Original title: Flow: The Normie Blockchain

Original author: Packy McCormick, consultant of A16z, founder of Not Boring Capital

Happy Monday, friends!

My favorite thing to do is to write about things that seem to be on the same page...but that turn out to be completely wrong. And that’s exactly what this article is about today.

Flow Chain, the blockchain first developed by Dapper Labs, has been criticized by many in the crypto world as being too centralized or corporatized. While that was true at first, the subsequent developments and the dynamics behind them are more complex and fascinating. What Dapper is building is a maximally decentralized platform that can support billions of users to create a complex world on the chain, even if it means that the Flow chain needs to make some difficult trade-offs in advance.

This article is a paid article for deep mining of the Flow chain. Like Solana and Braintrust, I think there is enough interest in the Flow chain to warrant a long Monday post. Although this article is paid to write, the opinions expressed in this article are true - there is no perfect blockchain; it is all about making the right trade-offs for the target users and usage scenarios. The future is multi-chain.

herehereDisclaimer:

Disclaimer:This article is not investment advice. I personally hold a small amount of FLOW. It is my practice to only write in-depth articles on companies or properties that I would personally invest in - however, this article is for entertainment and education purposes only. Readers who have looked at my portfolio over the past few months will know how frustrating it must be to invest in a property based solely on the fact that I have written about it. In addition, this article presents an apparent conflict of interest. So be sure to do your own research if you want to invest.

Let's start the journey of the Flow chain.

Flow: Progressive Decentralization of Mainstream Blockchain

TL;DR

This article is the longest one ever written by Not Boring, because let's do a quick summary:

Dapper Labs, the team behind CryptoKitties and NBA Top Shot, developedFlow chain, which aims to solve the expansion problem of Ethereum and support the open world.

The encryption community often thinks that Flow is too centralized and does not recognize it.

Flow wants to access the next billion users, not compete for native crypto users.

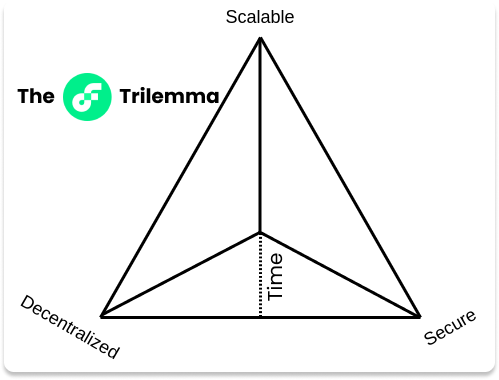

It’s a bet on time to solve the impossible triangle of decentralization, security, and scalability.

Since its launch in the second half of 2020, it has been gradually decentralized in all dimensions.

After acquiring Brud, it will gain DAO capabilities and increase investment in young people.

The Flow ecology is gradually rising, and this summer will turn around gorgeously.

first level title

Physical properties plus digital power

The encrypted world gives digital assets physical attributes and digital power.

Bitcoin is equivalent to gold, but it is more convenient to store and transfer.

DeFi is equivalent to the financial system, but removes the medium and adds programmability and composability.

NFT is similar to physical items, but has lower storage costs, and has programmability and composability.

DAOs are similar to limited liability companies, but are more flexible and fast, with stakeholder ownership and control.

In a few recent articles, I've explained why cryptography amounts to a back-to-basics. existDAO's DAOIn one article, I wrote, "I think stakeholder ownership is the natural state of things, it's just that we don't have the necessary technology or model to coordinate governance and ownership so widely distributed." Complacent in comparison.

Facts have proved that my knowledge is better thanRoham GharegozlouYears late. In December 2018, theDapper LabsThe CEO of , gave a TED talk titled: Life is heterogeneous: Ownership, assets, and our evolution.

In his speech, he went through the history of ownership, collections and currencies to emphasize the status of NFT (non-fungible tokens) in the grand narrative of human history. He even used Lego bricks to describe the concept of composability, a metaphor that didn't become the default until much later. At the end of his speech, he stated:

Blockchain is creating a world of digital assets and open source software that is as real and sustainable as the world of objects, and it can interact like Lego bricks. But don’t get me wrong, the barriers to blockchain adoption are still very high. Speed, scalability, user experience, and cost will all need to change dramatically before mainstream users will consider using these tools in their everyday lives. But if you look around, the unimaginable is happening.

For the first time in history, we have the reason and the ability to dismantle the feudal castles that control our experience on the Internet; for the first time in history, we can walk towards true digital freedom; in the hands of an ordinary person.

This statement is profoundly visionary. When Roham made this speech, it was a full two years before 99.99% of people first heard the word "NFT". Since then, many people have used Roham's concept to explain this new world.

Today, the company Roham co-founded, Dapper Labs, and its blockchainFlow chainWant to give the entire digital world the physical attributes of digital power. The Flow chain describes itself as an "open world blockchain". The Lego bricks it can be used to combine include encryption technology, Defi, NFT and DAO.

Roham and the Flow team understand that the open world, like the physical world, thrives as people from all walks of life, skills and abilities continue to join. Their job is to make it as easy as possible to bring ideas to life and assemble them with other people's ideas. They know that real-world cities and spaces are alive not because of the spaces themselves, but because of the people who live in them.

Geeks created the internet, but it was the participation of ordinary users in public spaces like chat rooms, Facebook, and Twitter that brought the internet to life. To see a thriving digital ecosystem, both are indispensable. But as Roham pointed out in his speech, the barriers to blockchain adoption are still very high. Speed, scalability, user experience, and cost will all need to change dramatically before mainstream users will consider using these tools in their everyday lives.

We spend more and more time in the digital world, playing online games in 2D worlds like Twitter, or fully immersive video games. We both use and shape the digital world. The question is whether in the digital world we will get the same attributes and voting rights that we have in the physical world. The answer is yes, if we can get things right. We will gain the attributes of the physical world plus the power of the digital world.

This is also the original intention of Roham and the team's decision to develop the Flow chain. It’s an open-world blockchain, but more importantly, it’s designed for access to millions, if not billions, of mainstream consumers.

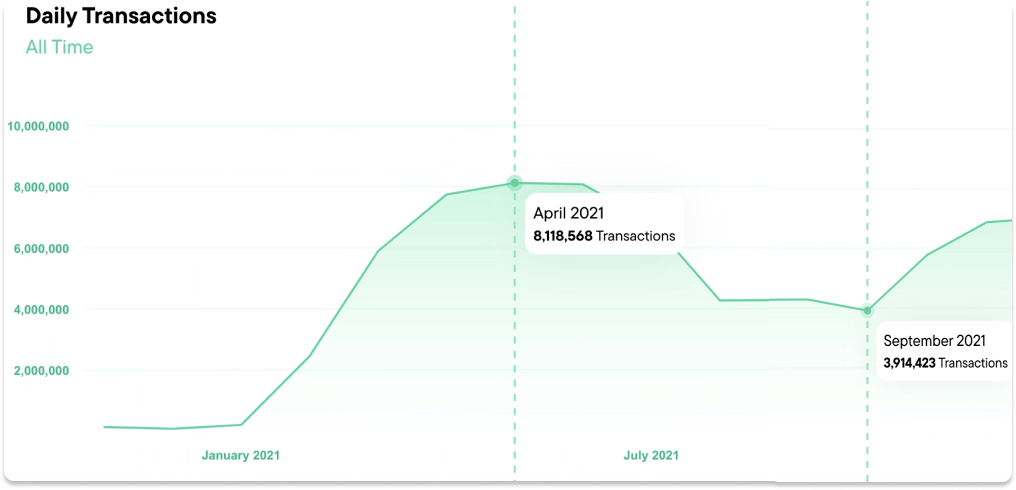

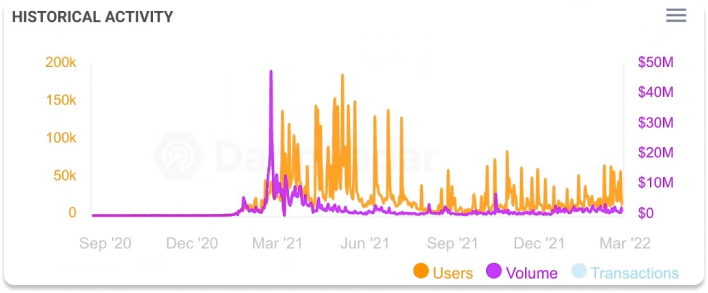

Although it looks like the Flow chain is a dark horse in the crypto world. But after a scorching spring of 2021, Flow usage is down.

The number of on-chain transactions peaked at 8.1 million in April 2021, and as of September, that number has halved to 3.9 million.

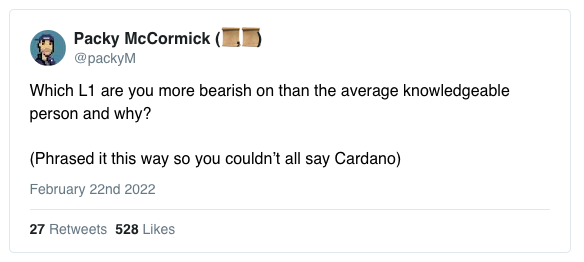

During the 5 months between April and September, the Flow chain did not generate a lot of discussion in the crypto field on Twitter. When I asked this jihadist question on twitter, my intention was to sound out my opinion on the Flow chain without giving away that I was writing this article…

...not a single one mentioned the Flow chain.

