Original source: Bankless

Author: William M. Peaster

Original source: Bankless

Author: William M. PeasterDear Bankless veteran,Last September, we published

Arbitrum Basic Guide

- Arbitrum is Ethereum's leading scaling solution when it was just launched on mainnet.

It was new and exciting, but at the time people didn't have much to do with it. You can go through the bridge and use some of the leading DEXs (decentralized exchanges) like Uniswap, Balancer, and Sushi, and only then, because Arbitrum was still in its early days.

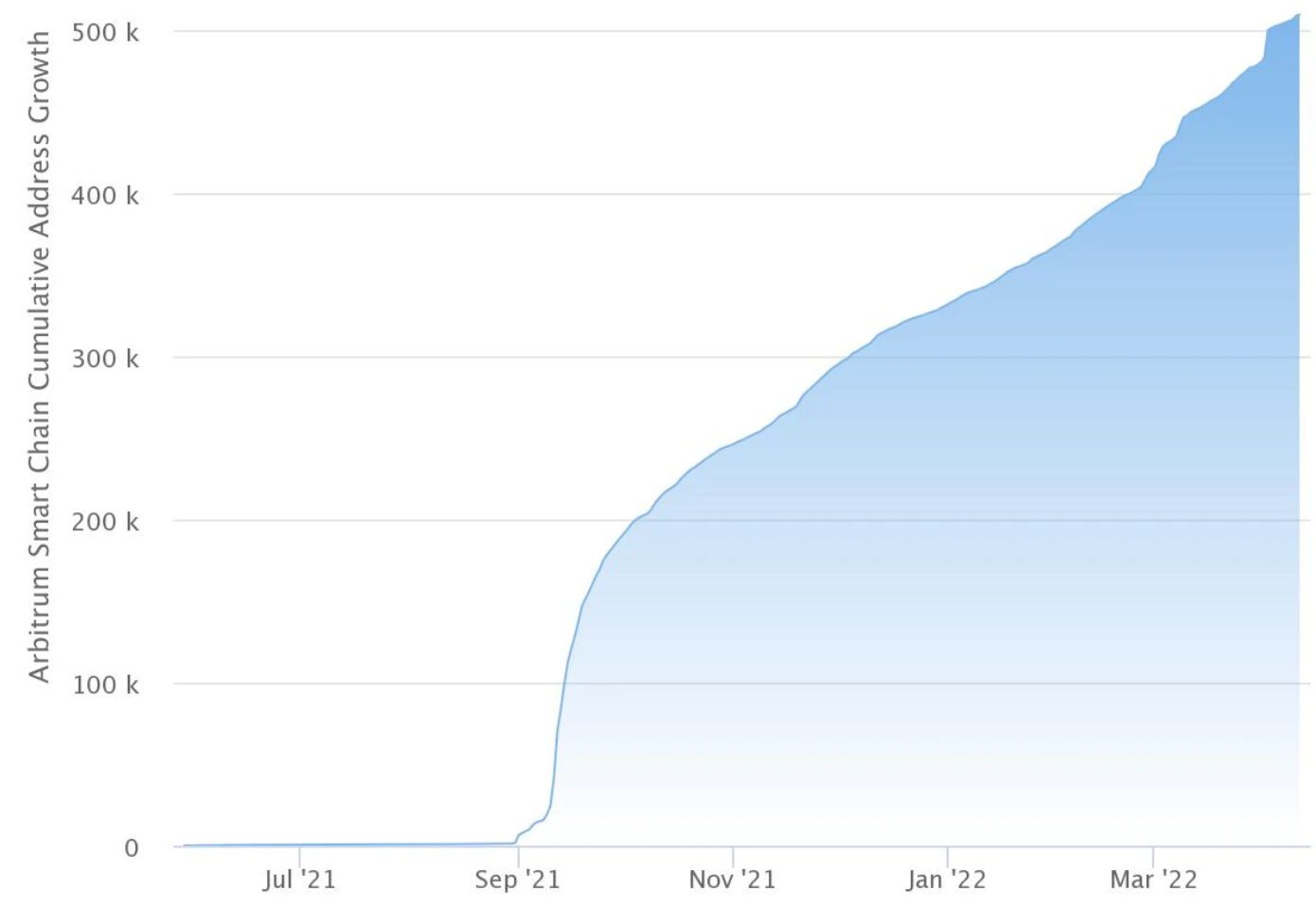

Let's fast forward to today and this ecosystem has grown rapidly. All Layer 2 locks are now over $6 billion in value, and Arbitrum represents $4 billion of that - over 60% of the market!

The network is also steadily approaching 1 million unique addresses (still early days!).

With more mobility, more infrastructure, and more opportunity. Less than 9 months later, Arbitrum already has a vibrant app ecosystem.

Lower fees lead to more opportunities.

So today we're going to revisit the best opportunities on Arbitrum.

——RSA

I'm curious, does this qualify you for an airdrop someday?

Let's explore today's article together.

Best Opportunities on Arbitrum

Arbitrum One is currently the most popular Ethereum layer 2 scaling solution, offering a range of L2 adventures and the best liquidity, at least for now.This Bankless tactic covers a handful of the hottest Arbitrum opportunities you might want to consider trying today!

