Compilation of the original text: Nanfeng

Compilation of the original text: Nanfeng

ETH is the world's first "assetsassetsalso,

also,therefore,therefore,Owning some ETH allows you to interact with the largest ecosystem of Dapps (Decentralized Applications) in existence.ETH is one of the main forms of money in the crypto economy.

ETH is very useful, and more and more people are starting to hold ETH because they believe that the usefulness of this asset has just begun.

However, many of the current yield opportunities mean that you have to part with your ETH temporarily, or if things go badly, lose your ETH permanently.

impermanent lossimpermanent loss"(impermanent loss), and if you withdraw liquidity when you encounter impermanent loss, then you may lose some ETH.

Or, maybe you bought the bottom of a new NFT collectible, but then the bottom price of that NFT item keeps dropping over time. This can indeed happen! Buying high and selling low will cost you in ETH!

So if your investment thesis is "long ETH", you want to hoard ETH, and you're interested in putting your ETH to work to earn more ETH, but you want to avoid more complexity and high risk strategy. So where should you go to find this income opportunity?

Please see belowTop 5 Opportunities to Earn ETH Yield Directly Using ETH with DeFi.

1. Vesper’s ETH Grow Pools

Estimated APY: 2.31%

what you need to know

Vesper is a platform that provides user-friendly DeFi products, and its first product is called Grow Pools.

Vesper's Grow Pools collect user deposits, and then put these deposits into income strategies (specifically, put user deposits into third-party DeFi products, which are mainly used for lending and income farming of various third-party DeFi projects), and the generated The interest income will be used to "repurchase more deposit assets in the pool and convert them into passive returns for pool participants." Both conservative and aggressive strategies are optional.

secondary title

How to join Vesper's ETH Grow Pools?

Go to app.vesper.finance/eth/pools and connect your wallet.

Scroll down the page, select the "conservative" or "aggressive" ETH Grow Pool and click "Deposit". Note: ETH Grow Pool with an aggressive strategy is an opportunity to have a higher 2.31% APY yield.

Enter the amount of ETH you want to deposit and click "Deposit" again.

Confirm the transaction on your wallet.