I feel that people in the crypto community on Twitter are not currently taking Flow seriously as an independent blockchain, because people's initial contact experience with the Flow chain seems to be too centralized. The debate under my tweet has turned to Layer 1 public chains like Solana, Avalanche, Near, Polkadot, and Celo, Layer 2 sidechains like Polygon, Fanton, and leading zero-knowledge proofs like Starkware and zkSync blockchain.

While each of the aforementioned blockchains has achieved permissionless deployment—that is, anyone can write a smart contract and deploy it to the mainnet without anyone’s approval—Flow is not yet open (although it This is expected to be achieved by summer). It doesn't feel like Web3.

But it would be a big mistake to underestimate Roham and the Dapper team because of this. They have done as much work as anyone to bring users (whether mainstream or speculators) to Web3, except for Satoshi Nakamoto and Vitalik.

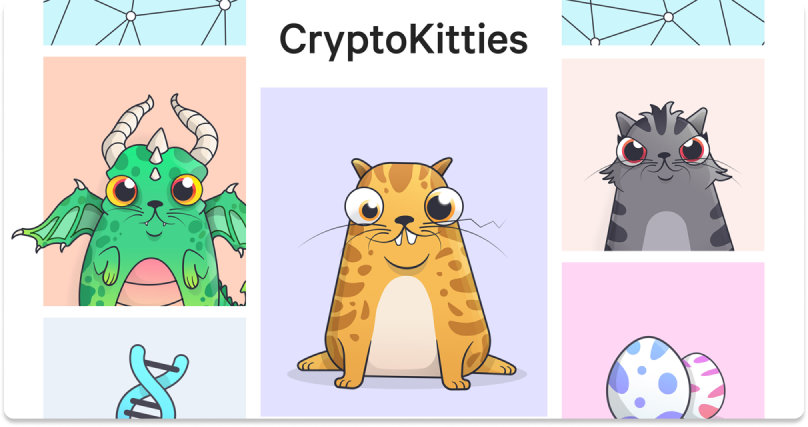

Cryptokitties

Cryptokitties

NBA Top Shot

As far as I know, the first stop for some of the most low-key speculators in the industry entering this space is either to buy the jpeg (technically, the SVG file) pictured below:

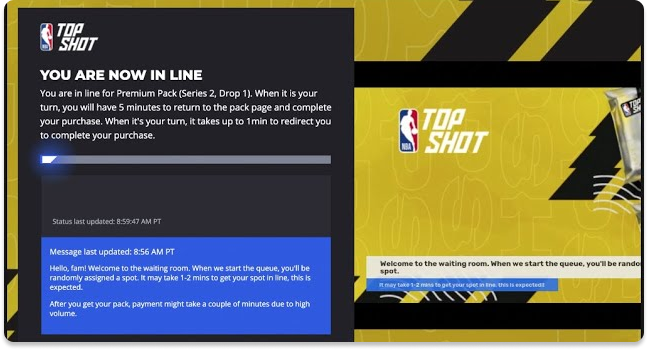

Or wait in line to buy the picture below....

…..enter credit card information and store NBA highlights in your own escrow wallet.

Encryption Kitties and NBA Top Shot are also my first stops into Web3. In my first article on Web3, Value Blockchains for the Open Metaverse, I wrote about these two projects. NFT is the first Web3 usage scenario that I agree with besides speculation. They represent my aha moments. As more and more things go digital, I realize that we need to own our own digital assets without a doubt.

Thanks to the emergence of the ERC-721 token standard, users can own unique digital assets. ETH and BTC are fungible tokens: the price of each ETH is exactly the same, and people don't care which one they own. The homogeneous tokens on Ethereum are all based on the same standard: ERC-20. But for each unique thing like an encrypted cat, the ERC-20 standard cannot meet its needs. So Axiom Zen, the development team behind CryptoKitties, created a whole new standard: ERC-721. If ERC-20 represents digital currency, then ERC-721 represents digital things. In fact, the market for digital things is huge.

Here's the crazy bit: CryptoKitties, the ERC-721 standard, and NBA Top Shot were all built by the same people: Roham and team.

Dapper Labs' current team, co-led by co-founder and CEO Roham, CTO Dieter Shirley ("Dete") and CBO Mikhael Naayem ("Mik"), has worked together since the days of Vancouver-based startup Axiom Zen and was based on Ethereum developed the CryptoKitties project. During the same period, Dete co-authoredERC-721 standard, and presentThe term "NFT"。

When they realized that Ethereum could not handle the transaction volume brought by CryptoKitties, they decided to form a new company, Dapper Labs, and developed their own blockchainFlow chain, and then created the first project NBA Top Shot based on the Flow chain to demonstrate the potential of this blockchain.

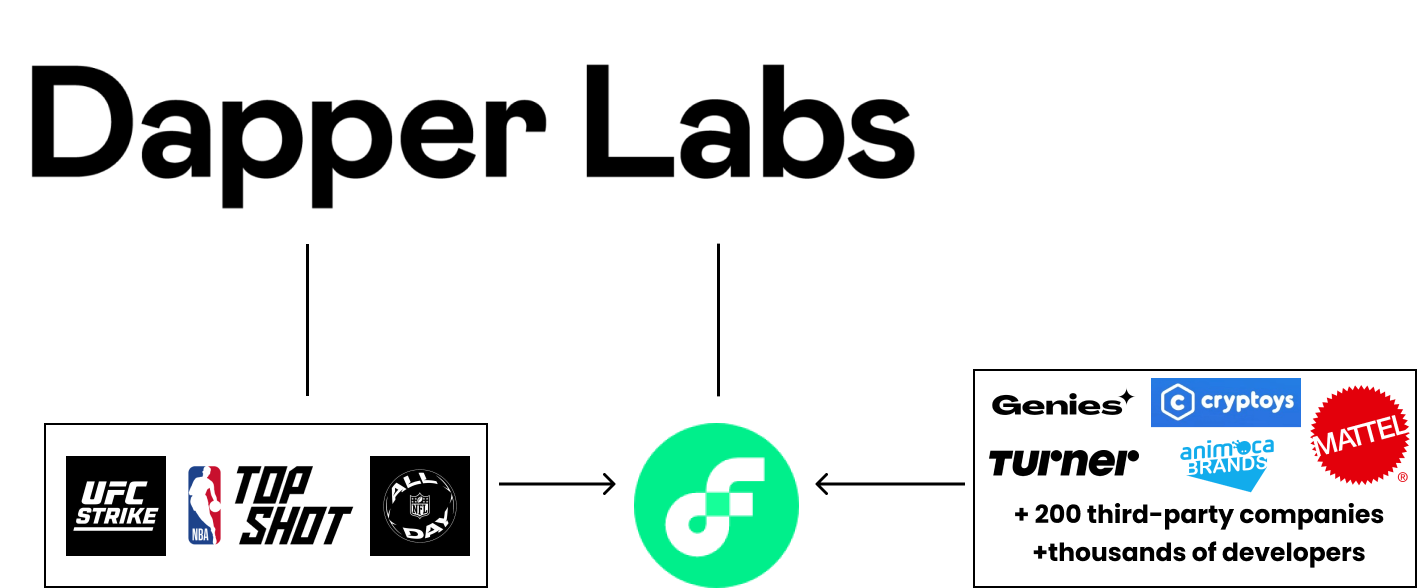

To avoid confusion, here is a distinction between the Flow chain and Dapper Labs. Dapper Labs is the parent company of the Flow blockchain and NBA Top Shot, while Flow is a separate entity from Dapper. The relationship between Dapper and Flow is like the relationship between the Ethereum Foundation and Ethereum, or the relationship between Solana Labs and Solana, except that Dapper Labs itself is a profit-making organization, and it will also develop some applications based on the Flow chain, such as NBA Top Shot, NFL All Day and UFC Strike. In the following, we will further discuss that the Flow chain is becoming increasingly independent of Dapper, and over time, it will become a completely independent entity.

Dapper of Top Shot with CryptoKitties actually creates an excellent funnel for the entire Web3, but at the same time this funnel is not airtight.

In the first half of 2021, when NBA Top Shot took off, millions of people experienced Web3 for the first time. But when they wanted to explore further... they found they had no choice. The Flow chain is dominated by Top Shot, and third-party developers cannot develop based on Flow without the permission of the Dapper team. In other ecosystems, permissionless deployments drive things wildly, but Flow doesn't open up to that.

Users either return to Web2, or are forced to continue exploring Web3 in other more mature ecosystems, including Ethereum and subsequent Solana.

Aspiring Web3 entrepreneurs and developers have largely chosen to explore on other chains. For the most hardcore Web3 developers, Flow allows users to pay with credit cards, and did not support the transition to non-custodial wallets in the early days, which are too centralized.

exist

existbecome the owner of the internetexist

existAn article from last AugustIn the article, I wrote that Solana focuses on the high-frequency DeFi track and is currently the leader in this track.

The Flow chain wants to win by connecting as many ordinary consumers as possible.

That meant Flow needed to start by partnering with these global brands that consumers love: NBA, NFL, UFC, La Liga, and Dr. Seuss. This is exactly the strategy that most people think of when they mention Flow.

andGeniesandCryptoysimage description

Cryptoys

In addition to today's mainstream consumers, Flow has its sights set on the next generation of users and developers. One of Flow's biggest hidden strengths is that it's trying to attract (and retain) all of its young users with a seamless experience of Genies, Cryptoys, Bruds, and more. These young people will become creators, developers and whales. Developing for these people means that Flow can have a long-term layout.

