Originally Posted by Ben Giove, Bankless Analyst

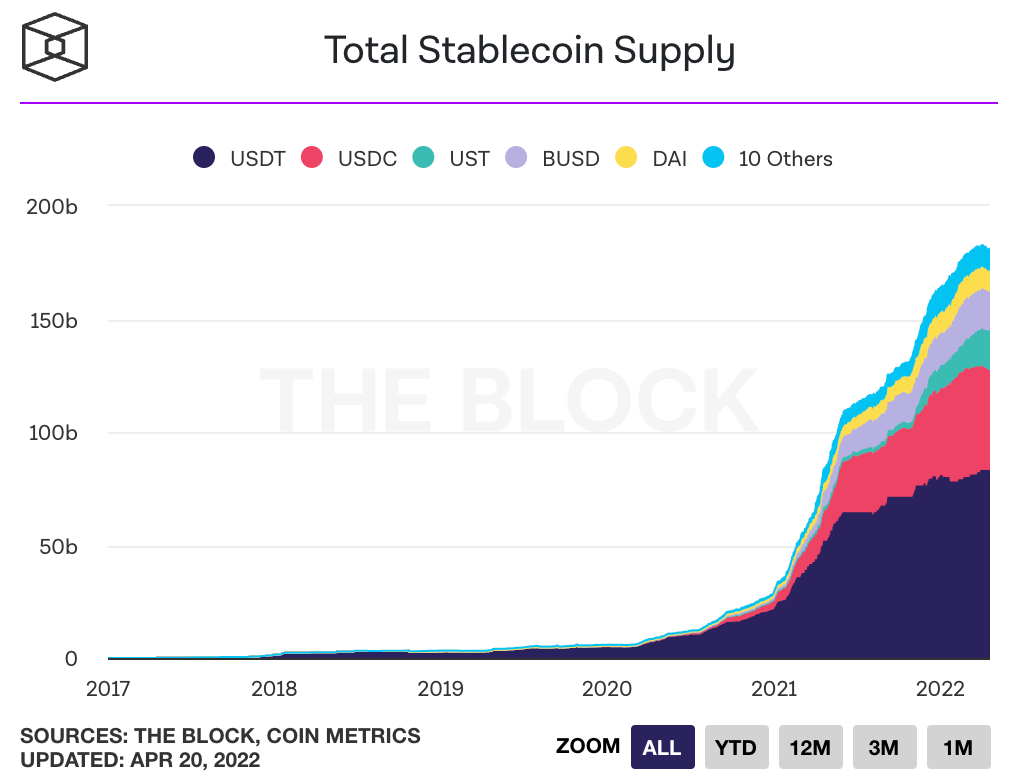

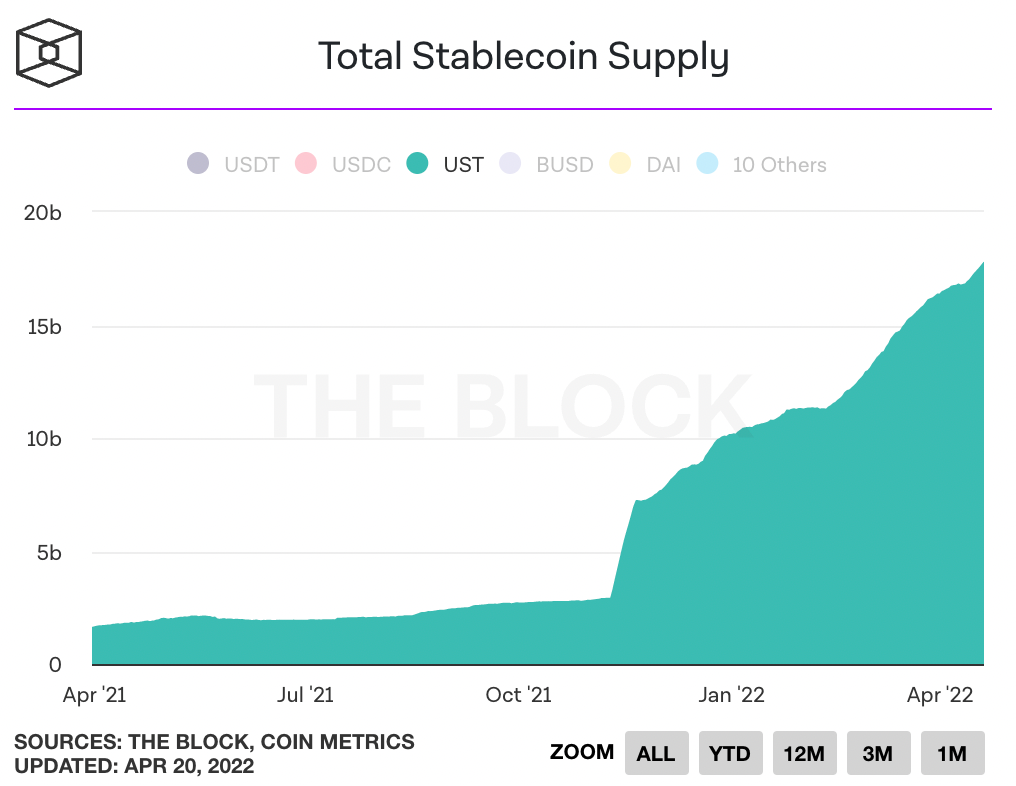

Stablecoins play a very valuable role in the Crypto space because they allow holders to keep "cash" in the ecosystem while leveraging the financial superpowers of blockchain and DeFi. Stablecoins are also one of the fastest growing verticals in the Crypto space,image description

Above: Supply growth of major stablecoins. Source: The Block

The most notable recent addition to the stablecoin space is Terra's UST,UST is the third largest stablecoin by market capitalization with a supply of over $17.7 billion.UST is driven by the Terra blockchain and its native asset LUNA. Since the beginning of 2021, LUNA has grown by more than 15,100%, with a market capitalization of approximately US$34 billion, ranking eighth among all encrypted assets.

This of course begs the question: how did Terra become so successful? How fast is UST growing compared to its competitors? What are the risks to the agreement?

The following will attempt to answer these questions.

01. How UST works

First, let's take a deep dive into UST so we can better understand how it works, how it achieves stability, and what role LUNA plays in it.

UST is an algorithmic stablecoin pegged to the US dollar.In order to mint UST, users must burn LUNAs of equal value (ie $1:$1); similarly, in order to redeem LUNA, users will have to burn USTs of equal value. this meansUST is not backed by external collateral assets, but relies on market incentives to maintain stability.