first level title

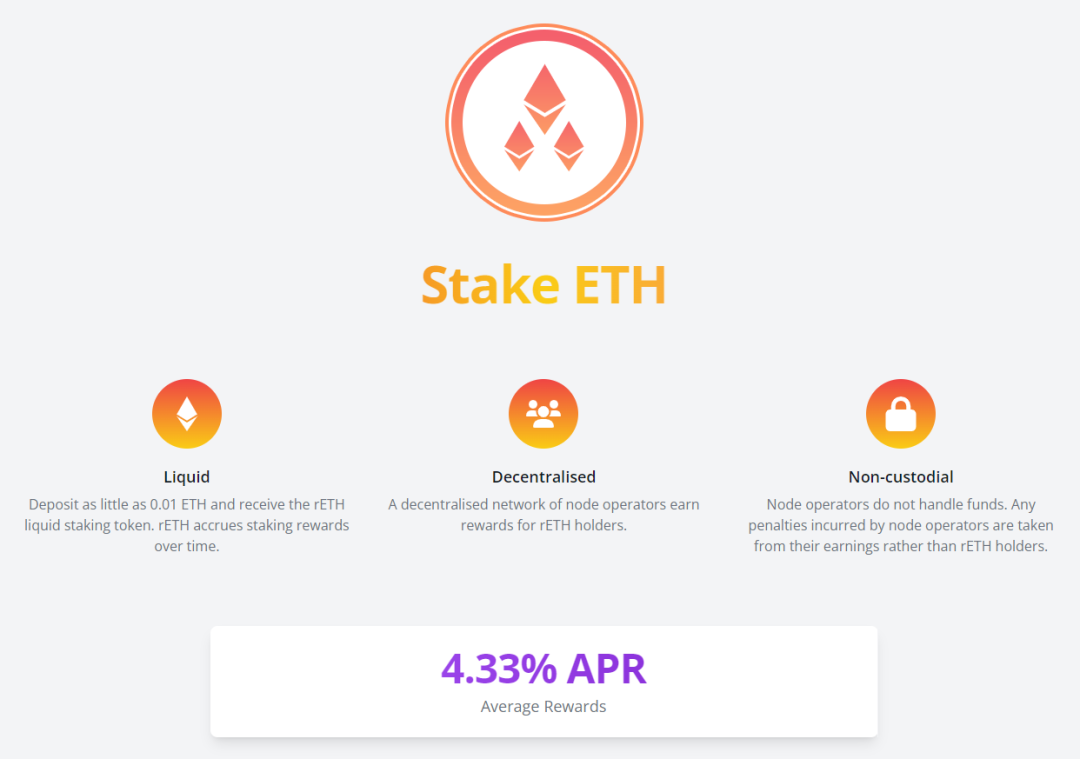

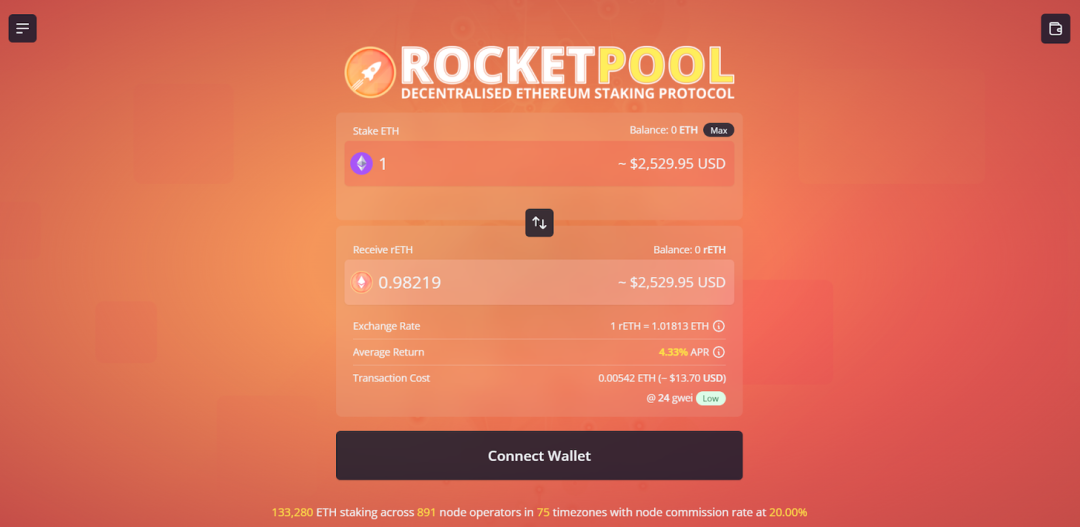

2. Liquidity staking (rETH) using Rocket Pool

secondary title

what you need to know

Staking as a ServiceStaking as a Service(DSaaS) agreement.

The project allows node operators to stake as little as 16 ETH, while users of its liquidity staking service can stake as little as 0.01 ETH.

secondary title

How to stake ETH with Rocket Pool?

Go to stake.rocketpool.net and connect your wallet.

Enter the amount of ETH you want to stake.

Click "Stake" to complete the deposit transaction on your wallet.

