secondary title

What are leveraged tokens?

Leveraged Token (Leveraged Token) refers to a fund product that uses contracts and other financial derivatives to track and "copy" the price performance of related underlying assets and amplify it by a certain multiple (such as 1.5 times, 2 times, 3 times). In other words, leveraged tokens track and magnify the return performance of ordinary digital assets several times. When the return on the target asset changes by 1%, the change in the net value of the fund will reach the target multiple such as 1.5%, 2% or 3%. When the leverage ratio is 1x, leveraged tokens are actually equivalent to traditional digital assets.

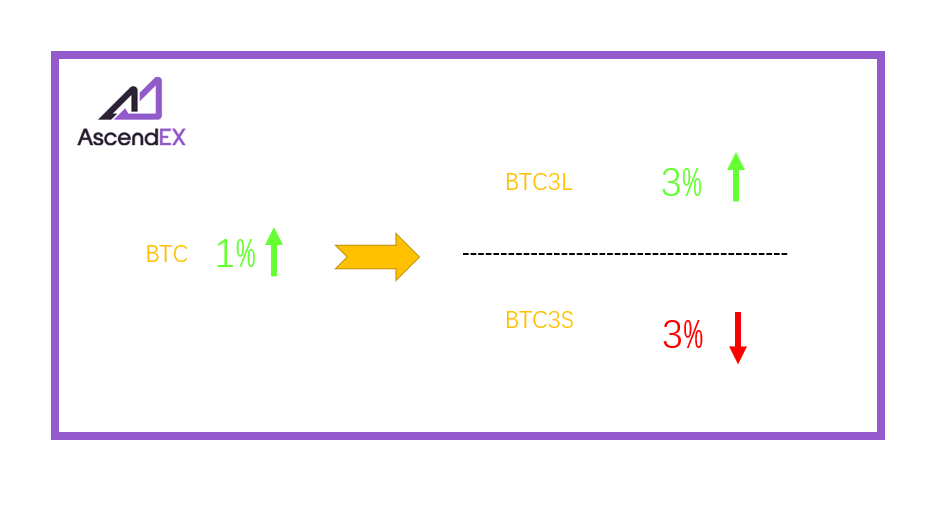

Leveraged tokens use a single digital currency as the underlying asset to track and amplify its spot price performance. For example, the leveraged tokens BTC3L and BTC3S mean that when the BTC spot price rises by 1%, BTC3L will rise by 3%, and BTC3S will fall by 3%.

In a nutshell, leveraged tokens generally have the following characteristics:

1. Leveraged tokens are perpetual products with no expiration date or liquidation date.

3. Leveraged token products are applicable to unilateral market conditions. Under such market conditions, leveraged tokens have their own compound interest effect, which can help investors expand their income.

secondary title

How do leveraged tokens work?

A leveraged token is essentially a fund.

Different varieties of digital currency leveraged tokens are essentially funds managed by professional financial teams. Behind each variety of leveraged tokens, there is a certain number of futures contract positions. Fund managers dynamically adjust futures positions through professional operations, so that the fund's net value can just maintain a fixed leverage multiple within a certain period of time (daily), achieving the effect of magnifying returns.

So, how is this effect or goal achieved? Here we have to mention the core mechanism to maintain the operation of the leveraged token system - the rebalancing mechanism.

rebalancing mechanism

The so-called rebalancing refers to adjusting the proportion of various assets in the investment portfolio. Corresponding to leveraged tokens, rebalancing means that the fund manager adjusts the corresponding digital currency perpetual contract positions behind each variety of leveraged tokens.

Generally speaking, the specific rebalancing method is that the fund management party will track and maintain the fund leverage ratio on a daily basis according to market fluctuations, that is, liquidate the fund assets at a fixed time every day, and rebalance according to the adjusted net asset value of the fund. Calculate the amount of leverage that needs to be established to ensure maximum tracking of the leverage target multiple.

