Original source:Messari

Compilation of the original text: The Way of DeFi

Main points of this article:

Original source:

Compilation of the original text: The Way of DeFi

Main points of this article:

The Optimism Airdrop and Ecosystem Incentive Program will usher in a new era of Ethereum scaling solutions.

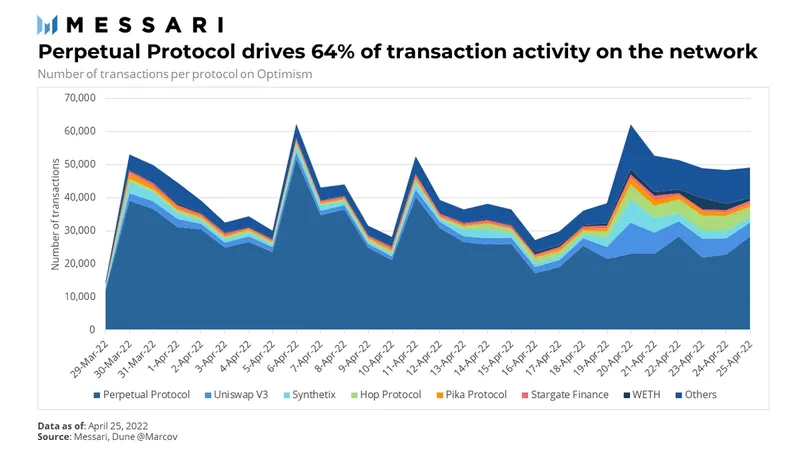

Perpetual Protocol, Uniswap, and Synthetix are the largest applications on Optimism, dominating trading activity and TVL.

The Optimism Network generates revenue through its rankers. OP token holders share governance with Citizen House, but maintain sufficient control over the network to generate value.

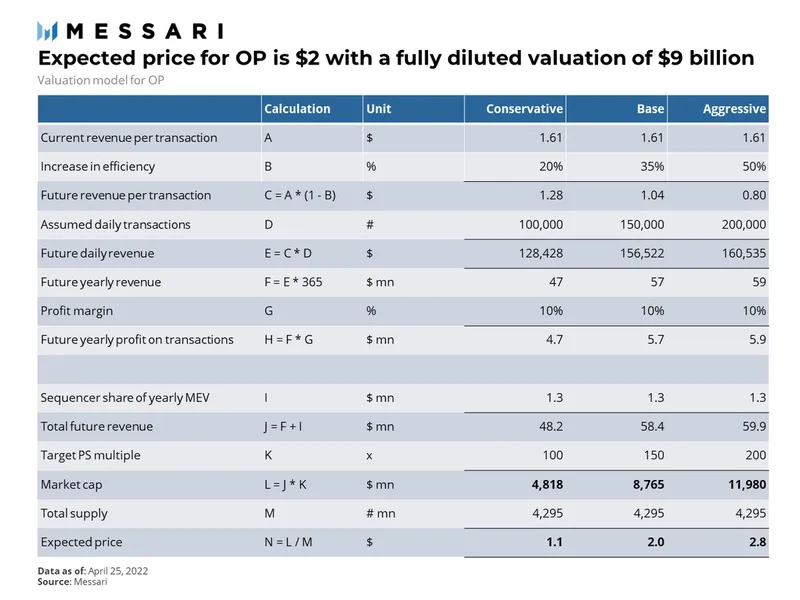

Based on our valuation model, Optimism should be a top 20 crypto asset at listing with a market cap of approximately $9 billion.

The Optimism airdrop plan has been officially announced, marking the start of the L2 war.

