This article comes fromBankless, Original author: David Hoffman, compiled by Odaily translator Katie Koo.

This article comes from

, Original author: David Hoffman, compiled by Odaily translator Katie Koo.

From the beginning, competition has characterized the industry, not the "hands-in-hand" envisioned by idealists. The encrypted assets with the highest market value have "blockchain superpowers": liquidity brings liquidity, capital produces capital, and network effects produce network effects. The winning public chain can capture all the above elements and easily maintain the number one position.

In this article, let us look back at the basic principles of the blockchain, understand what is meant by the "blockchain empire model", and how investors can use this to navigate the extremely complex L1 valuation process. Eventually, you will realize that the Ethereum Empire is coming.

secondary title

L1's key to winningThere is plenty of room in the crypto space to "big the pie" as we are early in a long growth phase for Crypto. At the beginning of the industry's outbreak, the space is large and there are many public chains to accommodate. It seems that the L1 that the ecosystem can carry seems to be unlimited, but this is just an illusion. In fact, if an L1 does not compete for the first position, it is dominated by other L1s.

The winning public chain will capture all liquidity + capital + network effects.

Currency wars are the order of the day in the crypto industry. The "money premium" is the scarcest resource in cryptocurrencies. This is what every blockchain wants, but not all have. Bitcoin accounts for the majority, Ethereum occupies some, and other public chains only get a little soup. The so-called too many monks and too little porridge is the status quo of the currency premium (detailed in Part Four).

secondary titleFighting for "Money Ability"The same competition occurs at the national level.When your currency is the global reserve currency, you have the most powerful asset in the world:

. When the world uses your money, you are number one. Any country can print money, but without the support of global demand, it can quickly slip into hyperinflation.

When you have the world's first currency, the global demand for your assets will greatly reduce the negative impact of currency issuance. Thanks to the "oil-dollar peg", any new supply of dollars is immediately absorbed by global trade. But wasteful spending and corruption have also eroded confidence in the dollar. Tokens based on decentralized blockchain networks are catching up with good times-jumping to the status of global reserve currency.

secondary title

The value of the chain is cycled the same as the country

The countries that have the world's reserve currency also have the world's most powerful military. Military power secures the value of money (the global economy uses its money) by controlling global trade.

This power is in a positive feedback loop: once it becomes number one, it becomes cheaper to maintain the military because of its control over the world's reserve currency; the value of the main reserve currency further subsidizes military costs, which in turn Consolidates the value of the currency.

Speaking back to the Crypto world:

The country's army = blockchain security;

Bitcoin's army = miners, PoW has erected a power wall around the Bitcoin economy, and anyone with weak energy cannot penetrate Bitcoin's PoW force field;

Ethereum's army = coin holders, PoS erects a capital wall around the Ethereum economy, and anyone with less capital than required cannot penetrate Ethereum's protective wall.

Each chain has a security fee payout. Blockchain sustainability is achieved by optimizing the amount of currency issued to produce security. The price of BTC and ETH is an important factor affecting the cost of security in these ecosystems. If the asset value of a chain increases by 10 times, then the security budget will also increase by 10 times accordingly. The price after 10 times also means that the system can obtain 10 times the security level under the same circulation.

Currency premium tied to security concerns

As the price of BTC increases, so does its supply of computing power. As the price of ETH increases, so does the interest in investing in Ethereum.

Bitcoin’s issuance rules are hard to reprogram, so an increase in Bitcoin’s value increases Bitcoin’s security fee payout (at least until its block reward subsidy is exhausted), which can lead to security fee overspending.

In contrast, Ethereum is more flexible in terms of issuance. As the price of ETH increases, the block reward distribution of ETH decreases:

Block 0 - Block 4369999: 5 ETH;

Block 4.37 million - Block 7.28 million: 3 ETH (2017, adjusted by EIP-649);

Block 7.28 million to date: 2 ETH (2018, adjusted by EIP-1234).

In 2021, EIP-1559 began to recover excess ETH through burning. Before the end of 2022, after Ethereum is upgraded to PoS, the issuance will be further reduced by 90%.

The security concept of Ethereum is to issue the minimum amount of ETH to achieve the required security.

Again, the country analogy: how do we optimize our military for maximum security at the least cost? The answer is to reduce the number of tanks and increase the number of drones.

The reduction in ETH issuance makes ETH more scarce, increasing its value on the secondary market. Higher prices on the secondary market increase the security of Ethereum, creating a positive feedback loop to achieve higher security with fewer issuances.

This is the monetary premium.What about L2? Is it also possible to build an empire mode?