For example, for the convenience of explanation, assuming that the current net value of BTC leveraged tokens is 100 USDT, for triple leveraged BTC leveraged tokens, the corresponding underlying asset BTC contract position is 3 BTC, that is, the contract position value is 300 USDT. Suppose an investor buys 1 BTC3L with 100 USDT. If the BTC price increases by 5% on that day, the net value of BTC3L will increase by 15%. At this time, the price of BTC is $105, the net value of BTC3L held by the investor is $115, and the corresponding contract value is $315. After this round of price changes, the actual leverage ratio of BTC3L has changed, and its current leverage ratio has become: 315/115=2.74, instead of the expected target triple leverage. At this time, the contract position corresponding to BTC3L needs to add another $30 to increase the position to $345 in order to maintain the target of 345/115=3 times leverage. Similarly, if the price of the underlying asset falls, the corresponding leveraged token also needs to be lightened to restore the leverage ratio to 3 times.

For example, for the convenience of explanation, assuming that the current net value of BTC leveraged tokens is 100 USDT, for triple leveraged BTC leveraged tokens, the corresponding underlying asset BTC contract position is 3 BTC, that is, the contract position value is 300 USDT. Suppose an investor buys 1 BTC3L with 100 USDT. If the BTC price increases by 5% on that day, the net value of BTC3L will increase by 15%. At this time, the price of BTC is $105, the net value of BTC3L held by the investor is $115, and the corresponding contract value is $315. After this round of price changes, the actual leverage ratio of BTC3L has changed, and its current leverage ratio has become: 315/115=2.74, instead of the expected target triple leverage. At this time, the contract position corresponding to BTC3L needs to add another $30 to increase the position to $345 in order to maintain the target of 345/115=3 times leverage. Similarly, if the price of the underlying asset falls, the corresponding leveraged token also needs to be lightened to restore the leverage ratio to 3 times.

In the current encryption market, the rebalancing mechanism of leveraged token products on mainstream platforms generally includes daily fixed rebalancing and temporary rebalancing. Daily fixed rebalancing, as the name suggests, refers to rebalancing operations at a fixed time every day; temporary rebalancing is mainly a rebalancing measure taken when encountering sudden risks.

secondary title

How to participate in leveraged token trading?

Leveraged tokens track the performance of digital currency spot tables, and their trading mechanism is similar to the digital currency spot trading mechanism. Common general trading rules are as follows:

