Original source: DappRadar

Compilation of the original text: Grain

Original source: DappRadar

Compilation of the original text: Grain

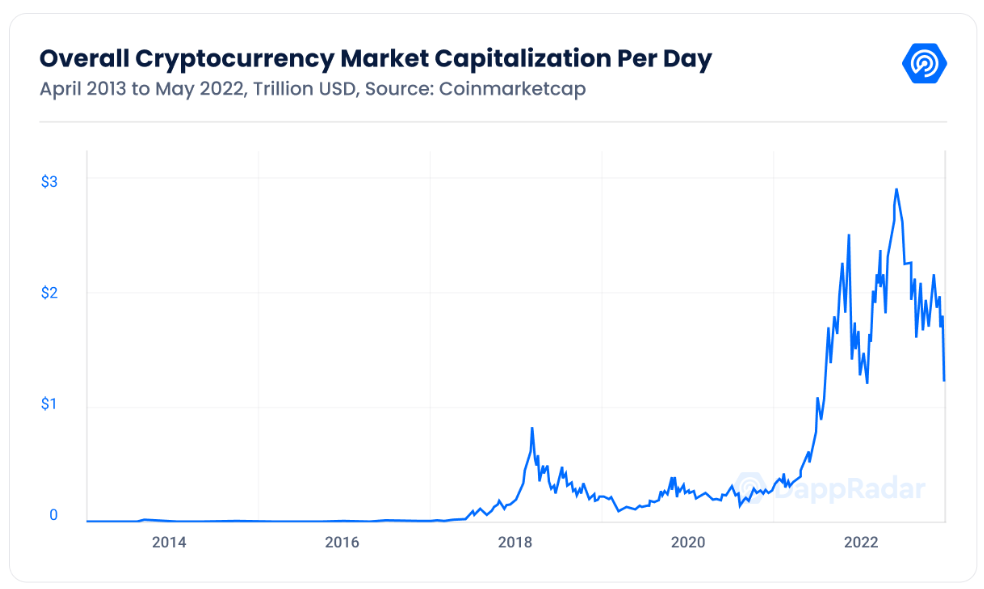

The young cryptocurrency market is facing the most critical period in its history.Since reaching an all-time high of $69,000 in November 2021, Bitcoin has fallen 55%. Just a few weeks ago, Terra, the second largest DeFi ecosystem, collapsed in the largest loss of wealth event in modern history. Retail, institutional and even corporate investors lost over $60 billion in LUNA and UST in a matter of days as the 7th and 10th tokens by market capitalization evaporated.

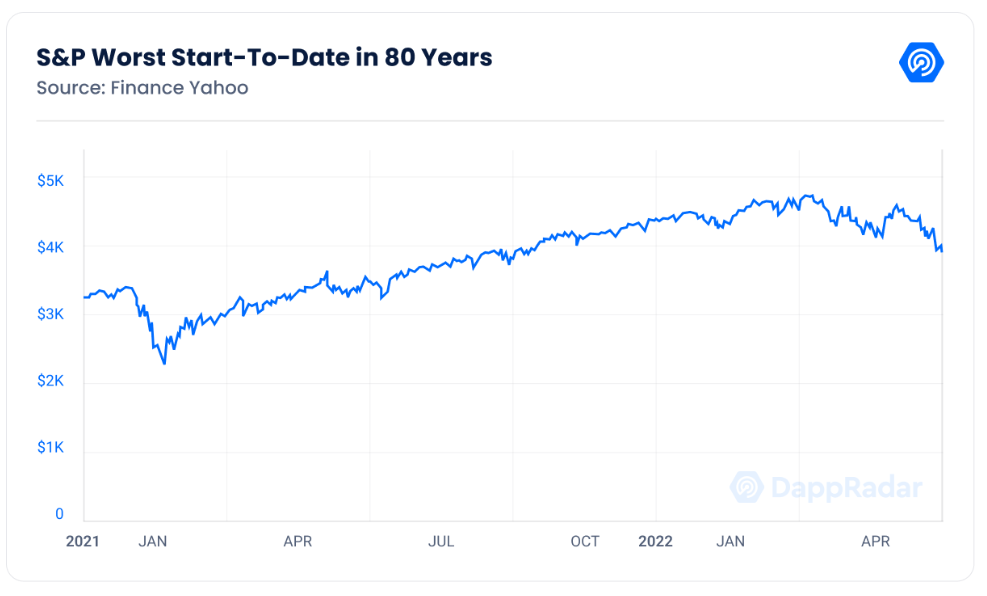

To complicate matters further, the correlation between cryptocurrencies and U.S. stocks will reach an all-time high in 2022.