Target:Explore cool Arbitrum projects

Skill:intermediate

time:1 hour

ROI:

Hop on the Arbitrum Express

image description

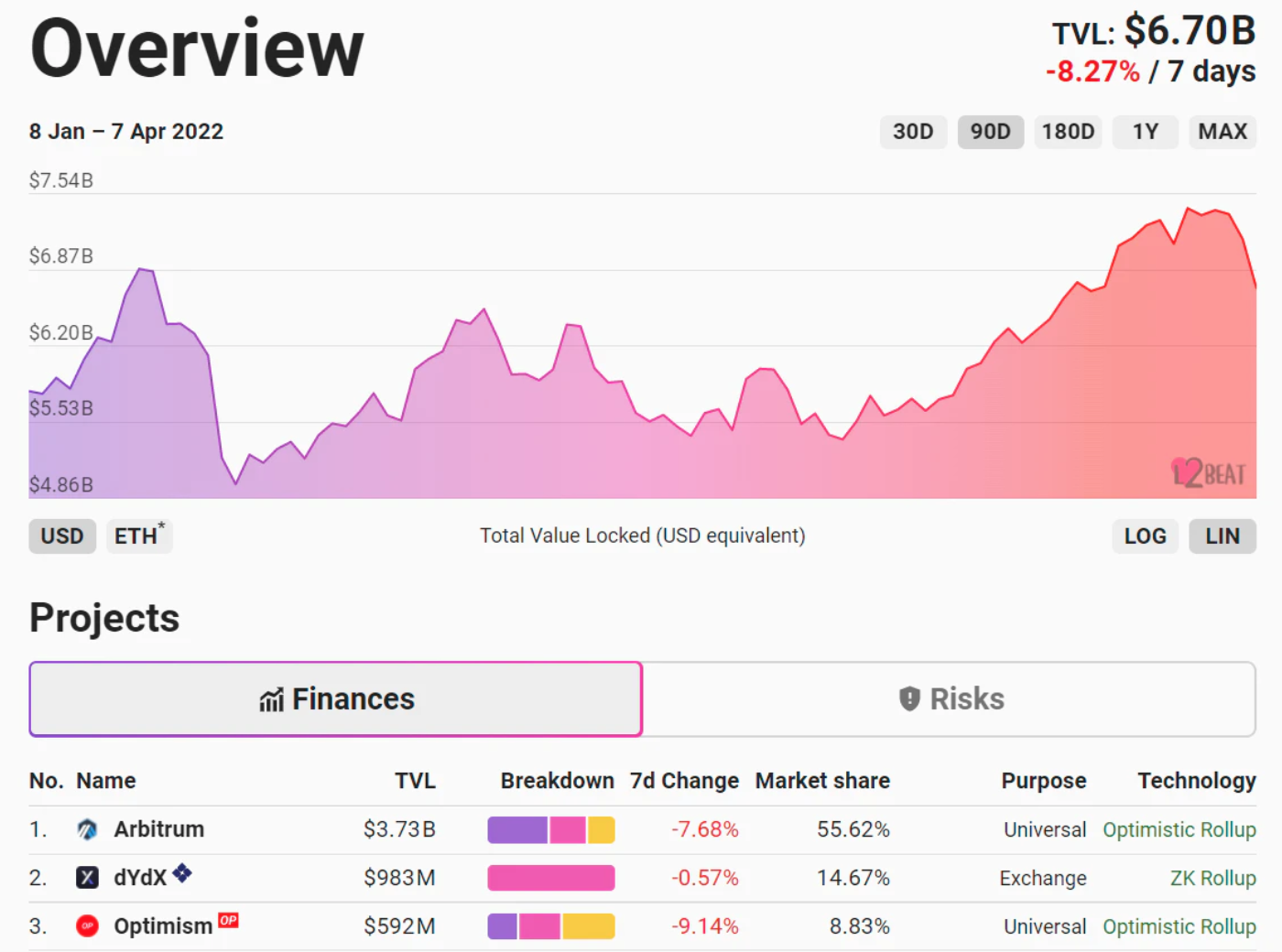

according toL2 BEAT Image via L2 BEAT

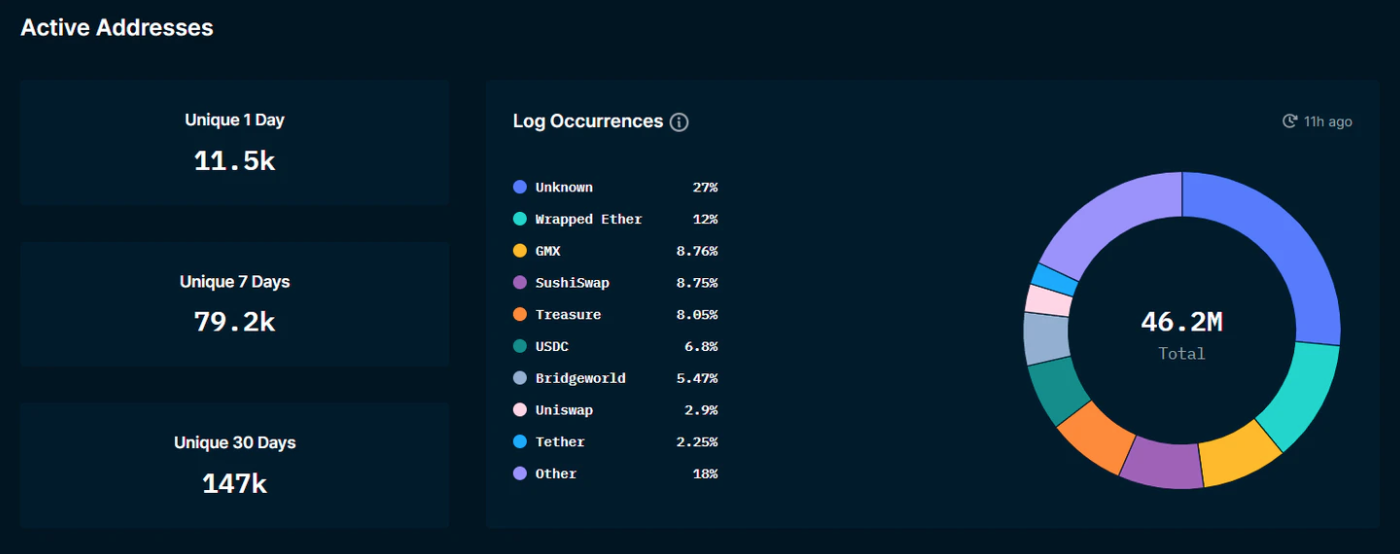

according toData provided, currently worth $6.7 billion in Total Value Locked (TVL) across all of Ethereum's most advanced scaling scenarios. Accordingly, Arbitrum's current TVL of nearly $4 billion means that the scaling solution now accounts for more than 50% of the market.Nasen Arbitrum's Dashboard

Up-and-comer L2 has hosted an impressive circa 150,000 unique active addresses over the past month, and nearly 50 million addresses since its inception, it shows. For comparison, Optimism L2 hosted about 40,000 addresses during the month and more than 24 million addresses so far.

image description

Mining Nasen to get more elite analysis results

Regarding the roadmap for L2, the creators of scaling solutions recently announced AnyTrust Chains, which will run alongside Arbitrum and offer ultra-cheap transactions, and Arbitrum Nitro, which will optimize L2’s network and further drastically reduce its transaction fees.

Here are some resources that can be used to help you navigate the Arbitrum ecosystem more easily.

ArbiscanGet the Essential Guide to Bankless' Arbitrum here

Basic tools:: A block explorer for analyzing Arbitrum transactions.

Arbitrum Bridge: The official bridge for ETH and ERC20 token transfers between Arbitrum and Ethereum. You can also use the Hop protocol as a faster bridge!

ChainlistArbitrum One Portal

: App scanner to stay up to date on new DeFi and NFT projects.

: A tool to add the Arbitrum network to your MetaMask wallet.

Below, I've rounded up what I think are the most compelling opportunities for adventurers on Arbitrum right now.