Ethereum's modular design structure enables it to expand infinitely. Rather than attempting to host a decentralized economy on top of a single (main) chain, Ethereum serves as a settlement layer for other chains. It's like the United States has the most powerful military power, guaranteeing and promoting global trade among countries, as long as countries adopt the dollar.

Ethereum now has the highest security, ETH transactions on L1 can guarantee and facilitate transactions between L2.The strength of the dollar comes not from the domestically produced part of the U.S. economy, but from the external demand for dollars by countries to participate in global trade. The US doesn't control the economies of Germany, France, Argentina, etc., but it still takes advantage of those economies. In order to trade with other countries, these countries must convert their GDP into dollar demand to import and export.

Likewise, Ethereum does not control the economy of the L2 blockchain. Each L2 has full sovereignty over its own economy. But when it comes to exporting GDP from one Rollup to another, L2 has to consume ETH for L1 transactions.

Aggregating tens of thousands of transactions into L1 transactions is how economic activity on L2 becomes interoperable with the rest of the Ethereum ecosystem.

The beauty of Ethereum's modular design is that you can add (essentially) an infinite number of L2s on top of it, making Ethereum as L1 the most fundamentally scalable blockchain design, allowing it to grow from a country to an empire.

The cost of developing a new L2 on Ethereum is close to zero. It's the equivalent of an empire that can easily project economic influence in new territories or foreign countries whenever it needs to. Each additional L2 will increase the net GDP of Ethereum, and Ethereum can freely increase L2 according to market demand.

All roads to Ethereum are increasing ETH value.

Ethereum's L1 and L2 are the federal and state of the United States

The L1/L2 structure of Modular Ethereum mimics the federal/state structure of the United States. Simple in the center, complex around the edges.

The US federal government is L1. It determines the "laws" that all states (L2) obey. These laws are meant to facilitate interoperability between states. It provides trust for efficient interstate commerce.

Ideally, the federal government would provide only the minimum required rules and regulations. All other laws and regulations can be left to individual states (L2).

The same pattern exists in Ethereum as well.

The EVM on Ethereum L1 coordinates economic resources between L2 as a rule. This common standard helps L2 share the economic benefits of each other's growth.

Sharing the same L1 protocol allows each independent chain to go from adversarial to united front. Due to the interoperability provided by the underlying L1, the success of one L2 Rollup on Ethereum has a positive impact on other Ethereum L2 Rollups and will become a "joint advantage".

The beauty of the L2/state rights model is that each L2/state can decide what works best for them.

Existing, "states" of the Ethereum "federation" include:

Optimistic Rollup: such as Optimism or Arbitrum;

Zk-Rollup L2 solutions: such as zkSync or Starknet;

Ethereum L2 scalability solutions like Immutable X;

Consortium chains like Hyperledger...

There is no limit to building L2 on Ethereum, as long as the EVM interoperability standard is adhered to. "Simplicity at the center" maximizes "expression at the edges". Empowering everyone to build what they want sparks creativity.

secondary title

Facing L2, we have a choice

The L1/L2 structure (federal/state structure) is an individual empowerment mechanism.

If states charge you more in taxes than they provide, the solution might be: live in another state. States must compete with each other to keep voters happy and retain their residency. States that do better at this will have more economic resources and more people.

The same happens in L2.

Has your usual L2 charge increased? Is it investing enough in its infrastructure, and is it keeping pace with innovation, or is it falling behind? If the L2 does not meet your requirements, you can replace it. L2 will compete with each other for users and locked positions, and this competition is beneficial to users.

Ethereum Empire

Ethereum is a modern instance of a global coordination model. Over time, Ethereum is fundamentally structured like the United States — maintaining its position by ensuring that global trade is denominated in dollars.

The Ethereum Empire will consolidate itself in two ways:

New L2s are created and added to the ecosystem, such as Ethereum's native Rollup (Arbitrum, Optimism, zkSync) leaving the crowded central empire and establishing new sub-lands outside the main castle;

Other less secure L1s join to become Ethereum's new L2.

These new forks of Ethereum can manage themselves and generate their own economies. But after every few blocks, they tie up the aggregate economic activity and transact with L1. In exchange for an ETH tax on processing transactions, the security authority of Ethereum L1 is delegated to L2.

Counterfeit L1s can issue more coins than Ethereum, which can pay lower security fees. But if you want to stop monetary inflation, you can always choose to accept the protection of Ethereum.

