Original author: 0xkydo.eth

Summary

Summary

The recent Curve War protocol war illustrates the important role meta-governance can play in cryptocurrencies. Aside from the Curve War case, meta-governance can work in a number of ways, with far-reaching implications than the protocol wars suggest.

secondary title

Review the agreement battle

In essence, Curve War is a continuous game process, in which all parties fight for Curve voting rights to guide liquidity, deepen liquidity, and increase revenue.

In order to achieve these goals, the participating parties attempt to achieve these goals by channeling the liquidity rewards of veCRV voting rights. If you want to know more about the background of Curve Finance and veCRV, you can visit the following address:

https://resources.curve.fi/base-features/understanding-curve

https://resources.curve.fi/guides/staking-your-crv)。

https://theknower.substack.com/p/the-mythos-of-curve-finance)

secondary title

Meta Governance and TradFi

First, let's define meta-governance in the cryptoeconomy. We define meta-governance as holding the tokens of one DAO to influence the decisions of another DAO. This is not a new word created by DeFi. We can find that it originated from TradFi and is called Investment Stewardship.

Investment stewardship refers to the responsible oversight of capital allocated by an institution on behalf of clients.

Institutional representatives hold a large number of voting rights and can influence the company's decision-making, so investment supervision is necessary. Currently, major investment companies (institutional funds and mutual funds) hold a significant portion of the voting power (equity) in most companies in the public market. For example, Apple, Amazon, and Tesla are 59%, 59%, and 43% owned by institutions, respectively. These institutions typically have dedicated teams actively voting on governance proposals on behalf of their clients.

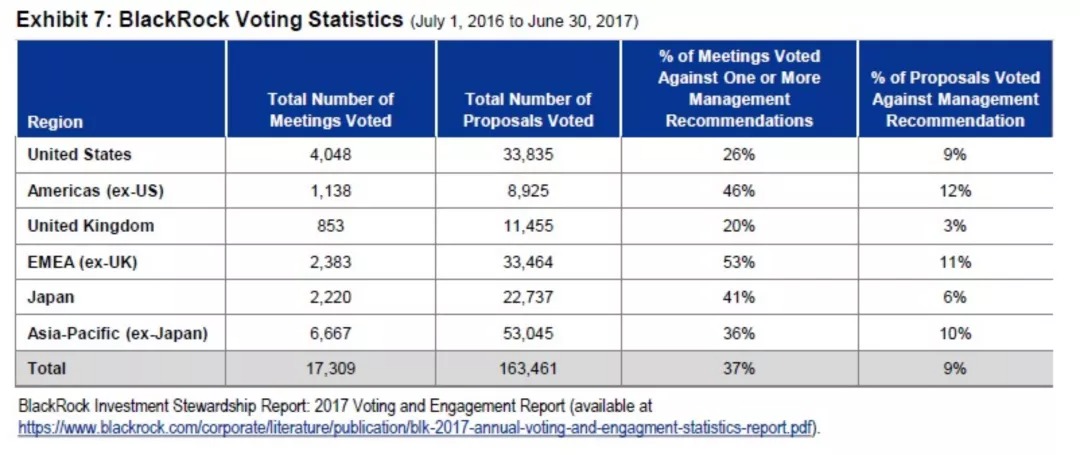

Investment stewardship is a complex management affair. Vanguard and BlackRock are the two largest institutional holders. The table below is a breakdown of BlackRock's voting summaries from July 2016 to July 2017. BlackRock cast a total of 163,461 votes during that period, dissenting from management's recommendations 9 percent of the time. Vanguard cast 137,826 votes (275,652 annualized) on 734 companies in the first half of 2021, representing $1.9 trillion in stock market capitalization.

Meta-governance is needed if the responsibilities of the investment management team are to be decentralized within the organization so that BlackRock shareholders cannot easily influence the outcome of BlackRock's vote on new Tesla proposals.

