Original source: Messari

Original source: Messari

first level title

Highlights of the report:

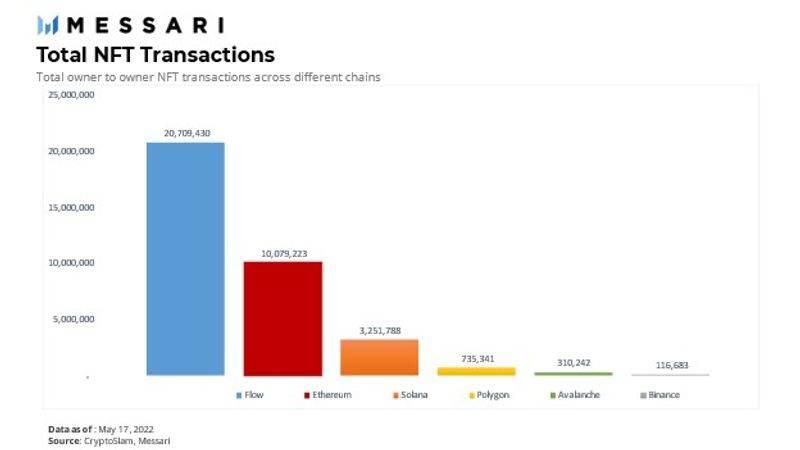

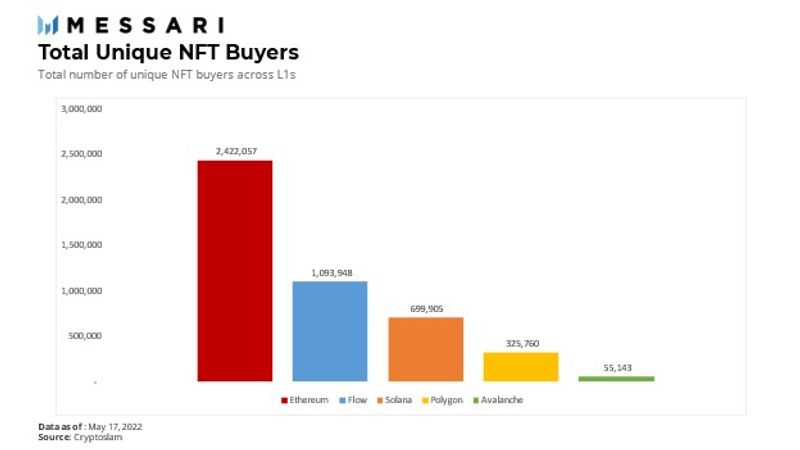

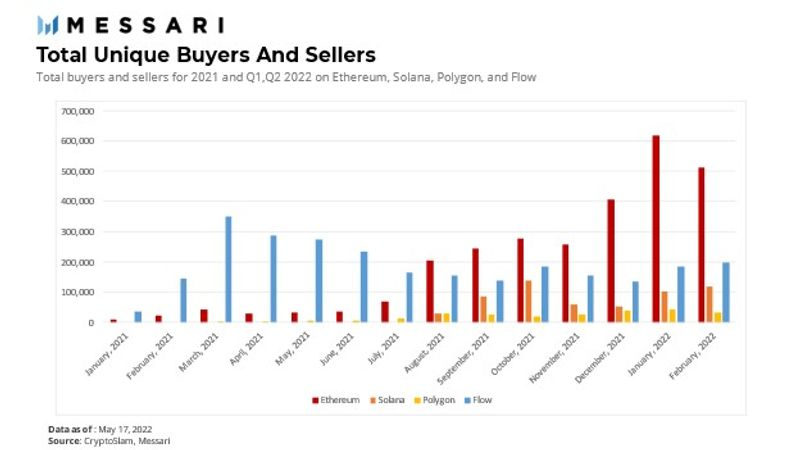

Flow currently takes the lead in C2C NFT transactions, surpassing Ethereum and Solana.AnnounceFlowRecently

An ecological fund of 725 million US dollars was established to further support the developers and users of the ecology.estimateIn Q2-Q3 of 2021, there will be a large inflow of funds in the NFT market,

The transaction amount increased by more than 8000%. Since then, individual investors, independent artists and consumer giants have turned their attention to the NFT market, ushering in the so-called "Renaissance 2.0". Platforms that provide NFT minting and trading services accelerate the pace of technological innovation and become a gateway for individual investors to participate in the crypto market and the Web3 world.