first level title

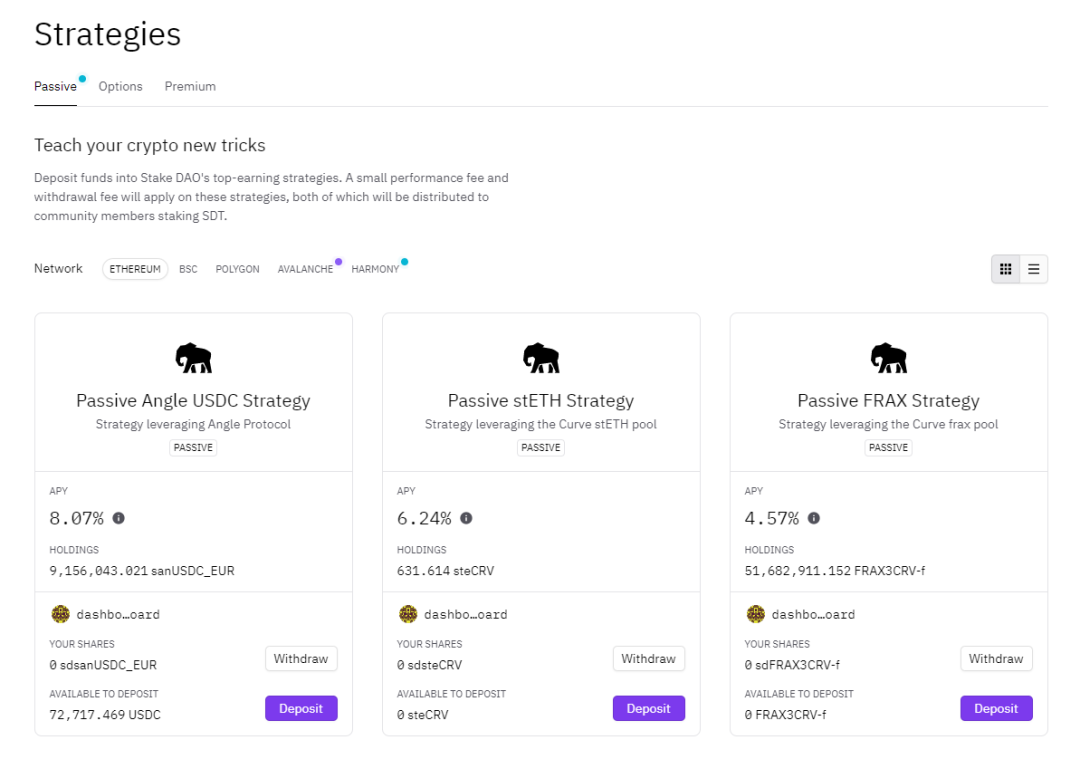

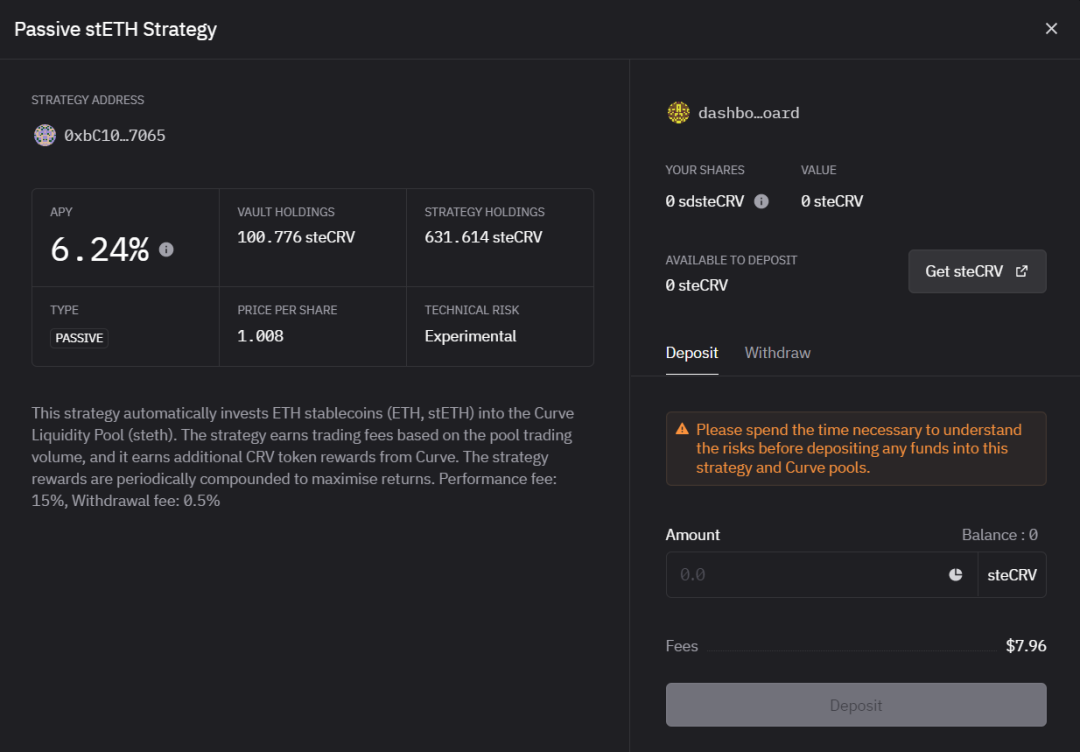

3. Passive stETH strategy of Stake DAO

secondary title

what you need to know

Stake DAO is a non-custodial platform that offers curated DeFi yield strategies.

The platform's Passive Strategies collectionCurve FinanceLP Tokens (liquidity provider tokens) and put them into other DeFi protocols (such as Convex Finance), so as to earn automatic income for depositors. This means that if users want to participate in the strategy of Stake DAO, they need to first go to Curve Finance to deposit assets and obtain corresponding LP Tokens, and then deposit the obtained Curve LP Tokens into Stake DAO.

secondary title

How to participate in the Passive stETH strategy of Stake DAO?

Go to the Cuirv stETH pool (curve.fi/steth/deposit), connect your wallet, enter the amount of ETH you want to deposit, and get the corresponding steCRV LP Tokens.

Then go to stakedao.org/dashboard/strategies and connect your wallet.

Click the "Passive stETH Strategy" icon on the page, and enter the amount of steCRV LP Tokens you want to deposit in the pop-up page.

Click Approve the transaction, followed by a final deposit transaction and you're done.

