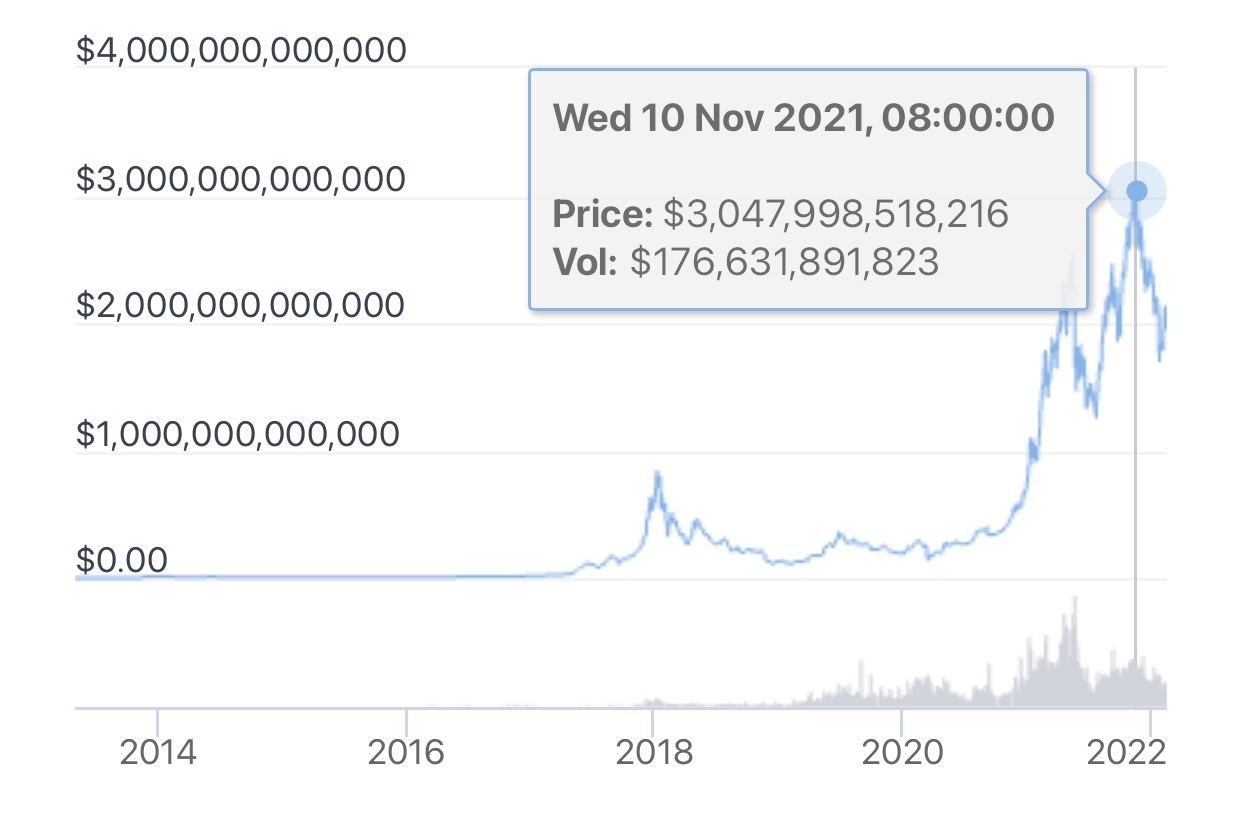

In 2021, many iconic events have occurred in the encryption market: breakthroughs have been made in the mainstream acceptance of Bitcoin, Tesla, MicroStrategy and other listed companies have successively purchased Bitcoin, and the world's first Bitcoin spot ETF has been approved in Canada. The SEC also approved the first Bitcoin futures ETF, and El Salvador announced that Bitcoin will be used as legal tender. Stimulated by many positives, Bitcoin has continuously broken new highs and reached the $60,000 mark for the first time. As the leader of the public chain, Ethereum started the 2.0 journey, and gradually entered the era of deflation while gradually transforming to POS. Under the leadership of the two leading players, the public chain, DeFi, Meme, GameFi, NFT and other sectors have exploded one after another, jointly promoting the crypto market value to break through the $3 trillion mark.