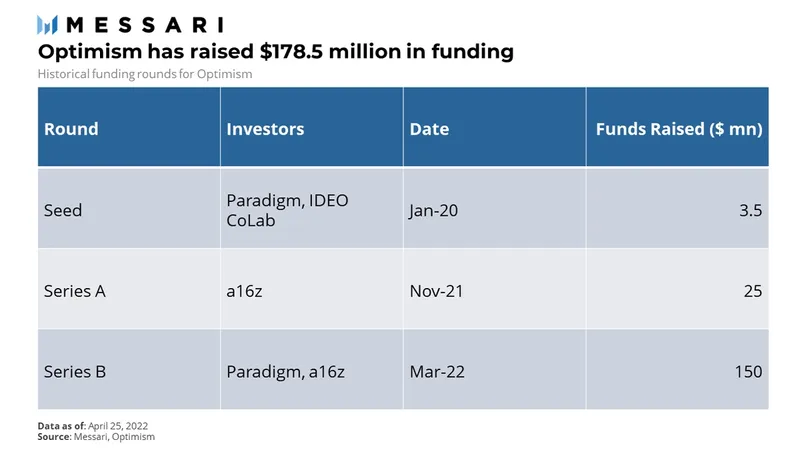

Last week, Optimism announced a retrospective token airdrop for active users and community members. The project has generated a lot of interest from the community as it promises to bring much-needed scalability to the Ethereum ecosystem. Currently, it is the second largest rollup expansion for TVL, and probably the largest rollup by market capitalization at the time of token launch.

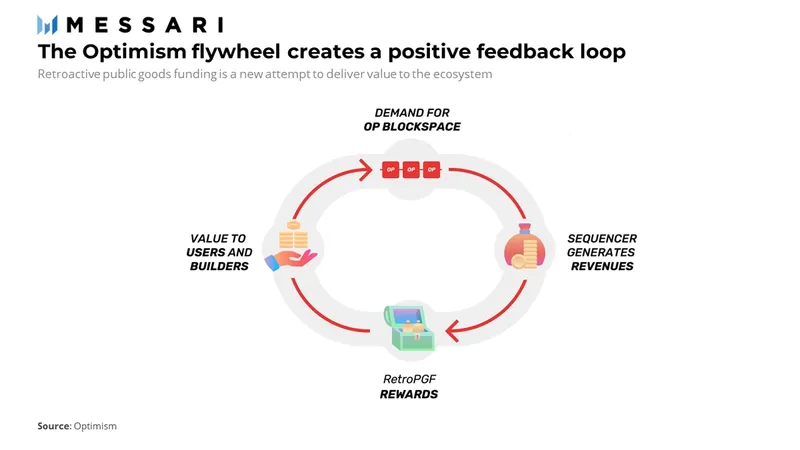

Optimism's vision is to create a positive growth flywheel that delivers value to all participants within the ecosystem. The Sequencer is responsible for adding and ordering transactions to Optimism. It generates revenue by selling block space. Currently, that revenue goes to the Optimism Foundation, a nonprofit that donates all surplus to public goods on the web. As more developers and users get incentivized through this funding, activity on the network should increase, increasing demand for block space and making the flywheel spin faster.

Optimism network

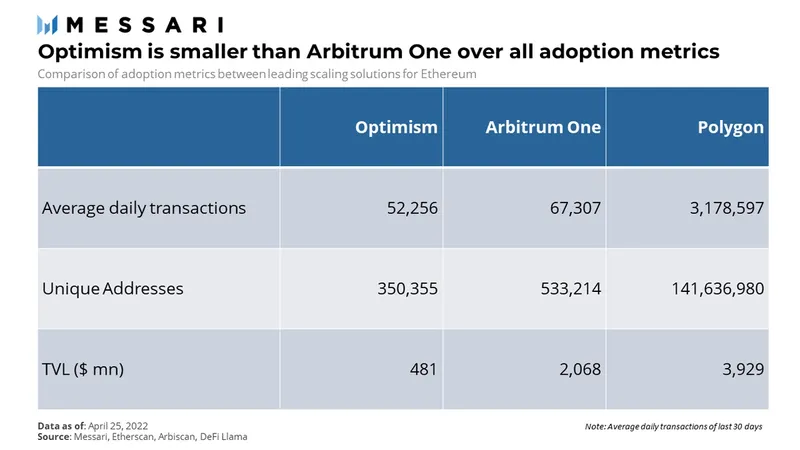

The Optimism mainnet launched in January 2021 and has seen moderate success in terms of adoption. It is second only to Arbitrum One, the leading Optimistic Rollup solution, in most metrics. Still, the two Rollups pale in comparison to Polygon’s proof-of-stake (PoS) chain, a sidechain scaling solution for Ethereum, in terms of adoption metrics.