Meta-governance is needed if the responsibilities of the investment management team are to be decentralized within the organization so that BlackRock shareholders cannot easily influence the outcome of BlackRock's vote on new Tesla proposals.

secondary title

First Meta Governance Event

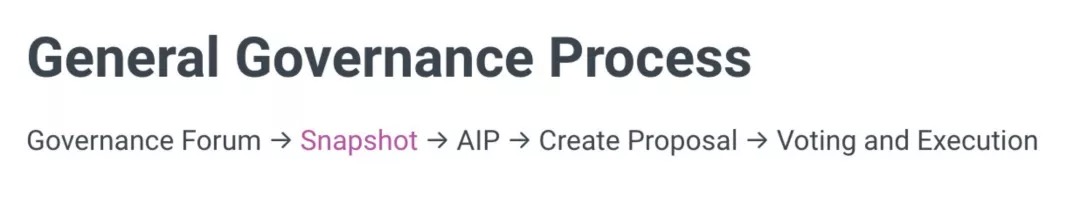

The first meta governance event occurred in the summer of 2021 when Fei Protocol circulated its $INDEX token on Aave. The actual course of events can often tell us more about meta-governance and paint a clearer picture of the foreseeable future meta-governance process than the outcome of a protocol battle. So, let's review the whole process of the incident next.

Before analyzing this incident, first introduce the parties involved in the incident

Fei Protocol

image description

secondary title

Index Coop

image description

first level title

Aave

image description

image description

process

process

June 21, 2021 is two months since Fei Protocol went live. At that time, Brianna (a core team member of Fei Protocol) released an ARC proposal on Aave's governance forum to promote the circulation of $FEI in Aave's lending market. The ARC solicits comments on behalf of Aave as the first step in the Aave Governance Proposal Process. For Fei Protocol, this is a crucial step, as it will directly determine whether it can be listed on DeFi's largest lending market.

In addition to the ARC, a Snapshot was created to gauge the Aave community's opinion on the proposal.

We can think of ARC and Snapshot as:

They are both used to understand what the community thinks about the proposal

ARC is used to obtain qualitative measurements

Snapshots are used to obtain quantitative measurements.

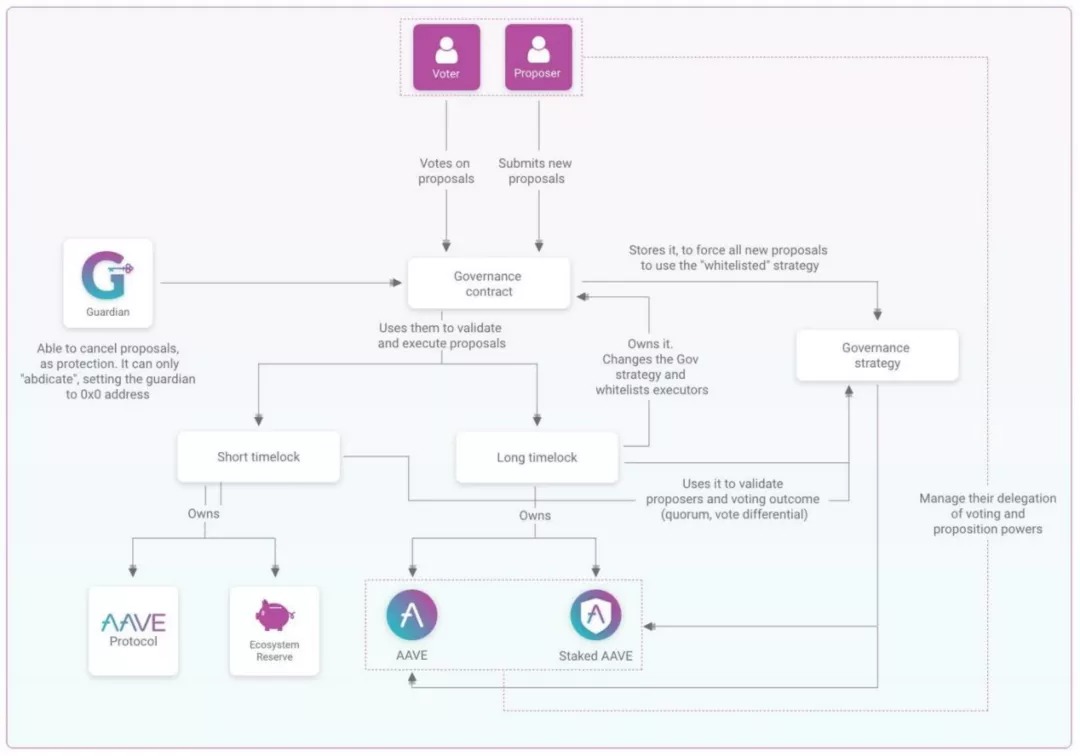

While anyone can issue an ARC on Aave's governance forum, not everyone can propose an AIP Aave Improvement Plan. And AIP is exactly what is needed to drive change on-chain. To propose an AIP, one needs to hold 80,000 $AAVE tokens (owned or delegated), which is worth $20 million at a price of $250 per AAVE.

