first level title

Liquidity mining can involve considerable risk. This article is for educational purposes only and should not be considered financial advice. Please consider your personal risk profile before making any investment decisions.

Table of contents

Table of contents

Three Simple Liquidity Mining Methods

Liquidity Provider (AMM Protocol)

Money Markets (Lending Protocols)

Validator Staking (Proof of Stake Protocol)

review

references

references

One of the most exciting opportunities DeFi offers has to be yield farming. Yield mining is a term used to loosely describe strategies for earning passive income from one’s crypto assets. The easiest way to conceptualize this is to imagine having a high interest savings account at your traditional bank, or perhaps a bond that pays dividends, but that only scratches the surface when liquidity mining is involved.

The mining metaphor in liquidity mining refers to the initial deposit of crypto assets and the eventual harvest of rewards, similar to the model practiced by farmers and agronomists. This article will discuss several specific ways to generate yield on cryptoassets, and more broadly clarify our understanding of the field of yield farming.

In traditional finance, an instrument that yields 5-15% to the asset holder is considered high yielding. Savings accounts at commercial banks typically offer less than 1% APY (annual yield on deposits) for fiat currency deposits. On the other hand, large DeFi platforms like Celsius offer higher yields for fiat stablecoins and other highly liquid crypto assets such as Bitcoin, Ethereum, Paxos Gold, etc.

This could leave liquidity miners with less return on their assets than expected, and further price drops as investors pull their tokens out of sale. These “carpet” or Ponzi protocols are often similarly designed to trap capital through high APY traps before the creators of the protocols start selling their coins or tokens to unsuspecting investors and disappear entirely. High double-digit and especially triple-digit APY numbers should certainly draw additional scrutiny.

first level title

Three Simple Liquidity Mining Methods

Liquidity Provider (AMM Protocol)

The first way to generate yield from a crypto asset is by depositing the asset into a liquidity pool. For decentralized exchanges, collecting funds into liquidity pools allows transactions to occur quickly and easily at any time. That is, these funds are collectively used to process all transactions that occur on these protocols.

Liquidity is absolutely essential for an automated market maker (AMM). AMMs offer permissionless transactions using funds from LPs. Tokens for Liquidity Providers (LPs) are issued when funds are deposited to track and verify contributions and calculate a proportional share of the pool to distribute earnings.

For example, on Uniswap v2, a pair of cryptoassets are deposited in equal amounts in exchange for corresponding LP tokens. For example, $500 in USD currency and $500 in Ethereum can be deposited into a liquidity pool smart contract in exchange for USDC/ETH LP-UNI-V2 tokens. Since Uniswap is an Ethereum dApp, the LP tokens created will of course also be specific to the Ethereum chain.

Using the above example, let us assume that USDC/ETH LP-UNI-V2 tokens worth $1,000 account for 0.01% of the entire Uniswap liquidity pool, which means that the entire liquidity pool contains even $10,000,000 worth of assets (5 million USDC in USD and ETH in USD 5 million)). For simplicity, these figures are hypothetical.

image description

USDC-ETH LP token holders are rewarded with UNI tokens from their share of protocol fees when users swap USDC for ETH, and vice versa.

If $10 million worth of USDC and ETH are traded on Uniswap every day with a transaction fee of 0.3%, liquidity providers will share in rewards of $30,000 per day. If we continue with the example above, where a 0.01% reward would net the LP $0.03 per day, or roughly $11 per year. If one speculates that the price of the UNI token will appreciate over time in the future, the rewards could be even greater.

Of course, one can expect higher yields by providing more liquidity. Additionally, providing liquidity to smaller pools means a larger share of transaction fees, although smaller pools are more likely to become illiquid or prone to security breaches. Therefore, due diligence must be done on financial security issues before becoming a liquidity provider.