Flow is one of the most well-known platforms out there. Flow is a one-layer (L1) Proof of Stake (PoS) blockchain developed by dapper Labs, which aims to provide a platform for Dapper Labs, independent project parties, developers and artists to create decentralized applications and avoid complicated Ethereum Layer 2 (L2) network expansion solution. The Flow blockchain adopts a unique multi-role network architecture design, which is simpler and more efficient than the Ethereum L2 fragmentation scheme, and the network speed and throughput have been improved.

first level title

brief historyNBA Top ShotDuring this time, Dapper Labs developed a

- One of the earliest and most well-known sports NFT projects on the market. With the success of NBA Top Shot and the release of Flow Beta mainnet V0.1 in the second quarter of 2020, Flow has risen rapidly in the L1 protocol ecosystem. Since the launch of the beta mainnet, Flow has cooperated with world-renowned sports brands such as UFC and NBA, and has deployed over 800 smart contracts on the network, with more than 4 million independent accounts.

first level title

FlowBlockchain

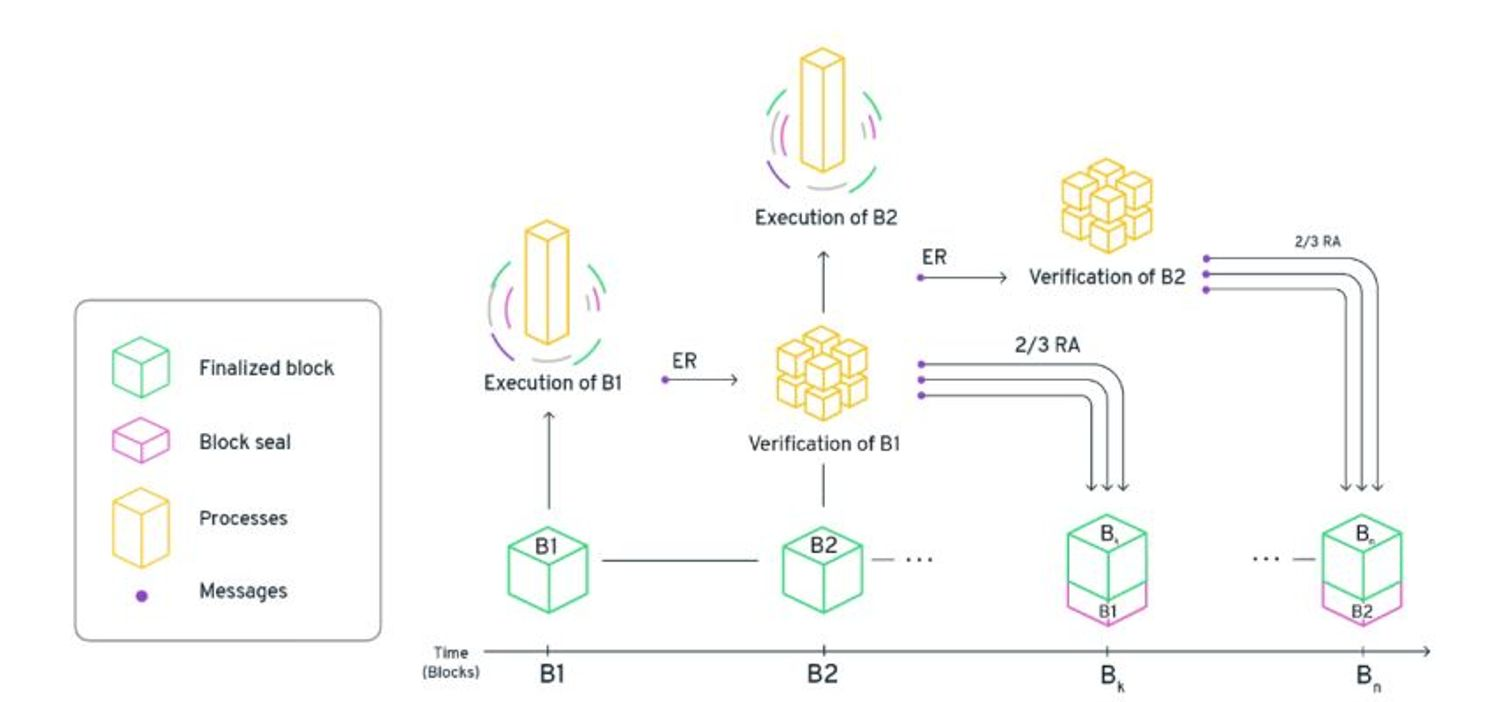

As mentioned earlier, the Flow blockchain network runs a multi-node architecture design. In order to avoid the complexity of Ethereum sharding, Flow's multi-node architecture can separate the tasks of verification nodes at different stages of the transaction, so that each type of node can focus on one task to improve the efficiency of each verification step and each transaction . In contrast, in the sharding design, the sharding nodes are responsible for different transactions, but no dedicated verification nodes are set up for each step of a single transaction.

This design encourages nodes to focus on deterministic tasks or non-deterministic tasks. The idea is that the main link that causes network congestion is deterministic tasks, that is, "objective" tasks, such as calculating the results of sequential transactions. Each node is continuously optimized in terms of existing capabilities, thereby improving the throughput of the overall blockchain, and then solving the problems of users and developers in the network.

