This article undertakes the "My view on Ethereum 2.0 (Part 1): The meaning of merger from the perspective of the world pattern", it talks about the valuation of Ethereum and the logic of its valuation. The article will be very long. If you really want to gain something in investment, please be sure to read it.

1

Regarding the valuation of Ethereum, there have been discussions in the industry all the time. Whether it is an entrepreneur like Arthur Hayes (founder of Bitmex) or an investor like Kevin (partner of Dragonfly Capital), more or less Thinking about how to make a more reasonable valuation system for Ethereum.

But before I talk about the valuation of ETH, I have to say a few digressions.

Now many people like to talk about "value investing" in the blockchain industry, but 99.99% of people don't know that it is difficult to talk about value investing in the encryption industry.

The predecessor of value investing is actually the "picking up cigarette butts" strategy: find those companies whose cash assets are higher than the stock market value and buy them, and sell them after the cash assets = stock market value. This is also a strategy commonly used by Buffett's teacher Graham and Buffett in his early years.

But after Buffett cooperated with Munger, the two brothers suddenly discovered that the parts with the highest investment returns are almost not picked up by cigarette butts, but those companies that are not sold in time and the profits of subsequent companies are growing very fast.

At this time, Buffett began to reflect and adjust his strategy, that is, not limited to the strategy of picking up cigarette butts, and included "profit growth" in investment decisions, and value investing was officially born.

Its connotation is to calculate the profit growth of a certain company in the next few years through the company's business model, management team, etc., convert the money that can be earned in the next few years to the present, and get a rough valuation. Finally, compare such a valuation with the actual market value to determine whether the company has "value" and is worth investing in.

This is the core of the value investment system, the company valuation model DCF established by discounting future cash flows.

So why can't we talk about pure value investing in the Internet age? The reason is also very simple, because the Internet, especially the mobile Internet, has greatly liberated productivity.

We say that the era of mobile Internet (web2.0) brings global P2P socialization. The impact of this change is also a challenge for all investors and entrepreneurs, that is, subversive development The resulting change in the rules of the game.

Let me give you an example. The company with the highest market capitalization in the traditional auto industry is Toyota, with a value of US$240 billion. Many people will be very excited to hear BBM, but to no avail, the market value speaks for itself. The ceiling of the traditional auto industry is Toyota’s 240 billion US dollars, but when we look at Tesla, Tesla’s market value is now 1.09 trillion US dollars, topping nearly 5 Toyotas.

But is Tesla profitable? No. I remember once Liu Qiangdong told Shen Nanpeng, "If JD.com can make a lot of money, that would be a very bad thing." In fact, Jingdong does not make money, but

JD.com's market capitalization is now $80 billion.

Not only Tesla, JD.com, but also Amazon. What supports their high valuation is no longer profit margins, but a huge market share completed in a very short period of time.

In traditional industries, the cohesion of the market takes a long time to accumulate, and even the market share of the industry leader is not high. Toyota's market share for traditional automobiles is 4.3%. For example, the top ten companies in China's women's clothing industry have a combined market share of about 10% to 15%.

At its peak, Tesla occupied 30% of the market share of the entire electric vehicle industry. What is even more exaggerated is that after the merger of Didi and Uber after the online car-hailing war, the market share was as high as 95%.

So, can the Internet still use Buffett's value investment system at this time? how to use? Domestic giants use capital to promote business model innovation, while foreign companies use capital to promote technological innovation. In essence, it is burning money for market share, not making money for a long time, and using DCF to value a set is all rubbish.

So why does Buffett reject Internet companies so much? He never bought Microsoft and Google. Even if he chose Apple later, he did not regard Apple as a technology company, but a consumer product.

The industrial revolution in the web2.0 era has led to changes in rules and business logic, leading to the emergence of a "winner takes all" game rule in the entire industry, making value investing no longer applicable.

Then the web3.0 era has perfected the "P2P socialization" form of web2.0, and the arrival of the trend of "thin platform, fat user" (for the concept of "thin platform, fat user", please refer to: "WEB3.0 changes the rules of the game: thin platform, fat users"), how can value investing be applied mechanically? Therefore, in the blockchain industry, people who say they are "value investing" are fools.