Let's see how this mechanism works with a simple example.

Suppose the price of UST is $1.01, which is above the anchor price of $1. This means that the demand for the UST stablecoin exceeds the supply. In this case, in order to lower the price of UST, arbitrageurs would be incentivized to burn $1 of LUNA to mint new UST, thus capturing the difference between the target anchor price of UST (i.e. $1) and the current price (i.e. $1.01) The difference of $0.01 between the gains.

A similar arbitrage opportunity exists when UST trades below its peg price of $1, meaning that supply of the UST stablecoin exceeds demand. If the price of UST is $0.99, arbitrageurs are incentivized to burn UST to mint $1 of LUNA and pocket the difference. This will reduce the supply of UST, thereby helping the price of UST increase to the anchor price of $1.

While this mechanism is relatively simple, it has so far proven to be very effective in expanding the supply of UST.

UST is very capital efficient as it does not require any collateral backing to mint new UST, compared to other stablecoin designs (such as over-collateralized stablecoins), this mechanism increases the convenience of UST in terms of supply growth. An over-collateralized stablecoin like DAI whose supply growth depends on the growth of people's demand for debt. This mechanism for UST has also proven to be largely effective in keeping the price of UST around its anchor price, as the protocol has never moved more than $0.02 since its May 2021 crash.