Additionally, the cost of using Ethereum can be quite high, as depositing both assets into the LP contract requires gas fees. As a result, many are turning to decentralized exchanges like PancakeSwap, QuickSwap, and SundaeSwap, which offer rewards to liquidity providers, but with lower fees compared to Ethereum because they operate on the Binance, Polygon, and Cardano blockchains. run on.

It should be noted that many liquidity pools reward LP token holders with smaller market cap tokens such as CAKE or UNI. While these assets are widely held and traded, inflation rates should be considered before making any long-term investment decisions. Critics warn that if demand growth fails to materialize, the liquidity of any given protocol could be severely damaged.

Money Markets (Lending Protocols)

Cryptocurrency marketplaces or lending platforms also offer crypto users the opportunity to generate income from their holdings. For example, Celsius, Aave, and Compound offer crypto loans to depositors, using overcollateralization to manage counterparty risk. This means, for example, that borrowers, in order to obtain a bitcoin loan, must provide more collateral than they received in the loan.

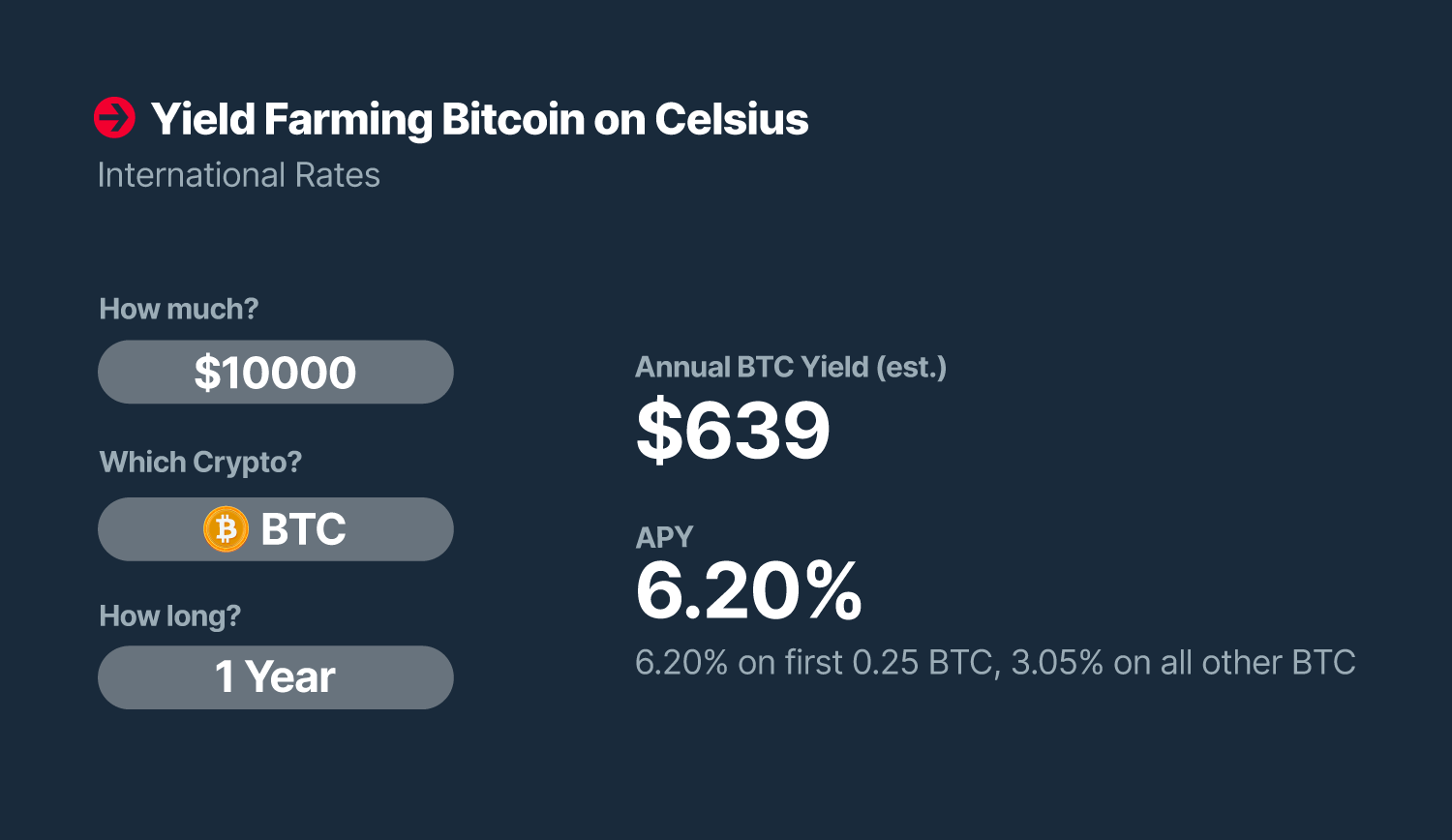