text

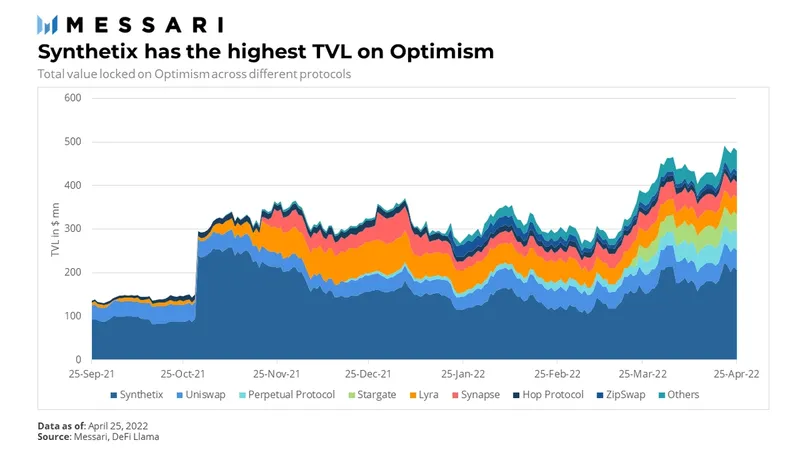

Synthetix is the dominant protocol on Optimism in terms of TVL, with around $200 million locked in funding, representing a 43% share. Uniswap ranks second with a TVL of $45 million. Perpetual Protocol came in third with a TVL of $41 million, up 33% over the past 30 days.

secondary title

EVM equivalence

Optimism goes beyond simple EVM compatibility to EVM equivalence. On EVM-compatible chains, developers will still need to modify their Web3 applications to use a different architecture. Additionally, tools built for Ethereum over time may not necessarily work for other EVM-compatible chains. EVM equivalence on Optimism solves this problem by performing almost identically on the Ethereum mainnet, allowing one-click porting of applications and all tooling to work. This approach will help Optimism grow its developer community faster and with fewer bugs than other scaling solutions.

secondary title

ecosystem incentives

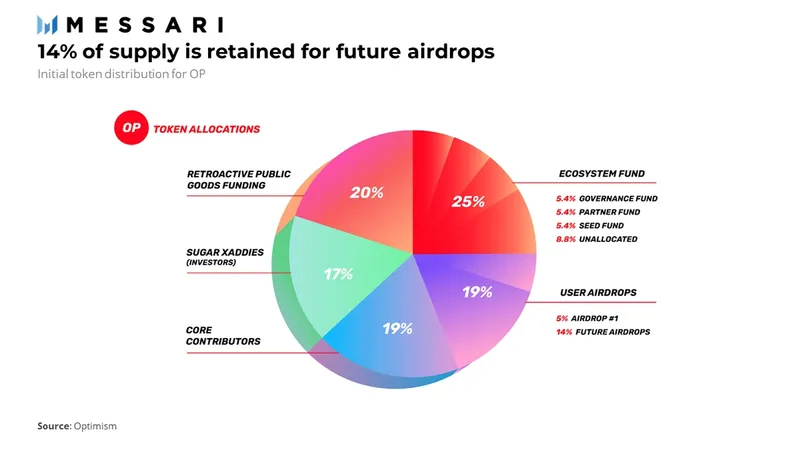

Optimism is very cautious about its airdrop plans; only 5% of the 14% airdrops promised have been confirmed. With more airdrops promised in the future, users are incentivized to be active on the platform.