This poses a challenge for Fei Protocol: where should they get these $AAVE tokens to get AIP to drive their token listing? Here are some options:

1. Purchase in the OTC market;

2. Lobby key $AAVE holders for changes;

3. Bribing the holder;

4. to borrow from somewhere;

......

*Fei Protocol itself can also technically borrow voting rights (i.e. Paladin), but it is still in its early stages and this approach obviously does not apply here.

Of these options, lobbying seems the most logical choice. Buying tokens in bulk for just one proposal seems like a waste. Bribing holders with $TRIBE may leave a bad reputation in the minds of users, and borrowing faces risks similar to bribery. Therefore, lobbying the major holders of $AAVE seems to be the most cost-effective way to go.

However, lobbying also faced challenges: For Fei Protocol’s team, the process was time-consuming and required multiple rounds of conference calls with different stakeholders. The entire process can take anywhere from a few weeks to several months. So, is there a more efficient way?

Make an on-chain response

While Fei Protocol was thinking hard about this issue, Bruno and Matthew Graham made another proposal unrelated to this issue. In this proposal, Bruno and Matthew list their reasons for adding $DPI to Fei Protocol's PCV to diversify risk. At the end of the proposal, the proposer mentions:

Also, we would like to know the community's initial attitude towards purchasing Index Coop's governance token INDEX... the benefit is to leverage meta-governance and have an impact on well-structured and fast-growing projects in DeFi.

