH in the futures market with one hand, and close the position after the pledge is unlocked arbitrage. This potential buying will be the main underpinning force for the stETH discount to persist.

Question 4: Is it possible to buy the bottom?

Next, I finally entered the topic of this article—is it possible to buy the bottom of stETH? This situation needs to be answered in combination with your own market outlook expectations and investment strategies.

If you continue to be bearish on the market outlook, then don't buy bottoms.

If you just want to play and leave, then I suggest you think twice, because it is uncertain how much impact FUD sentiment will have in the short term, and even if the anchor is restored, there will be only a few points of profit.

If you have sufficient financial resources and are willing to arbitrage, what you should now estimate is the relationship between "staking yield + discount rate" and "funding rate loss".

However, if you are optimistic about the future development of Ethereum in the long run and are willing to kill ETH for a year or more, buying stETH now or soon (exchanging the ETH in your hand) may be the best choice.

----------renew----------

tweetstweetsA very detailed estimate has been made in , and interested readers can click on the tweet for additional reading.