Tasks on the Flow blockchain are executed by four different types of nodes, and each node needs to pledge a certain amount of funds to perform specified tasks:

Consensus node: Determine whether each transaction exists and its sequence.

Execution Node: Executes calculations related to each transaction.

In order to ensure the security of the network, a large number of nodes on the Flow chain are consensus and verification nodes that perform non-deterministic tasks, thereby providing network security guarantees. Execution and collection nodes perform purely deterministic tasks and are therefore less vulnerable to attack. This also means that execution nodes must be run by specific specialized hardware devices.

source:image description

source:

Flow white paper

To become a validator on the Flow network, a certain amount of FLOW tokens must be staked as follows:

Consensus node: 500,000 FLOW

Verification nodes: 135,000 FLOW

Collecting nodes: 250,000 FLOW

secondary titleFlow chain dataDuring the initial phase of the project, Flow launched three

massive

Token distribution/participation plan to expand community member participation and network scalability:

1. Cloudburst Partners: Selected by initial FLOW token holders, run one or more types of nodes, and distribute rewards to builders on the Flow platform.

2. Floodplain Validators: Ecosystem participants interested in getting involved early and helping Flow expand its content and resources.3. Decentralized Reputation and Incentive Protocol (DRIP): Designed to distribute FLOW tokens to dApp end users on Flow to incentivize users to stake, delegate or actively participate in the ecosystem.During this period, Flow faced the potential risk of security and scalability breaches due to the majority of tokens being centralized with centralized entities. The transition to a decentralized network depends on when its token distribution plan incentivizes developers and users to participate in maintaining the security and scalability of the network. Since then, Flow has managed to decentralize the network through token distribution. As of now, community nodes have accounted for more than 68% of the network consensus nodes, Flow

also recently considered

is "controlled by the community".

The latest data shows that there are 305 nodes in the whole network:

Execution nodes: 7

Consensus nodes: 115

Validator nodes: 77

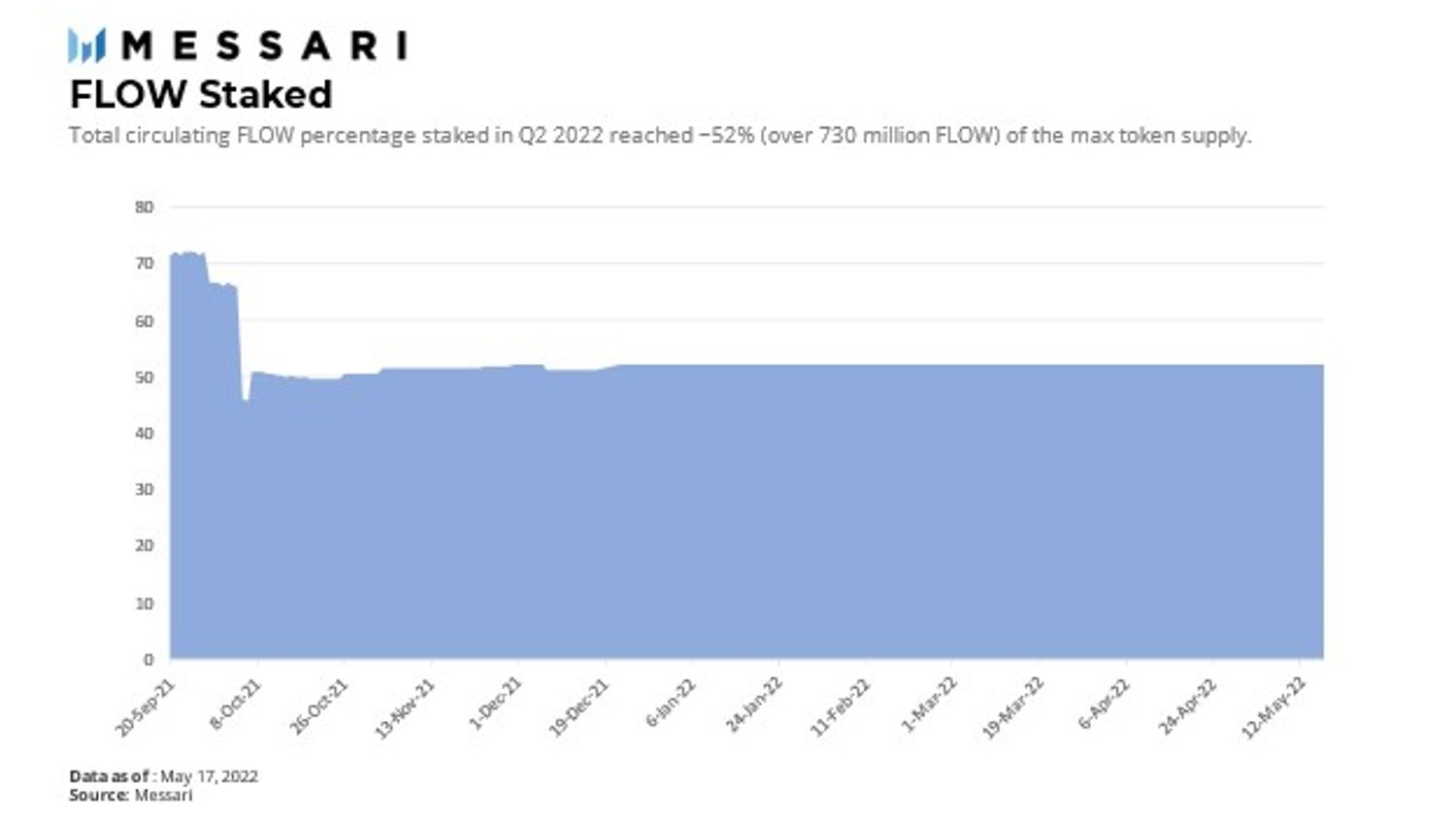

In addition, more than 31,000 users have contributed to the Flow network through delegation. Specifically, entrustment refers to the holders of FLOW tokens pledging FLOW by entrusting tokens to node operators. At present, the entire network has pledged more than 730 million FLOW (accounting for about 52% of the total supply), and the pledge reward exceeds 100 million FLOW (accounting for more than 7% of the total token supply).

Cadence

secondary title

SPoCK

Technical Features:Like most new L1 protocols, Flow has its own programming language, Cadence, for smart contract development. Cadence provides a higher level of decentralization when it comes to storing data such as digital assets. Unlike Solidity, which stores information on a central ledger, Cadence stores data directly in users' accounts. With no centralized data storage, Cadence can provide higher security for Flow's network architecture. It also provides an easier way for developers and users to create and transfer digital assets on the Flow chain.In addition, Flow integrates an innovative cryptographic technique called Professional Proof of Confidential Knowledge (SPoCK) to solve

Verifier's Dilemma

Flow Client Library (FCL)

Almost all L1 protocols allow interaction between crypto wallets (such as Metamask), decentralized applications (dApps), and blockchains. Traditionally, dApps have accessed crypto wallets through browser plugins or browser wallets. These methods, while adopted by many blockchains, hinder user entry. They are difficult to scale and require additional development for wallet and dApp interaction. In contrast, FCL allows developers to connect to wallets or dApps with just a few lines of code. It also allows any dApp to interact with any FCL compatible wallet and vice versa. For developers, this provides a seamless development experience for them to build dApps on Flow, and achieves consistency in the interaction between applications and various wallets.