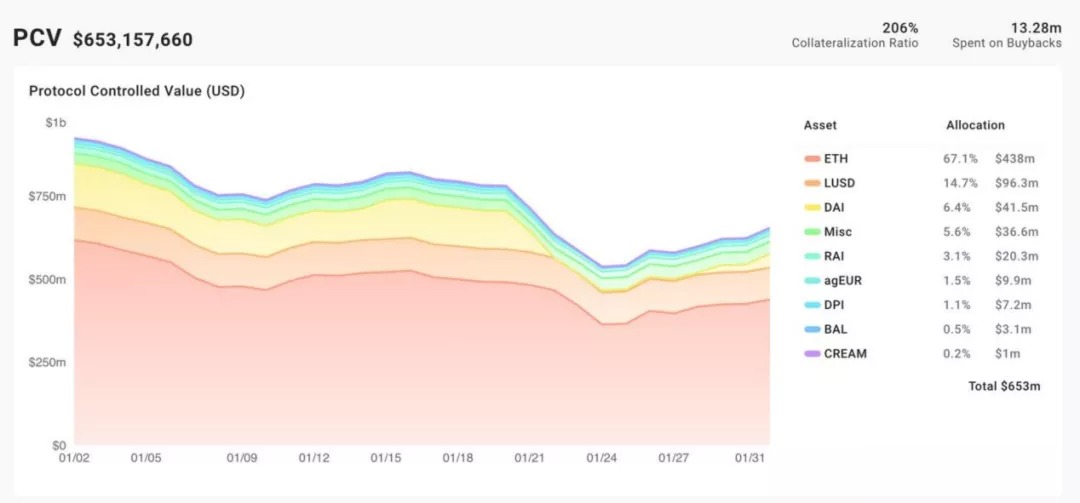

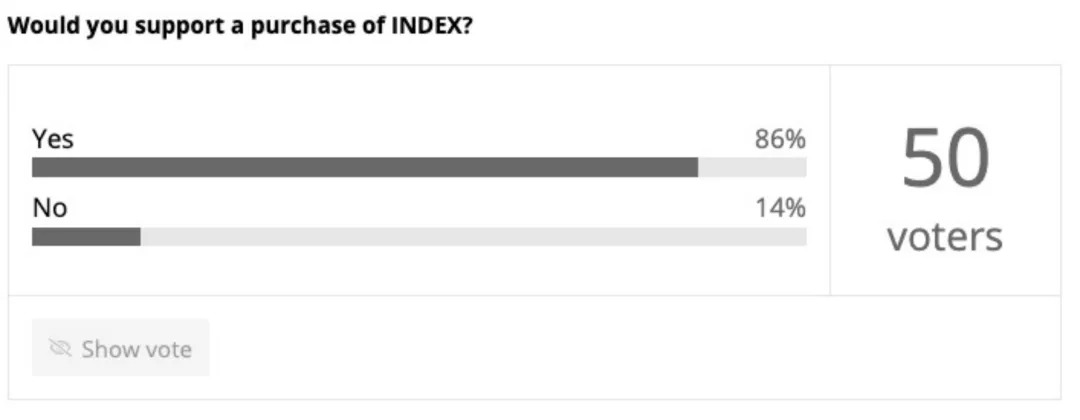

Why is $INDEX important to meta-governance? At the time of the proposal, the DeFi Pulse Index held over $100 million in major blue-chip DeFi tokens, most critically including over $100,000 in AAVE tokens. Fei Protocol only needs 80,000 $AAVE to raise an AIP, luckily $AAVE is one of six tokens that $INDEX token holders can use for meta governance. Therefore, if you only control $INDEX, you control the governance rights of these $AAVE tokens.