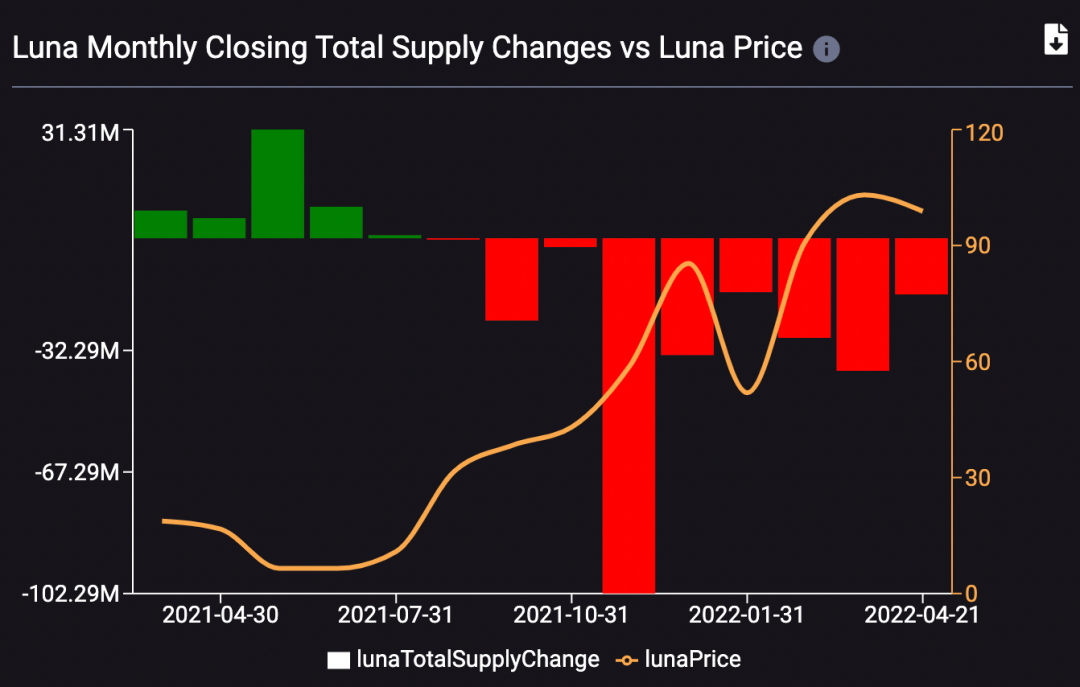

Another key insight that can be gleaned from this mechanism is that,This mechanism links the value of LUNA to the needs of UST.image description

Above: Change in total supply of LUNA at the end of each month (bar graph) vs. LUNA price (yellow curve). Source: Smart Stake

Although this mechanism is highly reflexive, itPositioning LUNA as a full bet on growth in UST demand has resulted in LUNA being deflationary for 9 consecutive months.As shown in FIG.

02. LUNA and Terra Blockchain

As mentioned above, Terra is a stablecoin protocol as well as an L1 (layer one) blockchain protocol.

Although

AlthoughTerra has a limit of 130 validators, but LUNA holders can pledge their own assets to validators in the network, allowing small holders to participate in the network's pledge process. Unlike other PoS blockchains,LUNA stakers can only earn gas fees and swap fees because the network has no LUNA inflation staking rewards.