That, along with the war in Ukraine, the highest inflation rate in 40 years, and U.S. monetary policy, are all headwinds for the downtrend of the past six months., trying to assess whether a crypto winter is indeed imminent, and where the cryptocurrency industry can look forward to in the coming months.

01

first level title

first level title

The IC0 Era and the First Crypto WinterIn 2017, driven by the ICO craze, the cryptocurrency field experienced the first significant expansion period, reaching the peak of the great bull market in December of that year, and many existing startups and new projects used cryptocurrencies as a new financing mechanism.From a macro perspective,

At the time, there was optimism about a sustained economic recovery.Tech and digital stocks are booming as Epic Games' "Fortnite" generates $8.5 billion in annual revenue and Apple emerges as the most valuable brand.

Excitement Surrounding Cryptocurrency Startups Has Drawn a Lot of Capital into the Space, most of which come from retail investors. Many businesses have changed their names to include “blockchain” or “cryptocurrency,” and some have even decided to reorient their entire operations to capture the trend — reminiscent of the dot-com bubble.However, adoption in the blockchain industry was low back then, and even less regulated than it is now.

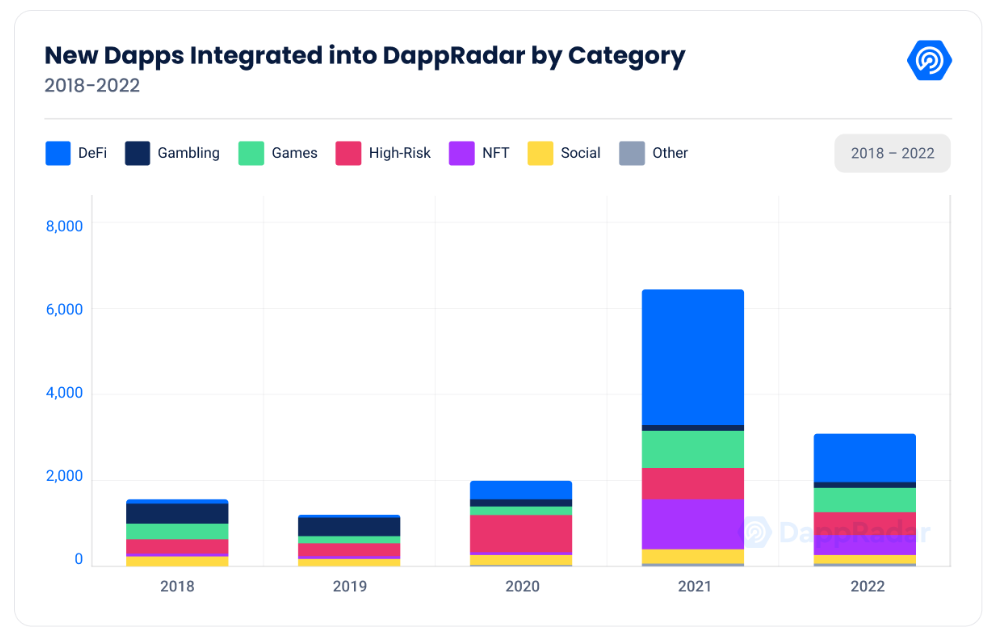

By the end of 2017, only 104 Dapps were live and running, when the total market capitalization of cryptocurrencies exceeded $800 billion for the first time. Cryptocurrencies such as BCH, MIOTA, DASH, and XMR are among the top 10 by market capitalization along with BTC, ETH, LTC, and XRP.

Lack of regulation and too much money spent on junk projects

, making this nascent industry quickly unsustainable. It is estimated that in the ICO era, 90% of projects fail within 6 months of launching. However, those projects that have become mainstream in today's industry, such as Decentraland and Enjin, were also born in the IC0 era.Multiple scams and failed projects have created a sense of uncertainty across the industry. After the BTC price hit an all-time high, reaching nearly $20,000 in December 2017, a series of events put enormous pressure on the industry, turning the biggest bull market ever into the start of a grueling crypto winter.At the same time that BTC hit a new all-time high, CME, the world's largest derivatives exchange, also launched the first Bitcoin-based futures.