The Retroactive Public Goods Fund (RPGF) also provides long-term incentives for developers to contribute to Optimism. Optimism also recently announced a “Stimipack” that dedicates 5.4% of the token supply to developer incentives.

Ecosystem incentives create another flywheel. The larger the market cap of Optimism at launch, the more funds will be available for incentives, potentially resulting in more user and developer activity. However, as any part of the flywheel slows down, a negative feedback loop is also created.

Industry Attraction - Porter's Five Forces Model

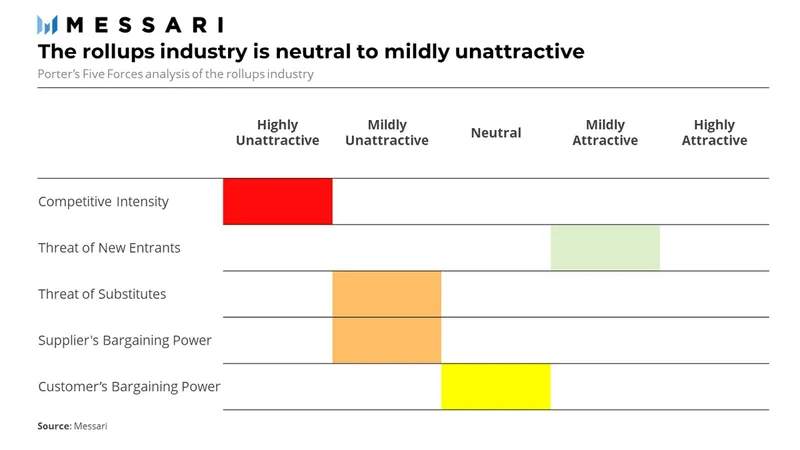

The Rollups industry is obscured by intense competition from other platform chains and scaling solutions.

Competition Intensity - Very High

The intensity of competition among Rollups is very high. Optimism not only competes with other Optimism Rollups such as Arbitrum, but also with other scaling solutions such as Polygon's PoS chains and ZK rollups such as Starknet. Vitalik Buterin expects ZK Rollups to outperform Optimistic Rollups in the medium to long term because they provide a better experience. ZK rollups have better security through proof of validity, and there is no long waiting period for withdrawals.

Threat of new entrants - low

New entrants will have to significantly improve current solutions in order to capture significant market share. It took years of development, and apart from Celestia, no such promising technology has emerged yet.

Threat of Alternative Choices - High

The threat of alternatives is high, and monolithic and interoperable blockchains a real threat. A monolithic architecture also has the advantage of a consistent overall experience compared to a modular architecture. Parachains on Polkadot, AppChains on Cosmos, and subnets on Avalanche are also working to increase adoption.

Bargaining Power of Suppliers - High

Application developers can be considered Rollup suppliers. The demand for developers is very high, giving them significant bargaining power. Developers must be incentivized by multi-million dollar ecosystem grants.

Bargaining Power of Customers - Neutral

A user can be considered a client here. The users are scattered and do not have much bargaining power. But in a highly competitive industry, new platform solutions buy user wallet share inorganically through airdrops and incentive programs.

income model

The Optimism Foundation runs a single centralized orderer responsible only for generating Layer 2 (L2) blocks and adding transactions to Ethereum’s Layer 1 (L1). The sequencer fee consists of two parts, the L2 execution fee and the L1 data fee.

The L1 data fee is the cost of publishing a batch of transactions to Ethereum. The sequencer adopts a cost-plus approach, charging users a price above the L1 cost. It currently charges 1.24 times the sum of gas required to submit a transaction and 2,100 gas. This generates a surplus that will be used to fund the growth of the ecosystem. It's worth noting that 99% of the fees charged by Optimism are L1 data charges.

OP Token

These user payments have brought Optimism $24.5 million in revenue so far.

