key points

Original source: Messari

Compilation of the original text: The Way of DeFi

key points

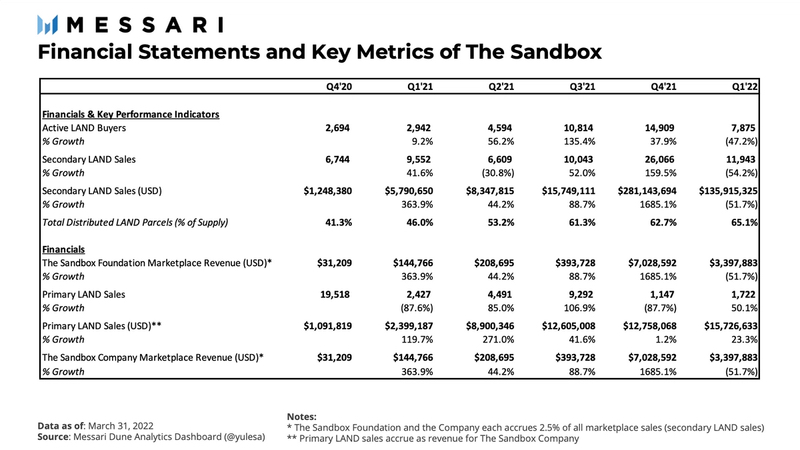

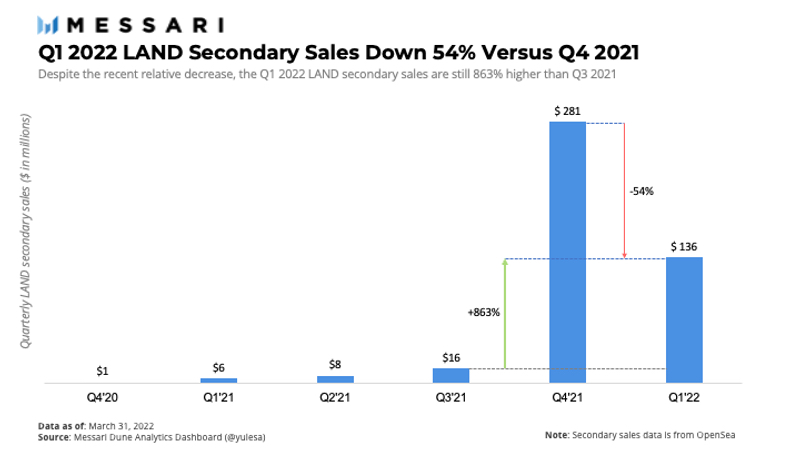

Secondary sales of digital parcels fell 54% given the overall market cooling, but were still up 865% from Q3 2021.

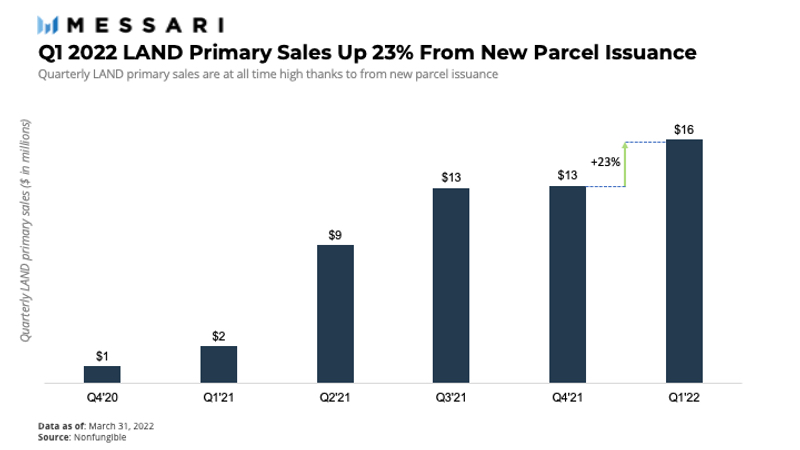

Primary sales increased by 23% due to the release of new parcels (Parcel).

Since the Alpha Season 2 game launched in March 2022, The Sandbox has over 2 million registered users.

A gas-free staking project launched on Polygon.

The Sandbox focuses on collaborations in gaming, music, entertainment and sports.