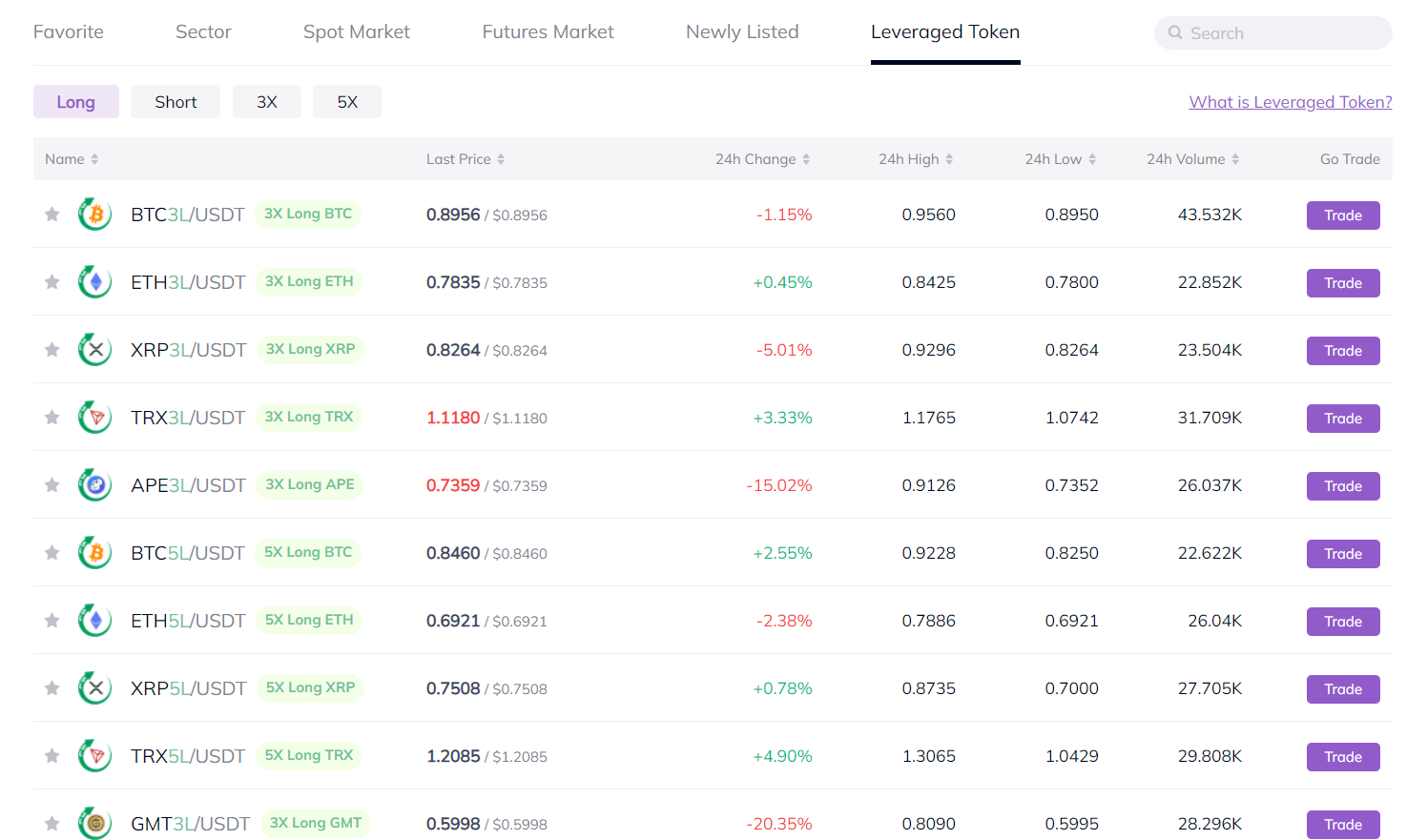

2. The common naming rules for leveraged token products are: underlying asset + leverage multiple + long-short direction. Taking BTC3L as an example, BTC means the underlying asset, or the underlying currency; 3 means 3 times leverage; L means Long, means long.

image description

(The picture comes from AscendEX)

3. At present, leveraged tokens on mainstream platforms generally support a leverage multiple of 3 or 5 times. For example, AscendEX leveraged token products support conventional leverage multiples of 3 and 5 times, and a few currencies only support 3 times leverage.

For ease of understanding, here we will take BTC leveraged tokens as an example to explain the trading process of leveraged tokens. For example, with BTC as the underlying asset, investors can choose to trade positive leverage token products BTC3L and BTC5L, or reverse leverage token products BTC3S and BTC5S. Among them, if you choose to buy BTC3S or BTC5S, it means you are shorting. If the market outlook of BTC falls as expected, the net value of BTC3S and BTC5S will rise; on the contrary, if the market outlook of BTC rises contrary to expectations, the net value of BTC3S and BTC5S will show a decline.

secondary title

Any other noteworthy details about trading leveraged tokens?

(1) When trading leveraged tokens, what is bought and sold is fund shares, not digital currency spot.

Although the trading mechanism of leveraged tokens is similar to spot trading, leveraged tokens still belong to funds in essence. When investors buy and sell leveraged tokens, the type of leveraged tokens traded is not the digital currency spot, but the fund shares of the corresponding type of leveraged tokens. Similarly, the transaction price when buying and selling leveraged token products is not the spot price of digital currency, but the net fund value of the corresponding leveraged token.

