Original source: Forbes

Author: Jason Brett

Original compilation: Unitimes

On Friday, Federal Reserve Governor Lael Brainard, nominated by U.S. President Joe Biden to be vice chair of supervision, sounded a warning about the rapid growth of stablecoins. Speaking at the 2022 U.S. Monetary Policy Forum in New York on Feb. 18, Brainard predicted that “if current trends continue, the stablecoin market in the future may be dominated by one or two issuers.”

Brainard described a “crypto-financial ecosystem”—particularly decentralized finance (DeFi)—that drives demand for stablecoins and leads to their rapid growth. Brainard also warned that the influence of cryptocurrency-related ads at the 2022 Super Bowl should be a signal of increased exposure of retail investors to stablecoins.

Meanwhile, the Senate Banking Committee and the House Financial Services Committee have both held hearings devoted to stablecoins over the past two weeks. Brainard herself is awaiting a decision from Congress on her Fed nomination, which appears to be deadlocked in the Senate with the White House and Republican senators over one of the nominees (not Brainard) .

According to Brainard, some stablecoin issuers themselves predict that “…stablecoins will also expand their influence in payment systems and be commonly used for daily transactions both domestically and across borders.” Assuming this is the future state of the market, Brainard calls for regulation The institution implements "a robust framework regarding the quality and adequacy of reserves and risk management and governance of the stablecoin market."

image description

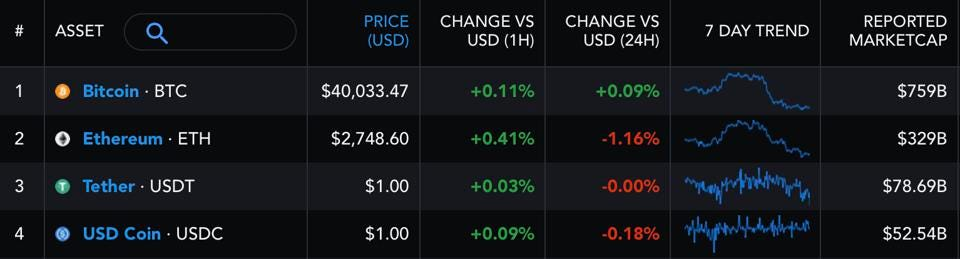

Regarding the possibility of one or two stablecoin issuing companies dominating the market, according to the results of the encryption market intelligence company Messari, the two leading stablecoin issuing companies are Tether (USDT) and Circle (USDC), the two US dollar stablecoins. Market capitalization ranks third and fourth in the cryptocurrency market capitalization rankings (as shown in the chart below), with a combined market capitalization of $407 billion.

image description

The picture above shows the top four cryptocurrencies by market capitalization according to Messari.io data, of which Tether (USDT) and USD Coin (USDC) rank third and fourth respectively, with a combined market capitalization of $407 billion.

Brainard said: “…as of January 2022, the largest stablecoin by market capitalization accounted for nearly half of the (cryptocurrency) market, and the four largest stablecoins combined accounted for nearly 90%.”

The risks of stablecoins have also been addressed in a recent report by the President’s Task Force on Financial Markets in the United States. According to Brainard, the three key risks of stablecoins highlighted in the report — bank run risk, settlement risk, and systemic risk — need to be specifically addressed, not least because of the growing concentration of the stablecoin issuer market.

Stablecoins and CBDCs may be “complementary”Brainard argues that a dramatic shift between stablecoins and deposits could lead to mass redemptions by safe-haven users in times of stress, which could be disruptive to financial stability. In a sign that the Fed’s analysis may indicate that stablecoins will exist in the future state of the market, Brainard argued,

“CBDC (central bank digital currency) co-existing with stablecoins and commercial bank currencies may prove to be complementary by providing a safe central bank liability in the digital financial ecosystem. Just like cash coexists with commercial bank currencies today.”Against the backdrop of the rapid growth of the new digital financial market ecosystem, Brainard said,The primary mission of CBDC (Central Bank Digital Currency) is to protect the public’s ready access to government-issued, risk-free currency in the digital financial system.

According to Brainard, if properly designed, a CBDC could be attractive as a store of value and means of payment, as it is seen as the safest form of money.

Following stablecoin hearings in the U.S. House of Representatives and Senate, Congressman Josh Gottheimer (D-NJ) released a discussion draft of stablecoin legislation. According to a press release from his office, the bill could "help reduce the risk of financial market instability, protect consumers, and support ongoing fintech innovation in the United States."

image description

Above: Rep. Josh Gottheimer speaks during a news conference about rising crime in the nation, on Capitol Hill in Washington, DC, Feb. 9, 2022. The latest figures show that between 2019 and 2020, the murder rate in the United States rose by 30 percent, and violent crime rose by 5 percent.

Recently, stablecoin issuer Circle (USDC) announced that it has issued $50 billion worth of USDC as of January 31, 2022, Dante Disparte, the company's chief strategy officer and head of global policy, said in a press release to members of Congress. “We welcome leadership from Rep. Josh Gottheimer, who has taken a thoughtful, risk-based approach to stablecoin innovation in the United States and how stablecoins can fit into the federal regulatory framework.”

Kristin Smith, executive director of the Blockchain Association, and Teana Baker Taylor, chief policy officer at the Chamber of Digital Commerce, both expressed support for Josh Gottheimer's bill, as well as the active engagement of members of Congress with industry in the legislative process.

Smith said: "Rep. Josh Gottheimer's bill is the most comprehensive and thoughtful stablecoin legislation we have seen to date. We are pleased that Congress has taken a proactive approach to engaging industry and government stakeholders, As they consider the best path for stablecoin regulation. We thank Rep. Gottheimer for his leadership in this area and look forward to continuing to work with him on these issues.”