FLOW token

The FLOW token is the foundation of the Flow blockchain, which allows developers and users to interact on the Flow chain. Holders can stake FLOW tokens, participate in maintaining network security, and contribute to the execution of computing and storage tasks across the network. FLOW tokens are also used to pay rewards to stakers and as gas/transaction fees for on-chain activity.

secondary title

FLOW distribution

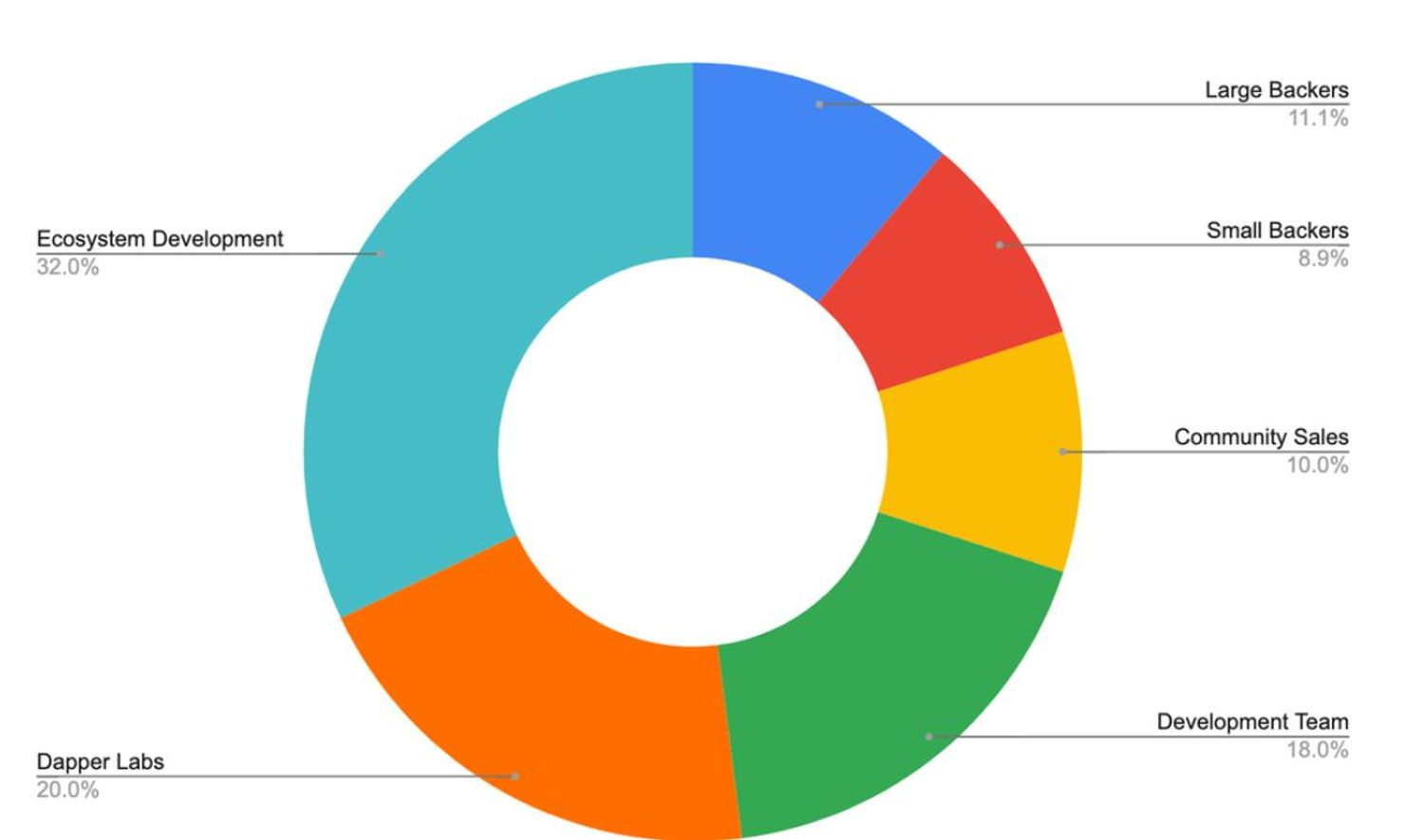

