With the launch of Centrifuge's Polkadot parachain, our next focus is to expand real-world assets and turn DeFi into the best infrastructure for Borrowing with these assets.

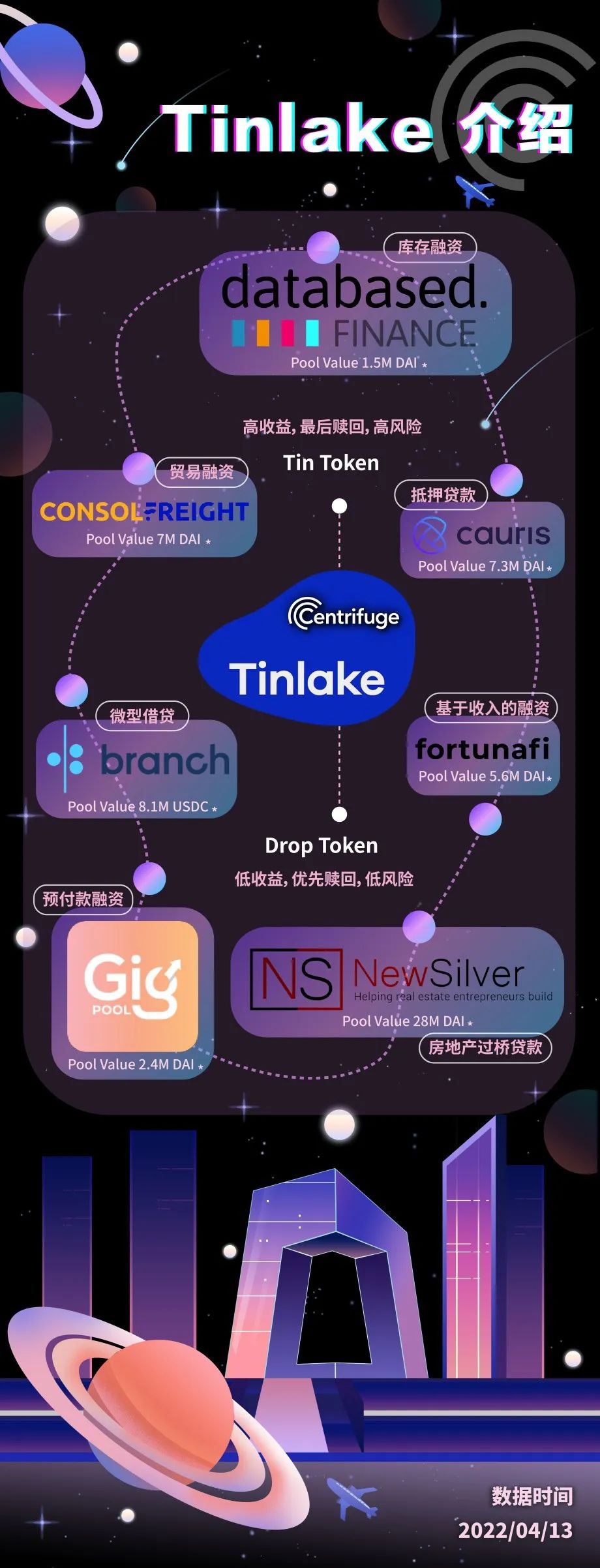

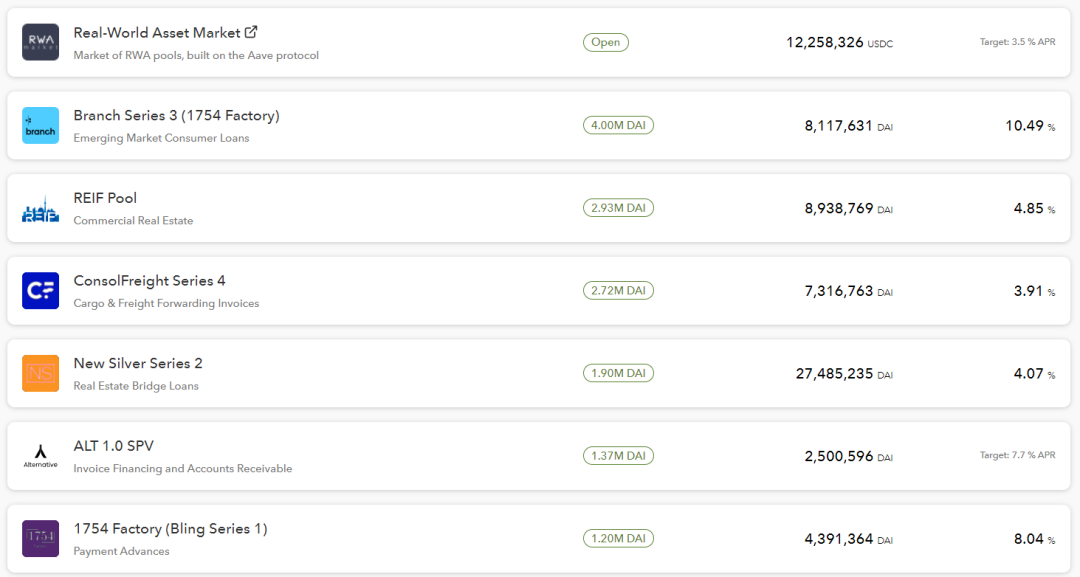

As of this writing, there are nearly 12 asset pools in the Tinlake market, and the total value locked in actual assets exceeds 80 million DAI. These asset pools target different market segments, such as commercial real estate, gig economy advances, emerging market consumer loans, fintech debt financing, freight and freight forwarding invoices, trade receivables, brand inventory financing, real estate bridge loans, etc. , and provide very innovative services to solve their unique Financing needs.