This part of the time dimension is often overlooked by those who do not have a thorough understanding of Flow. I also overlooked this for a while.

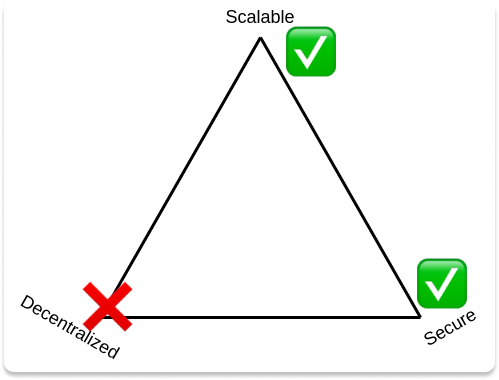

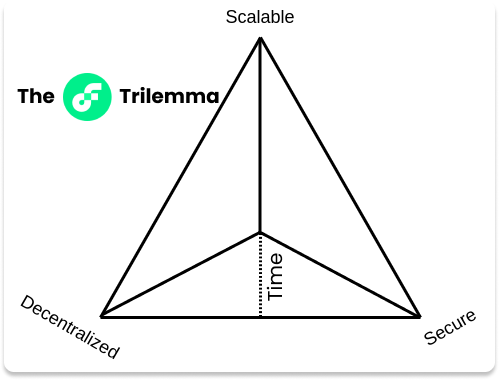

During my initial material gathering, I spoke with the Flow team, and at that time I think the team decided to completely sacrifice decentralization in exchange for scalability and security.Blockchain Impossible TriangleThe problem - that is, blockchain security, decentralization and scalability cannot be achieved at the same time.

Now I think the team is actually trying to add a fourth dimension: time to solve the impossible triangle so that no corner is sacrificed.

The Flow team rethinks how to develop a blockchain that can handle complex dApps from scratch to carry billions of users. They realized that it might be possible to solve the impossible triangle problem by adding a series of complexities in advance. This will reduce decentralization in the short term, but they can create a product and an ecosystem. In the long run, they can achieve all three Both.

In other words, it is impossible to solve the impossible triangle problem from the beginning with a simple method, but it is possible to solve it in the long run if the time constraint is relaxed and "decentralization" is carried out gradually.

So what exactly is this complexity?

From the ground up, Flow's architecture reimagines everything:

a new programming language-Cadence- makes tokens have their own resource types, which means that developers can develop better and protect users' assets.

A new multi-node architecture that separates consensus and computation,And the nodes are divided into four types: consensus, verification, execution and collection.

Dapper provides a hosted wallet for newbies, but experienced users can plug in or develop their own.

Due to the wallet key cycle, users can choose to switch to a non-custodial wallet at any time without transferring assets.

A more sustainable blockchain, according toA Deloitte report, Minting an NFT on Flow consumes less energy than sending an Instagram tweet.

Flow has been decentralizing in a slow, incremental way. They are not in a hurry. They're developing for the next billion users, mainstream consumers.

Developing for mainstream consumers means making different short-term trade-offs in pursuit of long-term goals, and it means making Flow the most popular platform for next-generation developers, allowing them to build rich composable experiences. It takes time.

Trading time for space is a risky move, and in the current fast-growing environment, there is no guarantee that it will bear fruit. But if the strategy works, Flow could become the first blockchain with a real network effect, "everyone is using it".

It's hard to bet against Team Flow not being successful. The team has gone through several hype cycles so far, but they just stick with development and continue to attract millions of users. Today, Dapper Labs has been developing for 4 years, and the Flow chain mainnet has been running for nearly 18 months. We may not even have to wait a long time to see it take off. Flow is finding its rhythm.

Remember when I mentioned at the beginning of this article that Flow’s on-chain transactions went through a cooling off period? Now it’s back. And it's gaining momentum.

Even in the current NFT bear market, Flow’s on-chain transactions last month were still three times higher than in September. In total, Flow has processed more NFT transactions than any other blockchain to date.

But Flow's ambitions don't stop with being an NFT blockchain. It is building an "open world blockchain".

As Layne Lafrance, Flow's co-founder and head of product, explains, "Flow is designed to be performant when people come together, collaborate and build on each other's products. Complex communities need to be able to evolution".

So last October,Dapper acquires Brud, the team behind virtual icon Lil Miquela, led by Trevor McFedries. Trevor himself is also the founder of the well-known DAO Friends with Benefits (FWB). He will be responsible for the layout of Dapper in DAO, called Dapper Collectives, starting from Brud DAO.

When I asked Trevor when he would launch the Brud DAO, his answer was a good representation of Dapper's approach to development: "We're rolling it out as fast as possible, but the mantra here is anti-Facebook: move slowly and get things done." right."

"We may be wrong," Roham himself admitted, "but if we're right, this is how you build new mainstream consumer products."

There's no guarantee they'll get things right. If you compare the market capitalization of Flow to other tier-one public chains, the numerical gap indicates that people think they are less likely to succeed. But the Flow team has been patiently putting Lego bricks together in pursuit of a larger, longer-term vision, and they understand better than anyone how to bring mainstream consumers to Web3. So it's worth looking at what they're doing:

Blockchain for mainstream users

CryptoKitties take off!

Post-Crypto Kitties

Flow's architecture

Acquire Brud and decentralize it

Young users and real network effects

Risks and Tradeoffs

Flow’s Token Economics

Milestones of Flow

first level title

Blockchain for mainstream users

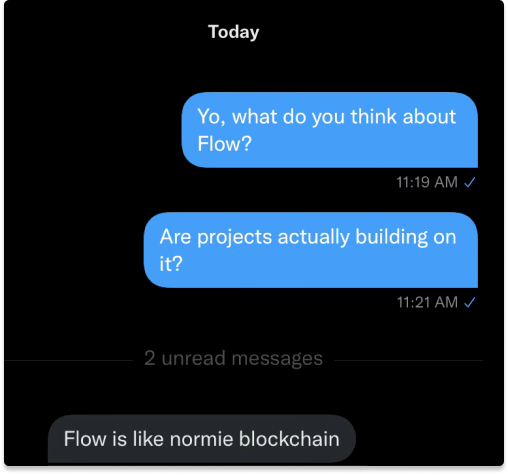

In the process of writing this article, I asked a friend in the circle what he thought of Flow, and he asked a friend in the circle again, and got the following reply:

"Flow looks like a mainstream blockchain."

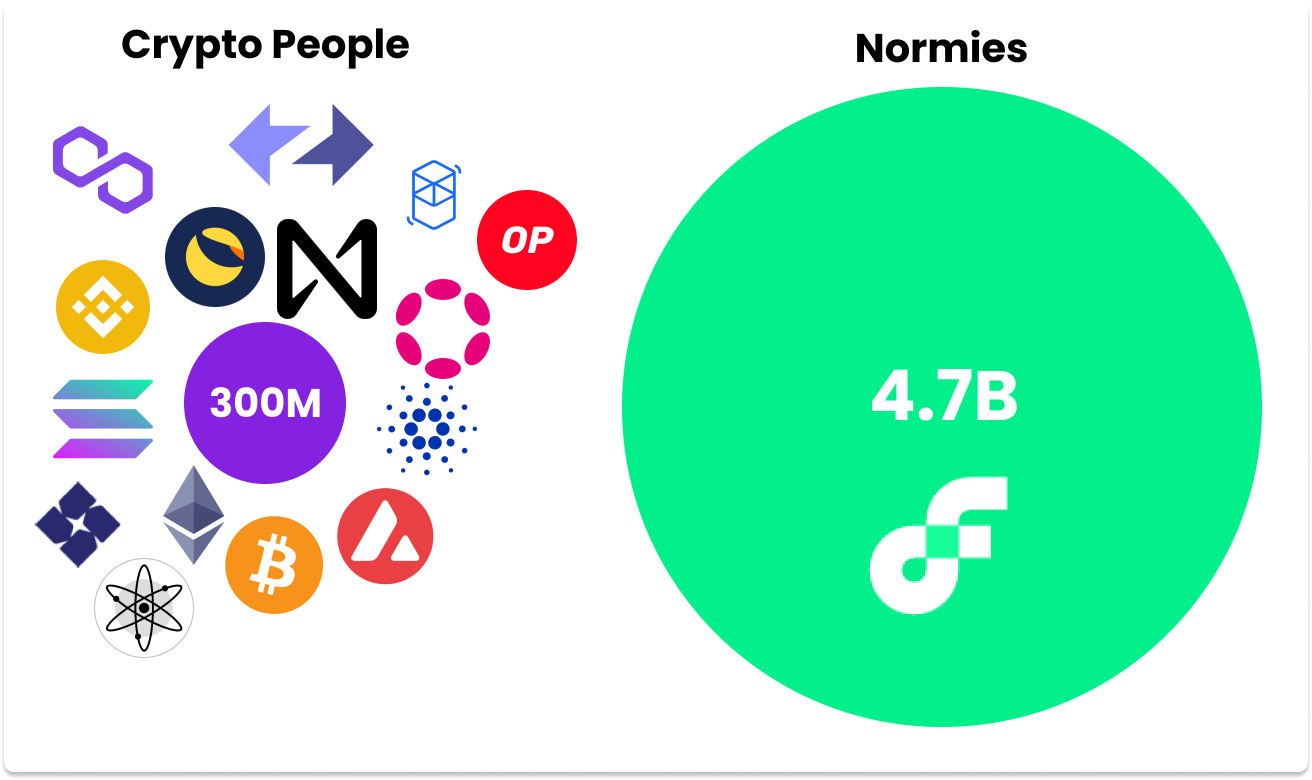

In the crypto world, such a comment might seem like an insult, but let's take a quick look at a few numbers.