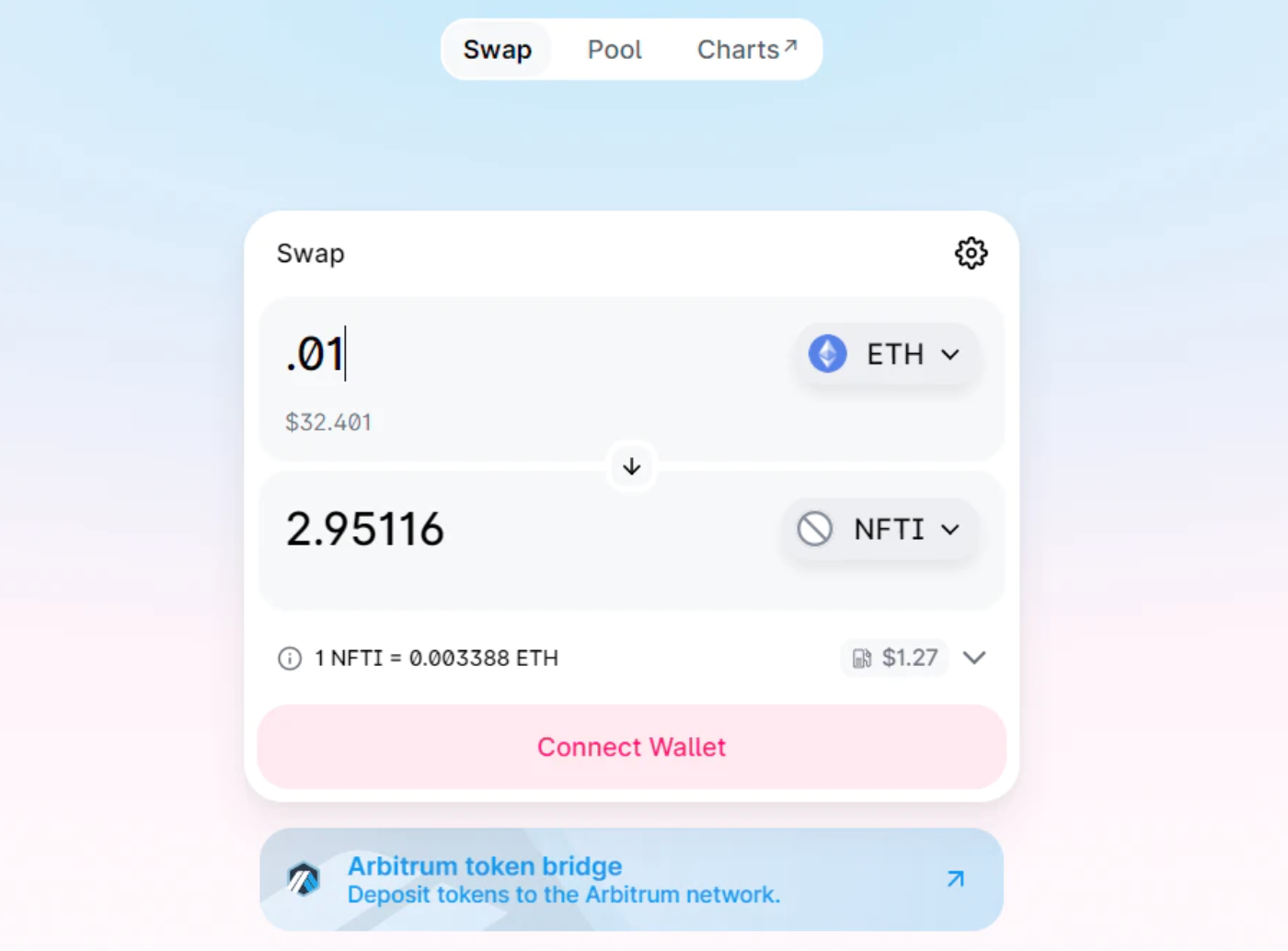

1. Obtain investment opportunities in blue-chip NFT through NFTI

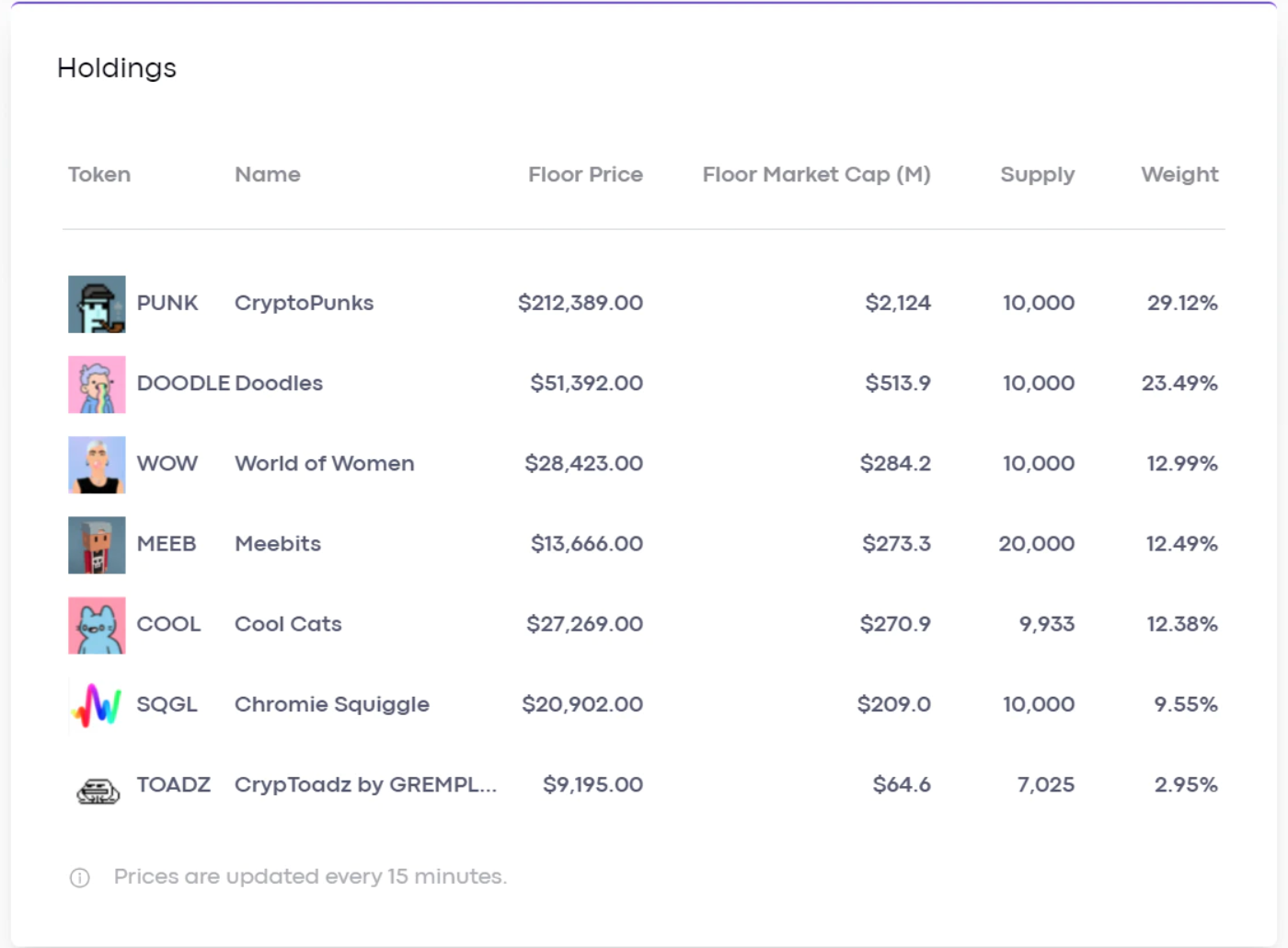

image description

Image via ScalaraWhat you need to know is:In February 2022, Scalara (formerly Pulse Corporation) disclosed that Scalara

NFT index

method, or NFTI. Within days, someone leveraged the method to launch the index via index tracking protocol Kuiper.

NFTI provides potential rewards for the floor price performance of top NFT collections. Specifically, the index serves as an auto-weighted basket of xTokens from the NFT liquidity protocol NFTX. In addition, NFTX's inventory pledge program provides NFTI holders with additional benefits unrelated to NFT price performance.

Initially, NFTI tracked CryptoPunks, CrypToadz, Chromie Squiggles, Cool Cats, Doodles, Meebits, and the World of Women series. Investors can now gain exposure to these blue-chip NFT projects with any budget using a single ERC20. In contrast, investing in these collections of NFTs by simultaneously paying their full reserve price is now equivalent to shelling out hundreds of ETH.FTI

Previously, the vast majority of blue-chip NFT liquidity existed only on Ethereum, so the arrival of NFTI on Arbitrum allows for the first time ever to enjoy fast and cheap secondary transactions around some of the largest NFT projects.

How to access NIf you haven't recharged your Arbitrum wallet with ETH, then recharge your wallet with ETH as a gas fee.。

Then go to the Arbitrrum deployment of Uniswap V3 in

ETH-NFTI pool

Using the "swap" UI, enter the amount of NFTI you want to trade, and complete the transaction with your wallet. Beware of high slippage!

You've got the NFTI, which you can hold long-term when you're bullish and want access to its collectibles, or you can sell through the same Uniswap V3 pool when you're ready to take your money out.

