original:Nansen

original:

For many investors who insist on the "buy and hold" strategy, it is of great reference value to find a way to know which tokens investment institutions buy in the secondary market. After all, sometimes investment funds know in advance what we cannot get known information. At the same time, when investment funds buy tokens, due to the problem of capital volume, there may be a relatively long period of opening positions and buying, which gives us a chance to find them. The data analysis tool Nansen shared an example for us.

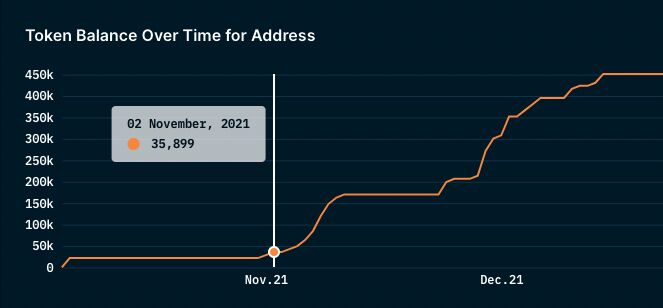

Fund A starts hoarding token X from November 2, 2021.

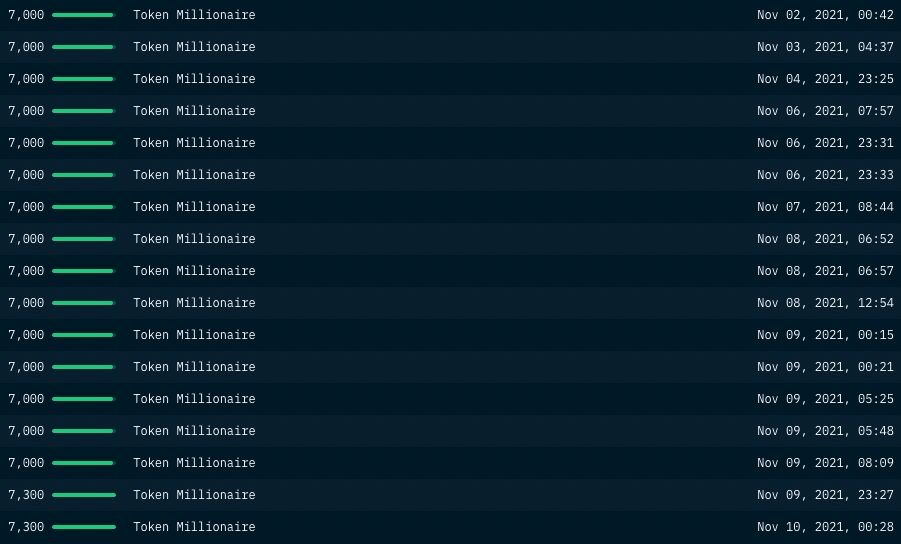

Almost every day thereafter, Fund A’s address will receive 7000-7300 token X, sometimes even several times a day.

So, how do we know who is buying such tokens? The address was tagged "Token Millionaire (a category of Nansen smart money)."

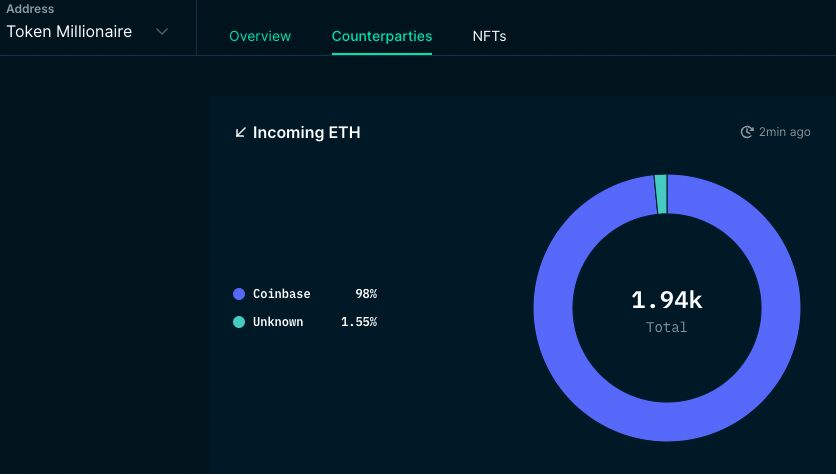

Click on this address to view, we found that 98% of the ETH received by this address comes from Coinbase. We can guess that Fund A is very likely from Coinbase.