As of September last year, the number of MetaMask wallet addresses was 21 million. We boldly assume that behind each wallet address is a different real person, which means that 21 million people can directly access Web3. Crypto.com estimates there are around 300 million crypto users worldwide, including all bitcoin holders and users of centralized exchanges like Coinbase. So we choose the number of 300 million.

The number of Internet users worldwide is about 5 billion. For simplicity, we make two extreme assumptions:

Of the 300 million current crypto users, none have ever used Flow.

Crypto purists either already belong to one of those 300 million or are too young to participate.

Both assumptions are crude and wrong, but wrong in exactly the opposite direction, so should cancel each other out.

So if Flow is the mainstream blockchain, it also seems like a very good playground.

Obviously, the picture above is an extreme display of the encryption landscape. The many layer 1 and layer 2 blockchains on the left are trying to make Web3 cheaper and more performant, allowing developers to create products that attract the 4.7 billion users on the right to Web3.

However, in order to please current Web3 users and developers, these chains may not be willing to make trade-offs in advance like Flow. The Flow team has proven that they don't care about looking cool. They are the ones who bring users cryptokitties.

While others are still competing to acquire existing crypto users, Flow is trying to attract all other users. Chris Dixon of a16z told me, “Flow is fighting a completely different battle. Sometimes you have to bet on the future.”

Therefore, when reading this article, please also turn your attention to the future. As Layne describes it:

Flow is designed to be future-proof. There will be digital cities on the blockchain, and Flow needs to provide the guarantees necessary to build cities—allow residents to survive, provide guarantees to developers, give property rights to owners, and ensure that no one will destroy it all. All cities built today must respect the environment, and Flow is no exception. This is a sustainable way of owning digital assets in the long run.

We hope that this is a product that spans generations, designed for a decade of dapps, and incubates the next ten years of dapps.

When you stretch out development timescales to decades, you make different decisions in the short term. In the case of Flow, for example, while its transition to permissionless development may have seemed endlessly long to some, a year and a half was very short in the larger narrative. Taking a long-term view is why there are more well-known projects for teenagers and children on Flow than other ecosystems, including Cryptoys, Genies, and Brud.

In one of my favorite classic tech quotes, from StripePatrick Collisonsaid before:

The concept of using timescales as a competitive advantage is pretty deep, because you're just willing to wait longer than everyone else, and you also have an organization that's oriented toward that.

After digging deep into Flow, I saw the same spirit and patience in the team. The Flow team is willing to trade time and short-term user acclaim for an opportunity to seek to do things right for billions of mainstream consumers.

This strategy is reasonable, and this trade-off is justified. However, before Flow can truly reach the billion-level user level, there are still some problems, including the following core problems:

Does it prove that a large number of mainstream consumers are more willing to enter Web3 through consumer-grade blockchain applications rather than applications that appear to be more Web3-native?

Can it attract enough users to attract the attention of developers and actively learn a new and EVM-incompatible programming language in order to build applications on Flow?

Can developers on Flow build applications that keep users in the Flow ecosystem?

Can Flow and ecological developers provide users with a complete Web3 experience?

It all comes back to the big bet Flow is making:

By going the other way - developing for mainstream consumers first, then progressively decentralizing - can Flow have its cake and eat it too? That is to say, not only obtain the real network effect, but also solve the impossible triangle?

first level title

CryptoKitties take off!

Roham Gharegozlougrew up on the internet. Born in Iran, his family moved to Dubai when he was 6 years old, and then went to Paris to attend high school. He found his permanent home online, making websites and running a side hustle. This experience helped him apply to universities in the United States.

He has a BA in Economics and an MS in Biological Sciences from Stanford University. In 2012, three years after graduation, he founded Axiom Zen, "a studio focused on mainstream applications of new platforms and emerging technologies, including blockchain and artificial intelligence, and has won multiple awards."

Back in 2014, Roham was attracted by the great potential of blockchain. At the Money 20/20 hackathon in Las Vegas that year, Axiom Zen won the grand prize. Of the 3 entries submitted by the team, 2 were Bitcoin Apps. OG

In 2021, an article by Coindesk named Roham as one of the top ten most influential figures in the encryption industry that year,and introduced him in detail, the article said Roham was initially attracted to the opportunity to de-risk the platform for developers. In 2016, he managed to convince Dete, chief software architect at Axiom Zen, to develop something tangible, fun, and even a little clumsy based on Ethereum to demonstrate the opportunity.

At the same time, Mik Naayem, Roham's high school classmate in Paris, had just sold his mobile game platform-as-a-service startup to Animoca Brands and decided to take a break. When Mik was still kitesurfing in Brazil, Roham kept talking to him about the blockchain. A few weeks later, Mik finally realized: this technology has the potential to give people ownership, rights and freedom.

(Case in point: at this very moment, people around the world are donating BTC and ETH to Ukraine:Click here to learn more or donate。)

After Roham repeatedly pleaded with him to "go north (from Brazil in the southern hemisphere to Canada in the northern hemisphere)", he finally gave in and headed to Canada. Upon arrival, the team was chewing on this statement:

We believe in a decentralized world, what kind of bridges do we need to build to get there?

At first they wanted to be a stable currency, and there was only USDT at that time.

Then they explored building a privacy-protected blockchain with zero-knowledge proofs.

But neither can achieve the ultimate goal: to make such new technologies permeate people's daily lives.

Finally, “One day, after yet another brainstorming session where nothing came of it, Dete’s colleague Mack Flavelle turned to him and said, ‘We need to put cats on the blockchain.’”

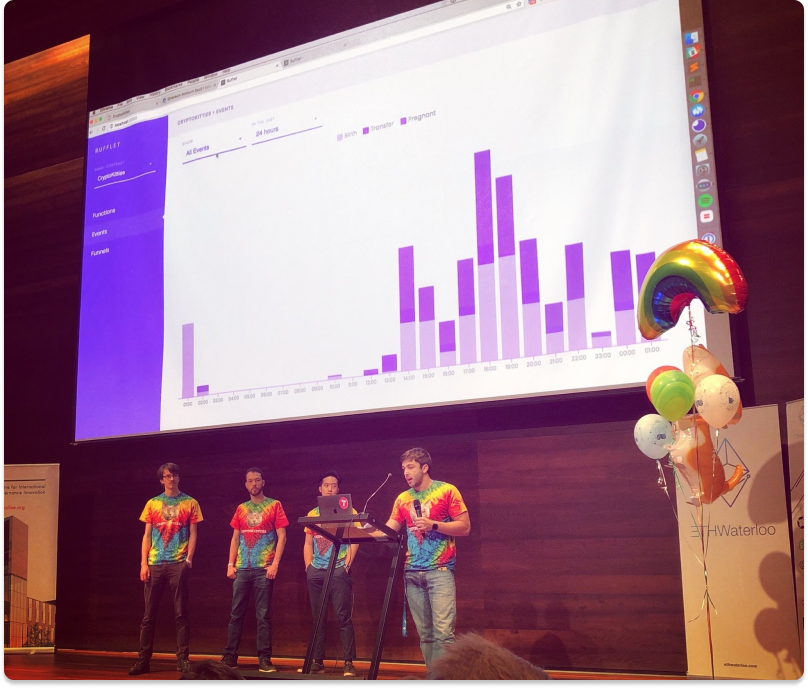

After figuring out what the phrase meant, the team jumped right into development. In autumn 2017, everything is ready. They launched CryptoKitties at the ETH Waterloo Hackathon.

CryptoKitties won, along with seven other projects, includingAnother project by Axiom Zen: Rufflet, a blockchain analysis tool. Bonus amount? $1000 worth of team designated tokens.

But the reward the team really wants is to bring blockchain into the mainstream world. they areCryptoKitties Manifestolists their beliefs.

Mik explained the logic behind CryptoKitties more succinctly: "The idea of getting people to accept a new technology, starting with banking services, is crazy."

In this version, Dapper's strategy is already evident. NFT should represent things that people care about and believe in. And the Internet loves cats. They are right.

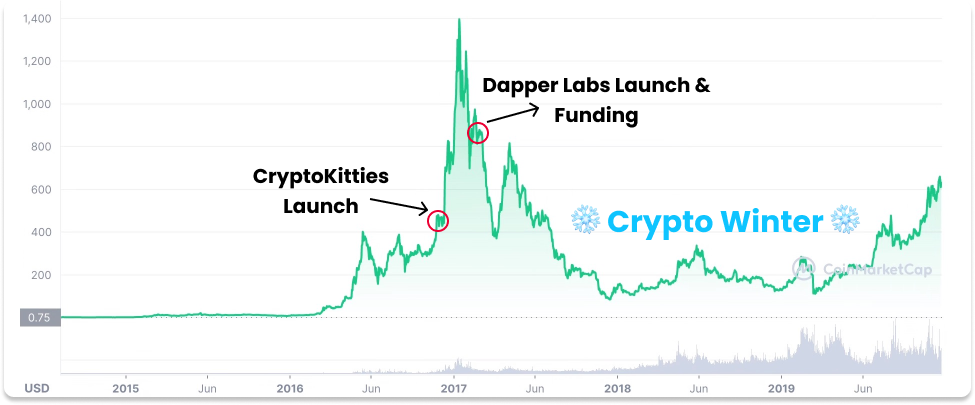

Consumers love CryptoKitties, and it does give many of them a way to interact with Ethereum. On November 28, 2017, just one month after the ETHWaterloo conference, the launch of the CryptoKitties mainnet caused serious congestion on the decentralized Internet of Ethereum. according toDelphi DigitalAn article by:

Unconfirmed transactions soared from less than 2,000 to more than 11,000. During this period, CryptoKitties contract addresses accounted for about 12% of all transactions on the entire network.