The Sandbox overview

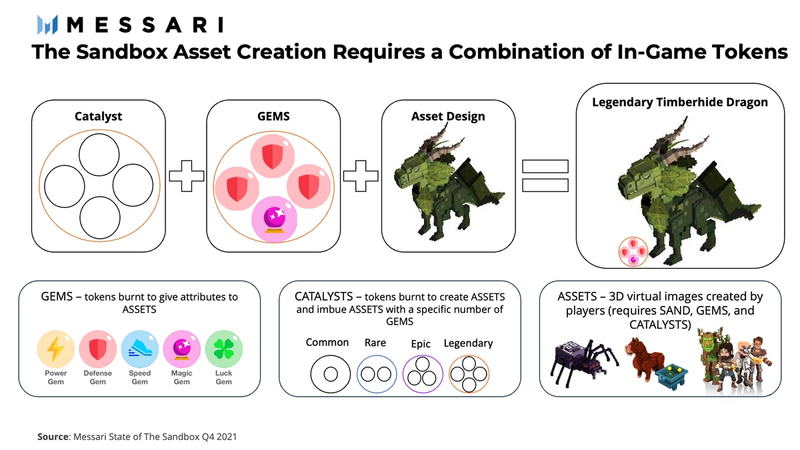

The Sandbox is a platform for creating and hosting entertainment experiences in virtual worlds. In The Sandbox, anyone can create 3D assets such as buildings, in-game items, and non-player characters. These assets can then be used to create diverse experiences including games, music and fashion events, social events, quests, art exhibits and competitions. The Sandbox provides creators with an intuitive set of tools that don't require any programming background or design experience. These tools include 3D editors for authoring and animating projects, game creators for authoring experiences, and game clients. The Sandbox is trying to make these tools as user-friendly as possible to unleash the creativity of its community. For example, 3D editors combine different in-game tokens to create user-generated assets.

These user-generated assets are ERC-721 non-fungible tokens (NFTs) that can be monetized on the open market. The Sandbox ecosystem leverages a range of tokenized game features, including: an in-game digital currency (i.e. SAND) for purchases, monetization and asset creation; digital land parcels (LAND) that can be owned in The Sandbox virtual world; Combining parcels to create larger lands (ESTATE); bundling assets and scripting logic to create interactive experiences (GAMES); 3D virtual images created by players (ASSETS); burning tokens to attribute assets (GEMS); Tokens to create assets (CATALYSTS). The Sandbox has a strong in-game economy due to the tradability of these user-generated assets within its virtual world.

In addition to owning the assets they build, creators can also offer experiences on The Sandbox Metaverse's LAND parcel. The long-term goal of The Sandbox is to empower creators to build immersive experiences. The possibility of monetizing LAND and the gaming experience attracted investors to acquire LAND. Top owners of LAND include big investors in The Sandbox like Binance, Everyrealm, and Galaxy Interactive, as well as NFT communities like Whale, MetaKovan, and Cyber Kongz. Additionally, The Sandbox is actively partnering with businesses willing to develop experiences in their virtual worlds and become early adopters. These partnerships span a range of business verticals, including gaming, music, entertainment, fashion and lifestyle, and more. Partner examples are described in the "The Sandbox Ecosystem: Notable Events" section below.

macro overview

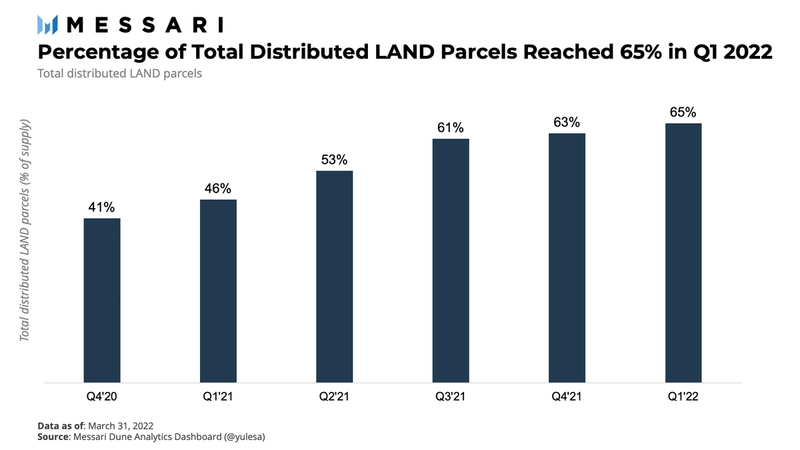

The number of The Sandbox LAND is limited - 166,464 parcels. Primary sales are required for new LAND parcels, which are sold to private entities (partnerships) or through auctions. Notably, 65% of LAND parcels have already been allocated, a 2% increase from Q4 2021.