Sequencers can also capture maximum extractable value (MEV) in the future. To recap, MEV refers to the value extracted by privileged actors (such as miners, validators, or orderers) by including, reordering, inserting, or ignoring transactions in the blocks they produce. Since there is only one sequencer on Optimism, only it can capture MEV. The Optimism team came up with a system for MEV auctions, under which they would sell other parties the ability to reorder or insert transactions in a block. Proceeds from the MEV auction will also flow back to fund Optimism's public goods.

OP Token

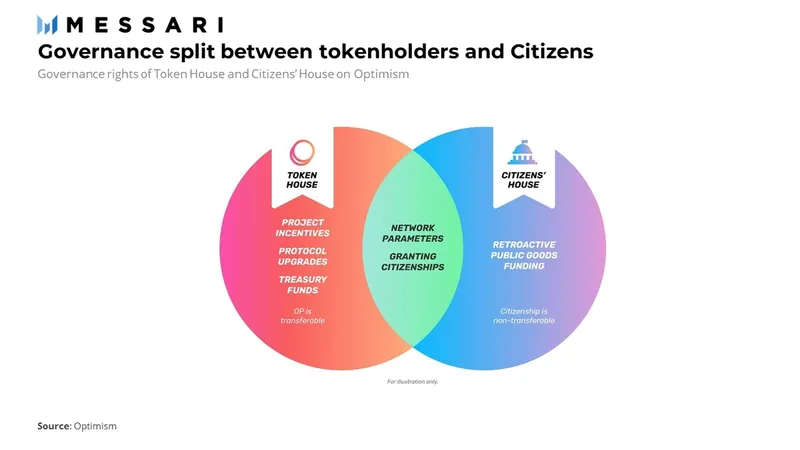

OP token is a new type of governance token. Token holders do not have sole governance rights over the protocol; they share it with designated citizens. This governance process and structure is based on its working charter and will evolve according to the needs of the protocol.

For our purposes, it is critical to understand whether the power held by token holders gives them effective control over revenue. According to the diagram above, token holders have control over all aspects of the protocol, with the exception of distributing income funds. However, the governance document says token holders will have input on how citizens are appointed. The working charter also gives token holders some control over the Optimism Foundation board, including the ability to remove directors and veto changes to foundation documents if they reduce their rights. While not absolute control, token holders do have enough control over the protocol that it is fair to assume that the sequencer's profits go to them.

The total supply of OP at launch is 4,294,967,296, with an annual inflation rate of 2%. In our model, we assume that all tokens held in the vault are distributed. While the document doesn't explicitly state this, annual inflation is likely to move in the direction of the RPGF and generate at least as much value for the protocol as its market price. Therefore, we can ignore inflation in the calculation.

valuation model

Optimism is a very young protocol in the still immature cryptoeconomy. It reinvests all flows into ecosystem participants and does not distribute cash flow to token holders. However, we assume that profits go to token holders under the assumption that control over protocol parameters will allow token holders to extract some value indefinitely in the future. Seeking a portion of traffic as rent is one way. Another example is "selling" their votes during governance decisions.

Revenue calculation and profit

As mentioned earlier, there are two types of income: explicit income and MEV.

