Edit: Southwind

Edit: Southwind

A little-known innovation of Crypto is DAO (Decentralized Autonomous Organization), which is a form of social organization built on blockchain and smart contracts.

Renowned investor Mark Cuban hailed The DAO as "capitalism meets progressivism." In the field of Crypto, DAO has been called "the most important innovation" and "future of work”。

DAOs essentially enable people to coordinate, invest and work at scale with economic certainty due to the immutable and open-source nature of the blockchain.

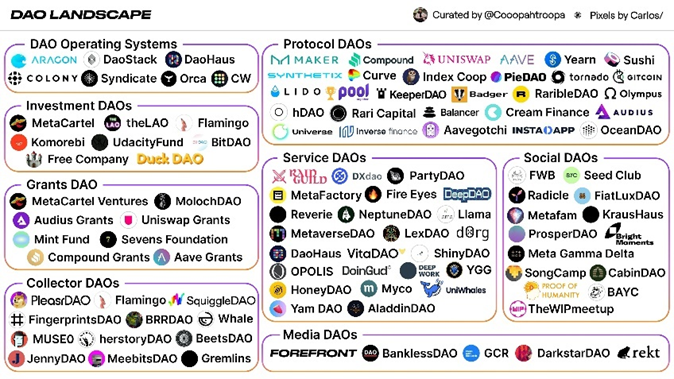

As of March 2022, about 215 DAO organizations are listed on the decentralized information analysis platform DeepDAO. These DAOs manage $9.5 billion in funds and have 500,000 active members. There are different classes of DAOs, includingDeFi DAOimage description

Source: https://coopahtroopa.mirror.xyz/_EDyn4cs9tDoOxNGZLfKL7JjLo5rGkkEfRa_a-6VEWw

This article will understand DAOs from the perspective of the historical development of the modern capitalist enterprise in order to better understand the coordination and economies of scale potential of these new social organizations.

01. The essence of the enterprise

We start with the most basic question: Why, on earth, do businesses exist? Why is the marketplace an archipelago of large corporations and SMEs, rather than billions of freelancers, independent workers and employers?

Economist Ronald Coase pointedly pointed out that firms exist to be efficient. A business is an organizational model that helps capitalists reduce the transaction costs of business activities. If CEOs had to haggle terms and conditions with an employee at every job, they would be spending all their time haggling and micromanaging instead of starting a business. An effective solution is to create a hierarchical corporate structure with employees on long-term contracts with the company so they can spend their time on management responsibilities.

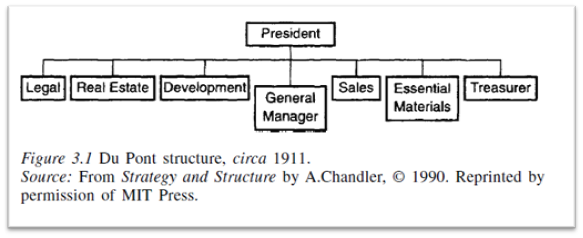

image description

Above: U-shaped structure of the enterprise

This seems like a very commonsense insight today. However, it is difficult to describe how groundbreaking Ronald Coase's interpretation was at the time. Before Ronald Coase, economists viewed the firm as a static black box that existed only in a market economy. In the post-Ronald Coase era, the analytical thinking of enterprises has evolved into a complex management structure that balances transaction costs.

02. Innovation from U-shaped to M-shaped enterprises

Ronald Coase's theory of the firm was not without criticism. Theoretically, the idea that a high-level central planner in a large corporation can oversee every aspect of the corporation and be able to immediately decide for each task whether to hire another employee in-house or to outsource it to the market is unrealistic.

Ronald Coase's explanation is imbued with neoclassical economic thought, in which business owners are assumed to be rational calculators (rational economic agents) who respond rigorously to market incentives and perform rapid cost-benefit analyze. (Editor's note: Homo economicus is an economic term that assumes that humans are always rational and self-interested, and pursue their subjective goals optimally.)

In the 20th century, Ronald Coase's theory of the firm was also overturned by real-world experience. As globalization has made the world's economies increasingly interconnected, businesses have sought to become increasingly complex by diversifying into markets far from their home base.

This centralized U-shaped structure is no longer sufficient to manage the growing range of complex management decisions. The weakness of the traditional U-shaped company stems from its concentration of decision-making power in the hands of a few top leaders, which makes the company's development process too slow and awkward. It may be easy to manage a company in the domestic market, but in different regions, due to different market conditions, supply chains, cultural phenomena, etc., the U-shaped structure is too difficult to manage a company.

