As our parachain goes live, I want to share key themes and thoughts about the future functionality of Centrifuge and the utility of CFG.

The past few months have been very busy for our engineers as we have been preparing for the parachain launch, growing Tinlake on Ethereum and building pools for Altair and Centrifuge (which will eventually replace Tinlake on Ethereum).

But we've got enough prepared now, let's talk about what's coming next. Our first focus is to scale real-world assets and turn DeFi into the best infrastructure for lending and lending against these assets.

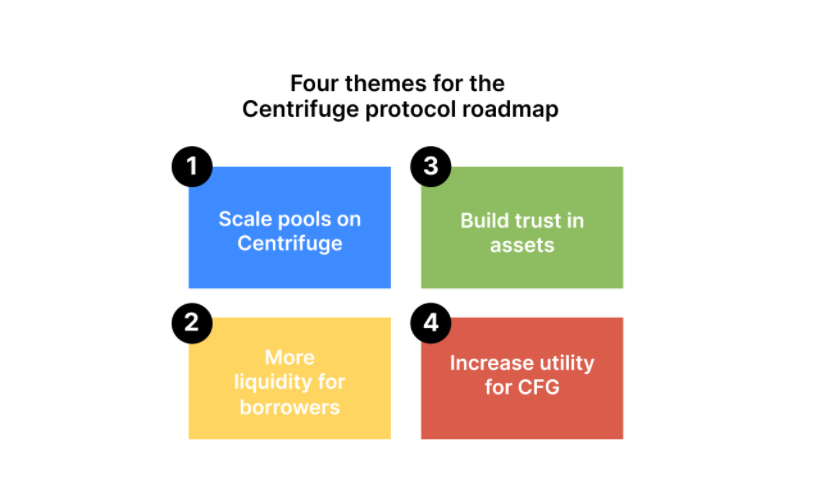

To achieve this goal, we believe that the Centrifuge community should focus on four main themes:

secondary title

1: Launch and expand real-world asset pools on the Centrifuge chain

Over the past nine months, we have built the Centrifuge pool from scratch on our chain. This release will eventually replace Tinlake smart contracts on Ethereum and includes several improvements:

Scalability: Pools on the Centrifuge chain will use a purpose-built, efficient runtime on the Centrifuge chain. This will eliminate expensive transaction fees on the Ethereum mainnet.

Multilevel: Centrifuge was first implemented inOn-chain binning, through the pool, you can now build multiple files to serve different types of investors. Binning supports different interest rate models and is very flexible.

secondary title

2: Build more liquidity for RWA in Centrifuge

Growing TVL on Centrifuge requires a focus on two things: investors who want to buy pool tokens in the protocol and issuers who can issue those tokens. The protocol should make it easier for investors to provide liquidity. In order to increase investor demand, we must consider three important topics:

Index Investing: Very few people actually want to actively manage their portfolio and invest in a personal pool. This can quickly become a very time-consuming job. An index will allow users to purchase a single token, giving them access to various pools on Centrifuge managed by CFG holders. Investors can spread their investments across many pools of funds without the hassle of managing individual investments.

Legal upgrades, KYC and onboarding: We can improve the legal structure, faster KYC providers and overall UI improvements to simplify the process of registering pools. We should strive to remove all barriers to entry for new users to Centrifuge.

secondary title

3: Build trust in assets

Build trust in real-world assets by building governance knowledge and tools for Centrifuge ecosystem members to accurately assess the risk of assets in the protocol and ensure that interest rates are set correctly.

Risk Assessment: Centrifuge Ecosystem Member "DeFi Capital Markets"Published a proposal to create a credit panel, a group within the DAO to support the risk assessment of the Centrifuge pool. The idea is to use this initiative to attract real-world credit experts to Centrifuge and help better build pools that live on the protocol.

Underwriter Token Model: The current underwriting model in traditional finance is as broken as the wider financial system. Misplaced incentives have resulted in today's big underwriters merely acting as rubber stamps, and investors don't know who to trust. We made our first design proposal on the forum to be adopted by the decentralizedunderwriter systemto incentivize the valuation and risk assessment of real-world assets. We believe this is the way to transform this antiquated industry into a new, decentralized, transparent, market-driven economy of underwriters.

4: CFG Token Utility

The launch of the pool on the Centrifuge chain is both an important milestone and a critical moment for CFG tokens. The following ideas are just a few that can enhance the utility of CFGs.

Origination fees: With the new pool, borrowers will pay protocol fees, which will go to the on-chain vault.

Staking Launch Pools: As new pools go live, token holders will be able to stake to show they are trustworthy pools. Equity serves as pool insurance in case of default, but also earns some transaction fees from the pool it insures.

Incentive rewards for protocol users: As we build a community of token holders, they can perform important functions in the protocol. The protocol could not only provide incentives to liquidity providers like Tinlake does today, but also provide incentives to other participants such as underwriters and oracles in the future.

With these four themes in mind, we are delighted that Centrifuge is the best infrastructure protocol for asset lending. This is a trillion-dollar market in traditional finance, and we are building more transparency, decentralization, and fairness into it.

Centrifuge tokenizes real-world assets, such as invoices, home mortgages, or delivered goods, and places them on the blockchain. Centrifuge enables users to obtain loans by collateralizing these assets, opening up a new avenue for financing. Centrifuge is based on the Polkadot network for speed and bridged to Ethereum for DeFi liquidity, so it can inject trillions of dollars of real-world asset value into DeFi.

Official website:

Official website:centrifuge.io

DApp Tinlake:tinlake.centrifuge.io

Telegram Subscription Channel:t.me/centrifuge

Telegram group:t.me/centrifuge_chat

Centrifuge Twitter:twitter.com/centrifuge

Altair Twitter:https://twitter.com/altair_network

Medium:medium.com/centrifuge

LinkedIn:linkedin.com/company/centrifugehq/

Tubing:youtube.com/channel/UCfNkoq7YLrr8MeSJ3a6jVcA/featured

Chinese channel

Centrifuge Chinese Twitter:https://twitter.com/CentrifugeAsia

WeChat public account ID: Centrifuge_CN

Chinese telegram group:https://t.me/centrifuge_chatCN

Chinese Telegram subscription channel:https://t.me/centrifuge_ann_cn

Chinese Medium:https://medium.com/centrifugeasia

WeChat public account: Centrifuge_CN

WeChat group: click on the "WeChat group" in the navigation bar of the official account, scan the code to join the group