Compilation of the original text: black rice

Compilation of the original text: black rice

At the 2022 Ethereum Developers Summit, co-founder Vitalik Buterin said that Ethereum is expected to merge the beacon chain with the mainnet through The Merge (merge) upgrade in August, enabling Ethereum to be switched to Proof of Stake (PoS) consensus algorithm. If the developers encounter some difficulties, the release may be delayed until October.

The much-anticipated Ethereum merger is not only a major "reshuffling" of the Ethereum blockchain, but may also be a watershed moment for the crypto industry, as it will greatly reduce the energy consumption problem of the second largest blockchain by market capitalization and significantly improve Internet transaction speed.

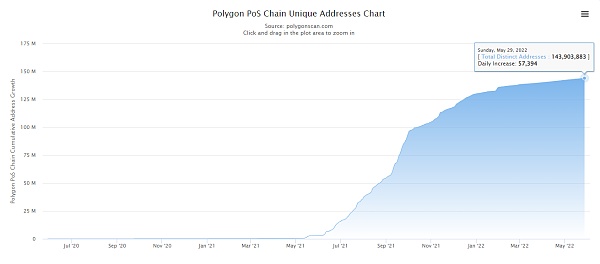

Over the past few years, one of the main ways to reduce Ethereum Gas fees has been Layer 2 solutions (Layer 2). Polygon alone processes more than 3 million transactions per day and holds approximately 140 million wallet addresses.

first level title

What is Layer2?

Layer is its most basic definition of "layer". Mainstream public chains like Bitcoin and Ethereum, which we are familiar with, all belong to the category of Layer1.

As we all know, due to the frequent congestion of the Ethereum network and the extremely high transaction fees, many large-scale applications cannot be implemented on the Ethereum network. For example, in the DeFi wave in the past few years, the handling fee was as high as hundreds of dollars, which is very unfavorable for users. Therefore, in order to solve the performance problem of the Ethereum network, on the basis of the Ethereum main network, the concept of Layer 2 was born - an overall solution dedicated to improving the performance of the Ethereum network "outside the chain".

If you compare Ethereum to a company, the business volume is large, which leads to low work efficiency, and many businesses are queued up when busy. So he opened a subsidiary (Layer 2) and handed over some business to the subsidiary, thus reducing the burden on the parent company.

Therefore, Layer 2 processes data in a way that reduces the burden on Ethereum, and transfers part of the data processing of Ethereum to Layer 2, thereby enhancing the scalability of the entire Ethereum network. Ethereum remains the ultimate "arbiter" when there is a dispute.

Currently, Ethereum Layer 2 has several solutions, namely: Rollups, state channels, side chains, Plasma, Validium, and hybrid solutions.

However, if Ethereum turns to the PoS consensus to achieve the goal of reducing transaction fees and expanding network performance, then users' demand for Layer 2 will be reduced. Additionally, moving to PoS may improve mechanisms for securing the network. Ethereum co-founder Vitalik Buterin believes that PoS can provide Ethereum with:

first level title

The merged Layer2 is more efficient

The increased efficiency of Ethereum may benefit the second layer.Alan Chiu, founder of Layer2 Boba Network, believes:

"As Ethereum becomes more efficient, Layer 2 will also become more efficient, while maintaining its current additional advantages."

As Harold Hyatt, Product Manager at Trusttoken, explained:

first level title

Significant contributors to Ethereum’s mainstream adoption

Ahmed Al-Balaghi, co-founder of multi-chain relay protocol Biconomy, explained: "Ethereum still needs as many scaling solutions as possible to really gain mainstream adoption, even after the merger." It is becoming more and more popular, but there is still a long way to go for mainstream adoption. By this year, only 4% of the world's population owns encrypted assets.

As adoption increases, the demand for networks like Ethereum will grow exponentially. Poapster, a contributor to Harvest Finance, a leading DeFi protocol, believes:

“We’re going to see ethereum becoming the universal settlement layer, and all the different Layer 2 and EVM compliant chains are going to be where small transactions happen.”

Therefore, the industry seems to believe that Layer 2 has a prominent role in the future of the Ethereum network. Brian Fu, co-founder of the money market protocol zkLend, is very optimistic about the future of layer 2:

first level title

Layer2 helps dApp usage increase

As scaling opportunities increase, Puff, a contributor to Iron Bank, a leading DeFi platform on Ethereum, opined:

“The merger will bring us one step closer to sharding chains. With the deployment of sharding, we expect Ethereum’s improved scalability and capacity to reduce costs and increase the accessibility of decentralized applications (dApps).”

The use of dApps will directly correlate with increased network participation. A decentralized blockchain network that is scalable and enables fast transactions allows each individual to control their own assets, identity and finances, independent of a centralized authority.

According to Thibault Perréard, head of strategy at Bifrost, "The real catalyst to unleash the future potential of Ethereum and truly realize the vision of DeFi is not PoS, but Layer 2."

PoS is considered more environmentally friendly, and interestingly, Eden Network co-founder Chris said that Ethereum’s proof-of-work (PoW) may not be over:

"Calculating the proofs needed for ZK Rollups is computationally intensive - what happens to all the mining rigs when the merger happens? Is it just the dust that settles, or will a miner develop a chance to repurpose their GPUs to secure these new networks?" market?"

Some PoW proponents believe that after the merger of Ethereum, Layer 2 will be useless, and Ethereum itself will most likely fail. However, zkSync's CMO Tyler Perkins is not convinced that the merge will affect layer2, and that "Layer2 will be positively impacted by sharding as it will increase the amount of data storage available for Rollups, thereby significantly improving their throughput."

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.