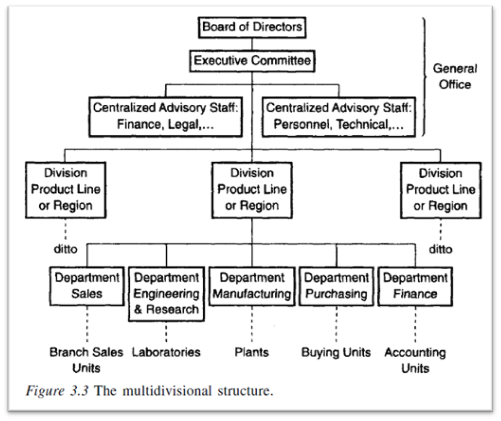

image description

Above: Enterprise M-shaped structure

The impact of M-shaped enterprise innovation is everywhere. Today's businesses recruit dedicated product, marketing and sales teams in each region of operation, rather than centralizing them at headquarters.

1) Decentralized decision-making of M-shaped enterprises

Why decentralize your business? Building on Ronald Coase's insights, later economists argued that there are two key drivers of the structural decentralization of M-shaped firms. The first driver was to try to address the knowledge constraints faced by top management when planning.

In foreign markets where competitive conditions, supply chains, laws, and consumer sociocultural preferences vary widely, large firms face serious intellectual complexities in order to compete effectively. M-shaped firms allow department managers to make day-to-day decisions efficiently because they have better local knowledge, while upper management focuses on strategy.

General Motors, for example, owed much of its success in the 20th century to this organizational model of separate divisions, which allowed lower and middle managers complete autonomy. During the crisis of 1920-1921, when GM experienced a 75 percent sales drop and record low production, longtime president Alfred Sloan began pursuing radical decentralization of the organization. Sloan stresses that line managers must be strictly "independent and able to accept or reject (senior management's) suggestions". In his blueprint he wrote:

"The general manager formulates all the policies of his department, subject only to the executive control of the president. The responsibility of each department head is independent, and he should exert his full initiative and ability to develop his particular business to the maximum extent, and to Take full responsibility for success or failure.”

The innovation of the M-shaped structure brought success to General Motors. The company leapfrogged its arch-rival, Ford, to set the standard blueprint for all future capitalist corporations.

2) Incentive work

The second driver of M-shaped firms revolves around issues of incentives. When compensation is tied to salary, employees in U-shaped companies have little incentive to work harder or be entrepreneurial in their own line of work. From a financial accounting point of view, such companies have idle human capital assets. Profits are not optimized.

The innovation of the M-firm lies in the improved alignment of incentives and rewards with lower management levels, allowing the firm to leverage this dispersed knowledge throughout the organization. It enables lower management to exercise their judgment and act as local "entrepreneurs" within the company, developing new sub-product variants, managing procedures, and adapting existing production methods to better suit specific The economic conditions of the market.

Of course, executives haven't taken a completely hands-off approach; some rules are still dictated by higher ups. But the point is that M-shaped structures allow for a range of decentralized adjustments and changes that are not possible in traditional U-shaped businesses.

03. Introduce DAO

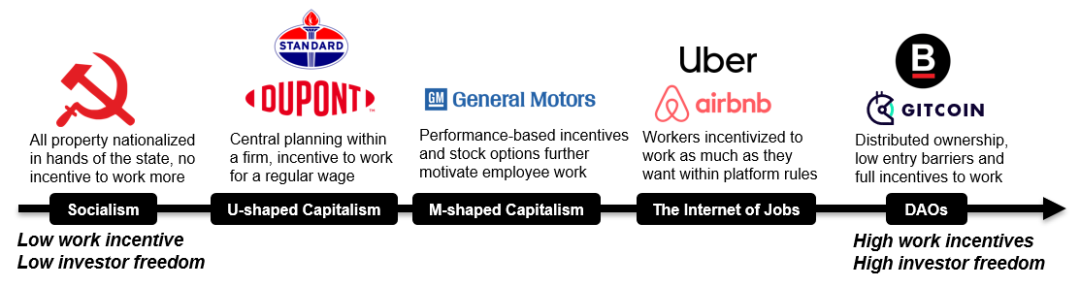

Readers familiar with DAOs probably already know how this is going. Backed by the blockchain, DAOs are the next iteration of the ongoing decentralization of the modern capitalist enterprise.

M-shaped corporations, like their U-shaped predecessors, are destined to be disrupted by DAOs. In a way, the internet and smartphones have started this process. In the so-called Gig Economy, companies such as Uber, Airbnb and TaskRabbit connect buyers and sellers in a decentralized way, unencumbered by strict hierarchical structures and long-term contracts.

What distinguishes DAOs from all previous forms of organization is their flat, decentralized structure and absence of central planning. DAO organizations share a treasury and raise equity capital by issuing their own tokens, attracting anonymous investors and employees who believe in their mission.

The transparent nature of the blockchain means that all DAO organization activities are managed on-chain and its smart contract code can be audited by anyone, allowing investors and employees greater transparency into the inner workings of the organization .