The following content will help you understand each Asset pool on Tinlake in more detail.

First go to the Tinlake homepage: tinlake.centrifuge.io. The top banner will show the total value of all Pools.

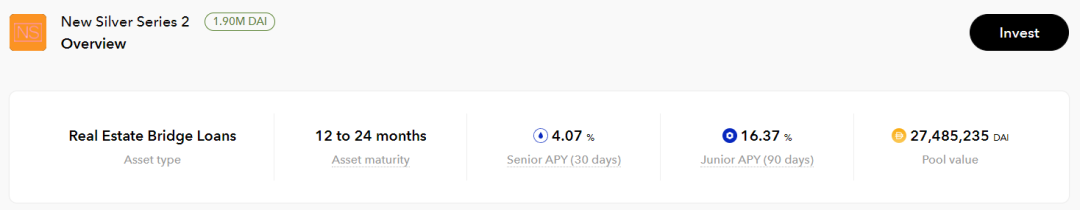

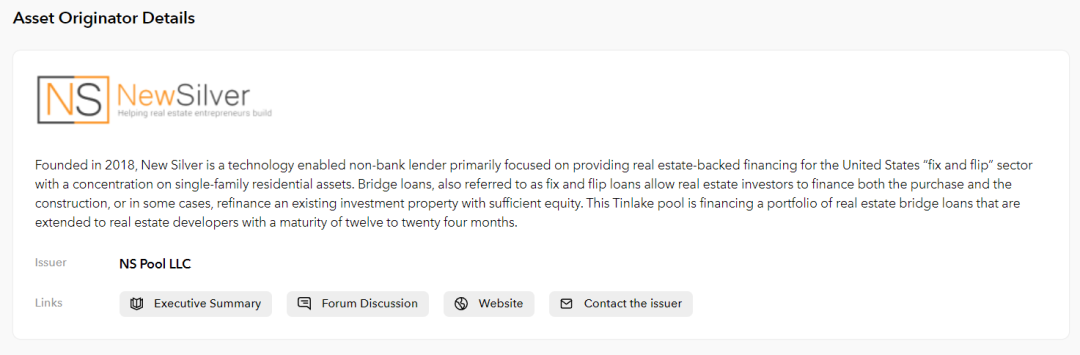

In the Asset initiator section, you can learn about the types of Assets in the Asset pool. For example, New Silver is a real estate bridge Loan Assets pool. This means that you, as an investor, will carry out Financing for New Silver's active real estate bridging Loan Assets. Pool Overview will help you to choose an Asset pool, where users can find a short introduction to Asset originators and Asset types. In the title, you will see the most important indicators of this Asset pool: Asset type, Asset repayment period, DROP APR and Asset pool value.

At the same time, each Asset pool is composed of two parts, Tin token and Drop token. Users can control the profit and risk of their investment portfolio through the ratio of the two tokens. Tin pass means high risk and high return. The risk comes from the later order of pass redemption. When starting pass redemption, Tin pass will only start after completing the redemption of all pass passes of Drop pass. The redemption of the certificate, which is also the low risk of the Drop pass. At the same time, the founder of the Asset pool, Tinlake Borrower, will be required to purchase a certain percentage of Tin tokens to reduce the risk of each Asset pool.

If you want to dig deeper into each Asset Sponsor, you can find more information about the company on each Asset Pool's page. For details, please visit tinlake.centrifuge.io. Interested members can also log in to the Centrifuge official forum (https://gov.centrifuge.io/c/pools/25) to learn about the latest information on each Asset pool. At the same time, the Centrifuge team will also arrange a Pool Party every month, so that the Centrifuge community has the opportunity to interact with Asset promoters and learn about their latest progress.

In order to let the community have a deeper understanding of the various asset pools of Tinlake, we summarize the specific situation of each existing asset pool for you below.

As the asset pool on the chain continues to grow, the workload of the protocol team in processing and filtering new asset applicants has reached its limit. At the same time, we also deeply feel the necessity of decentralizing the process of launching Assets, allowing the Centrifuge community to participate in this process, so as to truly allow the community to provide driving force for the process of launching Centrifuge Assets. The team will soon announce specific implementation details and bring updates to community members in a timely manner.

A live broadcast on this topic is under preparation, and detailed information will be announced later in the Centrifuge official community telegram group, so stay tuned!