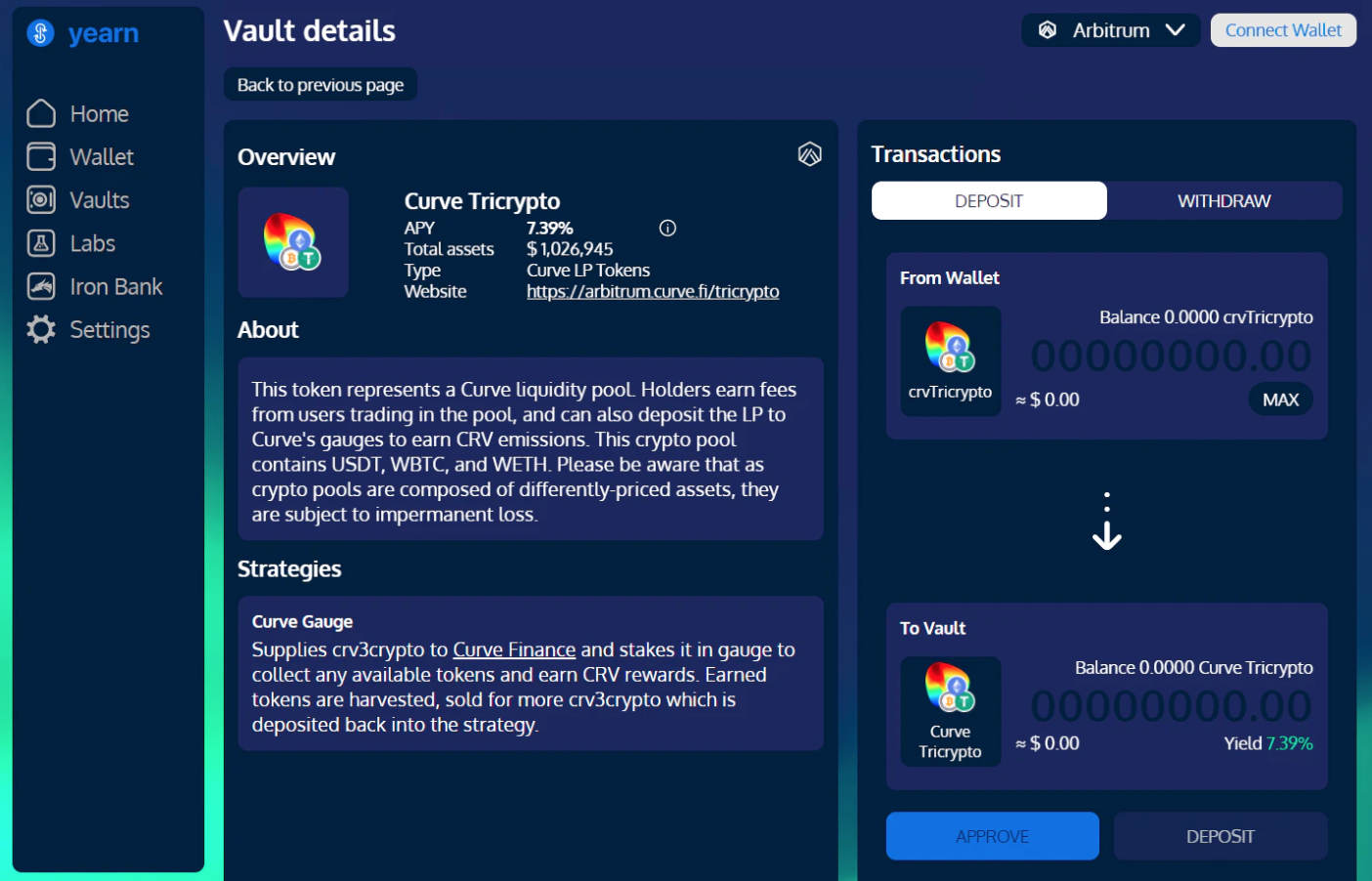

2. Invest with Yearn’s L2 Curve Tricrypto Vault

Please applaud...

Yearn has launched on Arbitrum.

Just four months ago, Yearn added support for its second blockchain: Fantom.

Today, Yearn added its first Ethereum L2: Arbitrum.

What you need to know is:

In February 2022, the team behind Yearn, a leading DeFi yield aggregator, announced the deployment of the protocol to Arbitrum. Notably, this deployment marks the first L2 supported by Yearn.

The Yearn team decided to trial Arbitrum first due to the L2's low cost, its reassuring TVL stats, and its compatibility with direct deposits/withdrawals via major crypto exchanges like Binance and FTX.