In traditional businesses, ownership is centralized, and key strategic decisions about hiring or expansion are made entirely in the privacy of top management. The M-corporation alleviates this problem to some extent, but it is still fundamentally a centralized structure.

The DAO's decentralized ownership allows anyone holding its native tokens to actively vote by connecting their wallets to a DAO voting platform such as Snapshot.

DAO skeptics argue that not all members will actively vote due to voter fatigue. There is some truth to this, but it largely ignores the relative improvements that DAOs bring about.

Even if not all members vote, the fact that the decisions of a DAO organization can be publicly accessed and scrutinized by more active members is a huge improvement, while the decisions of traditional companies are kept secret.

A good analogy for this can be found in the transition from political monarchies to liberal democracies in the 20th and 21st centuries. Peer-reviewed research in political science has found that most voters today are politically apathetic, yet political democracy allows at least a few active activists, journalists, and concerned citizens to dissent and raise awareness on selected issues.

Is this less ideal than full voter participation? indeed so. But is it a marked improvement over absolute monarchies? Absolutely.

1) Solve the incentive problem

The economic miracle of the DAO is how it links the incentives between work and reward so well. Recall that M-Corporations arose to allow businesses to expand aggressively while reducing the need for top management oversight.

This management philosophy was pioneered by Arthur Rock, a renowned venture capitalist known for his early investments in technology companies such as Fairchild, Intel and Apple Computers. Drawing on his experience at Fairchild Semiconductor in the 1950s, Rock pioneered the private limited partnership model, offering stock options to top executives and junior employees that has become synonymous with Silicon Valley stock culture.

This is a far cry from the days when only founders and venture capitalists had equity.

Locke is very clear that motivation is very important. For a company to succeed, key employees need to be motivated beyond salary. Through Fairchild, Locke secured stock options for scientists and engineers critical to the company's success. This "liberated capital" model provides strong incentives for workers and unleashes human talent.

DAOs extend this economic logic to every employee. Like gig economy workers, most DAOs offer flexible "pay for work" models. However, unlike gig economy workers, DAO workers are paid using native tokens (equity). Thus, DAOs offer two benefits to their workers: flexibility and stakeholders. This gives them a further vested interest in driving the growth of the DAO organization.

2) Where will DAO go?

Common criticisms of DAOs center on the fact that not all forms of organization need hyper-decentralized structures. This is true for DAOs that have a single mission and easily achieve economies of scale.

However, this is less a criticism of the DAO itself than a question of product market fit. Despite their massive innovations, firms in industries such as metals, tobacco, and sugar did not immediately adopt M-shaped firms because their expansion was not stalled by the same types of coordination problems.

Another common criticism points to DAOs' low barriers to participation that may pose scalability problems. In a large DAO where decisions need to be made across different areas of expertise, not everyone has the knowledge or motivation to make the right decisions.

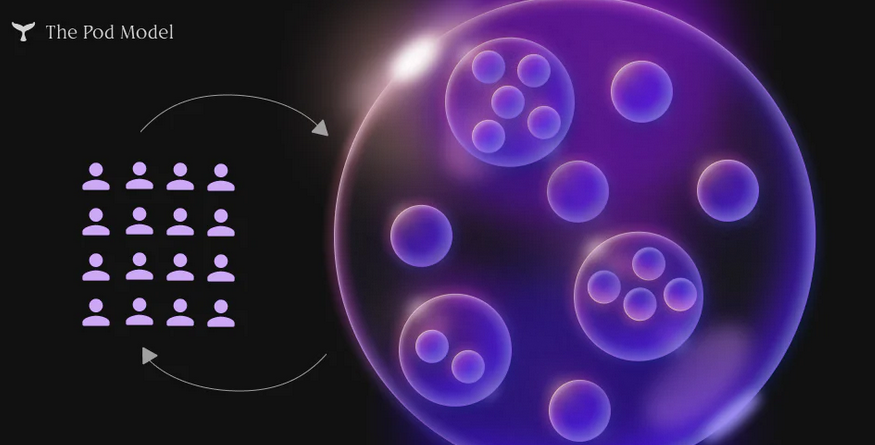

image description

Source: https://orca.mirror.xyz/Y2xvPmB4cJH51srGqY6Mm_g38lV-7cwvtyDePnyzfAE

A prominent example of this can be seen in GitconDAO with 25,500 members. To expand the scale of decentralized decision-making, Gitcoin adopts a governance system of community representatives (called Stewards), and community members vote on these representatives (ie, Stewards), and these representatives make decisions on behalf of community members. Stewards' responsibilities include defining organizational processes, community building, fundraising, anti-fraud governance, and product strategy.

DAOs are still in their infancy, but the innovations in blockchain technology that underpin them promise to solve coordination problems on an unprecedented scale.