However, during the transition period from the end of 2021 to the beginning of 2022, people began to be cautious about the performance of the market outlook: on the one hand, key indicators such as the US inflation rate and CPI have set new records for many years, and interest rate hikes are expected to rise globally. Once the monetary policy is tightened, the flooding since the epidemic will end, and the financial market is bound to suffer a downturn. On the other hand, since November last year, Bitcoin has fallen into a stalemate of weak adjustments after a continuous decline, and the maximum retracement from the high point has exceeded 50%. Such a trend, combined with the previous halving cycle, will inevitably make people worry.

However, during the transition period from the end of 2021 to the beginning of 2022, people began to be cautious about the performance of the market outlook: on the one hand, key indicators such as the US inflation rate and CPI have set new records for many years, and interest rate hikes are expected to rise globally. Once the monetary policy is tightened, the flooding since the epidemic will end, and the financial market is bound to suffer a downturn. On the other hand, since November last year, Bitcoin has fallen into a stalemate of weak adjustments after a continuous decline, and the maximum retracement from the high point has exceeded 50%. Such a trend, combined with the previous halving cycle, will inevitably make people worry.

However, compared with 2017, today's encryption market has made great progress, and a simple analysis based on pictures seems out of date. First of all, after nearly two years of vigorous development, the encryption ecosystem has become increasingly diversified and sound, and there is a possibility of decoupling of independent sectors from the overall trend of the market. That is to say: when the overall market is in a period of sluggish decline or disorderly shocks, it does not prevent the sectors that have made breakthroughs in the underlying facilities or application levels from going out of the independent market; secondly, with the entry of a large number of institutions, the liquidity of the encryption market today , anti-risk capabilities, and infrastructure construction, etc., have been greatly improved. This provides a more solid support for the market.

secondary title

1. The metaverse continues to expand, attacking the traditional Internet

Metaverse, from the 1992 American science fiction novel "Avalanche", refers to the virtual space that maps the real world, including the integration of the physical world and the virtual world and the virtual economy. In 2021, the metaverse concept has received unprecedented attention and has become one of the hot words of the year.

There are three main reasons for the explosion of the Metaverse:

First, breakthroughs have been made in technologies such as 5G, VR, artificial intelligence, and big data, which have laid a good foundation for the implementation of the Metaverse.