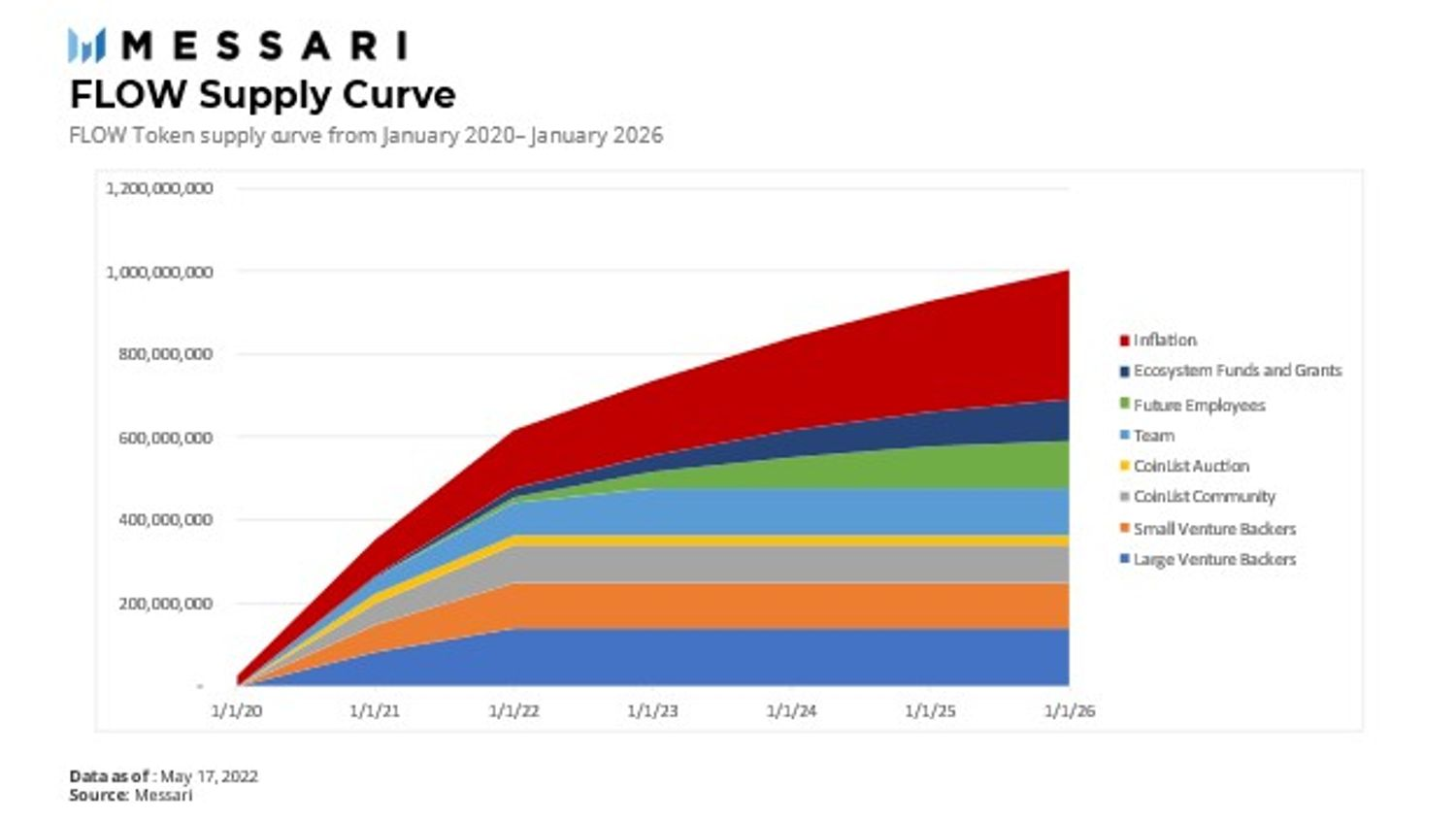

During the initial offering of the FLOW token, a total of 1.25 billion FLOW were minted and distributed to the following holders:

Dapper Labs: 20%, allocated to long-term treasury.

Development team: 18%, release in three years, one year cliff.

Ecosystem development: 29%, locked in the first year, and the unlocking time is not earlier than the first unlocking time of early supporters and teams.