Institutional investors are heavily shorting Bitcoin

, exerting unprecedented selling pressure on digital assets.Additionally, rumors of a possible ban on cryptocurrency trading in South Korea and other Asian countries, as well as a hack that cost Coincheck $530 million and halted trading on Japanese OTC exchanges in the ensuing months, sparked a bear market. .Finally, the price of BTC crashed to $7,700, down 65% from its December 2017 high.

Over-leveraged retail investors have lost a lot of money, coupled with market instability and imminent regulation, these factors led to a brutal and long winter that froze most IC0 projects that were still in their infancy.The crypto winter of 2018 lasted nearly 18 months. Apart from these prosaic figures, the period is characterized by

hardly any interest in participating

Four years later, will history repeat itself?

02

first level title

first level title

No hibernation, time to buildBefore comparing the current market situation with 2018, it is worth understanding how the blockchain industry got to its current state.

The last encryption winter became a critical period for the rapid development of the blockchain ecosystem,Axie Infinity、ETHLendThe foundations of the industry as we know it today were laid during this period.

Despite the downturn in the market at the time, leading projects are constantly working on building and optimizing their products. Lightning networks like ETH and BTC have achieved important milestones,(now known as "Aave"), and other projects, were also launched during that period of scarce interest.After 18 months of constant struggle,

The crypto industry is starting to show signs of improvement.

There has been renewed interest in the space, and prices have started to soar. However, it also put a pause on the recovery of the crypto market as the pandemic affected almost every industry.In March 2020, global markets collapsed amid massive disruptions in supply chains and intensive lockdowns across the globe. The price of BTC crashed nearly 50% in one day, and the S&P 500 fell 23% in two weeks. The fear of the next harsh winter is palpable.Although the situation is complicated,

But there are several verticals that take advantage of this market, tech stocks like Amazon, Netflix, Zoom and Peloton soared. Likewise, the Dapp space is starting to take shape as major projects successively announce their improved products.

In the summer of DeFi in 2020, a large number of projects have demonstrated the potential of decentralized finance. Curve, MakerDAO, Uniswap, PancakeSwap, and a handful of other DeFi projects have paved the way for a multi-billion market, with many projects named after food and animals,

The narrative of the Dapp industry has completely changed.At the same time, the United States has printed banknotes accounting for 80% of the historical circulation of the US dollar in just two years, and the amount of money injected into the economy to stimulate consumption has caused retail and institutional investors to turn their attention to the crypto market.Adoption, consumer confidence, and invested capital are all on the rise, fueling the start of the next bull market. In just 6 months, the price of BTC has increased by 134%.

