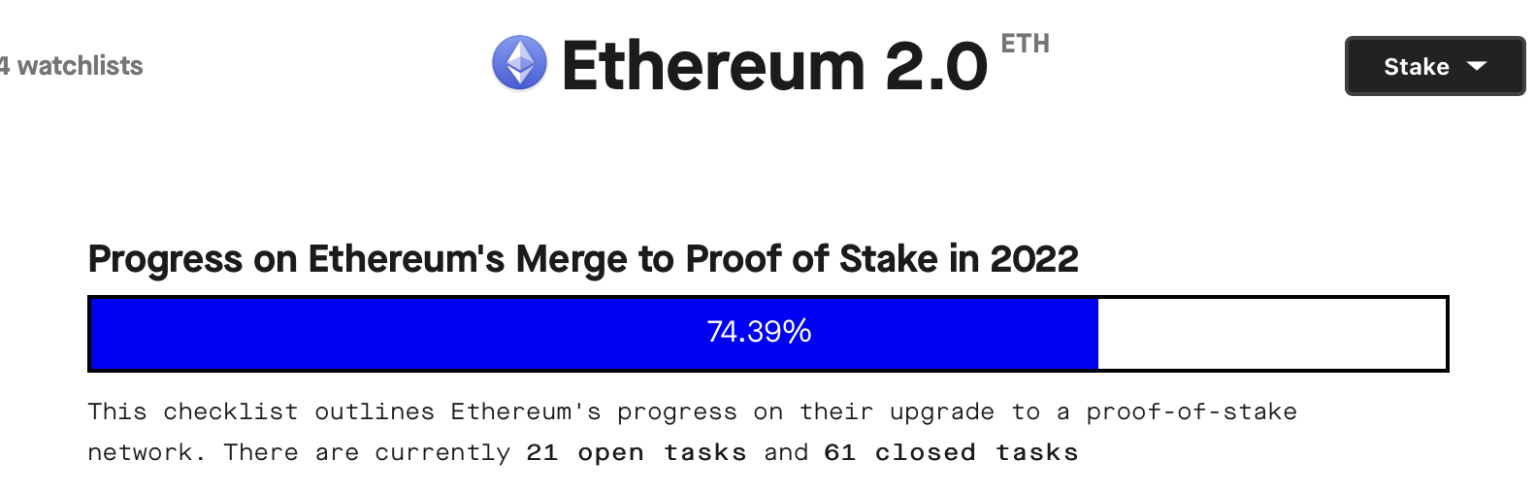

Ethereum is making great strides to embrace PoS. Although there are still many problems to be solved before the final integration of the Ethereum mainnet, it will be late. Miners may be the biggest "victims" of this ETH2.0 upgrade, where will they go?

image description

image description

However, while the switch from PoW to PoS is beneficial for the industry as a whole (especially for the environment), Ethereum no longer needs to consume energy to keep the network secure. But at the same time, it does mark the end of the second largest Crypto ecological mining industry that carries more than 70% of Dapp.

2. Pressure from miners

The integration of Ethereum may face pressure from two aspects of miners: sudden decrease in computing power & fork.

With the increasing certainty of integration, miners will choose to slowly withdraw from the Ethereum PoW consensus at the right time. At that time, the overall computing power of the Ethereum network may drop suddenly, and the remaining mines will have extremely high The right to generate blocks, extremely low crime costs and considerable profits will bring a devastating blow to nearly 3,000 applications on Ethereum. However, the current ETH2.0 client has already taken precautions against this - if the computing power of the entire network drops significantly, so that the security of the network is affected, the integration of Ethereum will be advanced.

The reason for the fork may be that the miners of ETH1.0 "hard resistance", that is, the block height before the difficulty bomb was opened, forked the chain - vowing to drain the last drop of PoW on Ethereum. It may lead to the coexistence of PoW and PoS consensus mechanisms in Ethereum for a period of time.

In the case of the above two situations, whether it is Dapp developers, users or centralized exchanges, they should play 12 points to avoid the loss of assets on the chain.

3. Where will the miners go after Pos?

However, the trend of the times, the integration of PoS and PoW will eventually come. If some miners withdraw from Ethereum mining before Merge, the computing power (hash rate) of the entire network will be reduced, and the remaining mines will be more profitable. In other words, as fewer and fewer people mine, it is easier for those who stay to get ETH.

So, at present, all Ethereum PoW miners have to face such a choice: those who have already paid back choose the opportunity to quit, those who have not paid back will persist until the end, and the fork of the first iron.

The existing mining machines of Ethereum are mainly divided into two types: graphics card mining machines and ASIC mining machines. A graphics card mining machine requires us to configure a PC to run the mining program. The performance of the graphics card determines the mining speed and computing power, and the motherboard and power supply largely determine the stability of the mining machine.