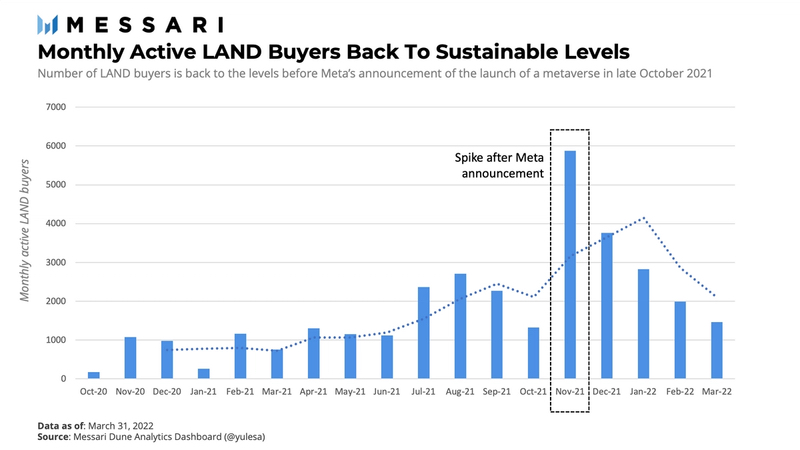

As the tumultuous first quarter of 2022 comes to a close, LAND secondary sales are down 54% compared to the previous quarter. From this perspective, the secondary sales volume in the first quarter of 2022 will still increase by 865% compared to the third quarter of 2021. This quarter's decline is the result of the Metaverse hype starting to die down since Meta announced the name change in October 2021. The market is just finding its balance, and despite the buying frenzy in Q4 2021, LAND demand remains healthy.

Meanwhile, primary LAND sales were up 23% relative to the second quarter of 2021. Primary sales are for newly released LAND parcels, usually to partners or through auctions. Nonetheless, primary LAND sales ($16 million) accounted for only 12% of the market's total LAND sales ($136 million) in 1Q21.

In terms of usage, The Sandbox launches its game Alpha Season 2 in March 2022. Notably, The Sandbox reached 2 million registered users during the launch period. Considering the launch lasted four weeks, tracking its daily or monthly active users isn't useful at this point. Rather, unique LAND buyers may be a proxy for interest in LAND utility. Instead, unique LAND buyers may be another proxy for interest in LAND utility.

exist

existprevious quarterly reportIn , our in-depth analysis found that LAND ownership is fairly concentrated, with top owners holding their parcels. A follow-up question is whether this holding behavior is only for top-level owners. This quarter's report analyzes LAND holding time and discusses the potential impact on land values in virtual worlds.

Micro Overview - Holding Behavior

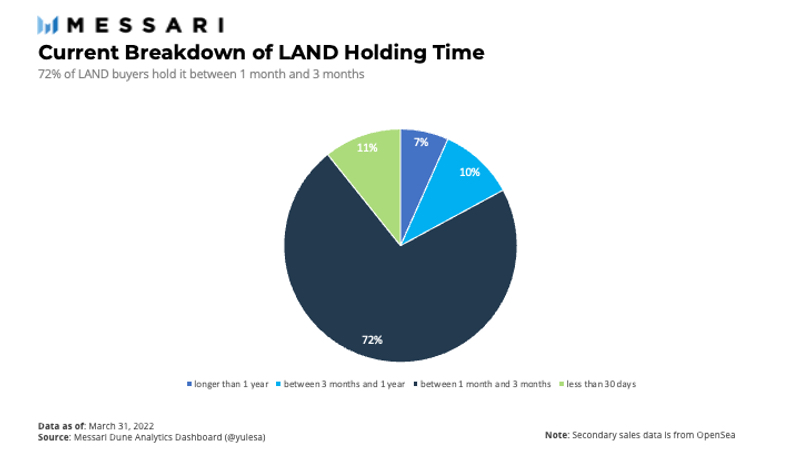

To understand LAND holding time, different clusters of buying and holding behavior can be considered. In this sense, for example, long-term purchases can be viewed as holding a plot for more than a year, while buying and selling can be viewed as holding for a period of less than 30 days. The current breakdown of LAND holding time shows that 7% of buyers have held LAND for more than a year, while 11% of buyers have held LAND for less than 30 days. Meanwhile, the vast majority (72%) of LAND buyers hold assets for 1-3 months.

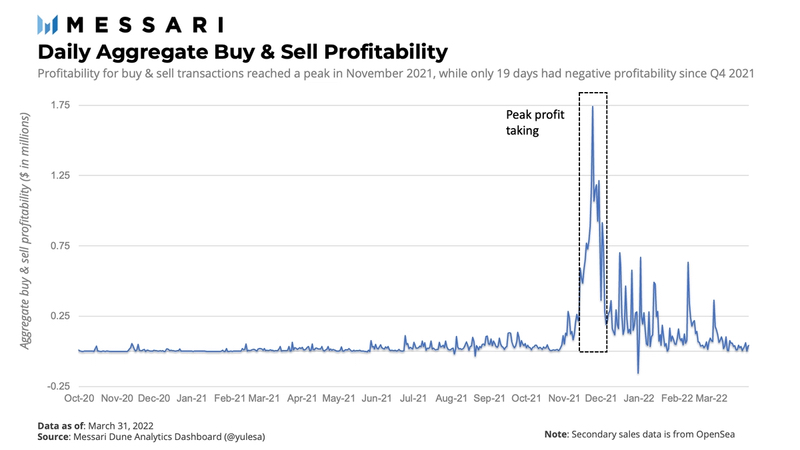

In other words, 83% of buyers choose to sell their LAND within 3 months of purchase. This suggests that profit-taking is a driving force for LAND owners to buy and sell their assets. Below we analyze profitable behavior by looking at buy and sell transactions that occurred over a 30-day period. For each buy or sell transaction, the difference between the sell price and the corresponding buy price is calculated on a daily basis.

