All victories come from persistence in faith. Believe in the power of belief, you and I have never been disappointed here. Welcome to pay attention to the starry sky value investment, there must always be someone looking up at the starry sky.

text

Speaking of the previous article: There are many articles about the Crypto industry and project research, but most of them analyze the project from the perspective of technology and data. In fact, this kind of article can't help investors see the next trend. Therefore, in the future, Akong will make a column of "I see XXX" series on the investment targets in the Crpyto industry, and put forward the project business model and personal investment views from the perspective of industry development trends. I humbly think that this is meaningful and valuable to readers.

The search volume of ETH for "every fool knows" has broken a new high in Google.

International friends led by Canada, Australia, Singapore, the United States, and the United Kingdom have expressed their concern about the "Ethereum Merger". The more concentrated keywords are "Ethereum Merger", "Proof of Stake (POS)" and "Ethereum 2.0 Release Date".

Regarding the technical issues of "ETH2.0", various media and technicians including Ben Edgington, the developer of 2.0, have written that if necessary, you can find Akong Ling, but this is not in the scope of today's discussion, or I do not recommend Practitioners too much to understand technology.

The reason is simple, we are investors, not technicians.

The reason why investment can gain income is because the target you invest in can bring value. This value comes from improving life and promoting social progress-and technology is only the path to achieve this goal. More importantly, Most people don't understand technology either.

So for Ethereum, we should pay more attention to the value brought by 2.0, the direction of investment, and the valuation that can be achieved in the future.

The articles I have written this year have seldom explored the technical path of a certain project, and more of them are based on the essence to generate some philosophical discussions.

This is because if you don’t understand the significance of the development of a certain project or track for social progress and industry progress, then the final result will be two:

1. Pay too much attention to unsolvable technical problems and fail to see the future, resulting in missed opportunities;

2. After a 90% plunge in a bear market, there will no longer be the belief that it can rise dozens of times in a bull market.as if I were in "Everyone knows about Ethereum, how about you?

"As I said, it seems that many people know about ETH, but many people either missed investment opportunities because of Ethereum gas fees, congestion, etc.;

Few of these people who know ETH can hold ETH until now. The reason for this result is that there is no belief-------Without the belief established because of "value", naturally there is no belief that is held for a long time and ignores market fluctuations.

So next, A Kong will use the risk value investment system to talk about the merger of Ethereum and how much the valuation of Ethereum can reach. It is estimated that it will be very long to write together. This time I will separate two articles Write, one is about the significance of Ethereum 2.0, and the other is how to value Ethereum.

Of course, the point of view will be very subjective, and it is up to you whether you listen or not.

In fact, discussing Ethereum 2.0, or the significance of the merger of Ethereum, requires a higher perspective. If we only look at his own development, we may actually see problems everywhere:

For example, is it possible that the transfer of Pos to Pow will cause Ethereum miners to "rebel"?

Is there a technical loophole in the long-term bounce of ETH2.0?

Many senior figures in the industry have been pessimistic for a long time because of the "corruption" of the ETH Foundation.

So back to Ethereum.

Let’s ignore the technical problems encountered in its development, let’s think about what kind of world Crypto will become in the next 3, 5 years, or finally? If we can’t see so far, we can also think about what is the value of Crypto’s existence?

Because you understand these things, you will know the value of Ethereum and whether the current direction is right.

In the previous article, I also talked about one thing intermittently, which was a change in my content. Part of the reason is that teaching market analysis cannot lead people to make money; another part of the reason is that the crypto industry can only practice risk after the "Summer of DeFi", especially after the concepts of metaverse and web3.0 are put forward. value investment.

Because at that time everyone was "exploring the road" and "looking for a nail with a hammer", thinking about whether this can be "decentralized" and that can be "decentralized", packing a lot of privacy and rights Things, such as DAC, decentralized media, etc., etc., and then the "plates" are fried in a rotating manner, with a strong "big A style".

Are all these things really worth it? Not necessarily --- or in a long, long period of time, it is difficult to realize the value, so most of the capital cannot see the future imagination.

But after the metaverse and web3.0 came out, coupled with the gradual enrichment of the infrastructure (it cannot be said to be perfect at this time), the real imagination of the encryption world began to explode.