03

first level title

first level title

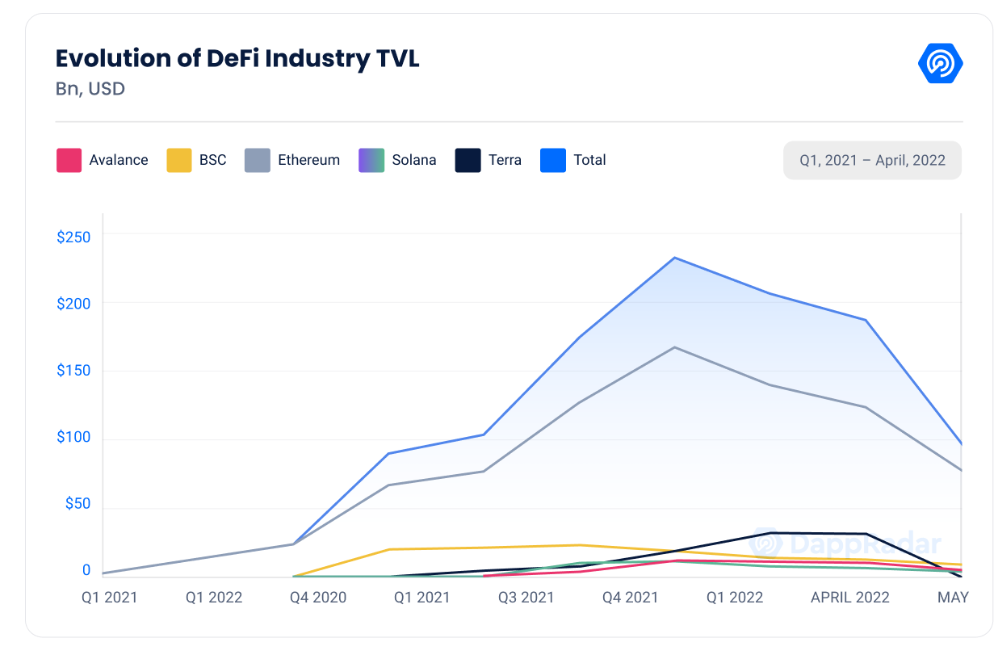

Three major sectors help the bull market in 2021By 2021, the crypto winter is a distant memory. The bull market sent BTC soaring to $60,000, and the cryptocurrency market cap topped $2 trillion for the first time in April of that year. BTC and ETH were consolidated as the top two cryptocurrencies, and BNB, USDT, DOT, ADA, UNI, and LINK showed a new face of the industry.At this point, the Dapp space is beginning to reap the seeds planted two years ago over the winter. The three main categories of the industry -

DeFi, NFTs, and GameFi

, showing exponential growth through most of 2021, attracting millions of new users and billions of dollars in investment. Web3 paradigms such as multi-chain interoperability and play-to-earn are on full display.For example, last November, DeFi protocols locked more than $200 billion in assets in smart contracts. The multi-chain model has helped Polygon and Avalanche become the leading projects in the DeFi ecosystem and locked assets worth billions of dollars.Then NFT also broke out, generating more than $22 billion in transaction volume last year. Meanwhile, the top 100 most valuable NFTs on Ethereum have a market cap of $16.7 billion. NFT artists like Beeple, Pak, and Fewocious brought NFTs to the mainstream stage, and collectibles like CryptoPunks and BAYC became a

cultural phenomenon

, to attract celebrities and brands into the space. As NFTs enable ownership and authentication, the potential of this blockchain use case is revealed.

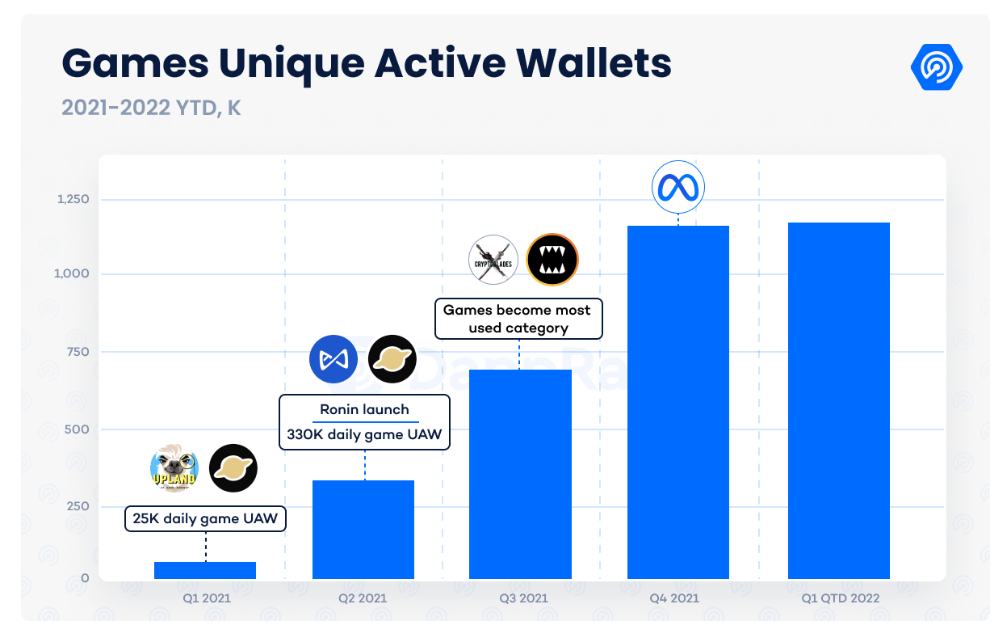

Similar to NFTs, blockchain-based games will grow exponentially during 2021. Games like Axie Infinity, Upland, and Alien Worlds employ cryptocurrencies and NFTs to compensate their players, creating new revenue streams. The popularity of such games, especially in emerging economies, has given birth to the concept of play-to-earn.