CryptoKitties became too large and developed too fast to fit in Axiom Zen anymore, so Roham, Dete, Mik and Mack decided to spin it off. In March 2018, they announced CryptoKitties as an independent entity and announced a $12 million funding round led by Chris Dixon of a16z and Fred Wilson of Union Square Ventures (USV), who were also early investors in Coinbase.

When USV and a16z invested, they invested in a digital collectibles company - not just cryptokitties, but not the entire blockchain. But ended up with a chain instead.

According to the Coindesk article, in April 2018, after announcing the financing in January, Roham began to approach the NBA to seek cooperation opportunities. But after seeing a few pictures of cats causing severe congestion on the Ethereum network, the team realized that it could not support the demands from the NBA.

and Kim CopeandLayne LafranceStart looking for other chains. Luckily, it was 2018 and everyone was developing the chain. They "read more than 100 white papers" and talked to more than 20 teams, but in Dete's words, "no one is building a chain that can develop high-quality, consumer-grade applications."

Of course, at first they assured Roham that they didn’t need to develop a new chain themselves, but eventually realized that they did need to develop their own blockchain.

“We had to develop our own chain,” Dete said:

And once we decided to develop our own chain, we got to the bottom of it. What else needs to be rethought? So we wrote a new programming language (Cadence) and developed a new interface (FCL) between dApps and wallets, allowing users to use mobile, custodial and browser wallets. We have done a lot of design on the protocol layer, so as to lower the learning threshold for users.

The investment required to develop a new chain is huge, but in the crypto mania of late 2017/early 18, such an investment seems to be worth it.

first level title

Post-Crypto Kitties

One criticism of Dapper Labs and Flow is that, unlike Ethereum or Bitcoin, Dapper is VC-backed. VCs got in very early, and ordinary users couldn't get in at that time. In this way, once the lock-up period of VC is over, they can let retail investors take over almost without any cost.

said:Cobiesaid:

Crypto VCs are also divided into two extremes: one is co-creators with long-term crypto-native thinking. They develop together with the invested companies and guarantee the survival of the latter in the bear market.

As far as Dapper is concerned, VC has ensured that the company can survive in the bear market, and Dapper’s follow-up price to the public is the same as to VC, even though VC enters first.

A16z's Chris was one of Dapper's earliest supporters and has supported him every subsequent round, even when things looked a little crazy. "I would like to trouble you to confirm this with the team first, can you tell me?"

"Okay, we can talk." Mik smiled.

“We were in a very difficult situation. In the middle of 2018, we were still labeled as CryptoKitties, a group of people who made pictures of cute kittens, but we were going around saying that we were going to develop a platform. People thought we had only one sword. So The challenges ahead are enormous.”

Just one month after Dapper Labs was officially established and raised $12 million, the market took a sharp turn and entered the encryption winter. In October, the price of Ethereum plummeted by 85% from the highest point in January, coupled with the declining trading volume of CryptoKitties, the team barely raised $15 million through the A2 round in October 2018. The round was led by Venrock, with participation from Google Ventures, a16z and USV. By the end of 2018, Ethereum was down again by 55%.

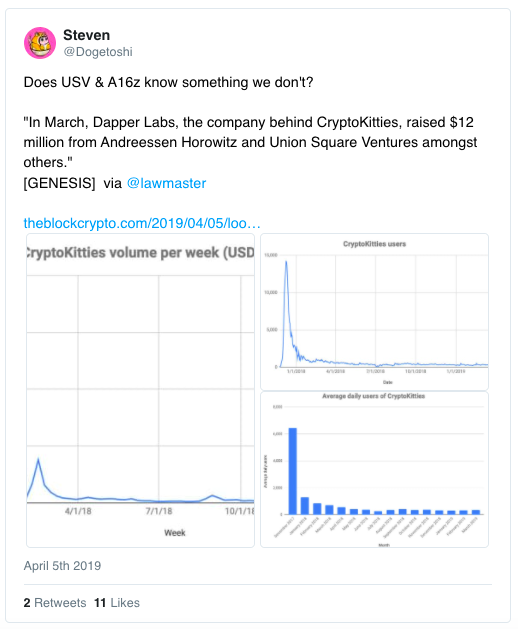

In 2019, things got dramatic. Most projects that were born during the ICO frenzy are no more. The competition between the new layer of public chains is fierce, but what they are fighting for is the leftovers. CryptoKitties usage continues to decline…

However, in December 2019, Chris Dixon and Fred Wilson arrived as promised and participated in the$11.2 millionof convertible bonds. While announcing the financing, Roham also announced Dapper's own chain Flow to the world, and explained the difference between it and other chains.

Bitcoin and Ethereum showed how encryption technology can make finance more open and transparent; Flow will show consumers of entertainment culture the same possibility.

This round is also the first time that VC investment can be converted into FLOW tokens in the future. At that time, the entry price of VC was $0.1/FLOW, and the current price of FLOW is $5.78. It seems that VC has made a lot of money again, but when VC invested, the prospect of FLOW was still unclear.

Let's stop and take stock. Until then:

CryptoKitties is about to celebrate its 2nd anniversary, and the trading volume is sluggish;

Dapper has raised $39 million;

The Flow chain has been announced, but the main network has not yet been launched;

At that time there was no other blockbuster dApp.

Then came the new crown.

When the new crown just broke out, VC investment had not yet soared, and the middle epidemic once threatened the survival of many start-ups. The company withdraws the lease of the office and lays off employees. Inside a16z, the team analyzed the situation of all the invested projects and asked "Who still has cash and who doesn't?" The most dangerous one is Dapper.

Mik told me how dire the situation was: “At one point, at the beginning of the pandemic, we only had six months of funds on our books. But then we got $10 million in financing.”

I asked Chris how he decided to invest again, and he told me candidly, "If I wasn't the head of the fund, it wouldn't have been possible to do this. Dapper had raised around $50 million at the time and hadn't developed Produce a product suitable for the market. If I were just an ordinary employee, it would be impossible for this project to pass.”

But Chris is indeed the person in charge of a16z. In addition to a16z, previous investors of USV and Dapper, including Venrock, Accomplice, Animoca and Samsung NEXT, have entered again. arriveWhen officially announced in August, the funding amount has risen from $10 million to $12 million, and eventually reached $13.4 million, as NBA stars Andre Iguodala and Spencer Dinwiddie join Coinbase Ventures and A.Capital. . The price of FLOW in this round is still $0.1.

"Then," Mik recalls, "things started to take off."

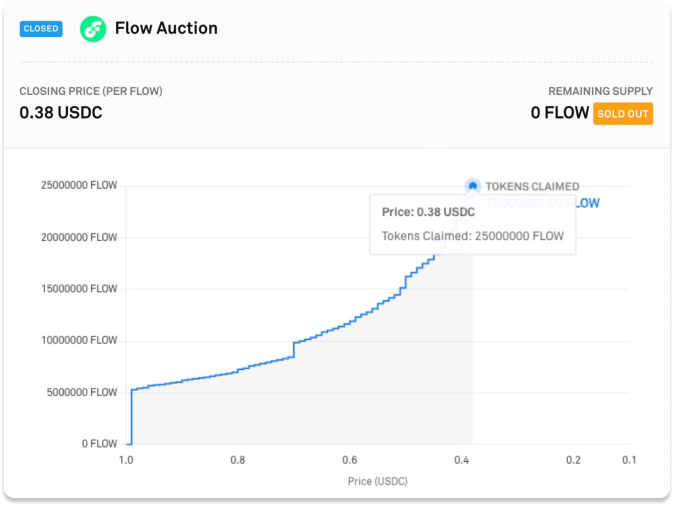

The turning point was the sale of the community round. September, Dappervia CoinlistThere is no limit to the number of participants, and each person can purchase FLOW worth up to $1,000, which is 10,000 pieces. Each FLOW is sold for $0.1, the same price that VCs have paid for the past two years. More than 12,500 users from 100 countries invested nearly $9 million, breaking CoinList's record at the time. In the second week, Dapper took out another 25 million FLOW for auction and sold it at a price of US$0.38/FLOW, raising another US$9.5 million.

When the FLOW token was officially issued in October 2020, a16z held the largest number among all VCs, accounting for 3.2% of the entire network. Not a bad result, given how uncertain things are, but not particularly surprising either...

The second week of NBA Top Shot is live.

On January 25th, Top Shot's volume soared that I noticed it, andwrote an article. The next day, FLOW was listed on Kraken. According to CoinMarketCap, the price on that day was $6.87. For institutional and community investors, the return has reached 68 times.

After Top Shot, NFT popularity soared rapidly, and the price of FLOW reached a peak of $39 in March. In late March, Dapper Labs, the parent company of Flow Chain and Top Shot, announced that it had raised another US$305 million from institutions led by Coatue (of course including a16z), with a pre-money valuation of US$2.3 billion in this round . this roundamong investorsIt also includes NBA legends Jordan and Kevin Durant, singer Sean Mendes and many NFL stars, which also laid the foundation for the cooperation between Dapper and NFL.