So, what kind of imagination space is this? An emerging, global virtual economy exhibits the characteristics of "fat users, thin platforms" endowed by decentralization and anonymity:The battle for web3.0! The world's richest man is fighting against the crypto VC giant, and the crypto world is ushering in historic changes and opportunities!》、《WEB3.0 changes the rules of the game: thin platform, fat users》

WEB3.0 changes the rules of the game: thin platform, fat users

On this basis, there will be a subversive revolution in all walks of life, and as a result, new wealth distribution will appear, and investment opportunities with unimaginable return on investment will appear.

When you understand this point, and then look back at Ethereum, Ethereum 2.0, and the merger of Ethereum, it will be very easy to understand its meaning, and you will also understand some problems that seemed very important and unsolvable before. The actual impact is not that great.

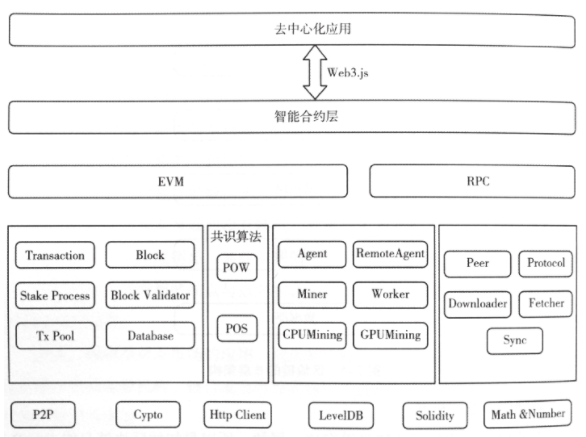

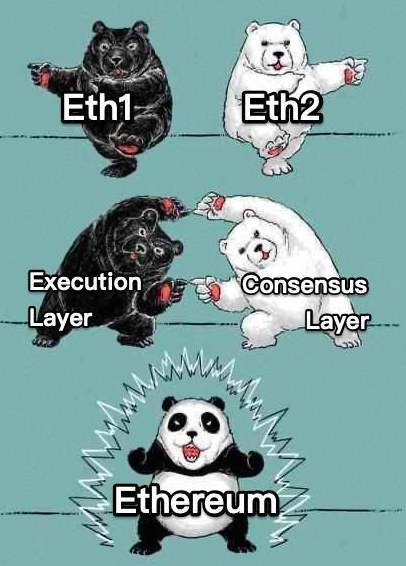

First of all, there is no Ethereum 1.0 or Ethereum 2.0 in this world anymore, and it is replaced by the execution layer (ETH1) and the consensus layer (ETH2).

The initial development route design of Ethereum is divided into four stages:

1. Frontier. The main network is online, mining and development are possible.

2. Homeland. Official version, optimized.

3. Metropolis. optimization.

4. Tranquility. Optimization, PoW to PoS.

This is the original established route of Ethereum. Its meaning is to continuously expand and optimize, and then transfer from proof of work to proof of equity. In this process, the original ETH1 will be abandoned through the difficulty bomb. Difficulty Bomb: Greatly reduce miners' income to encourage miners to switch from PoW to PoS

But the bounce of ETH2.0 all the time shows that the problems and difficulties that ETH2 needs to take into account are far beyond the imagination of developers. So that developers had to seek a "best of both worlds" approach, that is, on the basis of the Ethereum beacon chain being prepared earlier, they proposed an "early merger" proposal.

And it was officially finalized and "officially announced" at the beginning of this year: in the future, the names of ETH1 and ETH2 will be canceled, and the names of ETH execution layer and ETH consensus layer will be used instead of ETH1 and ETH2. To put it bluntly, "execution layer + consensus layer = new ether Square". And the structure of the new "Ethereum" main chain will become:

Ethereum main chain→beacon chain→shard chain.

It is enough to learn about technical issues, because learning this is enough to deal with some misunderstandings and risks of being scammed brought about by "ETH2.0 upgrade":

The first is that Ethereum 1 will not be deprecated. In the original design, it was indeed mentioned that ETH1 would be abandoned with a difficulty bomb, but in the current "consensus layer + execution layer" route, ETH1 and ETH2 are merged, and before the merger, all NFT encryption Tokens, the state history of the chain, and DeFi applications will continue to exist.

The second point is that there will be no forked coins or hard forks. Because the transfer of proof of equity has been a community consensus from the very beginning, there is no problem in holding ETH, and there is no need to upgrade ETH tokens to new ETH tokens for at least 5 years. So, now all kinds of ETH2.0 tokens, as well as the so-called testnet tokens are all scams, no, no, no...emphasized three times.

The third point is that there will be no collapse when the million-level ETH pledge expires. Many people will imagine that there will be a huge selling pressure on the expiration of the ETH pledge ----- will those who pledged when the value of 32 Ethereum is only 1WU want to make a profit?