Small supporters (contribution less than $1 million): 8.9%, 24-month lock-up period, one-year cliff.

source:image description

source:

Flow has not set up its own treasury; however, the Flow Foundation will participate in the management of 250 million FLOW tokens reserved in advance for long-term distribution and ecological development.

governance

secondary title

governanceOn-chain governance of FLOW stakeholders includes three types of decision-making processes:

1. Ecological decision-making:Includes issues related to electing board members and determining distribution of foundation funds.

2. Protocol parameters:Matters that involve network parameters and do not require protocol upgrades.

3. Protocol upgrade:All matters involved during the network hard fork will require significant participation and support from all FLOW stakeholders.most decisions

All are made off-chain, including submitting the proposal to the Flow GitHub repository, discussing the proposal in the community, and making a decision based on the community consensus, whether to implement the changes involved in the proposal. After the community has reached a consensus, changes need to be implemented through authorization for deployment to relevant nodes.

first level title

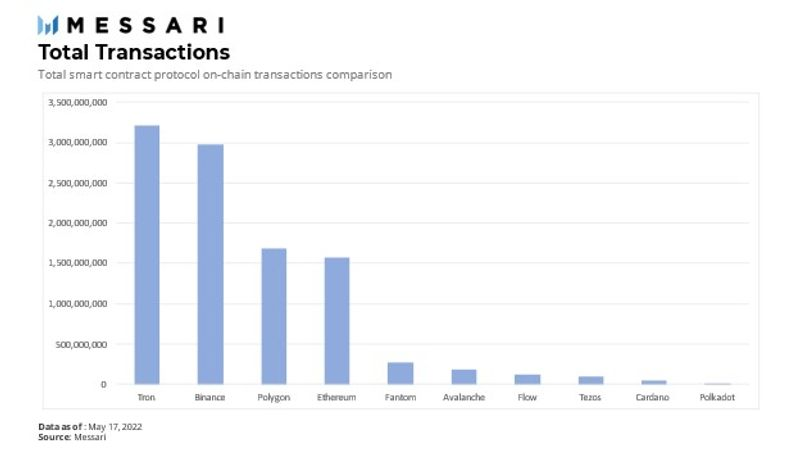

Considering Flow’s mainnet launch has been relatively short compared to other blockchains, the volume of on-chain transactions is impressive.supplyFlow currently has over 3 million active users in terms of total transaction volume and active wallets, including delegators and validators. Due to the short time the protocol has been online, Flow still has a long way to go to catch up with the "ancient" L1 ecology such as Ethereum. However, Flow has made significant strides in accelerating user activity, opening up new developers looking to build and deploy on the web.