So how should we invest? In the era of web 2.0, Zhang Lei put forward an investment philosophy of "long-term holding those crazy value-creating companies" to open up the primary and secondary markets; Shen Nanpeng put forward a deductive primary investment philosophy.

But no matter how it changes, from Graham to Buffett, to Zhang Lei and Shen Nanpeng. Everyone emphasizes "value", but in the ever-changing rules of the game, "value" is defined in addition to "profit growth".

Investing in the encryption industry is the same. We need to make more definitions for "value", such as the "value-at-risk investment system" I proposed (see "(Long text with 10,000 words, super dry goods) My 2021 crypto industry investment summary: Three billion-dollar outlets have been predicted, and the total return rate of Crypto exceeds 5000%"Last part) as well.

Even if the digression is over. Next, for the valuation of Ethereum, I will also start from the value-at-risk investment system and give my point of view and conclusion.

2

The value of the company lies in the product, and the value of the product lies in whether it can really improve people's lives and play an important role in promoting the development of society.

In this sense, whether it is Buffett, Shen Nanpeng, or Zhang Lei, they all come to the same goal by different routes (but everyone defines value differently). Then, it is the same reason to judge the valuation of Ethereum. What we need to do is to look at Ethereum in the way of "discovering value"

Therefore, we must have a VC-style thinking logic, and be able to use our own cognition to infer the shape of the industry and projects in the next 1 to 3 years. Even if it may not be so complete, we must at least think ahead and plan for one or two steps. , so as to obtain a more substantial return on investment.

At the beginning of the birth of Ethereum, everyone's understanding of it was actually very simple. After the iCO boom, some people used the valuation system of the traditional stock market to value Ethereum (or the public chain), but the result was obviously not OK.

Let me just give you an example: If the gas fee of Ethereum is halved, then the revenue of Ethereum will be halved, and the price-earnings ratio will double. But in fact, after the gas fee is halved, it is precisely for Ethereum to consolidate the moat (Ethereum was attacked because the gas was too high and the scalability was not enough).

Later, the founder of mysoundwise.com, Dr. Tasha Che proposed to use the concept of national economy to value Ethereum.

It probably means to use the concept of "GDP" to represent the total value of the network. Then use the currency quantity formula PQ=MV (money supply × currency circulation velocity = price level × commodity transaction volume) to calculate the network value of Ethereum, then the total value of the Ethereum network is equal to the total amount of ETH in circulation multiplied by Turnover times of ETH. This is also the most popular way of valuing Ethereum right now.

The general perception in the industry is that the future GDP of the Ethereum network will be very impressive, but not particularly huge. Because this valuation system regards ETH as a currency, if you want to obtain a high turnover rate, you must make the transaction friction cost extremely low (corresponding to the fact that the GAS fee should be low enough for everyone to accept).

In this way, the valuation of ETH will be relatively low, because it no longer has commodity value and premium space-would you use 1 dollar to buy 1.5 dollars?

Kevin made a better summary in an article last year, that is, to use GDP to value Ethereum, the core is three points:

1) ETH is just a means of payment

2) ETH has no IP value

3) The cross-chain cost is close to zero

But how do we see the current situation of Ethereum? First of all, ETH has a strong "goodwill" and IP effect, and developers and users are more willing to use the Ethereum network. At the same time, the market value of Ethereum is nearly 10 times higher than that of Solona.

At the same time, the value of Ethereum is no longer just as an ICO distribution platform as it was in the past, but supports the DeFi ecology, GameFi ecology, and the foreseeable web3.0 ecology and Metaverse ecology.

Under such circumstances, the valuation of Ethereum by PQ=MV theory is extremely one-sided and distorted. Therefore, we must combine the future development of the entire industry and propose a more "compatible" valuation theory.