image description

Community Sentiment for Buying $INDEX

first level title

victory result

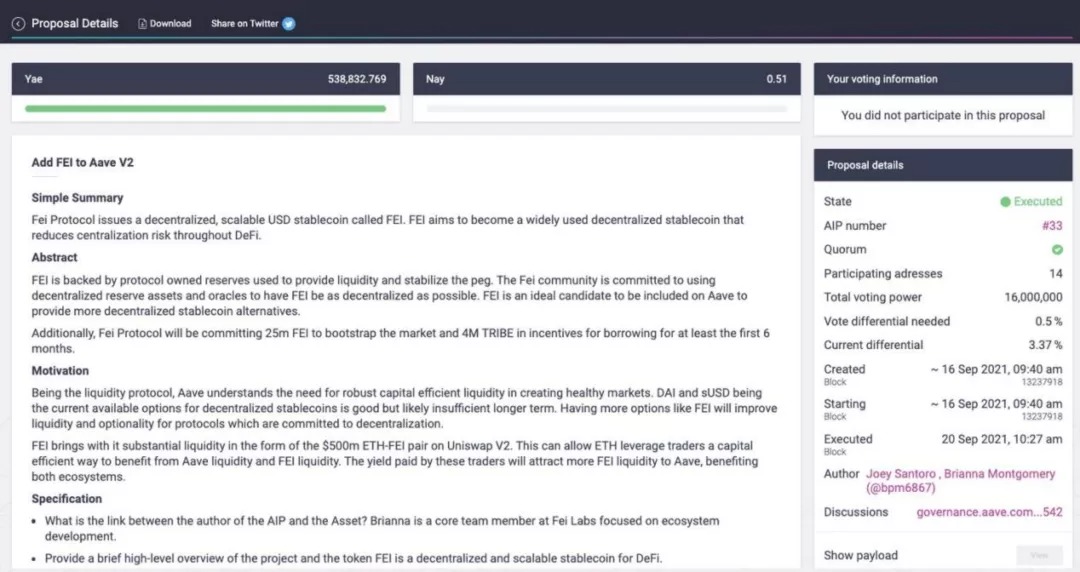

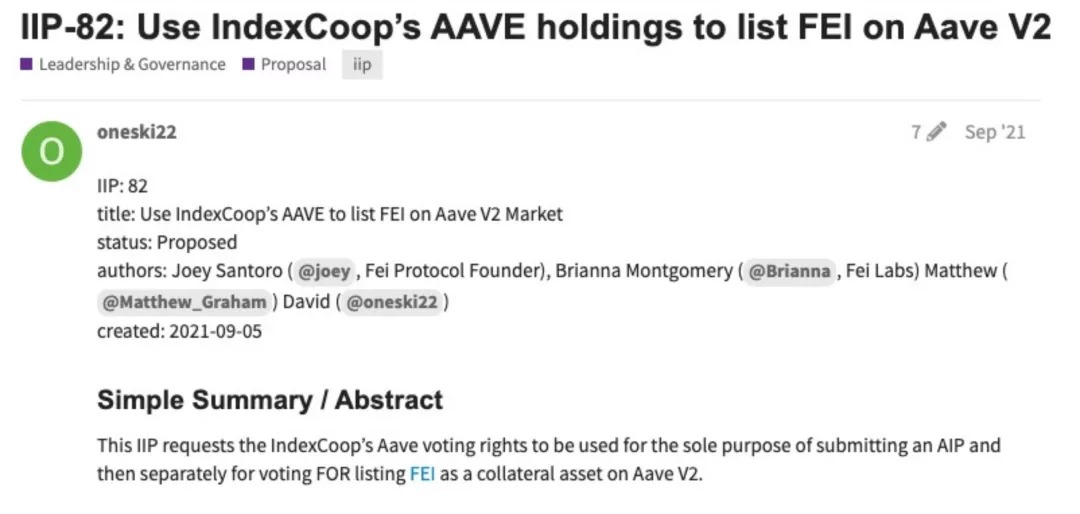

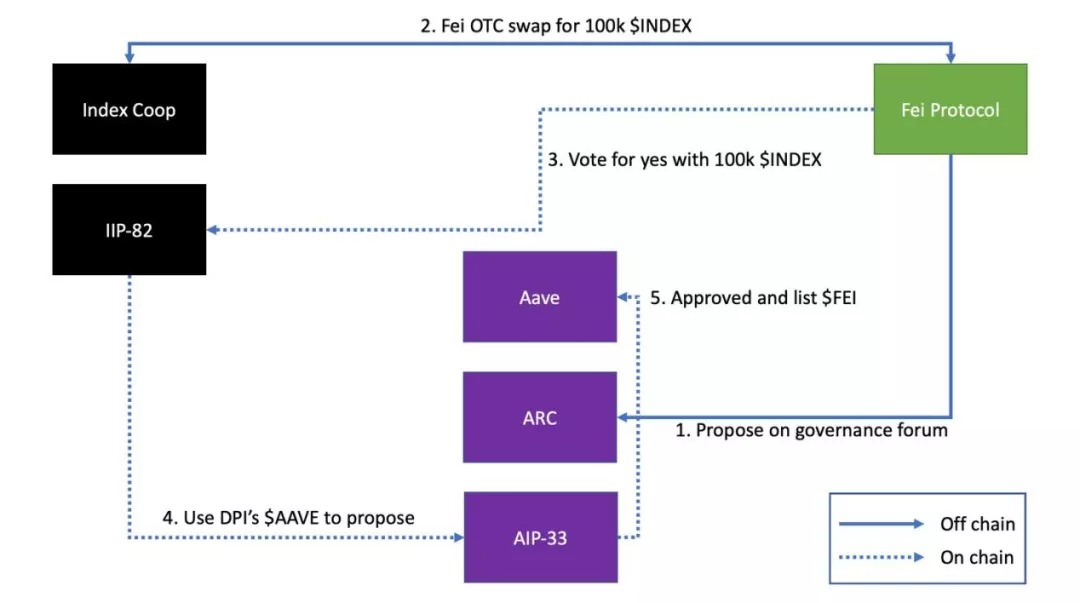

With 100,000 $INDEX on hand, Fei Protocol is just a few steps away from being listed on Aave. Index Coop’s core contributor Matthew worked with Fei Protocol’s team on most of the following contract interactions:

1. The Fei community will use its $INDEX to make proposals on Index Coop;

2. The Fei community will propose IIP-82: use its $AAVE to list $FEI on Aave;

3. Index Coop will propose AIP-33: List $FEI on Aave;

image description

image description

Index Coop's IIP-82

image description

Fei - index - Aave Meta Governance Interaction

first level title

The nature of the event

The protocol battle is a very different event than Fei Protocol's actions. However, both fall under my definition of meta-governance - holding tokens in one DAO can influence the decisions of another DAO. The main difference between the two seems to be motivation. I think most people in Curve Wars believe that the financial return will lead to the protocol's long-term success. We can see this through the normalization of bribery and the goal of "maximizing your rewards".