Editor's Note: According to the latest official statement from Terra, all transactions on the Terra network will generate Gas fees. Additionally, all transactions involving stablecoins incur additional fees, so-called swap fees, which include both “Tobin Tax” and “Spread Fee,” depending on the type of transaction. Specifically, Tobin Tax means that when trading between stablecoins and stablecoins through the Terra protocol (such as converting UST to KRT), the network will charge a certain percentage of conversion fees, and most stablecoin conversion fees will be charged in proportion It is 0.35%, but the tax rate of MNT is 2%; Spread Fee refers to the exchange fee charged when exchanging between stablecoins and LUNA through the Terra protocol (such as converting UST to LUNA), and the minimum fee is 0.5%. When the market is extremely unstable, the rate will be adjusted to ensure the stability of the agreement. These fees will be distributed to LUNA stakers in the network as revenue every block. see:

https://docs.terra.money/docs/learn/fees.html

LUNA validators own the governance rights of the system, voting on network upgrades and parameter changes. The most recent significant vote was the protocol's Columbus-5 upgrade, in which LUNA stakers removed UST seigniorage (the fee incurred to mint new UST). For a quorum to be voted, 40% of LUNA stakers must have voted on a proposal and at least 66.6% of voters must agree to it.

Validators also play another key role in the system,They are responsible for voting on the exchange rate between LUNA and UST (ie the price of LUNA).Terra does not rely on third-party oracle systems such as Chainlink, butUse LUNA validators as its oracles, that is to encourage LUNA verifiers to vote correctly on the price of LUNA. In return, these verifiers will get a part of the exchange fee between UST and other stable coins and between UST and LUNA as a return.

By using its own sovereign blockchain, and a network of oracles within the system, Terra is decentralized as it does not depend on any external entity for the system to function properly.

03. Adoption & Growth Strategy

As discussed by Terra founder Do Kwon, the core philosophy behind UST's growth strategy isEmphasis on creating utility and demand for UST, which helps build a strong network effect for UST.

Here are some of the strategies Terra has taken.

1. Anchor & Terra DeFi

One of Terra's most successful ways to increase the utility and usage of UST is toAnchor. As a currency market on Terra and Avalanche, Anchor allows UST holders to transferUST assets are deposited in it to obtain the current fixed 19.46% APY rate of return.Users can also stake derivatives of Terra or Avalanche chain's L1 assets (currently including bLUNE, bETH, bATOM, and wasAVAX)Mortgage to borrow UST。

image description

Above: TVL (Total Value Locked) growth in the Anchor Protocol. Source: DeFi Llama

The deposit yield offered by the Anchor Protocol is much higher than the typical yield offered by other major money marketAnchor became the first major demand driver for UST.

Nonetheless, Anchor could pose a risk to UST's stability due to the protocol's proposed lower yield and the protocol's yield reserve being reduced by $4 million per day, makingThis reserve will be fully depleted in approximately 2 months, which could lead to outflows of funds from the Anchor protocol and potentially lead to mass redemptions of UST.

Although Anchor currently accounts for 75.9% of Terra DeFi's $20 billion TVL, there are other DeFi protocols on the Terra network that are also obviously attractive, such as the decentralized trading platform Astroport and the synthetic asset protocol Mirror, which together hold more than 25 $100 million TVL.The ability to make UST work in these other Terra-native protocols can help offset potential supply shocks that could occur if Anchor yields are lower.

2. Active multi-chain expansion

Another way Terra generates UST requirements is throughIncrease the supply and utility of UST on many other blockchains. By utilizing cross-chain bridge solutions such as Wormhole,Terra has successfully built liquidity for UST on networks such as Ethereum, Avalanche, Solana, and Fantom.

On Ethereum specifically, Terra has achieved a ton of integrations that could make UST one of the largest stablecoins on the Ethereum chain, at the time of writingThe supply of UST on the Ethereum network has exceeded $755 million.

For example, Terra recently announced a proposal to create a 4pool pool on the decentralized exchange Curve, which will consist of four stablecoins: UST, FRAX, USDC, and USDT. The pool aims to be the underlying trading pool for the most liquid DEX in this DeFi (i.e. Curve), replacing the current underlying pool 3pool (consisting of DAI, USDC, and USDT) on the platform.