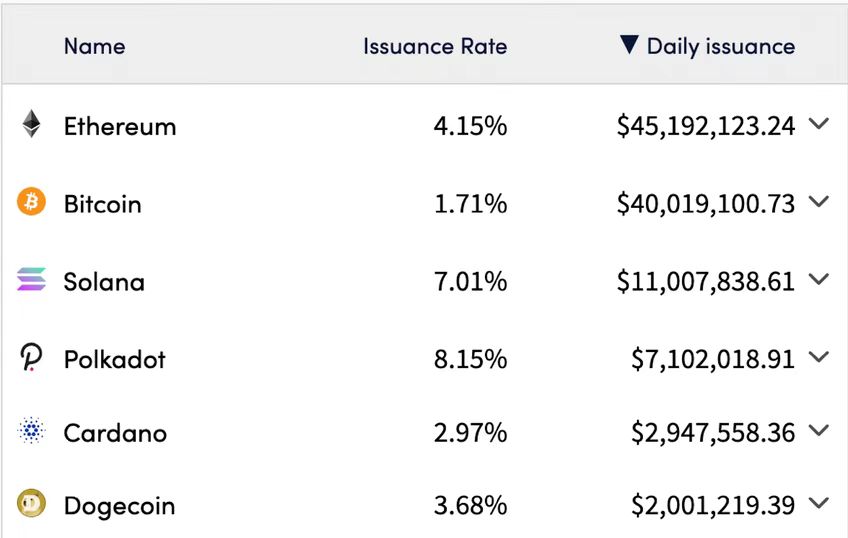

Speak with data and compare different L1

Ethereum currently provides $45 million in security fees to its network every day.

BTC's current inflation rate is only 1.7%, but it can provide a security fee of 40 million US dollars per day. So from the perspective of security efficiency, Bitcoin is 2.7 times that of Ethereum.

Solana's inflation rate is 7%, and its daily security spend is only $11 million. The security efficiency of Ethereum is 7.17 times that of Solana.

AVAX has an inflation rate of 5.5% and a daily security fee of $5.7 million. The security efficiency of Ethereum is 10.4 times higher than that of Avalanche.

This was before Ethereum switched to PoS (Solana and Avalanche were already PoS). In the future, the issuance of ETH will drop by 90%, while its security mechanism will be strengthened.

Competitive chains falling into the trap of "currency premium"

Both Avalanche and Solana tout their low fee L1, but this forces them to issue more tokens to pay for security. It is also true that Solana and Avalanche have much higher throughput than Ethereum. They generate more total block space to carry more data. If you have more block space, you have to increase the security payout to protect the extra space.

The larger the territory, the more troops are needed to guard it. Expanding a large kingdom is like expanding the size of a territory, rather than having people leave the kingdom to create small, scattered fiefdoms.

In order to outperform Ethereum in performance, the fake L1 improves the L1 throughput and reduces the gas fee. The consequences for these L1 long-term money premiums could be disastrous. This design choice creates high circulation while also limiting fee collection. This kills the currency premium, which is a trap for expansion.

In contrast, Ethereum's scalability at its L2 yields high L1 fees while minimizing the need to issue ETH.

Issue less and charge more. This is how the monetary premium is created.

Since issuance has been minimized, the burn fees from EIP-1559 capture the economic energy of the Ethereum ecosystem and inject it into the value of ETH (by making it more scarce). As the value of ETH rises, less ETH needs to be issued to pay for security. This reduction in issuance increases the scarcity of ETH, increases its value, and further reduces the need for issuance. This is a positive feedback loop of monetary premiums.Other chains trying to scale on L1 have negative feedback loops. Large-scale L1 requires high circulation and cannot obtain meaningful fee income. This forces supply inflation, reduces its scarcity, and puts downward pressure on the currency. It cannot subsidize issuance with fees, as that would defeat the purpose of these competing chains. As more and more are issued, the depreciation of the currency (due to inflation) triggers the need for further issuance.

The battlefield for the first place in L1 is always inclined to who can issue the least amount of currency to achieve the greatest security.

If you create security, you own everything (users and funds). If security is expensive to you, your options are limited.

Competition chain, let’s take refuge in Ethereum as soon as possible~

On April 13, people familiar with the matter said that one of Arbitrum, Optimism, zkSync and Starknet may issue tokens next month.

Optimism and Arbitrum, as L2 already in operation, do not need to issue coins from an economic point of view. They generate income by selling blocks, and then every time an L1 transaction is made, they pay a small "tax" to the Ethereum economy.

Avalanche, Solana, Terra, and basically all "non-dominant security efficiency" blockchains have a vulnerability. The longer they let inflation go, the worse the problem will be. In the future, by becoming Ethereum L2, their token issuance vulnerability may drop to 0, and bring immediate benefits, and even increase throughput.