By funding borrowers, Celsius users can earn yield on the assets they deposit, or choose to receive CEL tokens for a slightly more favorable interest rate. Celsius offers depositors a 6.2% annual interest rate on their first 0.25 BTC, rewarded from fees charged to borrowers on the same platform.

image description

Lending Bitcoin for liquidity mining, users earn over $600 per year for every $10,000 of BTC they deposit (at the time of publication).

Essentially, this enables users to continue to allow their assets to generate yield while still having the option to gain liquidity without the taxable event of selling assets for cash flow. By taking advantage of yield-generating opportunities in the cryptocurrency market, liquidity miners can generate more passive income with lower barriers to entry, as interest rates on DeFi platforms are much higher than those in traditional finance.

Validator Staking (Proof of Stake Protocol)

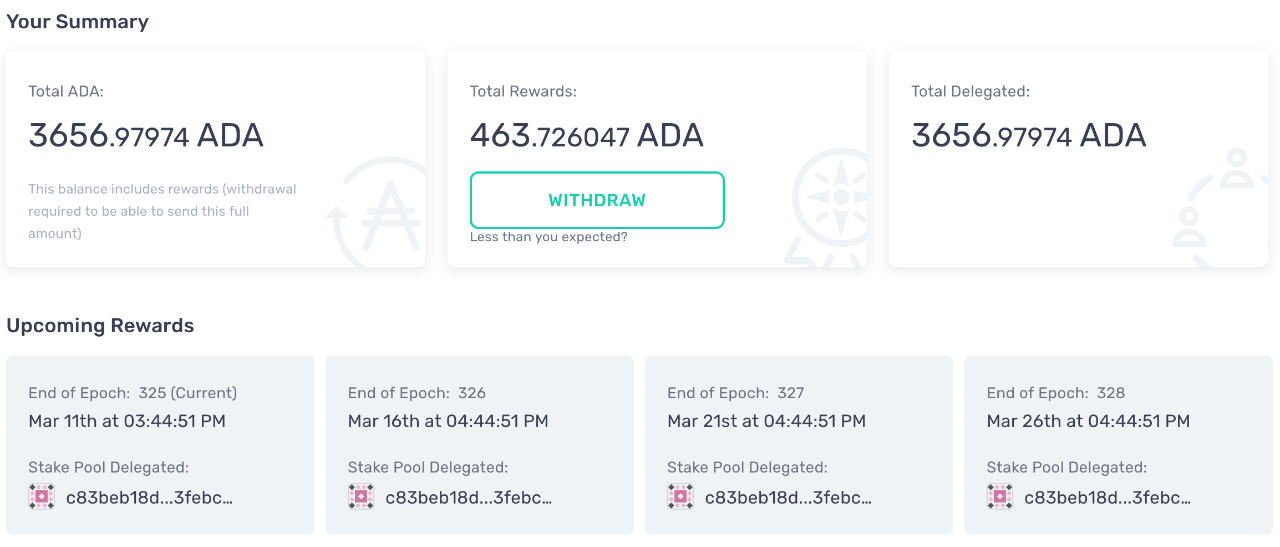

For example, staking ADA on Cardano involves joining a staking pool that is always participating in block validation and is not fully saturated with stakers. After putting funds into the staking pool, users will be rewarded with ADA tokens every period (5 days), estimated to return 4.5% - 6% APY of their deposit.

image description

Example of staking Cardano's native cryptocurrency ADA in Yoroi Light Wallet.