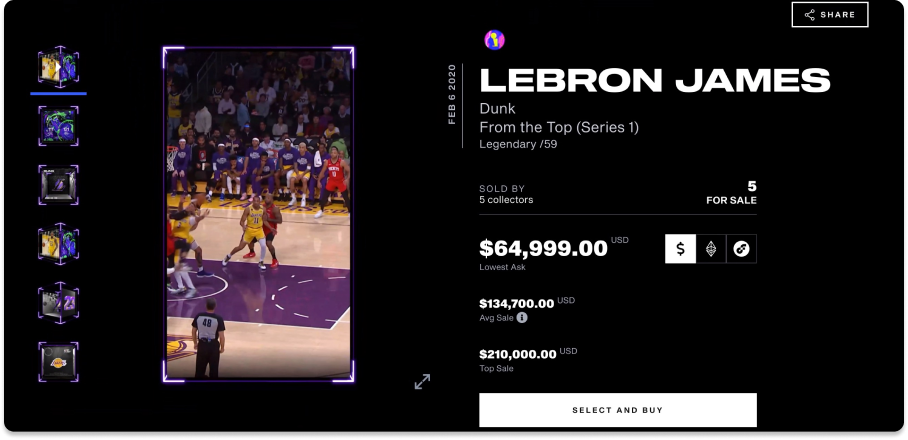

At the same time, NBA Top Shot data skyrocketed-on February 21, 2021, its single-day turnover peaked at $47.9 million, and on May 7, the number of users peaked at 186,000-and then began to decline.

Despite the decline in the use of flagship products, Dapper successfully raised another US$250 million in September. The investment was still led by Coatue, with a pre-money valuation of US$7.4 billion, and Mary Meeker of a16z and Bond participated in the investment.

It's a bold bet. As you may recall, the transaction volume on Flow hit a low point in September. The Dapper team has proven that they can capture market demand again and develop a blockchain product that consumers love, but entering at such a valuation means Investors are betting that Dapper's next projects, such as NFL All Day, UFC Strike and La Liga (La Liga), can continue to attract consumers. More importantly, they are betting that Dapper can use the Flow chain to attract mainstream consumers. developers.

first level title

Flow's architecture

The most important thing to understand about the Flow chain is to understand that it is designed to meet mainstream consumer needs - fast, low cost - without sacrificing security - and in the long run, without sacrificing decentralization. To this end, Flow's architects designed a multi-node architecture that separates consensus from computation.

Despite the huge transaction volume, Top Shot encountered no failures during its operation on the Flow chain. According to a report by CryptoSlam, the number of NFT transactions processed by the Flow chain (17 million) is more than twice that of other blockchains, most of which come from Top Shot.

But Flow is designed to handle several times the transaction volume from different dApps - not just NFT, but also DAO and DeFi; not only developed by Dapper itself, but also developed by a large number of independent developers. To attract them, Flow needs to divert a large number of consumers and provide a better development experience, starting with its programming language Cadence.

Every choice the Flow team made was to increase complexity initially in exchange for a better experience down the road. This is why Flow feels more centralized at first, but that's not the end state.

Therefore, this chapter will dig deeper into FlowGetting started must readThree main things in:

Flow chain: multi-node architecture

Cadence: Developer-first experience

Consumer: A Consumer-Friendly Primer

OK, here we go.

Flow chain: multi-node architecture

Link

Hear the joy of geeks! Both participants in this conversation have been trying to solve the same challenges, and have each come up with more advanced solutions than almost anyone else in the world.

But Solana's go-to-market strategy involves working with SBF and developing for hardcore traders, while Flow's strategy involves cats, slam dunks, and credit cards, which obscures a lot of the technical magic that happens at the protocol layer. We are going back to the blockchain impossible triangle again.

Each new layer 1 public chain essentially tries to solve the impossible triangle in a new and better way, either by eliminating the need for trade-offs, or by strengthening the advantages in a certain corner: scalability, decentralization and security sex.

articlearticleIn, he writes, "The Impossible Triangle represents the three properties that blockchains want to have (scalability, security, and decentralization), of which you can only have two if you stick to 'simple' technology. "

The title of this article isWhy sharding is good, the title does not implicitly imply that he believes that the non-simple technology to solve the impossible triangle is: sharding.

Like the Solana team, the Flow team also believes that sharding has several problems, the most important of which is that sharding breaks the "ACID" principle, thus destroying composability.

Sharding essentially transfers complexity to application developers and users:

In a sharded blockchain, a simple user action (buy CryptoKitties a hat with a stablecoin like TUSD) requires twelve transactions and seven blocks. In a non-fragmented, ACID-complete environment like Flow, the same behavior, and even more complex behaviors, only need one atomic transaction in one block.

As the first NFT dAPP development team that requires composability, the Flow team has the unique advantage of being able to understand the challenges facing Ethereum from the perspective of application developers. In addition, in addition to writing the first NFT standard and using CryptoKitties to cause the collapse of the Ethereum network, they also developed the first consumer-grade smart contract wallet on Ethereum, which contains a lot of information that they have since deployed directly on the Flow chain. Many features of the Dapper wallet.

After becoming Dapper Labs, the team hopes to cooperate with top IPs, such as NBA and NFL, to create NFT projects and blockchain games, but they know two things:

If they bring in the huge audience demand for IP, Ethereum will collapse again, neither they nor others can use it;

To attract more developers and creators to NFTs and the open world, they need to find a blockchain that is faster, cheaper, and easier to develop consumer-grade applications.

They initially had no intention of developing their own chain; but amidst the sea of options, they couldn't find a chain they wanted. So they finally decided to develop it themselves, and the Flow chain was born.

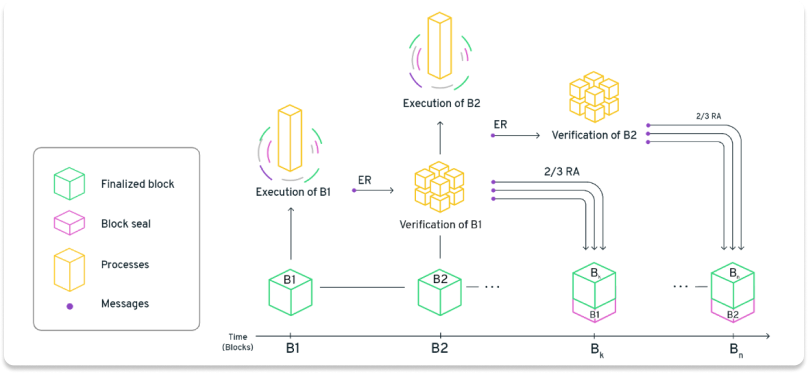

The core insight of the Flow team is that computation and consensus can be separated.

In simple terms, there are two types of blockchain tasks: non-deterministic and deterministic.

Consensus, that is, reaching an agreement on the order of transactions, is a non-deterministic task and is subjective.

Calculation, that is, calculating the result of the transaction, is a deterministic task and is objective.

The calculation consumes more computing resources, but the security risk is smaller; it is easy to prove whether someone is lying about the calculation result of 2+2. Consensus does not consume much computing resources, but it faces greater security risks. The architects of the Flow chain realized that a more efficient architecture could be obtained by separating the two:

Computing: fewer but more expensive computers to run computing nodes;

Consensus: Consensus nodes are run by more but cheaper computers;

Existing blockchains do not differentiate tasks assigned to nodes, so both throughput and security are limited. Flow wants to have it both ways.

"As a consensus node," Dixon explained, "you only need to know that the state change is valid, and you don't need to calculate it. Similar to the concept of zk rollups."

Released in September 2019 titled "Flow Chain: Separation of Consensus and Computation, Dete, Lafrance and Dr. Alexander Hentschel explain the logic of the new architecture.

The purpose of this paper is to formalize the separation of consensus and computation and demonstrate that this approach increases throughput without sacrificing security. Unlike most existing proposals, we achieve scalability by separation of concerns, in other words, our solution lies in more efficient use of network resources, not sharding.

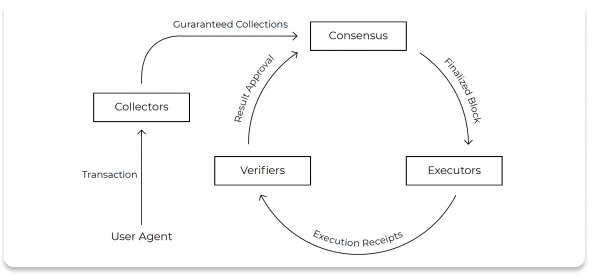

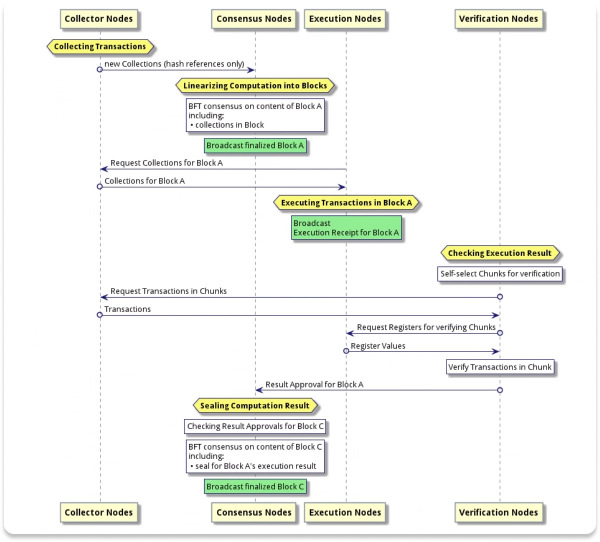

In February 2020, the Flow team released the second article "Technical white paper", explained the multi-node architecture in more detail, this time the white paper contains four types of nodes:

Consensus nodes determine the order of transactions on the blockchain;

The verification node is responsible for ensuring that the execution node does not do evil;

The execution node is responsible for performing the calculation of each transaction;

Collecting nodes acknowledge the existence of transactions and provide dApps with better network connectivity and data availability.