Yearn's debut product on Arbitrum is the Curve Tricrypto vault. Depositors of Curve's Tricrypto pool containing WBTC, WETH and USDT can bring their Liquidity Provider (LP) tokens to Yearn's vaults to boost their liquidity through automated, Curve-centric DeFi strategies income.How to Access Curve's L2 Tricrypto Vaultto Curve's on Arbitrum

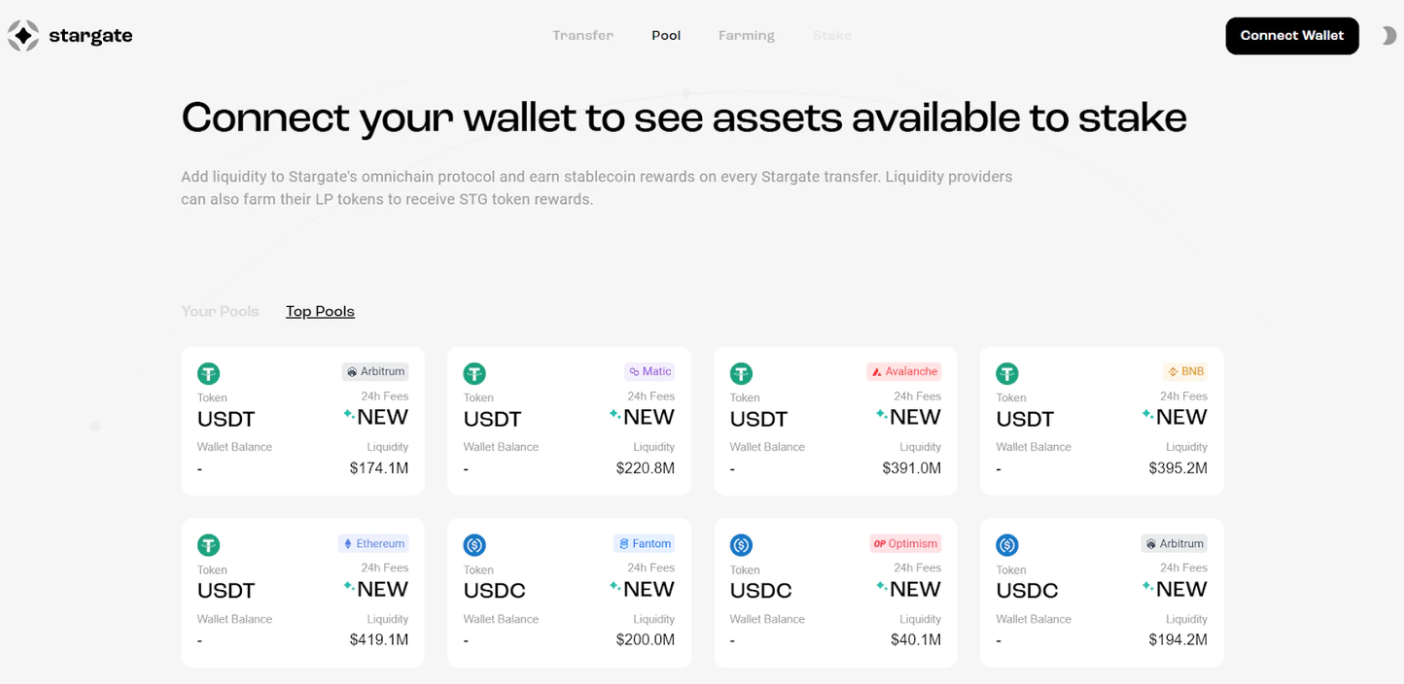

3. Provide liquidity on Stargate Finance

image description

Image via Stargate FinanceLayer Zero What you need to know is:

Stargate Finance is an "omnichain'" bridge protocol that is the first

A project launched on , Layer Zero is an interoperability solution that makes it easy for different blockchains to communicate directly with each other.