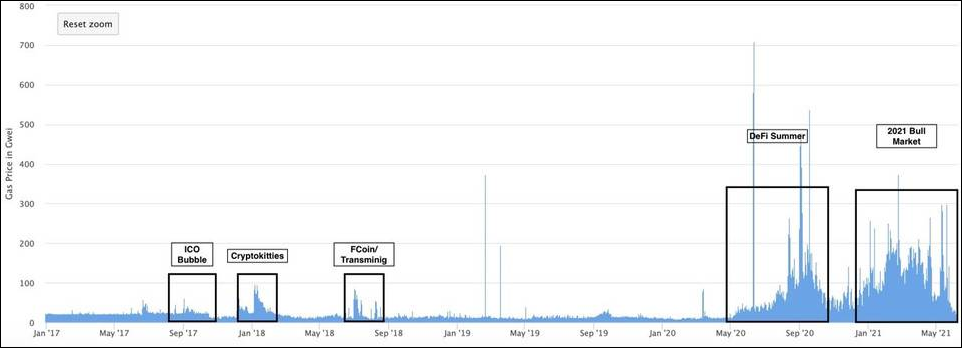

Summer of DeFi"Summer of DeFi"After the "halving market" was launched. We will find that the revenue of the entire Ethereum due to the TVL accumulated by DeFi and the transaction volume facilitated is in the billions of dollars.

And because of the high rate of return brought by AMM, the entire ecology has completed the "users bring liquidity → income → TVL rise → smoother transactions and lower costs → bring more users and more liquidity" a positive cycle.

At the same time, because Ethereum has formed a very deep moat in terms of the degree of decentralization and security during the long-term market inspection process.

If other public chains want to gain the market share of DeFi, they only have two legs to walk: on the one hand, cross-chain to Ethereum, so that the top DeFi projects can be deployed across the chain; To obtain liquidity in all aspects, which is commonly known as "exchanging funds for space and time".

Most of the public chains holding high the banner of "Ethereum Killer" are "offensive" aiming at the high gas fee and low scalability of Ethereum. But the reality is that Ethereum's route through layer2 and future 2.0 is constantly optimizing gas fees and scalability.

If the interaction cost of tens or hundreds of dollars now discourages many developers and users, then when Ethereum 2.0 arrives and layer 2 is perfected, the transaction cost and scalability will be reduced and improved exponentially. In my opinion, the accessibility of Ethereum is improved by a thousand times (Kevin said 100 times is relatively conservative).

Similarly, the growth of DeFi and web3 will also bring about a breakthrough growth in the valuation of Ethereum, and it will not just be regarded as a consumer product with means. At this time, how Ethereum is valued depends on what kind of shape the entire industry will take in the future.

Here I want to give an example.

Take Silicon Valley as an example, because Silicon Valley represents the development of the information industry in the entire United States. We need to understand that personal computers first appeared, and because there are personal computers, there will be software. Then, because software needs to run faster, personal computers will be required to have better chips and hardware. Only then did Microsoft, with Intel, and with Dell.

Here we need to think about one thing, that is, we may not have such a top-level thinking cognition and pattern, and we cannot become entrepreneurs who invent personal computers and software and investors who invest in these entrepreneurs, but after the birth of these things, we will quickly We can foresee and participate in the development process to a certain extent.

To put it simply, it is difficult for you and me to discover and participate in the birth process of 0~1, because there are only a few people in an era who do this kind of thing; but in the development process of the industry from 1 to 100, we can pass Judging and participating on a philosophical level.

Let's look at Ethereum along this line of thinking.

3

Ethereum can be the financial layer of the crypto world.

Many in the industry have seen this trend. The source of this trend comes from DeFi. The protocol open source and code open source brought about by decentralization will allow DeFi to obtain better innovation capabilities. This speed far exceeds CeFi (centralized finance), and the delivery speed And the cost is also much lower than CeFi.

At the same time, because of token incentives, it is no longer just for project parties, shareholders, and investors to enjoy the dividends brought about by subverting the industry, but to distribute this benefit to all discerning secondary investors and projects. builders and users.

More importantly, DeFi has realized the final trust problem of P2P socialization. Although the entire credit system has not been completely solved yet, the development of DID and NFT has shown us the method and hope of establishing an on-chain credit system.

So, the current public chain that can carry DeFi is Ethereum. As the value of Ethereum's native token ETH, it will gain the value empowerment of the financial layer as DeFi recasts finance.

Ethereum can become the operating layer of metaverse and web3, and ETH can obtain the value of cultural assets.

