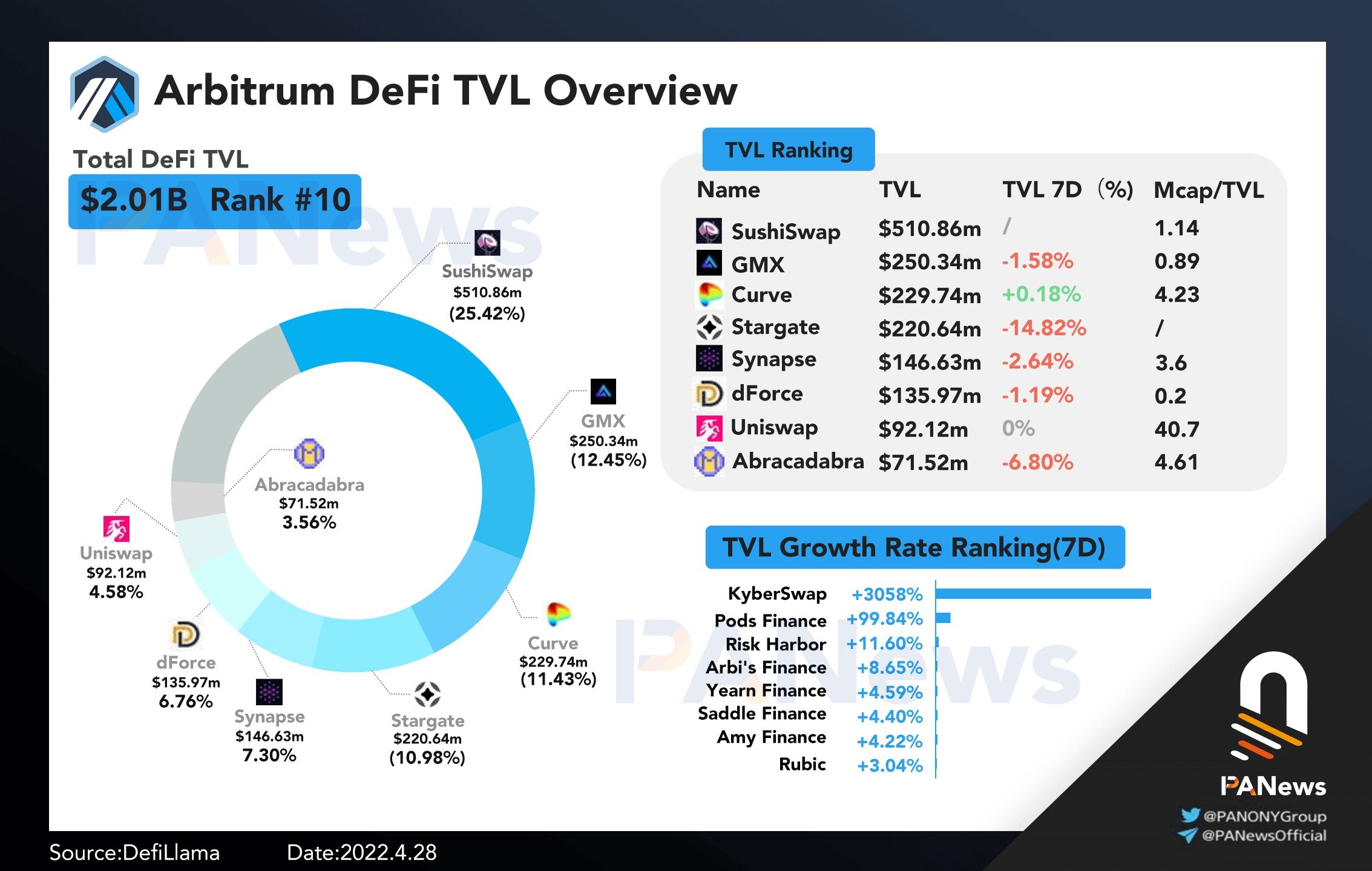

As a key part of the upgrade of Ethereum, the Layer 2 scaling solution has always attracted much attention. In the overall weak environment of the encryption market in recent months, the TVL of Layer 2 leader Arbitrum has grown against the trend. According to DefiLlama data, as of April 28, its TVL has increased by about 39.6% in the past three months. According to the information on the official website of Arbitrum, there are currently nearly 170 projects in the Arbitrum ecosystem, involving DeFi, NFT, cross-chain, oracles, wallets and other fields.

