We take a look at the current bearish cryptocurrency market and consider alternative investment options.

Even during a crypto bear market, it’s possible to make money by switching to new strategies rather than relying on a single avenue for profit. Let's take a look at the current trends on the Ethereum, Binance and Polygon networks. We will also assess whether the best value currently exists outside of the cryptocurrency market.

Cryptocurrencies do not exist in a vacuum. So it's no surprise that markets are falling as the world goes through turbulent times. Countries are still recovering from the COVID pandemic, inflation hits major economies and conflict looms in Eastern Europe. No wonder investors are plowing money into safe havens.

secondary title

Tokens of leading projects fell in the past week

The three largest blockchain-native tokens all fell over the past week. As the world continues to experience political and economic turmoil, it is safe to expect the short-term prospects of these tokens to continue along the same path:

ETH – the native cryptocurrency of the Ethereum blockchain. Its market capitalization is second only to BTC (Bitcoin).

BNB – the native cryptocurrency of the BSC blockchain. Binance is the largest cryptocurrency exchange in the world in terms of trading volume.

MATIC – the native cryptocurrency of the Polygon blockchain. Polygon is a network of secure layer 2 solutions and autonomous sidechains.

image description

ETH 7-day trend line

I can tell you that they follow pretty much the same line than the 7 day charts showing BNB and MATIC. In the cryptocurrency market, it is a self-evident fact that most coins still mirror the highs and lows drawn by ETH and BTC (Bitcoin). As the market matures, expect to see different tokens take different paths. But for now, it's safe to say that the path the two giants have taken, the rest is behind them.

image description

ETH 30-day trendline

secondary title

A Viable Hedge Against a Bear Market

Let’s get the bad news out of the way first: most coins with large market caps (except stablecoins) are down over the past 7 days. With a sea of red covering every market tracker, it's safe to say we're in a bearish period. But across all decentralized applications and markets, we can employ viable hedges to strengthen our position:

NFT: Stands for non-fungible tokens. Non-fungible means it cannot be copied or replaced with something else. It is unique and has its own digital signature, stored on the blockchain. While the value of the cryptocurrency world has declined, NFTs have fared relatively well. Bored Apes and CryptoPunks are two collections of NFTs worth investigating and potentially using to diversify your portfolio. DappRadar's Top NFT Collections page is a great place to start researching this particular market. People are also investing in fractional NFTs which are a more affordable route into the space. The most valuable NFTs exist on the Ethereum blockchain, often pegging their value to ETH and adjusting their ETH-to-USD valuation.

Short-term trades: While many cryptocurrencies have been trending lower, there are still plenty of bargains to snap up. If someone does the research and jumps at the opportunity, they could see huge gains in a very short period of time. On the Binance blockchain, we see Hashland Coin (HC) up 126.18% last week and QMALL up 178.09% over the same period. Sharp increases in the prices of smaller cryptocurrencies often follow positive announcements from currency developers or technological breakthroughs that are perceived as a boon. So keep an eye on the news and act fast when you spot an opportunity.

Bitcoin: Bitcoin is the biggest fish in the pond with a current market cap of $711.29 billion. If it were a company, it would be the seventh largest in the world, between Tesla and Berkshire Hathaway. For this reason, there are many powerful people who have a vested interest in not letting Bitcoin crash. While not a big deal, Bitcoin's growing institutional acceptance and its large market capitalization mean it's less vulnerable to market volatility. Its value may drop along with the rest of the market; but it shouldn't drop by that much. It's great for limiting your losses while leaving the door open for potential upside. With layer 2 solutions such as the RSK blockchain, users can directly use their Bitcoin holdings for DeFi.

Staking: Staking cryptocurrency means locking up your crypto assets for rewards or to earn interest. In a Proof-of-Stake blockchain network, users can stake their native tokens behind validators to earn interest, or possibly set up a node. In this case, they will participate in the verification of blockchain activity and will be rewarded for doing so. Additionally, there is another form of staking that is more targeted at consumers. Here, you provide liquidity or lock your tokens to reduce the overall supply in the market. This is similar to earning interest at the bank. However, in this case the APY is usually much higher and paid in the native currency of that particular project. Learn about staking here and read The Sandbox's recent announcement about staking.

secondary title

Future prospects

All of the above are useful ways to insulate against current market volatility. But what will the future of blockchain look like? What are the best assets to buy today in anticipation of future success?

All paths seem to converge on the Metaverse. A somewhat nebulous concept everyone is talking about, the metaverse is a collection of platforms and projects that aim to reshape our physical world in virtual reality. Residents of the Metaverse will be able to socialize, shop, study and work in a series of worlds created by different companies.

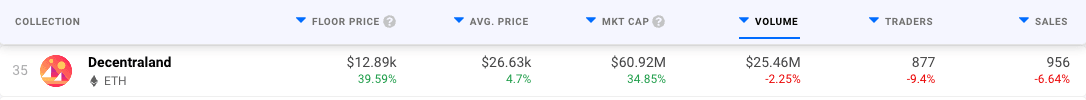

While the idea sounds crazy, the amount of money associated with these projects is huge and very real. Exclusive recently sold all 25 luxury islands it built inside the sandbox for $2.9 million. Collectors and investors can buy a Legendary Palm NFT for Nifty Island: the cheapest is 3.1 ETH ($8,407). On OpenSea, Decentraland

image description

On-chain analysis of Decentraland

The Sandbox, another leading platform in the Metaverse, raised $93 million in a Series B round last November. Snoop Dogg is one of its residents, and the developer just struck a deal with world chess champion Magnus Carlsen to host a virtual chess tournament for the live leading players.

The chart below shows the 90-day average land price and quantity within The Sandbox. The blue trendline shows a steady upward path that counters the recent downturn in broader cryptocurrency and blockchain asset prices. Who knows what the future holds for this technology, but as a potential long-term investment, it's definitely worth looking into.

90-Day Land Prices and Transaction Volume in The Sandbox Beyond Decentraland and The Sandbox, there are countless developers popping up with new ideas and projects for people to participate in. Any of these could be tomorrow's next big thing. Here are some Metaverse companies and platforms to watch:

Somnium Space

NFT Worlds

Gala Games

Wilder World

Bloktopia

Nifty Island

World events are affecting cryptocurrency prices. It is difficult to predict what will happen tomorrow, but it is impossible to guess what will happen in the future. By trying to gauge how culture moves and how people's tastes evolve, is the storm going to grow stronger.

The above does not constitute financial advice and opinions are given here for informational purposes only. Due diligence and research are highly recommended before making any financial decisions.