For example, take the summit leveraged token product BTC3L as an example. For ease of understanding, suppose you purchased 300 BTC3L at a price of 1 USDT, that is, you currently hold 300 USDT of BTC3L. So in this example, the 300 USDT of BTC3L you currently hold is not the BTC spot worth 300 USDT, but the fund share of the BTC3L leveraged token; 1 USDT is not the BTC spot price, but the BTC3L leveraged token net value of the fund.

(2) Correctly understand the splitting and merging of leveraged token net value

The so-called net value of leveraged tokens (net value of funds) reflects the fair value of each unit of fund assets currently held by users in the secondary market, and is also the price at which users buy and sell leveraged tokens.

In order to reduce the user's transaction entry threshold, increase the sensitivity of the net value price changes of leveraged token products, and optimize the trading experience, etc., the routine operation of mainstream platforms is to split and merge the net value from time to time. It should be noted that the splitting and merging of net worth only affects the display of net worth price and the number of leveraged tokens, and does not affect the total value of leveraged token assets held by investors.

For example, suppose you bought 100 shares of BTC3L at a net price of 1 USDT. When the BTC price increases and the net value becomes 10 USDT, the total asset value of BTC3L you hold at this time is 10*100=1000 USDT. Due to the high net value, the platform splits the BTC3L net value, reducing the net value to 2 USDT, which corresponds to 500 BTC3L shares you hold. At this time, although the net value of BTC3L has decreased, the total asset value of BTC3L you hold is still 2*500=1000 USDT.

(3) Leveraged tokens are more suitable for unilateral market

It is precisely because of this mechanism that in a unilateral market, the daily rebalancing operation will produce a compound interest effect, while in a box-like market, the price of the underlying asset will fluctuate and return to the original point, but the leveraged token holder If the net value of the account decreases, the so-called loss of funds occurs. Therefore, leveraged tokens are more suitable for unilateral market, that is, they should only be used as short-term hedging tools rather than long-term holding targets.

secondary title

What are the advantages of leveraged tokens?

1. No deposit, high capital utilization rate.

Compared with general digital currency leverage and contract transactions, when participating in leveraged token transactions, the user's capital utilization rate is higher. This is mainly due to the fact that when participating in leveraged token trading, there is no need to pay a margin, just like buying and selling spot goods. Without margin, some positions are occupied, and the utilization rate of funds is significantly higher.

2. The trading operation is simple, with leverage to magnify the income.

The leveraged token trading mechanism is similar to the spot trading mechanism. Select the target long-short leveraged token variety, and then you can buy and sell operations. No other steps are required, and the transaction operation process is simple.

At the same time, although the trading mechanism of leveraged tokens is similar to spot trading, compared with spot trading, leveraged tokens have their own leverage. And this effect of amplifying capital leverage to double the income can be realized without borrowing currency and without deposit, which has more advantages than digital currency leverage and contract transactions.

3. Compound interest benefits.

The leveraged token rebalancing mechanism enables it to have compound interest benefits under unilateral market conditions (unilateral rise or unilateral decline). This is because according to this mechanism, after the daily fixed rebalancing, the profit part of the position will be automatically added to the total position. In view of this, in a unilateral market, users can obtain greater benefits through the compound interest effect, that is, the so-called leveraged tokens are naturally suitable for trending market conditions.

4. No liquidation, risk controllable.

Since the transaction can be opened without paying a margin, theoretically, leveraged tokens have no risk of liquidation. At the same time, leverage tokens through the rebalancing mechanism can effectively control risks. For example, taking the leveraged token BTC3L as an example, the leveraged token can be reset to zero only if the underlying contract corresponding to the underlying asset BTC changes by 33%. But in fact, when the change of the BTC contract exceeds a certain threshold (such as 10%), the rebalancing mechanism has already played a role to automatically adjust the position, reduce the contract risk in advance, and restore the leverage multiple to 3 times leverage.