Two stablecoin issuers, Terra and Frax, are partnering with [Redacted] Cartel on the 4pool initiative, and at the time of writing they collectively hold a significant amount of CVX tokens, the governance token of Convex Finance, which controls absolutely Most of Curve's native token CRV. Because of this, with 4pool already live on the Fantom blockchain, and with over $31 million in TVL on the chain, 4pool seems to have a solid opportunity to change the competitive landscape for Curve liquidity.

In addition to Curve, Terra has begun to integrate with other Ethereum DeFi protocols, such as Rari Capital's Fuse, a permissionless money market protocol, and Terra is injecting UST liquidity into the Fuse pool.

3. Forex Reserve reserves

Another recent factor driving Terra's growth has been the creation of the "Forex Reserve". The Terra ecological development organization Luna Foundation Guard (LFG) announced on February 23, 2022 (see the picture below), that this non-profit organization has sold LUNA tokens from major entities such as Three Arrows Capital (Three Arrows Capital) and Jump Crypto. Raising $1 billion with the aim of hoarding Bitcoin (BTC) as a backing to help maintain the UST peg.

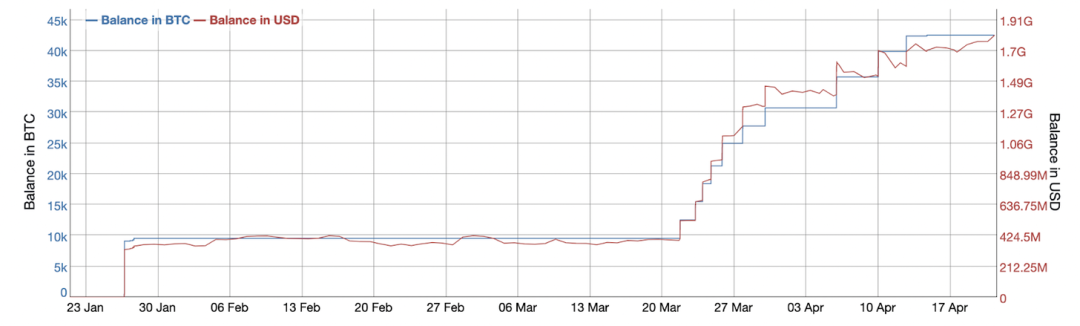

image description

Above: The growth of the number of BTC held in the addresses of the Terra ecological development organization Luna Foundation Guard (LFG). Source: BitInfo Charts

This reserve has helped prop up its price in the cryptocurrency market and has boosted demand for UST, possibly by spurring confidence in UST's ability to maintain its peg and its ability to meet people's redemption needs since Since the creation of the reserve was announced, UST’s market capitalization has increased by 45% and LUNA’s price has increased by 81%.

04. Status of UST

Now that we understand how UST works and the drivers for increasing its adoption, let’s look at some on-chain metrics to see how the stablecoin compares to its competitors.

1. Circulating Supply & Market Share

image description

Above: Supply growth of the UST stablecoin over the past year. Data source: The Block

This makes UST the third largest stablecoin after USDT and USDC. Considering that the other two stablecoins (i.e. USDT and USDC) are backed by fiat currency reserves and issued by centralized entities, this makesUST becomes the largest decentralized stablecoin of all cryptocurrencies, already more than twice the size of its closest competitor, DAI.