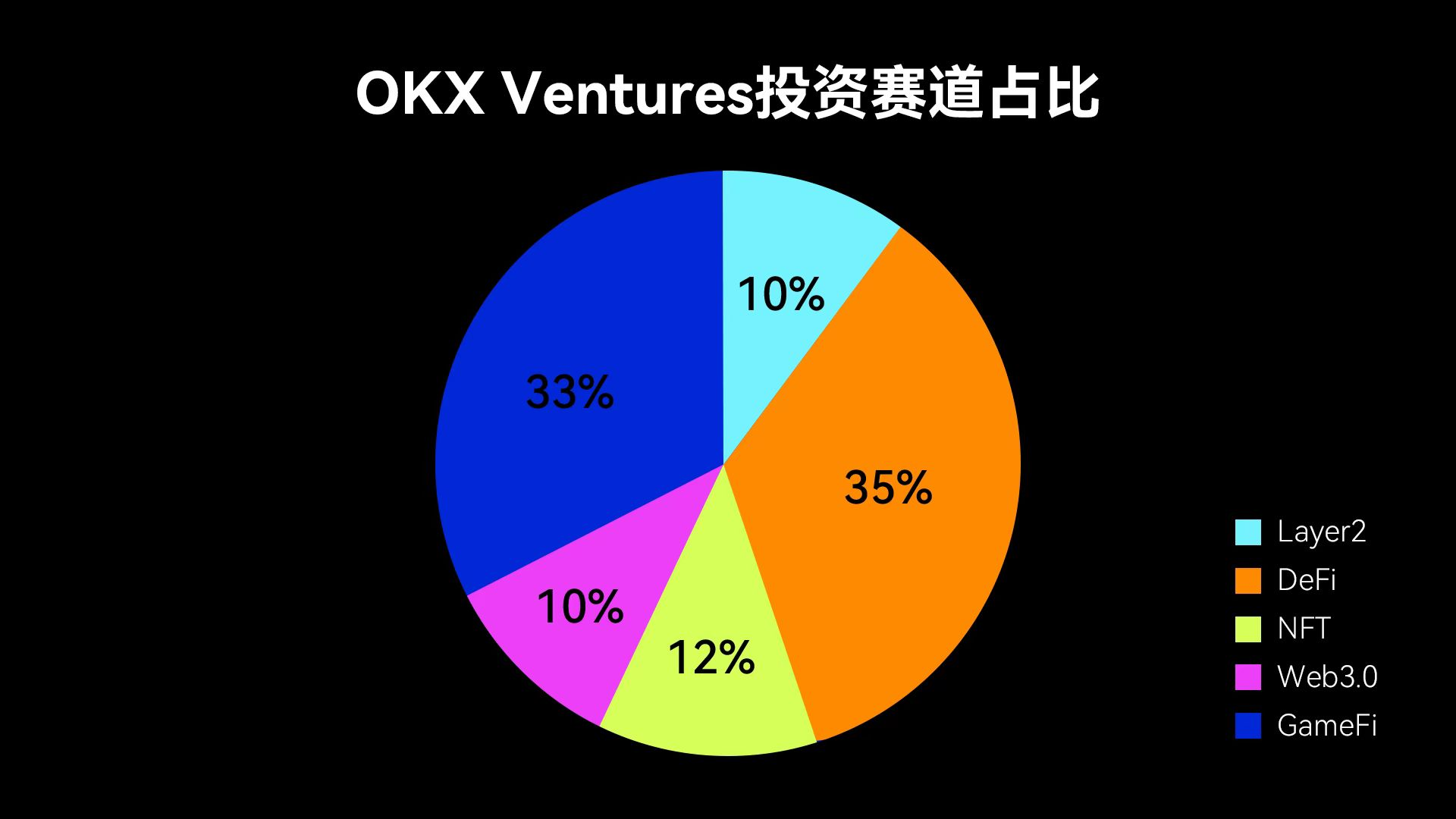

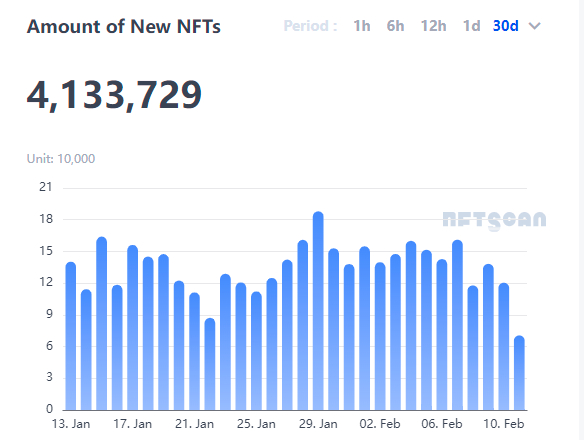

Second, NFT and GameFi have exploded one after another, and have achieved substantial development in terms of transaction volume, number of users, capital volume, paradigm innovation, and the number of leading projects. The perfect combination of NFT and FMCG, entertainment, sports, games, film and television IP and other fields has also accelerated the concept of NFT out of the circle.

Third, on March 10, 2021, Roblox was listed on the New York Stock Exchange, becoming the first stock in the Metaverse concept. Since then, traditional technology giants such as Microsoft, chip giant Nvidia, and Facebook have also entered the Metaverse one after another, which undoubtedly increased the value support and traffic entrance of the entire sector.

OKX Ventures believes that the current total market capitalization of the Metaverse sector in the encryption market is below the US$30 billion mark. Compared with the total market capitalization of the traditional game industry and traditional Internet companies of 16.8 trillion, there is a huge room for development. If the previous metaverse was just an imagination too far away from reality, then with the successive outbreaks of infrastructure, NFT and GameFi, the application scenarios of the metaverse will be further expanded and cover all aspects of the traditional Internet, such as finance, social networking, Production relations and other aspects affect the social process.

secondary title

2. Web3.0, the emergence of the next generation Internet

Web3.0 is a concept created based on the existing Internet and represents the next stage of the Internet. Compared with Web2.0, it has the characteristics of openness and decentralization, emphasizing that users have greater control over personal information and identity. That is to say: in the future Web3.0, users can have their own digital identities online and have absolute control over the degree of information disclosure. Thus breaking the information monopoly of Internet giants. At the same time, Web3.0 based on blockchain technology can also allow users to enjoy the dividends brought by the ecological expansion of the platform and the value generated during the interaction process. The essence of Web3.0 is the process of returning operational power to users.