Obvious income

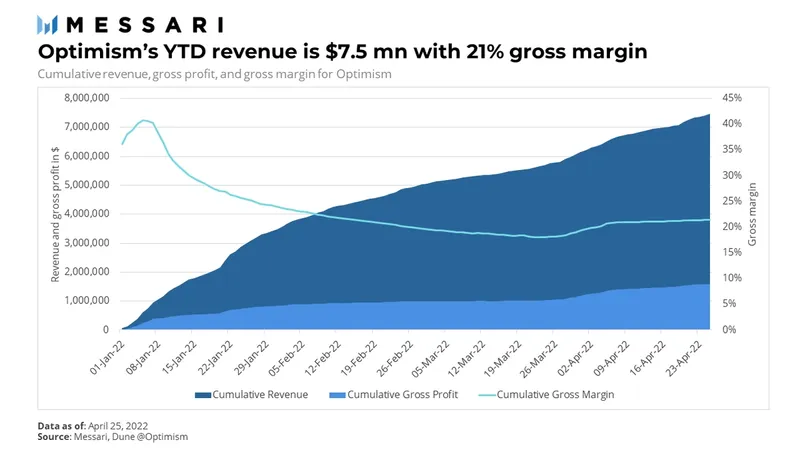

By analyzing transaction data, we found that Optimism has collected $7.5 million in total fees from users year-to-date. To post the transaction to L1, they paid $5.9 million in transaction fees, bringing their gross profit to $1.6 million, for a gross margin of 21%.

MEV

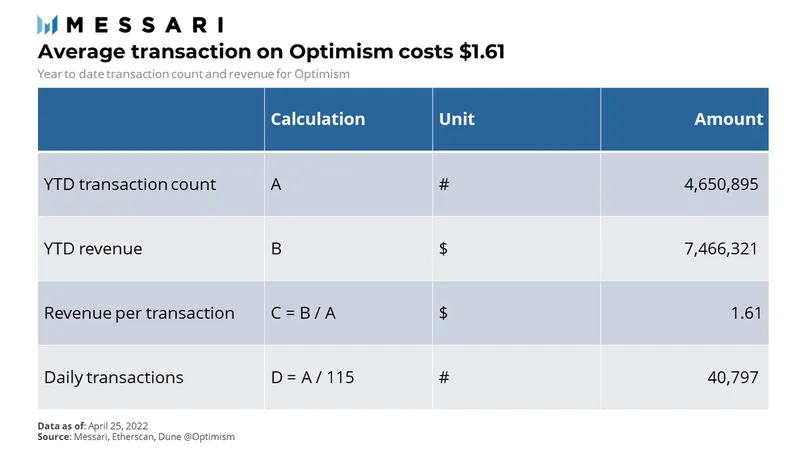

A key driver of revenue is Optimism's deal volume. Year-to-date, Optimism has averaged 40,000 transactions per day, but this number is likely to increase as adoption increases. One-click application deployment through EVM equivalence, ecosystem incentives, and post-airdrop excitement will drive growth in the short term. The ceiling for transaction growth is very high; Polygon's PoS chain averages over 3 million transactions per day. We assume a 150-400% increase in transaction activity on Optimism, with an average daily transaction volume of 100,000 to 200,000 transactions.

Year-to-date, Optimism's average revenue per transaction is $1.61. However, the growth of transactions reduces the L1 data fee per transaction, as it becomes more efficient to publish batches to L1. We assume a 20-50% reduction in revenue per transaction based on average daily transaction volume.

According to the Optimism Foundation post, the protocol has a target profit margin of 10%. We assume our calculations are the same.