No, the first merger will not unlock ETH, but after the merged hard fork starts (about 6-8 months), and ETH is not unlocked all at once, but unlocked in a queue, and only 1125 people can unlock it every day Unlocking, which means that the unlocking process will take one year, and only 3.8W ETH will flow to the market every day at most. will continue to improve.

Of course, there are more doubts and doubts, such as "Can giant whales change the rules of the game?", "Why did Ethereum not use POW from the beginning but upgrade?" Is it printing money?” and so on.

But in reality, these problems are minor problems.

Yes, it's actually a small problem. Because none of these problems can affect the fundamentals of Ethereum.

In 2019, when the Ethereum 2.0 upgrade was postponed again, many professionals in the market expressed their pessimistic attitude towards Ethereum. For example, comparing the total daily activity of DAPP on each public chain and comparing the price of each public chain token, the data at that time showed:

1. The total daily activity of the top ten DApps on the Ethereum chain is only 4312. On the contrary, EOS has 3 DApps with a daily activity of more than 10,000, and the number one DApp on TRON has also reached 4573.

Many bad-mouthers of Ethereum have come to the same conclusion:

text

The "old" Ethereum, due to the performance problems of the underlying system, is gradually declining and is facing a "moment of distress".

Performance, all performance. It is found that no, the attack on Ethereum is without exception focused on the high gas fee and extremely low performance of Ethereum.

But people often overlook a question: Is performance really so important? If performance is so important, why hasn't BTC's energy-inefficient network been subverted yet?

Haven't figured out what the problem is yet.

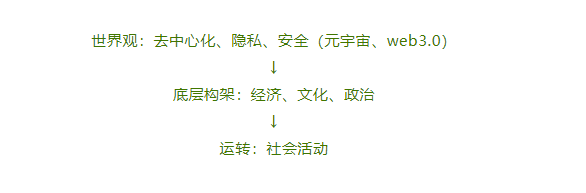

Ethereum is the largest public chain in the encrypted world. We can think of it as the strongest "country" in the world, but the meaning of the existence of this world must be to have a worldview and this worldview can make changes to the existing worldview. Subversive, and the meaning of the existence of all things in this world is to implement the "worldview and natural laws" of this world.

The core world view of the Crypto world is three: decentralization, privacy, and security.

Let me simply disassemble the system of this world:

In this system, the significance of the existence of Ethereum is to build the underlying structure and produce various "smart contracts" to realize social operation.

Then, the demand of Ethereum is stability and decentralization --- can you imagine a centralized public chain to carry this "world operation"? Another world dominated by centralization? In other words, if there is no decentralization as a "weapon", the performance and scalability that any public chain can achieve today can be comparable to the products of web2.0? This is self-destruction by giving up the core.

But contradictions are unified, and everything is relative. There is no absolute decentralization and centralization in the world. In the face of Crypto's "impossible triangle" and the complicated activities in social operations, Ethereum cannot afford a world.

Therefore, the future Crypto world must be a multi-chain world. There will be different demands for "centralization → decentralization" according to different social activities.The monetary system and the economic system must require security, decentralization, and partial privacy, and high-frequency activities such as social networking and games have greater performance requirements than security requirements. Then the public chain structure will become Ethereum + many characteristic public chains + cross-chain, each performing its own duties and operating jointly. This part of the discussion on the type of public chain, I am in "The future traveler polkdot: Unicom Wanlian's hand and a hundred times the chance!

"I have already talked about it, so I won't say more.

It is precisely because of the most mature technology and the deepest accumulation that Ethereum has transformed from an ICO platform into a financial settlement layer for DeFi, and at the same time obtained part of the currency settlement value possessed by BTC. The changes brought about by the upgrade of Ethereum have not changed its fundamentals of "decentralization". Instead:

Using PoS greatly reduces the Gas fee and the server level of the verifier; using the sharding network improves the network throughput; using eWASM reduces the difficulty of development.

These measures, without exception, will allow Ethereum to gain a lot of developers, lower barriers to entry, and higher user capacity--and this is based on the core of the fundamental purpose of "decentralization" superior.

The public chain you can imagine, who can replace Ethereum? In other words, is it still possible to use 400 billion US dollars to rebuild an Ethereum? The possibility is less than one in ten thousand.

The 2.0 upgrade that unlocks the shackles of Ethereum means that Ethereum has taken a key step towards a world-class financial settlement layer and the underlying structure of the Metaverse.