This is something Kevin never mentioned. In other words, the Ethereum ecosystem will be an important part of the Metaverse.

Of course, we now see many public chains, such as flow, sol, near or ftm, etc., and they may not disappear in the future. But these public chains have chosen to sacrifice "decentralization" for better scalability and faster speed.

However, what we need to understand is that the meaning of the existence of web3 (Metaverse) is the industrial subversion brought about by decentralization. But from a philosophical point of view, centralization and decentralization are contradictory entities. In a decentralized world that allows centralized things to exist, such as social activities and other high-frequency activities, the demand for decentralization is not so great.

However, among the key elements related to the world system such as economics, politics, and culture, decentralization is the meaning that supports the existence of this world.

Therefore, even if the Metaverse is a multi-chain structure in the future, the public chain that can carry economic, political, and cultural social activities can only be Ethereum, and now only Ethereum can be seen.

text

Ethereum can be a Capital Asset & Currency Asset

We default to the successful transformation of Ethereum POS, and in POS, the staker replaces the miner verification, in other words, the packaging reward (tip) belongs to the ETH staker. This means that ETH not only obtains the use value as a payment product (handling fee), but also amplifies this value because of "holding and earning interest".

For example, can we understand it as "the hen that lays eggs"?

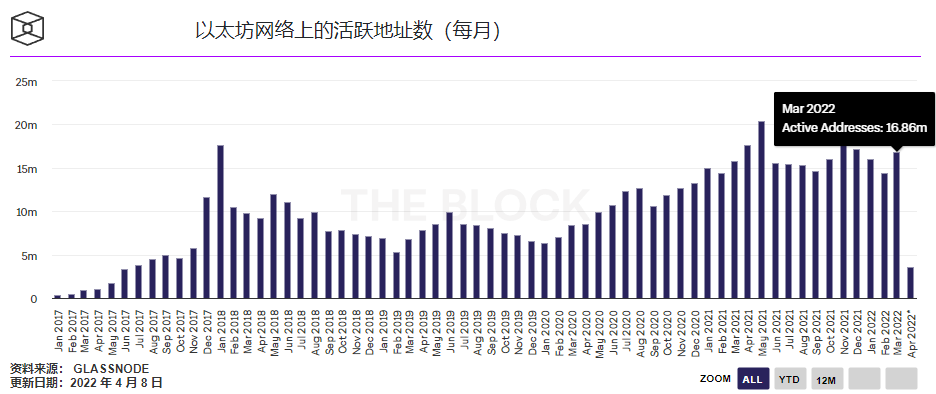

Then let's estimate the total value of ETH as a cash asset in the future. From January 2017 to January 2022, Ethereum network transactions increased from 44K to 1.2M, with an annual growth rate of 130%. But under this data, we can see that the number of active addresses on the entire Ethereum is only 16.6M.

If you can believe that the changes brought about by web3 are comparable to the early Internet, then you can also default to the future growth rate range of Ethereum as:

3~5 years growth rate can be maintained at 100%

5~10 years growth rate can be maintained at 80%

10~15 years growth rate can be maintained at 40%

15~20 years growth rate can be maintained at 20%

Kevin estimated the number of daily transactions for Ethereum to be 4 billion in 10 years with a growth rate of 125%. But I think there are still some problems with this calculation method - he may not have taken into account the accelerated development of the industry.

It took seven years for the PC Internet era to reach 100 million users, but after entering the mobile Internet era, it took only three years for the number of users to reach 100 million.

What does that mean? Internet, from web1 to web2, and then to web3 in the future, their development will accelerate faster and faster.

We can see that the number of monthly active addresses of the entire Ethereum network is only 16M, the number of 7-day active addresses is only 501K, and the average daily activity is less than 100K. The annual growth rate in the past four years is 140%. We conservatively use a growth estimate of 110%.

This means:

Four years later, the number of 7-day active addresses on the Ethereum network will reach 100 million.

Kevin calculates that the number of transactions on the Ethereum network will reach 4 billion in 10 years based on the current annual growth rate of 125%. I think it does not take into account the explosive growth of the number of active addresses on Ethereum. Therefore, the number of transactions processed by Ethereum will grow at a rate of 140%, reaching 8 billion in 10 years.