first level title

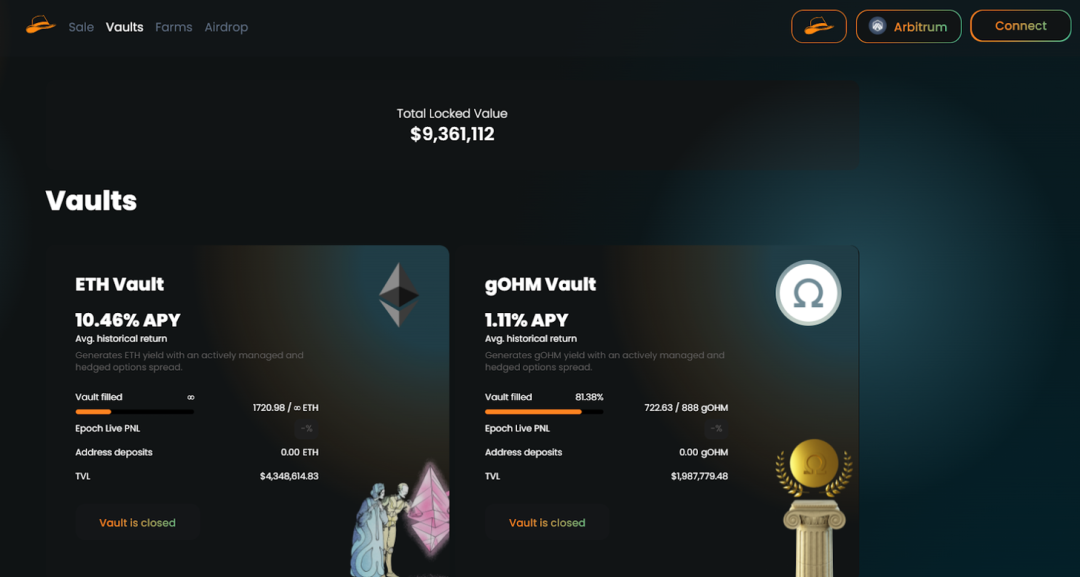

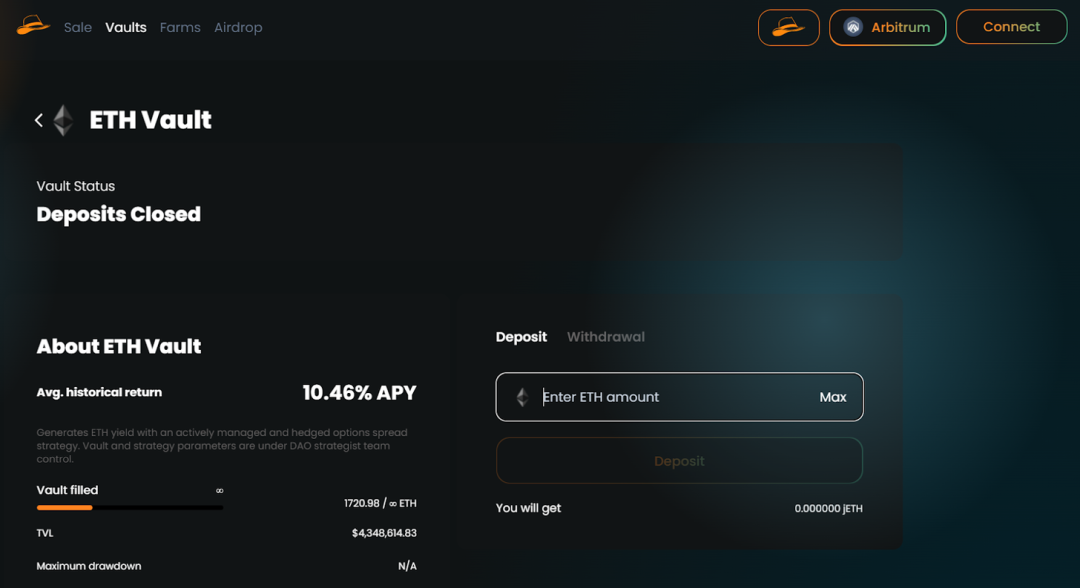

4. ETH Vault by Jones DAO

secondary title

what you need to know

Jones DAO is aArbitrumThe income and liquidity agreement of the network is centered on options trading.

The Jones DAO protocol simplifies the process of investing in products on Dopex, an options exchange built on Arbitrum. Jones DAO achieves this through its Jones Vaults (vaults), which are actively managed by the Jones DAO team and designed to generate yield through option strategies.

secondary title

How to join Jones DAO's ETH Vault?

When deposits are turned on...

bridgebridge"Transfer ETH to the Arbitrum network;

Go to jonesdao.io/vaults/ETH and connect your wallet;

Enter the amount of ETH you want to deposit;

Execute this deposit transaction, after which you will receive jETH representing your assets in that vault.