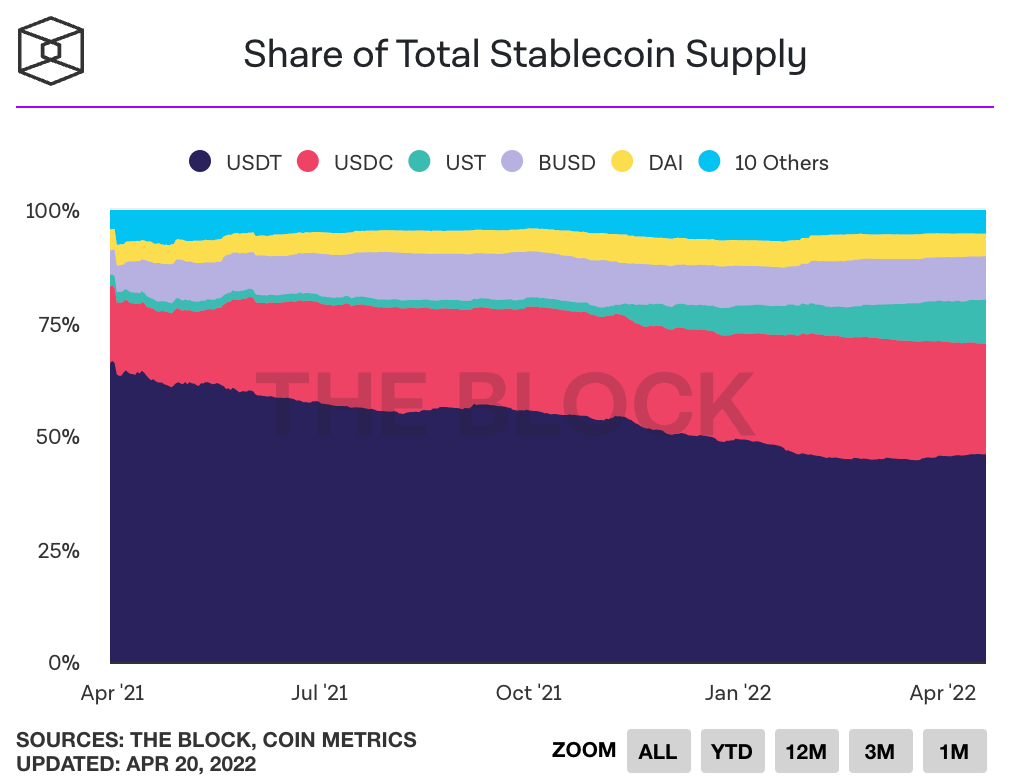

UST's market share has grown dramatically over the past two quarters.image description