For the meta-governance event of Fei Protocol and Index, I believe strategic cooperation is a long-term victory. There is little immediate benefit to the protocol or token holders by adding $FEI on Aave, but huge potential long-term benefits.

At the end of the day, meta-governance is just a tool for DAOs to achieve their goals. Different DAOs can be flexibly configured according to their own situation, so as to achieve the purpose of success.

Comparing meta-governance in the cryptocurrency and TradFi worlds, the differences are also stark. This is partly due to the infancy of DeFi, but also due to the different mechanism design. In TradFi, you cannot use BlackRock shares to influence BlackRock votes in its ETFs. But in DeFi, Fei Protocol can have an impact on the governance of Index, so Index has enabled all meta-governance voting through DPI.

For contributors, founders and teams.....

I am optimistic that meta-governance can be good for the crypto world and human collaborative activities, but there are many concerns. In the case of Fei-Index-Aave, the main goal of Fei Protocol’s purchase of $INDEX is not for meta-governance, but for long-term cooperation, which can be seen from the continuous holding behavior of Fei’s side (only $INDEX token price drops ). The intention of Fei Protocol is to cooperate with the index community for a long time. However, intents are not code, and intents can change.

Let me give a very likely example:

Projects A and B are on different tracks and both teams would see synergy between the two if they collaborated. To deepen the bond, A and B exchange tokens. So now, A holds $B and B holds $A.

Suddenly, A was hacked. Now A’s dollar is falling wildly, and the community makes a suggestion to B: “Given the current price trend of A, we should sell A to save our treasury.” How should this be handled?

Another very likely example:

A and B swap tokens and enter a bear market. Both $A and $B are down 50%, and A feels like it could drop further. In order to save his treasury and accumulate more stablecoins for the bear market, A sells $B.

Like the Fei-Index-Aave meta-governance process, the whole process is also very emotional, there are many hidden pitfalls, and other protocols should not intervene in these governance processes without careful consideration.

What should you learn from the Fei-Index-Aave incident?

1. Fei only holds a small amount of $INDEX (less than 1%) compared to their total funds, which mitigates the urge for either party to sell tokens, as the amount of $INDEX is so small.

2. Fei has cooperated with Index more than once. Their intent was never, "Oh, let's use Index's Aave to do this proposal." Their intent was, "I want to work with Index and its ecosystem." It just so happens that it holds enough $INDEX to propose an AIP.

3. Fei has experienced all possible situations encountered in the governance process. When doing a token swap, you should engage with the community and clearly communicate your goals. This is important for two reasons: 1) the community will understand future decisions if something goes wrong, and 2) by being open about your purpose, you increase transparency and reduce the likelihood that you or others will act "differently".

Can Fei Protocol do better?

1. Codify this interaction: contractually specify (smartly) when and under what conditions $INDEX can be sold, so that it can only be sold if those conditions are met. In Fei's case, since all PCVs back $FEI, Fei should be able to sell his $INDEX if the collateralization ratio falls below a certain value.

2. Closer interaction with Index: There are hundreds of proposals listed on Index, and it is impossible for Fei to know and vote on all the proposals. In this case, how should Fei's $INDEX be used? Here, delegation might be a good answer.

While working with Index on this first-of-its-kind meta-governance proposal, Fei is running a full stablecoin protocol. They have limited resources and don't have time to consider all possible scenarios. However, other DAOs should take these into account when using Fei Protocol's approach to maximize cooperation with their meta-governance counterparties.

Final Notes on Meta-Governance and Governance in General

Protocol wars are interesting, but represent only one meta-governance situation, and we will no doubt see more complex meta-governance cases in the future. Meta-governance, like governance itself, is a double-edged sword. If used poorly or even abused, this can be very harmful to an otherwise useful structure of the organization. I won't share explicit attack vectors in this article, but the recent TrueUSD vs. Compound controversy should alert other protocols that may be vulnerable.

Governance is never easy. And, since our structure is very different from the current governance structure in the TradFi world (mainly because in the cryptocurrency space, our governance decisions directly affect operations), there is a possibility that a new governance model will evolve, which will have a huge positive impact , I hope this post has sparked your interest in governance.