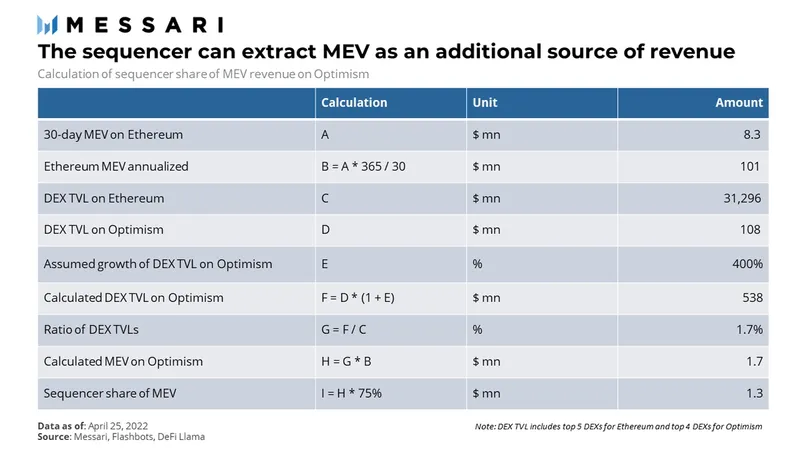

Currently, the sequencer does not collect MEV. We use the information available on Ethereum to predict future MEV. According to data from Flashbots, an MEV-focused research agency, the amount of MEV withdrawn on Ethereum over the past 30 days was approximately $8.3 million. It is worth noting that 99% of MEV in the history of Ethereum has been arbitraged through decentralized exchanges (DEX). Therefore, we hypothesize that MEV is positively correlated with the depth of DEX liquidity. We assume that the ratio of future MEV on Optimism to MEV on Ethereum will be the same as their DEX liquidity ratio. We assume 5x liquidity for Optimism as OP tokens go live and increase liquidity and trading activity.

However, none of these MEVs count towards the sequencer. Part of it is held by entities called Seekers who find MEVs. According to Flashbots, 60% of the MEV on Ethereum in the past 30 days was retained by searchers, while miners received 40%. The Optimism sorter should have a larger MEV split because it is monopolized. Even after decentralization, competitive public auctions should minimize the profits retained by searchers and sorters. We assume that the protocol acquires 75% of future MEV.

We should note that this calculation gives a lower bound on MEV. Flashbots only track a few types of transactions. It cannot track multi-transaction MEVs or MEVs with off-chain components.

final model

risk factors

centralized

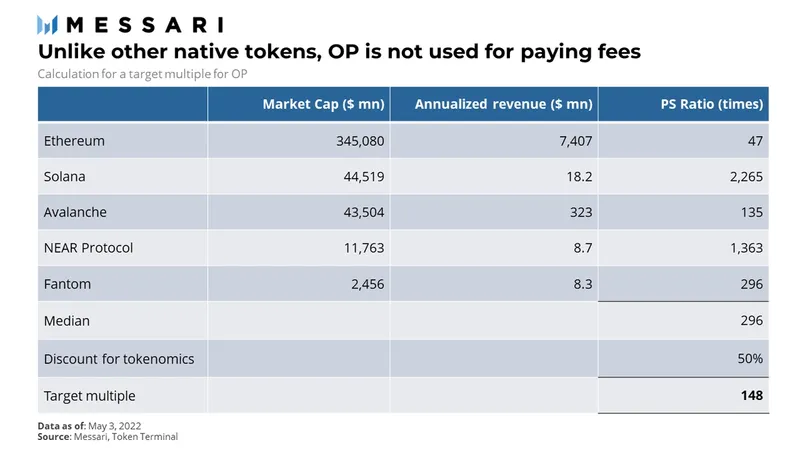

Valuing the OP token with a probability of 50% for "base case" and 25% for "conservative" and "aggressive", we get a target price of ~$2 and a target market cap of ~$9 billion. Such a valuation would place Optimism in the top 20 cryptoassets, ahead of Polygon.

risk factors

centralized

The Optimism Foundation is solely responsible for leading protocol development, running the sequencer, and selecting the first citizens. They have the power to act in the interests of OP token holders and further centralize power.

The model calculates the value of a token based on its current token economics. Tokens from other L2 projects such as Immutable X, Boba Network, and Metis have different use cases such as gas payments for fee shares and utility. If the OP token economics change in the future, it may affect how the token is valued.

Fierce competition

unproven technology

Optimism Rollup is cutting-edge technology that is still under active research and development. Core components of the technology, including fraud proofs, are not yet available for Optimism.

As mentioned earlier, competition at the platform layer is fierce. There are viable threats to current monoliths and interoperability chains. ZK Rollup, generally considered a superior solution, is also being developed and may surpass Optimistic Rollup. Competition from Arbitrum One could also heat up. Following Optimism's lead, it may launch its own token and incentive program. Competition can significantly affect revenue and profits.

final thoughts

protocol control