Assigning tasks to four types of nodes was a key innovation of the Flow chain, and it still is, no other chain uses this architecture.

The figure below shows how the four types of nodes cooperate to complete the transaction confirmation in a pipelined manner. Each node has a dedicated task and passes the task result to the next node.

My first question after reading these articles was, “What happens if a consensus node confirms a transaction, but is eventually overturned by an execution or verification node?” The Flow team also has a solution for this problem.

This picture looks complicated, but it actually represents a series of checks and balances in the network, "As long as there is a node that is honest, no matter what kind of node it is, it can punish dishonest collection or execution nodes, and Trigger recovery from losses due to invalid data." Transactions in block A are not finalized until two blocks later, when all checks are complete.

The image below represents a visualization of this process:

Just like in a car factory, the entire assembly line can operate quickly and efficiently, but any node can pull the safety rope to prevent a specific transaction from passing through.

Although the description of the blockchain is vague on the interface of Top Shot, its underlying architecture is always the Flow chain, and this architecture runs smoothly. In the early stages of the project, many nodes were run by Dapper, but as time went by, they continued to be decentralized, and now most of the security-related consensus nodes in the Flow network are run by third parties. This number will continue to increase in the future, and the Flow chain will become more and more decentralized. (you can clickFlowscanCheck the real-time information of the nodes in the whole network. )

“Flow was developed on the principle of maximum decentralization at scale,” Dete explained. “Anyone with a home computer can participate in consensus or verification.”

Currently, the Flow chain is secure and scalable. Over time, it will continue to be decentralized.

It seems that decentralization does not only require the decentralization of nodes; it also means that for third-party developers, permissionless deployment can be achieved.

Therefore, in the process of developing the Flow chain, the team decided to create a new programming language,Cadence。

Cadence: Developer First Principle

"As a businessman," Roham recalls, "I was terrified when my CTO told me he wanted to develop a new programming language when we had only one year left in our books."

Developing a new programming language not only requires resources—something Dapper Labs lacked early on—but it also means making a huge trade-off: time.

Developers who want to develop on Flow need to learn a new language first, and existing blockchain developers need to rewrite their dApps on Flow.

The programming languages for both Bitcoin and Solana already exist: C++ and Rust. The Ethereum smart contract language is Solidity, which has become the standard language for most Web3 applications. Many Layer 1 and Layer 2 chains are "Ethereum-compatible," meaning that their smart contracts are partially written in Solidity, so they can plug into the Ethereum Virtual Machine (EVM).

Having an independent programming language and architecture means that the Flow chain is not compatible with Ethereum. It forces developers to make choices and learn. It's a risky gamble: even if it turns out as expected, third-party ecosystems will take longer to develop. Cadence does not have rich open source resources, nor does it have a large number of audit institutions to audit smart contract codes. Cadence is also another reason why Flow had to be more centralized in the first place.

Nevertheless, Emilio Cueto, CTO of Cryptoys, told me that the learning curve of switching from Solidity to Cadence is very easy. Where there is a difference, Cadence often wins.

Obie Fernandez, founder and CEO of Let the Music Pay, developed the NFT platform based on the Flow chainRCRDSHP,He is also a fan of Cadence:

We have tried several blockchain programming languages, and Cadence is arguably the most developer-friendly among them. We like its familiar syntax, and high productivity, especially when compared to Solidity.

This endorsement is very powerful. Before founding RCRDSHP, Fernandez served as the CTO of Andela and author of the Ruby on Rails development bible "The Rails Way"The author of the book.

The magic of Cadence is that it is a programming language designed specifically for digital ownership.

According to the must-read for getting started with the Flow chain, "CadenceIt is the first developer-friendly, resource-oriented smart contract programming language. "

Unlike "programmable currency" in other programming languages that appeared later, Cadence actually turns currency into a data type, which means that it can operate on currency like ordinary numbers or strings. For example, unlike strings, Cadence does not support copying and pasting currency directly, which means that it is easier for developers to keep user assets safe.

The idea came at the right time. Facebook's Libra team also developed the resource-oriented programming language Move in a similar way.

The Flow chain also provides a series of additional optimized experiences for dApp developers:

The developer-friendly syntax is easy to read and more importantly, easy to audit.

The open source SDK and standard library developed by the Flow team (such as FT and NFT standards, that is, ERC-20 and ERC-721 on the Flow chain).

A powerful static type system allows errors to be reported during compilation instead of waiting until the actual runtime.

Upgradable smart contracts allow developers to release labeled test versions to mainnet and find and fix bugs before giving up control of the contract entirely.

The Flow Client Library (FCL) simplifies the interaction between dApps and wallets without writing special code on either side.

Additionally, Flow's minimal environmental impact—a transaction on Flow consumes less energy than a Google search—is extremely attractive to developers, users, and partners alike.

Cadence and other developer-friendly decisions made by Flow make users safer and have a flatter learning curve for new developers, which is one of Flow's great strengths. But it also means making a trade-off: complexity and time.

At the beginning, Dapper only allowed teams that had passed its own audit to deploy projects on the Flow chain. But now, as long as the project has been audited by a well-known audit institution, it can be developed on the Flow chain, and the audit fee is borne by Flow. At present, more than 50 teams can freely deploy. Flow is expected to be fully open to permissionless deployments by this summer, which will be a key milestone to watch.

Because Flow has not yet enabled permissionless deployments, many developers are hesitant to enter Flow. But Dete also explained the logic behind it: "Because today's network is so complex, we have to protect it."

He pointed out that early projects on ethereum also had bugs, but since usage was so small at the time, it didn't matter. But for any current blockchain, the potential risk increases. Therefore, Flow deliberately chose not to open in the short term to ensure that everything goes well and open at the right time.

When facing consumers, Flow also made the same choice.

Consumer: A Consumer-Friendly Primer

Starting from the protocol layer, Flow simplifies the process of developing products that protect user safety and provide convenient experience.

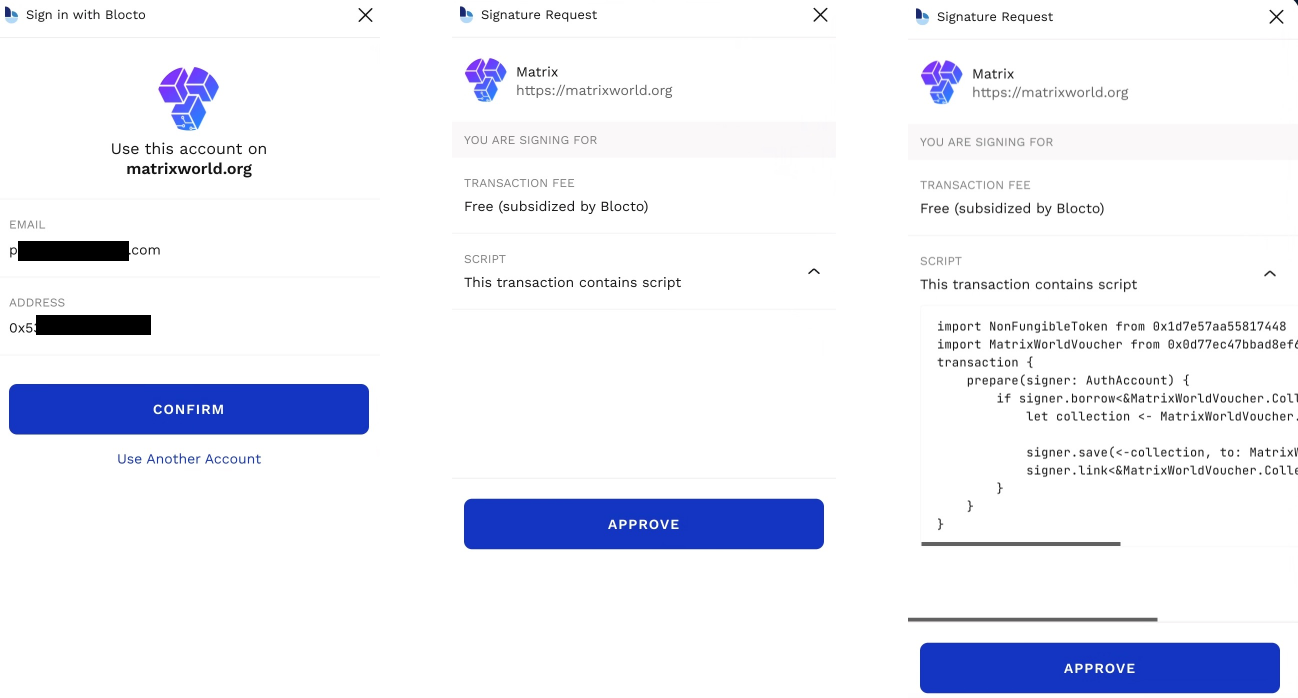

Flow, for example, touts human-readable security, meaning wallet developers can tell consumers in plain language what permissions were specifically approved when signing a transaction.