At present, there is a lot of controversy about Web 3.0: On the one hand, a group of bigwigs led by Musk have questioned Web 3.0, thinking that this concept is just a pseudo demand for lack of application scenarios. On the other hand, after the development of Web3.0, a certain prototype has been formed, such as the content platform Mirror, the storage sector Filecoin, the main payment MetaMask, the social platform Discord, and the domain name system ENS.

OKX Ventures said in the report: "The traditional Internet has entered an obvious bottleneck. Web3.0 is the key word for the transformation of the pattern, and it is also a good medicine to solve the current pain points of Web2.0. Although the application of the concept of Web3.0 is relatively limited, It mainly focuses on storage, decentralized social networking, payment, domain names, etc. As more and more teams and companies join the development of Web 3.0, and more composable applications are integrated into Web 3.0, this current view It is a concept that was relatively vague in the past, and it will definitely gain more mainstream acceptance.”

Ouyi CEO JayHao also said: Metaverse is the transit station of Web3.0, which allows users to perceive Web3.0 in advance and creates convenience for the end of Web3.0. It is believed that as the metaverse concept continues to heat up, more applications will emerge from Web 3.0.

secondary title

3. Decentralized autonomous experiment, DAO

With the rise of metaverse and Web3.0 concept, decentralized organization DAO has become a very important topic. DAO is a digital world organization form based on blockchain technology, a flatter organization with common goals and values. It can be said that DAO, which has the characteristics of information transparency, community autonomy, freedom and openness, is a new type of cooperative organization that is more in line with the concept of Web3.0.

2021 is a year of rapid development for DAOs. Especially in the last two months, Constitution DAO (PEOPLE) set off a wave of paradigm shift in organizational form, raising more than 11,600 ETH, allowing more people to feel the charm and infinite possibilities of DAO. A large number of imitators also emerged, such as AssangeDAO (JUSTICE), which raised a record-breaking 17,400 ETH.

According to the OKX Ventures report: As of January 2022, there are more than 4,200 DAO organizations in the industry, covering three major directions: investment, application, and governance, and covering multiple fields such as development tools, services, social networking, creation, and collection. The 183 DAOs counted by the DeepDao website have a capital scale of more than 9.6 billion US dollars. The cumulative number of organization members and token holders reached 1.7 million, an increase of over 22.3% in the past month.

secondary title

4. Decentralized Derivatives Track

Derivatives are one of the key elements of all mature financial systems, and are an economic contract relationship based on a highly developed social credit. As a relatively high-level financial instrument, derivatives allow investors to conduct arbitrage, hedging and other operations, so as to better execute trading strategies and cope with complex and volatile markets. At present, the decentralized derivatives platform is still in the early stage of development, and there are problems such as high interaction threshold and relatively insufficient transaction depth.

OKX Ventures said in the report: Derivatives have always been one of the main forces driving the entire financial industry forward. The volume of derivatives in the traditional financial field is 40 to 60 times that of spot products. In the encrypted market, the transaction market value of derivatives It still accounts for less than half of the entire digital asset market volume. In contrast, the development of derivatives still has huge room for imagination. In addition to the comparison of volume, mature players and institutions in the market have also begun to try to use derivatives to avoid risks and obtain more value capture. According to estimates, the current daily trading volume of DeFi derivatives is only equivalent to 1/6 of the spot trading volume of DeFi, which is equivalent to 1/100 of the trading volume of CEX derivatives. With the decentralization of DeFi derivatives without permission and the addition of professional liquidity teams, we can expect a breakthrough in the market share of derivatives DEX.

According to recent media reports: Andre Cronje (founder of YFI) said: With the launch of solidly dex, two new products will continue to be launched: one of them is Levzu, an on-chain leveraged spot perpetual contract, which can create any long/short combination, pay Margin for any asset, displaying dynamic real-time funding rates. The active layout of many development teams and the continuous launch of innovative new products seem to be evidence of OKX Ventures' judgment.

The crypto market in 2022 will be a complicated and promising year. On the one hand, macro factors such as monetary policy and the international situation will further affect the direction of the entire market. On the other hand, the unparalleled market depth and Dapp ecology also provide sufficient support for the subsequent strengthening of the market, and high-potential tracks such as Metaverse, Web3.0, decentralized derivatives, and DAO will also Create more opportunities. A new year, a new beginning, looking forward to the continued prosperity of the encryption ecosystem.