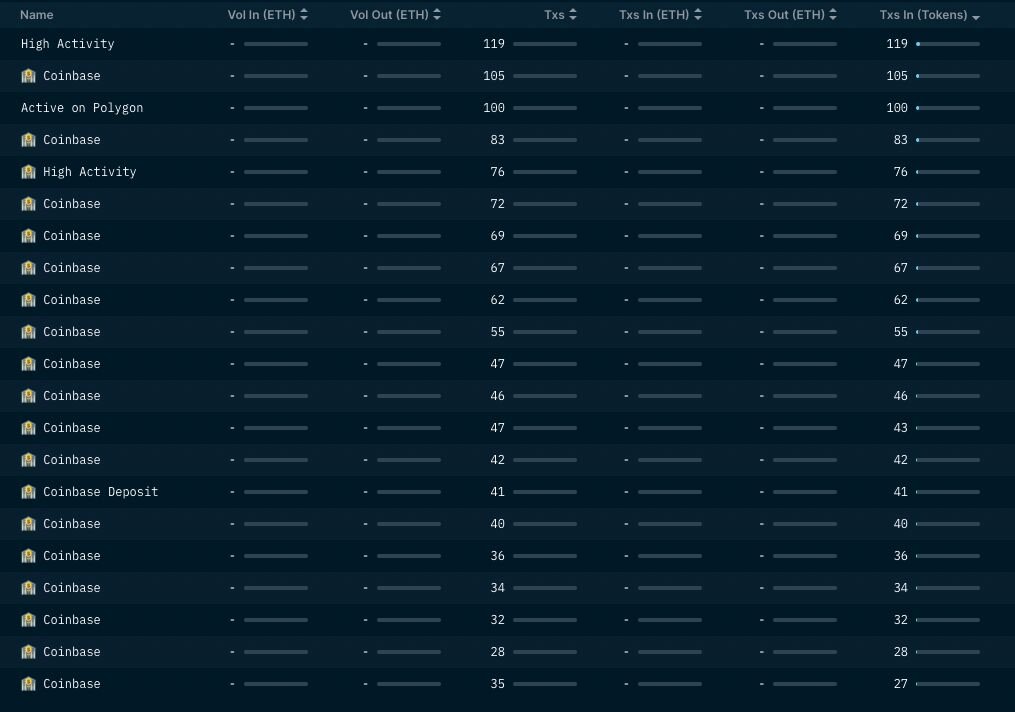

Looking at the non-ETH token transaction records, we found that Coinbase seems to be the main source of tokens. We can assume that Fund A has been buying Token X from Coinbase.

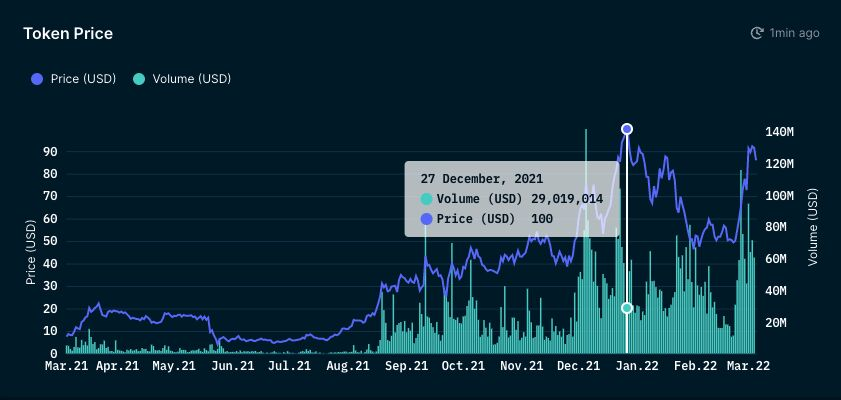

When Fund A first bought Token X, the price was $44.

Token X reaches an all-time high of $100 on December 27, 2021.

Despite the overall downturn in the crypto market, almost all tokens fell sharply, and Token X remained above $80.

I believe many friends have already guessed what Token X is.