After I log in with Blocto walletMatrix World, the approval page clearly shows my authorization - "You are signing to approve transaction fees - free (subsidized by Blocto)" - and lets me know there is a script currently running so I can check. The page is clear and easy to understand.

Human-readable security helps avoid incidents like the recent OpenSea hack, which took advantage of the fact that when a user approves a transaction, they don't really know what to authorize.Click here to view the specific reasons. Human-readable security is therefore essential to attracting mainstream users. Taking history as a mirror, mobile apps really took off after Apple guaranteed the safety of downloads. In the world of Web3, this is even more important due to the large amount of money that exists.

In addition, Flow allows users to apply for a wallet without having to store or memorize a 12- or 24-word mnemonic, which is equally important for mainstream users to get started. Compared with other wallets, the Flow wallet experience is more like an ordinary consumer application, but at the same time allows users to upgrade to a more advanced experience.

“Top Shot initially integrated a custodial wallet within a private interface,” Dete explained. “Our new products, such as NFT All Day and UFC Strike, use FCL, which is an open interface. Now Top Shot also allows Users transfer assets to non-custodial wallets. But we believe that users don’t need to apply for a non-custodial wallet every time to participate.”

Instead, Flow wants to give users choice.

Some users always want to pay by credit card and escrow the NFT or token to the wallet developer.

Other users want to log in, pay and store NFTs and tokens with non-custodial wallets, such asBlocto- Currently the most popular third-party non-custodial wallet on Flow.

The Flow team also believes that some users want to start with a managed wallet and a more centralized experience, and gradually transition to a non-custodial wallet. Some of them will hope to transfer assets to other chains through cross-chain bridges or wormholes.

Progressive decentralization

Progressive decentralization

A lot has been said, so I want to pause and give you a framework for thinking about Flow.

Among the classic treatises on Web3, one of my favorite books is "Progressive Decentralization: A Handbook for Encrypted Application Development" by Jesse Walden. In the book, he proposed that a successful blockchain application requires three elements:

Community Involvement

Community Involvement

community ownership

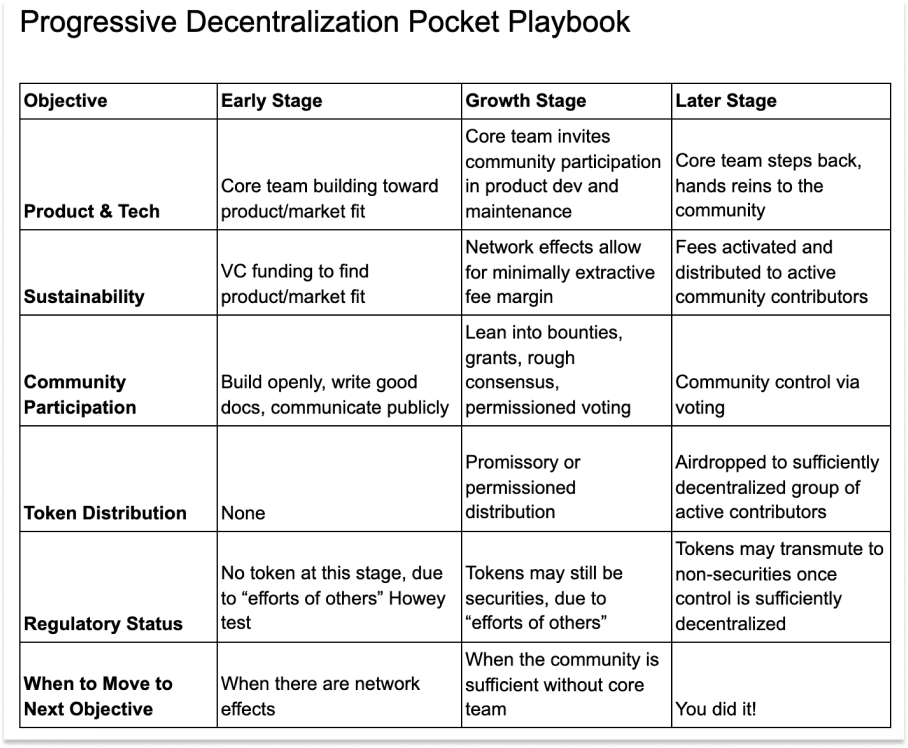

The following table can provide a quick reference:

Of course, this manual is more applicable to applications, such as decentralized applications (dapps) that have been transformed into DAOs. The blockchain should have a higher degree of decentralization.

While I've blurred the technical definitions a bit, and Flow is decentralized in every way from the table, since it has issued tokens and the network is not controlled by any one entity, Flow is at every level Both exhibit progressive decentralization:

The blockchain is gradually decentralized. More and more ordinary people run consensus nodes on low-resource hardware, and the number of consensus nodes controlled by Dapper Labs has dropped to less than one-third.

Development is gradually decentralized. From the beginning, it was completely developed by Dapper, and then it was open to developers who passed the Flow audit, and then it only needed to pass the audit of an audit agency authorized by Flow, and finally realized the permission-free deployment this summer.

The user experience is gradually decentralized. The user experience is better, and users can give up the custody wallet and choose to use the non-custodial wallet.

Flow's decentralization is fluid and dynamic, not static or fixed.

The usage scenarios on Flow also reflect this dynamic process.

Dapper Labs built Flow to serve the gaming, media, entertainment, and open world. NFT is just the first example, and the usage scenario requires more "Lego bricks" to be combined.

As a result, the DeFi (decentralized finance) project Flowty was launched in early February. This is a P2P NFT lending market, which has reached 65 loans with a total amount of more than 300,000 US dollars. The largest deal to date involves a LeBron James Cosmic Top Shot Moment card with a $50,000 loan. Flowty is also progressively decentralized: at first it only supported high-value legendary NBA Top Shot assets, and later it gradually opened up to more Flow collectibles. Other DeFi projects, including decentralized exchanges, will also be launched gradually. These projects do not focus on attracting insiders, but focus on building financial structures that serve NFT, games and the open world.

Entering web3 from DeFi may not be suitable for ordinary people, but the Flow ecology starts with NFT and gradually transfers to DeFi, allowing ordinary people to enjoy the benefits of the financial system on the chain. step by step.

first level title

Acquire Brud and decentralize it

The reason why Dapper entered the DAO was that the founder of Brud suffered frequent setbacks in his progressive centralization efforts. This is not surprising at all, because progressive decentralization and a complex community run through the development of Dapper.

In 2016, Trevor McFedries founded Brud, aiming to create a new model of digital storytelling based on "community-owned media and co-built worlds". This is exactly the scenario Flow expected. Brud's flagship virtual idol, Lil Miquela, has more than 10 million followers on social media, and the interaction with fans helps to flesh out the character's image.

When Trevor chatted with me, he said that the reason why Dapper acquired Brud was because he tried to transform Brud into a DAO, but the board of directors disagreed. For several years, he had been proposing to the board that the company should turn to the community, but they were skeptical of cryptocurrencies and showed little interest. One of the board members told him that the token they invested in last time was declared invalid by the SEC (United States Securities and Exchange Commission), so they did not want to repeat the same mistakes.

But Brud's purpose is to build characters, stories and worlds based on the community, and Trevor believes that community ownership is the only model suitable for the company's business, so he never gave up his ideas. Realizing the futility of persuasion, Trevor decided to let the facts speak for themselves. "One of the purposes of launching FWB is to make the board realize the great value of DAO."

FWB stands for Friends With Benefits, a DAO launched by Trevor in September 2020 focusing on the cultural field. Turns out he was right. A year later, in September 2021, FWB received a $10 million investment from a16z. While the Dapper team popularized NFTs, Trevor and FWB popularized non-DeFi DAOs.

The success of FWB and the growing upsurge of DAO finally convinced the board that decentralization is the right choice. However, many people on the board of directors were unable to hold tokens due to the restrictions of the fund documents, so they asked Trevor to find cryptocurrency investors and buy the company's equity they held. After preparing the relevant documents, Trevor began to contact investors, including Roham. Both Dapper and Roham were active in the web3 investment space, but after Trevor and Dapper started getting in touch, he changed his mind:

No one is better at crafting next-generation experiences than you, and we both believe the future is multi-chain. Why not choose us? You create tools for the Brud community, but on Flow, you create tools for everyone.

The deal didn't go through right away, because Trevor needed to be convinced that Brud and Dapper were a cultural fit. After several rounds of contacts between the two teams, Trevor found that the two companies were very suitable for each other. "We're artsy emos, a bunch of super friendly smart Canadians."

In October 2021, Dapper Labs officially acquired Brud and announced the establishment of Dapper Collectives, with Trevor as the CEO of the department. Dapper Collectives "is committed to paving the way for the decentralization of social media and the democratization of online communities of common interest on Flow, ensuring that the community of creators captures value".

USV's Fred Wilson described the upcoming initial work at Dapper Collectives in his blog post:

Taking Lil Miquela and her 10 million fans as a starting point, give Dapper Labs products two major characteristics - community ownership and joint construction;

Create and publish open-source tools to allow other mainstream communities to gain access to decentralized ownership and decentralized governance on the Flow blockchain;

Help the most far-sighted web2 companies realize the decentralization of operations, carry out interactions at the CEO and board levels, and improve