Data source: The Block

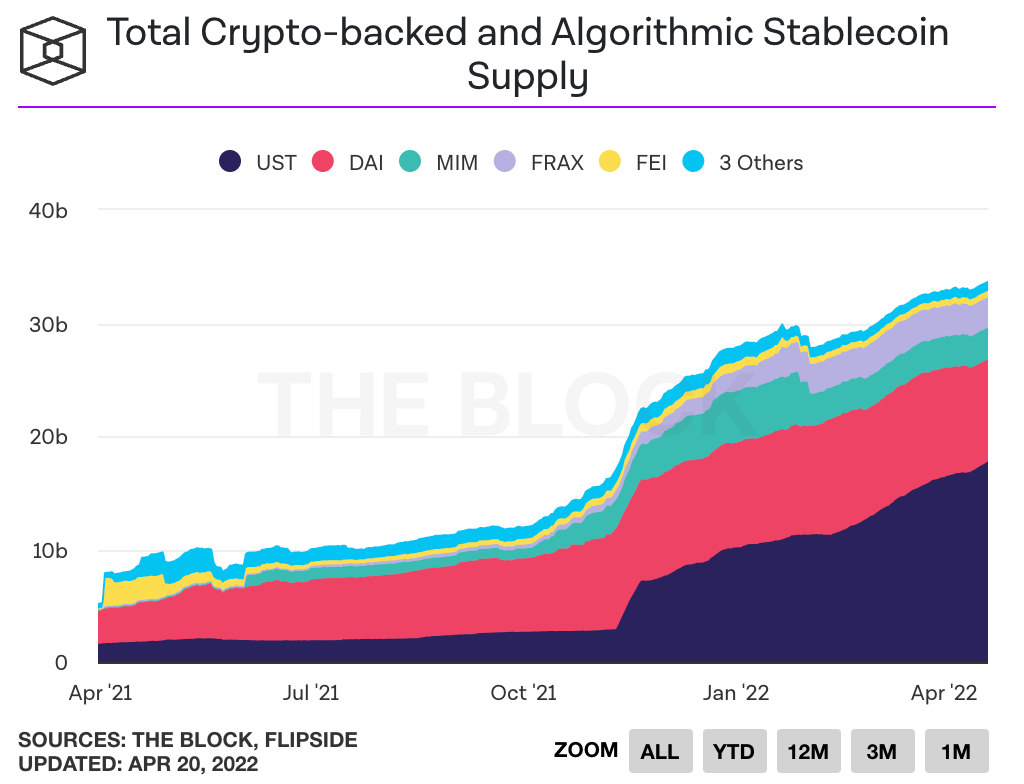

image description

Data source: The Block

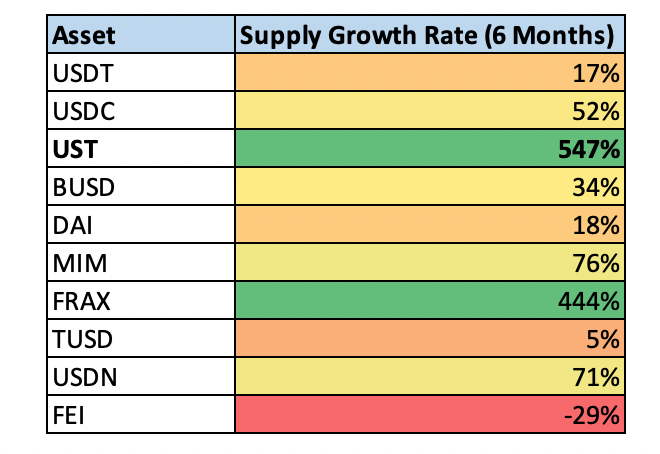

2. Growth rate

As indicated by its growing market share, UST has been growing at a faster rate than its competitors. A closer look at these growth rates shows just how big the difference is.

image description

Data source: CoinGecko

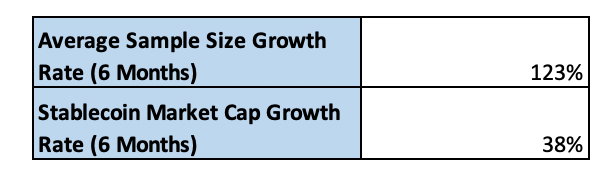

This means that UST has grown 4.4 times faster than the average of the 10 selected stablecoins over the past 6 months, and 14 times faster than the entire stablecoin industry.

Data source: CoinGecko

In this rapidly expanding, long-term growth stablecoin space, UST has proven itself to be the fastest horse.

05. Risk factors

Now that we've highlighted UST's massive growth and the keys to its success, let's take a moment to highlight some of the risks to the protocol.

1. An inflationary death spiral

Perhaps the biggest risk Terra faces is a so-called "death spiral," as has happened with stablecoins such as Iron Finance. Such situations include runs (i.e. mass redemptions) on UST, which are often the result of the stablecoin falling below its peg price, which has already happened to other algorithmic stablecoins. If this happens, LUNA will be minted at increasingly higher prices, causing more UST holders to lose faith and further inflating the asset's supply until it loses its full value.

2. Limited number of validators

As mentioned above, the degree of decentralization of UST depends on the Terra blockchain network that secures the stablecoin. Given that Terra only supports 130 validators, this could be a centralization vector if the protocol faces significant regulatory scrutiny.

3. Anchor yield decreases

4. Competition

4. Competition

Competition in the stablecoin space is fierce. Terra will need to continue to grow and iterate on the protocol and build its network effects in order to defend its competitive position.

06. Summary

As the largest decentralized stablecoin, UST has taken the Crypto world by storm.

With LUNE, a native asset accumulating value through UST's market demand, and an aggressive strategy to drive demand generation, utility and build network effects, and phenomenal growth rates, Terra appears poised to continue its lunar dominance.