Arbitrum EcologyDeFiList of locked positions

privacyprivacysecondary title

DeFi

izumi Finance: Liquidity Optimization Protocol

izumi Finance is a liquidity optimization protocol based on Uniswap V3, which proposes "Programmable Liquidity as a Service" (ProgrammableLiquidexist

existUniswap V3secondary title

Project official website linkhttps://izumi.finance/home

YIN Finance: Liquidity Management Protocol

decentralizeddecentralizedLiquidity management agreement, its investment institutions include Fenbushi Capital, SevenX Ventures, Shima Capital, etc. Users can subscribe to "CHI" in the agreement, which is the active liquidity management strategy provided by YIN Finance, to achieve better fund management. Each CHI represents a different liquidity management strategy. After users subscribe to CHI, their assets will be converted into the liquidity described by the corresponding CHI.

SafetySafetysecondary title

Project official website linkhttps://yin.finance/

AAVE V3: Improving Capital Efficiency and Safety

The AAVE protocol V3 version was officially launched on March 17, aiming to enhance cross-chain functions while improving capital efficiency and security. Currently, it supports Polygon, Arbitrum,Avalanche, Fantom, Harmony, and Optimism, as of April 21, had a TVL of approximately $1.21 billion. In addition to Gas fee optimization, risk management improvement, etc., the new functions of AAVE V3 mainly include:

Assets flow across chains. AAVE V3 supports users' assets to move seamlessly between markets through different networks, and can transfer the liquidity provided by users from one network to another, which supports cross-chain lending. For example, users can deposit funds in Polygon, and then Borrow on Arbitrum and finally repay on Avalanche.

Efficient mode (eMode). In AAVE V3, different assets will be set as specific categories, usually referring to a group of assets linked to the same underlying asset, such as stablecoins linked to the US dollar (such as USDC, USDT), assets linked to ETH (such as ETH, stETH) etc. When lending the same type of assets as the user's collateral, the user can obtain higher borrowing power.

secondary title

Project official website linkhttps://aave.com/

Vovo Finance: Structured Product Agreement

contractcontractprotocol), the product has passed the audits of PeckShield and Hashloak, and is currently in alpha mode.

InsuranceInsurancesecondary title

Project official website linkhttps://vovo.finance/

protocolborrow moneyprotocol

Yield Protocol is a fixed-rate and fixed-term loan DeFi agreement to solve the problem of interest rate fluctuations in current lending agreements. It is incubated and invested by Paradigm, a well-known institution in the industry. Other investors include Framework Ventures, CMS, and DeFi Alliance. Currently supported tokens includeETHsecondary title

Yield Protocol introduces a fyToken certificate for the deposit function, and users can redeem the underlying assets one-to-one after the predetermined maturity date. fyTokens are similar to zero-coupon bonds in that they pay no interest, but instead trade at a discount and users can redeem them at full face value for a profit at maturity. For example, if you have a fyDai token, you can exchange it for a Dai after the expiration date.

Project official website linkhttps://yieldprotocol.com/

QiDao Protocol: Over-collateralized lending protocol

QiDao Protocol isPolygonEco-native over-collateralized lending agreement, the currently supported mortgage assets include MATIC, WETH, WBTC, LINK, AAVE, CRV, etc. The mortgage rate is 130~150%, depending on the mortgage assets. After users mortgage their assets, they can lend the stable currency MAI minted by the system. The current borrowing rate is 0. The agreement only charges a repayment fee of 0.5% of the total debt when the user repays the debt. The fee is denominated in mortgage tokens.

