Last year, the crypto industry witnessed a rapid expansion of the decentralized marketplace. Each team has joined the competition with its own vision of building a differentiated trading platform, including infrastructure, covered asset classes and products, and user experience. Even those superficially similar designs, such as liquidity management, order clearing mechanisms, and governance schemes, have inherent differences.

Injective is one such example, with its mainnet launching in November 2021. The Injective Protocol provides a fully decentralized order book trading infrastructure for accessing cross-chain spot and derivatives markets with zero gas fees, thanks to its unique technical architecture.

first level title

Comprehensive trading experience

Injective is experimenting with various products ahead of the mainnet launch. In addition to the existing 11 perpetual contracts and spot markets, the platform also launched products in traditional asset markets such as synthetic stocks, oil, natural gas, gold, and foreign exchange futures during the Solstice testnet. The community hopes to reintroduce some of these markets in 2022, with complementary products to the order book model.

Options, synthetic assets, prediction market DApps, or any other tool that can leverage Injective's matching mechanism can be built on its chain. Since the chain aspires to be a complete toolbox for the decentralized financial market, it can also access many other related financial products, such as lending services and trading guilds, to enhance the financial service attributes of its protocol.

In addition to its vision of decentralization, permissionless marketplace creation was a fundamental design choice for its operation. That's why on the Injective chain, community members can build novel financial products, start capital pools for existing products, and open new markets for trading without centralized institutional oversight. New market proposals still require governance approval to go live on the frontend - however, the protocol also allows users to quickly get a market live by paying a fee, which was recently reduced from 1000 INJ to 100 INJ, making the process faster and more independent .

The permissionless status of market creation, and concerns about the solvency of the protocol led Injective to adopt a risk coverage model that is independent for each market. Because Injective doesn't want the risk of one market to spread to other markets, it requires each new derivatives trading pair to establish an insurance fund before being allowed to start trading. In this way, even in the case of extreme market volatility, the funds in the insurance fund will be prepared to deal with potential losses. After the insurer sets up the insurance fund pool, users can use their mortgage tokens to invest in the fund pool and profit from the liquidation proceeds.

To prevent front-running and improve user experience, the protocol uses Frequent Batch Auctions as its order clearing mechanism. In FBA, all orders submitted to the memory pool (Mempool) will be executed at the end of each block (the block time of each block is about 1 second), and will not be published on the order book until the bidding process is completed . Obscuring information by implementing a delay time enhances the trading experience for traders and allows market makers to offer deeper liquidity with tighter spreads without fear of high-frequency traders disrupting market-making activities.

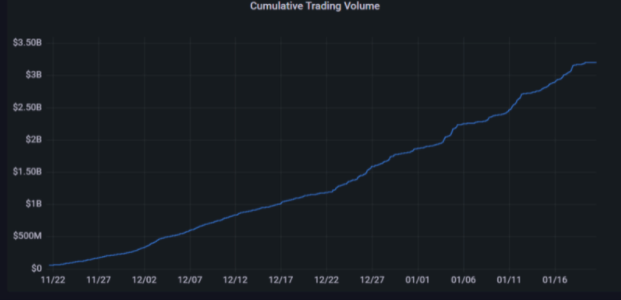

Liquidity and attention are the most valuable resources in the crypto industry. After the mainnet launch, Injective launched an incentive program called Astro, which aims to increase the liquidity on the order book and attract traders to join the platform. The program will distribute 10 million INJ tokens (approx. USD 120 million equivalent at launch), 70% of which will be allocated to users as trading rewards and 30% will be allocated to liquidity providers under the Professional Market Maker (DMM) program . The Astro Incentive Program is an ongoing campaign, and the protocol this year is also focused on recruiting more market makers to build a healthier order depth for traders.

first level title

first level title

Zero gas transaction

Due to its technical design, the chain operates like an engine. It provides core functionality but requires other supplementary parts to be accessible to users. Currently, applications on the Injective Chain process transactions by acting as an information bridge between users and nodes.

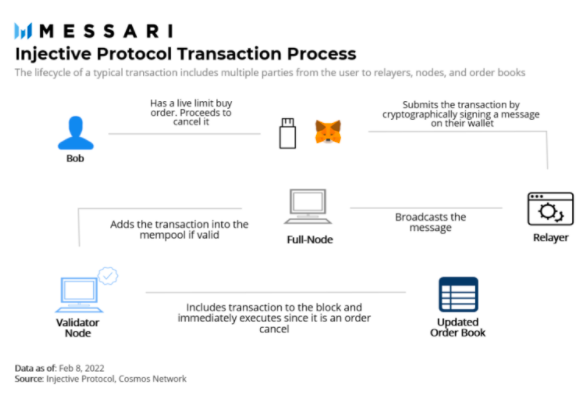

Although Injective Chain is built using the Cosmos SDK, it uses custom Ethereum accounts, and wallets generated by its application, to parse EIP-712 type data. Users submit their interaction requests to access DApps (relay front-ends) by sending cryptographically signed messages. These messages are then broadcast by transactional DApps to a full Injective Chain node, where they are unpacked and added to the mempool. Nodes examine transactions and include them in a block, while ordering transaction execution according to their category importance—clearance and cancellation requests take precedence.