Stargate Finance currently supports a range of stablecoin pools across multiple blockchains, compatible with the Ethereum Virtual Machine (EVM). These chains include Arbitrum, Avalanche, BSC, and others.

By adding liquidity to Stargate Finance's liquidity pool, users can earn a small reward for every transfer made through Stargate Finance. Additionally, Stargate FinanceLP tokens can be staked to earn further rewards denominated in STG, the protocol's native token.

How to get a chance to stake Arbitrrum on Stargate FinanceStargate Finance PoolAdd some USDC or USDT to your Arbitrum wallet for staking.

then go to

page, connect your wallet.FarmingClick the Arbitrum USDC Fund Pool or Arbitrum USDT Fund Pool option and deposit the amount you want.

With your new LP tokens, navigate to

You are done! That's how to join Stargate Finance mining on Arbitrum. Note that USDC and USDT mines currently offer approximately 10% and 9% APR, respectively.

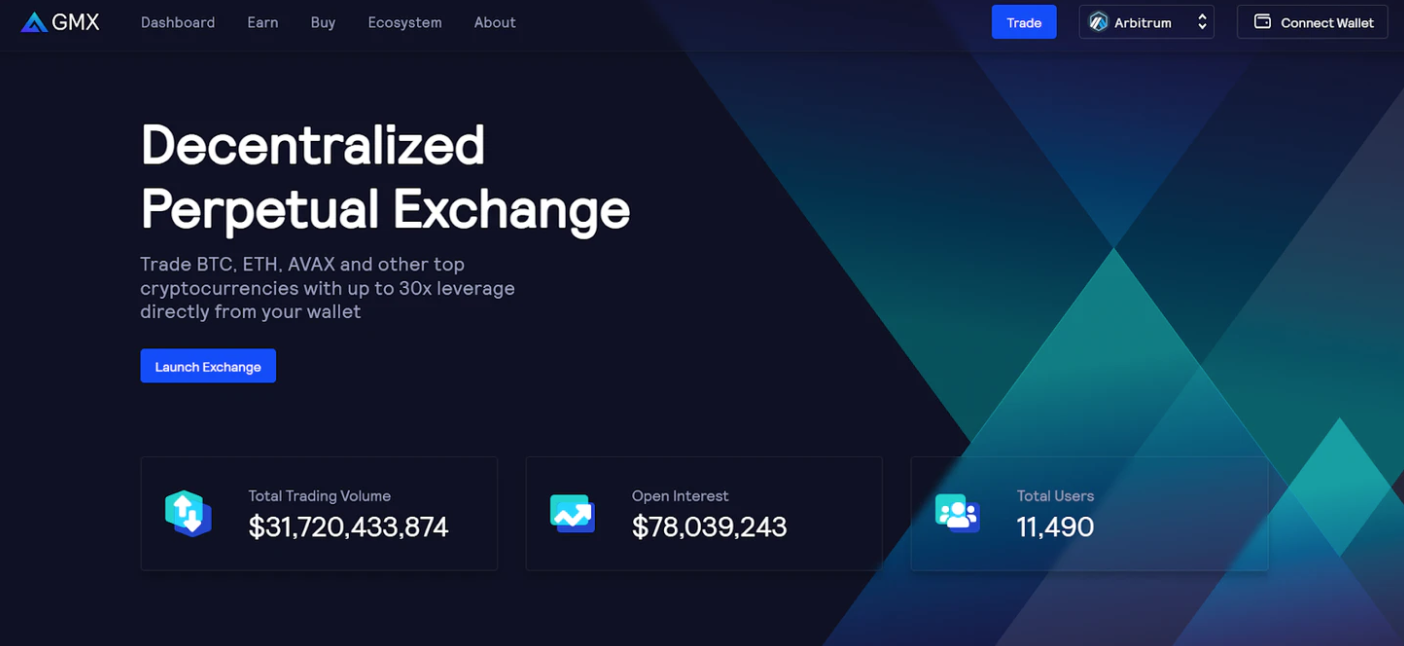

4. Stake on GMX and earn up to 47% APR at current rates

image description

Image from GMX

What you need to know is:

GMX is a decentralized spot and perpetual exchange, currently live on Arbitrum and AVAX. At the heart of the protocol is a multi-asset pool through which liquidity providers can earn income through market makers and support for leveraged trading.

GMX's other central token, GLP, is the protocol's native liquidity provider token. Simply put, GLP is an asset index that spans tokens that exist in GMX's underlying multi-asset pool, and can be staked with GLP to earn ETH and esGMX rewards.