According to DeFi Llama data, as of April 28, the TVL of the QiDao protocol is about 340 million US dollars, and it currently supports Polygon, Fantom, Avalanche,Arbitrumsecondary title

Project official website linkhttps://www.mai.finance/

Superfluid: Fund Flow Protocol

Superfluid is a DeFi project that focuses on the field of capital flow. It supports simultaneous transfer of different funds in the same account, which improves the efficiency of funds for users and reduces the number of times users need to sign transactions and gas fees. Its investment institutions There are Multicoin Capital, DeFiance Capital, Delphi Digital, Semantic Ventures, etc.

Superfluid is a network composed of interlaced value streams of many assets, and these value streams can run synchronously. For example, Jack contributes from his dailyDAOsecondary title

Project official website linkhttps://www.superfluid.finance/home

DeFIL: Filecoin ecological lending platform

EthereumEthereumsecondary title

Project official website linkhttps://defil.org/

NFT

Solv Protocol: Financialization of NFT

Solv Protocol is a project that applies NFT to financial scenarios. It converts digital assets such as tokens into an NFT-style certificate with financial attributes, and supports quantitative operations such as splitting and merging to realize NFT certificates in the financial field. Widely used, its investment institutions include Binance Labs, IOSG Ventures, etc.

At present, Solv Protocol has launched Vesting Voucher (attribution certificate) and Convertible Voucher (convertible voucher). Vesting Voucher is mainly used in the field of token distribution management, especially in the management of tokens in the primary market. It is necessary to set the expiration date and the number of tokens And attribution type and other parameters, it is equivalent to the project party packaging the relevant content of token distribution and unlocking into an NFT, and investors can directly purchase and trade.

first level title

Project official website linkhttps://solv.finance/home?linktree

secondary title

Umbra: Create stealth addresses to support private payments

secondary titleOptimism。

Unlike Tornado Cash, Tornado Cash is an on-chain mixer using zero-knowledge proof technology. Since everyone's funds are concentrated in the mixer, the link between the deposit address and the withdrawal address can be broken, enabling The effect of protecting privacy. Umbra does not use zero-knowledge proof technology, nor does it break the link between the sending and receiving addresses, everyone can see who sent the funds, everyone can see the address the funds were sent to, but this receiving address was never Used on-chain, so it is impossible for any outside observer to know who is controlling it, suitable for private payments between two people or merchants.

Project official website linkhttps://app.umbra.cash/

Cross-chain

Stargate Finance: Solving the cross-chain trilemma

Stargate Finance is the first product launched by LayerZero, a full-chain interoperability protocol, which solves the trilemma of "instant finality", "unified liquidity" and "native assets" faced by cross-chains. As of April 28, its TVL is about 1.7 billion US dollars, before PANews inCross-chain bridge Stargate practical experiencesecondary title

Project official website linkhttps://stargate.finance/

Router Protocol: A cross-chain protocol that supports asset swaps

Router Protocol is a cross-chain protocol that supports asset swaps, which can directly transfer DAI on Arbitrum to USDC on Avalanche. In addition, Router Protocol will also support developers to build cross-chain Dapps on its protocol in the future. Currently, the Router protocol supports Ethereum, Arbitrum, Avalanche, Polygon,BSCsecondary title

Project official website linkhttps://www.routerprotocol.com/

wallet

BitKeep Wallet: Multi-chain encryption wallet

asset Managementasset ManagementProject official website link

Project official website linkhttps://bitkeep.com/

airdropairdropWill be worth our attention. In the future, PANews will continue to pay attention to the development of the entire Arbitrum ecosystem. Welcome to download the APP and follow the author to continue to pay attention.