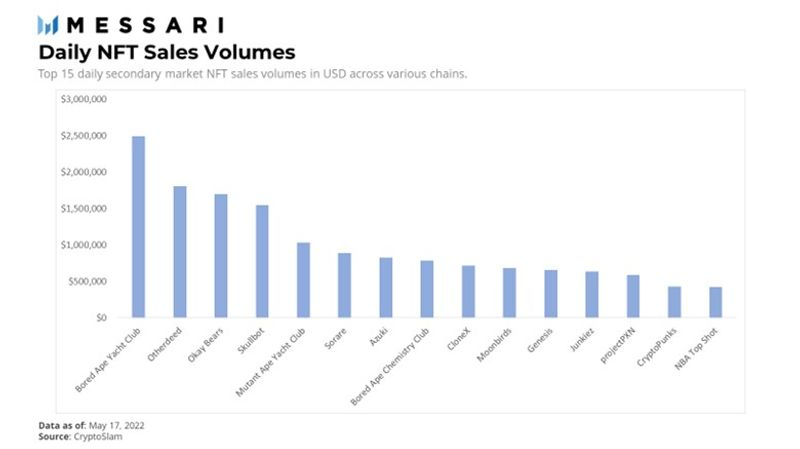

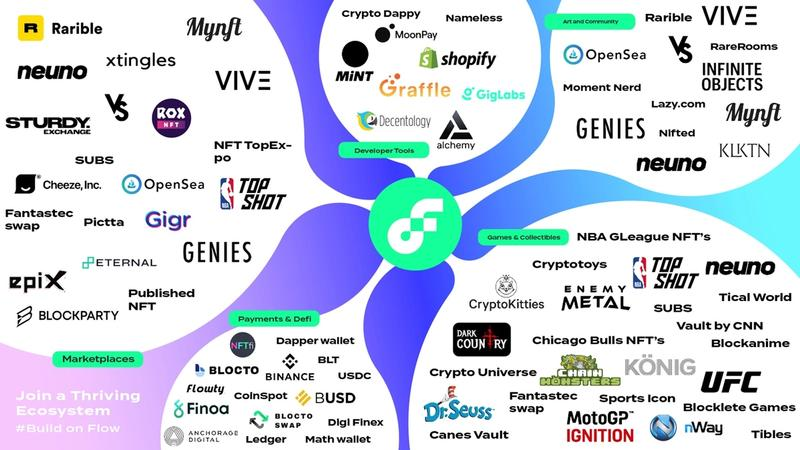

Sufficient support to attract dApps in various tracks, such as DeFi and Web3 projects. As more and more projects are built on Flow, the gap between it and other chains in terms of network traffic and ecological participation is also shrinking.participateAs mentioned earlier, there are currently more than 800 smart contracts deployed on Flow, and it is especially known for attracting NFT projects. The volume of NFT secondary market transactions on the Flow chain is in stark contrast to other L1 chains (and the L2 chain on Ethereum). Flow seems to be the best in C2C transactions of NFT. In addition, as users of native projects continue toparticipate, and a large number of new items

, Flow continues to make great strides in the NFT field.

After the testnet, the number of new developers entering Flow has increased significantly. Cooperation with well-known brands such as Samsung, Ubisoft, and Warner Music Group gives Flow a unique advantage, allowing it to continue to attract mainstream users, not only entering the NFT market, but also further exploring richer encryption projects. On the other hand, the mainstreaming of Flow-based DeFi and Web3 projects can also increase the awareness and participation of users and large institutions in Flow.

L1 Chain Competition and Risks

compete

secondary title

compete

The development of the L1 chain has always been at the forefront of the encryption field, the evolution rate is constantly accelerating, and multiple technologies are proposed to improve the throughput, security and speed of the blockchain.obviously increase。

source:Electric Capital

source:

The above data is compiled from open source repositories and code submissions from multiple platforms, including GitHub, Gitlab, CoinGecko, and DappRadar. In 2021, among public chains with more than 50 developers, Flow's growth rate will rank ninth, and if only full-time developers are considered, Flow's ecological growth rate will rank fifth.

secondary title

potential risks

Flow's multi-node architecture helps with this balance. The division of labor of nodes allows each type of node to give priority to certain aspects of scalability, security and decentralization. As it stands, consensus, validation, and collection nodes are more decentralized than execution nodes. Because execution nodes are responsible for performing deterministic tasks, they do not require the same degree of decentralization. On the other hand, execution nodes require specialized hardware devices to run, so they are more conducive to scalability.experienceDue to the complexity of executing nodes, network performance and availability issues may arise. While the failure of these nodes does not threaten network security, failure of all eight execution nodes could halt transaction processing. For example, in a recent network upgrade, due to the introduction of new execution identifiers for execution nodes, Flow

experienceThere was a network outage. Specifically, the execution nodes are responsible for deterministic tasks, but the newly implemented identifiers are non-deterministic, which leads to block generation failures, and nodes require additional memory to maintain network operation. The design of the Flow blockchain is to give priority to ensuring safety when there is a conflict between liveness and safety, so the network was suspended at that time to avoid packing wrong blocks., and clearly states what happens during periods of network instability. The team is also taking steps to avoid similar incidents in the future.

future direction

future direction

Flow has yet to provide a clear roadmap. However, according to the core vision of Dapper Labs, the Flow chain can carry large-scale, high-detail encrypted games. Dapper Labs is currently bringing in other projects and mainstream consumer brands to gradually realize this vision, and also plans to migrate existing projects such as CryptoKitties to the Flow chain.

image descriptionIncrementFiSource: Dapper Labs

- A decentralized market and liquidity engine designed to build the first batch of DeFi protocols on the Flow chain.AnnounceThanks to the influx of mainstream partners, high-quality on-chain projects, and the performance of the blockchain itself, Flow has established an important position in the encryption industry. According to Dapper Labs' project team data, the Flow testnet has more than 6,000 developers actively building and learning how to deploy smart contracts using Cadence. NFTs and crypto games have seen widespread adoption among mainstream investors, and Flow continues to empower artists and developers to innovate in the space. Flow recently also

Announce