EnterHow to get GMX or GLP for stakingEnter

GMX purchase page, follow the instructions to get the amount of GMX or GLP you want.If you buy GLP, you've already done all that because your GLP was automatically staked when you bought it. Then you can pass

GMX Earnings Page

Track your gains or unwind your positions. Note that GLP staking now yields 47% APR (27% ETH + 20% esGMX).

Then scroll down to the GMX staking UI, click "staking" and complete the transaction with your wallet. Keep in mind that GMX staking currently has an APR of 28% (11% for ETH + 17% for esGMX).

5. Earn up to 60% annual interest rate through Vesta liquidity mining

image description

Image via VestaLiquity What you need to know is:

and

Similarly, Vesta is a "zero interest" lending protocol.

However, while Liquity exists on Ethereum and only supports ETH collateral, Vesta is built on Arbitrum and supports multiple collateral types such as ETH, renBTC, gOHM, and GMX.

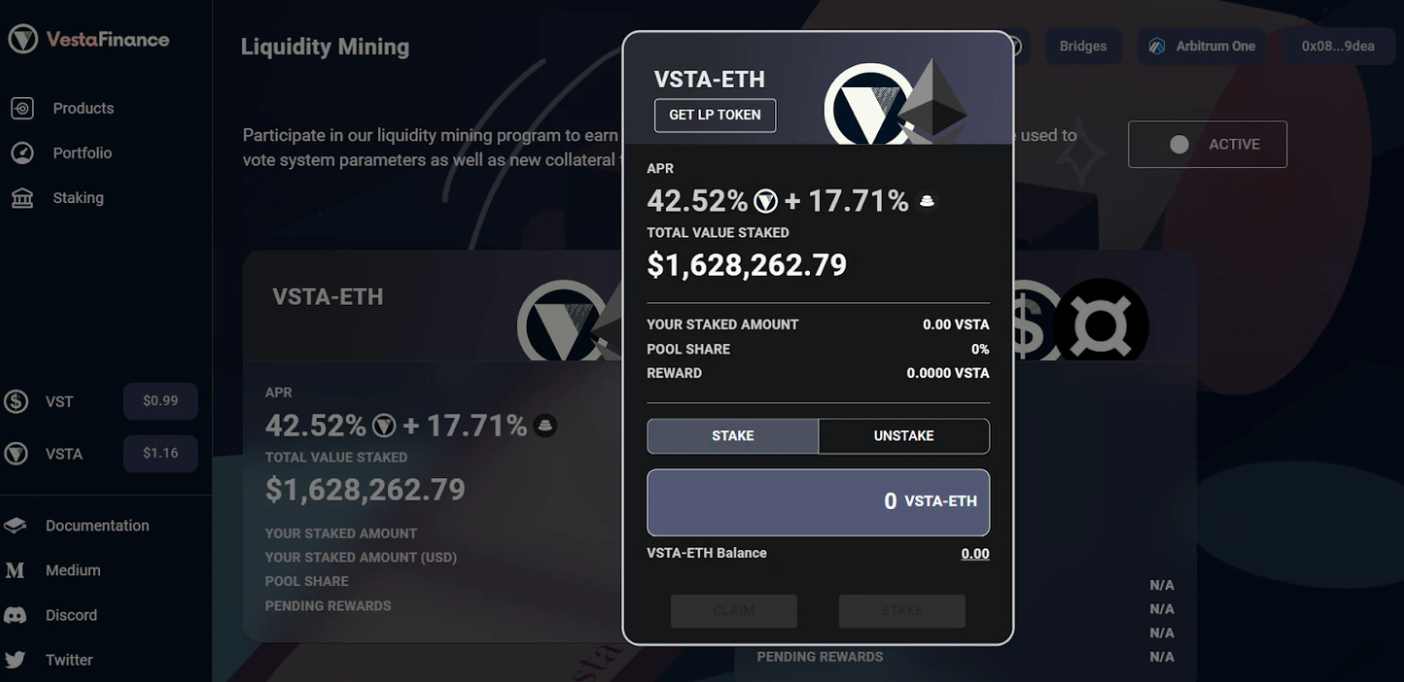

The protocol’s native USD-pegged stablecoin is VST, while the project’s native governance token is VSTA. In order to bootstrap the liquidity of VSTA, the Vesta team is currently running a liquidity mining project centered on Balancer's ETH-VSTA pool on Arbitrum. So now users can stake their pool of LP tokens on Vesta to get 42% VSTA rewards + 17% annualized BAL rewards.How to get Vesta's liquidity miningto the Balancer

Then enter Vesta'sLiquidity miningLiquidity miningLiquidity mining

Liquidity mining

page, click the VSTA-ETH option, and the user interface described in the above figure will appear.

Enter the amount of VSTA-ETH LP tokens you want, then click "Stake" to complete the transaction with your wallet. Keep in mind that your cumulative staking rewards may be offset by impermanent losses from the associated VSTA-ETH pool.

Forge ahead

The projects described above are all pioneering at the frontiers of Arbitrum and offer compelling exploration opportunities for today's L2 adventurers.

Of course, these projects come with risks, although they are the best proof that the era of fast and cheap DeFi and NFT activity has arrived.

action stepsCheck out NFTI, Yearn, Stargate, GMX, and Vesta on Arbitrum!。