first level title

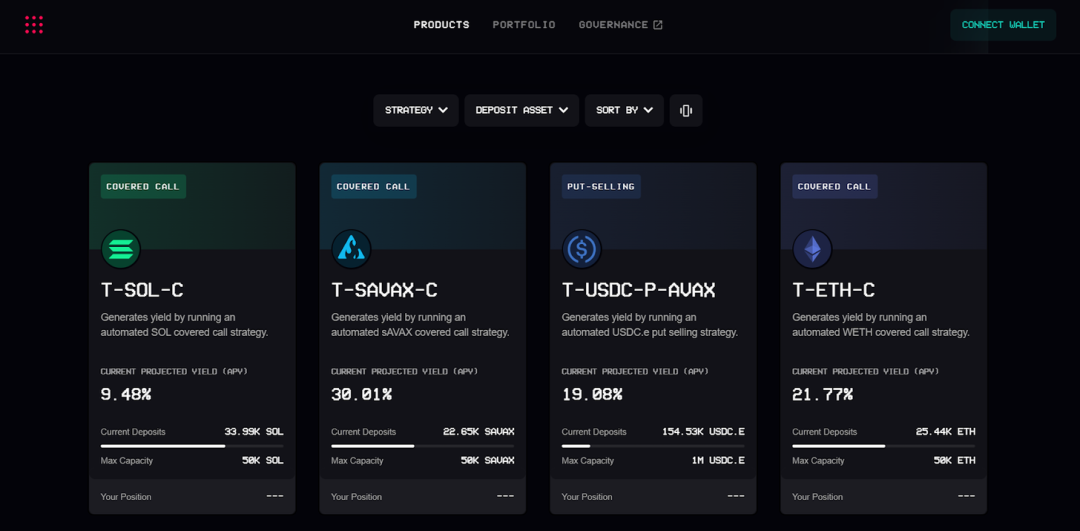

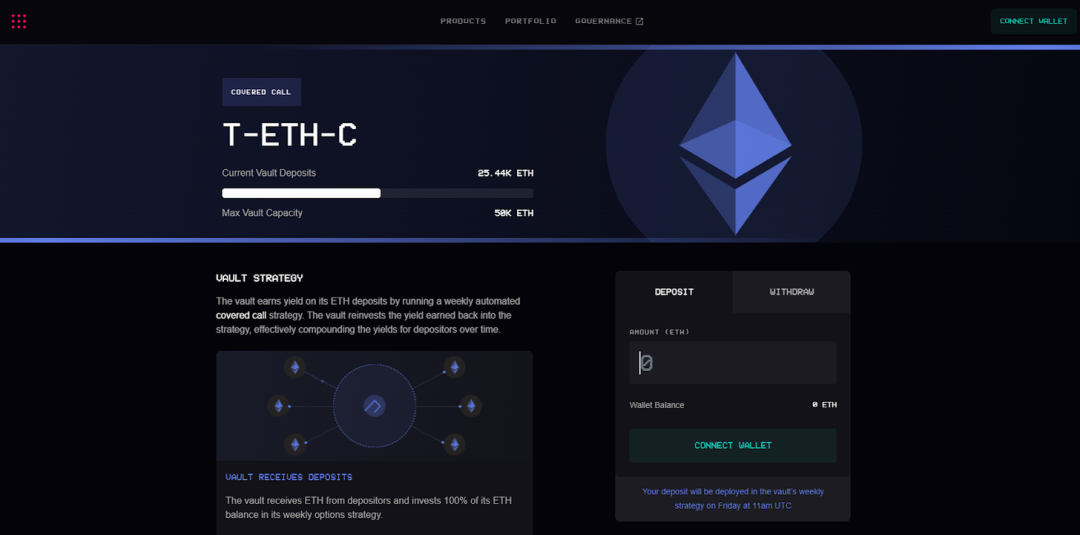

5. Ribbon's ETH Covered Call Vault

secondary title

what you need to know

Ribbon Finance is a decentralized protocol for creating crypto structured products such as Theta Vaults that execute automated option selling strategies.

Ribbon's ETH Covered Call Vault is a strategy of automatically selling call options on a weekly basis, that is, creating ETH call options on the DeFi option protocol Opyn (at this time, the option token oTokens will be obtained), and then through the decentralized token auction platform Gnosis Auctions sell oTokens to market makers, thereby generating revenue.

secondary title

How to join ETH Covered Call Vault?

Go to app.ribbon.finance/v2/theta-vault/T-ETH-C and connect your wallet;

Enter the amount of ETH you want to contribute, then click "Preview Deposit", review the key information, and click "Deposit Now".

Complete the transaction in your wallet.

read

readSummarize

Summarize

ETH is arguably the most useful currency in the crypto economy.

The future looks very bright, so it would be great if you could maintain direct exposure to ETH while earning more ETH.

The ETH income opportunities described above are not without risk, although their risk-adjusted returns are attractive, especially if you think the world will increasingly accept ETH and you want to earn as much as possible ETH Earnings!