Note that the peak profit taking occurred on November 24, 2021 - roughly a month after the Meta rebrand was announced. Profit-taking behavior has since returned to sustainable levels. Furthermore, since October 2020, there have been only 19 days of negative aggregate profitability, with December 31, 2021 being the most negative. One might consider buying LAND as a call option on The Sandbox, gaining traction among users.

While 2 million user sign-ups indicates a high level of interest in The Sandbox gaming experience, in terms of experience building, the case of Digital LandStill in early stages. Intuitively, providing an immersive experience in The Sandbox could be a potential catalyst for sustainable value creation and capture. In this sense, users are eagerly waiting for the launch of an immersive encrypted user gaming experience. Creators are well placed to build immersive virtual experiences and deliver them to users. In capturing that value, owners may acquire specific LAND parcels in the hope that hosting virtual experiences on these parcels will in turn drive increased user activity. This could further create a "flywheel", thereby increasing the long-term value of the LAND plot.

However, currently creators cannot use LAND parcels to offer experiences to others. This may temporarily hold back real demand. While most LAND buyers may initially be inclined to hold, the lack of practical means to monetize LAND may tempt them to (sell) at a profit despite their experience. Therefore, it was important for The Sandbox to continue to build on the pillars of the immersive experience and increase accessibility for users.

For The Sandbox to continue to thrive, immersive experiences needed to be created and adopted at scale. In this sense, an important measure will be the number of active users of the full game version not bound by a specific time interval.

Partner

Partner

Brands are showing no signs of getting tired of joining The Sandbox ecosystem. Driven by the enormous possibilities of building and monetizing experiences, a range of brands have announced partnerships with The Sandbox across multiple verticals, notably: Gaming (Ubisoft, SM Media and Ethernity), Music (Warner Music Group), Entertainment (SHIBUYA109), Diversity and Inclusion (World of Women), Sports and Gaming Participation (HSBC), and Fashion and Lifestyle (Gucci, Arianee). Developing further partnerships will remain an area of focus for The Sandbox for the foreseeable future.

The Sandbox Alpha Season 2

In March 2021, The Sandbox launched Alpha Season 2 of its virtual world. Playing for 4 weeks, users can earn Alpha Passes and earn SAND, The Sandbox's utility and governance token. The Sandbox reaches the 2 million registered user milestone for the first time. As part of Alpha Season 2, The Sandbox released 200 missions and over 35 experiences, available to PC and Mac users who sign up for a free account. With the upcoming release of Season 3, The Sandbox will continue to expand its user base.

Staking on Polygon

route map

route map

Progressive decentralization

Progressive decentralization

Through progressive decentralization, The Sandbox aims to incentivize its community to come up with their own experiences. That said, The Sandbox is inspiring its community to build experiences for players and potentially unleash the next generation of highly successful games. While not yet deployed, The Sandbox DAO will be able to vote on foundation grants and make decisions on game development. The Sandbox DAO will be jointly managed by SAND token holders and LAND holders.

Network Effects and Ecosystem Growth

As LAND will continue to be gradually opened and distributed in 2022, The Sandbox needs to expand its network effect. There will be ongoing efforts to secure further partnerships and grow its ecosystem. The aim is to expand and attract businesses of all kinds — Metaverse agencies, fashion houses, virtual real estate marketplaces. Ideally, these businesses will build their own sales, creating jobs and providing a wider experience for players in The Sandbox.

Introducing a public In-Game experience

Summarize

Summarize

The Sandbox ecosystem continues to grow in Q1 2022, with notable partnerships and over 2 million registered users at the launch of the Alpha Season 2 game. This past quarter, it also experienced the effects of a correction in the overall market. As the Metaverse hype started to die down, Digital Land's market sales returned to sustainable levels. The Sandbox's ambitions are wide-ranging, with the potential to become one of the largest platforms for experiential entertainment.

Based on its numbers and partnerships, The Sandbox remains at the forefront of the virtual world. However, there are still some potential downsides. The true test of The Sandbox's long-term viability will be the technical backbone on which to build a more immersive experience for its future players. With a successful Alpha release, now is the time to test what works, track feature adoption, and take a strategic approach to the roadmap and its execution. The ability to quickly adapt and adopt strategies that best suit their virtual world technology developments will be key. For The Sandbox to be a true entertainment metaverse, immersive experiences need to be created and adopted at scale.