With Facebook's rebranding, a new hype cycle was created, a narrative around a "metaverse."The whole industry is full of optimism.

04

first level title

first level titlecomplex macro situation

The time comes to 2022,The current state of the industry is much better than it was four years ago.Hundreds of applications spanning multiple blockchain ecosystems attract2.5 millionactive wallets; the situation for investors is also quite different,

Institutional and corporate investors now dominate the cryptocurrency spaceFrom a macro perspective, the situation is also different now than it was in 2018.

also,The negative impact of the Ukrainian-Russian war has brought serious challenges to global markets, and a few weeks ago, the Federal Reserve raised interest rates by 0.5% for the first time in two years, confirming doubts that the Fed was about to raise interest rates at the beginning of the year to deal with rising inflation.also,

The rush of money printing is starting to have an impact.The Terra incident has put more pressure on the crypto market, which is experiencing a macroeconomic recession for the first time.

05

first level title

first level title

Is winter coming?Comparing the factors that led to the cold winter of 2018 with what we see now, there is a stark difference.First, the blockchain industry has gone from a small group of isolated networks to

A series of interconnected ecosystems, attracting millions of daily users. Three major categories — DeFi, NFTs, and GameFi — thrived, growing into multi-billion dollar segments.Similarly, the situation for investors has changed from a large number of retail investors to

Large institutions and enterprises with more economic power. Awareness of the space is higher than ever, cryptocurrency sponsorships are seen in nearly every major sport, billboards for Web3 products are in multiple cities around the world, and BTC could be the key to Venezuela , Argentina and other countries facing hyperinflation.The same is true for NFTs.

This type of digital asset is decoupling from the stock and crypto markets, has proven to be one of the most resilient assets in recent history, just as art has historically been one of the most resistant investment vehicles.A Web3 brand built at the forefront of the Metaverse, showing the

endogenous growth. Web3 brands like Yuga Labs, The Sandbox, and RTFKT have partnered with numerous retail giants, including Adidas, Nike, HSBC, Warner Bros., and more. We are witnessing talent flow from leading Web2 projects to the blockchain world.Despite the importance the blockchain industry has become, challenges remain. The collapse of Terra has sent the sector into a trough, and apart from DAI and some other stablecoins, many stablecoins including Tether have struggled to maintain their prices during periods of high volatility.

Trust in the Entire Algorithmic Stablecoin Segment, Might Keep Smart Investors Out of Weak DeFi, so safety and regulation are topics that need to be brought to attention as soon as possible.The record high correlation between the stock and crypto markets has also brought another burden.

(BTC Correlation with S&P 500)

06

first level title

first level titlewinter is here

Therefore, comparing 2018 with the current situation, despite the impressive maturity of the encryption industry, the Web3 community is also accelerating expansion,But cryptocurrency winter may well be upon us.

The macroeconomic situation coupled with Terra’s collapse has added to the woes of the crypto market, which is already facing a correction phase. However, due to the level of popularity,

Everyone's interest in this industry should not plummet like it did in 2018.As a digital asset with unique economic attributes, BTC, NFT and other cryptocurrencies will still be needed. At the same time, corporate and government adoption will force lawmakers to work on policies to regulate digital assets, which will generate headlines in the mainstream media.However, we need to take into account that the cryptocurrency market is cyclical. Sustained growth is not sustainable for any industry.Consolidation and capitulation cycles are healthy

", which can create financial stability."

To quote Musk:

A recession isn't necessarily a bad thing. I've been through it a few times. What tends to happen is that if you have a boom that lasts too long, it misallocates capital and starts throwing money at fools.The same applies to the crypto winter, a period that should be seen as an opportunity to cleanse the market. In tough times, successful projects will continue to be built, while empty ones will fall through the cracks.。

Well-Positioned Against a Secular Bear Market

Note: The above content is for communication only and does not constitute any investment advice. The currency market is risky, so you need to be cautious when entering the market.