At the same time, I still agree with Kevin's judgment on the explosive growth of Ethereum transaction volume, that is:

“Ethereum’s transaction costs are cheap, and its capacity has been successfully scaled to enable programmable micropayments between smart contracts. The above assumptions are entirely reasonable”

We have seen the breakthrough of Ethereum in layer 2 and execution layer, and the cost of DeFi transactions has been reduced by 10-20 times. After the successful expansion of Ethereum 2.0 in the future, this means:

"The transaction cost of Ethereum is cheap, and it has been successfully expanded. Programmable micropayments can be made between smart contracts. The above assumptions are completely reasonable. After more than 3 years of development, Ethereum has finally ushered in a scalable solution that is about to land moment. As we highlighted before, the cost of DeFi transactions can be reduced by 20-50 times in the next 6-12 months, which will mean an exponential growth in the number of transactions”

So now Ethereum handles 3.7 billion US dollars of ETH and 61.9 billion US dollars of stable coins every day----this is far underestimated, because other tokens on ERC20 are not counted, so even with a 70% annual Based on the growth rate, the total transaction volume processed by Ethereum will be 13 trillion U.S. dollars in 10 years (much higher than Kevin’s estimate of 5 trillion U.S. dollars).

According to the calculation of Ethereum processing 8 billion transactions per day and reaching a transaction volume of 13 trillion US dollars in ten years.

*5% of the 13 trillion US dollars is from high-value DeFi transactions (airdrops, arbitrage needs to run ahead), and the transaction fee is 0.05% of the total value;

*8 billion transactions are calculated at $0.01;

*The transaction fee is stable at 5% growth;

*Assuming that the risk-free interest rate is 2% after ten years and the necessary risk compensation rate is 5%, then ETH pledgers need to obtain a long-term rate of return of 7%.

If the above conditions are met, then the fee revenue of Ethereum after 10 years will be 144.18 billion US dollars. Taking fee revenue as "dividends", we can calculate that the total value of Ethereum in the next ten years is 7.5 trillion US dollars.

Next calculate the portion that is a monetary asset. This part of the value we can roughly take as"digital silver"Come and see. When the Ethereum network becomes the operating layer of Metaverse and WEB3, ETH can replace a part of BTC as a "value store" to a certain extent and obtain its value.

Of course, although there are some preconditions, I think it can be reached by Ethereum:

1) Low inflation. At present, the inflation rate of ETH is 4.3%. When POS proves that the inflation rate will enter into dynamic deflation based on the number of pledges, it seems to be 0.43% at present, but with the increase of the pledge rate, there is a high probability that it can be stabilized at around 2% in the future (Tim Roughgarden's claim)

2) The POS of Ethereum 2.0 can withstand the test of the market.

3) For the first-mover advantage of the DeFi system and the security and decentralization of the TOP1 level.

The currency value of Bitcoin is 14.6 trillion U.S. dollars (I don’t count the specific calculations. The calculation results of foreign professional institutions are extremely conservative. If you need to add me at the end of the article to receive the article), then if ETH gets a 10% share of BTC, Then the valuation of ETH's currency value part is between 1.5 trillion US dollars.

4

Judging from past developments, the value of Ethereum is actually one that is constantly being explored and value-added. And in such an early stage of the Crypto industry, too much infrastructure has not yet been built, and it is far from entering the development of landing applications.

Our valuation of Ethereum today is limited to:

1) Consumer goods

2) Currency value

3) Capital assets

4) Value of cultural assets

Among them, the value of cultural assets cannot be given a specific valuation, because this value needs to take into account history, power, and the total wealth of the entire encrypted world (refer to "NFT, 95% bubble and 5% chance of surpassing BTC, how do we face it?》 definition of cultural assets), which is an unimaginable, exaggerated valuation.

So even if we calculate with an estimated valuation, the total market value of ETH will reach 9+X trillion US dollars in the next 10 years.

In other words, the market value of 10 trillion is only the lowest valuation of ETH in 10 years.

Then, compared with the market value of ETH at this moment, there is still 30 times the space; if you can seize the opportunity in every unpredictable plunge, how much space do you think there is in ETH in the future?