Tezos also offers a 6% APY staking reward for running your own staking node, although this might be a hassle for the average user. Centralized exchanges like Coinbase allow their users to stake funds through their own validators, stakers get 4-5% APY, and Coinbase keeps the rest for the technical heavy lifting. Funds can be pledged or unstaked at will, and given the liquidity of this arrangement, the yield is extremely attractive.

Ethereum 2.0, recently renamed ETH's "consensus layer upgrade," also allows users to stake funds and even run their own validators once the upgrade is ready to go live. Stakers can earn rewards based on several variables for validating transactions. To run a full validator node requires 32 staked ETH, and those with less ETH need to stake a larger pool.

Unlike the previously mentioned staking options, staked ETH cannot be unstaked for the time being, and users wait indefinitely for network upgrades to go live before they can access their initial deposits, let alone the staked earnings.

first level title

Liquidity Mining Risk

As with using any form of cryptocurrency, yield farming has inherent risks. Nonetheless, it is important to understand the specific hazards that need to be prepared before doing any liquidity mining.

There is always a risk of volatility when using non-stablecoin cryptoassets for liquidity mining. Those looking for crypto yields can easily be liquidated and lose money if their assets suddenly lose value and they are unable to add collateral in the case of DeFi lending.

Impermanent losses are another concern, as price fluctuations between paired assets can move in the opposite direction to when the cryptocurrency was initially deposited. However, this only applies to liquidity providers, as impermanent losses do not apply to staking or currency markets.

Inflationary tokenomics is another concern for liquidity miners. After all, if the rewards for liquidity providers are too generous, the spot price of the token could exceed demand, putting downward pressure on the price, creating negative sentiment around the token and driving away liquidity, making it unattractive over time. more people.

“Countries such as El Salvador, Switzerland, Taiwan, Portugal, and Singapore have made it clear that crypto assets will be welcome, embracing innovators and encouraging economic dynamism with friendly tax regulations.”

Rug pulls, pump and dumps, and outright fraud also pose a threat to those seeking to maximize returns through liquidity mining. Depositing cryptoassets to a protocol usually means pairing a rug pull token with Ethereum as a liquidity provider.

Once the spot price of a rug pull token reaches a certain threshold, rug pullers sell their tokens and disappear from the protocol. Liquidity providers may find that they have been earning high yields denominated in devalued tokens. Other examples include yields being locked and unavailable until an indeterminate date, exposing liquidity miners to devastating losses.

In contrast, other jurisdictions either strictly regulate the ownership of exchanges or crypto assets, or fail to provide investors with the sufficient clarity needed to participate meaningfully in the space. Nonetheless, positive regulatory developments have been a general trend across the globe, with places that initially took a defensive stance on cryptocurrencies, such as Russia and Thailand, recently announcing steps to regulate ownership and trading of the asset class.

first level title

Regardless of the method used, yield mining is a complex and risky endeavor. Nonetheless, the amount of value locked in DeFi contracts continues to trend upwards over time. When given the opportunity to put money to work, crypto users seem eager to supplement their lifestyles with passive income. The decision to engage in liquidity mining involves considerable risk and is at the discretion of each individual. As such, this article should be considered educational and by no means an endorsement of yield farming as an investment strategy.

Related Reading

Baydakova, A. (2022 21 Feb.). Russian government introduces crypto bill to parliament over central bank objections. CoinDesk.

Reuters Staff. (2022 25 Jan.). Thailand to regulate use of digital assets as payments. Reuters.

Vermaak, W. (2021). What is yield farming? CoinMarketCap.