Injective Chain's unique transaction processing method is very beneficial to user experience. Users can avoid the burden of Gas fees by interacting with transactional DApps. Since the trading platform broadcasts signed messages to Injective Chain nodes instead of traders, all fees related to chain interaction are paid by transactional DApps, and traders do not need to pay any gas fees. This allows users to trade without having INJ in their account. In addition, Injective also allocates a reward pool of $100,000 to cover the Gas cost when users transfer funds from Ethereum for the first time, making it more user-friendly.

Complete decentralization is a top priority for the Injective community. This is why consensus mechanisms, backend infrastructure, governance, and transactional DApps are all central to decentralization. While most protocols are targeting front-end decentralization, users are most familiar with back-end and governance decentralization. Some protocols do not use alternative front-ends to interact with the protocol, which in part contributes to the centralization of the front-end.

As a Layer-1 protocol built for decentralized finance, Injective allows anyone to build customized transactional DApps on top of the protocol, creating multiple portals for users. Each trading portal receives 40% of the transaction fees introduced by its front end in return for processing transactions. The Injective ecosystem welcomes more nodes to play this role similar to a middleman.

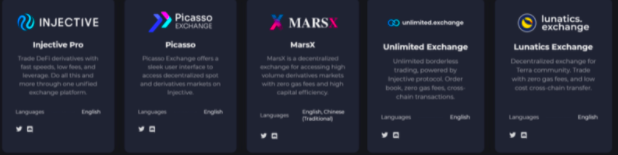

Currently, five transactional DApps have been built on the Injective Chain: Picasso Exchange, MarsX, Unlimited Exchange, Lunatics Exchange, and Injective Pro provided by the core team of Injective Labs.

All of these trading platforms connect to the same markets by sharing the same order book, but they provide users with varying degrees and forms of access. For example, compared with Injective Pro, the Picasso trading platform provides a Swap trading mechanism for its spot market, and its UI is similar to AMM DEX. MarsX chose to allow users access to two of the perpetual contracts markets, while other trading platforms display all live contract markets. The trading platform built based on Injective has different front-end access points, which provide specialized value products, thereby improving user experience and tailoring products for users in different regions.

first level title

Injective's Core Interoperability

The Injective protocol is designed to bring in liquidity from multiple other chains across chains, so this chain allows traders to communicate with other IBC-enabled chains through its IBC, as well as interoperate with the Ethereum mainnet through the Injective cross-chain bridge.

first level title

INJ Token Economic Model

The native token INJ was initially released as an ERC-20 and then migrated to its own chain. INJ is a multipurpose token that functions like a bolt in the most critical areas of a complex engine:

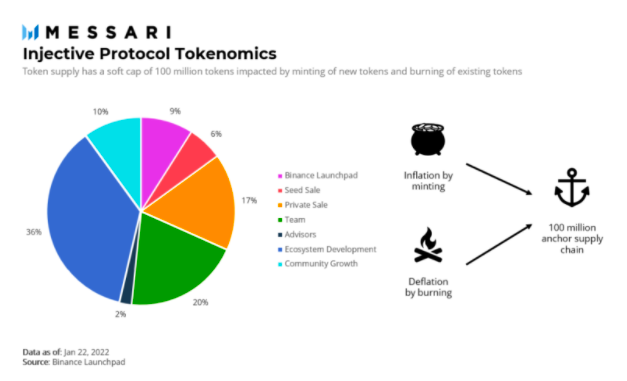

1. The security of the chain depends on INJ:Since Injective's Tendermint consensus is based on Delegated Proof of Stake (dPoS), block producers need to pledge INJ to verify blocks and receive INJ as a contribution reward. Currently, the minimum amount required to become a validator is 1 INJ.

2. The governance of the trading platform is the governance of the chain:INJ holders can vote on trading platform improvements, parameter changes, new feature implementations, as well as chain updates and inflation reward mechanisms.

Since it is critical for the chain to maintain its security and governance efficiency, the Injective Protocol incentivizes staking by offering discounts on transaction fees. Through the Injective VIP program, the more INJ staked, the greater the transaction fee discount.

3. Used for transaction fee auction:After allocating 40% of the transaction fee to the DApps that introduced the transaction, the remaining 60% of the transaction fee income will be auctioned and destroyed. The protocol conducts weekly auctions, and participants bid for that week's transaction fees through INJ. The final successful bidder can get a basket of tokens and arbitrage profits, and the INJ paid by them will be destroyed.

The maximum supply of INJ is initially set at 100 million. However, since block rewards are compensated by minting new tokens, there is inflationary pressure on this number, turning it into a soft cap and an anchor for the required supply.

first level title

Future plan

With solid and excellent execution, Injective can further expand its influence with the help of its community, increase the adoption rate of the Cosmos ecosystem, and promote the continued growth of decentralized trading platforms. The introduction of new products such as future insurance DApps and trading guilds can further enhance the user experience, making Injective a more comprehensive decentralized financial toolbox.

Original link