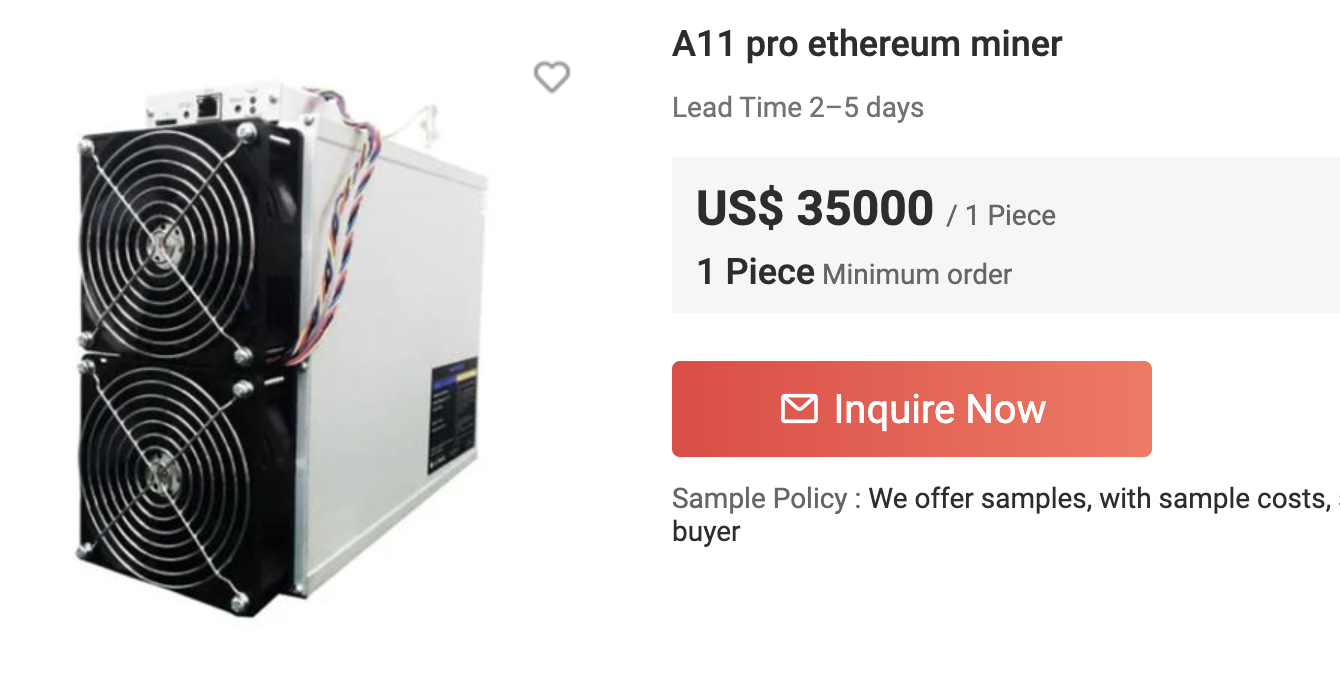

In contrast, ASIC mining machines (Application Specific Integrated Circuit) use integrated circuits (chips) as the core of computing power, and integrate specific encryption currency algorithms into the chip, thereby greatly improving computing efficiency.

Obviously, miners with graphics card mining machines will have more choices and take lower risks. They can choose to sell their existing mining machines to complete other computing-intensive tasks other than Crypto before Ethereum completely turns to PoS mechanism mining. In addition, graphics card mining machines can also mine other types of cryptocurrencies, such as Ethereum Classic, Ravencoin, Dogecoin, Litecoin, etc., but because these projects using the PoW consensus have a small market value, the profit is far less than mining in Ethereum. And the price fluctuates greatly. Therefore, these graphics card mining machines have not been withdrawn yet.

In addition, it should be noted that once the final integration plan and code are finalized, these large number of powerful GPU mining machines will migrate their computing power to other PoW networks, and the hash rate will increase suddenly, which will affect the original mining Ecological reshuffle.

Another type of miners who use high-end ASIC mining machines such as Innosilicon A11, especially for those who have entered the market soon, because the fixed cost has already been invested, and no one will take over the highly customized ASIC at a high price, they may have only one way: Run at full speed until the last block before Merge.

In addition, miners who operate ASIC mining machines are most likely not to follow PoS, but to fork out the second Ethereum Classic after the original ETH1.0.

image description

Average computing power of ETH network

The integration on June 8 was only the integration of the first testnet (Ropsten), not the official mainnet integration. Several major testnets will be merged in a few weeks, and if all goes well, we may see the official integration of the Ethereum mainnet in Q3.

Disclaimer: OKLink Academy is for informational reference only and does not constitute any investment advice.